Cover Page Designed by me, @msquaretk | created on imarkup app

This is the fifth day in the second week of the trading competition. I am a member of the team "fredquantum-kouba01 Traders". Today, 04/03/2022, I will be giving the details of the trade I took. The post will show the project background of the token as well as the technical analysis done on the trading view. I will also include the screenshots of the trade on my binance exchange app. So follow me closely.

The name and introduction of the project token, and which exchange it can be traded on, project/team/technical background

Before we see the technical analysis, I am going to be showing details of the project background of the token. So, I will tell you about the team or developers who created the token, the growth and the uses cases of the token. The name of the token is XTZ. And I am going to be trading the pair XTZUSDT. I will do the analysis on trading view and then make a real trade on binance exchange platform.

XTZ (Tez) is a native token of Tezos blockchain, a decentralized blockchain which is used for peer to peer transaction. It was created by husband and wife named Arthur and Kathleen Breitman. They first proposed it in the year 2014 before it was later created in the year 2017. Tezos has foundation called Tezos foundation.

In the year 2017, they started raising funds for the project. They did **Initial Coin Offering (ICO) and received about 66,000 Bitcoins and 361, 000 which was used for the development of the project. After the ICO for the project, there was a kind of misunderstanding between Kathleen and the person who was working with him. This made the development of this project to be a bit slow, but the argument was resolved in the year 2020.

Tezos uses the same consensus protocol with Ethereum. It uses proof of stake consensus mechanism. The type of on-chain Tezos allows the protocol to be adjusted and that enables hard fork to be avoided on the network. In addition, the primary protocol of Tezos uses what's known as liquid proof of Stake (LPoS). Here, the validators that validate blocks before it's added to blockchain are called Bakers.

These bakers are selected based on the number of tokens, XTZ they have staked, and the receive the reward inform of minted XTZ when they have successfully validated the block and added it to the blockchain. Another interesting thing about it is that, holders of XTZ can delegate their token to the bakers and also share in the block reward.

Tez can be stored in many wallets. Some of these wallets are, trust wallet, umami, temple, galleon wallet, kukai etc.

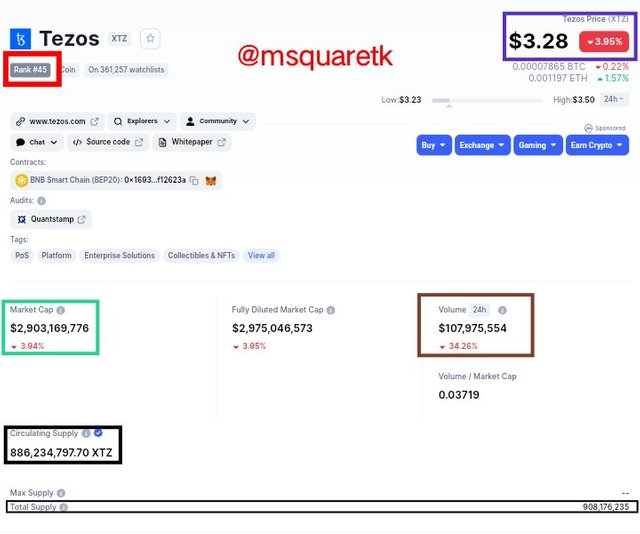

According to Coinmarketcap, it's ranked #45 and it's currently trading at $3.28.

It has a market capitalization of $2, 903, 169, 776;

Volume of $107, 975, 554;

Circulating supply of 886, 234, 979 XTZ;

Total supply of 908, 176, 235 XTZ

The screenshot below shows these details according to Coinmarketcap.

Screenshot from Coinmarketcap | SOURCE

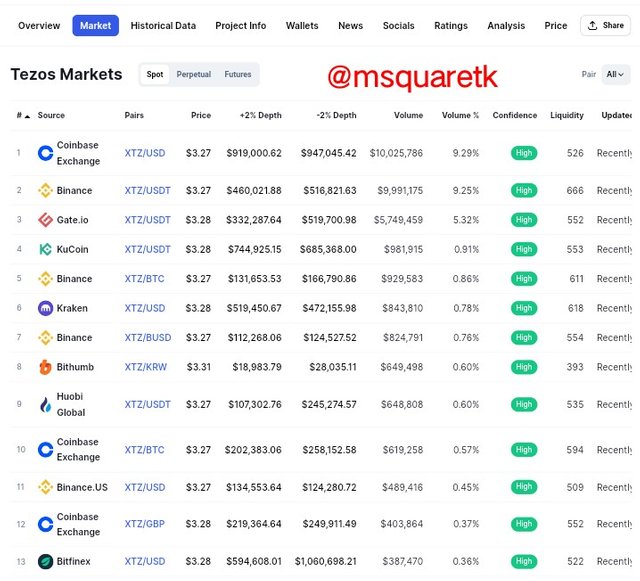

Let's now see Exchanges XTZ can be traded on.

Exchange It can be Traded on

XTZ can be traded on so many exchanges and it's paired with so many other tokens. Thanks are some of the exchanges where XTZ can be traded on

- Binance

- Kucoin

- Huobi Global

- Kraken

The screenshot below shows these exchanges according to Coinmarketcap

Screenshot from Coinmarketcap | SOURCE

Why are you optimistic about this token today, and how long do you think it can rise?

I'm optimistic about the token because I think it can rise based on the area where the price is. Where the price is, it's a key support level which can support the price and send the price to the upside. According to my analysis, the price should rise to at least $3.434 which is the closest resistance level to where the price is.

Now, having seen the project background of the token and the growth so far, let's move to the technical analysis which is the most important part of this task.

Technical Analysis of the Token, XTZUSDT

Having seen the project background, the founder (s) , the use cases and the growth so far, I'm going to go into technical analysis and show you what I did on trading view before I took the buy position. Then, I will also include he screenshots of the order on my Binance exchange app.

Like I always do. I first add the indicators I want to use to the chart anytime I want to trade if I have to. Sometimes, if I save the chart, I don't need to add any Indicator to it unless I want to change strategy because each market requires its own strategy. The way to approach a ranging market is different from that of a trending market. So, I will use bollinger bands, stochastic oscillator and price action in this strategy.

Upon opening the chart of XTZUSDT, H1 timeframe, I saw that the price is at a key support level. It's indicated with a green horizontal line in the screenshot below. Also, looking at the Stochastic oscillator, the price has entered the oversold region and its lines have crossed. The crossing of the lines in the oversold region is a buy signal. See the screenshot below.

Screenshot from Trading view | SOURCE

On that same timeframe, H1, we can see that at that support level, the price is also at the lower band of bollinger. Lower bollinger can also acts as a support level. This serves as a confluence to the support level. In addition, hammer candlestick pattern formed at the lower band and support level. Hammer is a price reversal especially when it forms at a key support level.

Screenshot from Trading view | SOURCE

So, having these many reasons (confluence) :

- Price on a key support level

- Stochastic oversold and its line crossed

- Price at the lower band of bollinger

- Hammer candlestick pattern formed at the support level

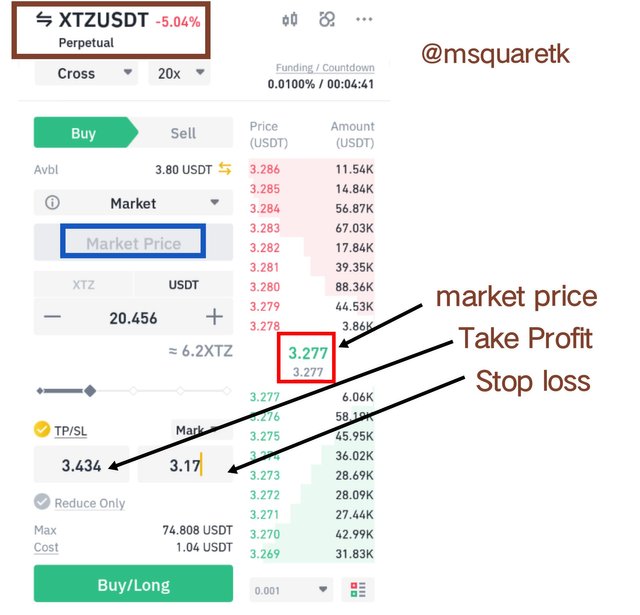

I opened a buy entry at $3.279 and the stop loss was placed below the last low created at $3.177 and take profit at the nearest resistance level at $3.434. See the screenshot below.

Screenshot from Trading view | SOURCE

Now, having gotten the price levels for my entry and exit, I took a real trade on binance app using margin trading option and set the stop loss and take profit appropriately.

Screenshot from my Binance App

The screenshot below is taken after the execution of the trade. It shows the buy order XTZUSDT running.

Screenshot from my Binance App

Your plan to hold it for a long time or when to sell?

I don't plan to hold the trade for long because it's an intraday analysis. Also I'm not in possession of the asset since it is a margin trade. If it's spot trading, I can decide to hold he asset for a long time. But in margin trading, you can't do that because, when the price hits the exit, that's the end of the market for you. For my analysis, it should be more than 48hrs before the exit should hit.

Do you recommend everyone to buy? and the reasons for recommending/not recommending

If I would recommend people to buy the token, then it must have been when I bought it. And the reason I would recommend it is because of he analysis I have done in which I have confluence before I actually bought the asset. It's also pertinent that I include a warning that they should manage their risk very well when recommending them to buy because cryptocurrencies are very volatile.

Conclusion

In this post, the post showing the token I traded for the fifth day of the second week of the trading competition, I have been able to give a brief introduction of the token, the founder (s) and growth/history of the token. I have also done technical analysis of the trading view platform using the knowledge gained. Then I made a real margin trade on binance app.

Thanks to my Team leaders this week, @fredquantum and @kouba01 for the review so far and the corrections. I will upload the results of all the trades this week and the shirt video on Google form. Thank you all for reading.

Consulted Article 1 Source

Consulted Article 2 Source

Consulted Article 3 Source

CC: @fredquantum

@kouba01

Write by @msquaretk