Introduction

Hello Crypto Lovers!

It is the 4th day and the last day of trading contest for week 4 of the season 6 in the crypto academy. My name is Kehinde Micheal and my username is @msquaretwins here on this great platform. Thanks to our amiable leader for the Team Investor, @pelon53 and the entire members of the team. Today again, I will be discussing another interesting project in the crypto space. So please, join me as we learn together here. Happy reading!

Historical Background of ATA

ATA full name is Automata. It is a new cryptocurrency inbthe crypto space. It is a decentralized blockchain system that allow development and deployment of Decentralized Application. The blockchain is a cross chain system that provides decentralized service to decentralized Application. It helps many developers to create and build Decentralized Apps on the system.

It was created in 2019 by an expert and analyst who was a former employee of National University of Singapore. With the use automata platform unnamed voting can be done, miner extractable value and calculating of trust technologies can be done. The project has many investors and partners, some of it partners are Almeda research, KR1, IOSG Ventures, Divergence Capital, etc.

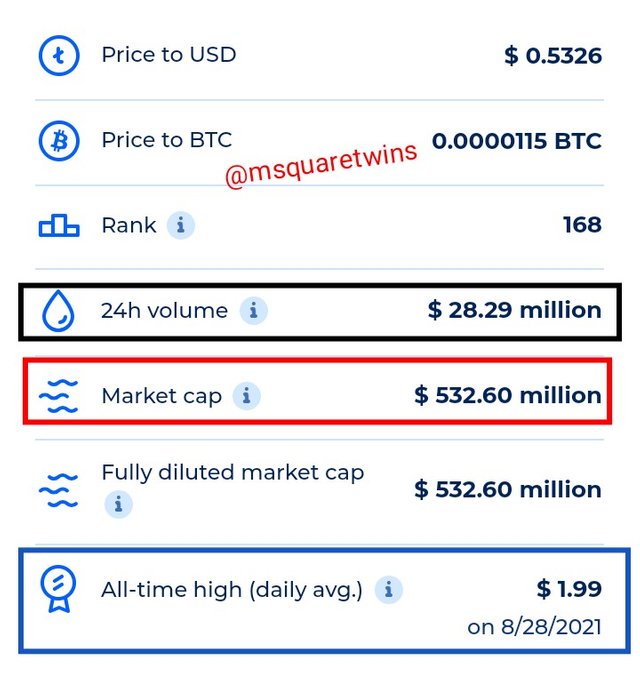

ATA is the native token of Automata blockchain. The token type is both BEP-20 and ERC-20 token. The token is used for many purposes. It can be used for staking purpose so as to keep the ecosystem healthy and functional. The total supply of ATA token is 1,000,000,000 ATA. The current market capitalization is $532.60M as indicated by a red box in the screenshot, the all time high of the token is $1.99 and this was attained on 28th August, 2021.

source

source

Exchanges Where ATA can be Traded

ATA can be traded on many exchanges, Some of the exchanges where it can be traded are;

- Binance Exchange

- Nami

- Coinbase

- Robinhood exchange

- AEX

- Kucoin

- PrimeXBT

- Gemini

- Indodax

- Bitvavo

- Changelly exchange

- Mandala

- CoinEX

- Coinsmart

Technical Analysis of ATA/USDT

The screenshot uploaded below is a chart of ATA/USDT on a daily chart timeframe. As we can see in the screenshot, price has been on a downtrend creating lower highs and lower lows. We see a fake move upward at the last high created. And price retraces back and approach this high. Now, in market, a fake move is a place where important details are always hidden. Let's change the chart to a lower timeframe and see the left side of the chart.

Then I changed the chart to 4 hour timeframe as seen in the screenshot below. We can see that at the left side where we identified fake move up on daily timeframe that there is an imbalance there as identified by a red box in the screenshot. Now, an imbalance area is an area where price is expected to fill, and often time, when price fill imbalance in market, it often retraces back from the area of imbalance. And as we can see, we have been having reaction around this place on this time frame.

Then I changed the chart to 30 minutes timeframe as we have it uploaded below. As we can see here, there is a break of trendline which price was following at my area of interest. This shows that we have a break of structure and that price is about to change back to downward direction.

Then I changed the chart to 15 minutes timeframe and added a RSI indicator to the chart. As we can see from the picture below, at this area of interest, RSI indicator also entered the overbought region which also signifies that price is ready for a bearish move. With this confluence at my area of interest, I opened a sell order with;

- Entry = $0.5090

- Stop loss = $0.5311

- Take profit = $0.4641

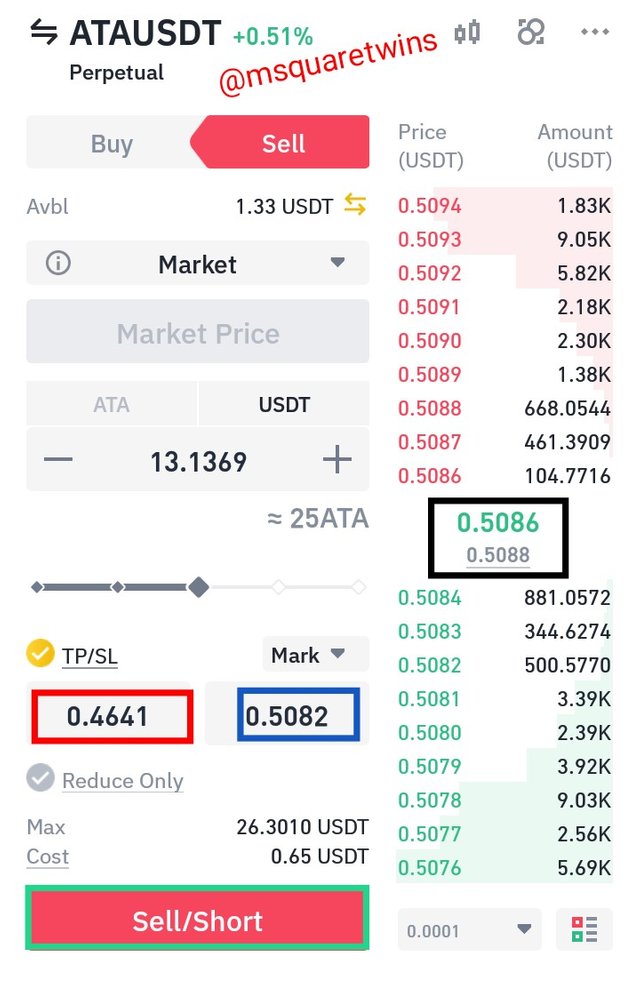

Then I took the real sell order on Binance trading platform. I set the stop loss order and take profit order at a current market price and then hit the sell button as seen in the picture below.

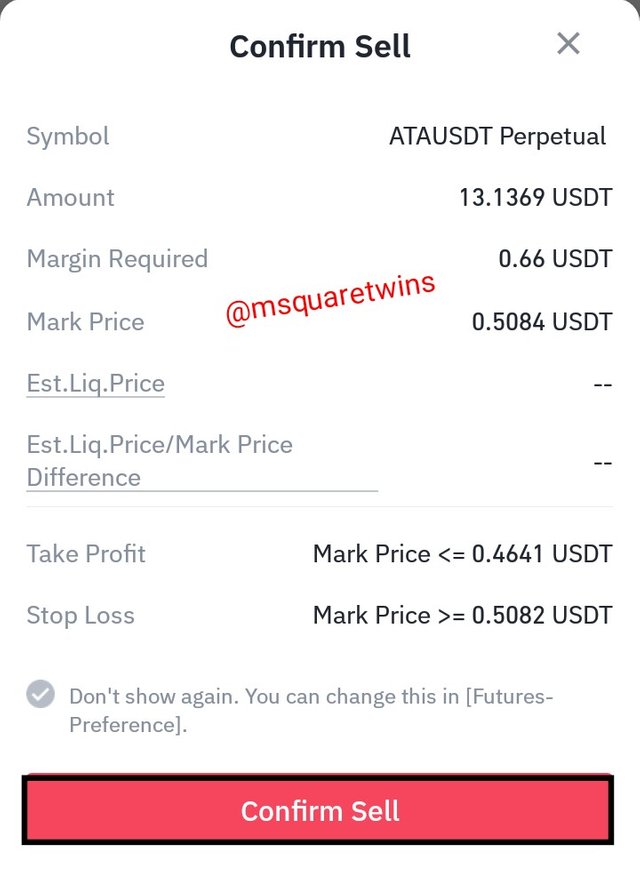

Then I confirmed the sell order by clicking the confirm button as shown in the screenshot below.

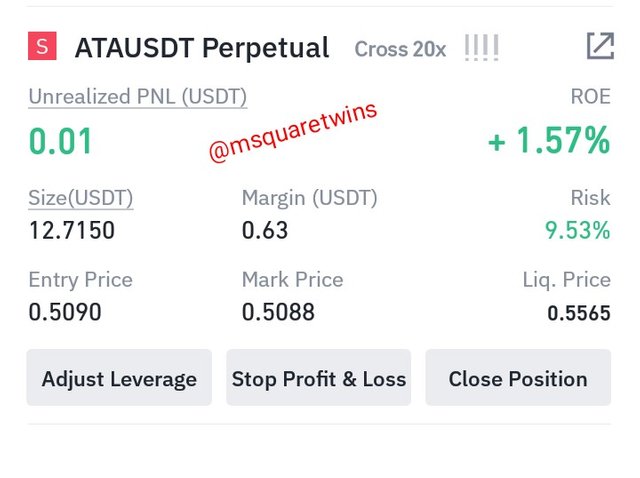

The picture below shows the running order of ATA/USDT on a Binance trading platform.

What is your plan? Do you want to keep it for a long time? Or when to sell it?

Well, I do not plan to keep this token Based on my analysis, I believe the token is going to make a low at least to a recent or previous low recorded in 30 minutes timeframe. So, my interest is to sell it to the a previous support level.

Do you recommend that everyone buy it? The reasons for recommending or not recommending it.

I will not recommend anyone to buy the token now because I am of the opinion that the token will make a new low, and since it better to buy at the deep or better at the discount, I will advice traders to wait and look for opportunity to buy at the discount. The only advice I can give now is for traders to look for a sell opportunity and sell to the nearest support level.

Conclusion

In this post, I have discussed extensively about Automata project, the uses cases of the project and the exchanges where ATA token can be traded. I also did the technical analysis of the token on many timeframe with a confluence also from RSI indicator. The real sell order was taken on Binance trading platform. Lastly, I said my opinion whether to sell or buy the token.

Special thanks to my team leader, professor @pelon53 and the entire members of the Investors Team. You are the best.

Cc @pelon53