Question 1

The order book is a book that contains details of the price sellers are willing to sell and also contains the price in which buyers are willing to buy. It can also be defined as a book in the crypto exchange market that's shows the price various buyer's and sellers are willing to buy or sell.

The main difference between the local market and the order book is that the order book only allows us to trade in pair i.e exchange between 2 things while in local market you could trade different commodities as much as possible as long as you have what is acceptable by the seller.

For example The trades in the crypto order book are thing like BNB/BTC which means you are buying BNB but you are exchanging it with the BTC you have and like wise if it is BTC/BNB means you are receiving BNB in exchange of your BNB, while that of a local market you could go into a local store with $100 and purchase a lot of different thing with it, you could buy milk ,flour, juice ,ice cream e.t.c as long as you have enough money to purchase them all. I hope this example is well explanatory.

Another difference is that you order book provides us with technical analysis that Traders can use to analyze and predict the price of assets in the crypto market but local markets do not provide us with this opportunity.

question 2

Pair: from our normal understanding of pair which means "2" for example a pair of shoe, a pair of socks , a pair of scissors e.t.c. just like that, we do have trading pair also in the crypto world infact any trade been carried out in the crypto exchange market is in pair, crypto trading pair refers to the combination of two crypto-assets and which are traded against eachother. For example STEEM/BNB, BTC/BNB BTC/USDT e.t.c.

Support and resistance

Support refers to the lowest zone price reached before moving back up, While Resistance is the highest zone price reached before going back down. Also note that Support and Resistance does not last forever Because they can be broken and price can get through them.

Limit order: This order is placed to either buy below or sell above the current price. there are 2 types of limit order the buy limit and the sell limit. In the buy limit if a trader wants to buy a particular asset at $10 and the market or current price is at $15 he or she can't be in the screen till the price falls to that level instead the trader uses the buy limit so whenever the price drops to $10 the market automatically exacute the trade and so is it for sell limit if the current price is at $20 and you want to sleep at $30 you set a sell limit at $30 so whenever the prices reaches $30 the market execute the trade automatically

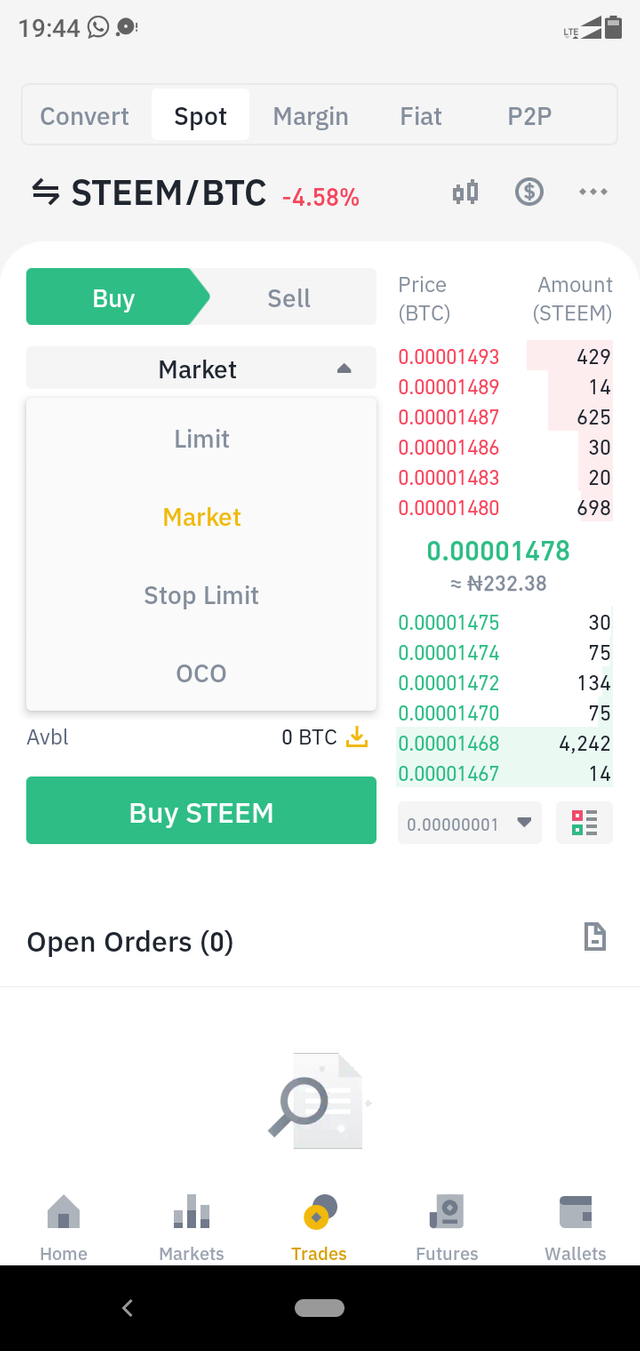

Market order: this is different than limit order,in the limit order you fix your price but in market order you buy and sell at the current price I.e the market price. There are also 2 types of market order the buy and the sell market order in the buy market order you buy at the market price and in the sell you seek at the market price.

question 3

the main feature of the order book is the buy and the sell order

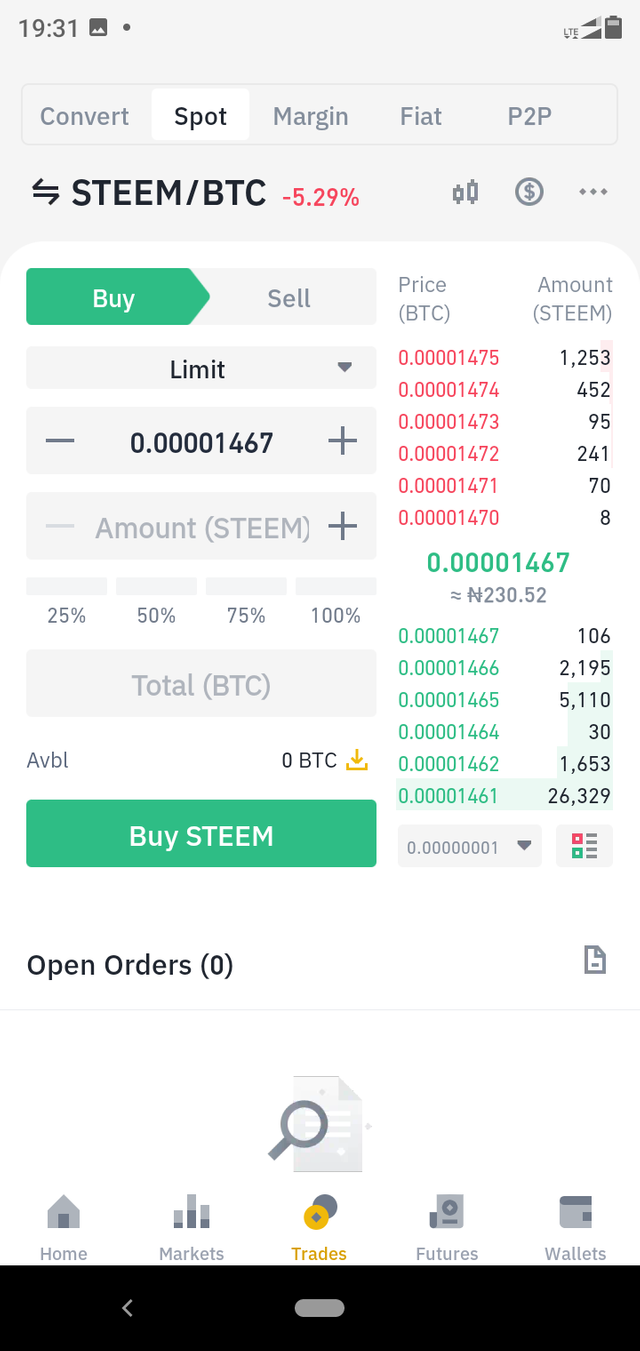

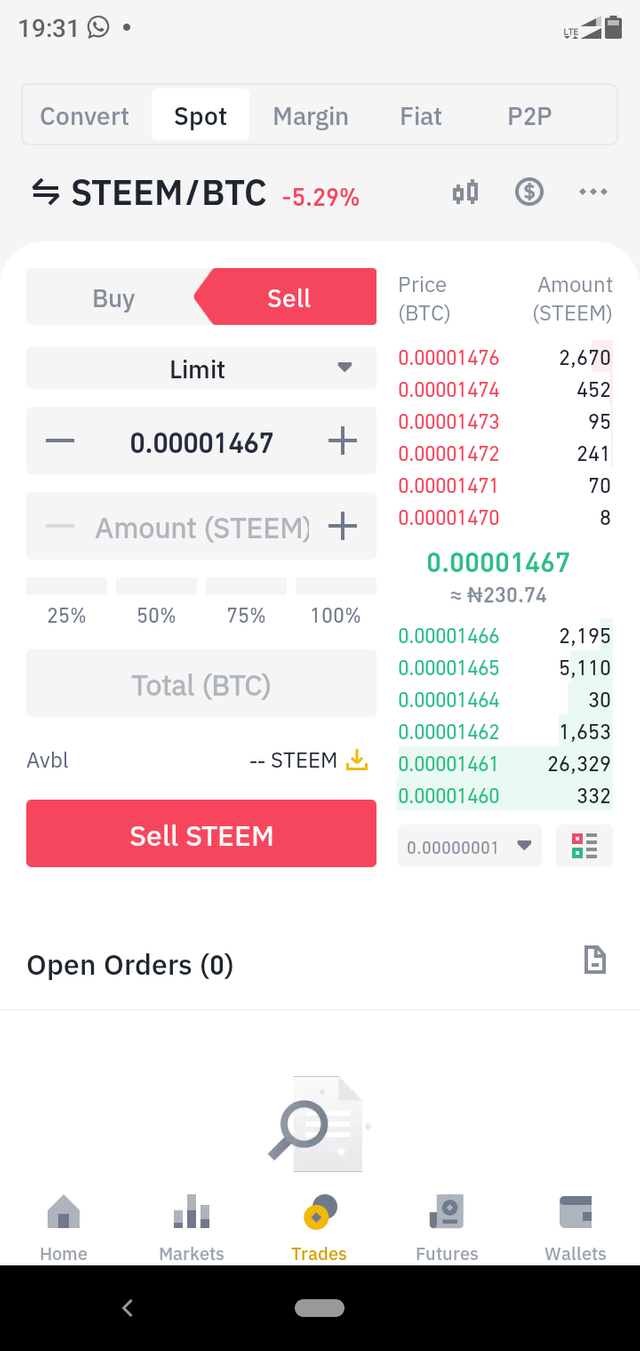

Click on market and go to spot

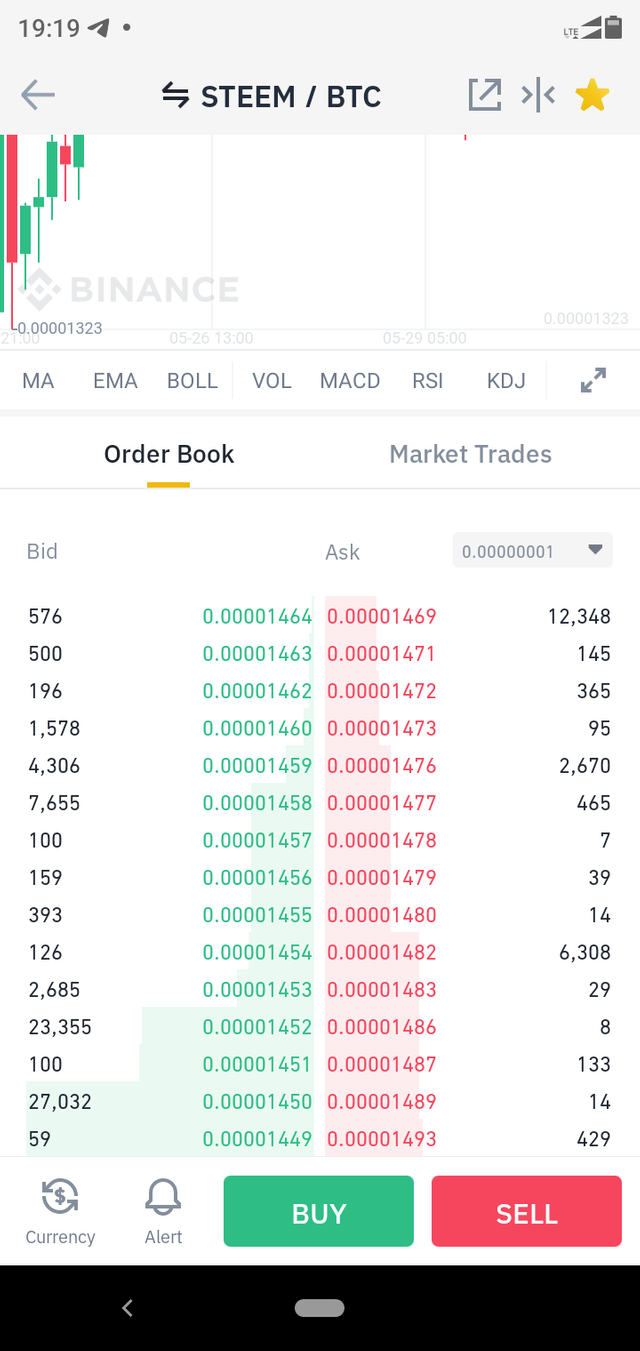

The above screenshot from my verified binance accounts shows the order book of STEEM/BTC. The green is the buy order while the red represents the sell order.

Buy order: this happens when a trader wants to buy an asset with another asset just like the pair in the picture above STEEM/BTC, the trader wants to buy Steem coin with the Bitcoin. For you to perform the buy order you have to select the pair of the asset you want to acquire with the one you want to exchange it with, input the amount of unit you want to buy and click on the buy(green) botton to execute your order. The price at which a buyers buys an asset is called the BID price.

Sell order: this order is placed when a trader wants to sell an asset to acquire Another assets, the pair should contain the asset you want to sell and the one you need. Click on the amount of the asset you want to sell and click on the sell(red) button to place your order.the red botton is for the sell order and the price a trader seeks an asset is called the ASK price.

Question 4

The Stop order is an order placed to buy above the market price and to sell below the market price, In placing your stop order you must have knowledge about the support and resistance so as for you not go go into loss in the trade . In the stop limit order there are 2 price to be inserted The Stop limit : this is the price at which you want your trade to execute and the Stop price : this is the price at which you want your trade to end

Buy stop order

In the image below I place a buy stop order for the currency pair STEEM/BTC

I set my stop limit to be 0.00004 let's assume this is my resistance level and price will fall after getting to this point

And my stop price to be 0.00001 lets assume this is my support level and price will rise after getting to this point

I insert the amount of steem I want to trade with to be 5steem.

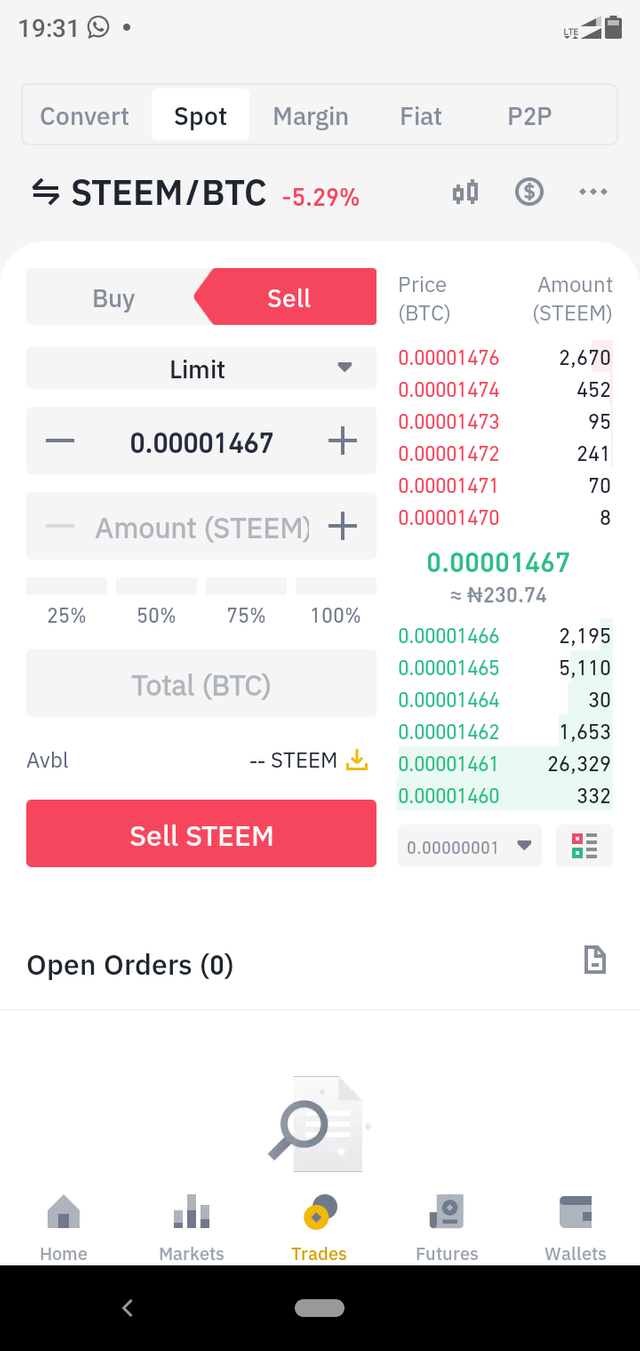

Sell stop order

In The image below I place a sell stop order on the currency pair STEEM/BTC which means I will seek STEEM for BTC.

I set my stop limit to be 0.00003 let's assume this is my support level and price will rise after reaching this point

I set my stop price to be 0.00005 let's assume this is my resistance level and price will fall after reaching this point.

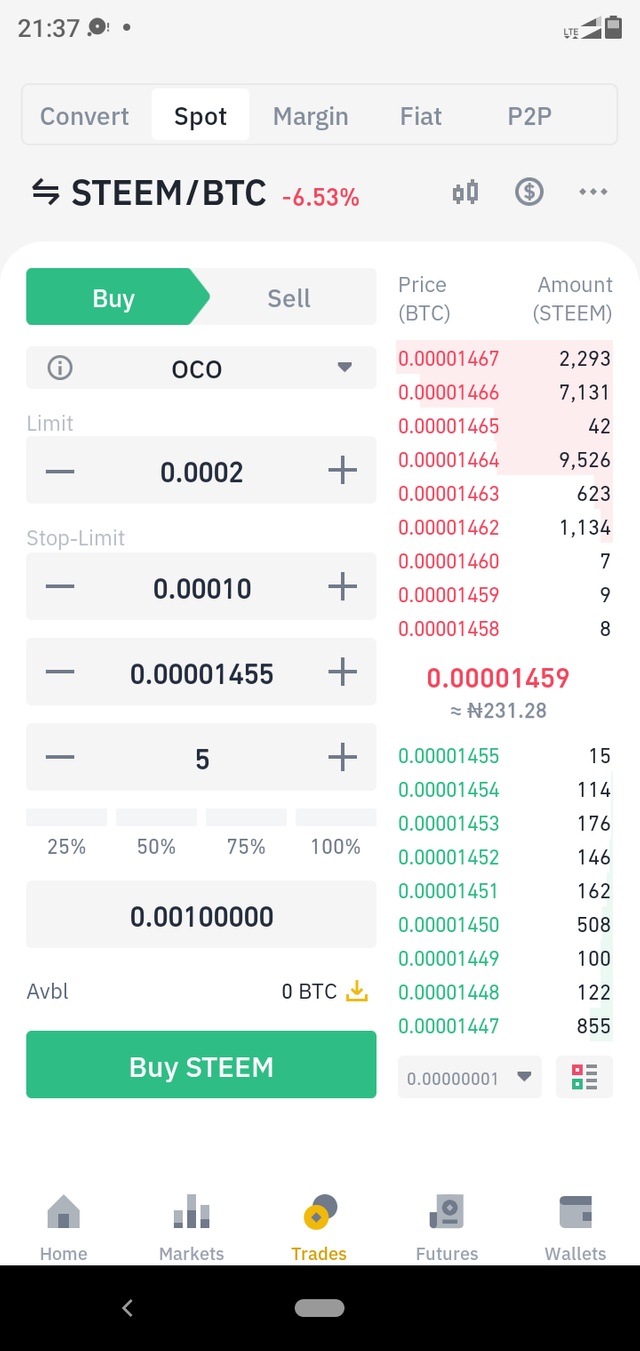

How to place buy and sell order in OCO.

OCO which means One - cancels - the-other - order is a pair of orders which one is canceled if the other is executed. For example if a limit and stop-limit order are placed at the same time and the limit order gets executed, then automatically the stop limit will be canceled Likewise, the limit order will be automatically cancle if the stop-limit order is executed.

Follow the following steps below to place a buy OCO order.

I will be using STEEM/BTC pair for this, I set my stop at 0.00010 and my limit at 0.00001455

Click on OCO

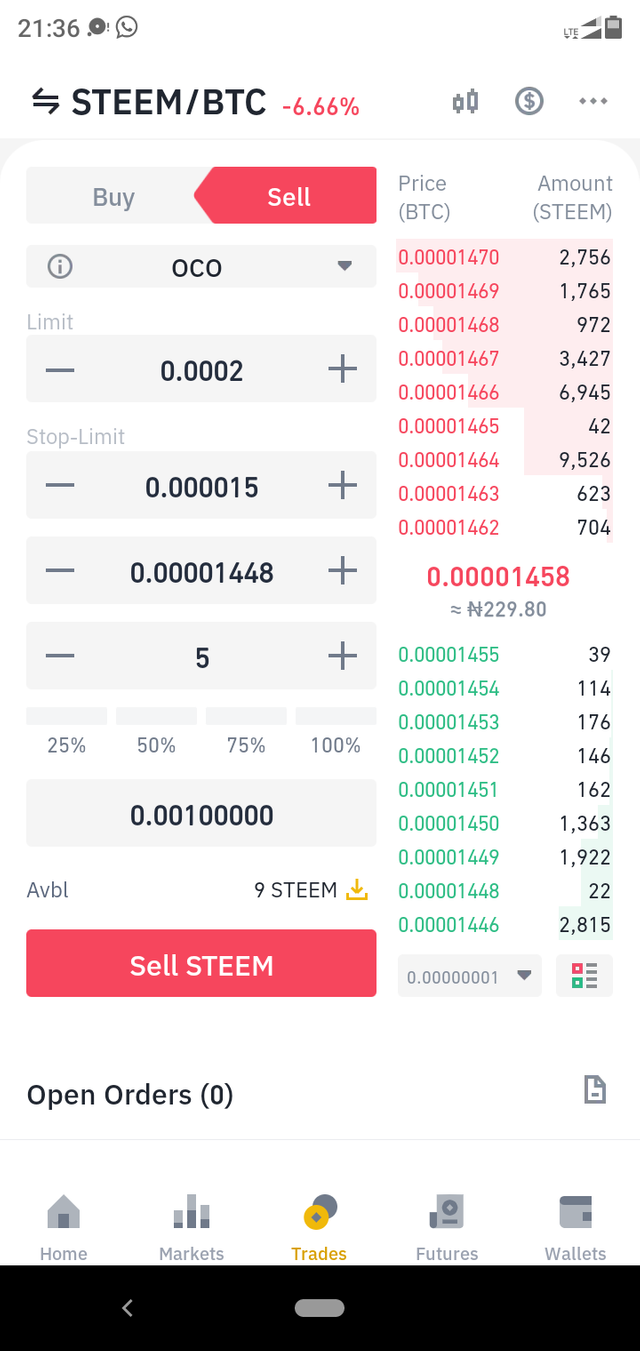

The same procedure can be used to Place a sell OCO order

I set my stop at 0.000015 and my limit and 0.00001488.

question 5

The order book is a great feature in the crypto market and it's usefulness has no bound.

It helps to made certain decision in the exchange market. It proved a trader with overall trend of the pair, certain amount of price traders are buying and selling.

It also helps not to make mistakes like buying when it's too high and selling when it's too low cause this would make the trader to be in loss or low in profit if he buys when it's too high and sells when it's too low. The order book also helps to keep records of transaction

conclusion

The order book which has helped me to prevent losses was the limit order. Thank you so much @yousafharoonkhan for this great lesson I really learnt alot from it even though I've made some mistakes in the past which made me lose some money like buying when it was very high, there was this time last money that one steeem was worth over $1 I actually say the trade late so i stayed on the chart for a while and it kept increasing so I decided to buy Steem but unfortunately it fell drastically. But in sure with this new lesson and knowledge I've acquired from your lesson such won't happen again.

#yousafharoonkhan-s2week7 #cryptoacademy #nigeria #steemit #steemexclusive #steemitblog

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

BUT

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 4.8

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good day sir @yousafharoonkhan that's for notifying me about that and I've done the correction immediately. Kindly review my assignment again sir.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@stream4u

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @mykhell007,

At the time when @yousafharoonkhan reviewing a task, the grade was not applicable due to insufficient SP, for this, you can check Voting Rules announcement by @steemitblog.

Later on, you have increased your SP by 7.XXXSTEEM before 6 hours, and this we can see currently under your Wallet.

If you did this same earlier before the review then it was good. Now, as there is no content changing after reviewed by @yousafharoonkhan and you received a good review from him. Will will discuss this internally and @yousafharoonkhan will provide you further update.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Alright sir @stream4u thank you so much I'm awaiting his reply and I hope it favoured me 🙏

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yes respected @stream4u

i reviewed the homework and placed grade

]

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @stream4u and @yousafharoonkhan

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit