Introduction

Hello friends,

I welcome you to this wonderful day. I hope you have been enjoying the week 5 in the academy. My name is Kehinde Micheal and my username is @msquaretwins here on steemit. I have attended the lecture presented by Professor @imagen on "Bitcoin's Trajectory" in the intermediate class. In this post, I will be answering the questions posted in the homework section. Happy reading!

1. How many times has Bitcoin been "halved"? When is the next expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that are or have halved

Let's first establish what halving is. Halving is a process of slashing the amount of crypto into half. This method help to cut the supply of crypto in circulation there by help it to maintain it significance in crypto world. Anytime halving is done on Bitcoin, the reward of the miners is cut into half as well. For the case of Bitcoin, it is done after successful mined of 210,000 blocks. Each block is mined at approximately every 10 minutes. Apparently, Bitcoin halving is done at every 4 years.

Bitcoin was created in 2008 and the rewards of the miners from 2008 till 2012 was 50BTC. The first bitcoin halving was carried out in 2012 and this in turn cut the amount of miners reward into half. Now the reward miners get from the day halving was done in 2012 till 2016 was 25BTC. That means the second halving was carried out in 2016 and that reduced the miners reward to 12.5BTC. Another halving was carried out in 2020 and the reward was reduced to 6.25BTC.

| Halving | Year it occur | Miners Reward |

|---|---|---|

| First halving | 2012 | 25 BTC |

| Second halving | 2016 | 12.5 BTC |

| Third halving | 2020 | 6.25 BTC |

Therefore, Bitcoin has been halved for three times since it inception.

To know the next expected halving date, let's take a look at the illustration in a calculation below

• First halving formed at 210,000 blocks.

• Second having formed at (210,000 + 210,000) which is 440,000 blocks

• Third halving formed at (440,000 +210,000) which is 660,000 blocks

• Therefore, the next halving is expected to formed at block( 630,000+210,000) which is 840,000 blocks

The exact block at which the next halving will occur is 840,000 blocks as established above. But the year it will form has not been established. Then let's take a look at the calculation below:

Every block takes 10 minutes to form

And 210,000 blocks are mined before halving occurs.

Therefore, the total minutes it takes 210,000 blocks to form will be;

10 x 210,000 = 2,100,000 minutes

To get the hour for this we divide the total minute by hour

2,100,000/60 =35,000 hrs

Take hours to days, we divide by 24

35000 hrs/24 = 1458.3 days

Take days to years, we divide by 365

1458.3 days/365 = 3.99 years

So, it takes approximately 4years for bitcoin halving to occurs.

Following the series shown in the table above, and the result from the calculation, therefore the next halving is expected to occur in the year 2024

The current amount bitcoin miners receive is 6.25 BTC as seen in the table above.

Edample of Some Cryptocurrency that have halved are

• Dogecoin

• Bitcoin

• Litecoin

2. What are consensus mechanisms? How do Proof-of-Work and Proof-of-Staking differ?

In blockchain, there are networks nodes that confirm and validate the transactions that are performed on the blockchain. For this to happen, the nodes must agree together and that is where consensus mechanisms come into play. Consensus mechanisms are mechanisms that allow network nodes to work together in agreement.

Consensus mechanism is otherwise called consensus protocol. They are mechanism that are used to reach agreement on the state of things in blockchain. They are the foundation upon which the verification of blocks in every blockchain network rely. They establish the facts that must be met by the nodes and the network participants before a block can be added to the blockchain. Until the consensus mechanism used in a blockchain validates the authenticity of data or transaction presented by the nodes and the miners, a block would not be added to the blockchain. Not only this, the security of the network is achieved through consensus mechanism.

Various types of consensus mechanism are used in blockchain to establish agreement of the network node or the state of the network. Each consensus mechanism has it own advantages and disadvantages. Some of these consensus mechanism are;

Proof of Work (PoW), Proof of Stake (PoS), Proof of Burn (PoB), Proof of Capacity (PoC), Delegated Proof of Stake (DPoS), Propf of Authority (PoA), Proof of History (PoH) etc.

What is Proof of Work?

Proof of Work (PoW) is the first known consensus mechanism that helps in securing blockchain ledger. It was introduced by the Father of cryptocurrency, Nakamoto Satoshi. This consensus mechanism helps to prevent double spending on the blockchain. PoW helps to reach agreement before transaction or data is added to the blockchain. As mentioned earlier, to add a new block, am agreement has to be reached by the network. Proof of Work is used to reach the agreement. In blockchain, block are added to the chain of blocks by miners and they are the one that execute Proof of Work. The system of execution used in Proof of work is tedious as it involves miners to solve complex mathematical Puzzle.

What is Proof of Stake?

Proof of Stake is another type of consensus mechanism that helps in the securing cryptocurrency ledger. In proof of Stake, validators are chosen based on the number of cryptocurrency that they are holding. The validators do the work of adding new block to the blockchain. On Proof of stake, validators stake their crypto asset to act as network validators. The system use a random process to know who will be the next validator in adding new block to the blockchain.

Difference Between Proof of Work (PoW) and Proof of Stake (PoS)

| S/N | PoW | PoS |

|---|---|---|

| 1. | PoW is energy consuming as it requires more time to solve mathematical puzzle. | PoS does not use mathematical puzzle and at such, it does not consume energy. |

| 2. | Miners need to get gadget that are expensive for them to do computing | Validators need to invest in the Cryptocureency of the blockchain |

| 3. | Because of the mathematical puzzle involve with PoW, it is time demanding | PoS is faster than PoW because it is based on the number of crypto assets validators own. |

| 4. | Miners in PoW are involved in rat race | There are no miners in PoS. Validators are used in PoS blockchain. And there is no rat race in PoS compared to PoW |

| 5. | The first miner to get the mathematical puzzle is given block reward | validators are rewarded with network fee. |

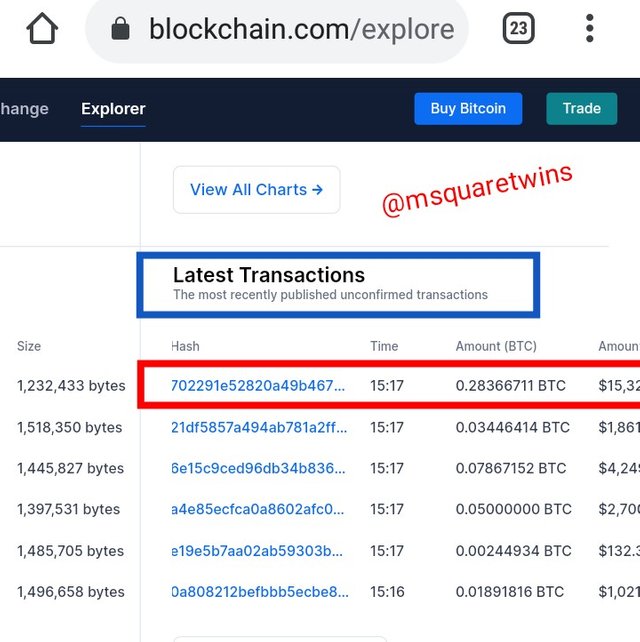

3. Enter the Bitcoin explorer and indicate the hash corresponding to the last transaction. Show Screenshot.

• To enter Bitcoin explorer, we go to bitcoin explorer site

• Then bitcoin explorer home page will appear foe you. scroll down the page to see transaction as shown in the screenshot below

• The click the last transaction as indicated by a red box in the screenshot above.

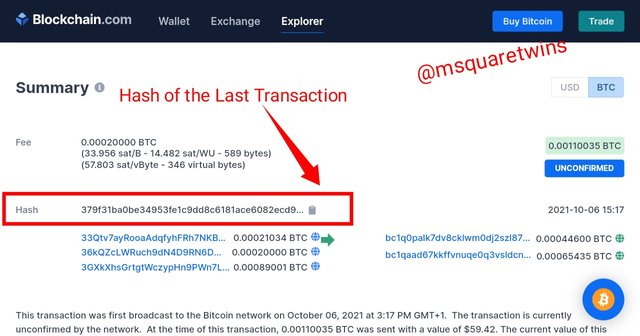

• The a page will appear that contains the information of this transaction as displayed below.

The hash of this transaction as indicated by a red box in the screenshot above is: 379f31ba0be34953fe1c9dd8c6181ace6082ecd93a3fbc10fb5e3c0b06dd4265

4. What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

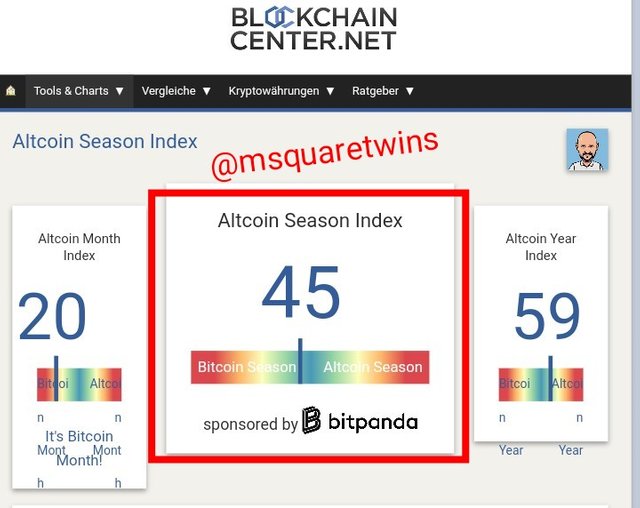

Altcoin Season is a crypto season usually 90 days where 75% of the top 50 cryptocurrency perform well than Bitcoin in market. During altcoin season, Bitcoin tends to lose it dominance.

Are we currently in Altcoin Season? No, we are not in the altcoin season. I got to know this from this site: https://www.blockchaincenter.net/altcoin-season-index/

According to the picture above, it is clear that we are not in altcoin season as the percentage of top 50 altcoin that performed well than bitcoin is just 45% and this is less 75% required for altcoin season to occur.

The picture below also shows that we are not in the altcoin season, instead we are in bitcoin season as displayed in the screenshot below.

From the screenshot above, the last Altcoin Season was around ending of March 2021 to July 2021 as displayed in the screenshot. This period is demarcated in the screenshot by red lines. During this period, the top 50 perforned better than bitcoin in crypto world and the performance recorded was ≥75% during this period. The start and the end of the altcoin season is indicated by the black arrow in the screenshot.

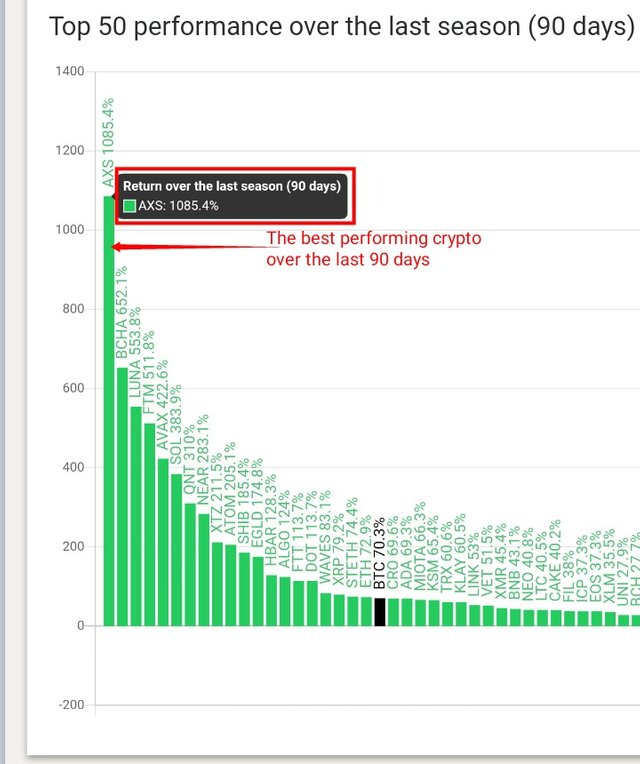

Mention and show 2 charts of Altcoins followed by their growth in the most recent Season.

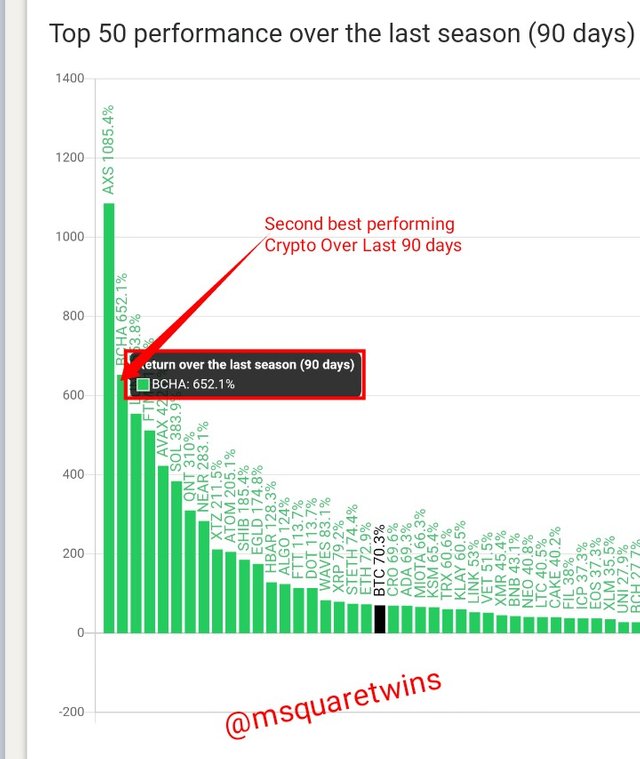

The first Altcoin I want to mention is Axie Infinity AXS. This crypto is the top performing crypto over the last 90 days as seen in the screenshot below with a return of 1085.4% over this period.

The screenshot below is taken from coinmarket cap. This is a chart of axie infinity over the past 90 days. The growth of this asset has bee linear of this period. As seen in the screenshot below, the crypto asset has experience increase in price from early August to this month. The price of AXS was around $12 early in the month of August. Then it rose rapidly until it reached around $140 dollar. This aaltxoin has been between $120 to $140 for the past few day now.

The second altcoin I am considering is Bitcoin cash (BCHA) This altcpin is the second best performing crypto in the last 90 days with return of 652.1% as seen in the screenshot below.

The screenshot below shows the chart of bitcoin cash over the last 90 days. And this crypto asset increased in value tremendously during this period. This altcoin was around $27.6 around early August but the price increase greatly and reached about $360 in early Septemver before it retraced to $197 where it currently is.

The reason for the increase in the price of this two asset over the past 90 days is because the buying capacity for the two crypto increased rapidly. Many people acquire the token within this period and that caused the price to increase.

5. Make a purchase from your verified account of the exchange of your choice of at least 15 USD in a currency that is not in the top 25 of Coinmarket (SBD, tron or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders / developers? Indicate the currency's ATH and its current price. Reason for your answers. Show Screenshots.

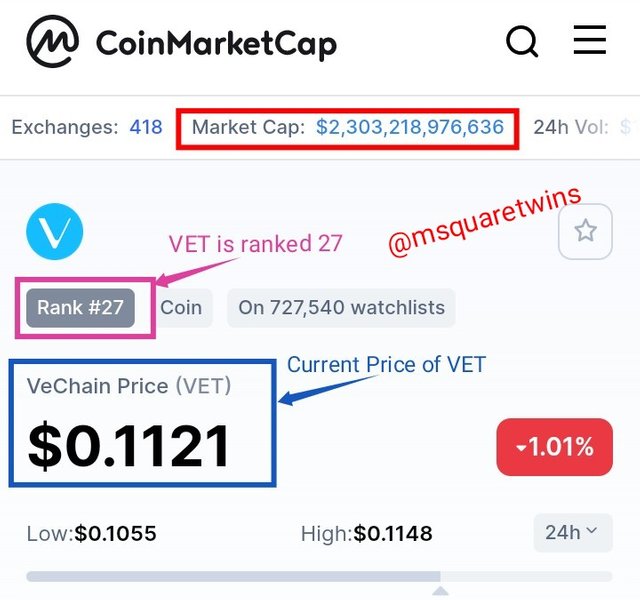

For this question, the coin I will be buying is VeChain token. And according to coinmarket, this token is ranked 27th as at the time of writing this tadk ad shown in the screenshot below.

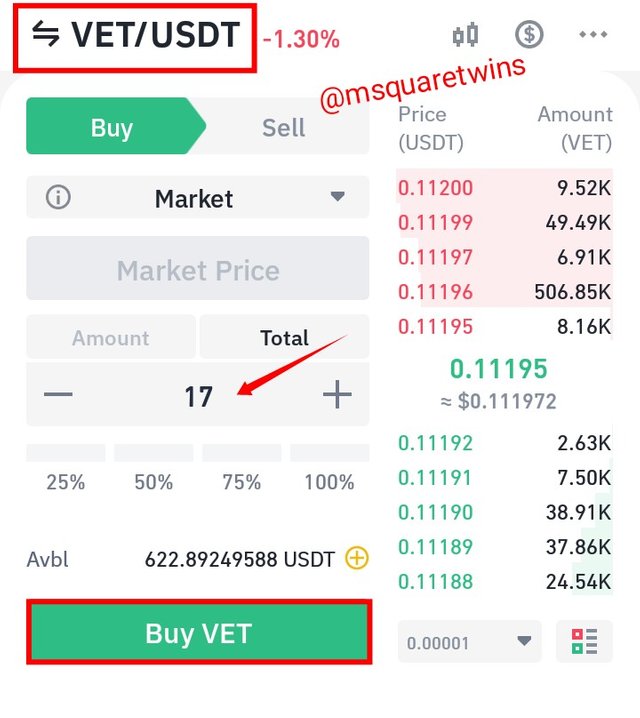

• Then having confirmed that the coin of my interest is not among the top 25 crypto, I then make purchase of VET token on my Binance account as seen in the screenshot below. 17 dollar of USDT was used to buy VET tken.

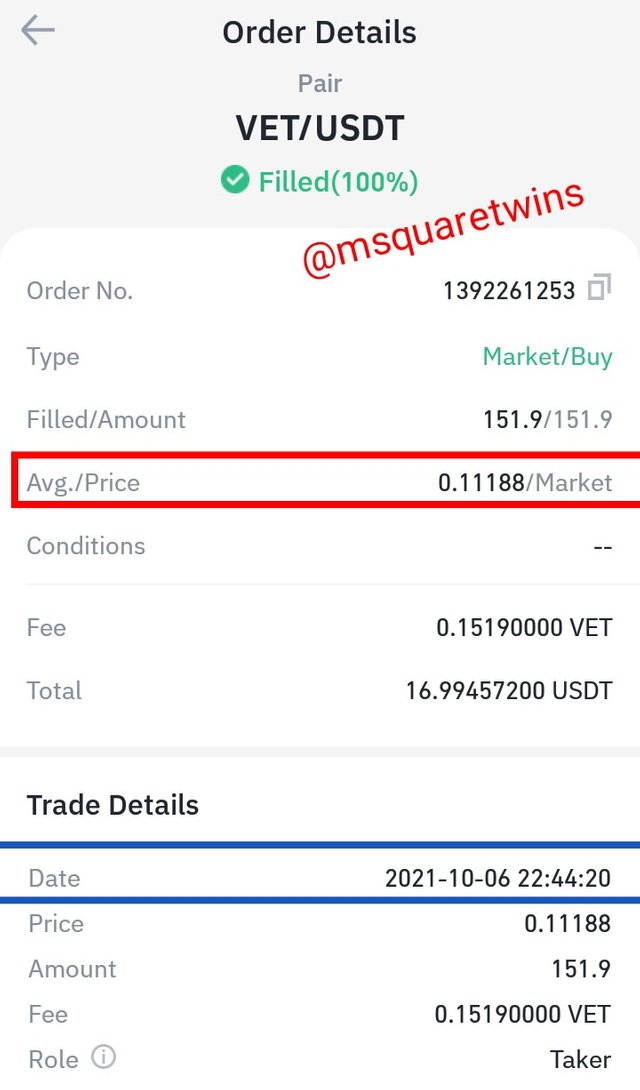

The last picture is the screenshot below is the order detail of VET/USDT . This asset was bought at $0.11188 and 151.9 amount was filled.

Vechain is a smart contract based platform that help to provide better management for business and enterprises which also inculcate the use of Internet of a thing. The token seeks to enhance the business operation and products around the world. This vechain system came to being in 2015. The vechain is based on internet of things and management of supply chain. It is was developed in 2015 by Sunny Lu.

The picture above shows the market Stats of Vechain token. According to Coingecko the current price of VET as indicated in the screenshot by a red box is $0.111372 with market capitalization of $7,459,827,094. As seen in the above picture, VET token made it All Time High (ATH) of $0.280991 in April 19th this year as indicated by a blue box in the screenshot above.

Reason Why I chose VET token

The reason why I chose to invest in VET token is that it has a potential for maximum return in the future because of it current growth. This project was created in 2015 and its current market capitalization is more than 7 Billion. This tells us that many people has invested in this project and that the buying capacity of this coin is increasing. Additionally, in Vechain, each block forms at every 10seconds which is faster than many of it counterparts.

Conclusion

The development of Bitcoin has opened ways for thousand of crypto currency around the world. The adoption of bitcoin since it inception has been growing even till date and this has led to development of many blockchain and cruptocurrency. This technology has revolutionized the world and has greatly affected many major field. Thanks to the father of cryptocurrency, Satoshi Nakamoto who developed and created bitcoin, the first cryptocurrency.

Many fields are constantly benefiting from the blockchain technology. For example, many football teams in sport industry now have tokens which they sell to their lovers or fans and which in turns help them to generate profit. The fans use the token to partake in the decision and also do some other things. Not only that,DApps are also made possible because of the innovation from bitcoin that has spread to so many blockchain. What of NFT? Blockchain has also made it possible for artist to sell their work and collectible for a greater profit as compared to the traditional ways of doing it before as a result of Non Fungible Token on different blockchain.

The relevance of bitcoin and many other cryptocurrency is maintained through halving, one of the the creative way used to slash the supply of cryptocurrency in circulation. The better thing about cryptocurrency is the high level of security that it offers for the holders of crypto. This security is achieved through different consensus mechanism used in blockchain technology and of course through cryptography.

Special thanks to Prof. @imagen for this great topic he taught us this time around. It added a whole lot to me.

Written by : @msquaretwins

Cc: @imagen

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit