Asslam.o.alaikum!

i hope that you are all ok and enjoy the good health by the grace of ALLAH Almighty today i will talk about Wyckoff Method i am thankfull to fendit who give us beautiful task so lets start our task .

Richard Wyckoff developed this method in 1920 and has a system that explains how the market goes. Use each of them in the long run and invest in different stock exchanges There are stages in the market that will help establish our position in terms of asset purchase and investment.

"Composite Man" and the fundamental laws.

This guy doesn't exist on the market. Others can influence or benefit investors. It's like an imaginary operator, which helps you study the stock market as if it were under its control.It provides investors with trends, accumulation, distribution and other aspects that the market offers. In short, the sophisticated man is primarily a representative of the market maker and presents him as a very rich man who behaves correctly so that investors can buy cheap and sell high. Most investors use it to predict asset prices and other aspects and learn how to make a profit from their business without going bankrupt. In order to do that, we have to make a profit in the future.

Some Characteristics of the Composite Man:

Observe where the market is in current situation and predicts each of its trends

Recognize your assets to keep up with trends so you can analyze what your investors are doing.

Help investors buy and sell assets.

phases

source

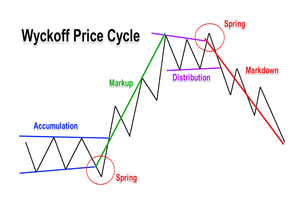

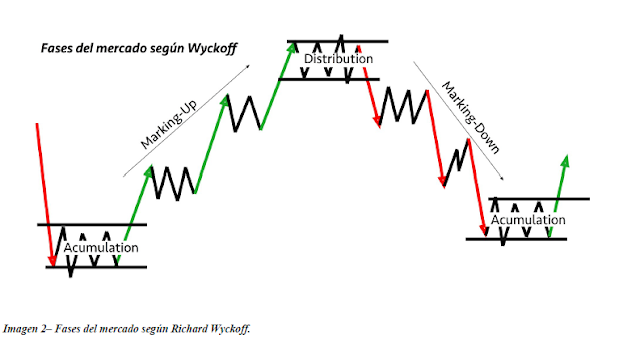

¶ Accumulation Phase:

In this first phase, we are waiting for the assets to accumulate and sell according to their trends. Here, investors or traders are showing an increase in these assets and what they do with them. What can i do We are available for acquisition and there can be many negotiations for each asset. If you are not very interested in assets, the volume will be less noticeable and investors will monopolize those assets before they enter the market

¶ Bullish Trend:

At this stage investors imagine and analyze the fixed volume at each peak, this is done in order to wait for the exact moment to buy or sell the assets, and this work is done after the accumulation, as the man will mix in an attempt to raise prices and reasons. investors to invest in.

Distribution:

This is the stage of the cycle. Here the price moves in many directions after the expiration of a very big trend, investors with reliable information start throwing large bundles of stocks or assets and this distribution continues for many months. I was satisfied with the order, only a few last buyers left.

Downward trend:

Given the fact that the all-encompassing man is discussing all his assets, he will now be tasked with stimulating the market so that prices continue to fall, because the offer is more than just a buy, because the majority of investors want it too. The price continues to fall so that the maximum capital is not lost

The Fundamental Laws are:

The law of supply and demand: This law guides us that when the price exceeds the supply, the price goes up and when it is the other way around, that is, when the people who sell more buy, the reason is that That the prices are too high. More, but when it sells more, it causes the price to go down.

The Law of Cause and Effect:

his law distinguishes between supply and demand, as there may be a period of preparation, i.e. when assets accumulate, it is (cause), and that is why (effect) is there. It will be better than usually in the case of a cut, but here there is a distribution (cause) of assets and a decrease (effect) in prices

The Law of Effort versus the Result:

This law shows that asset prices are the result of efforts made while volume exists, there will be more negotiations and therefore this trend is likely to continue, ie if the price is in line with volume, it will continue.

In my opinion,

this method gives us credibility, and this work of the compositor is certainly valuable to thousands of investors, traders and analysts, and it is very useful for understanding the general cycles of financial markets.

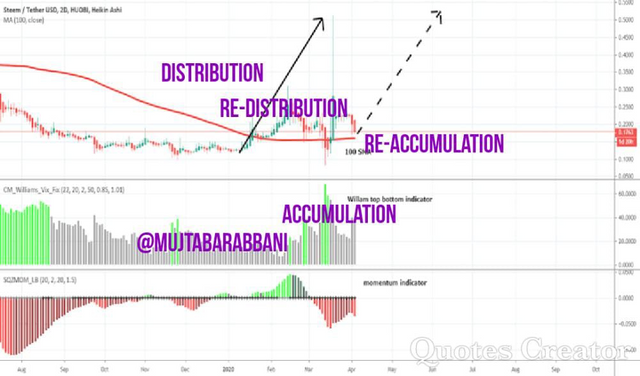

Cryptocurrency Chart:

1) Accumulation:

It is clear how the market has been tilted on the 29th, looking at the volume stable, that is, there is no specific volume, the price is stable and it shows how the cycle starts.

- After the rise, although it is worth noting that it was not that huge, but it is seen again as it accumulates again and then stops until a strong increase occurs so that the investor interacts with it.

- At the distribution stage, it is seen how the volume increases, as well as how the prices reach the peak, and here investors take the opportunity to sell their assets or shares despite the fact that Despite this shortcoming. Distribution is approaching

Conclusion

It is the Wyckoff method that focuses on understanding different price trends, and there are many operators using this method today, largely due to its complex structure, organization and operations with high probability. It can be identified and you are making profits for each user. The procedure requires a lot of practice, but it is worth trying and applying.

Cc

@frendit

@steemcurator01

@steemcurator02

@steemcurator03