This is my entry to Cryptoacademy: The Steemit Crypto Academy Weekly Update [ August 16th, 2021 ] : New Courses. Homework Post for @awesononso: Steemit Crypto Academy [Beginners' Level] | Season 3 Week 8 | Blockchain Rewards. I invite all Steemit.com users to join. @juanmolina @betzaelcorvo @corinadiaz @zmoreno

1. In your own words, explain block mining and block reward.

What is Cryptocurrency mining?

Simply put, Cryptocurrency Mining is the process of validating transactions and packaging them into blocks under certain specifications, in order to add them to the public ledger of the blockchain and receive in return a commission for each blocked transaction.

The miner receives rewards for this activity, in which he makes available the CPU and GPU resources of his computer, in addition, to employing certain computer skills to solve complex mathematical problems.

Image created by the author, Steemit logo

What factors influence the mining process?

It should be noted that mining will depend on the computational power available to the miner, as well as, the technology he/she chooses to use.

For this, I will mention two important aspects in the creation of blocks:

SegWit (Segregated Witness)

It is a bitcoin transaction format created in 2017, which intervenes in the processing speed and transactional capacity of a block.

It influences the maximum limit of the size of a block, allowing external transactions at low cost which provides a solution to the Bitcoin network scalability problem and therefore to the derivative problems faced by node operators.

Segwit increases the capacity or block size from 1 MB to 4 MB, allowing bitcoin transactions outside the main chain, which decongests the network and potentially increases the possibility of operators' profits, since, by producing more blocks, they would also increase the amount of commissions they can earn.

However, this system also has certain detractors, who choose not to use the upgrade and operate with the previous 1 MB protocol; claiming, among other things, that the commissions earned by miners would be lower for each individual transaction.

ASIC (Application Specific Integrated Circuit)

It is nothing more than the technology that is available for mining. It is the hardware designed to optimize mining, with the ability to make highly complex calculations in a short time, providing computational resources to the network and leading the miner to opt for the rewards for the creation of blocks.

It directly intervenes in the performance of node operators for data processing, block creation and for finding the corresponding hash in the blockchain.

There are cases of cloud mining where companies sell hash power to miners, these work with supercomputers, computer exchanges or private platforms that provide greater share of participation in the solution of the algorithms. For this you must join a bounty pool.

However, each miner must have his or her computer featured with certain hardware specifications in order to operate as a node.

How does Segwit work?

I will try to explain how Segwit works as I have understood it, using a simple example which roughly illustrates the process and the cancellation of rewards to the miner.

Example:

"Suppose A wants to send B a certain amount of BTC. Due to network congestion they decide to use the off-chain micropayment system. For this, before sending the transaction to the network both must sign it to avoid the maleability of the smart contract. The transaction is received by C (miner) who is assisted by D (Lightning Network) to process the transaction outside the network and validate it. Using the Segwit (Segregated Witness) protocol, the transaction is processed quickly and included in the block with a corresponding hash. Finally, B receives the amount of BTC sent to him by A and the miner C receives a transaction fee for having intervened in the creation of the block."

Segwit-ASIC comparative analysis.

According to my own opinion, these two previous aspects (segwit & ASIC), related to cryptocurrency mining, become determinant, since, the feasibility for miners when opting to carry out this activity on the blockchain will depend on both of them.

It is remarkable how competitive it is to mine BTC, in such sense, any node operator has to thoroughly study the possibility of investing in an ASIC as well as make decisions regarding the use and operation of Segwit before operating. On the one hand, the investment made on the ASIC hardware, as well as its maintenance, must be taken out and on the other hand, we have the case that operating with Segwit implies a greater demand of resources given the size of the blocks, added to the fact that the commissions per transaction would increase only when performing a large volume of block validations and not for individual transactions.

Block rewards

Block reward is a system on which the entire Blockchain economy depends as it represents the way to contribute to the security and functioning of the network, as well as, the only way to generate new cryptocurrencies.

The record of transactions validated by miners goes to Coinbase, the global cryptocurrency system where block rewards and the introduction of new cryptocurrencies to the ecosystem are accounted for. The activity of the miners by the creation of blocks is recorded in this trading platform who issues the economic incentives by creating new cryptos.

The block reward system is programmed into the protocol of each cryptocurrency.

How do bitcoin block rewards work?

In the following part I will try to express how block rewards work, for this I will take the Bitcoin network as a reference.

Bitcoin produces a block every 10 min approximately and generates a reward for the miner who finds the SHA-256 hash.

At the beginning the amount of bitcoins received as block rewards was 50 BTC for the miner who finds the hash, reducing this amount to half every 210,000 block produced in the network, through a process called Halving. Accordingly the rewards per block were reduced to 25 BTC in the halving of 2012, to 12.5 BTC in the halving carried out in 2016 and to 6.25 BTC in the halving that took place on May 11, 2020. This poses that this will reduce the rewards down to 0 according to the 21,000,000 bitcoin that represent the limited amount of BTC cryptocurrencies that can be issued.

Reward distribution process per bitcoin block

Initially I would like to point out that block reward payments are not the same for all cryptocurrencies. Each blockchain creates an operating protocol for its cryptocurrency with unique characteristics that guarantee security, operability and data encryption.

The bitcoin network will be used as an example.

Transactions sent to the network by users undergo a validation process from which a small fee is deducted to pay the miners, and "valid" transactions are stored in a block which will have a unique SHA-256 hash identification upon completion. At the moment the block packing is finished, with approximately 2048 transactions, the Coinbase transaction is generated by the miners. This special feature transaction reflects the amount of BTC to be issued as a reward. The block is entered into the blockchain for node consensus and the cancellation of rewards is directed to the wallet address of the miners who intervened in the creation of the block, who must be previously authenticated with a registration code.

N° of transactions per bitcoin block

The number of transactions per block is calculated as follows (according to the conventional bitcoin system of 1 MB per Block):

- Production time of a block: 10 min.

- Weight of each transaction: 0.5 KB

- Block size: 1024 KB (1 MB)

N° Transactions per block = 1024 / 0.5

- No. of transactions per block = 2048 Transactions (every 10 Min)

Note: The Segwit system increases the number of transactions per block up to 4 MB, therefore, the above calculation corresponds only to the conventional bitcoin 1MB system.

2. What do you understand by Bitcoin Halving?

What is Halving for me?

According to my own opinion after studying the subject, I understand that Halving is an automated event within the Blockchain specifically designed to halve the block reward received by miners.

The halving process has a certain periodicity and for bitcoin blockchain is performed for every 210,000 blocks mined.

Other Blockchain such as: Bitcoin cash (BCH) and Litecoin (LTC), have also performed this event, but it should be noted that the process varies according to each network.

"As an example, we can mention the case of Litecoin where each block is created every 2.5 minutes and the halving takes place for every 840,000 blocks mined".

Through halving, mining is incentivized as competitiveness increases among miners motivated to halving and proof of work would be the biggest advantage. According to my own criteria, this would happen as long as the prices in the market remain or go up, if not, it could cause an opposite effect.

By reducing the supply of the currency by half, the price is expected to increase in the market. The idea is to maintain the health of the blockchain and avoid inflation caused by the sustained issuance of new cryptocurrencies.

3. What are the effects of the Halving on miners?

Consequences of the Halving

In my opinion, halving is a process that can have certain repercussions on the economics of a blockchain by influencing the psychology of miners who tend to withdraw their nodes in search of other solutions.

This greatly affects the hashrate of a blockchain so security could be compromised.

It should be understood that the hashrate is nothing more than the computing power offered by the mining platforms to validate the blocks. A reduction of this resource can open the door to new malicious nodes that can take advantage of the situation to program an attack on the network.

Unfortunately, miners will see at first glance that they have to do the same work for half the pay and this has an impact on their motivation and possible performance.

Another possible consequence is that after a halving (given that the price and production of cryptocurrencies would have been halved), one can expect the price to drop precipitously after the event.

Perhaps because there is great uncertainty or distrust on the part of the miners who see the cryptocurrency value reduced and may think that it is not profitable to feed the network with their computing resources.

Let's remember that miners must invest in new technology and maintenance of CPUs, GPUs or ASICs.

On the one hand, halving turned out very well for bitcoin but other cryptos like bitcoin cash and litecoin presented bearish behavior of more than 30%. As far as I could understand according to my research on the subject this will depend on the market; if the demand remains constant and if the holders do not sell their assets at the same time.

4. What is the current block height on the Bitcoin blockchain? How many more blocks before the next halving? (Screenshots and full workings)

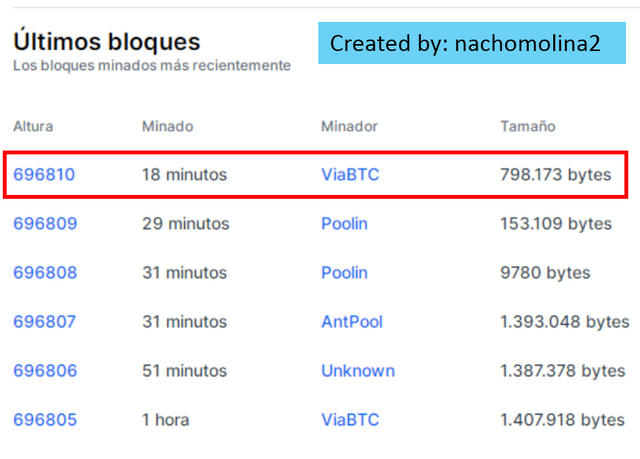

As of the time of writing this post the current block height on the Bitcoin blockchain was as follows:

blockchain.com

As we see in the screenshot the last block has been mined 18 minutes ago with a size of 798,179 bytes and the height or number of the block is 696,810.

I will proceed to calculate how many blocks are left for the next Halving.

First we must remember that the next halvig would have to be event number 4 and that the periodicity between one halving and the next occurs every 210,000 blocks.

- Block height for the next Halving = 210,000 x 4

Block height for the next halving = 840,000.

Now we subtract the block height remaining for the next halving from the current block height I just investigated in the blockchain.com explorer.

(Current block height: 696,810)

- No. of blocks until the next halving = 840,000 - 696,810

No. of blocks until next Halving = 143,190.

5. Do you think the reduction of Steem's inflation rate can affect other currencies? Why?

According to me, STEEM is a coin that is ranked #235 by market capitalization. Based on this it is notable that it does not exert any dominance. At the same time the Steem economy and its technical specifications indicate that the STEEM cryptocurrency is designed for blockchain sustenance through its native social media platform Steemit.

In such sense, STEEM according to its utility and protocol "could not" come to affect other cryptocurrencies in the global market.

However, it does exert a direct influence on SBD and smart media tokens (SMT), which would be affected by the reduction in Steem's inflation rate.

"It should be noted that STEEM is reduced 0.01% every 250,000 blocks which is a controlled and rather low inflationary reduction percentage. According to the DpOS system by which the platform is governed I also understand that the block reward is received by the tokens (10% of the new coins), who are selected by vote. The rest of the new coins (90%) are for rewarding content creators, curators and SP holders. "

All these aspects influence the Steem Blockchain economy and the inflationary reduction rate leaves me to see that rather the ecosystem should regulate the production of tokens in order to avoid disproportionate trading.

SBD: On the one hand SBD is designed in order to stabilize the Steem blockchain economy in a frank value relationship with STEEM. Therefore, the value of SBD despite being anchored 1:1 to the US dollar will always depend on STEEM as a utility token and native cryptocurrency, hence inflationary reduction would directly affect it according to the activity of the blockchain itself, the supply and demand in the market; and the trust placed by users in the platform.

SMT: As we all know smart media tokens are built on the Steem Blockchain architecture and some of these tokens are actively employed on the platform for payment of rewards to content creators among other uses. This working relationship with STEEM under the same blockchain could imply that the inflationary reduction generates an impact on these. According to my own opinion and according to what I have understood in this class the value of many of these tokens would be affected since they operate in the same network and the reduction affects all levels of the architecture of a blockchain.

6. What is the current block height on the Steem blockchain? How many more blocks before the next 0.01% reduction? (Screenshots and full workings)

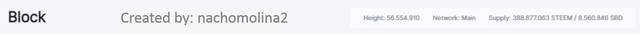

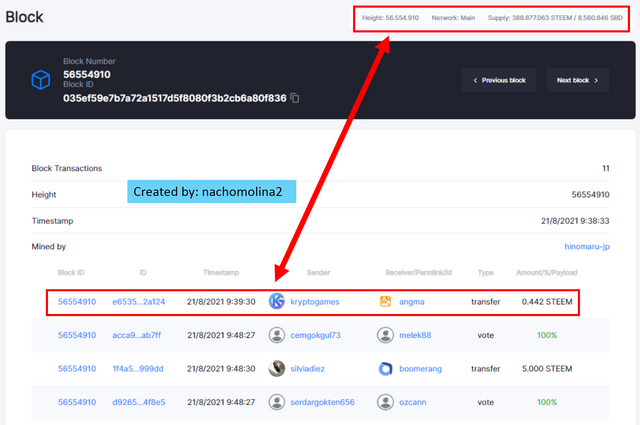

As of the time of writing this post the current block height on the Steem blockchain was as follows:

steemscan.com

As we see in the screenshot the last block was mined on the date 8/21/2021 at 9:39:30 under the number:

56,554,910 (block height).

steemscan.com

The above graphic shows in detail all the necessary characteristics and information of the current block at the time of this post. Which we will analyze in detail below.

I will proceed to calculate how many blocks are missing for the next reduction.

First let's keep in mind that Steem's inflationary reduction rate is 0.01 % every 250,000 blocks and the current block height is: 56,554,910.

Now we need to find the number of reductions that have happened so far. For this we divide the current block height by the number of blocks for each reduction.

- No. of reductions so far = 56,554,910/250,000

No. of reductions so far = 226,22

226 reductions have occurred. The next reduction will be the number 227.

Block height for the next reduction.

- Block height for the next reduction = 227 x 250,000

- Block height for next reduction = 56,750,000.

Finally we calculate the number of blocks until the next reduction.

- Number of blocks until the next reduction = 56,750,000 - 56,554,910

- Number of blocks to the next reduction = 195,090

Continuation of last week's work:

What is the current value of BTC on the day you perform this task? If you were to make a purchase of $2,500, then, a.) How many satoshis would you have? b.) What is the value of a satoshi for that day? (Show completed work and correct to 3 sq ft) (1 satoshi = 0.00000001 BTC).

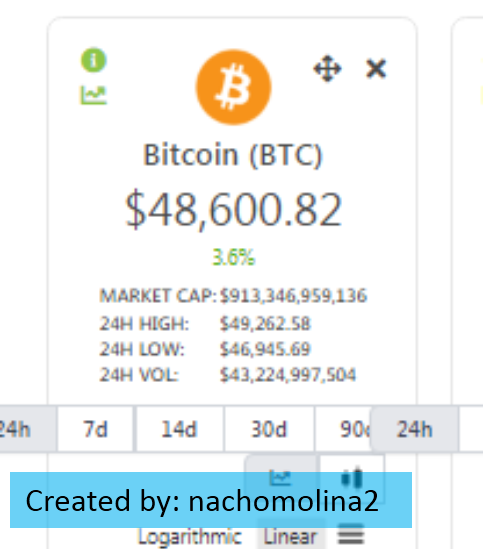

This is the value of BTC for the time of making this post: $ 48,600.82 USD. It was queried on the Coingecko platform according to as visualized in the screenshot.

Let's proceed with the calculations:

1 satoshi = 1/100000000 x 1 BTC

1 BTC = $ 48,600.82 USD

1 satoshi = 1/100000000 x 48,600.82

1 satoshi = $ 0.0004860082

1 satoshi = $ 0.000486 (up to 3 s.f)

We already got the price of 1 satoshi = $ 0.000486 USD. Now we calculate the amount of satoshi you would have for $ 2,500 USD.

$ 2,500 / $ 0.000486 = 5,144,032.92

With $ 2,500.00 USD you would get 5,140,000.00 satoshi (up to 3 s.f.)

Final answer:

a) $ 2,500 USD = 5,140,000.00 satoshi (up to 3 s.f)

b) 1 satoshi = $ 0.000486 (up to 3 s.f)

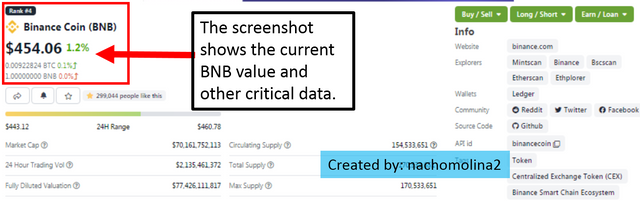

What is the current value of BNB on the day you perform this task? If you were to make a $30 purchase, a.) How many Jagers would you have? b.) What is the value of a Jager for that day? (Show completed work and correct to 3 square feet) (1 jager = 0.00000001 BNB) (Screenshots of the current value must be provided).

Coingecko.com

At the time of writing this post the value of BNB is: $ 454.06 USD. It was consulted on the Coingecko platform according to as visualized in the screenshot.

We proceed to the calculations:

1 Jager = 1/100000000 x 1 BNB

1 BNB = $ 454.06 USD

1 Jager = 1/100000000 x 454.06

1 Jager = $ 0.0000045406

1 Jager = $ 0.00000454 (up to 3 sf)

We have already obtained the price of 1 Jager = $ 0.00000454 USD. Now we calculate the amount of jager you would have for $ 30 USD.

$ 30 / $ 0.00000454 = 6,607,929.51

With $ 30 USD you would get 6,600,000.00 jager (up to 3 s.f.)

Final answer:

a) $ 30 USD = 6,600,000.00 jager (up to 3 s.f.)

b) 1 Jager = $ 0.00000454 (up to 3 sf)

Conclusion

The rewards per block within the Blockchain can vary considerably according to each ecosystem. Thus it can be noted that the work of miners will depend on the investment they can make in technology, as well as, the type of system or format they choose to work with.

Specifically, the bitcoin network is managed with the conventional 1 MB system and with the Segwit upgrade that allows a block size of up to 4 MB. However, the halving event represents another circumstance that miners will have to contend with from time to time.

Thus I conclude that bitcoin mining despite having its pros and cons in a profitable activity for miners since the current value of bitcoin is quite high and they will always count on rewarding rewards despite the periodic halving, which despite filling the market with some uncertainty about the real fate of BTC, so far, has only made bitcoin blockchain grow.

After finishing this week's homework assigned by Professor @awesononso I have managed to understand a bit more about Blockchain rewards and is the functioning of inflationary reductions within the blockchain.

Grateful for this new installment of #steemitcryptoacademy, it was a pleasure for me to have participated throughout season #3. Congrats to the whole team and the teachers.

Cc: -

@steemitblog

@steemcurator01

@steemcurator02

@awesononso

@lenonmc21

Original content

2021>

Twitter:

https://twitter.com/addverso/status/1429148101294571520?s=20

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit