Introduction

Hello Crypto Lovers,

I welcome you to week 7 in Season 5 in the steemit Crypto Academy. Merry Christmas to you and Happy new year in advance. My name is Kehinde Micheal and my username is @msquaretwins here on this great platform. The first lecture I read this week is on Risk Management and Trade Criteria which was presented by Professor @reminiscence01 in the beginners class. Therefore, in this post, I will be answering the questions posted in the homework section. Happy reading!

1. What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?

Cryptocurrecy trading is associated with great risk because of high volatility therein. Many people lose money in crypto trading because of poor risk management. As traders, It is not enough to know great strategy that can be of great advantage to your decision in market. Without proper knowledge of risk management in trading, all your trading strategy or ideology will prove watery and as such, you will not stay long in market.

Risk management means action taken before an order is executed to control the losses that may be incurred in unprofitable trading which helps to safeguard the trading capital. In essence, risk management is the strategy employed in trading to keep the loses to the barest minimum. We can therefore say that risk management is the forecasting and controlling of losses from trades that go against prediction. It is the most essential part of trading because if a trade get it wrong with risk management, he has gotten it wrong in so many ways.

Traders often suffered great loss when their trades is not properly managed, and this is where risk management comes to play. If a trader has good knowledge of risk management, if though he lose some trader orders and win some, he may still be profitable with proper risk management.

Importance of Risk Management in Crypto Trading

• It Helps to Control Losses: Like I have said, cryptocurrency market is very volatile and as such if proper risk is not put to place, traders can lose all his invested money or trading capital. But proper risk management helps to control the losses that may arise from any unprofitable trade order.

• It Helps Traders to Develop Confidence: Another great advantage of risk management is that it gives confidence to traders. Traders who have great knowledge of risk management and put it to practice often have peace of mind in their trade orders and this gives them confidence knowing fully well that their orders are not taken without putting risk management in place.

• It Helps Traders to be Focus: A trader without proper risk management may think his strategy is not good enough when he continuously lose in market, and that may make him to be moving from one strategy to the other. Having a good risk management therefore empowers traders to be focus and consistent with their strategy.

• It helps Traders to Control Emotion Trade orders that does not taken with good risk management may batter the emotion of traders. This is because at any loss in market, they may want to keep chasing the market in order to recover their loss which is not a good way to trade. Risk management however helps traders to control their emotion in market.

2. Explain the following Risk Management tools and give an illustrative example of each of them. (a) 1% Rule. (b) Risk-reward ratio. (c) Stop loss and take profit.

Like I have established above, cryptocurrency is a volatile market, to be profitable as traders, proper risk management must be put to place. In this question, I will explain and clearly illustrate some of the management tools traders can used for proper risk management.

(a) 1% Rule

This is one of the great risk management tool that most traders use in trading for proper risk management. 1% rule is a strategy that used to minimize the losses and safe the entire trading capital. The one 1% rule is nothing but not risking more than 1% of the trading capital. Profitable and successful traders don't risk more than 1% or at most 3% of the total trading capital. This is employed to keep the trading account healthy and to avoid the blowing up of account.

To make an Illustration of 1% Rule, let's assume I funded my trading account with $200 and that is all I have in my account and I want to employed 1% rule. Risking 1% of my $200 (1/100 x 200) account on any trade means, I will just lose $2 out of my trading capital on any unsuccessful trade order taken.

Let's now assume that I open 5 trades order and the whole orders go against the prediction, it means I will lose a total $10 ($2 x 5) out of my trading capital. With this, my trading capital will remain just $180. Therefore we can see that with 5 losses, I still have enough capital to trade.

But what happens if I risk like 12% of $200. It means I will lose $24 (12/100 times $200) on any unsuccessful order taken. And with 5 losses in a row, a total of $120 will be lost. This means the trading account is already bleeding. We can see the power of 1% rule. It is a great way to protect trading account.

(b) Risk to Reward Ratio

Another important strategy or tool to maintain proper risk management is setting risk to reward ratio. A trade order taken that is going well may reverse and then enter loss back if proper risk to reward ratio is not set. Or the amount of money lost may be huge if there is no promotion for risk to reward ratio. It is recommended to use 1:2 Risk to reward ratio or above.

For instance, If I am risking a $5 on a trade, then my profit target should be at least $10. A trade with the same amount of risk and reward does not worth taking. Some people use the same amount for risk and reward, like 1:1, this is not quirt health in crypto trading. If a trader is risking say $5 dollar, he should expect to gain times 2 or more than what is risking.

(c) Stop loss and take profit.

Stop loss and take profit are both order that is set to manage risk in trading. They are called exit orders. Stop loss helps to close a trade order when a trade order goes in a wrong direction against the expectation or prediction of a trader. It helps to close a trade at a loss. Take profit order in the other hand helps to close a trade order at a profit after the trade has move in a positive direction to a point.

It is good to have it in mind that trade can either go in your direction or go against you, and as such before an order is taken, there should be predetermination of stop loss and take profit order.

In setting trader order as regards to stop loss and take profit, different strategy used to do that. Market structure, resistance and support line, indicators and chart pattern can be used in setting these trade orders.

It is pertinent to know that stop loss order should be set in line with what a trader is willing to lose. The amount a trader is willing to lose per trade will also determine the kind of lot size he uses to take a trade order. All this should be put to consideration in setting stop loss order in trading with proper risk management. Also, take profit order should be at least two times the amount a trader is willing to lose.

3. Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required). (a) Trend Reversal using Market Structure. (b) Trend Continuation using Market Structure.

The following are expected from the trade.

• Explain the trade criteria.

• Explain how much you are risking on the $100 account using the 1% rule.

• Calculate the risk-reward ratio for the trade to determine stoploss and take profit positions.

• Place your stoploss and take profit position using the exit criteria for market structure.

(a) Trend Reversal using Market Structure.

Entry Criteria

• The picture uploaded above is the chart of ADAUSD on a 5 minute time frame. As we can see, price was making a series of higher highs and higher lows which indicates that the asset is in bullish trend.

• But at a point, price failed to create a new high, then in a short while, price reversed to break the previous low which then confirms the break of market structure of the current bullish trend as indicated by a red box in the screenshot.

• Then after the break of the market structure, price come back and makes a retest of the broken low and then form a resistance. Then after the retest of the broken support, a trade order is taken after the formation of a bearish engulfing candlestick.

Exit criteria

• For a stop loss order, a stop loss order was place slightly above the new resistance. It was placed at $1.581112. The trade order will become invalid if price come and touch the stop loss order.

• The take profit order was also set. This was set targeting the nearest support level such that the risk to reward ratio is 1:2.

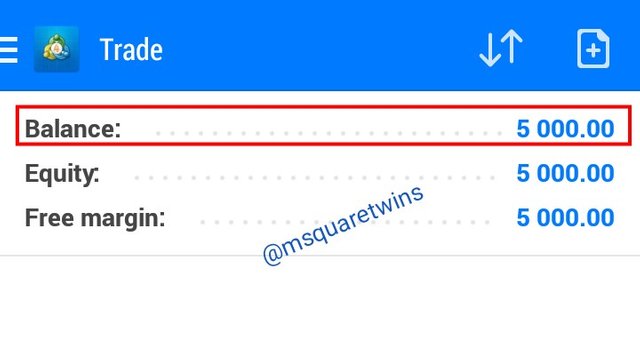

The I opened my MT4 App to perform the sell operation. Firstly, I took the screenshot of my available balance. The screenshot below shows that I have a total of $5,000 in my trading account.

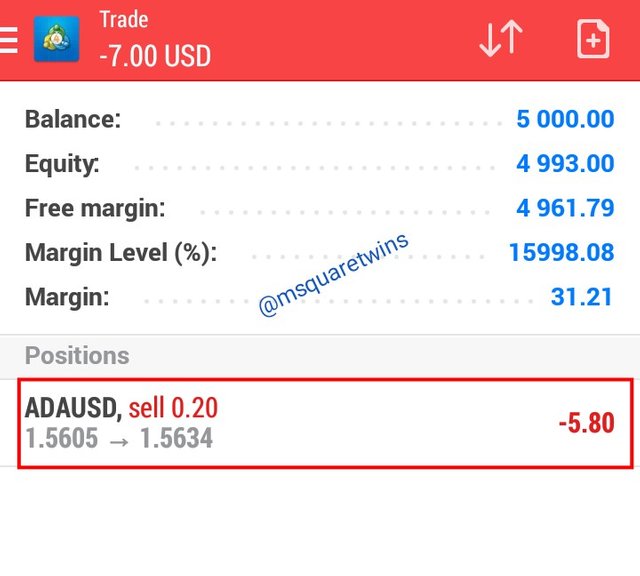

Then I proceeded to take the trade order. The entry price is $1.5605 and the stop loss order is $1.5811 and the take profit order is $1.5154

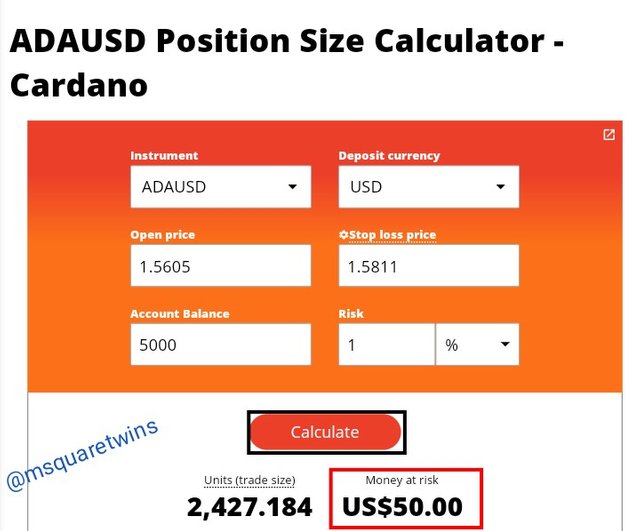

For this trade, I used 1% rule, I risked 1% of my trading account. That is (1/100 x $5000) which is $50. The image uploaded below shows the trading size and the risk of my trading account after putting my entry price and stop loss price in the box provided to get the calculation.

source

sourceThe screenshot uploaded below shows the order taken on chart. The entry, stop loss and take profit order is indicated on the chart.

The screenshot uploaded below shows the running order of of ADA/USD immediately it was taken.

(b) Trend Continuation using Market Structure

• The chart uploaded below is a chart of XRPUSD on a 3 minutes time frame. As we can see, price was making a series of higher high and higher low. Then price broke the previous high upward and then came back to make a retest of the previous high as indicated in the screenshot

• Then price reverse back up with a buy candle as indicated in the screenshot. At the close of this candle, a buy order was made.

Then after the formation of a bullish candle, a buy order was taken. The entry price is $0.94622 The stop loss, which was placed below the new support is $0.93300as seen in the screenshot below. The take profit was set at $0.96392 such that the risk to reward ratio is about 1:2

Then I opened my MT4 App to place the buy order. I took the buy order with 0.37 Lot size. The calculation used for this lot is explained in the next screenshot.

The picture uploaded below shows the position size calculation mentioned above. In the calculation, I put the open price and the stop loss and then indicated the percentage of the risk and the balance and then clicked calculate. Then the result appeared for me. The money at risk is $50 and the trade size in unit is 3,787.879 as indicated by a blue box in the screenshot.

Now to get the lot size:

1 units of XRPUSD = 0.0001

3,787.87 unit = L

L = 3787.87 x 0.0001 = 0.37

Therefore the lot size to be used is 0.37

Hence, the reason for 0.37 lot size used above.

source

sourceThe picture picture uploaded below shows the buy order of XRPUSD on MT4 Chart. The entry, stop loss and take profit order are indicated.

The picture uploaded below shows the running order of XRPUSD taken immediately the order was placed.

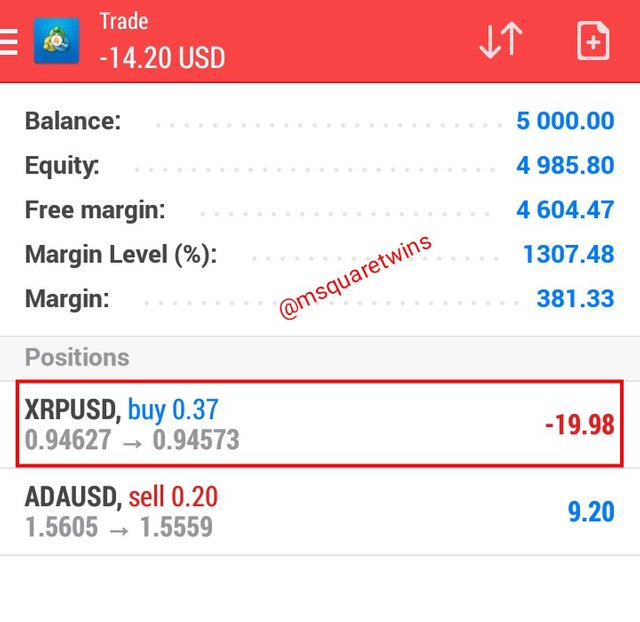

Then after some time, I checked both order taken and I saw that the two orders are moving nicely as uploaded below.

Conclusion

Risk management is an important aspect of trading which must be inculcated in the trading strategy to be profitable. It helps to minimize or cut losses that may be incurred in any unsuccessful transaction or order. More so, risk management helps traders to be confident and to control their emotion.

In this post, I have explained the meaning of risk management and different risk management tools that are employed and clearly illustrated each of them. Finally, I opened a demo trade for both trend reversal and trend continuation with clear explanation of of trade criteria, 1% rule of risk management, risk to reward ratio and stop loss and take profit.

Special thanks to Professor @reminiscence for this great lecture.

Hello @msquaretwins , I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

I'm impressed with your submission. Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Professor @reminiscence01 for the review, and many thanks for the quality lecture presented in the class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice one Twin @msquaretwins

Compliment of the season

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Same wishes @cinnymartins. Happy new year in advance.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello bro, I’ve tried using the Meta Trader 4 App for demo trading but I don’t quite get how to add the assets to it.

It only has a few assets there I can add and not Crypto

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@abdulkahargunu, to do add more assets, click the + icon as indicated in the screenshot below by a yellow box.

Then, scroll down and click on cryptos to add more asset.

However, it depends on the broker you are using. You can consider eaglefx demo.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit