Greetings everyone

Hope we are all doing great? I welcome you all to Week 6 of season 4 of the Steemit Crypto Academy community. Today will be looking at the lectures and answering homework questions given by prof @reminiscence01 on the topic of Trading Cryptocurrencies. Below are provided answers for the questions he ask.

Question 1

-Spot trading

-Margin trading

-Futures trading

Spot Trading

Spot trading is the buying of a cryptocurrency at an exact market demanding price of the asset and the asset (cryptocurrency) will be given to you straight away. It is the easiest trading form as it reflects the Normal Exchange of a foreign currency with that of a local currency at a local bank. As long as you are ready with the amount required to purchase that crypto, you will be able to get the asset at its current market price.

This trading method allows those willing to buy and hold assets for a long period to make profits which are buying the crypto asset at a cheaper price and selling it when the assets price increases.

Advantages

1.) The amount you are willing to use for the asset purchase is solely determined by you thereby giving you power over the transaction and the transaction amount.

2.) The process of spot trading is easy and fast as you receive what you pay for at the instant the trade is placed.

3.) The buyer in this trade has the advantage of placing his order at his desired price and amount by drawing up a market price.

4.) The buyer can use any leverage of his choice to realize a great profit.

Disadvantages

1.) The buyer's fund must be available before a trade can be performed.

2.) Stop trading has a low-profit level when compared to future and margin trading.

3.) Traders might wait for a very long period after buying an asset before realizing a profit and thereby avoiding any losses on the acquired asset.

Margin Trading

This is a trading method in which the trader acquires assets which more costly than his initial capital by borrowing and adding his capital thereby increasing his purchasing power to be able to make the trade successful by realizing a bigger profit. This capital that is being borrowed is called Collateral and it is given to borrowers for margin trading.

This helps the traders to take advantage of market opportunities by helping them out with the amount which they require to trade.

Advantages

1.) The traders can request a loan to invest.

2.) Margin trading offers more profit with little capital if the market workers are in the trader's favour.

3.) Assistance is given to another trader who has plans on increasing his profit margin.

Disadvantages

1.) Since a trader is being borrowed capital, there is an interest that is being paid.

2.) Traders in Margin trading are required to be experienced to make the right trading decisions and avoid trade losses.

3.) Margin trading is not advisable and is recommended to be used by beginners.

Futures Trading

These are the fluctuations of the price movements in the market. In this type of trading, the trader moves his asset by using the stock market to increase or raise the number of futures contracts to trade thereby encouraging merchants to place a buy or sell order based on market prediction progress.

Just as the Margin trading, futures trading gives opportunities to traders to buy contacts with small capital y leveraging their value which gives room for the merchant to close their trade at the initial agreed time.

Advantages

1.) Merchant can cease advantage of leverage funds to make great profits.

2.) Futures traders can gain from the alternative conditions of the fluctuating market.

3.) Traders do not need all the funds before entering a trade.

4.) Operations are carried out when traders have the advantage of doing so.

Disadvantages

1.) The leverage funds are needed to carry out the trades.

2.) Here assets are not being traded but rather contracts are.

3.) only traders with great experience can carry out such operations.

Question 2

There are several types of orders in trading which includes

- Limit Order

- Market Order

- Pending Order

- Stop Order

- OCO Order

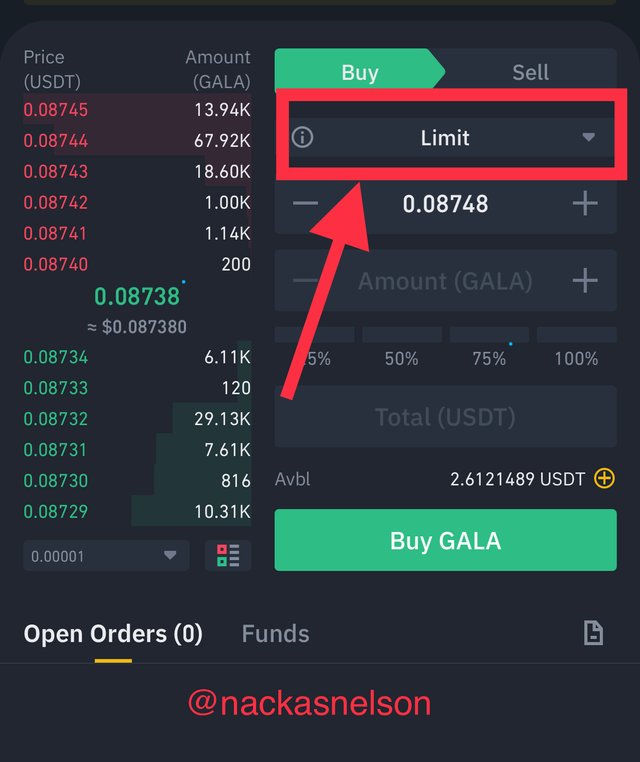

Limit Order

This is an order in which a trader does not pay the available market price. The limit orders are placed in the order books with the idea that they will be carried out successfully if the price meets up the order which has been placed.

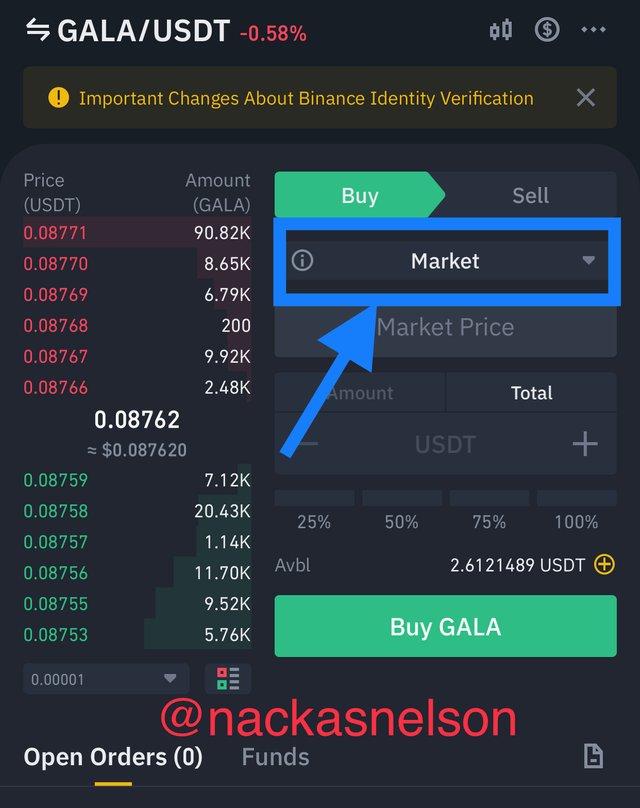

Market Order

This is an order in which a trader places a buy or sell order at the current market price and this order is carried out as soon as it's placed without any delay. This order allows the trader to buy or sell at the immediate market price.

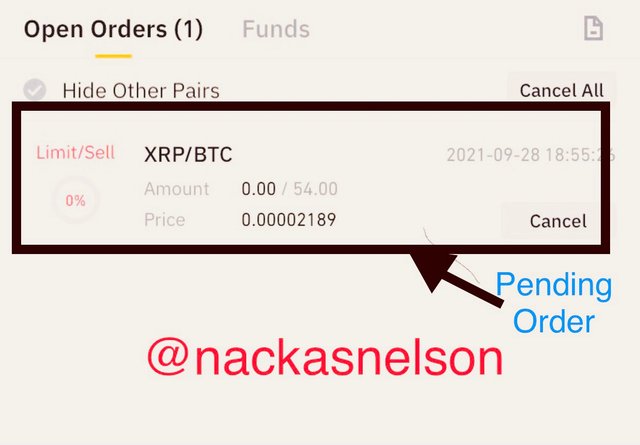

Pending Order

This order is not being carried out at an instant. With a pending order, the merchant is allowed to buy or sell its asset(cryptocurrency) at a price that suits him as he waits for the order to be carried out at the price which is being set for the order.

Stop Order

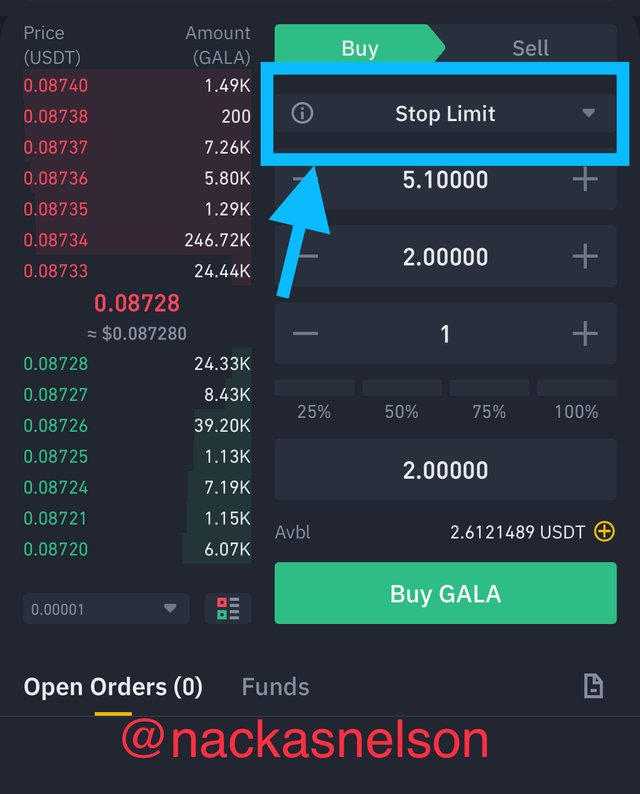

This is a type of pending order whereby it consists of two different prices which are the limit and the cap prices. Traders here are required to set both the limit price and cap price. The cap price is the initial want price which can turn the limit order into a limit order while the limit price is the price where the limit order is being executed.

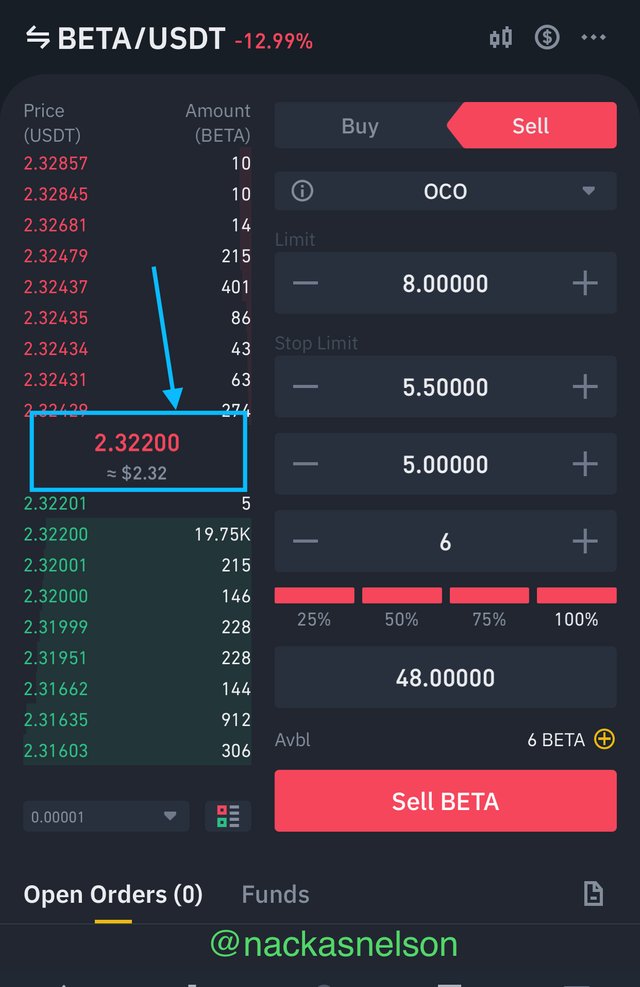

OCO Order

This is an order which has two link orders options which are the limit order and a stop-limit order whereby when one is being carried out, the second-order automatically cancels. This is a very important order for traders this is because the OCO order measures the risk in markets that are volatile and assist the traders to have complete control over the trade which is being performed.

How can a trader manage risk using an OCO order? (technical example needed).

As seen above, the OCO order gives traders the ability to input both a limit order and a stop-limit order thereby helping traders reduce the risk which can be realized if the market sees a drastic drop from the predicted limit price. This limit price takes profit and the stop limit will execute the trade if the market notices a drop-in price. For a sell order.

Example: Am having 6 BETA to sell with its current market price at 2.32200 so to manage the risk, I will be using an OCO order to place my trade at a limit price of 8.0 and a stop limit of 5.5 so that if the market price doesn't reach 7.0 and starts to drop, the stop limit will minimize my loss and sell the asset at 5.0.

Question 3

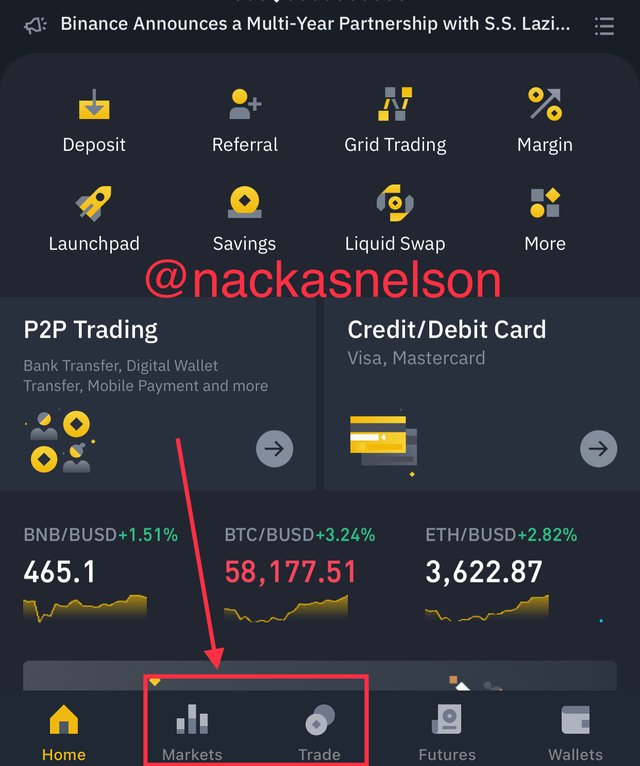

We begin by opening our Binance and we will be using the trade and market features on the app.

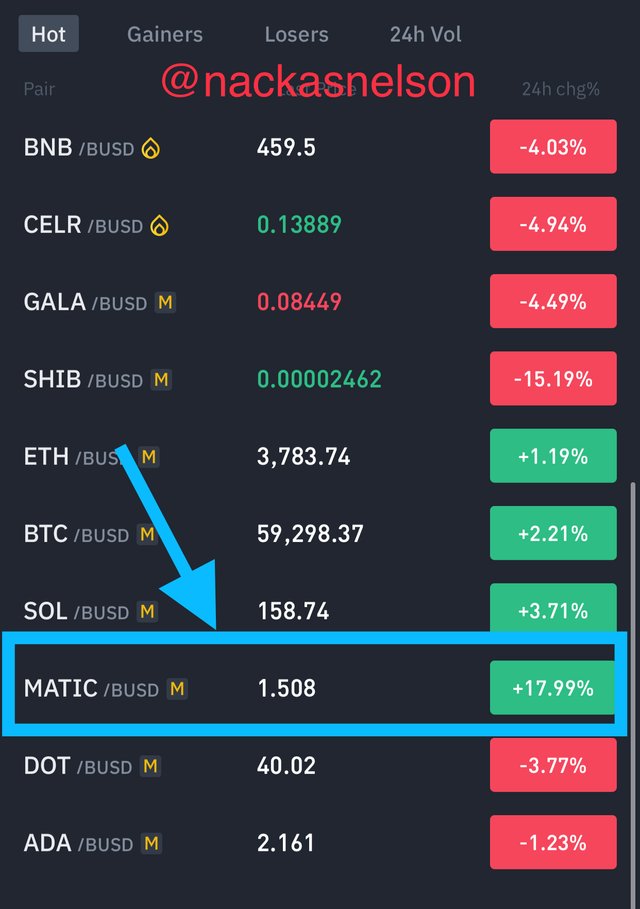

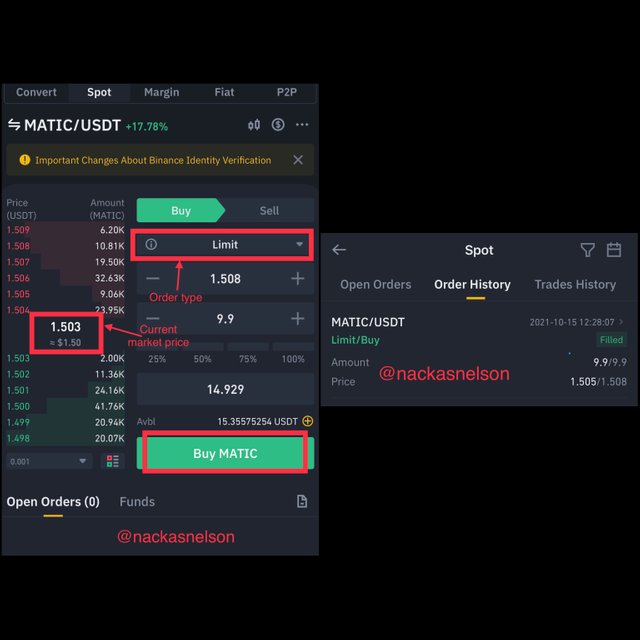

We then click on trade and search our trading pair then click on spot at the top left of the page after which I then click on the pair to exchange to the desired pair. I will be making the trade on the pair MATIC/USDT.

I then verify to be sure the trade order was on limit after which I inserted $1.508 as the limit price and I bought my MATIC at the current market price of $1.503 and the volume of $14.929 USDT. Then a market order was then opened for the trade to be carried out.

Question 4

i)Why you chose the crypto asset

ii)Why you chose the indicator and how it suits your trading style.

iii)Indicate the exit orders. (Screenshots required).

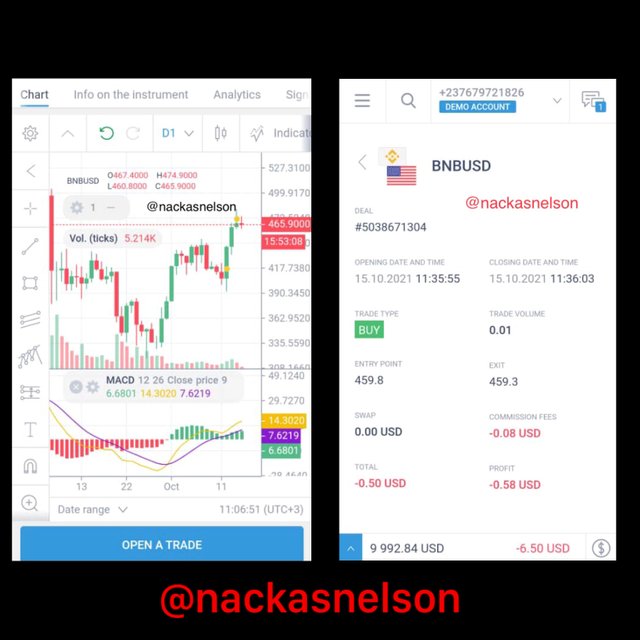

I move on to Liteforex and registered my demo account to carry out the trade and I will be using the BNBUSD pair with a MACD Indicator to analyze the trade.

Binance token was selected because of how familiar the coin is and how easy it is to go about the coin because it has a very strong base as it is the native token for the overall best cryptocurrency blockchain know as Binance and it is the token that is used as the fee charges of the platform.

The MACD Indicator was chosen because of its ability to show trade signals by using the trend direction which is shown by the zero line and with the MACD line which is over the signal line showing the continuity of the trend movement.

The analysis below shows that the MACD indicator is moving at a continuous upward movement as the indicator moves above zero and the indicator line moves above the signal line. My Buy order was entered at 459.8 BNB and excited at 459.3 BNB with a trading volume of 0.01 and realizing a loss of 0.58$. This analysis can be better understood on the chat below

Conclusion

Cryptocurrency Trading is necessary and important in the crypto community and it's an easy and very beneficial way of income generation nowadays from using different trading methods to manage loss or maximize profit. Traders can take advantage of the market volatility by studying and placing the right trade this can only happen with constant study, exercise, and experiences from past trade failures to be a great analyzer.

Thanks to professor @reminiscence01 for such a great lesson.

Cc: @reminiscence01

Hello @nackasnelson , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello prof @reminiscence

It's the 6th day of my post and it hasn't been voted yet

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Alright. It will be curated.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit