I welcome each and everyone of us to a great time out once more in the seventh week of this season.

The lesson today is a great one and explains a very important Defi platform known as WAVES. We know that the relevance and steady development in blockchain technology, gave rise to the Decentralized Finance (DeFI) which explains a collection of softwares including user projects that have their source of running on the blockchain and seek to advance finance majorly.

So from here, saying that the apps and software being run and initialized on blockchain network s are embedded in an ecosystem where the need for middlemen in transactions /app usage, is eliminated but instead, smart contracts implemented. The topic of today's lesson, Waves, could be seen as one of such of Defi's promising platforms since there are several upcoming projects offering important features to have a share of the dominance, the Ethereum network enjoys presently on the network.

1.) Describe the Leaked Proof of Stake (LPoS) consensus mechanism. What are it's differences with Proof of Stake (PoS)

The Leaked Proof of Stake consensus

mechanism is the native consensus mechanism of the Waves Exchange and before i explain this mechanism let's see a brief definition of the Waves platform.

This waves platform, could he seen as a diverse purpose digital platform aimed towards helping users of it to hold crypto assets, exchange them, share and enhance the assets while done in a very secure pattern

Initial Coin Offerings could be seen as the basis that originated the Waves project after over $18 million dollars were raised in 2016 by a Russian investor known as Alexander /Sasha Ivanov and firstly, was created in a language, known as Scala before it got released on Decentralized Exchanges and wallets.

Well like i said before, the Waves platform makes use of the Leased Proof of Stake consensus protocol in addition to Waves NG protocol and they work closely for intense scalability and increased transaction workout.

The Leased proof of Stake could be seen as a branch of the proof of Stake working on the Waves platform that gives way for the leasing of user tokens to main nodes, to get a part of the interest earned from their leased tokens.

In this system, users of the platform could either lease their tokens to main nodes and gain interests from it or decide to operate their own nodes and generate personal interests which leaves the platform's network as open source since anyone could be a part of it's network enhancement.

Moreso, the leased proof of Stake allows for use of a separate network user's mining strength to process new blocks without having to release WAVE tokens from his/her wallet.

Lease cancel options are also made available for stoppage of leasing and the network user involved in the leasing, chooses the node to lease to, properly. A thousand WAVE tokens are the least amount required to work upon a node and the interest given, is equivalent to the transaction made on the network

Differences between the Leased proof of Stake and the proof of Stake :

The leased proof of Stake (LPoS) as we know, is a kind of the proof of Stake (PoS) protocol and irrespective of their similarities, they have differences too.

Firstly, in the proof of Stake, users are required to add new blocks to the chain for running of activities while in the Leased Proof of Stake consensus protocol, users are to choose between adding new blocks or leasing their tokens to a major node

Secondly, in PoS, creation and validation of next blocks, are based on how much worth of the tokens are held but in the LPoS, the balances of leasers, could be given to full nodes

The LPoS could be seen as an advanced form of the PoS since, it offers better and advanced issues than it and better for adoption

(2.) Login and exploreWaves.Exchange,

Indicate your functionalities or options. What are the investment modalities that you offer to your users

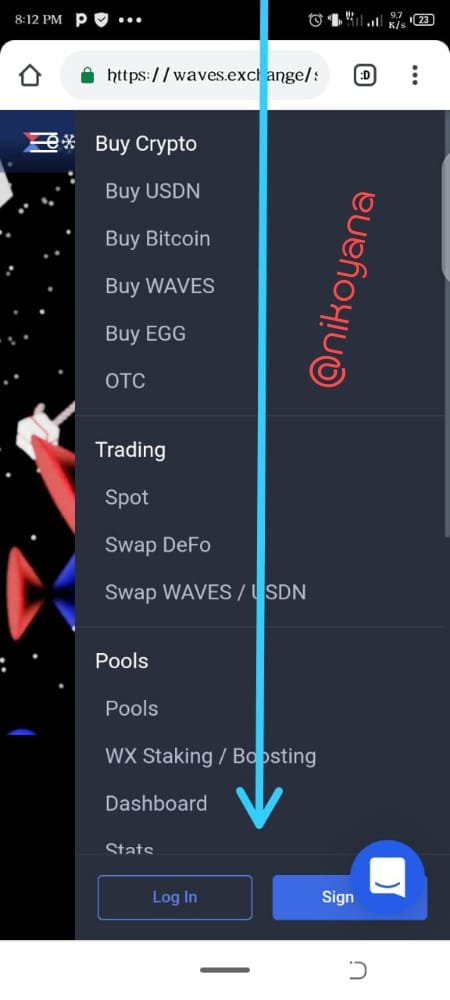

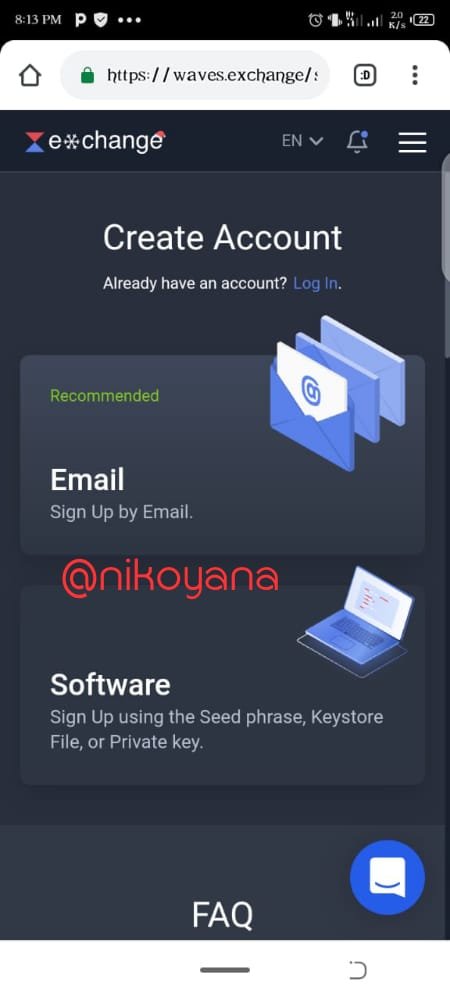

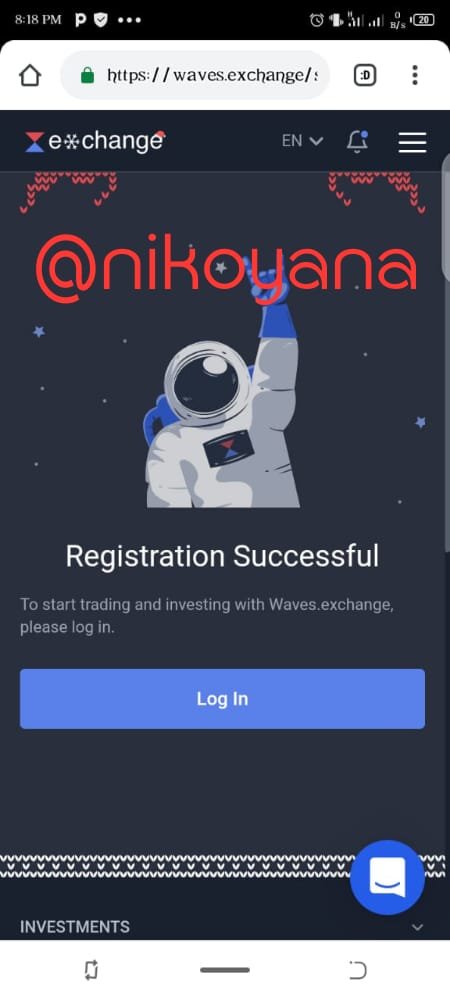

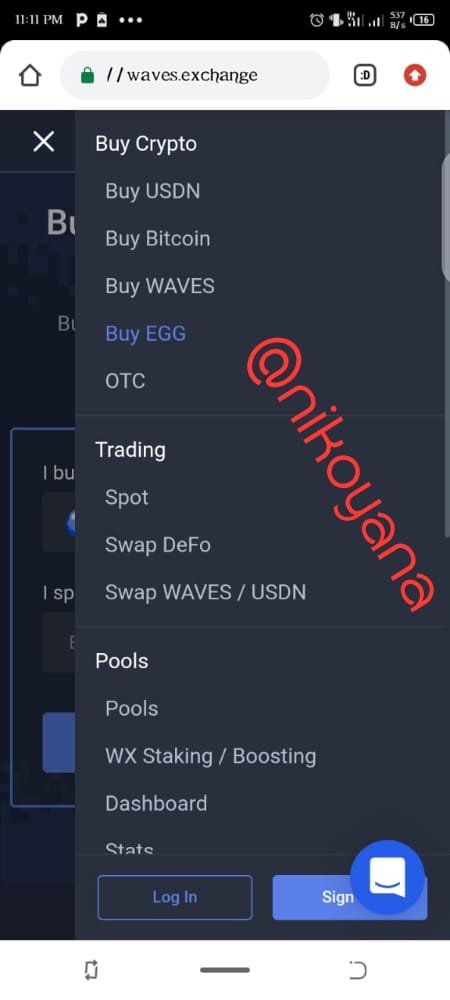

I just got into the Waves Exchange platform moving to the menu bar by the top right, i discovered that I'll need to sign up or log in to use the exchange effectively

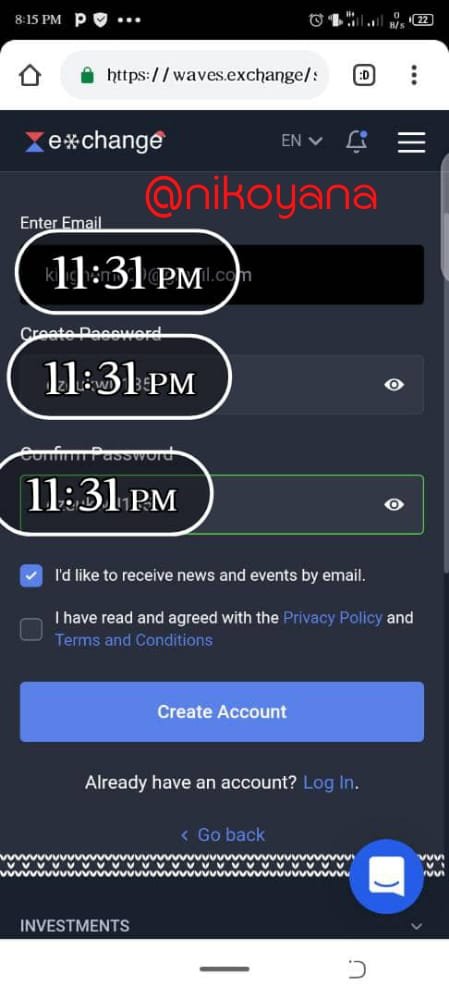

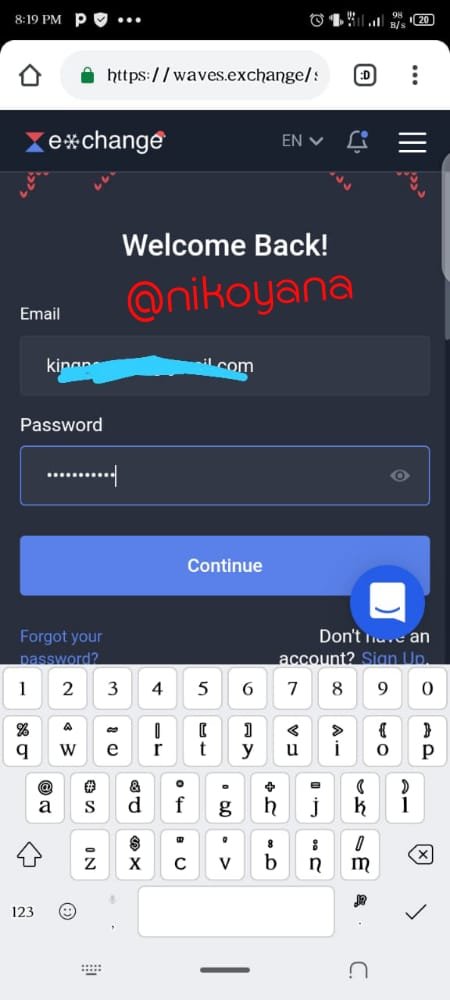

So i get to sign up with my email and password after i was given options either through email or with a seed phrase and so after verifying using a code, my account is complete and then i log in, using my details

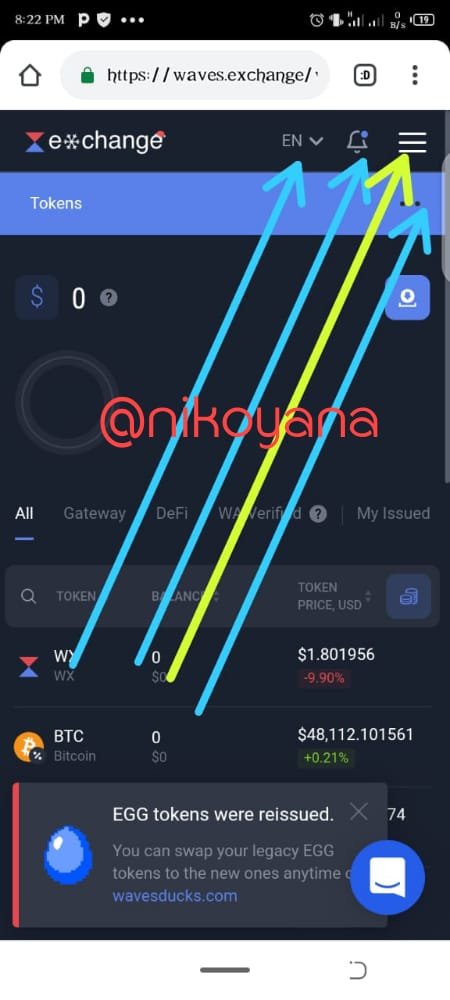

Well, this is what the home background of the exchange looks like

On the top right, we see the icon for changing languages, and then the notification bar while the menu bar close to it.

Down, we see the part that shows $0 since i have no current valuable tokens and down we see tokens in their different classifications including gateway, defi and other categories of tokens

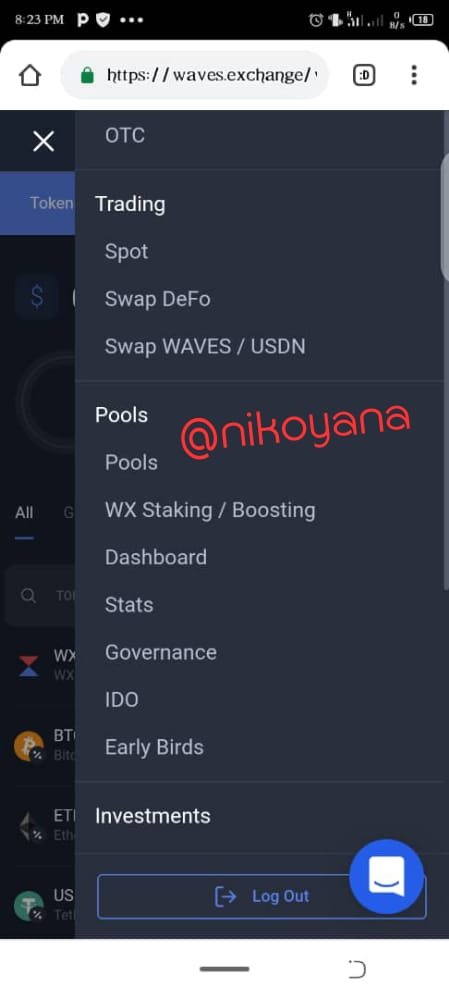

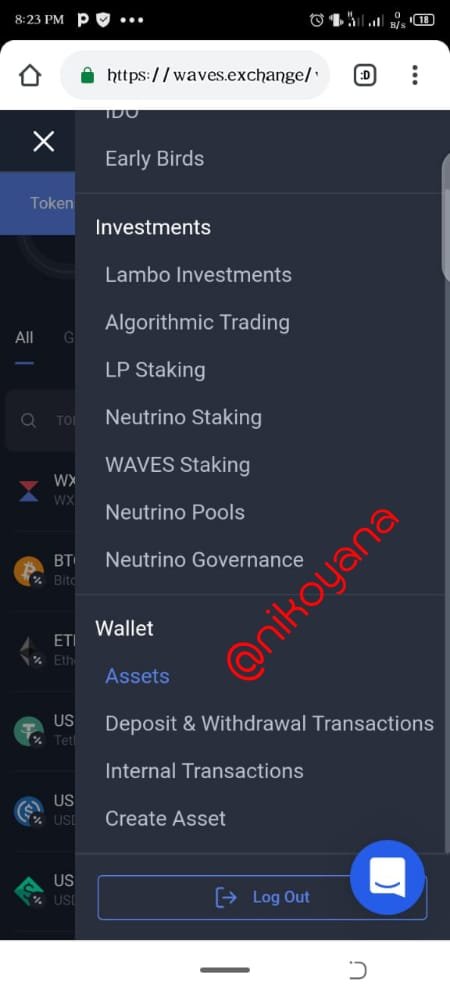

Now going to the main menu, we see different categories of activities done on the platform,

The first, trading shows spot trading and swapping of the WAVES token with USD

The second part, is for users who would want to Stake tokens in liquidity pools and the rules about the exchange, including pattern of governance and initial dex offerings (IDOs)

The investment part is aimed towards different long term /short term stakings like the algorithmic staking even staking of the tokens, neutrino staking, pools etc.

The final level is meant to regulate the exchange wallet and helps users in deposits and withdrawal of funds online including a kind of neutrino feature for creation of assets too.

3.) Make from your account a purchase of WAVES for an equivalent amount of 10 USD from an available exchange.

3.1) Describe the process. Show screenshots

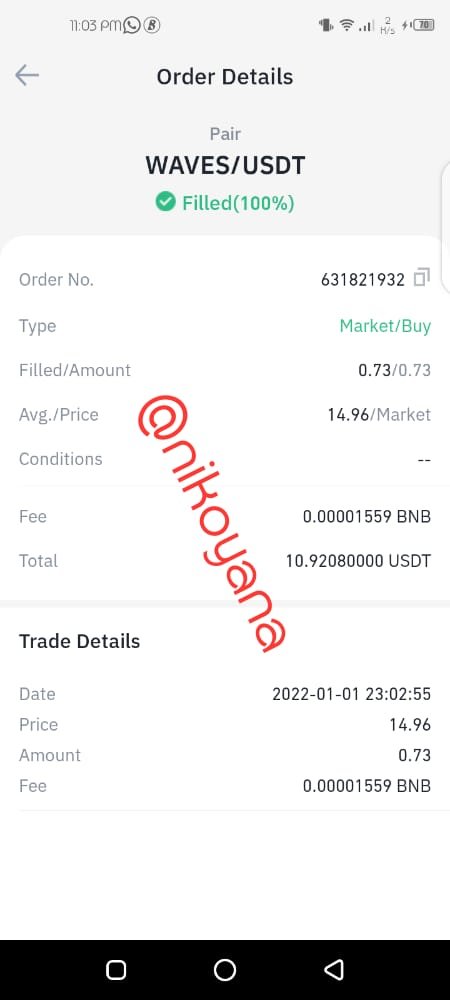

I will be using binance for this operation.

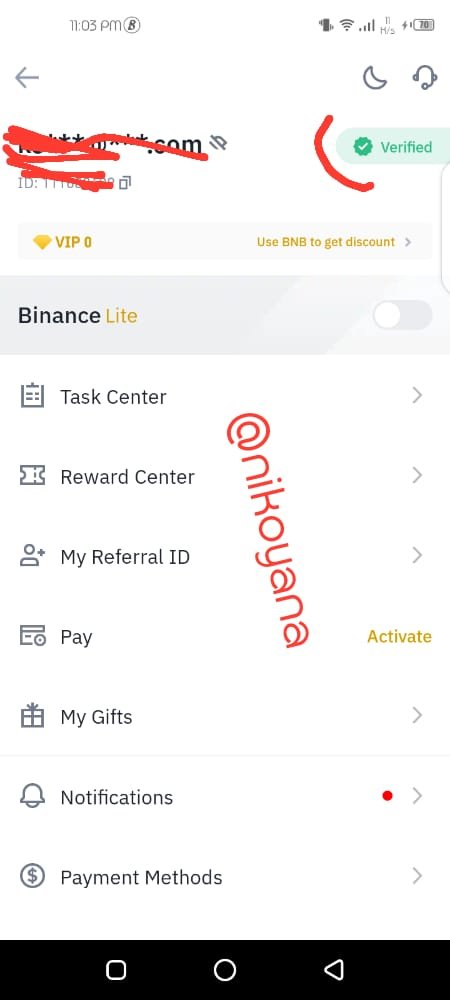

First login to binance as I have done.

Below is the screenshot of my verified binance

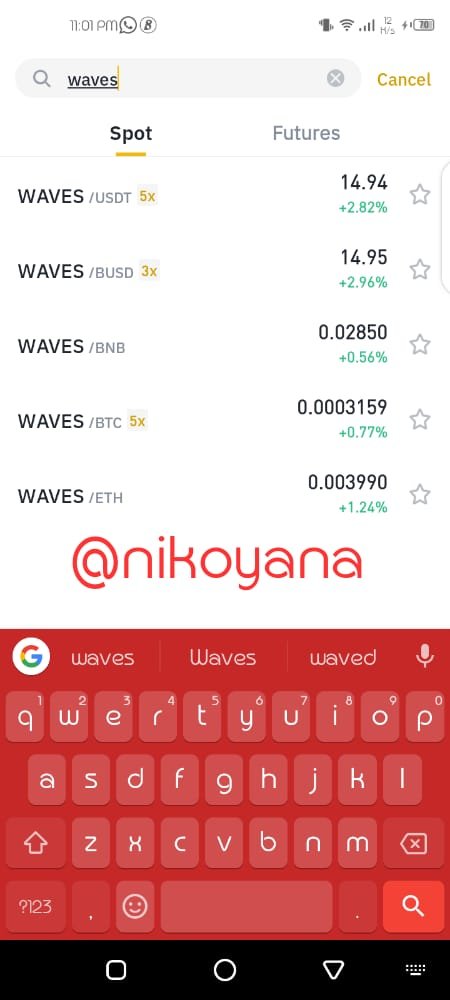

Go to market and search for wave against the usdt pair

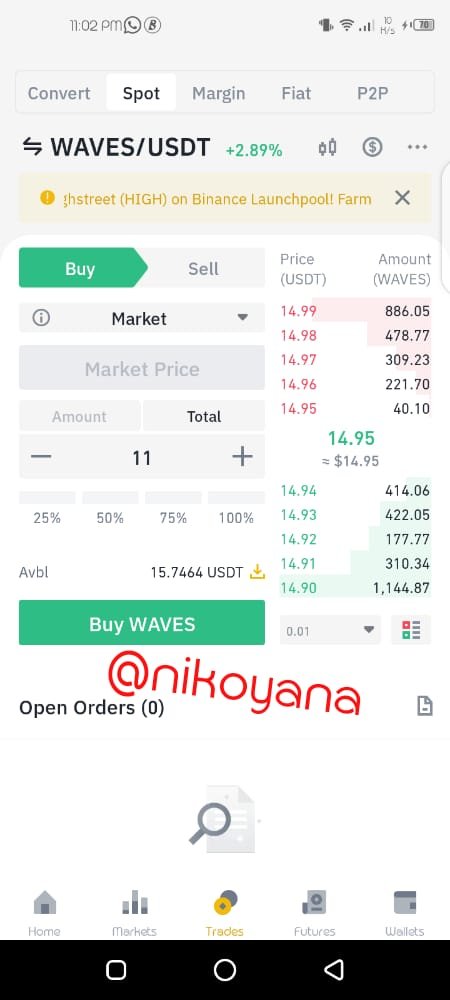

Click buy, I will be buying at the market price as we can see I am making a purchase of 11usdt

Below is my order receipt for the purchase

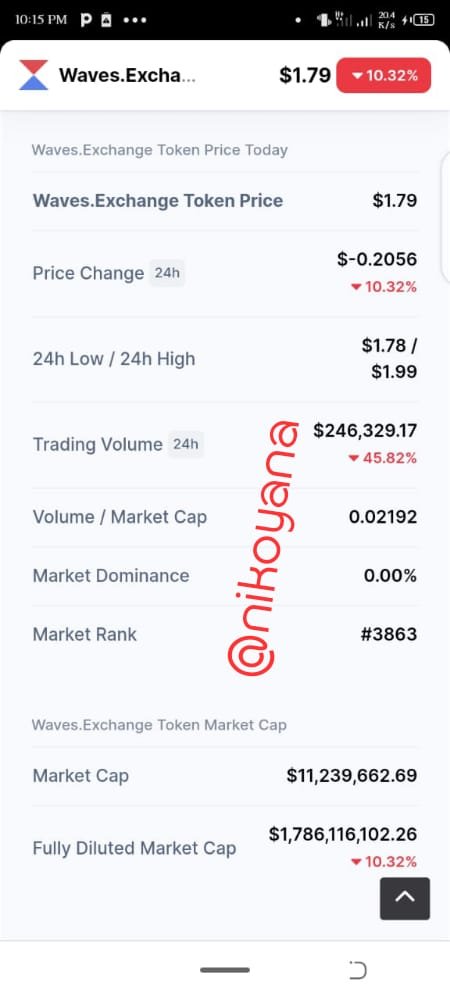

(4.) What is the WX token? What are its functions within the Waves ecosystem? What is your value and Market Capitalization at the time of writing your post? Show Screenshot.

The WX token, could be seen simply as the native token of the Waves Exchange and a very essential part of operation and maintenance on the network. Payment of transactions fees and execution of the creation of choice tokens are all functions served by the Waves Token. More so, the token helps to determine users who can add blocks to the Waves chain and those who earn interests on transaction fees and any intending node must possess at least 1000 WX tokens and the charge on leasing, cost 0.002 WX tokens

Functions of the Waves token within it's ecosystem :

We understand that every native token has a purpose being served in a block chain and now considering Waves, I'll say :

For every transaction implemented on the exchange, the fee or commission charged by the exchange, is paid in WX token and so users who possess it find it rosy to pay for transaction fees on the exchange

With the help of the WX token, custom tokens are created using the neutrino protocol and the token is the basis for anything to be done or created in the platform

Adding of more blocks on the blockchain, is also a function of tokens since they are done based on how much value of tokens is held by the users

Value and Market Capitalization of the WX token as at the time of writing, the Waves Exchange token's price is at $1.79 and it's market cap at $11,239, 662. 69

Every other data about it could be derived from the picture above.

(5.) Describe Waves Ducks What is this project about? How is it accessed? Be as explicit as possible. Show Screenshots

Waves Ducks could be seen as one of the products of the waves exchange. It is an NFT-like online gaming platform where users are rewarded for their gaining and selling of their online ducks and eggs for crypto assets. Just like physically, the platform makes way for the growing of these Ducks, including the egg tokens and farming them properly.

Prior to this question, i mentioned that the Waves exchange token, allows for the creation of custom tokens and the egg token is one of them as genesis ducks could be gotten by buying with the egg tokens after which they are well bred and then special one emerges which is quality and has good market value when sold at the market place.

This is one of the best NFTs for now as it's top ten and over a thousand waves have been gained by a selling trader of birds?

Accessing the Waves Ducks, entail users to swap their tokens for egg tokens like i researched or users could join media communities who give tokens for free.

After now, a perch is bought for an egg and once a compatible duck is around, the tray below shows the number of seg, so fat

(5.) that contains 8 characters and so with respect to its value, the worth in the market, would be same

There are eight letters that owe to the duck's nature :

A-Elon

B-Satoshi

C-Doge

D-Bogdanoff

E-Chad

F-Harold

And in cases like this, the head could be Satoshi, feathers be doge, eye be chad etc while the next letter after the dash entails the next generation and the next letter too after the third dash shows color

CONCLUSION

The lesson and work just done explains the concept of a Defi project seeking for great development and improvement just like Ethereum who is proven to hold majority of work space in the Defi Network.

The Waves protocol which we've considered, makes use of the Leased proof of stake which allows for the leasing of tokens to main user nodes and not necessarily demanding the creation of nodes by users.

The Leased tokens here equally generate interest for the leasers..

We had to, look into the Waves exchange considering its various features including :trading, swapping, liquidity pools and neutrino governance.

We saw its token that's meant for the payment of fees on the network and for participation in governance.

Finally we see, an NFT that is offered by the Waves exchange known as waves ducks where users buy Ducks through custom egg tokens and maximise their profits along the process.

I really enjoyed the lesson and i feel the work was worth the energy put into it. One more time thanks professor @imagen

IMAGE SCREENSHOT REFERENCES:

waves.exchange

binance

coinmarketcap

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit