Heya Steemians, I hope you are doing great? This is my submission to Professor @allbert's lecture on Trading with Accumulation / Distribution (A/D) Indicator. The answers to his questions are as below;

WHAT THE A/D INDICATOR IS AND HOW AND WHY IT RELATES TO VOLUME.

First of all the A/D ( accumulation distribution), the indicator is used mainly by traders who prefer technical analysis. It was developed by Marc Chaikin who happens to be a trader and analyst. This indicator bases the volume of trades placed in the market of an asset or commodity and the corresponding accumulation pressure or distribution pressure.

The A/D indicator detects the accumulation and distribution area through the past data of the price action of required assets and the volume of an aggregate figure of trades taken place hence the A/D indicator is said to be a volume-based indicator.

The term “accumulation” denotes the level of buying (demand), and “distribution” denotes the level of selling (supply) of a stock. Hence, based on the supply and demand pressure of a stock, one can predict the stock’s future price trend.

HOW VOLUME IS RELATED TO A/D INDICATOR

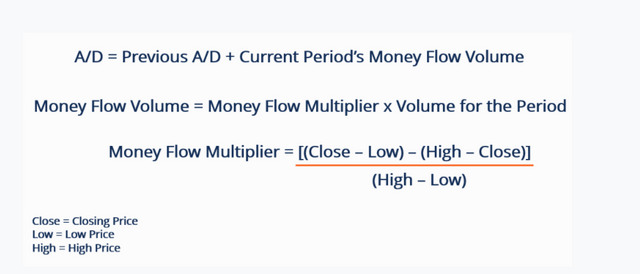

The A/D indicator generates trends based on market volume. Volume indicators are usually built on special algorithms or calculations. The formula of this volume-based A/D indicator can be shown in the screenshot below taken from the mentioned source.

.png)

HOW TO PLACE THE A/D INDICATOR USING TRADING VIEW

- First of all you will need to open the trading view interface.

.png)

- After opening the site you go to Indicators and strategies

.png)

- Type in Accumulation in the pop-up menu

.png)

- You will see Accumulation and Distribution then you click on it to get the indicator loaded onto your chart.

.png)

Explain through an example the formula of the A/D Indicator.

The formula is as follow:

Now with a practical example, let's first use real parameters from the chart of US30 assets on Tradingview.

.png)

The Maximum Price Point of the Asset for the previous candle = 34969

The Minimum Price Point of the Asset for the previous candle = 34422

The Closing Price Point of the Asset for the current candle = 34755

The Previous Accumulation/Distribution is 18.786M

The market volume was 274.511K

According to the first step of the formula let me calculate the value of the Money flow multiplier i.e. MFM by putting values in the equation

MFM = (C – L) – (H – C) ÷( H – L)

MFM = (34755 –34422) – (34969– 34755) ÷ 34969– 34422

MFM = 0.2175

Let us calculate the value of current money flow volume i.e. CMFV

CMFV = MFM x Period Volume

CMFV = 0.2175 x 274.511K

CMFV= 59,706.1425

Let us finally calculate value of A/D

A/D = Previous A/D + CMFV

A/D =18.786M +59,706.1425

A/D = 18,786,059,706.1425

A/D =18,786.1M

The Value of A/D I calculated is similar to mention in the picture in the right corner can be seen marked

How is it possible to detect and confirm a trend through the A/D indicator?

- Can be used to identify Bullish and Bearish Trends

Most traders are taught to always trade with the trend and never against the trend. Therefore this indicator we come in handy of a trader wasn't to snipe our his entries and also prevent trading in a ranging market.

When the price actions of the chart are in move in the upward direction and the A/D indicator is also in an upward trend, this indicates accumulation. What this tells every trader is that there are more bulls (buyers)on that asset’s market. This indicates high buying pressure.

Otherwise, when the price action of the chart is in a downward direction and the A/D indicator follows accordingly, this indicates distribution. With distribution, there are more bears ( sellers) having dominance in the market of the asset at that particular point in time. A Trader can use it to understand what is going on in the market and enables them to accumulate assets or sell them at high prices since there is high selling pressure.

.png)

From the above chart, you could see that the A/D indicator corresponded to the market directions to help traders know the exact trend and appreciate what is going on in the market.

- Spotting Divergences

Divergence is basically seen when the trend of an indicator is opposite to that of the chart. So a bullish price movement will be followed by a downward trend on the indicator and vice versa. And these can be seen using the A/D indicator.

This can aid traders in preparing for market reversal so that they can employ that to place trades to profit off them. Traders can place sell orders in the event of a bearish divergence after the bearish price direction begins or a buy order with respect to a bullish divergence once the price action of the chart forms an upward price movement. The ability to spot divergence help prevents traders from falling for the wrong market direction and highly increase signs of winning.

.png)

.png)

Through a DEMO account, perform one trading operation (BUY or SELL) using the A/D Indicator only

For the demo session, I analysed Steem/USDT and I managed to spot the trend direction and placed a trade successfully which immediately went into profit. I could create a broker on trading view since it didn't support my country but then my analysis went right and it was a winning trade.

.png)

What other indicator can be used in conjunction with the A/D Indicator. Justify, explain and test.

The A/D indicator has its pros and cons and as such using it alone won't be so much safe. Therefore it's is best you complement it with other indicators to make cancel out false signals and also snipe out the best ones.

I personally like to employ the rsi which helps me with the overbought and oversold zones which helps me in combining it with the A/D indicator to place trades.

So if the price comes out from oversold and the A/D indicator moves in the bullish trend I take a buy trade and vice versa for sell trades.

.png)

.png)

I thank Professor @allbert for this wonderful lecture.

First of all, I want to make it clear that I am aware that you edited the post 4 minutes after the assignment closed. However I will let it go for this last time... next time I will not allow it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well noted Prof . Thank you so much I will do my best to finish on time this week

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit