Hello steemians, I hope you are doing okay. This is my homework post is Exchange order book and its Use and How to place different orders? by @yousafharoonkhan The lecture was pretty much explained in the very simple and easiest way. Here take a look at my homework.

Question no 1 :

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted).

Order Book

The order book is a collection of the all the order history for a specific trading pairs that are exclusively underway on a market. An open order is simply other investment's declaration that they are likely to purchase or sell a type of asset at a certain price.

The XRP/USDT trading pair is a sample of an order book. Users who have put buyers and sellers on the marketplace to buying and selling Xrp for US Dollar will be listed in the order book.

Order books were first used on stock markets, and they are currently growing increasingly popular in crypto exchanges. The books are usually digital, giving them access to investors all over the world over the internet.

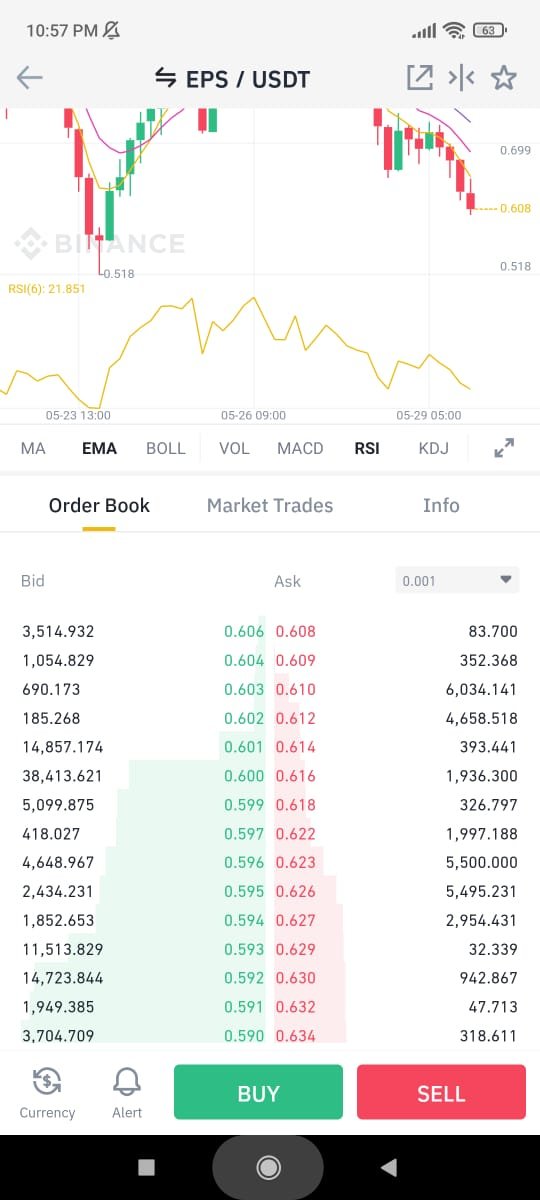

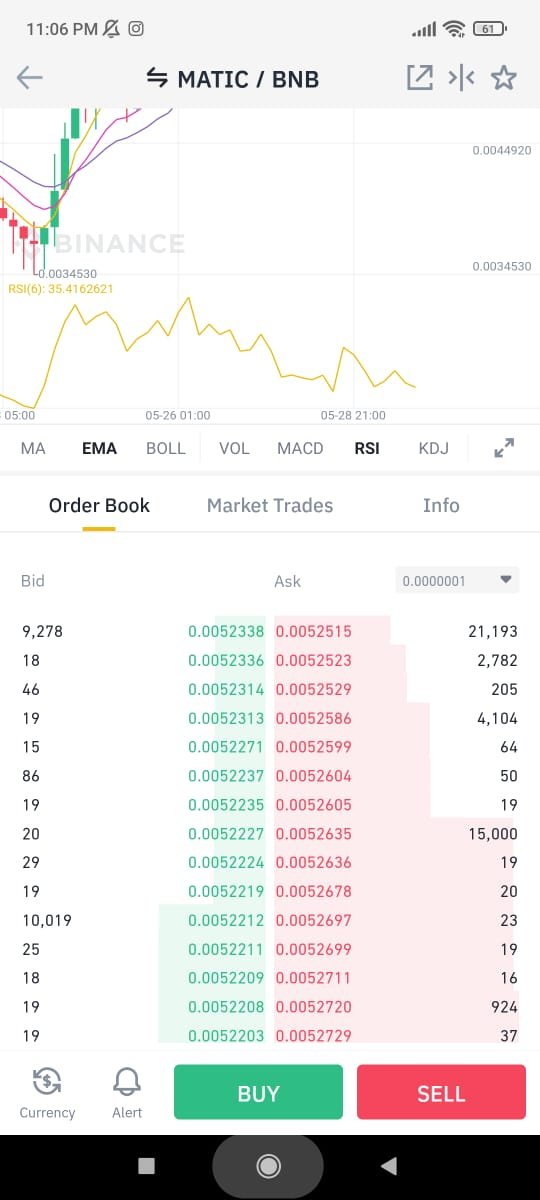

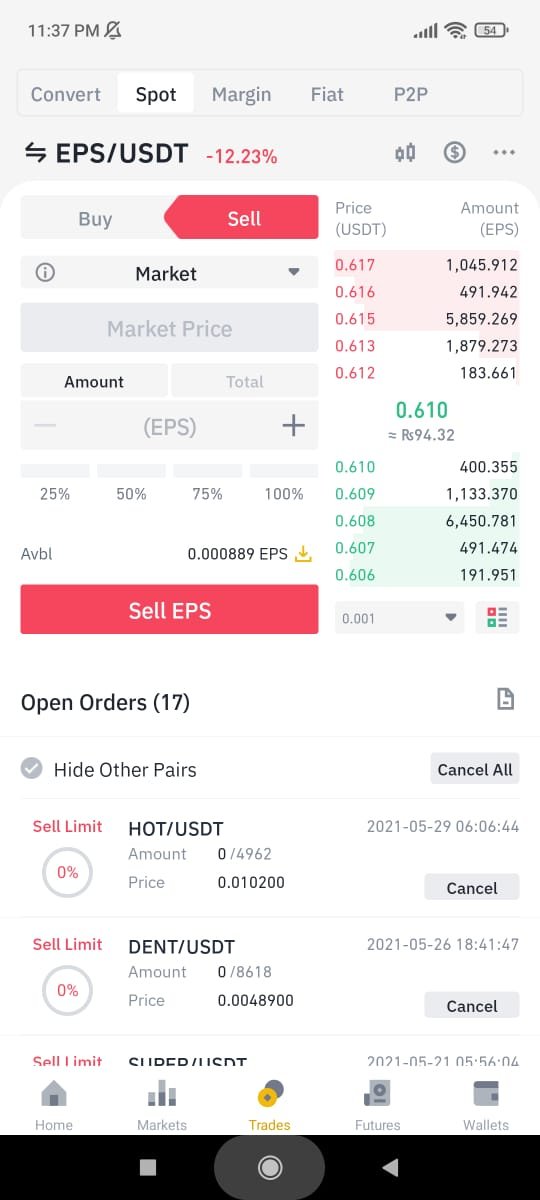

Example of Order Book of EPS/USDT pair

Question no 2 :

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

- Pairs

- Support and Resistance

- Limit Order

- market order

- To find order book I will be using binance exchange so lets get started.

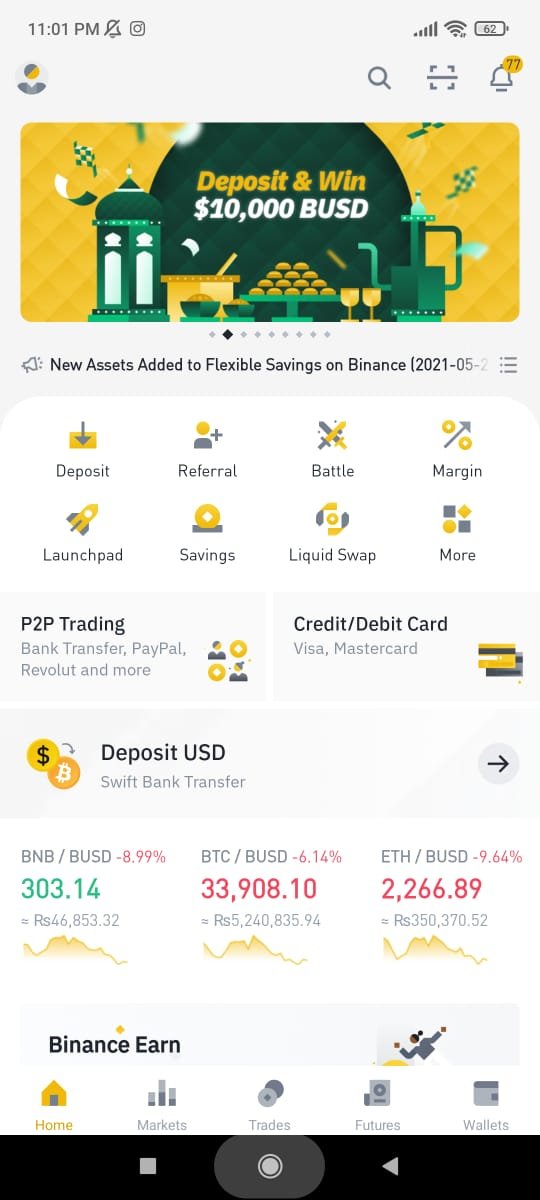

- First open binance exchange and it will appear like this,

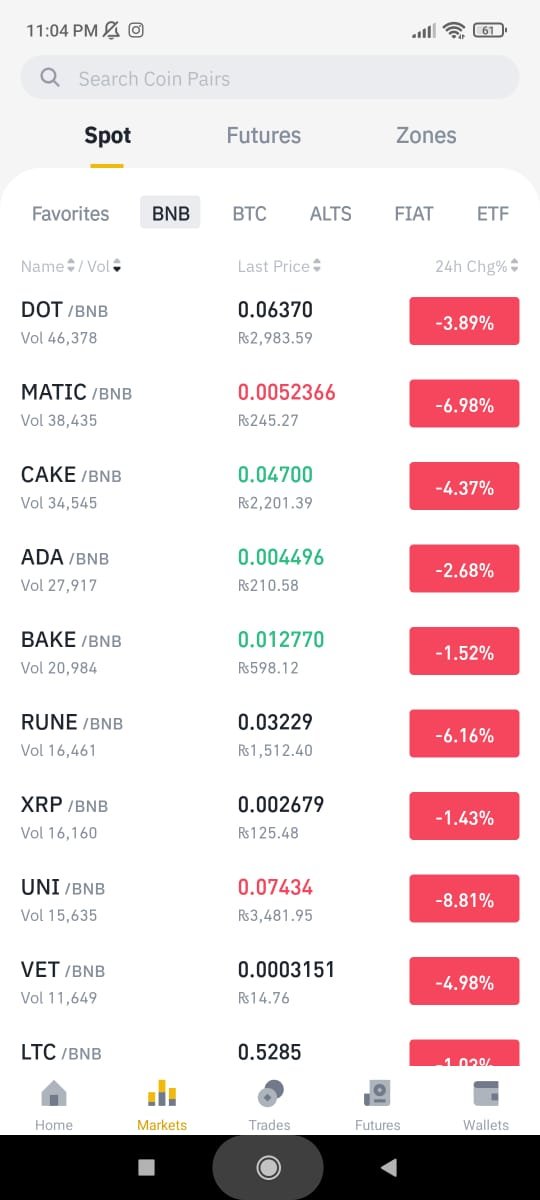

After that click on market shown below and you will see this page.

