This lesson sheds light on the entire scope of Crypto trading including its types and even markets orders,and much more lessons.

I wish to express my understanding of the lesson through my work below.

designed by me from canvas

designed by me from canvas1.) Explain the following stating its advantages and disadvantages:

-Spot trading

-Margin trading

-Futures trading

Explanation of Spot trading, advantages and disadvantages :

Spot trading could be seen as an investment basis of acquiring crypto assets /other securities, managing them and then selling off when there is a notable appreciation in their value.

In this kind of trading, unlike others, the traders /buyers purchase the main assets and choose to sell off, trade and buy at any time they choose to (ie there is assumption of full ownership of the assets) . Like it's name implies , the worth of assets at their time of transactions could be termed as Spot prices

Pros of Spot trading :

Elimination of the risk of liquidation :One of the major benefits of Spot trading is that, traders do not totally lose from falling markets since even when the market trend goes against their predictions, they could still stand and recuperate from the market stands, be it Bullish or bearish

Encouragement of minimum capital :Spot trading allows for investment with even the "widow's mite" as there is no minimum amount of capital that could be invested in the market.

This allows every trader gain and utilize the market irrespective of his' capital sizeAbsolute ownership of assets :In other kinds of trading, the assets are not fully owned by the traders but in spot trading, it's owned by him

Cons of Spot trading :

Risk to invested capital :The market could take different shapes at times and transactions made while in a volatile nature of the market could claim capital

Traders can benefit from only one pattern of the market in spot trading whereas eg future traders can benefit from the market either ways. This explains that market movements could only be beneficial when Bullish

Limits knowledge of the market :Non comprehensive trading leaves user/traders partly ignorant of market trading and keeps them at the beginner level

Margin trading :

Margin trading entails the act of utilizing funds lent by a broker to trade a financial security or asset which the broker recognizes as a collateral for a loan taken.

The initial funds lent by the broker to buy the assets is considered as a margin and the net amount gotten after subtracting the loan amount from the final value of the transaction.

Advantages of margin trading :

The presence of bigger leverage increases, the expected financial returns even in situations of investors who have limited capital

This kind of trading allows investors the chances to open diverse positions while using little funds

Disadvantages :

- The same beneficial leverage, in marginal trading could be a loss factor, since when the market trend goes against their prediction, the loss could be unbearable.

- The complexity of this kind of trading, demands expertise as to know the right market decisions to make ie it requires proper fundamental and technical analysis before trading can work

Futures trading:

Futures trading could be seen as a very complex and advanced mode of trading since it involves not just buying and selling of assets but doing that with the price movements and their predictions too.

In this act of trading, traders predict price movements and act on them, eg if a trader predicts a fall in price, he goes short (sells) and vice versa

Advantages of futures trading :

Relatively low transaction costs :In futures trading, fees and commissions placed on transactions are low compared to other kinds of trading for example 0.5% is the charge of the total worth of the transaction

Money is made faster by speculators :In the futures market, money is made faster since every market movement could be beneficial to the correct predictors even with reduction of market loss risks with trade orders present ie stop loss and take profit orders

Liquid quality :The future markets, have the quality of being liquid and so efficiency of trade orders in the market is maximum since there numerous contracts leaving futures amply liquid

Disadvantages or futures trading :

Complexity in nature :Firstly, future contracts are not traded by any broker /regular brokers but only by registered future brokers. It's volatile assets' nature, could be risk bearing to consumers who trade on stable expectations

Request of large initial deposits :Unlike other tradings, futures tradings, demand large volume of capital to begin with and even in the emergence of a mini capital leverage company, the prices of capital assets still remain exorbitant to average traders, maybe from spot trading

2.) a) Explain the different types of orders in trading.

b) How can a trader manage risk using an OCO order? (technical example needed).

The different types of orders in trading , include :

Market Order :

The market order, explains a trade order meant to go long or short of an asset the prevailing market price. In this kind of order, control of price at which assets are sold /bought is left out of the control of the person. This explains further that if a particular asset is traded intensively, there would be trade orders, carried out before yours and brining forth a new price.

Eg :If a trader makes an order to buy 200 assets (maybe ripple), they get 200 ripples at ripple's asking price

Limit order :

A limit order could be termed, a trade order geared towards buying an asset at a particular price or even better one.

This limit order, gives traders the advantage of not buying and selling stock at a price they don't want meaning that when limit orders are placed, if the general price level isn't in accordance with the limit order price, the order won't be placed.

The limit order has two subs including the:

Buy limit order :

This explains the fact that the trader can't buy an asset for more than ¥ if the limit order set is ¥

Sell limit order :

This entails that the trade won't sell an asset below ¥ if the limit order set for the asset is ¥

Stop orders :

Stop orders could be seen as trade orders designed to minimize trader's losses on market positions. This order also known as a stop loss order goes short of an asset once it gets to a particular price or also goes long of an asset based on its activation.

Eg we can take a situation where a trader who bought at ¥10 now sees the value at ¥20 would sell once the price gets to ¥15, he now puts a stop loss at ¥15 meaning that the trade would automatically go short once it gets to ¥15

Stop-limit orders :

Like it's name implies here, we see that this order, has joint characteristics of both stop and limit orders. This order demands the setting of double prices, one being the stop price and the other being the limit price.

Here once the value of the asset gets to the stop price, it turns to a limit order.

Eg Ade a Binance trader who owns an asset at worth of 50$ but would sell the asset if it gets below 40$ meaning that it could be sold at 39$ or more. Here a stop limit order could be set by leaving the stop price at 40$ and limit order at 39$ meaning that when the stock gets below 40$,it becomes a limit order at $39.

Trailing stop orders :

These orders have the likeness of stop orders and can be used in both long and short positions. These orders are determined by the percentage change in market value of assets with regards to an already marked out price.

For example I can choose to buy a stock at price of 50$ and place my trailing stop order at 30%. Here we get that if the value of the stocks reduce by 30% or more, it automatically goes short

b) How can a trader manage risk using an OCO order? (technical example needed).

Like I gave a previous example in the Stop-limit orders (OCO) orders, where, Ade a Binance trader who owns an asset at worth of 50$ but would sell the asset if it gets below 40$ meaning that it could be sold at 39$ or more. Here a stop limit order could be set by leaving the stop price at 40$ and limit order at 39$ meaning that when the stock gets below 40$,it becomes a limit order at $39.

Here we see that the risk of Ade having more than $2 loss in value of his assets is eliminated but instead any order which takes place first cancels the order and leaves him with no serious losses

3a) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

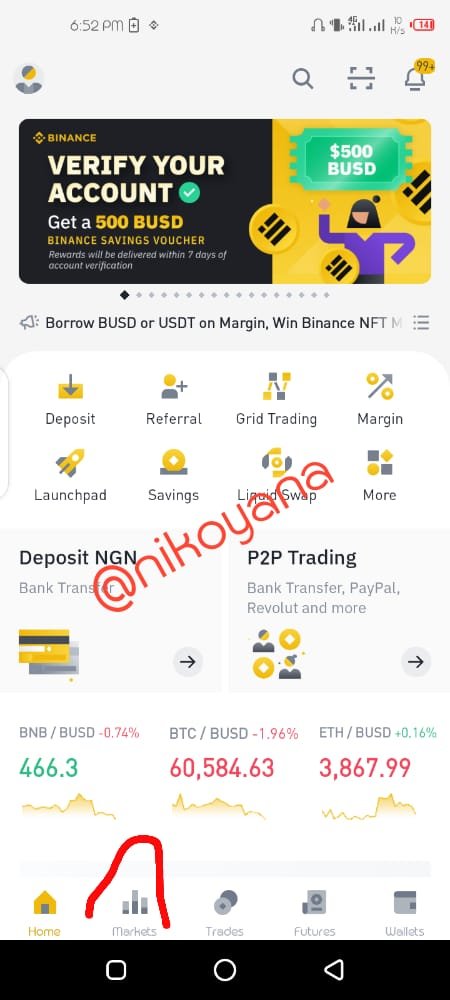

- For this question, I will be using the binance app, when you open the binance app, click on the market

- Search for the trx/usdt pair and click on it as you can see below

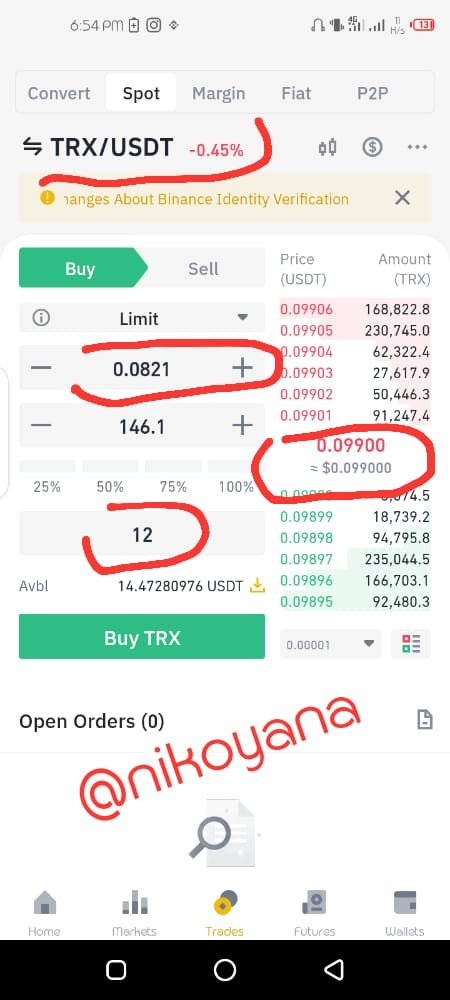

- Click on buy as we intend to buy trx with the usdt coin.

- You have to make sure it is set to limit, and twerk the price to what you want other than the current limit price then click on buy.

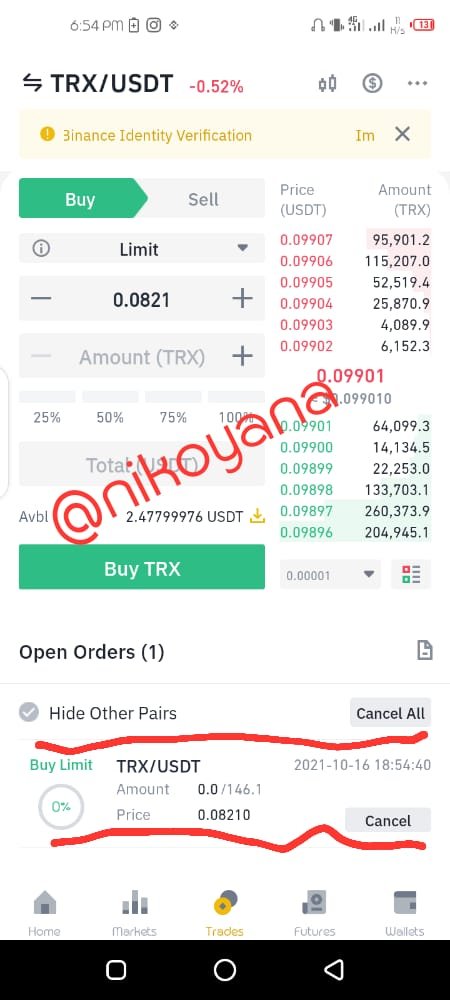

- We can see below that the order has been placed.

4.) Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

i)Why you chose the crypto asset

ii)Why you chose the indicator and how it suits your trading style.

iii)Indicate the exit orders. (Screenshots required).

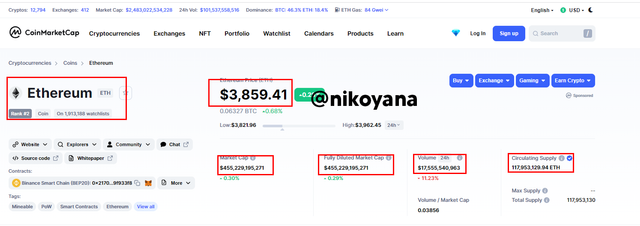

Why I choose ethereum

The ethereum coin as we can see is the number 2 coin on the coin ranking list and it gives permission for the usage of smart contracts on the decentralized app system, without interference, it gives data security, great scalability and a lot more, the advantages of this coin can't be overemphasized

Below are the current details of this coin.

Using the bollinger bands to execute trade

The bollinger bands is one the most use technical indicator that has proved the test of time with consistence profit.The bollinger band consist of centerline that is an exponential moving average and two other bands, one is below the centerline and one is above the centerline. The bollinger bands is used to show thw channel of price at any time frame.

When the market has high volatile price movements , the band normally expands but when there is a low volatile price movement the bands tend to contract. So the bollinger bands can be used to determine the volatility of a market at a particular time.

When the price touches the upper bands, that is an indication of overbought, which is an indication of trend reversal and this can be right time to enter your sell order. But when the price touches the lower band, it signifies an oversold position, so indicate the trend is about to reverse of trend, upward, buyers will be ready.

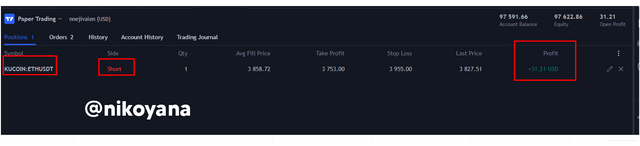

In the ETHUSDT chart in the 2 hour time frame, we entered a sell order with the following reasons.

Entry condition

- The price touched the upper band

- The upper band signifies overbought which is time for sellers

- I entered executed a sell order knowing that the price was heading towards the lower bands

Exit Condition.

- I used the closet high resistance as my stoploss

- With the risk to reward ratio of 1:1 I entered the take profit position

- And I can also remove the trade manually, if I am satisfied with the trade

- As you can see it has already started yielding profit.

CONCLUSION

This work explains the totality of the kinds of trading including their levels from simple to complex.

We considered the advantages and disadvantages of the tradings.

The trading orders were also well defined as we saw them in their different ways and even situations where two orders could be executed.

One more time, I appreciate the professor for this lesson

Best regards

@reminiscence01

Hello @nikoyana, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit