The crypto space is now one of the most trending topics. Each day we see abundance of new crypto currencies entering into the market with various tokenomics. Each one comes with its own roadmap and other marketing dynamics just to woo various investors to their project.

One of the marketing dynamics is that some of the coins are locked up only to be released at a future date. What does this mean and what does it entail for the crypto asset?

This topic forms the basis for this week's crypto academy engagement contest with the topic Token Unlock.

Use your own words to define what an unlock token is? And in your opinion, why do some projects choose to lock a quantity of these tokens?

Just as the name implies, it is the releasing of coins or assets that have been locked or kept out of supply in the crypto market for a specific period of time.

Sometimes we see a terminology like TVL (total value locked) being used to let us know the number of coins and its value that have been taken out of circulation. These locked out crypto currencies have a date in which it is schedule to be relaunched in to circulation.

This is a practice seen in the crypto industry. So many reasons causes token lockup. One of the reasons is that this helps to maintain price stability of assets and thus prevent massive sell offs by early investors to take profit in their investment.

Another reason is that early investors are susceptible to sell off and abandon the project after making early profits, so locking up their tokens ensure that they remain with the project.

Sometimes too, the project managers might demand that the coin should be locked and released after meeting a specific criterion such as the launching of a main net and some other requirements too.

Locking up of coin brings about increased trust among the two parties. Since both parties indicate commitment to long time success of the project through lock ups.

It gives investors higher control over their investments reducing volatility in the price of the coin.

So locking up some tokens of a project helps to ensure that their is liquidity for the project, thus ensuring growth, stability and sustainability of the project.

Clearly explain the method(s) by which these tokens are locked and then how they are released.

The lock up and unlocking of tokens is executed with the use of smart contract. These are contracts designed in such a way that they do not depend on a second party for execution, rather it executes on its own once the conditions are met. So they are just codes or programs in Blockchain that performs this function.

A smart contract is normally created to mitigate the transfer of coin within and until a specific period of time or when certain criteria are met. While doing so, It will have a mechanism that locks up the coin, not allowing it to be transferred till the conditions are met.

For instance, during a coin sale event, there will be a particular address to which the coin will be sent to. So the smart contract will generate and distribute the coin into the wallet of the investor. But if there is going to be lock up of tokens, the smart contract will hold the coins like a middleman until the requirements for releasing the coins are met, then it will release it and allow transferability by the investors.

Sometimes it could be that the unlock criteria will be in batches, or whatever manner as is decided by the investors and developers.

Using smart contracts ensures that security of the tokens are guaranteed, transparency and automation of release of coin is also ensured. Another benefit provided by the use of smart contract is that it can not be tampered with or altered once it has been added to the Blockchain.

We have various examples of token unlock. They are

° Time based lock ups: In this case, the tokens are locked up for not less than six months, and can last for over 2 years before being released or unlocked.

° Milestone lockup: this is when the lockups are released if a certain target have been met. Targets like reaching a specific number of holders, reaching a particular value in revenue and even launching it's mainnet.

° Tiered lockups: in this case, some percentage will be released after ICO while majority of the tokens will now be released in a definite percentage over a period of time. This provides profitability for the investors while they hold on for longer gains and growth from the project.

° Lockups based on performance: the tokens are locked up until a certain profitability percentage is achieved.

These are the 4 main different modes of token lockups.

What is the impact of an unlock token on the price of a crypto and how is it monitored? Give an example.

Unlocking a token affects the market liquidity. The release of more coins implies the more supply of the coins into the market and an increase in the market capitalization of the tokens.

So the token unlock

increases the liquidity of that crypto currency.

leads to higher trading volumes,

increase price volatility and

buyers and sellers dynamics comes into play.

So unlocking tokens surely affects the market and price volatility which may be on the positive or negative depending on the project involved.

The developers watch and monitor the dynamics as the effect of the token unlock plays out. A negative response towards it; that is price decline can lead to the project developers extending the time for the next token unlock

They can also bring up staking options with high APRs to persuade the owners of the unlocked tokens to take for usdt rewards or even the token rewards. This in turn reduces the quantity of the coin in circulation.

On the other hand, a sustained increase in price will cause them to stick to their planned scheduled of unlocking tokens.

Recently, we had several token unlocks and we rightly noticed the unlock effect on the crypto market.

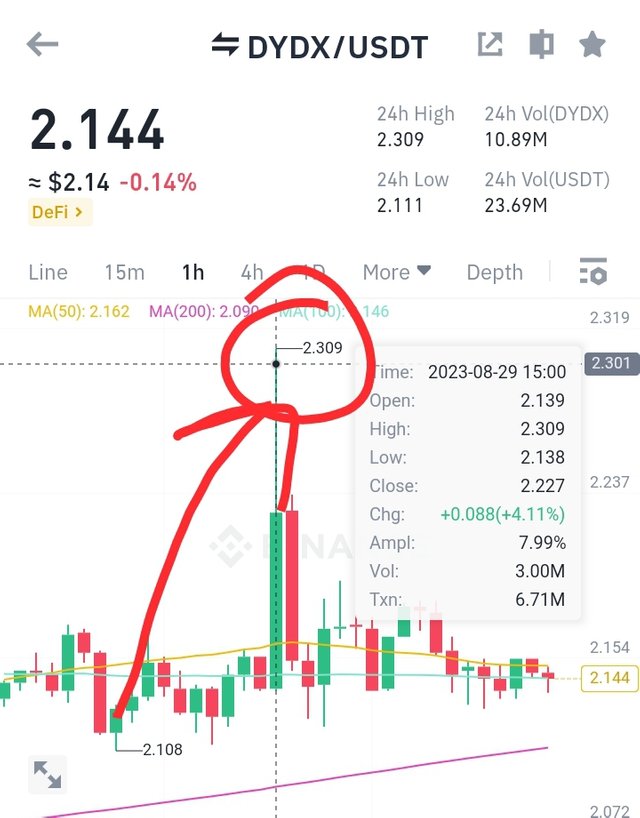

The token DYDX recently unlocked some of it's token. Before now, 75% of the token was locked up and they planned to unlock only about 4% of the lock token which is about $13.41 million. The unlock was done on the 29th of August 2023, by the project team, we saw much market and price volatility during the time of the unlock.

We can see the increased price volatility in DYDX and it gradually moved back to the base after the unlock. For now they will be watching the effect of the token unlock for some appreciable time.

Do you think that all cryptocurrency ecosystems have developed this kind of lock? Steem.Inc Among them? If yes or no, do you think it is or will be beneficial if used or added to its ecosystem? For what?

I think all crypto currency ecosystems have a way of locking up their tokens either within their ecosystems or outside it. Usually in many exchanges, we see staking adverts for various cryptos. So staking is a way of locking up coins even though this is at the discretion of the investor. Most at times very sweet and an attractive APR rates are attached to it, which woos investors to it. The longer the staking period, the higher the APR. This also reduces the supply of the token in the market. Sometimes, they also create liquidity pools for crypto tokens, for which investors are rewarded with LP tokens which can be staked and USDT is earned as a reward.

Steem. Inc is also amongst these ecosystems with a system of locking up their tokens. These they do through power ups. When users power up, it is a way of locking up coins, thus reducing circulation of the token in the market. In reward, they are given steem in steem powers for doing that.

I think doing that is quite beneficial and a positive one for steem inc. Reduction of coins in supply also affects prices positively. It is an indication of trust and confidence by the investors in the ecosystem and their desire to see the project grow in the long run. With the level of power ups being done, I even expect the steem coin to reach 1500 naira this coming bull run.

List the risks and benefits of unlocking tokens in a simple and understandable way.

There are some benefits attached to unlocking of tokens. These can be stated as follows

Token unlock assist the investors determine the change in supply of tokens. This enables them to determine their trade entry and exit points.

It is a positive gesture shown by the developing team of their trust in the project, thus ensuring fairness in their dealings.

Token unlock is a way of distributing tokens to investors which creates more trust and support from them for the project

Unlocking tokens are a way of raising funds to sustain the running of the project.

Some of the risk of unlocking tokens are

There is the tendency for the coin to dump if the unlocking price is way much higher than the investment price.

If the number of traders in the market willing to buy the coin is low, it can lead to a massive drop in price.

If the tokens that were unlocked is very big, the economics of supply, demand and price comes into play. Price will fall due to excessive supply.

If there are negative speculations about the coin, there is 80% possibility that they will massively sell off there unlocked tokens.

Conclusion

Token lock is an important part of the crypto ecosystem. It can make or mar it, determine its demise or growth, and how long the project will survive the ecosystem.

It has been a great learning section and I believe that I have done justice to the tips. I hereby invite @marianaceleste, @abdullahw2 and @azamjee to please take part in this contest

Good luck to everyone taking part!

This is my introductory post here

https://twitter.com/Celina58042963/status/1697333039171318182?t=oGGXqS3fZORRjFsP8vCi4A&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You've provided a detailed and informative explanation about token unlocking in the crypto space. Your insights about the reasons for locking tokens and the impact on the market are well-expressed. The use of smart contracts and different lockup strategies is explained clearly. Additionally, you've discussed the benefits and risks of unlocking tokens. Good job!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much. I think the unlocking of tokens should be done with discretion. It is to the good 9f both the investor and the management of the ecosystem. Thank you for your good comment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very informative for a newbie in the crypto world. I am eagerly waiting for one of my EVL tokens to unlock as it reminds me of Dogecoin and the best part of the story is I got them absolutely for free. The name is dos BEP20 and I have 200 million of them. I guess if it reaches even 0.01, it would do wonders for me. Thanks for your support, and my best for this one.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Imagine is your 200 dos BEP20 is unlocked, mehn, you will be on cash if the price should get to $0.01. And to crown it all, you got them for free, wow! Token unlock is really a wonderful thing that can happen to everyone that loves to take advantage of crypto projects both old and new. I pray we all succeed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's not 200 but 200 million

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, sorry, I forgot to add the million. That's huge dear

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

👍🎉

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mam , you have clearly described about tokens unlock with practical examples. And yeah ! It's good for both investors and management of the ecosystem. You are insights are detailed about this topic. You have presented a very good publication. Thanks my dear for this wonderful post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure! Thank you dear

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

♥️♥️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Token lockups in the crypto world serve as a vital tool for maintaining stability, trust, and long-term commitment. They prevent early sell-offs, instill investor confidence, and ensure sustainable growth.However,unlocking tokens can impact market dynamics, with both benefits and risks, affecting prices and liquidity. Understanding these mechanisms is crucial for crypto enthusiasts and investors.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have said it all. Thank you for your input

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I love the way you formatted your work, it made it look neat and easy to read, nice content by the way

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Outstanding post @ngoenyi! Your detailed explanation of token unlocks in the crypto space is incredibly informative. Your ability to simplify complex concepts and provide valuable insights is highly CCommendable. I've learned a lot from your post and it's a Valuable resource for anyone looking to Understand token unlocks better. Keep up the excellent work & I eagerly await more insightful contributions from you! 🚀💡

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola Ngoenyi 😊

Tu post estuvo increiblemete completo y bien detallado, me encanto los ejemplos que diste con la grafica y demas. Se ve que tienes una buena base sobre estos temas porque los explicas con mucha naturalidad y entusiasmo.

Te deseo suerte y exitos en el concurso

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Estoy aprendiendo de tu capacidad de síntesis y habilidad para abordar este tema así como en otros temas de las semanas previas. Por un momento pensé que la quema de criptoactivos podría tratarse como una forma de bloqueo de tokens pero esta no tiene cabida en el desbloqueo, es decir, nunca regresarán porque simplementes se eliminan.

Gracias por compartir contenido de calidad.

¡Un gran abrazo!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit