It is a beautiful thing to see a new year and I am also glad we are in the week 7 of this season 5, and it was really delivered excellently by the professor, I will be explaining based on my understanding of this strategy. let's dive.

1. Say in your own words that you understand about the Trading Strategy with “Price Action and the Engulfing Candle Pattern, also describe each step to be able to execute it (Place at least 2 examples in clear cryptographic assets and with your own charts mandatory) ?

Trading Strategy with price action and the Engulfing candle pattern uses price action to determine buy or sell orders in the market. This trading strategy avoids spikes, trends that are about to end, gaps, signals that were created by sudden imbalance, and sentiment readings. With these types of hurdles eliminated, you're able to make more accurate trades with predictable outcomes.

Trading Strategy with price action and Engulfing candle pattern is becoming popular, especially in rapid trend changes. This trading strategy outlines how to take advantage of these major trends to have successful trading entries by correctly identifying when the trend is about to end. Technically, engulfing candle pattern is used as an entry zone- the zone to look for trades once the prices signal that the trend is about to end.

Execution of Price Action and the Engulfing Candle Pattern required more than one time frame. For great results, traders should execute this strategy on lower time frames like 30 minutes, 15 minutes, and 50 minutes. I will now show you steps to be taken below.

Steps in the Engulfing candle pattern.

1. Look for relevant chart: In order to trade based off of price action and the engulfing candle pattern,, a line should be drawn on a chart with a clear and harmonic trend. This ensures that there is a movement in price that is moving in a higher or lower direction. If this isn’t present, then the strategy layed out shouldn’t be executed since at its core, it centers on clean trading.

Find a clear trend with clean price action by viewing price movement for a 15minute time period. Half of a candle must be a double or a triple before entering into a position to profit from this strategy.

2. After identifying the harmonic trend, you should focus on finding a strong reversals; if large investors and institution are entering the market against your identified dominant directional trend then you might want to consider positioning yourself for trade volatility.

In a strong breakout, the movement of the price will be opposite to the dominant trend, and there must be a minimum of 3-4 candles that show this new direction.

3. The next step is the recognition of break after the identification of strong movement explained in step 2. The break in price will be to the direction of the previous dominant trend, if this movement was bullish. This retracement will be seen at a resistance level where there has been a change to create an equilibrium point between both traders.

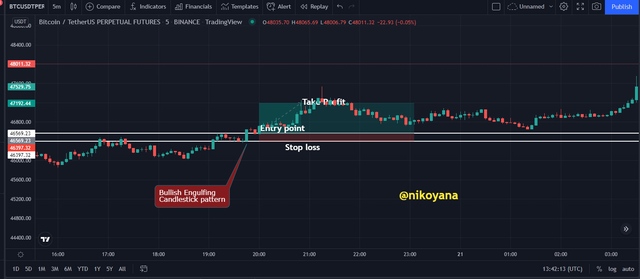

We are interested in the bullish engulfing candlestick pattern. As the previous trend is bearish and our opposed momentum is bullish, we then wait for after price to form a candlestick pattern after the bearish retreat of the strong impulsive move. I then marked the high and the low point of the engulfing candle stick with two horizontal lines and then a vertical so we can recognize it in a 3mins timeframe.

4. The fourth step is to change the chart from 15 minutes to 5 minutes and look for entry. If the zone has already been broken and you've made a change to 5 minutes, wait until price does a pullback and then make an entry to the upside with stop loss below last retracement and take profit near last resistance level

Place at least 2 examples in clear cryptographic assets and with your own charts mandatory

2.Explain in your own words the interpretation that should be given to a large strong movement in the market. What does the price tell us when it happens?

Price Action and Engulfing Candle Pattern can be used to predict changes in current trends of the market. The Engulfing Candles form when the price makes a series of higher high and higher lows with clear, clean direction of price harmony which means that the trend is bullish. When Price Action fails to make a higher high, but instead makes a strong move in the opposite direction, it indicates that there will be a change of current trend in market.

A large, strongly trending movement can mean more money is on one side of the trade. A bullish trend with significant cash piling up on one side of the trade might imply that traders or investors that believe the price is going to continue to rise will jump into the market. However, a bearish trend with a strong and dominant amount of money piled up on one side of the situation might be signaling a reversal to shorts.

When a large strong movement happens, the current trend about to change. This change in direction is called a "price signal." Large movements from bots and institutions who often pump a lot of money into the market are often a leading indicator of a change in direction.

3. Explain the trade entry and exit criteria for the buy and sell positions of the trading strategy with Price Action and Engulfing Candlestick Pattern in any cryptocurrency of your choice (Share your own screenshots taking into account a good ratio of risk and benefit)?

Creating a trading strategy with Price Action and Engulfing Pattern for entry and exit can be done in minutes, just follow the steps I mention next

We must make sure that the trend of the price movement is clearly understood before taking trades. The impulse or momentum at the beginning of a price trend should have no ambiguity, and the pullback should be one with easy to read price movements.

You can use strong candles as signs of a trend change after there are three to four candles with good body in the opposite direction of the dominant trend. If this isn't met, keep looking for other opportunities in the market. Strong candles signify strong moves and usually signals an upcoming reversal.

Important things to note is the strategy of an Engulfing Candle Pattern, a pattern where a penny is engulfed or taken up by a larger candle. This engulfs a smaller body that had been acting as a price consolidation previous to being taken up. We identify this pattern in 15 minute time frames and mark the zones with horizontal lines which will be the area of interest. After switching to 5 minutes, if there has been no break inside those time frames, we wait for a strong break with clear evidence

Agreeing with the theory of price action, traders will need to find clear support or resistance in order to set up their entries. They should set their stop loss below the bullish candle and take profit at the nearest resistance for strong moves against the previous bearish trend. Strong movements against the previous bullish trend warrant a stop loss at best close above the bearish candle and a take profit at last support. The profitable target should have at least 1:2 risk to reward ratio.

IMAGES FOR SELL ENTRY AND EXIT

IMAGES FOR BUY ENTRY AND EXIT

Make 2 entries (One bullish and one bearish), using the “Price Action and Engulfing Candlestick Pattern” trading strategy. These entries must be made in a demo account, keep in mind that it is not enough to just place the images of the execution, you must place additional images to observe the development of these operations to be able to be correctly evaluated and see if they really understood the strategy.

SELL ENTRY

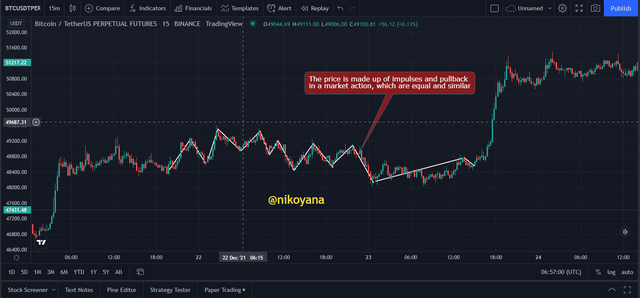

The following screenshot is a 15 minute time frame snippet of the BTCUSD chart. The screenshot has perfect examples of both an impulse and a pullback, something needed in order to use this strategy successfully. These impulses and pullbacks are roughly of equal size and harmony, which shows that the current trend is bullish.

Then, there was a sudden, large movement against the current market trend. This movement was set into action by larger investors and institutions. Based on this sudden drop in price, now looks like a good time to sell stock.

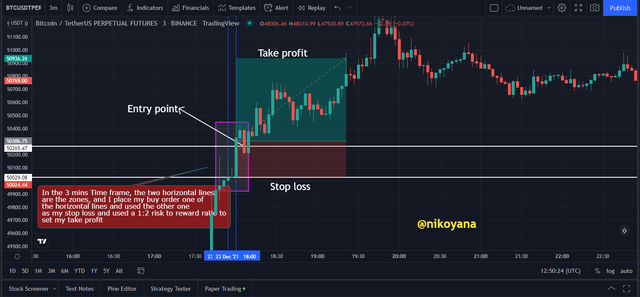

At a change to a 5 minute chart, price had already gone below the zone marked. I waited for a pullback until the zone and then took a trade going down. The stop-loss was placed slightly higher than the candle and the take profit at the last support.

BUY ENTRY

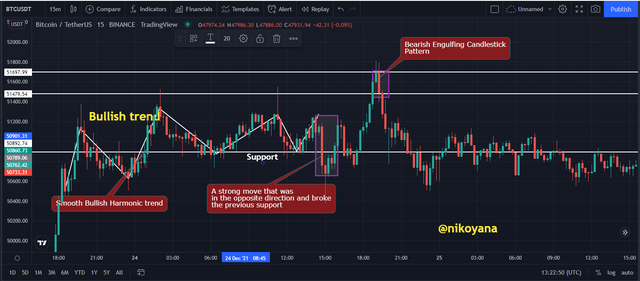

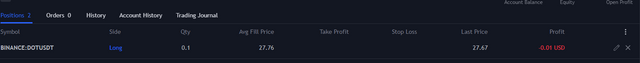

The chart below reveals the strategy of DOTUSD trading based on the engulfing candle pattern. Notice that there is a series of lows with an equal and similar trend-line with related support and resistance levels.

The engulfing candle pattern means that the current bearish trend is about to change. This pattern could be due to bullish bets, but more often than not it represents institutional or high-volume trade which can drastically influence price movements.

I waited for the market to gather liquidity. At the pullback of the strong large movement, I marked the upper and lower part of the bullish engulfing candle to form our area of interest.

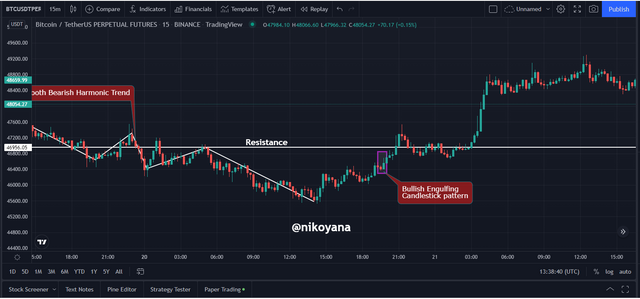

I use the engulfing candle pattern to enter when I see that prices moves higher after 15 minutes. When I switched to 5 minutes, the zone had already broken upward so I arrived in time to make a trade. When price retracted to this area. Then I made a buy entry

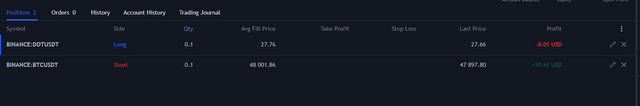

below is the trade result for both charts after some time

CONCLUSION

Trading Strategy with Price Action and the Engulfing Candle Pattern requires patience from traders. Traders must analyse a chart with an isolated trend, identify a movement against the current trend that is strong, then wait for an engulfing candle pattern to form after a pullback of the strong move to mark an area of interest.

In this post, I have offered an explanation of my trading strategy with both price action and engulfing candle patterns. I provide a detailed explanation for each step and provide clear examples from charts. This important strategy also employs guidelines for entering and exiting positions to maximize potential gains. Finally, I take two live trades one for BUY and the other for SELL to illustrate this.

Thanks @lenonmc21

IMAGE REFERENCE

TRADINGVIEW