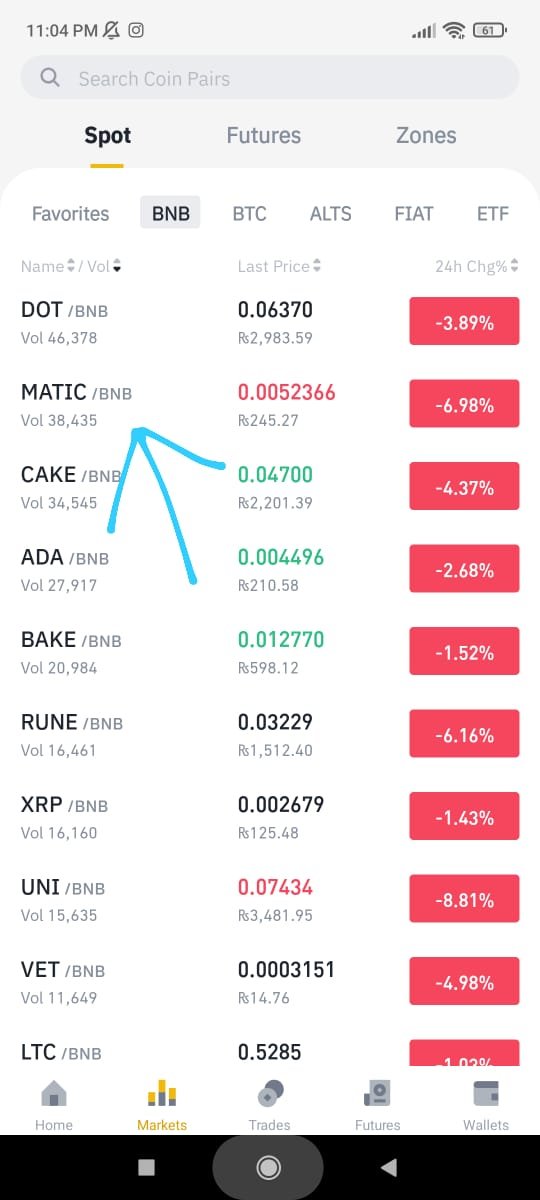

After that select any pair like I am selecting Matic/Bnb pair so I will click on that

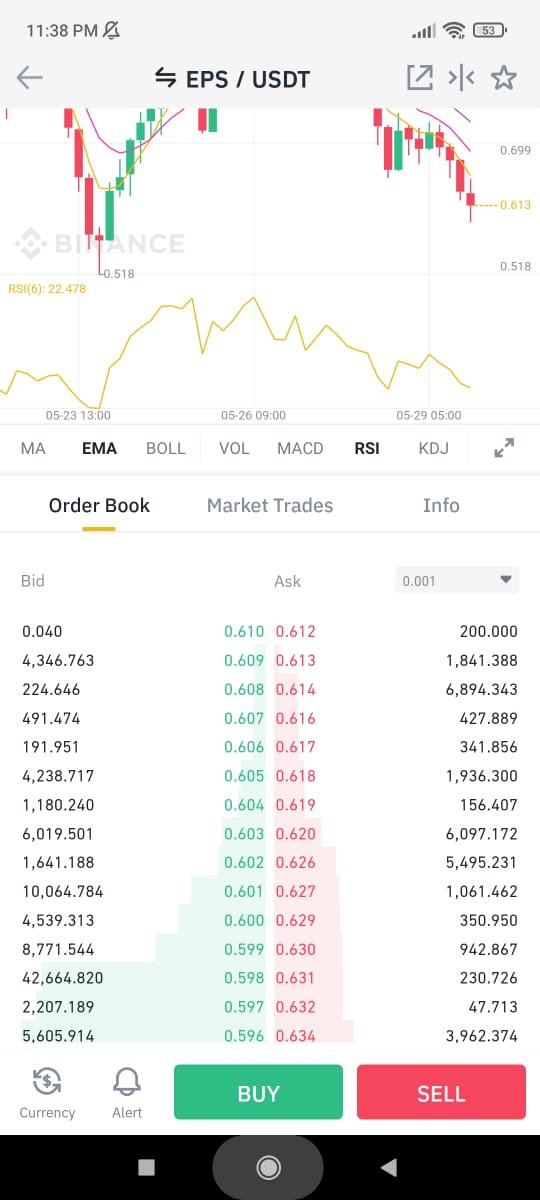

You will see candle charts in your screen like this

just scroll down and here you go you have reached the order book screen.

Pair.

“crypto pairs” are commodities which can be exchanged for one another on a crypto exchange, such as ADA/USDT and Steem/BTC Trade pairings evaluate the costs of several currencies. Investors should be aware of trading pair for 2 purposes: Since some cryptocurrencies could only be purchased with the other coins, understanding currency pairs is essential if you want to diversify your cryptocurrency ownership other than the most popular coins.

Markets.

Cryptocurrency exchanges are online marketplaces where people may acquire, offer, and trade cryptocurrencies for those other digital or standard currencies. Currencies can be converted into large state currencies, as well as cryptocurrencies into cryptocurrencies. Binance, Bitfinex are among of the largest exchanges, with daily trading volumes above $100 million.

Limit Order.

In limit order You are the one who sets the limit price. As a result, if you put a limit price, the deal can only be performed if the current value meets your limit price (or better). As a result, limit orders can be used to purchase or sell at a high or low value than the market price.

Support

A current price where a downturn is predicted to stop due to a concentrate of desire or purchasing activity is known as support. The supporting zone is formed when the value of a cryptocurrency asset falls and desire for the item rises.

Resistance.

A point of resistance is one that a value of the asset struggles to pass through due to significant selling pressure. The presence of resistance levels is sometimes linked to large sell barriers, which prohibit the value from climbing any higher.

Question no 3 :

Explain the important feature of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words).

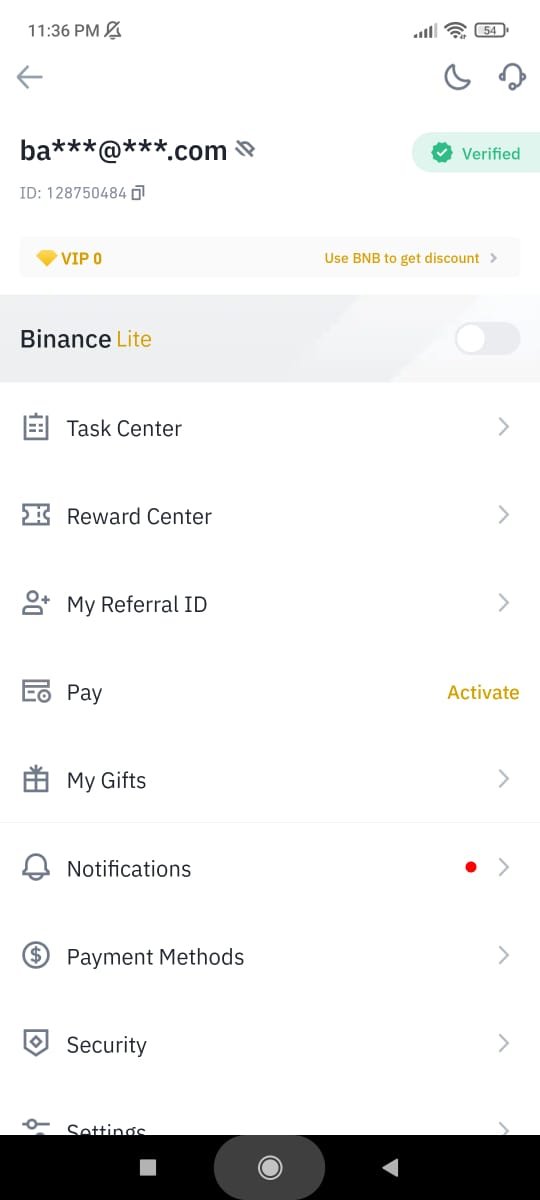

As i dont have my account verified yet so I am using my friend binance account and here is the screenshot.

Buying and selling

It is though that we may put the trades that we'd like to make the exchange; there are several instruments in this area that help with the purchase or sale, as well as the observation of market fluctuation and price comparison.

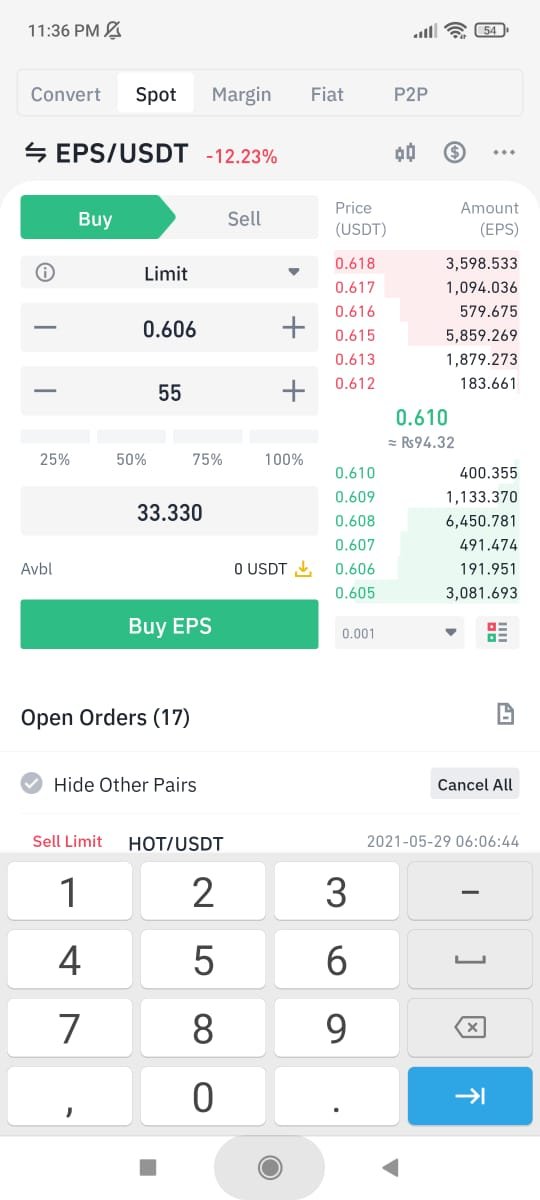

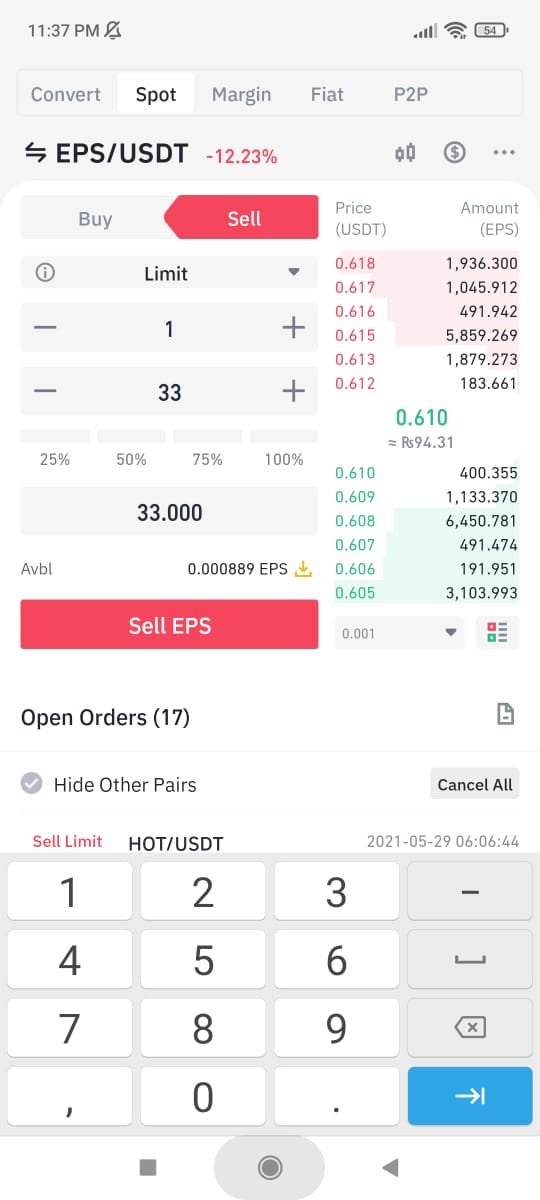

using limit

With this transaction, users may pick the rate at which one you want to purchase. The pricing can be the same as it is now or a good price.

Using Market Option

By selecting the market price, we can make an instant buy or sell.

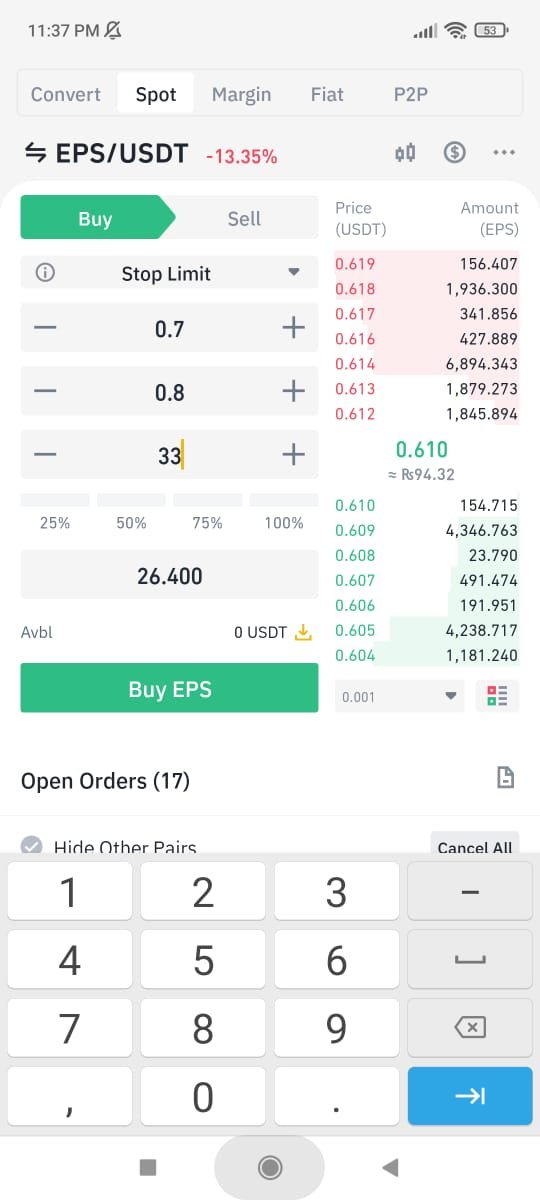

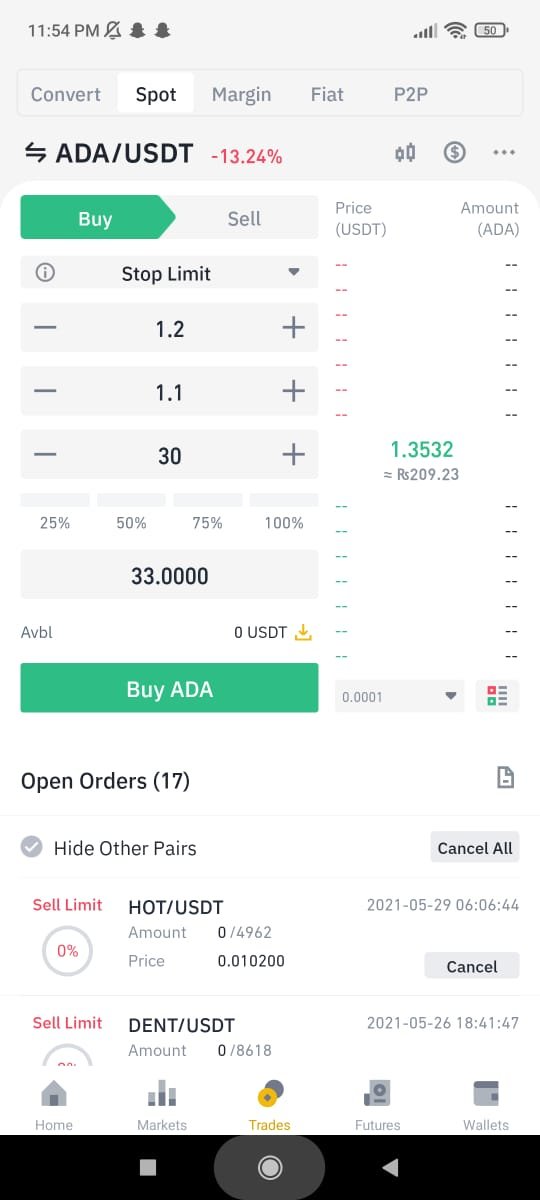

Using Stop Limit.

Specify a price at which the purchase or selling order should be triggered and the transaction will be executed once the market value meets the cost specified in the buying and selling transaction (Price).

Order Book

The order book is a collection of the all the order history for a specific trading pairs that are exclusively underway on a market. An open order is simply other investment's declaration that they are likely to purchase or sell a type of asset at a certain price.

Question no 4 :

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

StopLimit Trade

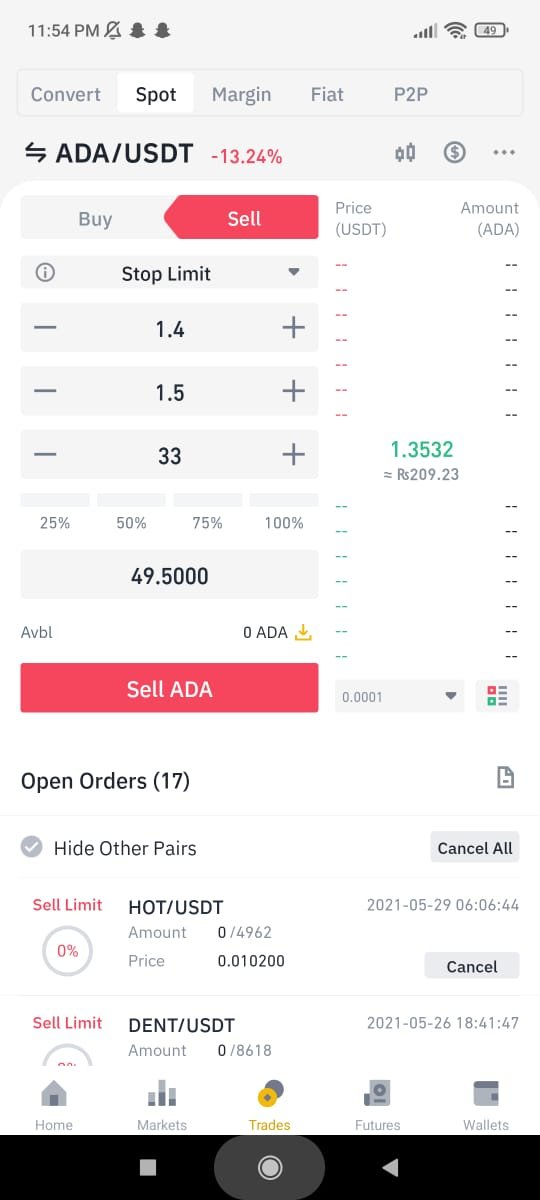

To spot Trades on Stop-Limit and OCO trades, first go to the market list and select the exchange pair users want to use I am using ADAUSDT

so first of all the current price is 1.353$ so I want to trigger my buy order so I put 1.2 as trigger price and I want to buy it on 1.1 here is the screenshot

so first of all the current price is 1.353$ so I want to trigger my sell order so I put 1.4 as trigger price and I want to sell it on 1.5 here is the screenshot

Using OCO

You can put 2 transactions at once with an OCO, or "One Cancels the Other" transaction. It includes a limitation and a stop-limit order, and only one of them can be implemented at the same time.

To put it another way, as long as one of purchases is half or totally satisfied, the other is instantly cancelled. It's worth noting that cancelling one transaction will also delete another.

To trade ADA with OCO, he must first specify his cost of a ADA he wishes to sell, then establish the value of the limit limit and stop trade. Then after, he must deduct the number he want to sell. It operates in the following way: if the price of ADA reaches its limit price, then it will be performed, as well as the stopping limit order would be canceled. If it falls below the stopping stop loss, however, the order will be made at the stopping suggested price, as well as the limit order will be canceled.

.jpg)

If a market value of ADA increases above the maximum while purchasing, a maintain network will be placed and the stopping maintain network would be immediately canceled. When the value of the asset goes just below stop price of a stopping market order, it becomes a prospective, which is processed at the limit price. The limit order would be canceled by defaults.

.jpg)

QUESTION NO 5:

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

An order book displays real-time purchase and selling prices. It enables users in the economy to enhance well-informed judgments. It also aids market participants in analyzing market conditions and changes over period.

One can acquire a currency at a rather cheap price by establishing a purchase order limitation of a lower value, so that if the currency reaches that worth, ones transaction will be executed instantly, and if you'd like to sell it, you can do so at a higher cost and earn a profit. Therefore, limit order limits and OCO operate in the dealer's advantage. This is a different kind of trade volume wherein you don't know the current market or activity so that you can choose the stop price, limitation, and quantity to get the profit you want.

Example.

if i want to buy ONT and its current market value is 0.97 so according to some research and fundamental analysis we predict that it will dip but after some times it will pump soon so will put a buying limit of 0.8 and put a selling limit of 1.3 or 1.2 or after doing technical analysis a major resistance is at 1.4 so i will be selling this at 1.3 by using a limit order

Conclusion

After reading the esteemed lecturer @yousafharoonkhan's post, I can assume that stock price is an important part of the cryptocurrency industry; all that have to do is master basic fundamental trading and basic analytical abilities, and you'll be capable of making some very massive benefits. It allows the cryptocurrency trader to operate more efficiently.

Thats all from my side. I hope you like it and for the reading this. Thank you.

#yousafharoonkhan-s2week7 #pakistan #steemit #steemexclusive #orderbook

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

question no 1 is not well explained , answer is very much short that not clear points

If you look at feature in the order book, you will see a lot of technical and simple advance feature. You have not searched for futures in detail. it is very much important to explore the order book to use the feature that will help you in trade

You have not specified the OCO and stop limit order correctly and if you look at the screenshot it is incomplete and look that you did not place order correct, how possible that your stop price are less and you want to place sell on high,, so here is confusion in answer , it look you did not understand this question and you have not specified your order in the text format, .

How an order book can help a trader make a profit , your answer was very much short , need more detail to explore this question۔

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 5.7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemcurator02

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit