Hello, lovely guys. How are you doing today? I hope you're having a wonderful week. I'm pleased to be a part of this memorable talk. In this essay, I'll tell you about my experiences with the Ultimate oscillator indicator.

.jpg)

What do you understand by the ultimate oscillator indicator? How do you calculate the ultimate oscillator value for a particular candle or time frame? Give real example using chart pattern, show complete calculation with accurate result

Price momentum is measured by the Ultimate Oscillator indicator. It was created in 1976 by William Larry. The price momentum indicator has been labelled as such since it generates few trade entries. This is a trend-following indicator that produces less trade signals throughout all time frames.

The Ultimate Oscillator was designed to remove trading methods that are almost usually developed by other oscillators and are short-lived. The scenario produces few trade indications and is regarded to be operating regularly in the market.

To highlight the multiple durations in a moving market, the indicator utilizes time periods of 7, 14, and 28.

How to calculate the Ultimate Oscillator

Before using any market indication, it is important to comprehend the instrument, because "ignorance is not an excuse" in the market. Let me walk you through the process of calculating the indicator.

Formulas

To begin, we offer the ultimate oscillator indicator formula, which is then calculated using the formula below;

UO = [[((A 7 * 4) + (A 14 * 2) + (A 28)] * 100

Where;

UO represents the ultimate indication.

The total of the seven sessions is a 7.

Number 14 represents the average of the 14 periods.

Number 28 represents the average of the 28 periods.

Now I'm measuring the buying force and the true range;

The buying demand is determined by using the formula = current close –min (previous close or current low).

= max (prior close or current high) - min gives the true range (previous close or current low)

How to identify trends in the market using the ultimate oscillator. What is the difference between ultimate oscillator and show stochastic oscillator.

We can notice price fluctuations by employing the ultimate oscillator, which detects potential overbought and oversold market conditions. The indication is separated into two principal lines: 70 and 30. Crossing the 70 level suggests that the market is overvalued, while passing the 30 level shows that the market is oversold. Following that, I'll go through each of them in further depth.

Uptrends with Ultimate Oscillator.

In comparison, indicator values for the Uptrend trend identification are identified in the oversold zone, where band values are reported to be between 30 and far below, suggesting that a trend reversion to an Upward from the trend is likely.

Ultimate Oscillator Downtrends

To spot a downtrend using the Ultimate Oscillator, the indicator trend should be found in the oversold zone, where the overall market is recorded to be in range values of 70 or above, suggesting that a trend reversion in the bad direction is likely.

Different between ultimate oscillator and slow stochastic oscillator.

| ULTIMATE OSCILLATOR | SLOW STOCHASTIC OSCILLATOR. |

|---|---|

| The Ultimate Oscillator is limited to three time periods. | This only employs one time period. |

| The computation is composed of three time periods. | The computation is based on the single time period. |

| A signal line might be included. | It is not included. |

How to identify divergence in the market using ultimate oscillator, if we are unable to identify divergence easily then which indicator will help us to identify divergence in the market.

Divergence to the upside

Divergence to the upside

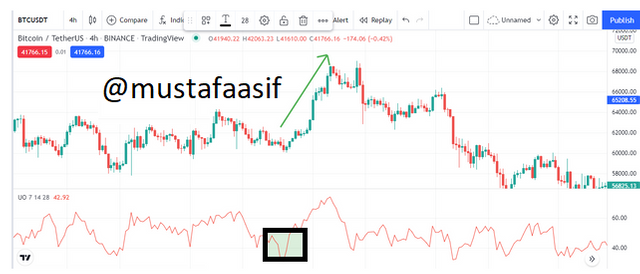

When the price fluctuates with the formation of lower lows, the indicator goes with the construction of higher lows as it rises higher, there is a positive split with the final oscillator. The formation of lower lows in the btc/usdt values in the graph below indicates a trend reversal from the current downtrend to an uptrend, whereas the indicator travels in an upswing with the formation of higher lows, suggesting a loss of momentum from the present decline to an uptrend. This is illustrated below.

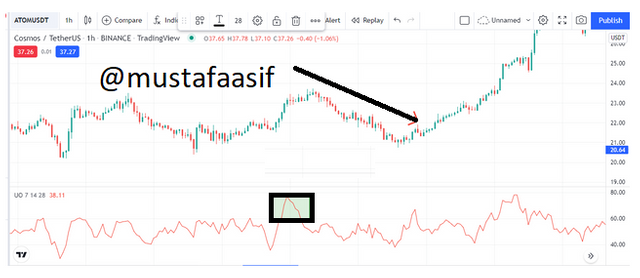

Divergence to the downside

When the market price is followed by the formation of cost of high, the bearish divergence with the ultimate oscillator occurs, whereas the indicator is accompanied by the formation of lower highs as it goes lower. In the chart below, we can see the formation of higher highs in xrp/usdt prices, while the indicator goes in a downward direction with the formation of lower highs, showing a trend direction change from the current upswing to the current drop. This is illustrated below.

Another signal to aid in the detection of divergence

If we are unable to find a split in the market, a preferable signal to use is the stochastic indicator or the relative strength indicator, which detects overbought and oversold regions by generating upper and lower highs.

In this regard, we can discern zones of bullish and bearish divergence in the graph below.

What is the 3 step approach method through which one can take entry and exit from the market. Showing real examples of entry and exit..

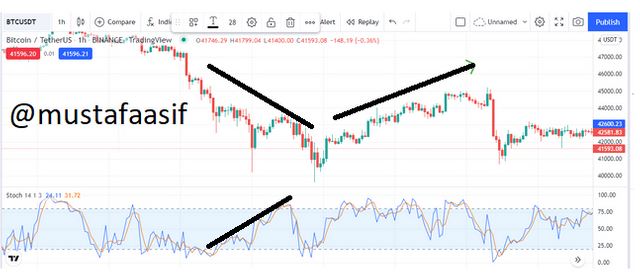

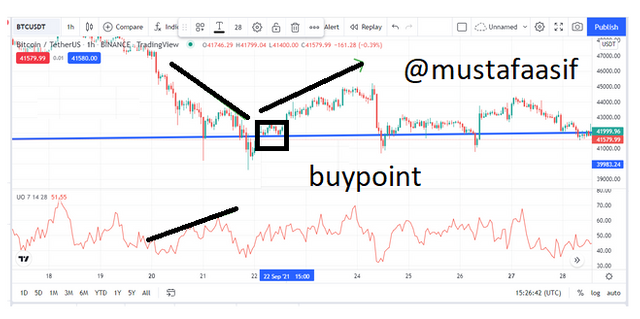

Market Entry Position - Buy Signal

The market is slowly declining with lower-low signals, whilst the Absolute Oscillator indicator is trending upward with a higher-high signal. Based on the indicator's suggestions, this indicates increased purchase pressure.

If signal range values are less than 30, indications from the indicator must be observed first in the oversold zone. This insures a recovery since the market is at a low point and there is more buying push than selling pressure.

Finally, in order to create a true bullish divergence scenario, the indicator should be observed above the divergence high, i.e. in the overbought zone.

Exit Positioning in the Market -

The price movement continues to rise with higher-high signals, however the Ultimate Oscillator indicator is pointing downward with a lower-low signal. According to the indicator's signals, this indicates increased panic selling.

The indicator's signals must be noted first in the overbought zone, which is defined as indicator band values greater than 70. This insures a comeback since the market has peaked and there is far more selling pressure than purchase desire.

Finally, in order to demonstrate a real bearish divergence scenario, the indicator should be inspected below the divergence high, i.e. in the oversold zone.

What is your opinion about ultimate oscillator indicator. Which time frame will be preferable to use ultimate oscillator and why

The Ultimate Oscillator has shown to be more reliable due to the fewer indicators it provides, showing that it has a poor sensitivity for changes in the market. Although the Ultimate Oscillator may be used alone, I feel it is best used in concert with other strategies. It aids us in determining the current market trend. This indication is used to identify when to purchase and sell. It doesn't generate a lot of signals, hence the bulk of the signals we obtain from this method are correct and have little volatility.

This oscillator is well-balanced since it always represents the market cycle's reality and informs us when it doesn't. The ultimate oscillator indicator was created to respond correctly over a long period of time, allowing it to adapt to any trading style and timeframe. Because the lowest period, 7, has a high weight, the ultimate oscillator indicator is an especially powerful tool in short-term trading. With three distinct periods contained in its reading, it is considerably easier to filter out false and misleading signals from the findings.

When it comes to determining the best duration for this indicator, the ultimate indicator examines three separate periods (7, 14, and 28 periods). As a consequence, most traders will be able to choose the timeframe that best meets their needs. When the volatility of a portfolio's assets is high, I like the default time frames of 7, 14, and 28. If the volatility of the asset is low and it does not generate buy and sell signals when passing through the upper 70 and lower 30 levels, The responsiveness of the signal must be boosted by shortening the time period. Several trading signals can be recognized in shorter time frames. The combination of 7, 14, and 28 looks to be great since it finds the correct balance between all of the price appearances and timeframes.

Conclusion

The final signal is a movement indicator. The Ultimate Oscillator Indicator is a near-perfect indicator that helps investors to take more precise trades. Although the ultimate oscillator indicator is a very useful tool for trading cryptocurrencies, it does have certain disadvantages. Its advantages outweigh its disadvantages. It was designed to achieve a range of goals. It's used to figure out what the market's current trend is.

It comes in three different periodic timescales, each of which has been demonstrated to produce less signal in trading activities, as well as a reduced inclination for price volatility and, as a consequence, a lower susceptibility to free markets. The ultimate oscillator is distinguished by low volatility and a small number of signals. Because it employs three averages of various price periods for a given commodity item, the fundamental calculating method of this Oscillator is very balanced.

The ultimate oscillator indicator is a great technical research tool for studying different market times and things that occur.

#utsav-s5week8 #cryptoacademy #club5050 #steemexclusive #pakistan

@steemcurator02

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemcurator02

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemcurator02

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit