Greetings professor and fellow students, I'm delighted to be part of this great lecture giving exposition on exchanges completely including types examples and even exchange activities.

My homework task is presented below, thanks professor.

1. Perform a complete analysis of the currency of some exchange. Not allowed: BNB, KuCoin, Cake, and Uniswap.

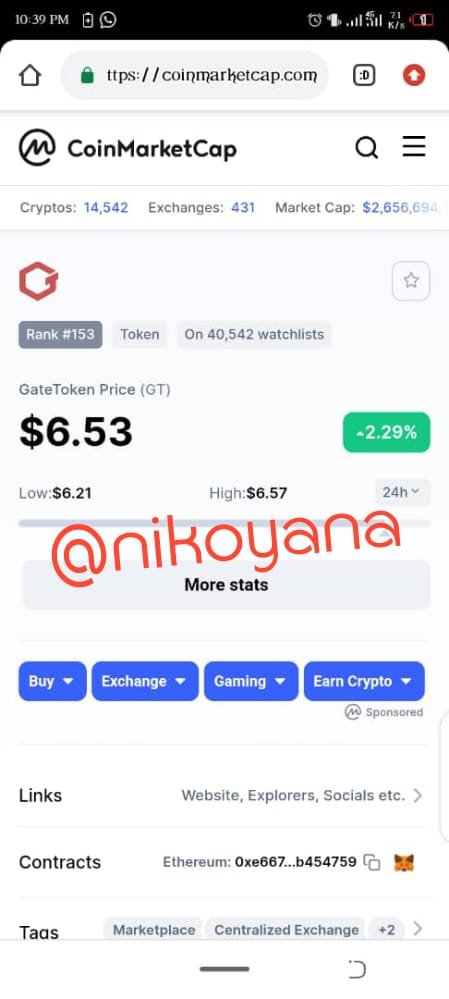

The Gate token is the native token of Gate public chain and is used for payment of transactions fees on the gate network.

The Gate exchange is a major exchange that seeks to provide users with features like liquidity, staking etc.

Uses of Gate token :

This token serves its users with heavy fee reductions /discounts on their trades including the fact that users who hold and lock their tokens have interests to earn and gain from

This token is valued at $6.26 with a market cap of over $506,765,104 its maximum supply is unknown but circulating supply is at 77,765, 175 gate tokens and a fully diluted market cap of $1,958, 760, 578

Other fundamental analysis of this token could be seen at :

2. Make a purchase equivalent to at least 15 US dollars of the currency you explained above. You must make some move with that currency within the exchange that created that currency. Show screenshots and explain in detail the steps to follow. Example: transfer of funds, Staking, participation in a Launchpad, futures trading, etc. State the reasons why you chose that option (trade) on that platform.

I have already given a brief explanation of the exchange above and now I will be making a purchase from the exchange. let me go straight to the purchase of the gate token

- go to the google playstore and download the gate.io application

- create an account if you are new to the exchange and do a kyc registration

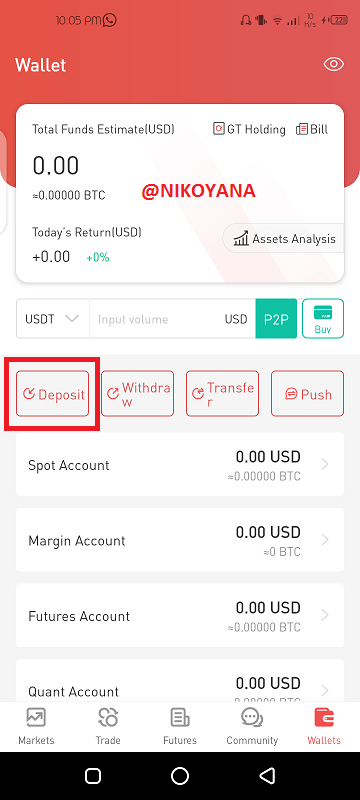

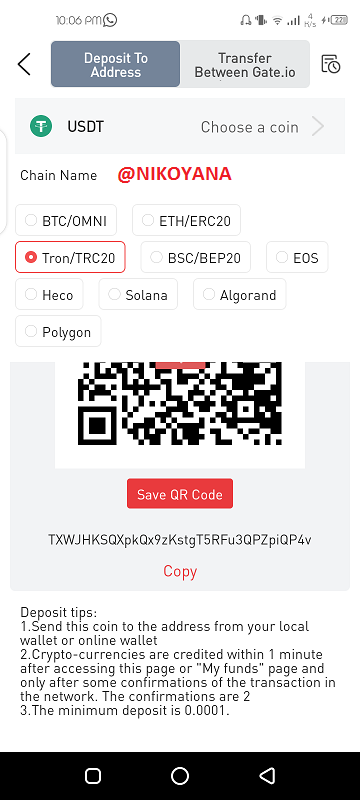

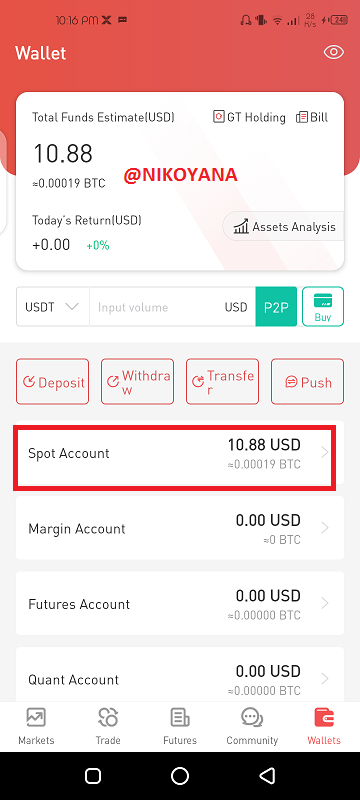

- navigate to your wallet and make click on deposit

- I will be using the trx20 network because of the transaction fees

- As you can see I have deposited 10.88USDT in the gate.io wallet as this is all I could afford now after the compulsory power up requirements but I had to submit the assignment, I would make a correction of the screenshot as soon as I earn and buy the coin

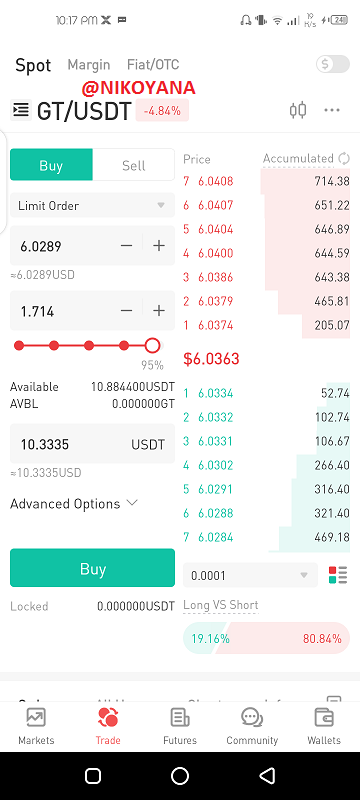

- search for the gt/usdt pair in the market and trade them

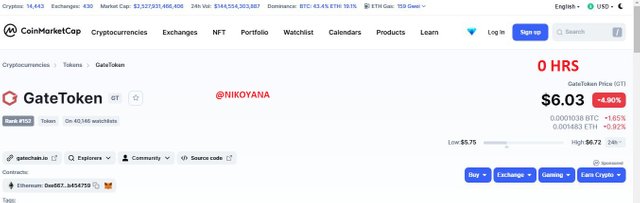

- below is the value of the gt coin

3. Show the return on investment in time spans of 0, 24, and 48 hours from the time you bought. Take screenshots where you can see the price of the asset and the date of the capture.

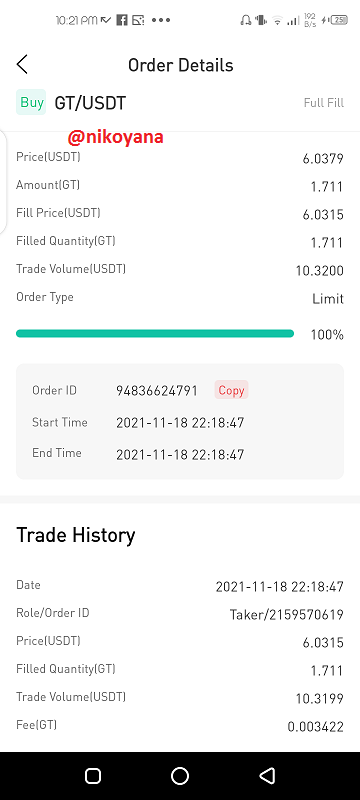

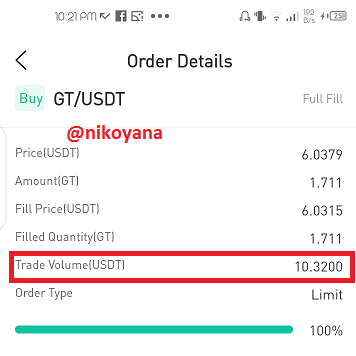

from the image above we can see at 0 hrs the original purchase price of the asset at $6.03

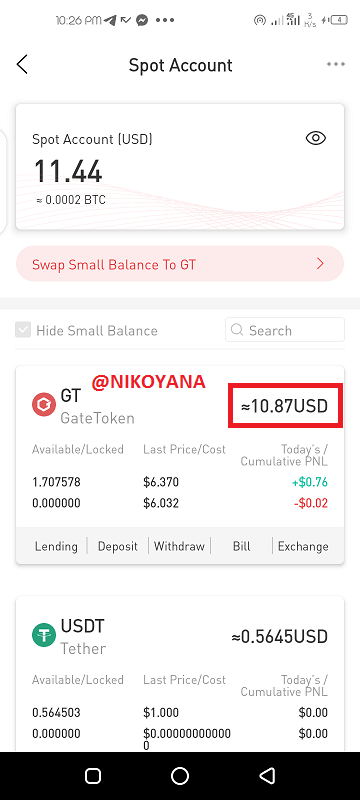

at 24hrs from the image above, we can see an increment in the asset price that was also reflected in the chat taken at 24hrs

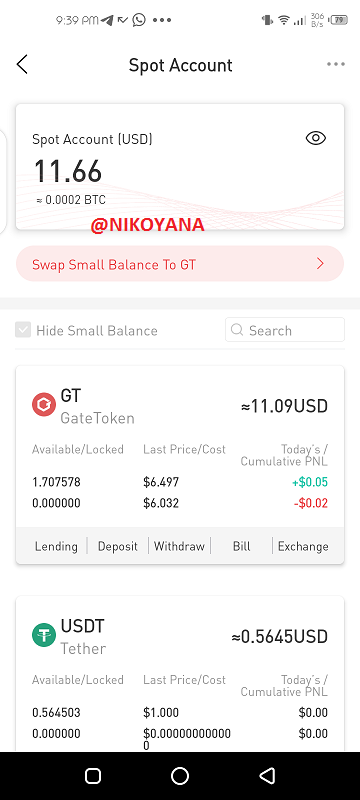

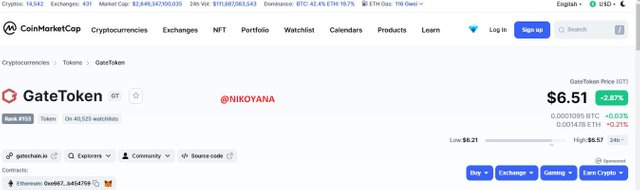

at 48hrs from the image above, we can see an increment in the asset price that was also reflected in the chat taken at 48hrs.

3.1) Has the asset's price acted independently or does its price strictly follow the correlation with Bitcoin?

I tried to be observant on the sequence of the chart and you will notice that for each dip on the BTC/USDT chart, there is a followup dip on the GT/USDT chart.

Also we can see that as the price of bitcoin is on the rise, there is also a rise in the price of the gate token. so I will say that the asset is not acting independent of the bitcoin but rather follows in correlation to bitcoin.

4.) What are futures trading?

Futures trading could be seen as the most advanced and complex form of trading. In this case of trading, trades are not just done by buying and selling assets but trades are based on prediction and price movements. We can liken its name "futures", to the fact that trades are made based on future price movements and value of the assets in question.

Futures traders, predict and act for example if I, as a trader predict that Uniswap would fall in price, I'll go short of it and vice versa.

Therefore, to standard terms, we can define Futures trading as crypto financial agreements that entitle a trader to buying, selling or making transactions based on predicted positions of the asset (price).

There are moreso merits and demerits, to future trading and we'll be considering each

Merits of Future trading include the following :

Market liquidity :One of the basic features of futures markets is the fact that they are very liquid there are many contracts and effective market orders that leave the market very liquid

Speculation advantages :In a futures market, making of money isn't one-sided but double sided since money can be made from both sides of the market be it bullish or bearish. Traders here could maximize every trade /price movement and position and the aid of market orders reduce the risk associated with these movements ie (take profit and stop loss orders

Low fees charged on transactions: In the trading of futures, the commission, fees, charges levied on transactions are relatively cheaper compared to other kinds of trading eg in the futures market about 0.5% is the charge levied on transactions

There are also demerits of these trading which include that :

Ambiguous nature : firstly its a renowned fact that futures aren't traded just anyhow but by only verified brokers /futures brokers and secondly, to the average trader

, who has knowledge of just stable markets, it could be a very risky and trade-harsh burden on him /herLarge capital demands :Futures trading are advanced and so requires large initial deposits unlike other simple forms of trading that demand less deposits. The verified futures brokers here too in a bid to make profit could increase the prices of capital assets to scare normal traders away

5.) What is the margin market?

The margin market could be seen as a digital platform meant for the lending of crypto funds by a broker to a trader /investor to trade a financial /crypto asset which the broker recognizes as a collateral for the loan given out

In the margin market, the collateral given to the broker due to the fact that he holds his financial assets and risk involved it is called the Margin.

Eg if a guy called Jones buys a security for $200 using $40 of his funds and 160 borrowed from a broker,the net value will be $40 and the least margin condition would be $20.

If the security price reduces to $170,the net value now stands at $10 so to keep the broker's minimum margin up, he'll need to bring up the net value to $20 or bigger by either going short of the asset or giving back part of the loan.

The margin market have several advantages and disadvantages, and we'll be looking at them simultaneously.

Advantages of margin markets :

In a margin market, traders are given the opportunity of opening different market positions with the use of lesser funds since brokers are

available to lend funds for traders to make profitsSecondly, the leverage provided by margin markets, help traders with limited capital and funds the chances to maximize their returns in the crypto market

Disadvantages of Margin trading :

This kind of trading demands much of knowledge and is a delicate kind of trading involving heavy analysis and proper knowledge of market situations before traders can make up their minds to borrow funds

When the market doesn't go in favor of the predictions originally made by a trader, the same leverage that was a beneficial factor increases the loss that is incurred and makes it quite heavy for traders

Before I delve into the assignment proper I'll like to give a concise definition of Exchanges and we can simply define them as a digital exchange that paves way for the buying, selling and exchanging of crypto currencies for each other or to fiat currencies.

These exchanges work while implementing intermediaries /smart contracts (ie for centralized and decentralized) that helps connect wallet to wallet and fund to funds. Here the exchange charges network fees on transactions of assets bought, sold or even traded

Before I delve into the assignment proper I'll like to give a concise definition of Exchanges and we can simply define them as a digital exchange that paves way for the buying, selling and exchanging of crypto currencies for each other or to fiat currencies.

These exchanges work while implementing intermediaries /smart contracts (ie for centralized and decentralized) that helps connect wallet to wallet and fund to funds. Here the exchange charges network fees on transactions of assets bought, sold or even traded

6.) 2 real life examples of what happens to the crypto currencies of an exchange when its hacked into or turns out to be a fraud

When exchanges are turn into fraud, user funds get dumped and useless as well as when they are hacked into. The tokens most times are made away with and users are left hopeless.

An example of an Exchange fraud could be seen in the case of OneCoin Exchange xcoinx which was a scam and deceived customers about the fact that currencies could be changed for another on the platform

The owner, Ruja Ignatova begun this exchange in 2014 while making investors to belive that it worked like other currencies and could be mined with billions of it in existence.

After some years of its start up, inquiries begin about it and they claimed to have the backup of the Vietnam government which the government refuted, the co-founder was arrested by the Bulgarian police after then

Another instance of a coin exchange failure or fraud could be seen in the list of exchanges that turned out to be scams is Bitconnect

Bitconnect could be seen as another major fraudulent exchange that scammed over 4billion in dollars while claiming to have an indomitable algorithm for trading. They even came twice, as their second scam project was BitconnectX

CONCLUSION

in summary I'll like to give a concise definition of Exchanges and we can simply define them as a digital exchange that paves way for the buying, selling and exchanging of crypto currencies for each other or to fiat currencies.

These exchanges work while implementing intermediaries /smart contracts (ie for centralized and decentralized) that helps connect wallet to wallet and fund to funds. Here the exchange charges network fees on transactions of assets bought, sold or even traded.

Getting to learn about the exchange coin was really lovely and taking part in the practical aspect watching my asset grow is a thing of Joy. thank you all for going through my assignment

SCREENSHOT REFERENCES

cc

@imagen

Gracias por participar en la Quinta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit