Introduction

It is the first week of Crypto Trading Competition and I am not only happy to be part of this competition, but also happy because I will be able to put all I have been learning since I joined the academy into practice. I am Kehinde Micheal, and my username is @msquaretwins here on this great platform. For this week trading competition, I am happy to announce to you that I will be joining the team FRONTLINE led by Professor @dilchamo and @shemul21. I hope to give my best as part of this team. Happy reading!

My first Cryptocurrency I will be trading for this week is TRX. Let's see wonderful thing about this crypto.

Introduction of TRON Coin

Tron is a decentralized blockchain system that was founded by a man called Justin Sun in year 2017. Justin Sun is a popular man that is known for technology and entrepreneurship. Tron foundation was developed to help the growth of the Tron ecosystem and since the launch of the project, Justin has been the team lead. The project was developed to reduce the use of centralized platform of online payment. The main focus of Tron blockchain in the area of smart contract.

The mainnet of the Tron ecosystem was released in June 2018 after a successful initial coin offering. Based on market capitalization, Tron has taken top 20 crypto in the list of cryptocurrency. Tron helps developer of Decentralized Application to create their App and to use it via smart contract. The transaction speed is part of what makes the platform unique and maximally sought after by many DApps developers. The platform has the ability of processing 2000 transaction per second. More so, Tron has a very low transaction fee and that makes many traders to use it for transaction.

History of Tron

The early background of Tron can be traced back to year 2017. It was this time that the CEO of the foundation, Justin Sun created a non profit organization which is Tron foundation. The aim of the organization was to build a decentralized internet infrastructure. Justin Sun graduated from Ma’s Hupan University, China. His background set him in tone for the techworld.

There are many things that can be achieved on the platform. Token assets can be issued on the platform. Development and smooth running of DAPPs is possible on Tron platform as well as staking and voting to gain more reward and assets transfer.

What is TRX

TRX is a short name for Tronix. It is a native token of Tron blockchain. It is a utility token that is used as currency for all TRC token on the Tron ecosystem.

The current market capitalization of TRX is $6,376,199,628, and the market trading volume is $1,032,543,913 which is quite okay. This show that investors are investing on this project. The total TRX stake is 28,487, 725,318 and the staking rate is 27.99% as seen in the screenshot below.

source

sourceThe total circulating supply is 101,769,814,727 as seen in the screenshot below.

source

source

Exchanges where Tron Can be Bought

• Binance: TRX can be bought and exchanged on Binance exchange platform. Almost all countries can use this platform expect the US resident that are not eligible to buy TRX from this exchange platform.

• Bitpanda: This is another platform where TRX can be gotten. This platform is suitable for European residents. People outside Europe are not allowed here.

• Uphold: TRX can also be gotten from this platform, but just that it is srightly for US residents and people outside IS are not allowed to use this platform.

• WazriX This exchange platform is the one designed specifically for China.

• Kucoin: TRX is also tradeable on kucoin exchange platform.

• coinbase : TRX can be traded on coinbase

Some other exchanges where TRX can be obtained are; Cryptoradar, Kraken, Simpleswap, stealthEX CEX.IO.

Let's take a look at the technical analysis of the project.

Technical Analysis of TRXUSDT

Here I will perform a technical analysis of TRXUSDT.

Daily Timeframe of TRX/USDT

The chart uploaded below is a chart of TRXUSDT on a daily time frame. As seen in the screenshot below, The asset has been bearish for a while now as confirmed by market structure. Price keeps making series of Lower Highs (LH) and Lower Lows (LL) on a daily time frame. The immediate resistance and support level are identified on this time frame. A demand zone is also identified as marked by a blue box in the screenshot.

It is visible that we are still very bearish on this pair since the previous high was not broken. Until the previous high is broken, we consider this pair bearish and we look for every opportunity to take a sell order.

Then, I switched my chart to 4 hours timeframe to do multiple time frame analysis of this token.

4hour Timeframe of TRX/USDT

The chart uploaded below is a chart of TRX/USDT on a 4 hour time frame. At the switch of the chart to 4 hour time frame, we can see that we have same market structure as that of daily time frame. As we can see, price has broken the previous bullish structure and has turned to bearish structure in this time frame as well. This is visible, as price keeps making a series of Lower Highs (LHs) and Lower Lows (LLs). Both Daily Timeframe (TF) and 4 hour TF have the same directional bias.

Then, I switched the chart to 2hour timeframe.

2hours Time frame of TRX/USDT

The 2hours time frame of TRX/USDT asset is uploaded below together with a stochastic oscillator as seen in the screenshot below. Just like daily and 4hours time frame, the 2hour time frame of TRX/USDT also aligned perfectly with the bearish bias on daily and 4hours. This means, that Daily, 4hr and 2 hrs time frame are saying the same thing about the direction of the asset. Perfect!

As said earlier, stochastic oscillator is added to this chart to further reinforce the technical analysis. Stochastic indicator is a powerful indicator that is used to measure the momentum of an asset. It is also used to determine the trend direction of an asset. More so, this indicator, just as Relative Strength Index (RSI) measures the overbought and oversold region of an asset. The overbought region ranges from 80 to 100 where the oversold region of stochastic oscillator start from 20 downward. When an asset is overbought, sell order is always envisage and when it is oversold, traders look for opportunity to buy it.

The stochastic oscillator have two lines, %K line and % D line. The cross of this lines at the overbought region mean a sell signal while the cross of the lines at the oversold region signifies a buy signal.

Now, let's take a look at the picture uploaded below again. We can see that, at a resistance level, the stochastic lines enters overbought region and crossed each other as indicated by a red box in the screenshot. This therefore present a sell opportunity.

At the cross of the stochastic lines at the overbought region which also lies perfectly to our resistance level, I took a sell order immediately.

The entry price of the sell order is $0.06272, and the stop loss order was set at $0.06540 and the take profit order one is at the support level around $0.0610 and the final take profit is at $0.05936 as seen in the screenshot below.

Demonstration of the real Trade order on Binance Exchange Platform

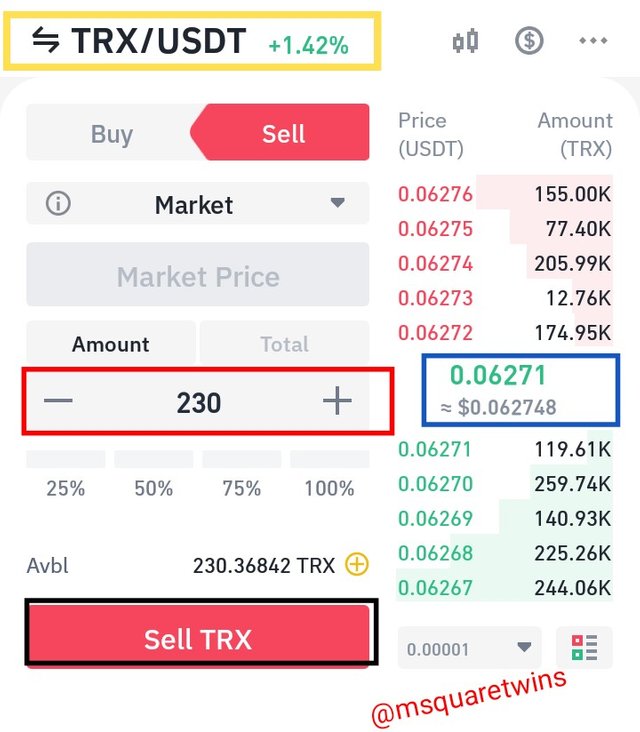

The sell order of TRX/USDT was done on Binance platform via spot trading as displayed below. At a market price of $0.06271, I made a sell prder of 230 TRX as displayed in the screenshot below and the order was executed.

The picture below shows the order details of a sell order of TRX/USDT. As seen in the screenshot below, we have filled amount of 230 TRX as indicated by a red box, and at a price of $0.06721.

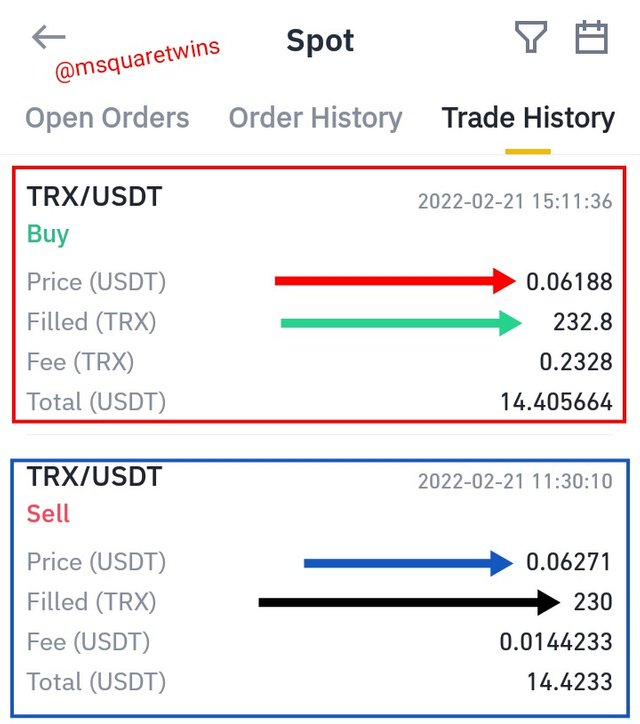

The picture below is a trade history of TRX/USDT which also shows the filled amount to be 230TRX and price $0.6271

Result of TRX/USDT Order

After some hours, price reached the support level where the target order for TP 1 was placed and at the same time, stochastic oscillator also entered the oversold region and the two lines of the oscillator crossed each order at the oversold region. This signal a buy order. I then exist a sell order and bought TRX at this point.

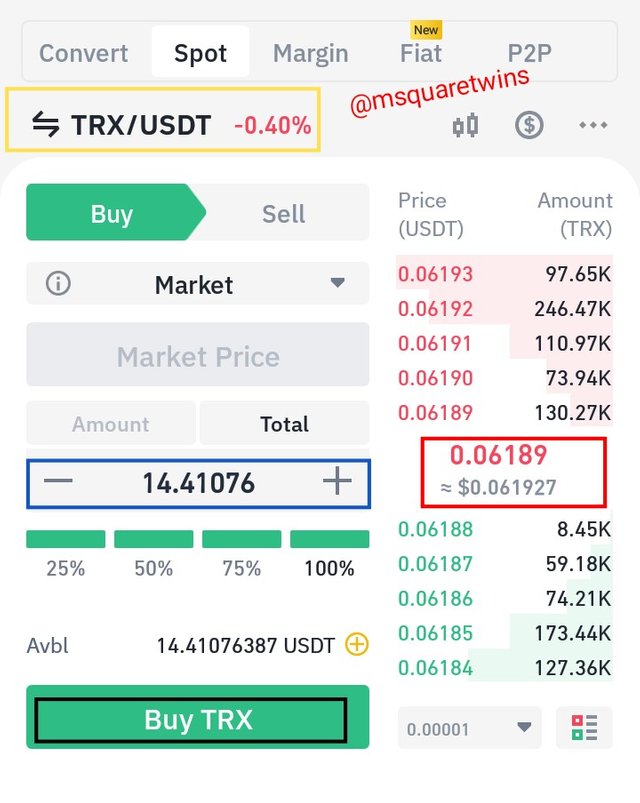

Then after a reaction at that support zone, I bought TRX at a market price of $0.618 as seen in the screenshot below.

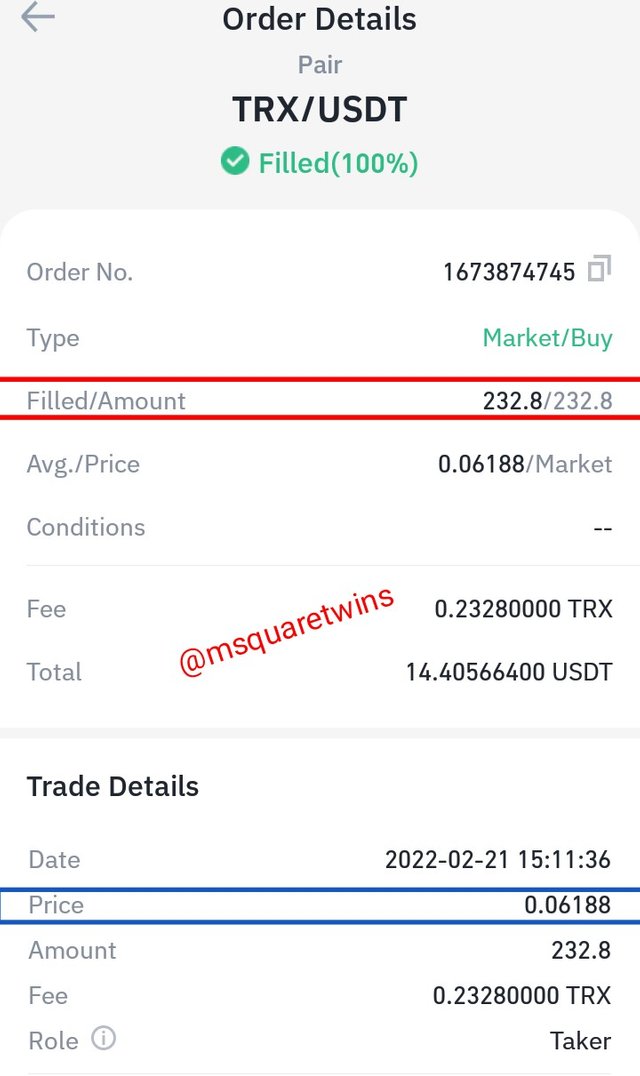

Then the order get filled. I know have 232.8 TRX as seen in the screenshot. Now let's see if the trade is a lrofit or loss.

The picture uploaded below is a trade history of both sell and buy order of TRX/USDT done on Binance spot trading. As seen in the screenshot below, I sold 230 TRX at a market price of $0.06271 and I bought it back at $0.06189 to get 232.8 TRX. From this transaction, I made a profit of 2.8 TRX (232.8 TRX - 230 TRX).

Why are you optimistic on this token today, and how long do you think it can rise?

I am optimistic about the token because many investors are investing on the token. More so, the trading volume shows that traders are trading the asset. Also, the market structure of the asset is very clean. This is because, almost all the timeframe analysed shows a bearish direction of the asset. Hence, I am optimistic about the token.

Before TRX can be rise, the resistance zone must be broken upward. But at it stands, I believe price will go to the support zone first and if it fails to break the support zone, TRX may experience a rise from there.

Do you recommend everyone to buy and the reasons for recommending/not recommending?

I will recommend trader to buy TRX especially at the support zone. If the price of TRX that is falling now fail to break the daily support zone which was identified on the daily time frame, then I believe, TRX will experience a massive buy up. So at this point, I will recommend traders to buy TRX.

Conclusion

In this post, I have clearly given the historical background of Tron coin and I have given the introduction of the project. Not only that, I have also explained the native token of Tron platform and the use cases of the token was also mentioned. More so, i also listed some exchanges where TRX can be gotten.

Finally I did a technical analysis of the token using multiple time frame analysis and also with the help of a powerful indicator called stochastic indicator. Proper resistance and support level were also put into consideration in the analysis along with the indicator and time frame analysis done. Also, real trade orders were taken on Binance spot trading and the result and trade history were uploaded in this write up.

Special thanks to my team Leader, Professor @dilchamo and @shemul21 for their guidance and I hope to hear from them soon.

Thank you for reading through.

Link to the original post : https://steemit.com/hive-108451/@msquaretwins/trx-usdt-sell-or-s6w1-or-team-trading-contest-post-for-team-frontline

Professor @shemul21, please this repost for week 1 of the trading contest done for your team has not be curated.

I will appreciate your help on this.

Thank you.

Cc: @shemul21

@steemcurator02

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit