it is week 4 and I am glad to be part of this week homework post, I will go straight to the homework post and answer the questions immediately

1- Define Arbitrage Trading in your own words.

it is amazing how we have many related world and real life experiences in the crypto market place, and I would explain why I said so, first of all lets define the two words listed in the question above

ARBITRAGE: the word arbitrage as we already know is the technique of buying different assets or commodities from different markets with the aim of taking advantage of the price differences in the market

TRADING: The word trading isn't new to us as it comprises our daily lifestyle, it is simply the exchange of goods or services for a compensation to reward the seller by the buyer

having known the meaning of the two words we could easily detect the meaning of Arbitrage Trading but I will be explaining it in a layman words so we could all understand

ARBITRAGE TRADING It simply the act whereby investors take advantage of time from a market that hasn't yet adjusted to the current exchange rate in order words from a market where the asset or security is currently below the value and selling it to a local exchange with the aim of marking profit. It is less risky but I bet you that it requires a high level of professionalism if not all asset could be lost

2.Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

during the course of my research, I discovered that truly there are a lot of Arbitrage but I will be defining just 3 as instructed

DEFI ARBITRAGE:

This is a strategy in which the investors aims at generating profit from different decentralized finance(DEFI) lending protocols for example if a lending protocol offers 5% on yield interes and returns and another offers 7% on yield interest and returns, the investor will therefore take advantage of the percent margin converting the small yield margin of 5% to 7% gaining an extra 2%BETWEEN EXCHANGES ARBITRAGE

This is a great method as explained in the lecture to buy a currency or asset from one exchange at a lesser price then transfer it to another exchange where it is sold at a higher price than the first exchange there by making gain on the difference per time. Although transaction fees seem to be a challenge of this method but one can gain on a higher margin higher than the price of the transaction fee and one could also gain if he holds stable coins on both exchanges where he can buy and swap simultaneously. Examples of exchanges include; Binance, Coinbase, Huobi etcSTATISTICALARBITRAGE:

This is a bit complicated as we work with statistical and computational methods to trade cryptocurrency at different time frames, working with bots that can perform more than 100 trades at a time due to a predicted future of the assets by the developer of the mathematical and statistical models. This is done by mostly experts and professionals in the field as a little mistake could bring about unending tears

3- Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

TRIANGULAR ARBITRAGE:

Just like we were taught in the lecture, the Triangular Arbitrage has to do with 3 different assets being traded on the same exchange to gain profit for example if an investors decides to take advantage of 3 assets let's say STEEM, ETH, BTC

and swap them with the end goal of making profit, so the investor has to be swift and take advantage of the market values,First make a trade of STEEM for BTC at the limit price

next make an exchange of BTC for ETH at the limit price

then lastly make an exchange of ETH for the STEEM

it is compulsory to end at the starting point, so if the starting point was STEEM, we must end at STEEM and hopefully make profit but it is usually at a low risk

4- Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

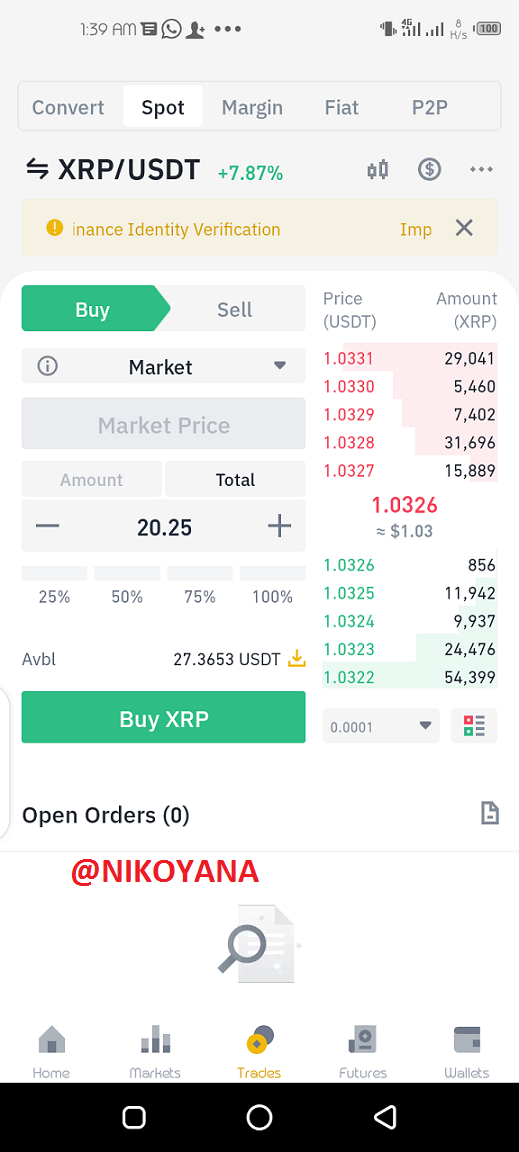

- First of all I will be using the binance to purchase the Ripple (XRP) coin, I will be purchasing at the cost of 20.25 USDT at 1.0326 market price

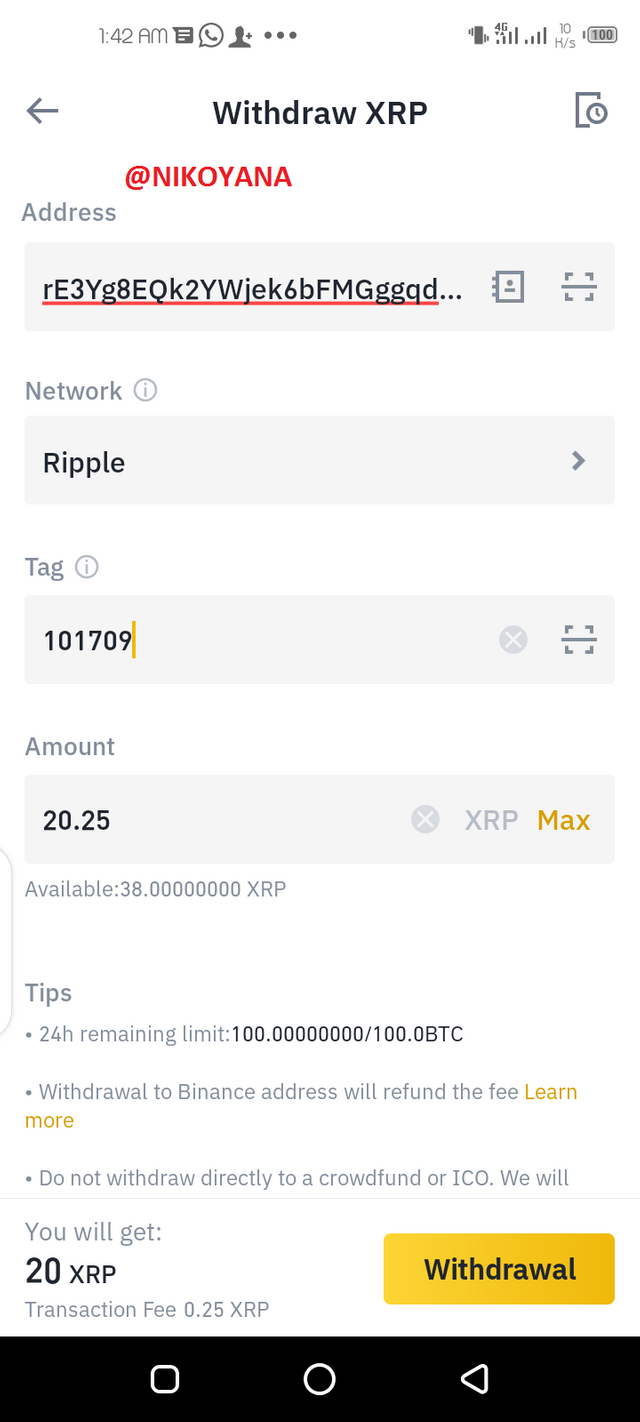

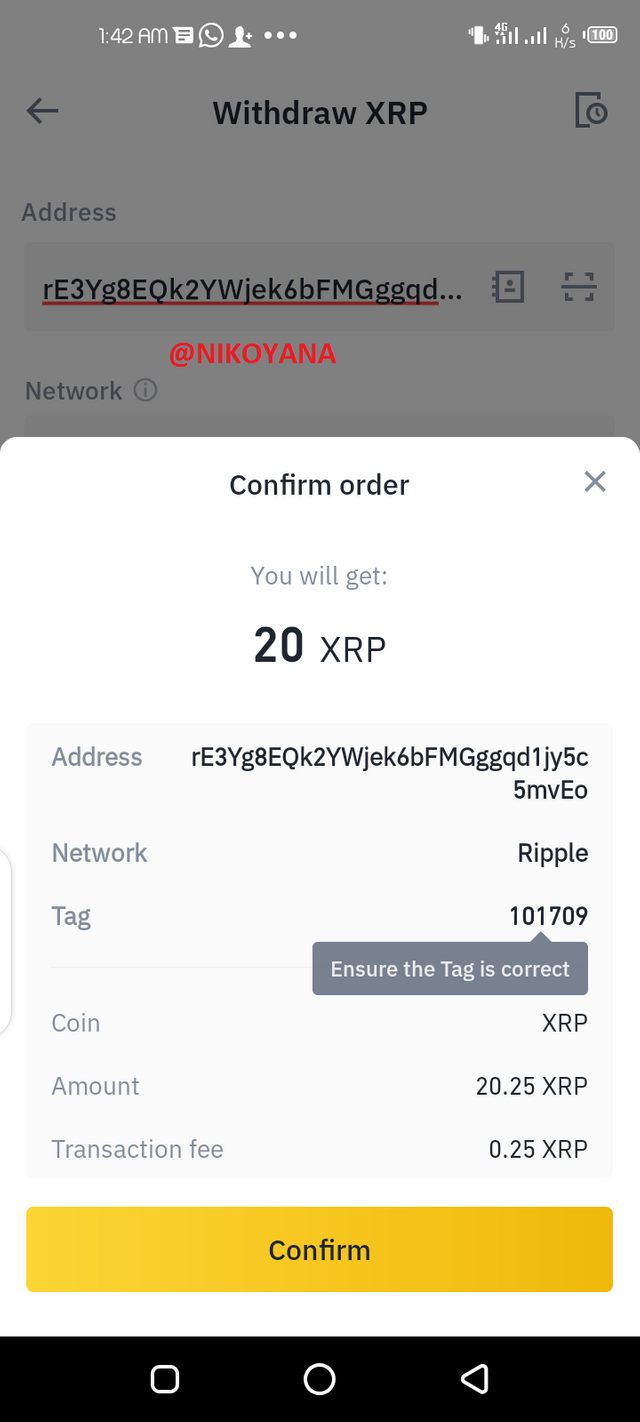

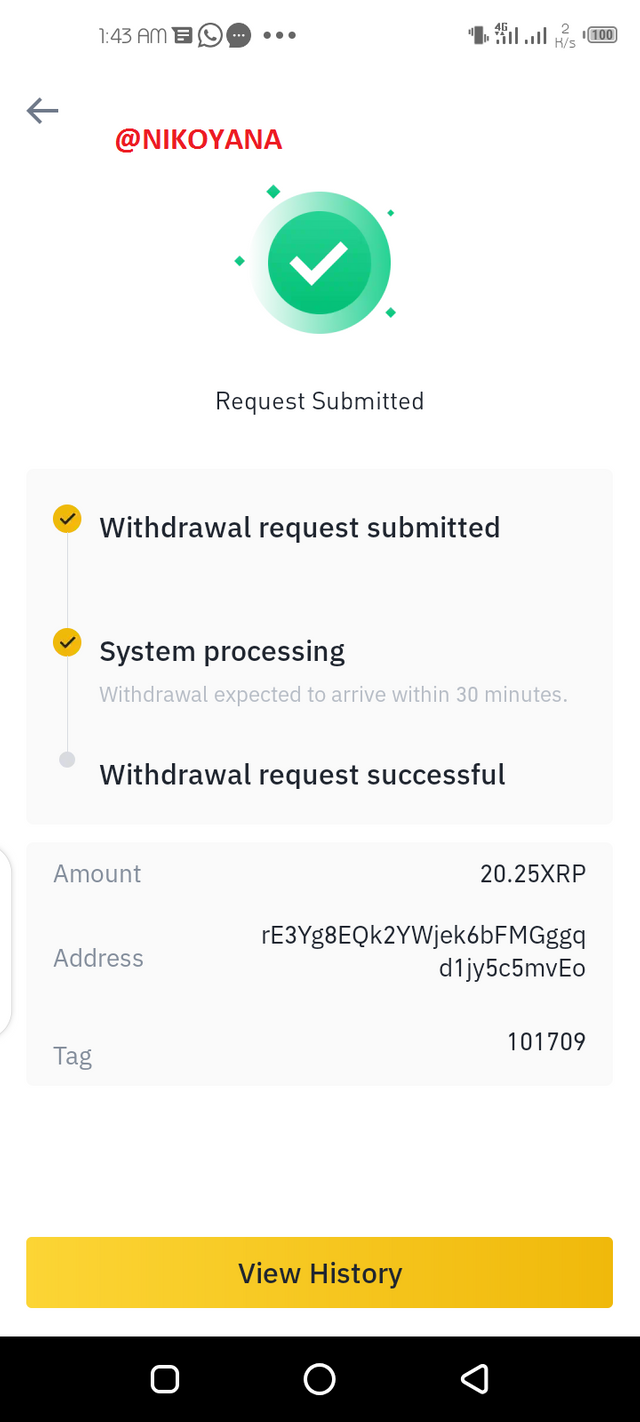

- I will be withdrawing it to my huobi exchange which will cost a transaction fee of 0.25xrp so

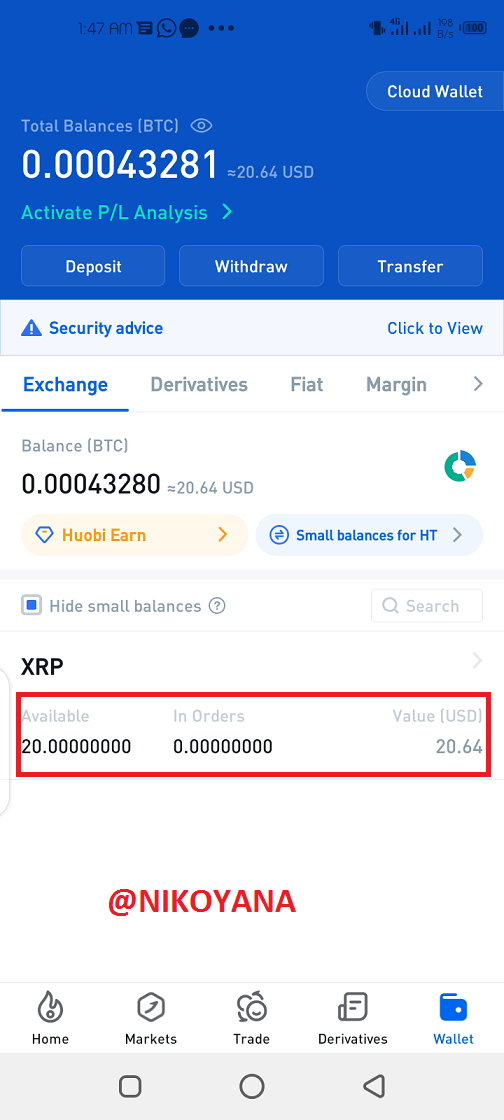

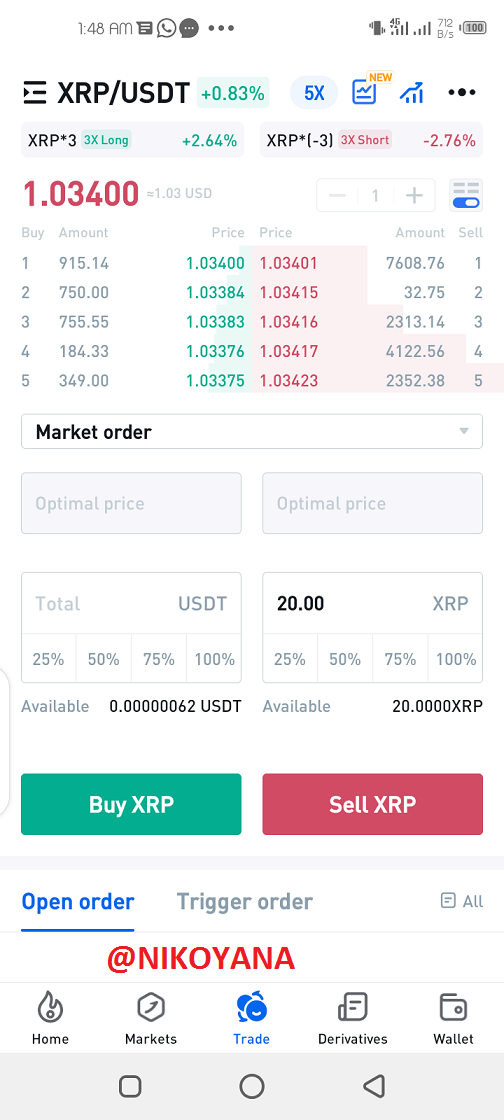

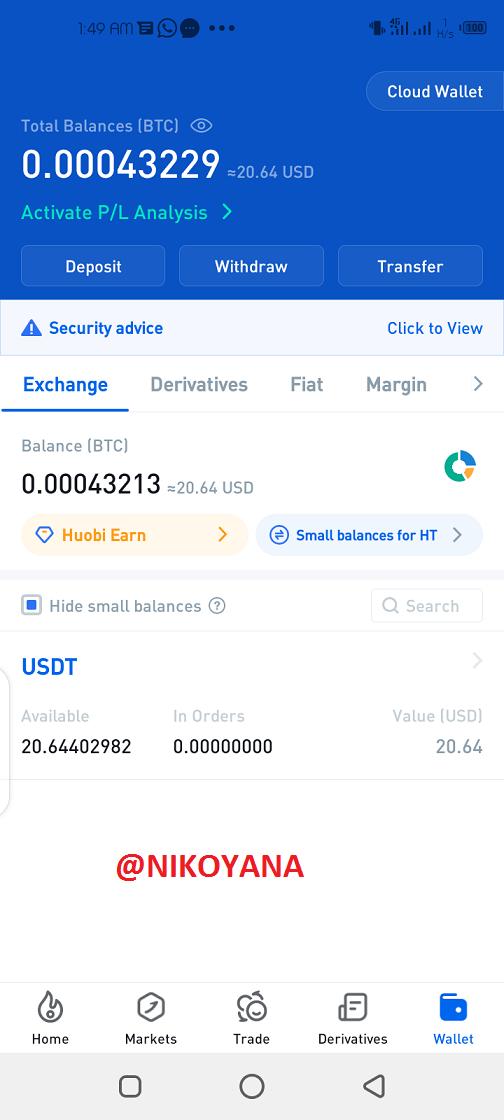

- going to the Huobi we can see that our XRP has arrived the exchange and I will be selling the XRP coin at 1.034 as compared to 1.032

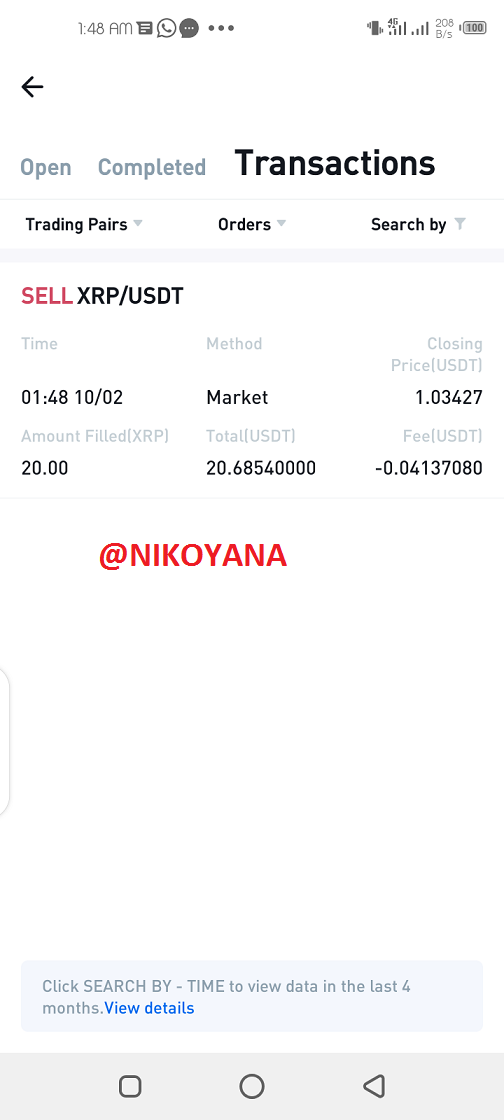

- Below is the details of the sold XRP and we can see the converted USDT below having 20.68USDT

We can see that despite the transaction fee of 0.25 usdt , I was able to make gain of 20.68-20.25 = 0.43

5- Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

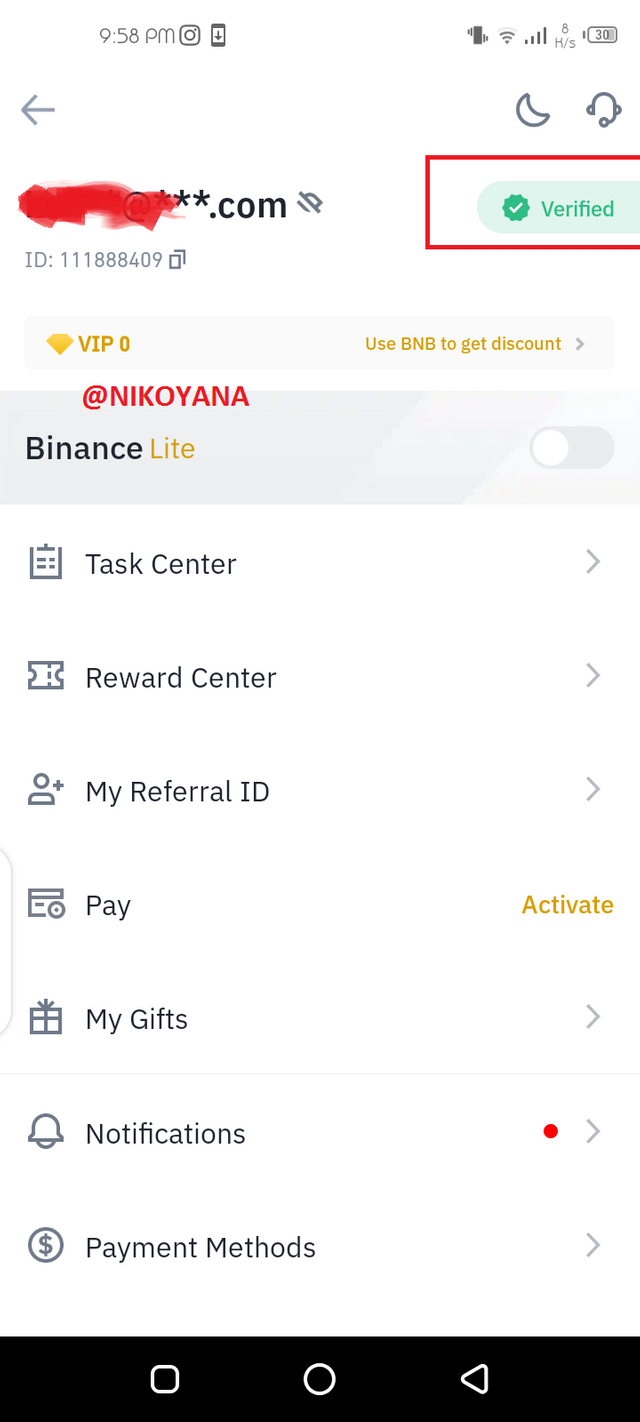

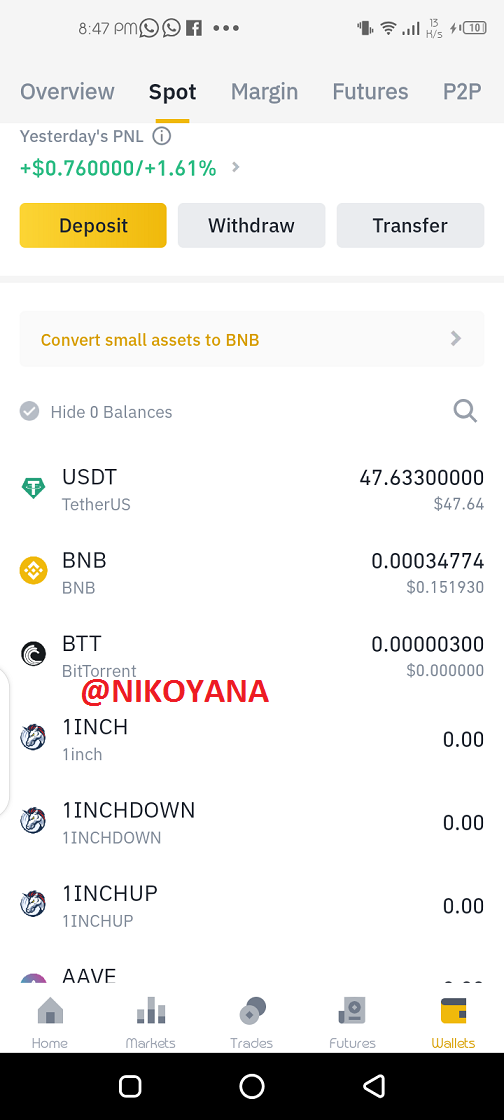

For this task I will start by showing my verified account on binance

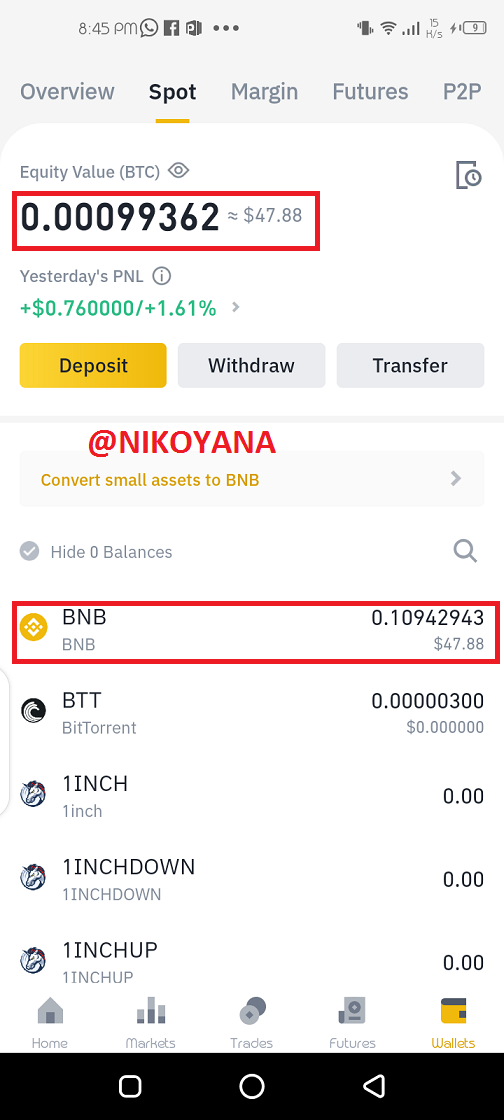

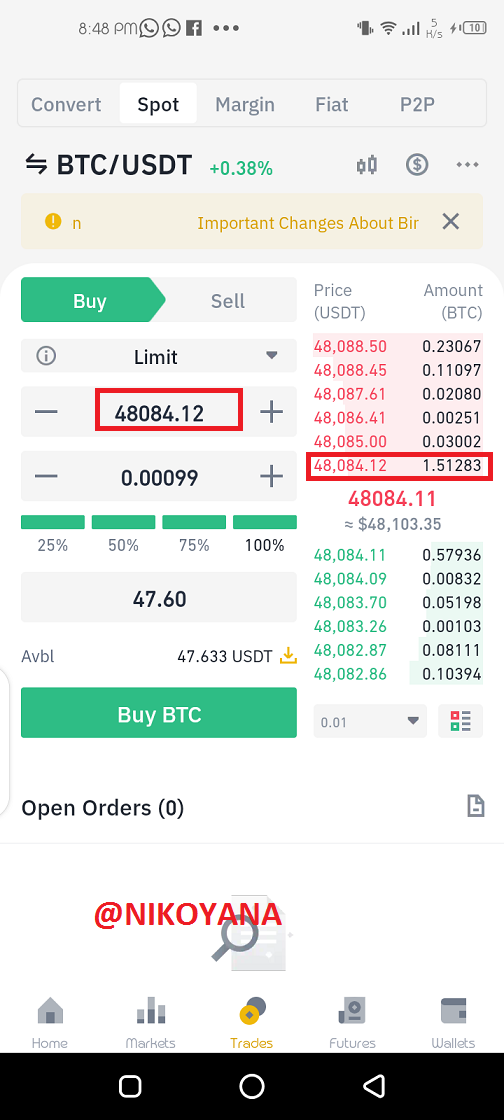

- I will be changing from BNB to USDT to BTC and back to BNB, below is the initial amount of 0.1094 BNB that I am using for this trade an equivalent of $47.88

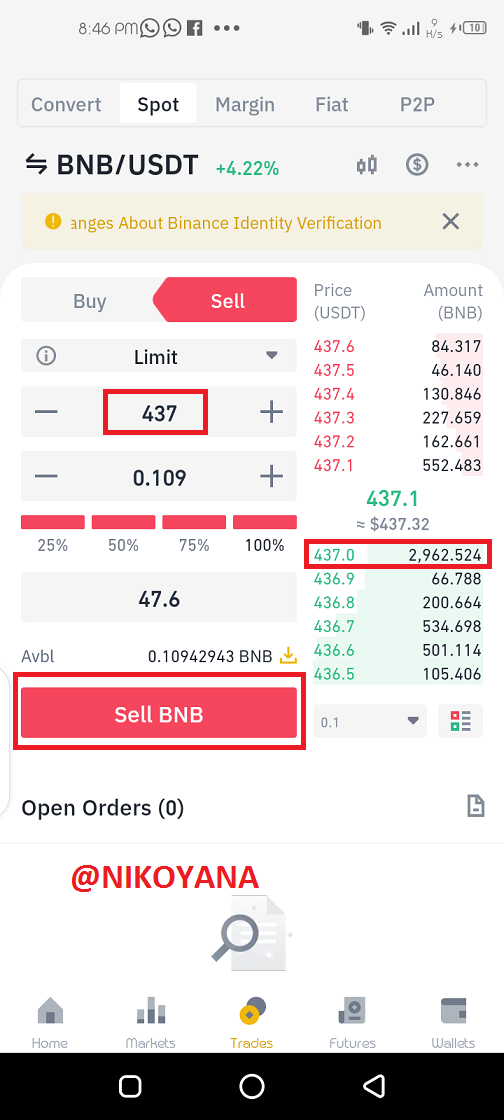

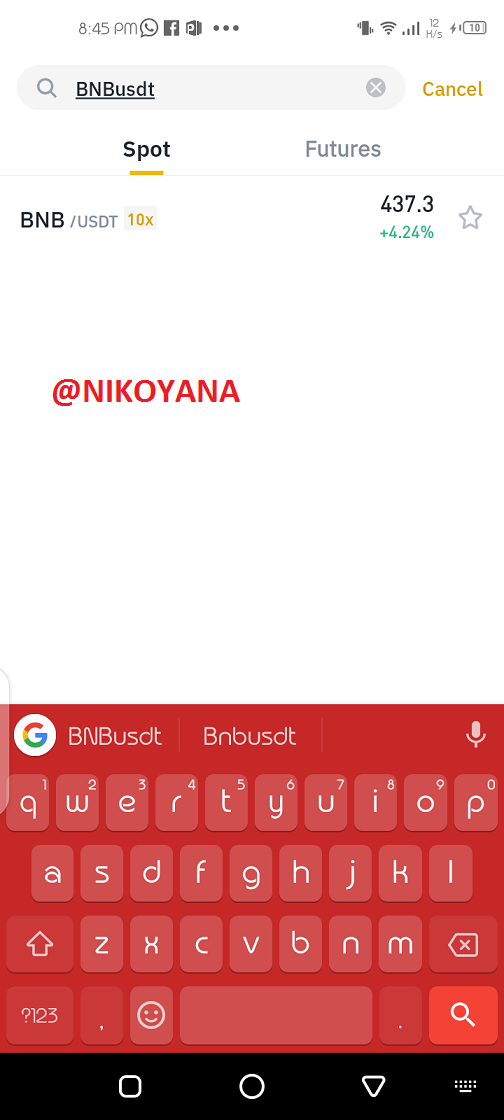

- Then navigate to the market and search for the BNB/USDT trade and the made the exchange at the limit price as instructed and click on sell BNB for USDT

- Then next I will be swapping the USDT for BTC , and I will be swapping at the limit price

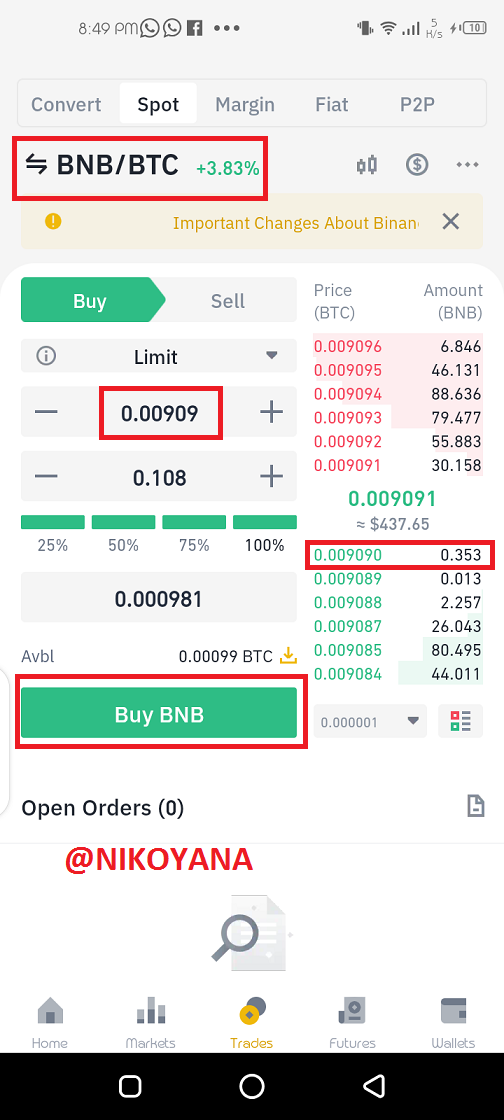

- Lastly to completely the triangle, I will be exchanging BTC for BNB at the limit price as we can see below

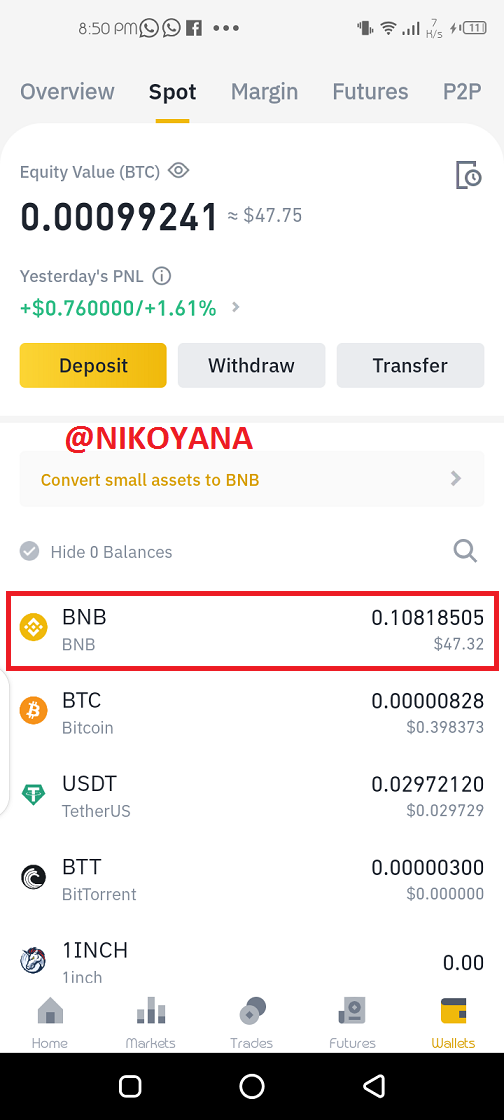

we can see from the images that after all the exchanges I was left with 0.1081 BNB equivalent $47.32

from the triangular arbitrage, I made a loss of $0.56, probably due to exchange rates and liquidity rates

6- Explain the advantages and disadvantages of the triangular arbitration method in your own words

ADVANTAGES

- very quick means of making profit

- it works better with bots

- little risks as the loss may not be high

DISADVANTAGES

- It requires high level of expertise

- the profit margin is usually small

- it wastes time to strategize and make the move

CONCLUSION

The homework post was entirely new to me and I am happy that I was able to learn and atleast attempt the homework post although I made a loss but it was a worthy effort. In summary, I think it is a great strategy with little risk but requires a high level of expertise. thanks for reading my post

best regards

@reddileep