Good day steemians I will like to talk about risk and aversion in this topic.

Risk in our normal english terms means anything that involves danger and the outcome can be positive or negative, every firm or any investment that starts up is faced with risk which can emerge from different angles such as government can bring out a policy that will affect that particular firm or investment such as levelling high tariff on its goods or ban that particular good or devaluation of that economies currency while

Aversion means a strong dislike for something, therefore risk aversion is the tendency to prefer investment with certainty of profit than investment with uncertainty of profit(that is investment whose outcome is not known).

1.Which is your risk aversion which, of these products you find the most appealing and why

Preferably I would like to go with

Conservative tolerance to risk : here there is a preferably low or minimum level of risk and volatility to traders, but the amount of profit here is low.

Profit here is low compared to aggressive risk tolerance because the aggressive risk tolerance takes higher risk than conservative, the higher the risk of an investment the higher the return of that particular investment.

Conservative tolerance risk takes lower risk in-order to prevent loss on profits of investments.

Investors or traders whose tolerance to risk is low are advised to use this risk aversion because it enables the trading to be on the safer side for the trader.

The product i find appealing currently is the dual investment because i receive my yield base on two cryptocurrencies, here i have a chance to deposit my BTC coin or invest my coin by trading that the coin will appreciate in value in a fixed number of days which can be one month or two etc which comes with a fixed rate of interest, after that period elapses two situation are observed here

A) when the BTC coin increases in value after that particular fixed number of days i would have my btc coin now paid in usdt in the new appreciated value plus the fixed interest also in usdt and not the initial value of the btc coin at the start of the trade.

B) Here when the btc coin after that fixed number of days depreciate in value i would still have my btc coin back (as the value was before the trade plus my fixed rate of interest) but this time not in appreciated value and not in usdt but in btc.

2.Explain in your own words fixed and flexible savings,high risk product and launch pools.

a) Fixed savings :as we all know in banking term the holder of the account deposits a fixed amount in the bank for a particular period of time which can be one year or two years depending on the agreement the money cannot be withdrawn until this agreed period elapses and comes with a lucrative interest.

Now let's come down to crypto terms fixed savings has to do with keeping your coins in wallet and that wallet will be locked for a particular number of period which could be one month, two month, etc here that coin cannot be staked anywhere again or be used for any transaction again until that period elapses and it comes with a higher interest.

This method is applicable for only investors who are tolerant to high risk.

b) flexible savings: in this type of staking can be related to current account compared to bank where money deposited is not on fix term purposes, the money can be withdrawn at anytime but the interest here is low or no interest at all compared to fix.

The same way in binance if you stake your btc coin using flexible saving method means the btc coin is not to be staked or deposited for a fix period, you can reclaim the coin anytime, anywhere and it also attracts lower interest.

High risk products are products that have high risk and they include:

a) Defi staking: decentralized finance staking is all about staking your coin and hoping to get profit, financial services here is done in a decentralized way(there is no third party) defi operates by staking or locking your btc coin for a fixed period of time, within this fixed period the staked btc coin cannot be used for any transaction until the period elapses, the trader can now receive the btc coin plus interest for locking the coin for that fixed period.

b) Liquidity swap :here users of binance can stake thier coin to fund or launch new projects in turn becoming a liquid provider, by providing liquidity to these projects the user earns interest and fees.

c) Dual investment: is more like fixed saving because after staking or locking your coin for a fixed period you receive a return base on two cryptocurrencies, after staking your coin there are two outcome that is expected which comes with a fix interest.

For example if the stake coin was

1btc which equals 50000naira

and you trade that 1btc in the next month the value will worth100,000usdt with 5℅ interest if the value of 1btc appreciates in 1 month time to 100000usdt the trader receives 1btc worth in usdt and interest worth in usdt but if the btc depreciates the trader gets his 1btc back this time not in usdt but in the same btc and the interest in btc.

d) launch pool: after binance as an exchange has verified and validated

Initial exchange offering platform who wants to launch thier token on binance before been listed on the market exchange launch pool is used, users of binance can now stake thier binance coin or BUSD for that particular token which in turn provides liquidity to the token which can help the IEO to continue the project of that particular token in thier white paper at the same time users of binance who stake for the token also earn because the token after a while may increase in value than the previous value staked by users of binance.

- Show and give details on how to set the investment you choose in binance.if you don't use binance as your exchange let us know which alternative you have in your own exchange and simulate the process of investing in binance.

I will be Demonstrating my Flexible Investment Plan using the binance app.

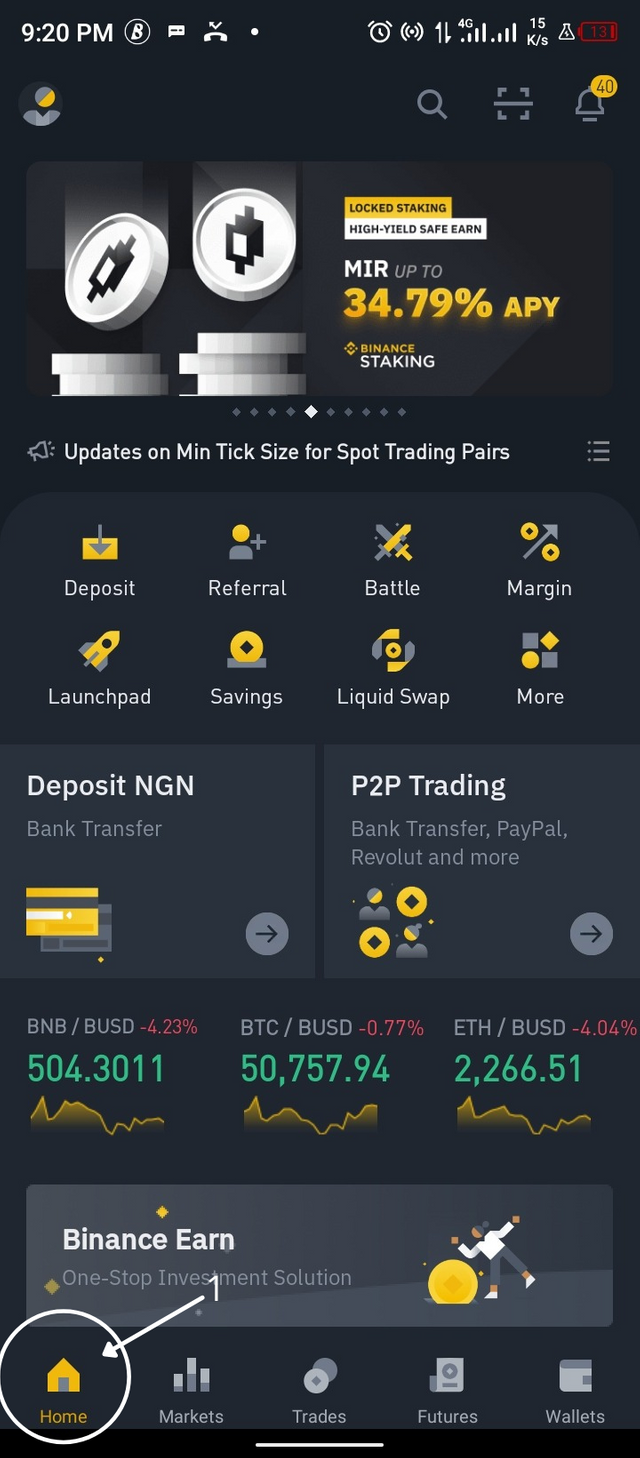

i. Click on the Home Button:

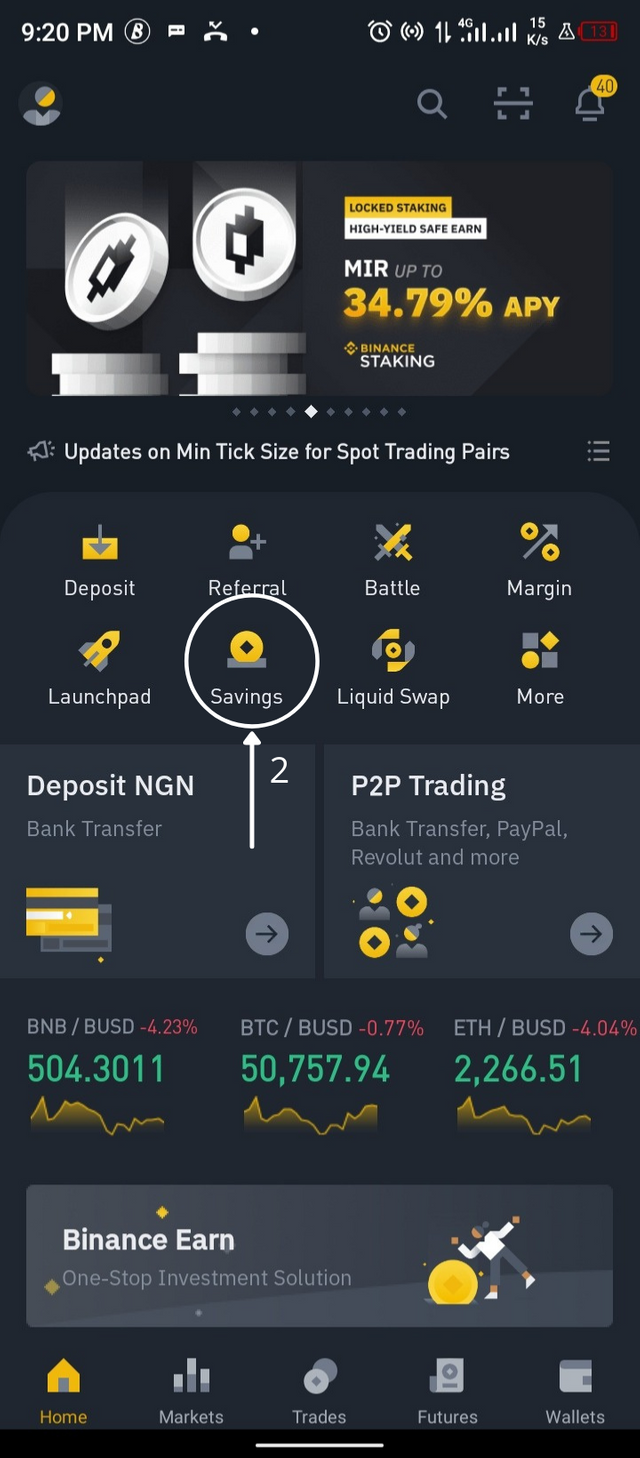

ii. Click on the Savings Button:

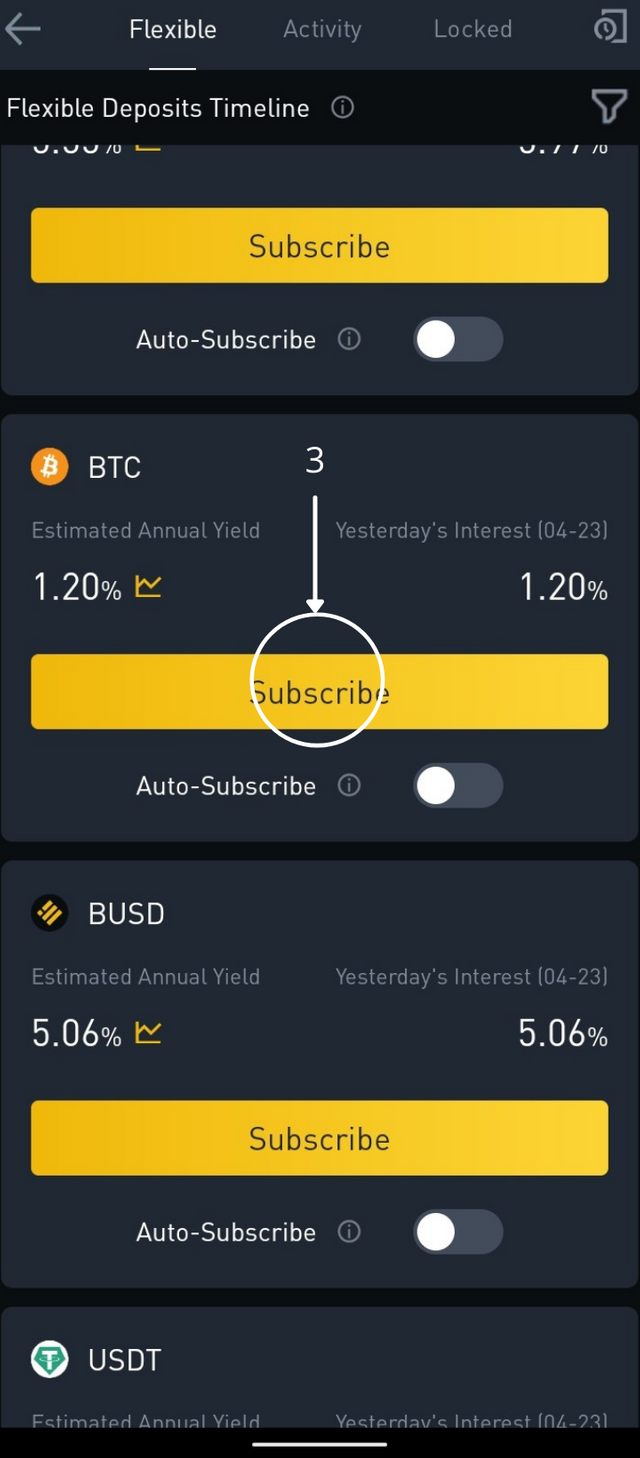

iii. Select your preferred coins to save with, then click on the subscribe button.

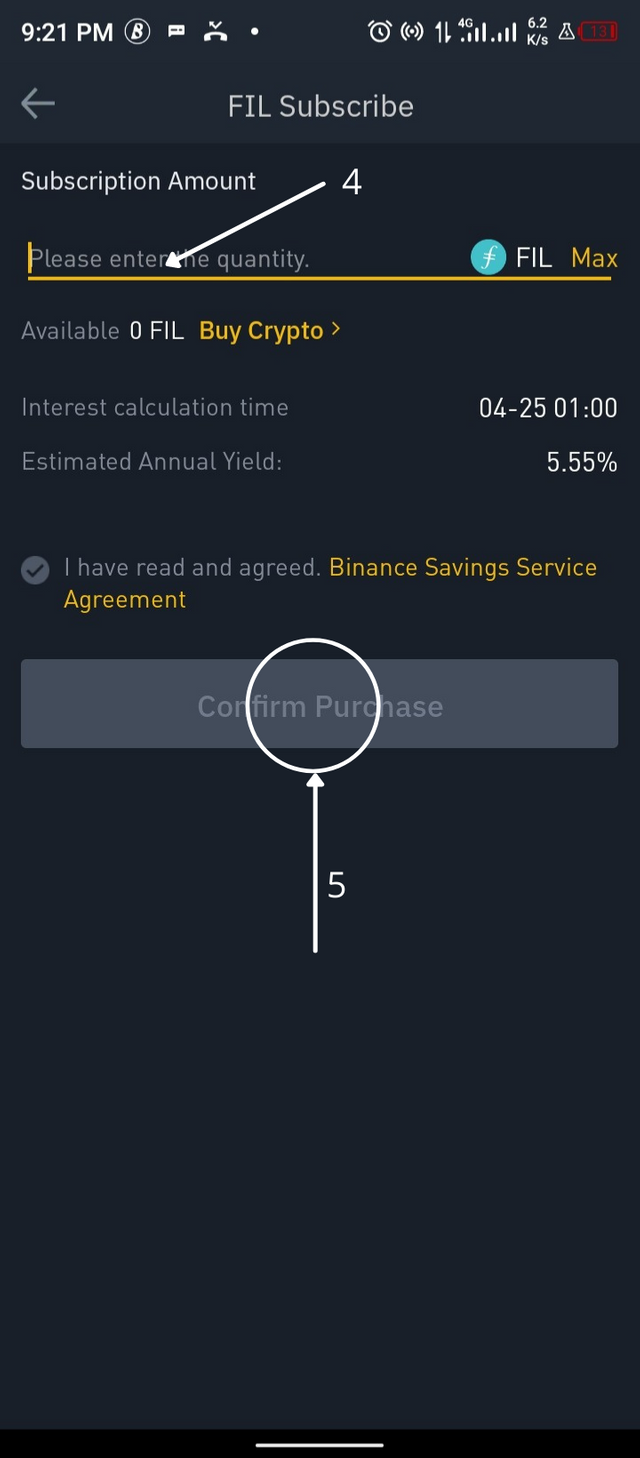

iv. Input your desired subscription amount

v. Click on Confirm Purchase.

Conclusion

I really appreciate professor @fendit for the wonderful lectures which has enabled me understand how to make my money work for me using the binance platform, and more exploring other staking platforms on the binance Earn.

Thank you for being part of my lecture and completing the task!

My comments:

Your work was fine, but i'm not really convinced you understood how dual investments work. Aside from that, it was all good! Some concepts could have been developed a bit more, though...

Overall score:

5/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit