In this week’s Risk Management lecture, Professor @reminiscence01 explains the topics of trade criteria and risk evaluation. These two components of a decision making process emphasize a quality-centric methodology to help identify opportunities for profit and shield against downside risk.

there may be few errors due to google translate, but regardless I hope it will be minimal. having said that, let's dive!!

1. What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?.

Cryptocurrency trading is associated with great risk because of its high volatility. Many people lose money due to poor risk management, as traders it is not enough to be knowledgeable about a successful strategy for the industry. It is also important to know the proper techniques for risk management in cryptocurrency trading; without it, your strategies or ideals will prove worthless and you won't last long trading.

Risk management means creating action before an order is executed to control losses that may be incurred in trading. Managing risks involve strategies that keep the losses to the bare minimum, for example if a trader doesn't do risk management then his trade has already gone wrong. The first step is forecasting and controlling any potential loss involved in the trade, it's because if this step is not done right other ones can go wrong too.

So traders need to be aware of risk management before they trade, which is a way for them to have a better overall experience. Studies have shown that properly managing risks can lead to being profitable at the same time. That’s why knowledge in this area is such an important factor in trading.

Advantages of Risk Management in Crypto Trading

LOSS CONTROL:

The cryptocurrency market is very volatile. As such, if you do not put proper risk management in place, you could lose all your invested money or trading capital. But with proper risk management measures in place, you can control the losses that could arise from any unprofitable trades.

BUILS CONFIDENCE

Risk management gives peace of mind and allows traders to develop confidence. Risk management also helps traders develop knowledge of risk management techniques. Additionally, having a risky trade with an appropriate amount of risk will allow trades to have assurance that their orders are not taken without planning for that risk factor.

CLEAR CUT FOCUS

Finance is unpredictable by nature, and prices can fluctuate up or down with no warning. So without adequate risk management, trading strategies tend to fail, so traders experience frustration and change strategies faster than they should. Good risk management, however, keeps traders focused on their strategy and consistent making them more likely to stay in the game for the long haul.

EMOTION CONTROL

Risk management helps traders control their emotions in the market by allowing them to exit trades that do not follow good risk management principles. It can also help traders avoid ruin if their emotions overwhelm them and result in making reckless decisions such as chasing the market to try and recoup any past losses.

2. Explain the following Risk Management tools and give an illustrative example of each of them.

a) 1% Rule.

b) Risk-reward ratio.

c) Stoploss and take profit.

a) 1% Rule.

Funds are lost in the form of trading debts that cannot be offset, simply because of the lack of practical knowledge or understanding of proper risk management. For example, one rule is to not risk more than 1% of the total trading capital. Don't be too stubborn to lose what you have built up for this important lesson - just trade smarter! This will keep your account healthy, and prevent it from being blown up on risky moves.

The 1% rule limits an investor to withdrawing one percent of the account balance per trade. This reduces risk by allowing the trader to take more risks without jeopardizing their original capital. for instance I funded my account with $500, fitting into this rule will be trading with 1% of my capital which is (1/100 * 500) = $5

Let's say I open up 4 trades on my trade, but they all end up going against the prediction. That means I will lose a total of $20 on my trade. With that, my trading capital will stay at $480. Meaning 4 losses still leaves me with enough money to trade

let's imagine I do otherwise trying to make a mega profit and trade with 20% unluckily for me the trade turns out bad, I will be losing $100 at the spot then imagine that 4 trades go bad in a row that will be me running mad because that will be losing $400 at a row.

b) Risk-reward ratio.

One important strategy or tool to maintain proper risk management is setting a risk to reward ratio. If a trade order reversal occurs and then enters into a loss, all going well with the trade may depend on the selection of a satisfactory risk to reward ratio, so it’s recommended to use 1:2 Risk to Reward Ratio or above.

When you are trading, be sure your risk amount is in line with the potential profit. One way risk management may be approached is to have just enough of a potential winnings. So if I risk $3, my reward should at least be close to 6 dollars. which is 1:2 RRR Worse case scenario, the trader only has $3 which is a 1:1 RRR.

c) Stoploss and take profit.

Stop loss and take profit are both order set to manage risk in trading. Both of these orders help a trader be confident investing their money by helping them close a trade order on a certain price, or reaching a certain metric. We use stop loss to close a trade when it looks like it is going in the wrong direction from the expected performance. We use take profit to end a position at a point where we have reached our earnings goal

Setting predetermined stops for buy and sells creates guarded trading strategies. If the trade goes against you, it will automatically stop trading yourself before setting a timer to sell or buy. Not only does this save time, but it also helps minimize risk.

it is important to set stop loss orders in accordance with what you are willing to lose. The lot size should be proportional to the amount of money that you are willing to lose per trade, all of which should be considered when setting stop loss order during trading with proper risk management. A take profit order should at least be double the amount of money that you are intending to lose.

You can use different strategies to set stop loss and take profit order in your trader. For example, market structure, support lines and resistance lines chart patterns and indicators can be used to make your trade orders.

3. Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

a) Trend Reversal using Market Structure.

b) Trend Continuation using Market Structure.

for the cause of this question my initial trading view demo account was $10,000 using the 1% rule that will be

1/100 * 10,000 = $100

so I will be risking $100 per entry according to the 1% rule. let's move down to the trend reversal and continuation strategy

TREND REVERSAL (MARKET STRUCTURE)

We will make entry based on two criteria- Bullish trend reversal and Bearish trend reversal. For this RISK MANAGEMENT practical, I will only make a demo trade for one of those reversals.

BULLISH TREND REVERSAL

This means that during a bullish trading period, the market reaches a high point but can't exceed it. When this happens, sell trades are placed since the market is reversing into a bearish trading structure.

CRITERIA FOR ENTRY

- When RISK MANAGEMENT traders notice the price failing to make new highs and instead breaks previous lows, they wait for the price to retest the broken low in order for it to form a new resistance. At this point RISK MANAGEMENT traders can make a Sell entry when a bearish engulfing candle is formed. see screenshot below

CRITERIA FOR EXIt

For exit criteria, it is helpful to have a Stop Loss and Take Profit strategy. For your trade setup, the Stop Loss should be placed just slightly above the new resistance area.

Using Take Profit Criteria, determine your profit limit by next support. When you activate the take profit, set it at 1:2 risk to reward ratio.

BEARISH TREND REVERSAL

This is a trend reversal that takes place when we had a bearish trend and at one point the price couldn’t create lower lows and instead broke resistance and began an opposite trend.

ENTRY CRITERIA

To make entry, you look for the price moving back towards previous highs, signaling a trend reversal. Once it reaches, wait for it to retrace - forming a new support - until the bullish engulfing candle forms or when the small body candle forms with the long wick pointing to the downside.

EXIT CRITERIA

Stop Losses protect a trade from going against potential losses. Instantly position your stop loss just below a new support, and if the price goes down to that point the trade becomes invalid.

If the resistance is less than the risk/reward ratio, The Take Profit is set at a target on the resistance. Otherwise, the first Take Profit level is set at the total risk/reward ratio point on the upside at 1:2 RRR

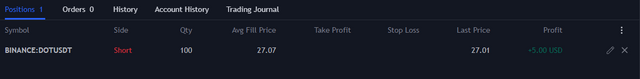

PRACTICAL TRADE USING THE TREND REVERSAL

On a DOTUSDT chart on a 15minutes time frame, I followed the rules just the way I listed and set my stop loss and take profit at 1:2 RRR

below is the result for my trade, keeping to the 1% rule and placing with a bid of $100.

TREND CONTINUATION

If you are trying to make profitable trades in the market, it pays to do your technical analysis carefully. You can trade in either a bullish trend or bearish trend, but keep in mind that even an upward trend may experience fluctuations normally resulting in profit opportunities when price retraces back to the same level. Technical analysis and management strategy are key when placing trades in order to successfully take advantage of these profit opportunities.

I will be stating the entry and exit criteria as well as placing the demo trade

ENTRY CRITERIA

The Trend Continuation System allows an investor to time their entry correctly. The system uses slow downs in trend progress, breakouts on pattern structures like the rectangular patterns to find patterns that show the trend is coming back.

It is best to make entry during the retracement to ensure maximum profit as soon as the breakout is formed

EXIT CRITERIA

For exit criteria, the Stop Loss price is below the previous support if starting a long position and above the previous resistance if beginning a short position. If receiving a Stop Loss signal, then the trade is not invalidated.

we take profit at the 1:2 ratio or the next resistance or support level we reach. If our next target is neither of these points, we set them as our initial and final targets and wait for the 1:2 ratio to be hit before selling

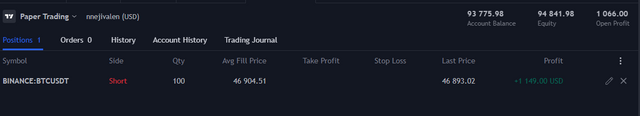

PLACING A DEMO TRADE

FRom the BTCUSDT chart on a 15 minutes time frame, we can see a trend continuation pattern, having followed all the rules listed above, I place my stop loss and take profit at a 1:2 RRR to ensure a good profit.

Below is the result of my trade keeping to the 1% rule and placing a bid of $100

CONCLUSION

The advantages of risk management cannot be overemphasized as it helps build seld control and helps us to avoid total loss due to greed or fear. In this home work post, I have been able to define the risk management and also stating it's advantages.

I also gave the entry and exit criterias for a trend continuation and a trend reversal procedures indicating charts for better understanding. along side placing a demo trade for both conditions. I enjoyed the home work and I thank the professor @reminiscence01 for delivering such a great lecture.

thank you all for reading through, happy new year to you all

IMAGE REFERENCE : TRADINGVIEW

Hello @nikoyana , I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

I'm not satisfied with this chart. The analysis is not clear enough.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit