Introduction

Dear Crypto Lovers,

I bring greeting to you from this side. I hope you have been having a nice week. I am Kehinde Micheal and my username is @msquaretwins. This time around, I have attended lecture presented by Prof. @awesononso on the topic The Bid-Ask Spread (Part II) in the beginner's class. In this post I will be answering the questions posted in the homework section. Happy reading!

1. Define the Order Book and explain its components with Screenshots from Binance.

Order book is a series or list of all open orders for a specific asset. This order book may be electronic or manual. But for exchanges it is electronic which is systematically organized by price. Order book records both buy and sell orders of a specific asset. It also show bid and ask price along with price, amount and total cost of an asset.

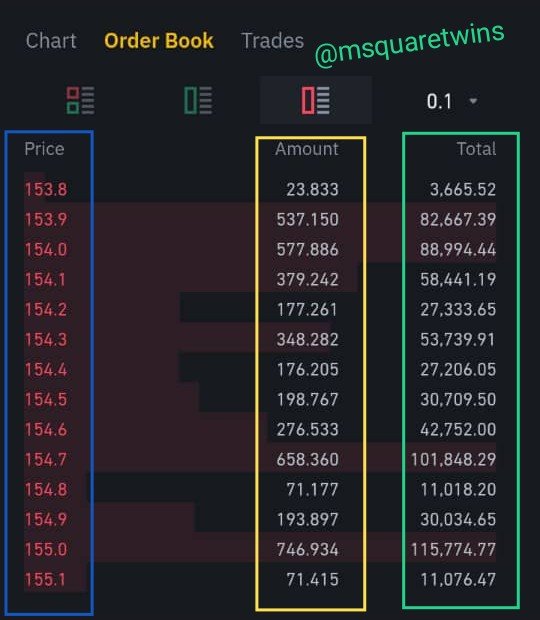

The screenshot above is a screenshot of LTC/USDT taken from binance. It has three Columns. The price, amount and total. Total is the product of price and amount of LTCUSDT asset. The screenshot shows the Bid side of LTC/USDT asset. The Bid price is indicated by a red long vertical box in the screenshot. As seen from the screenshot, the bid side is arranged by price, highest to the lowest. The amount corresponding to each bid price is indicated by a blue box in the screenshot. Also, the total of each other is indicated by a yellow box as seen in the screenshot above.

The picture below shows the ask price for LTC/USDT asset. Let's take a look at this below.

Like bid screenshot, the ask side also contains, price, amount and total. Ask side of the LTC/USDT order book is also arranged by price as indicated by a blue box in the screenshot above. The amount and total (price x amount) of each order are indicated by yellow and green box respectively.

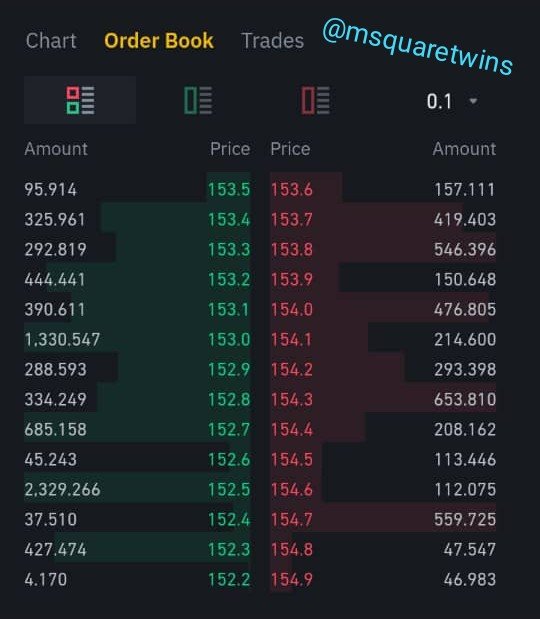

The screenshot uploaded below shows both ask and bid side.

The bid side consist of a list of buy order and it is listed in green colour in the screenshot above. And the ask side is a list of sell order which is listed in red colour. The two sides are arranged by price. The amount corresponding to each price is also listed as seen in the screenshot.

2. Who are Market Makers and Market Takers?

Crypto Traders have two ways to initiate orders in market. They may initiate it at current market price or at future price. At times traders will define his own price for a particular asset. When price then reach the defined level, it get executed and the order will be filled at this level. Those that set price to their own preference in trading are called Market makers. They make their own price for sell order and buy order. In short, Market makers are traders that set limit order for asset which is expected to be filled in the future. They don't initiate their order at current market price. Instead, they use future price to define their orders.

Conversely, Market takers are traders that initiate their order at current market price. They buy or sell crypto asset at instant market execution and their order is expected to be filled almost immediately following the initiation. They do not set limit for order, they accept price as they see it in market.

3. What is a Market Order and a Limit order?

Market order is an order that is taking at current price in market. This type of order are always filled immediately it is placed. It can be called instant filled order. Those that place this type of order are called market taker.

In contrast Limit order is an order that is set at a price different from the current market price of an asset. This type of order can be called defined order because it is set by traders. Unlike market order, Limit order does not get filled immediately. Rather, it gets filled at a future price set by traders. The traders that set this type of order are called market maker.

4. Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

As rightly discussed above, market makers are those that set limit orders in market. They initiate their order at a price different from current market price. This therefore means that there will be many orders waiting to be get filled at different price level and this will create a lot of liquidity at different zone level.

The market order would then get filled with ease. Then market taker would come to the market, initiate their market order and will be matched with limit orders that have been set at a price level they are initiating their orders. At this point, the limit order set by market maker and the market order placed by market takers are filled. Therefore, market makers create liquidity and market takers take the liquidity

5. Place an order of at lease 1 SBD for Steem on the Steemit Market place by (a) accepting the Lowest ask. Was it instant? Why? (b) changing the lowest ask. Explain what happens. (Make sure you are logged in to your wallet)

To get this task done, I entered my wallet from my steemit profile page and login in.

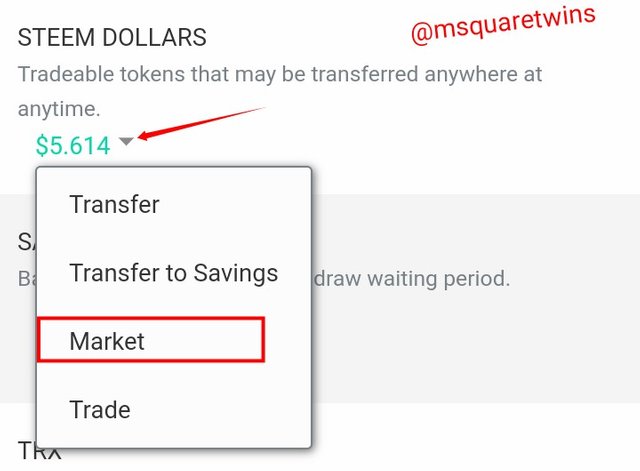

Then from the wallet page, I scroll to SBD and click on the arrow icon as indicated in the scrwenshot below. Then a drop down box appeared and I clicked market as indicated by a red box in the screenshot below.

Let's get (a) done.

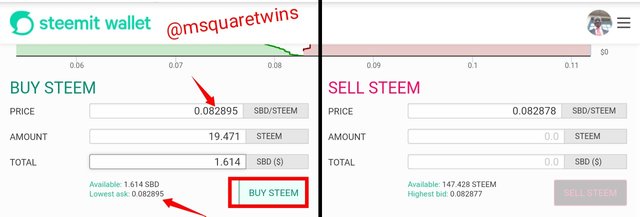

When you open market, it will display steem and SBD market place. We are interested in buy steem. So I go to buy section as seen in the screenshot below. the lowest ask price at the time of doing this task is 0.082895 I then accepted this ask price as indicated by red arrows in the screenshot. After that, I put the amount of SBD I was willing to exchange for steem and clicked buy.

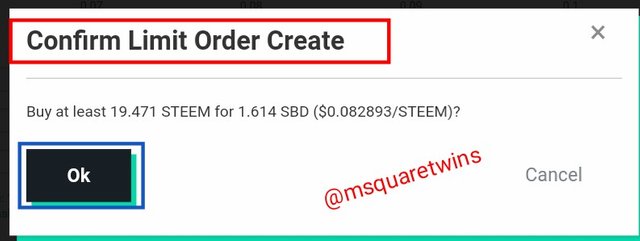

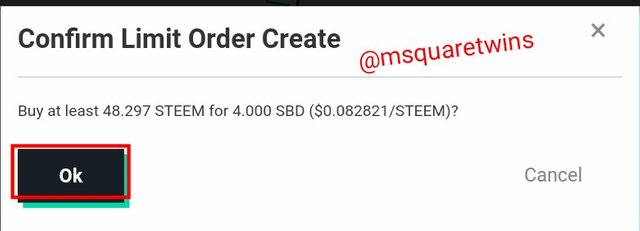

Then a page appear and this page ask me to confirm the order and I pressed okay as shown in the screenshot below

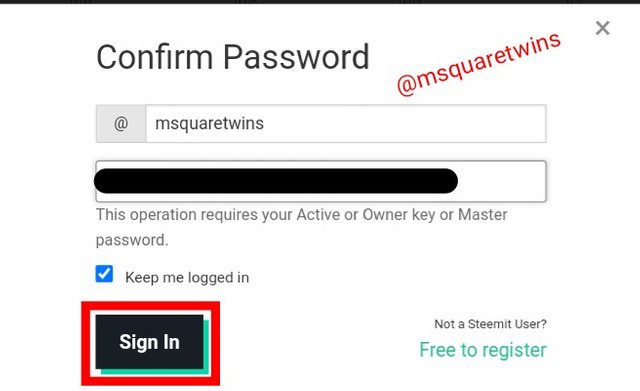

After the above step, I confirmed the order with my active key as shown in the picture below.

Then the order was created as shown below.

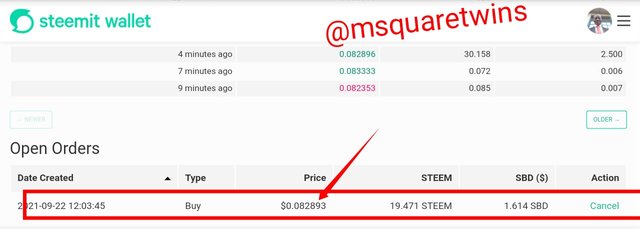

Note The order was created but was not filled instantly because the ask price which was 0.082895 when the order was initiated has changed to 0.082893 as indicated by a red arrow in the screenshot below.

Now, let's move to the second part of the question.

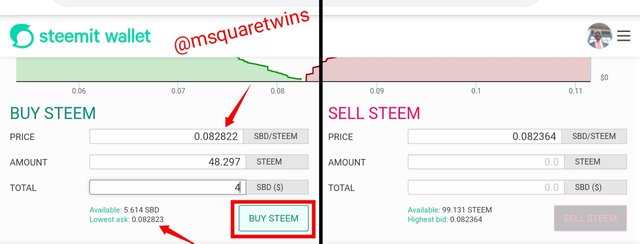

(b). This question asked us to change the lowest ask and that's exactly what I did in the screenshot below. The lowest ask is 0.082823 and I changed it to 0.082822 as indicated by red arrows in the screenshot. I put the amount of SBD in amount tab and then clicked buy.

The the next page asked me to confirm the order and I clicked okay. This page us uploaded below

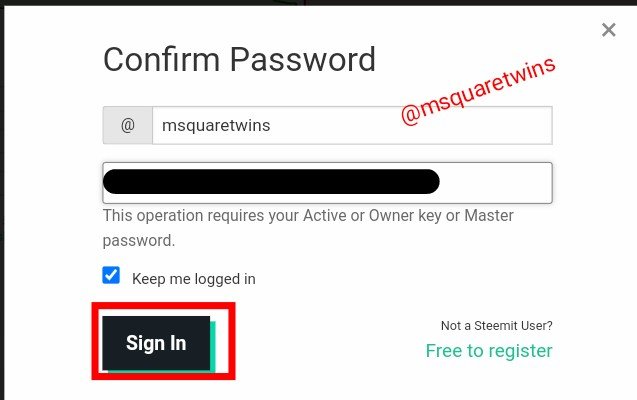

I confirmed the order with my active key and clicked sign in as shown in the screenshot below.

Then the order was created. The order was created at a price of 0.082821 which is lower than the 0.082822 I put when I was initiating the buy order. This means that the ask price has changed even from 0.082823 to 0.082821 during the time of placing this order.

6. Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

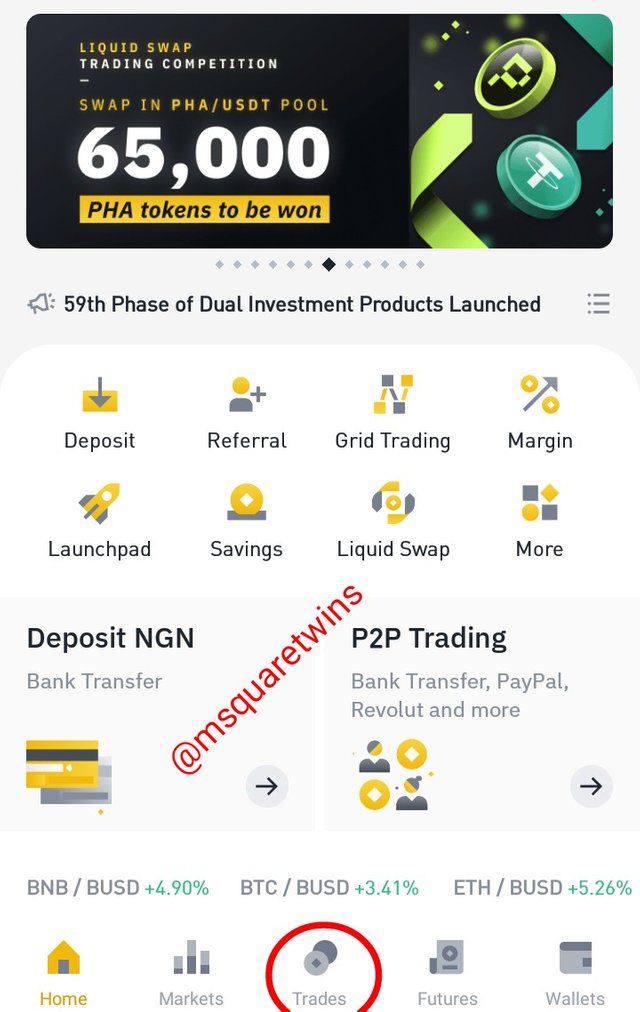

• The first thing I did was that I located Binance App on my phone, open it and then logged in. Then it appeared as seen in the first screenshot below. From the home page, I clicked Trades as indicated by a red circle in the left screenshot.

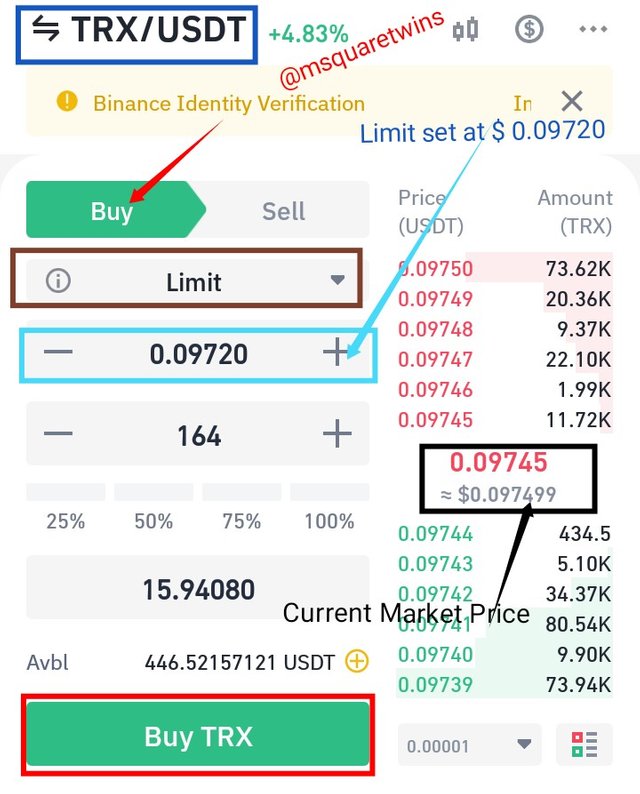

• Then trades page appeared for me. Since my interesting was in buying TRX/USDT, I searched for TRX/USDT asset and clicked it as indicated by blue box in the second screenshot below.

• The current market price as at the time of performing the task as indicate by a black box and arrow in the second screenshot was $0.09745. But the question asked me to place the limit order. So I neglected current market price and set my own limit order. I set the limit at $0.09720 as indicated by a light blue arrow in the second screenshot below.

• I put the amount and the placed a buy limit order as shown in the screenshot.

• Then the order was open and waiting to be filled at the set future price.

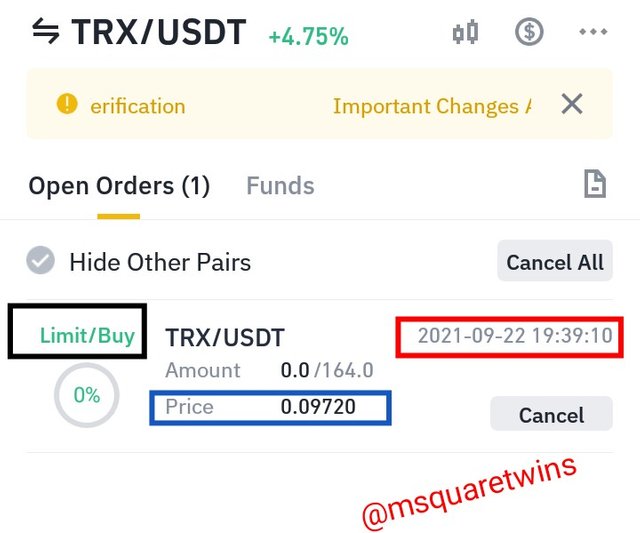

• The order open exactly at 19:39:10 on 22nd Sept. 2021 as shown by a red box in the screenshot below. The buy limit price which is $0.09720 is indicated by a blue box in the screenshot.

Below is the screenshot of the open order.

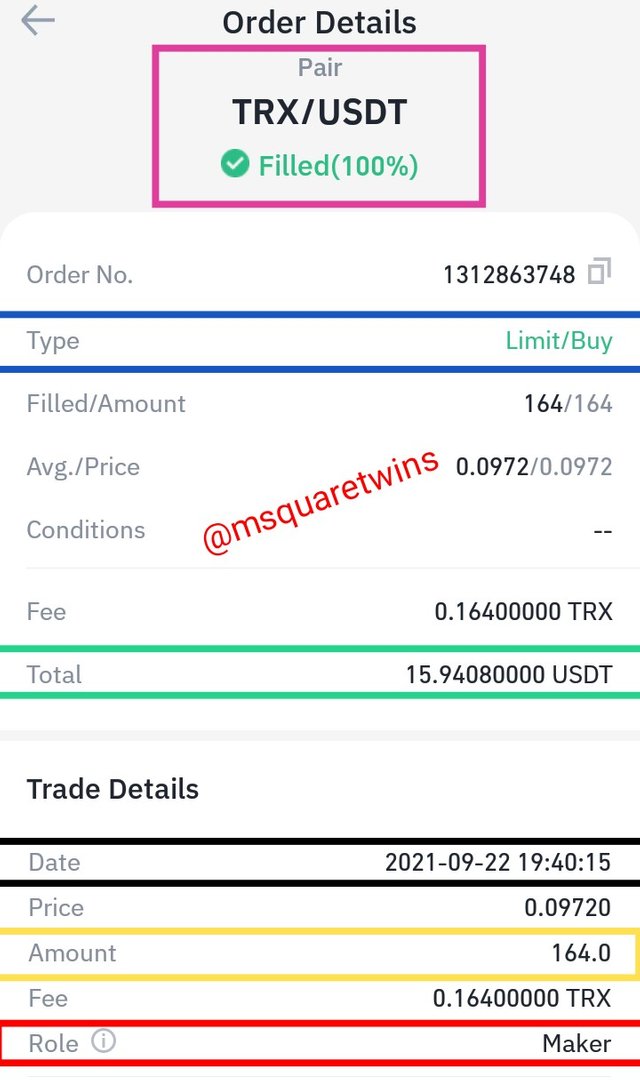

• Later, the buy limit order got filled at 100%. The order details is uploaded below.

• The order got filled at exactly 19:40:15 the same day it was created. It took 1 min 5 secs for this order to get filled.

• As seen in the screenshot, the type of this order as indicated by a blue box is Limit/buy

• Also notice that the role I played in this order is Maker as indicated by a red box in the scrwenshot below.

The impact of my order as a market maker is that it provided liquidity at $0.09720 price level. Many market order will be filled along with my limit order at the price level.

7. Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

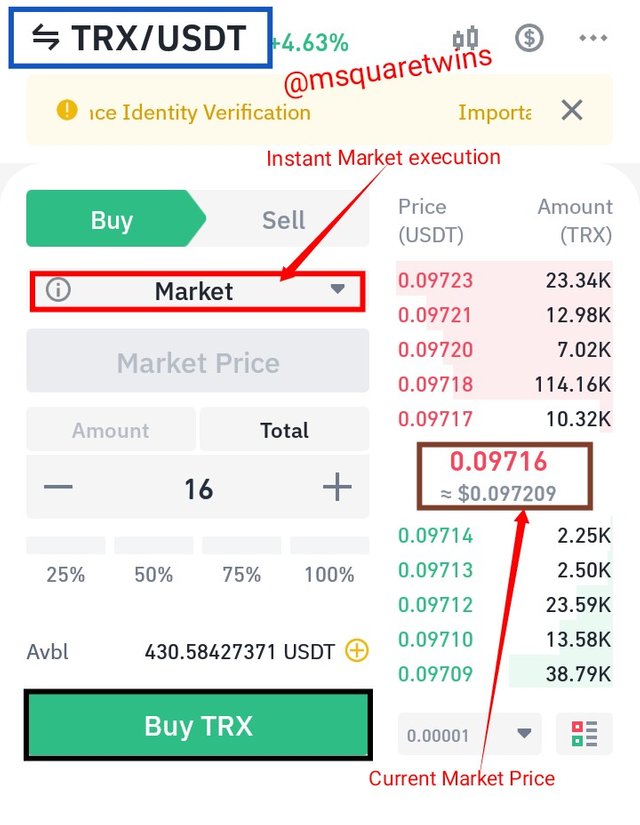

• From the Binance homepage as described in question 6, I clicked Trades. Then the page appeared for me as seen in the screenshot below.

• I searched for TRX/USDT as indicated by a blue box in the screenshot.

• Then since the target is to place a buy at market price, I put market price as indicated by a red arrow in the screenshot. The current market price as at the time of doing this task was $0.09716

• I put USDT amount that I wish to sell for TRX and the placed buy at instant market execution.

• Then the order got filled immediately.

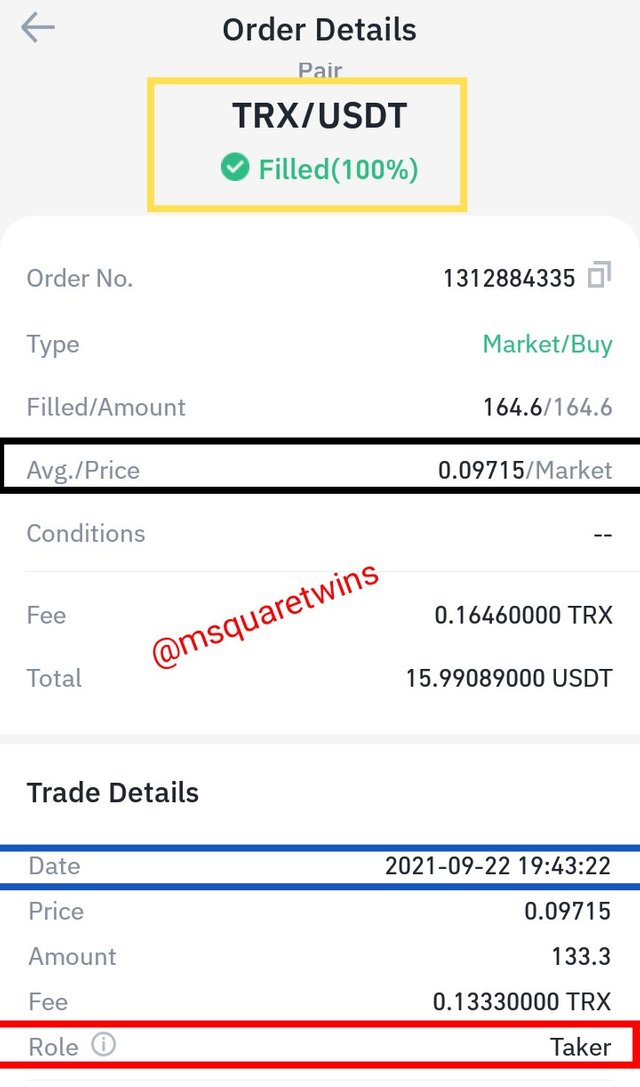

• The price at which the order later got filled was

$0.09715 which a little bit smaller to the market price from which the order was initiated. The order was initiated at $0.09716. This situation that happened here is called slippage. Slippage refers to the difference between the execution price of an order and the price it gets filled.

• Note: the role played in this order is taker as indicated by a red box in the screenshot.

• The screenshot below shows all the order details

The impact of this order in market is the taker impact. This order took liquidity at the price it was filled. There are many limit orders that were waiting to be filled at a price where my order was filled. The limit order provides liquidity at that place and my order took liquidity by getting filled at that price. Hence, I played a role of Market taker.

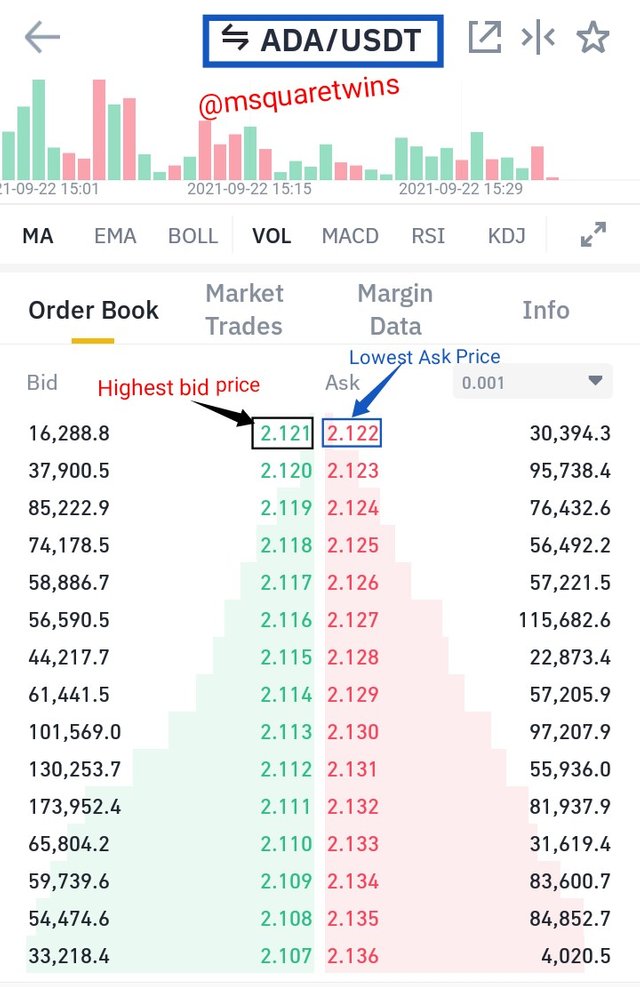

8. Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price

The screenshot above shows order book of ADA/USDT asset. The highest bid price is $2.121 as indicated by a black box and arrow in the screenshot. The lowest ask price is $2.122 as indicated by a blue box and arrow in the screenshot above.

Let's now calculate part one of the question

a.)

Given; Bid price = $2.121

Ask Price = $2.122

Bid-Ask Price =?

Bid-Ask Price = Ask Price - Bid Price

Bid -Ask Price = $ 2.122 - $2.121

Bid-Ask Price = $ 0.001

b.) Mid market Price = (Bid Price + Ask price)/2

Mid market Price = ($2.121 + $2.122)/2

Mid market Price = $2.1215

Conclusion

Order book is very important to know what is going on in market. This also provide transparency of order in market. Through this lecture I was able to know order book for the first time and and also get to know the relationship between market makers and market takers and how the two react to liquidity in market.

Special thanks to Prof. @awesononso for this great lecture. I really gained a lot in his lecture.

Thank you for reading

Written by: @msquaretwins

Cc:- @awesononso

Hello @msquaretwins,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Some work can be done on the arrangement.

A few points a missing on questions 2 and 3.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Prof. @awesononso. I hope to participate in your next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit