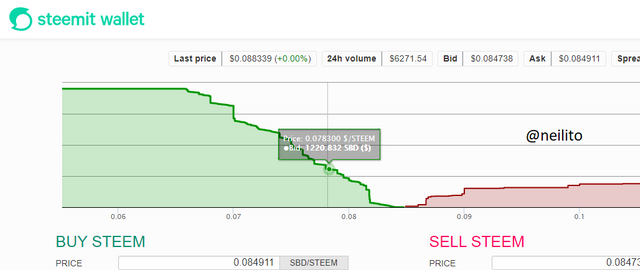

BID-ASK PRICE

In the world of trading, there are certain fundamentals that each and everyone should be well knowledgable of. One of these is the Bid-Ask price. So when it comes to the trading world, the Bid price basically means the highest price at which buyers(bulls) are willing to pay for that commodity while the Ask price is also the lowest price that a seller(bear) wants to sell the commodity.

.png)

.png)

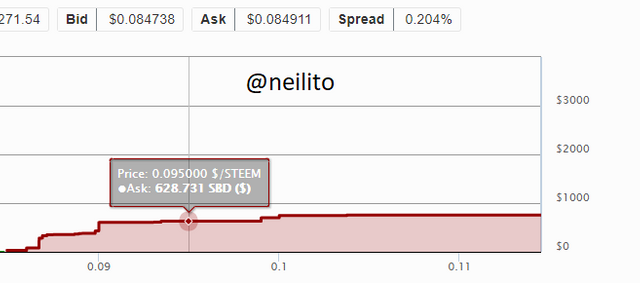

BID-ASK SPREAD

So when we talk about the Bid-Ask Spread is it basically the difference between the Ask Price and the Bid price. The Bid-Ask Spread can be simply referred to as Spread. This can be represented mathematically as :

Bid-Ask Spread = Ask price - Bid price

.png)

IMPORTANCE OF THE BID-ASK SPREAD

The spread of a market basically gives you an idea about market liquidity. When we talk about market liquidity it takes us to the volume of the market. Market volume is basically the number of people buying or selling. If the market has a bigger volume it means there are a lot of people in there buying and also selling.

Therefore if a market has more people readily buying and selling it would have a lesser spread and the market would be seen as a market with HIGH liquidity whereas if it has a bigger spread it means there the market volume is small and the market would have LOW liquidity. This can be easily seen when you compare the percentages

If Crypto X has a bid price of $5 and an ask price of $5.20

a.) To determine the spread you will use the formula: Ask price - Bid price

Spread = $5.20 - 5$

Spread = $0.20

b.) To determine the Bid-Ask spread in the percentage you will use the formula: (spread/ask price) x 100.

Bid-Ask spread in the percentage =($0.20/$5.20) x 100

Bid-Ask spread in the percentage = 19.23%

If Crypto Y has a bid price of $8.40 and an ask price of $8.80;

a.) To determine the spread you will use the formula: Ask price - Bid price

Spread = $8.80 - $8.40

Spread = $0.40

b.) To determine the Bid-Ask spread in the percentage you will use the formula: (spread/ask price) x 100.

Bid-Ask spread in the percentage =(0.40/8.80) x 100

Bid-Ask spread in the percentage = 4.54%

THE ASSET WITH THE HIGHER LIQUIDITY AND WHY?

The asset with higher liquidity would be Crypto Y and this is because it has a smaller spread than that of Crypto X. Also we just learnt that a smaller spread means more people(bigger Volume) are actively buying and selling easily so the spread would be small.

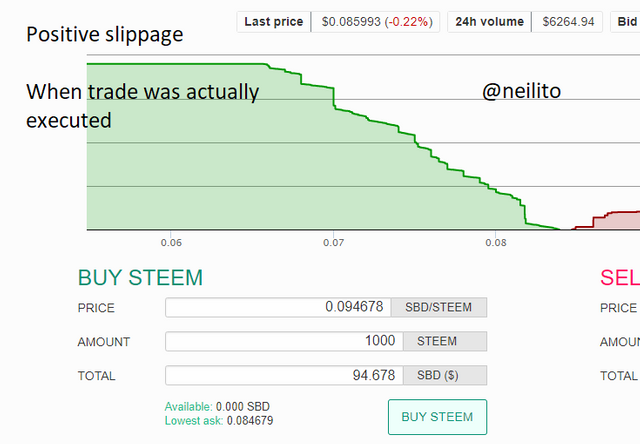

SLIPPAGE

In the world of trading, Slippage refers to the difference between the expected price at which you input a trade and the actual price at which the trade occurs. In simpler terms, this happens when the order that you placed on the exchange is executed at a price that’s different from the price that you requested.

This is usually a result of high volatility in the market and fast-moving markets prone to unexpected quick turns in certain trends.

POSITIVE AND NEGATIVE SLIPPAGE

A positive Slippage is basically when you bought at a price you saw favourable but then due to market volatility i the order gets executed at a lower price. For example, if you decided to buy at $90 but the trade got executed at $85

The slippage would be 90 - 85 which gives you 5 . Therefore the slippage here is 5.

.png)

.png)

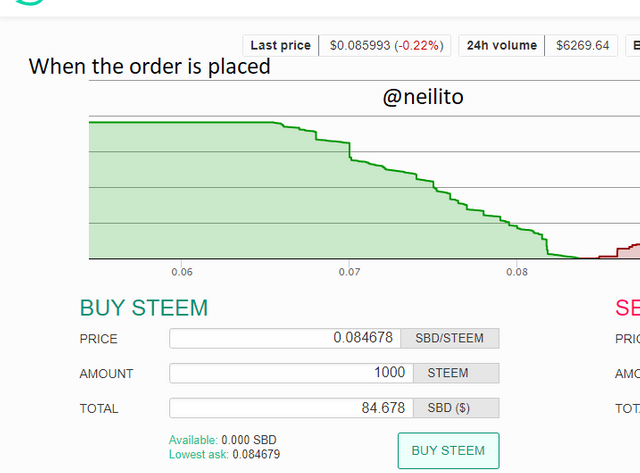

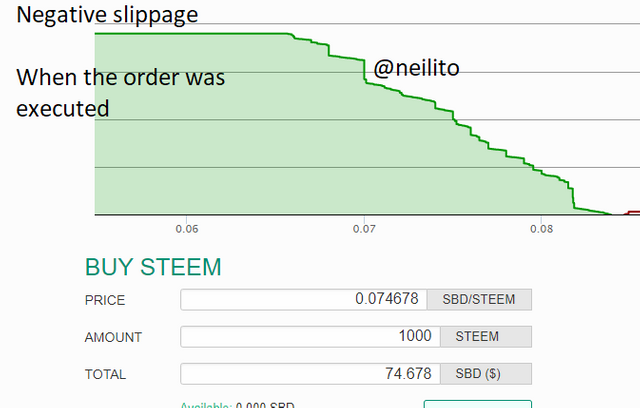

Negative Slippage

A positive Slippage is basically when you bought at a price you saw favourable but then due to market volatility, the order gets executed at a higher price. For example, if you decided to buy at $90 but the trade got executed at $95

The negative slippage would be 95 - 90 which gives you 5 . Therefore the negative slippage here is 5.

.png)

.png)

Special thanks to professor @awesononso for such a wonderful lesson. It was great to have been part of your class.