Introduction

The close of week 8 of season 4 in the crypto academy is already coming to an end. I hope you have been enjoying this week. I am Kehinde Micheal and my username is @msquaretwins here on this great platform. I have read and understood the concepts of Capital Management and Trading Plan presented by Prof. @lenonmc21 in the beginners class of the academy. Therefore, in this post I will be answering the series of questions posted in the homework section. Happy reading!

1. Define and Explain in detail in your own words, what is a "Trading Plan"?

You may hear the phrase "If you fail to plan you are planning to fail". Planning is an essential part of life and it can mar or make businesses, projects, goals or any set vision. Without planning, it may be highly difficult to achieve a set goal or objective.

Before a man begin to build house, he first sit down, count the cost to know what he will need to get for the project to go on smoothly. If this is not done properly, the success of the project will be doubtful. A pilot does not take off from the ground without first plan how his take off is going to look like. As individuals, we plan our daily life, what to eat, cloth to wear, decision to do something or the other. All these are to tell us that the importance of planning can never be overemphasized.

Planning in trading is not an exemption. In fact! It is very important in trading because it deals with capital. So what is a Trading plan in essence? Trading plan is a rule, regulation or standard set by investors to guide their trade decision. Trading plan help traders to stay focus when executing trade order or strategy in market. A good Trading plan answer the question of how, when and why.

Trading plan will help traders to know exact time and why a trader should take trade and time to stay out of market. Trading plan is often based on individual personality, trading idea and expectation based on his experience in market.

Trading plan takes into account all the essential parameters of trading to be able to execute a perfect order. Essential parameters of trading like the size of lot to take when buying or selling an asset, the capital management in form of the percentage of the total capital to risk, the percentage of profit a trader set, percentage of loss he can afford to lose on a trade and the trading style or system used by individual.

If all the parameters and conditions set by trader in his trading plan are not met or fulfilled, it may affect him, so in that case, he allows it to go until he sees the favourable conditions that fully meet his plan before he decides to enter market.

2. Explain in your own words why it is essential in this profession to have a "Trading Plan"?

The same way we do planning for food menu, building projects, business idea etc, in the same way, planning must be done for traders to achieve their set goals and objective. Whatever you have committed your life to do is part of your life and then you must plan for it. This is because you will always spend your time, energy and resources on it. Therefore, for your time and resources not to be spent frivolously, it is important to plan whatever you commit your life to, and in this case, trading. So it is worth planning for.

It is important to plan our trade because it can help us stay out of market trouble by helping us not to take bad decision in trading. Additionally, trading plan is also useful because it helps traders to manage their emotion even when the odd is happening to them in market.

For instance, sometimes around May this year, in one of the week, I was trading XAUUSD and I have made gain a day previous to the odd day for me. There was no trading plan for me since I didn't set any, I was just entering market as opportunity presented itself. On that faithful day I lost more than $40 on XAUUSD but not at a time, but on the same pair. I think took the order 5 or 6 times.

The emotion was just driving me that I can make what I have lost in the previous order and I kept taking order till I lost more than the aforementioned amount. Look at it this way, If I had trading plan, say, after 2 loss a day or maximum 3, I will leave market, I might not incurred loss up to that amount of money I lost that day.

Furthermore, having a plan make traders to be disciplined and consistent. Discipline and consistence do not come in trading without a written down plan. For instance, If it is part of my plan to always take 4 trade orders every day from Monday to Thursday unless if the lost incurred is up to 2. This will help me to be disciplined and as such I will maintain a consistent life of trading.

3. Explain and define in detail each of the fundamental elements of a "Trading Plan"

As said earlier, trading plan takes into consideration so many elements, conditions and parameters. In this question, I will be explaining the basic elements of a trading plan. But before that, let's try and list them first. The fundamental elements are;

• Capital Management

• Risk Management

• Trading psychology

• Monthly Planning and Control of Account

Capital Management

Capital management is very important aspect of trading plan. This is because without capital in the first place, you can not think of entering a trade. Planning start right from here. In this place a trader must ask himself if the fund in his account is sufficient enough to take a trade order. What are assets the money can be used for because cryptocurrency are volatile and the volatility differs from one crypto to the other?

For instance an account of $20 may not be able to take many trade for BTC/USD considering the level of volatility in this pair, whereas, such account may be able to take many order if used for another pair. So, this is part of the questions to consider in capital management.

More so, in capital management for trading plan, traders determine the amount of money they are will to risk for trade orders. This is done to determine the certain or specific percentage of total capital we are willing to lose per a trade order.

Example of Capital Management

Deciding the percentage of loss: It is very important to determine the percentage of the total capital one is willing to lose per trade. For instance, for beginners who are just starting, the may risk 1% of their capital. For example one percent of $200 is $2, and 1% of $400 is $4. That means, a trader with $200 in his account can afford to lose $2 per a trade. Traders with sufficient knowledge and experience in market may raise the percentage they are willing to lose.

Setting Profit Percentage : It is also very important to plan the profit percentage. It is not only important to know the specific amount one is willing to lose, it is also very important to set and plan the percentage of profit per trade. Of course, the aim of every trader is to make profit. So if the percentage of loss set by a trader for every trade is 1% of total capital, the profit percentage could be 1%, 2% or maximum 3%. Profit percentage should not be less than percentage of loss.

Trading days and Time: This is another important part of capital management in a Trading plan. Traders must be able to set time and days to trade and stick to it for effectiveness and efficiency. Some traders fail to do this and this makes them to fall sick unnecessarily. For example, a trader may set his trading operation day from Monday to Thursday. This will help him to relax and do some other activities on Friday, Saturday and Sunday and as such, he or she will be refreshed. Another important thing is time, a trader must be able to check and set the exact time of the day that works better for his trading style or strategy.

Risk Management

Another important element of a trading plan is risk management. If risk is not properly managed it will affect the capital and that may cause a huge loss in the long run. In trading, the number of wins is not always 100% percent. That is to tell you that traders do not only win they also lose. But as I said, the goal of every trader is to keep the losses minimal while maximizing the profit. This is where risk management comes into play. Risk management helps to keep under control the losses that may be incurred during trading.

Example of Risk Management

Let assume that I wish to lose maximum of 2 trades per day and maximum 5 wins per day to keep the loses under control. This means, if I trade and win 5 orders per day, I leave the market regardless of any other opportunity I may see again on that particular day. Also if otherwise happens and I lost 2 trade orders, I must immediately leave the market and terminate trading for that day.

Trading psychology

It is also very important to train and plan our psychology. This very important because if the psychology is not properly trained it can disrupt what you have previously planned in capital management and risk management. Additionally training psychology is also important because trading always comes with emotion. These are the few things to take note;

- Never let the emotion dictate your trading. It is very important not to be emotional why trading, always stick to your plan.

- Greediness can run your plan: Don't be too greedy. Greediness can make you to lose what you have earned in market. Watch out for this please.

- Check the time that is best for you and operate only during this time for efficiency and effectiveness.

- Trading requires monitoring and proper attention. Therefore, you are advised not to trading if you are busy.

Monthly Planning and Control of Account

The last element in a trading plan in this task is planning and control of account. This is done to control and to have view of target for days, weeks, or month. This will help traders to know what he can make per day based on the number of trades he planned daily, and to be able to calculate the specific amount of profit he can make per day and consequently for month.

For instance, if a trader plan 1% profit per trade for his initial capital of $200 and planned a maximum of 3 entry per day, and intends to trade 4 times a week. This means that the profit/trade will be $2 and the profit/day will be $2x3 ($6), and the profit/week will be $6 x4 ($24). The profit per month will then be $24 x 4($96). If the trader is consistent, he can continue with the profit he has made plus the initial capital, ($200 + $96) for the next month. And then continue like that till he decides to withdraw part of the money or certain amount. This is now planning and control can help a trader achieve monthly goal.

4. Build a “Trading Plan” and cover all the basic elements discussed in the class. For this, you should NOT take the examples that I put in my class (Including the example amounts), use your own examples and your own images to make said plan, you must also base this "Trading Plan" as if you were operating on the platform of " Binance ”, taking into account that the minimum amount of exchange or investment is $ 10.

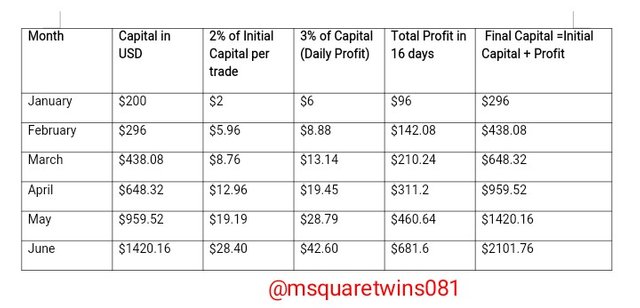

The screenshot below is the table of a trading plan covering all the basic elements of a trading plan discuss in this task.

As seen from the screenshot above, the table has six columns. Each column is explained below.

Column one: This is the column that shows different months, from January to June. Basically, this column is the column of month.

Column two: This column is the column for initial capital for each month. The capital for January is $200. Note that for February the initial capital would be the final capital which is the initial capital plus the profit made in the previous month, January. And the initial capital capital for March will be the final capital of February which is initial capital plus the profit made in February. And the next goes the same way.

Column three: In this column, I find the amount I wish to risk per operation, here it is 2% of the initial capital.

Column four: Column four contains the percentage of the daily profit. For this it is 3% of the initial capital

Column five: Column five contains the total profit in 16 days for each month.

Column six: This column is the column for final capital which is the summation of initial capital and the total profit for 16 days.

For this task, the Capital management goes thus;

The initial capital I started with is $200 and and I set I risk 2% of the initial capital per trade and with 3% profit target per day. The number of trade days per week I put into consideration is 4 times precisely Monday to Thursday. I chose this to be able to get some other things done from Friday till Sunday. In total, the number of trading days per month is 16.

For risk management, it goes thus; Basically, 3 to 4 trades per day is put into consideration to put the losses under control so as to effectively and efficiently manage the account. In short, I wish to have maximum 4 trade per day and maximum to loss. This means that if i lose 2 trade, I will get out of market and end trading for that day. Also if i win 4 trades, I withdraw from market.

And for trading psychology, I am a morning person, I planned the table above planned to execute them in the morning and I would make sure that the emotion did not affect the trading plan highlighted above. Noting that it is not a good habit to trade when I am not emotionally balance or when I am not in the right frame of mind, I will also make sure that I don't take any order when I am not emotionally okay. And more importantly, I will not take a trade during my busy time.

And finally for planning and controlling of account, as highlighted above, the capital I will start with is $200, with this, I will risk 2% of this initial capital and the 3% of this capital per day. And the trading days will be from Monday to Thursday making a total of 16 days in a month. The profit generated will be added to the initial capital which will be the starting capital for the second month. I will repeat this procedure for six month as highlighted in the table above.

Conclusion

Capital management and Trading plan is a key part of trading. This is because it serves as the foundation of trading. If this part of trading is faulty, the whole part is in danger. It is therefore recommended for traders to master the act of capital management and trading plan to be able to control their account and also solve some emotional part of trading.

The basic element of a trading plan, like capital management, risk management, trading psychology and controlling of account must be understood for efficiency and effectiveness in trading.

Special thanks to Prof. @lenonmc21 for this great topic he presented in the beginners class. It added a whole lot to me.

Written by :-@msquaretwins

Cc:- @lenonmc21