INTRODUCTION

In today's world, investors crave for impressive returns on their underlying assets. This means that they are looking for investment opportunities that can give them a substantial annual return on their investment which is why crypto entrepreneurs are now looking to embrace the world of defi (decentralized finance). One of such defi opportunities is Justswap.

1. Present the Just Swap platform in your own way, demonstrating its importance within the Tron ecosystem blockchain.

WHAT IS JUSTSWAP? OVERVIEW

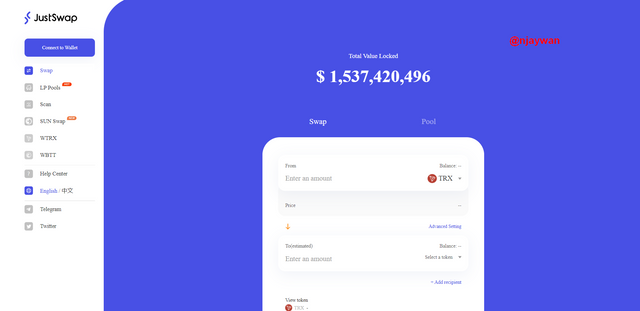

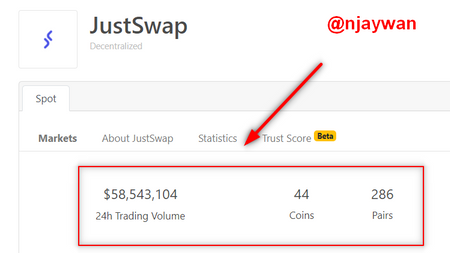

JustSwap is a decentralized exchange protocol that is established on the tron network and allows smooth exchange of erc-20 tokens. It has a total locked asset value of about $1.5 billion at of the time of writing.

To visit just swap, navigate : https://www.justswap.org/#/home

JustSwap currently has 44 coins on the exchange with 283 trading pairs, with a trading volume of $54,561,821 as of the time of this post.

Here, liquidity is provided by users or investors looking to leverage their assets by adding liquidity to the liquidity pool. Transactions are automated and all transaction fees that are generated by various trades goes to the liquidity providers.

Liquidity providers are therefore individuals who render the tokens for sale on the platform in order to generate revenue. They are therefore the market makers of the exchange. This is because, without liquidity, there will be no transactions.

Liquidity can be added by connecting your tronlink wallet and to JustSwap which we will be looking at later in this article.

PROS AND CONS OF JUSTSWAP

PROS

- There are no intermediaries or central authority.

- Trades are automated providing smooth and fast transactions.

- Instantaneous swapping of tokens without any hinderance.

- High profitability for both buyers and sellers.

- No single point failure due to lack of central authority.

CONS

- There is no designated customer support to contact in case of any challenges.

- It lacks many features such as the stop limit, margin and futures trading on centralized exchanges.

2. What tokens does JustSwap support trading? How is the price of a JustSwap token determined (how it works)? Use an illustration to explain it.(screenshot required)

JustSwap is established on the tron ecosystem and supports tokens that are based on the tron network. Thus, it supports the trading of trc-20 tokens. After various transactions, the generated fees goes directly to the liquidity providers and the protocol itself. All of this is automated with no central authority.

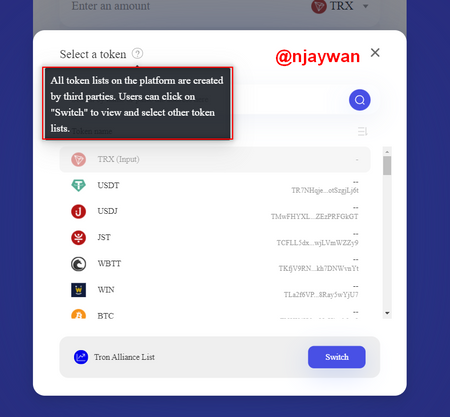

The list of tokens on JustSwap are created by third parties. This means that JustSwap itself doesn't provide these lists and individuals are free to also create and add their own lists as well.

For price determination,

The liquidity on JustSwap, its transations and other functionalities are done through smart contracts eliminating the possibility of a controlling organization.

Thus, to maintain accuracy in the validity of these transactions, this formula is used by the Automated Market Maker (AMM);

where,

X is the first token

Y is the second token

K is the constant.

The formular ensures a balance since k is always constant. X and Y changes but must always conform with the formular. This means that there must be an equal number of original and replacement tokens. Where x is reducing, y needs to increase to balance out.

Let's look at a practical example,

If there are 5X tokens and 12Y tokens, it means that our constant K will be given by,

Say one x token was to be removed. This would mean that we now have, one less X so Y will have to increase to match that. Let's see,

Our new Y value will then be found by,

Difference then becomes 15 - 2 = 3

This implies that for each X token that is removed, an additional 3 Y tokens must be added.

Note, prices are subjected to variation to cover for transaction fees so the X and Y values could deviate slightly at times. But since the transaction is automated, the system constantly readjusts the price to cover for these expenses.

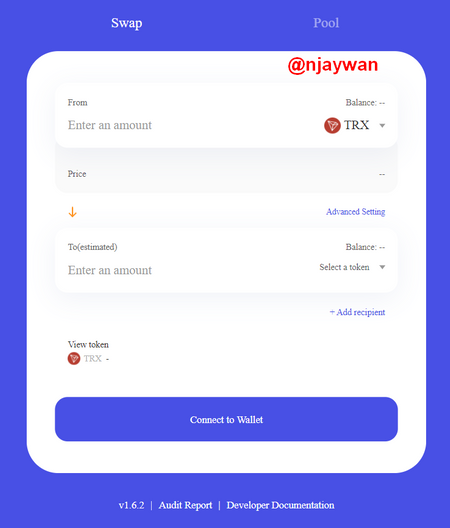

3. How do I connect my wallet to JustSwap.io? Is there a mobile app? (Screenshots needed)

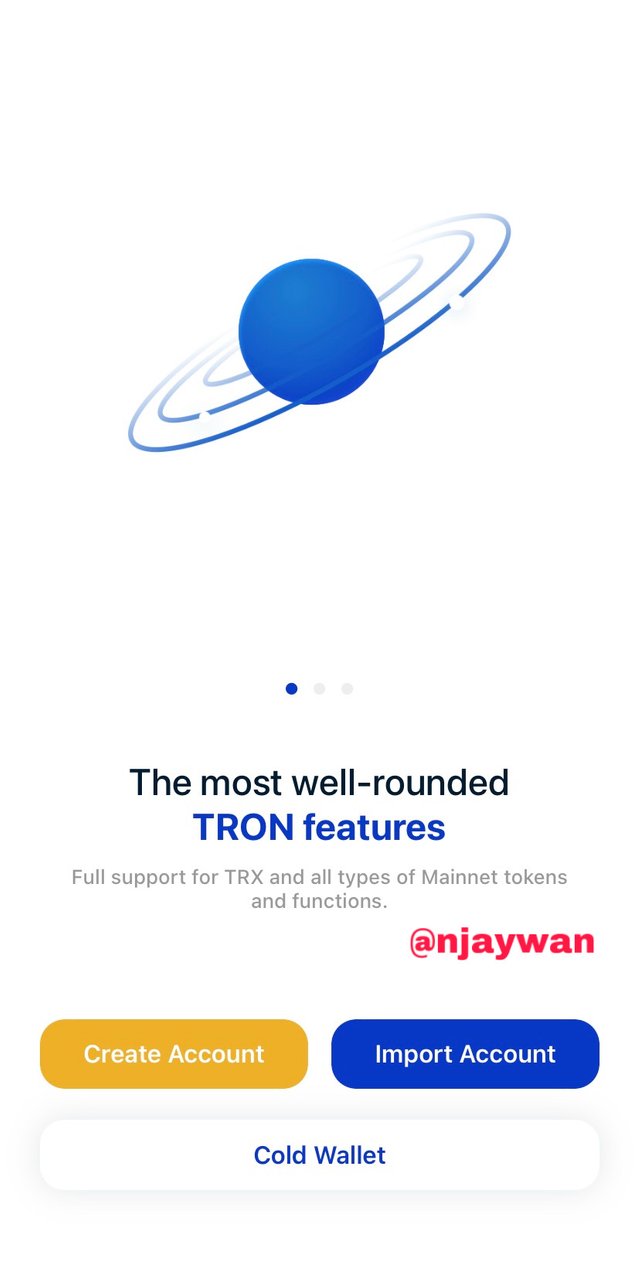

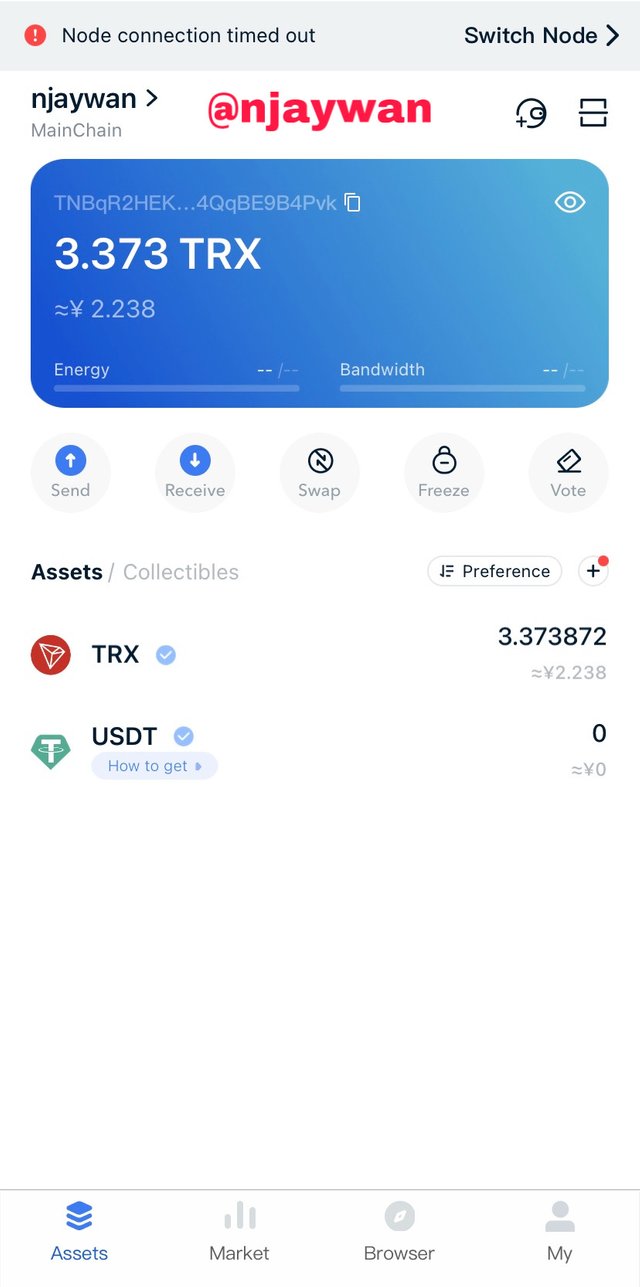

- Since Justswap do not support mobile app we download the tronlink wallet

- After downloading we try to connect the wallet to your account

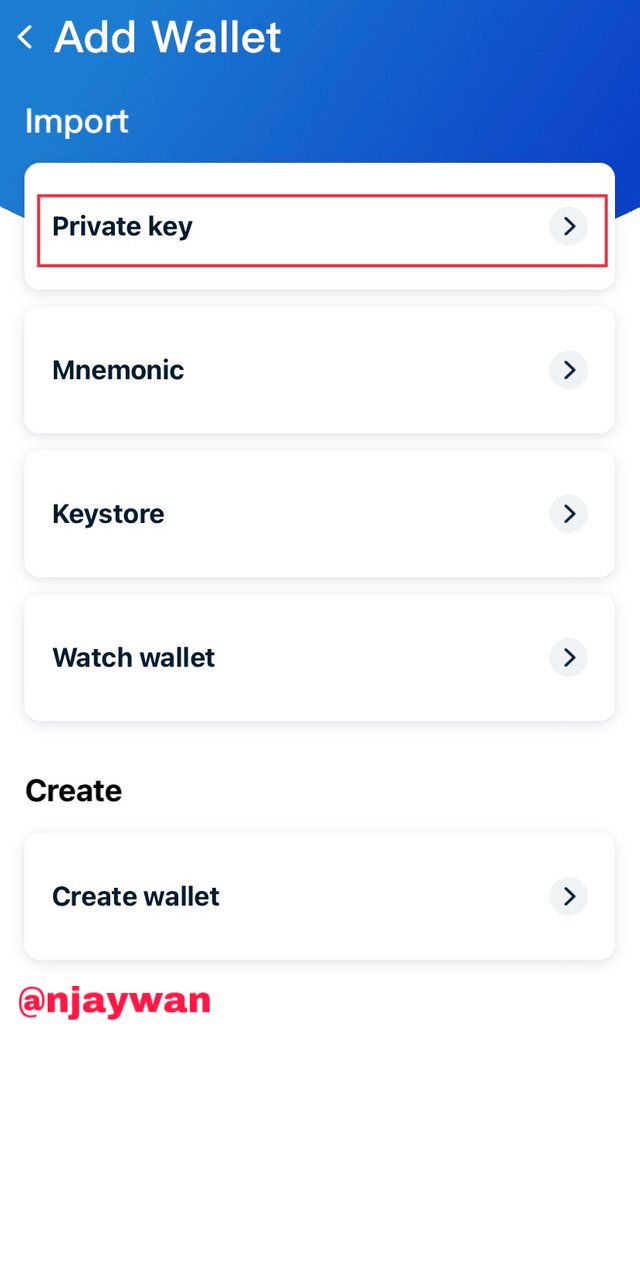

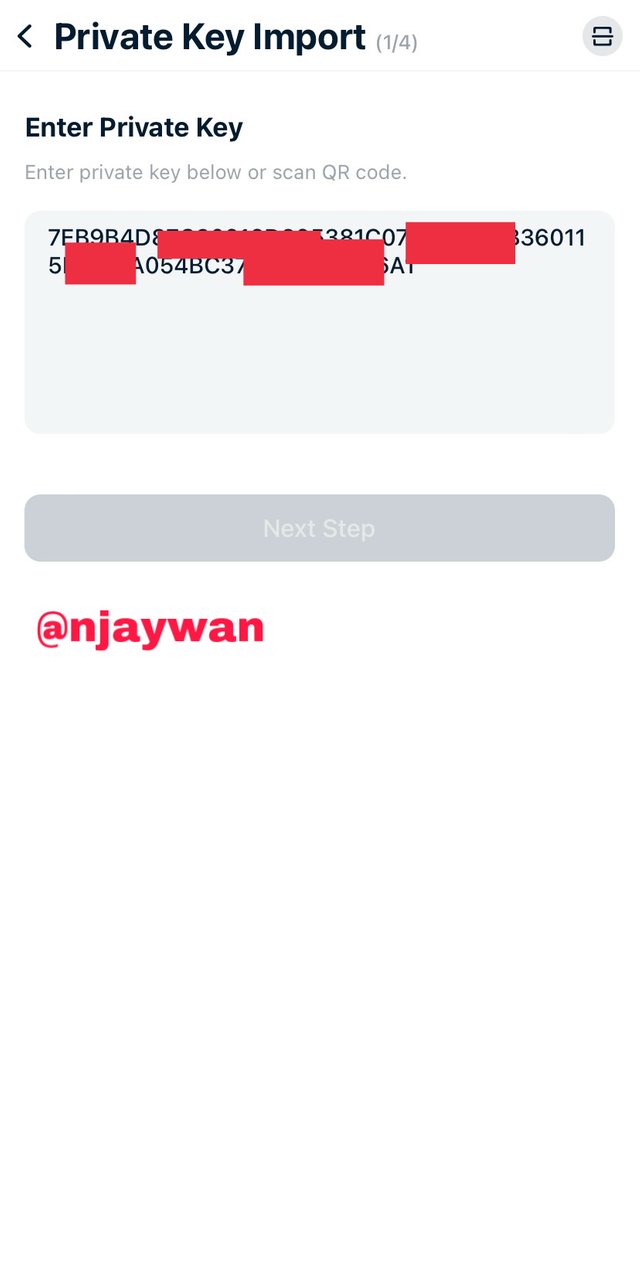

- Here we are going to use our private key to import the wallet

- Now we enter our private key

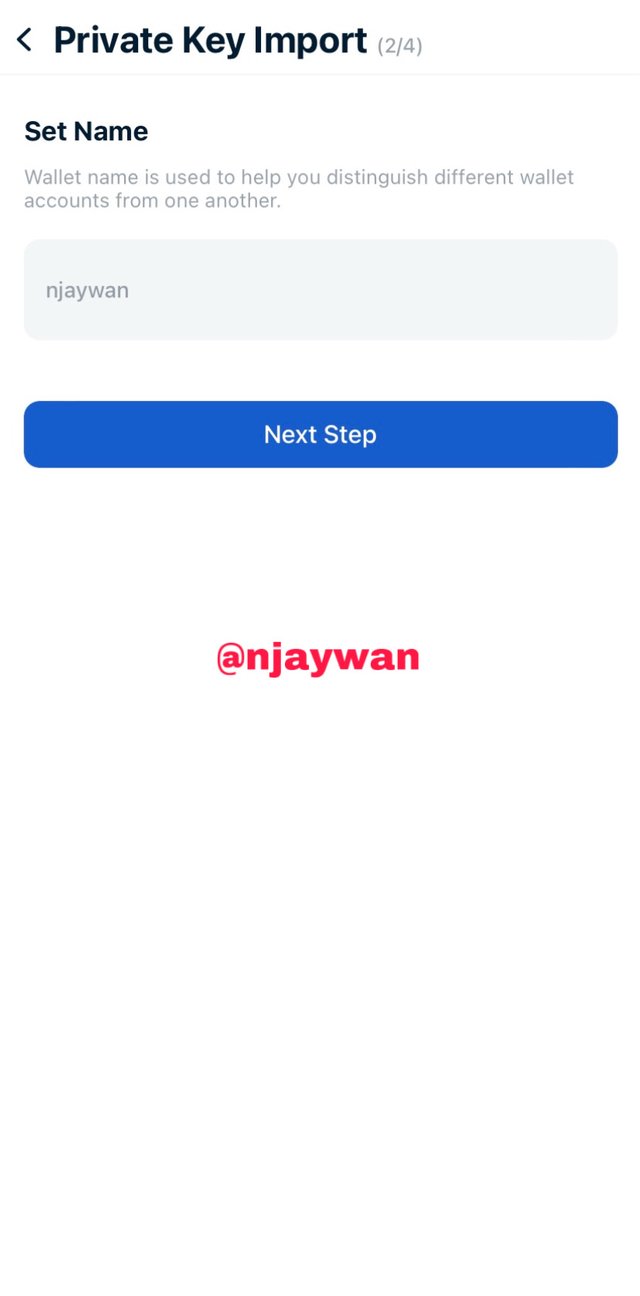

- We enter the username

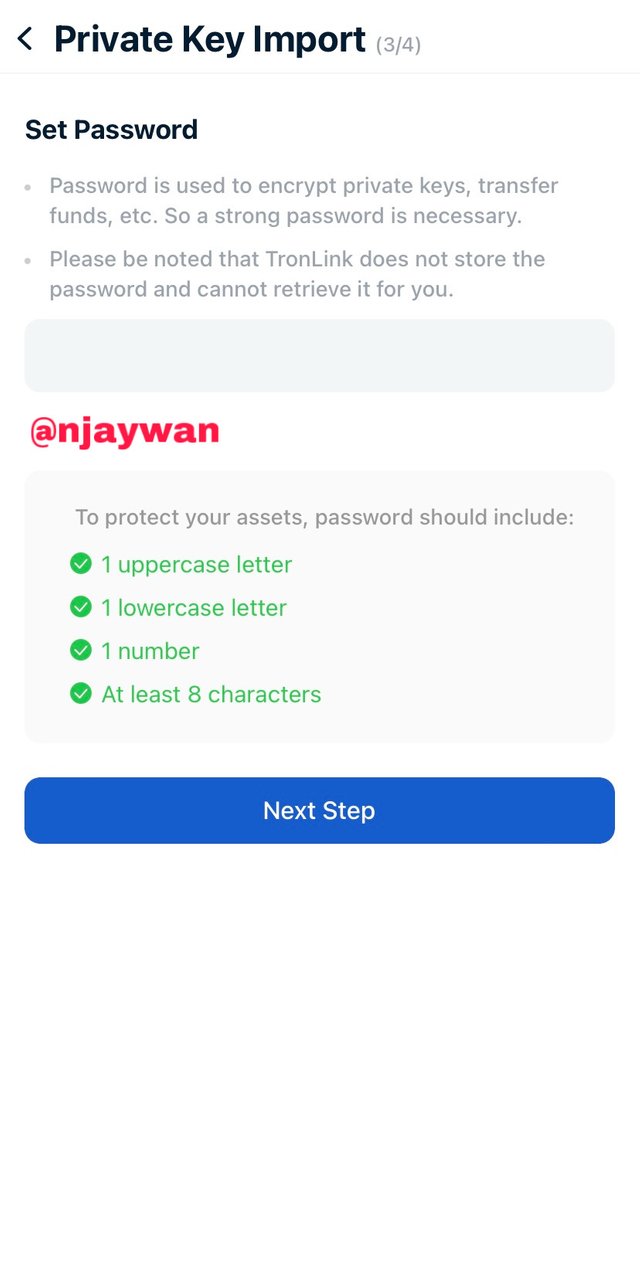

- We set a new password

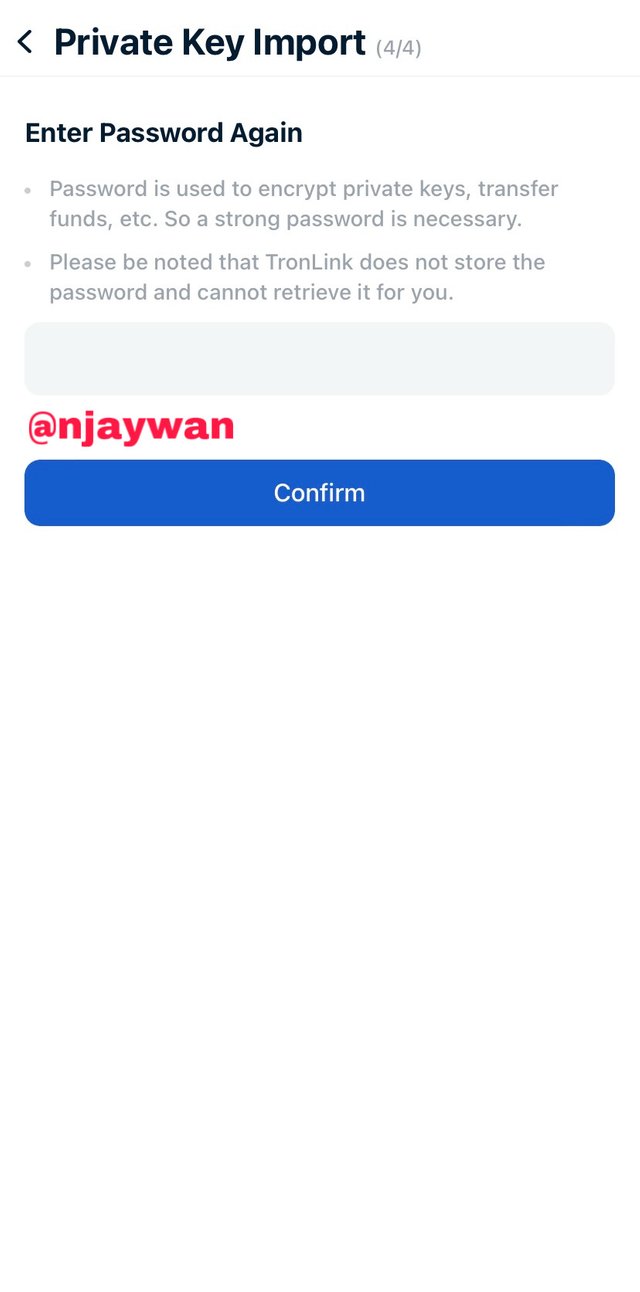

- We confirm password

- Afterwards we open the account

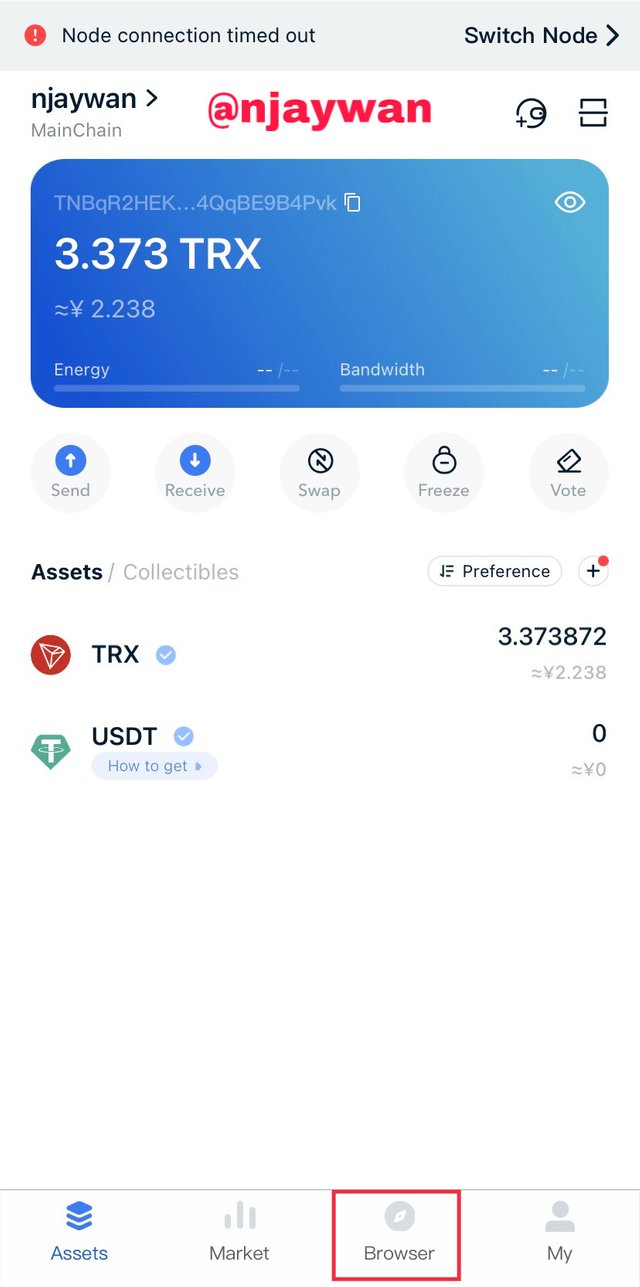

- Click the browser at the down button and search for Justswap to enter enter Justswap

Just like numerous Dapps, Justswap doesn’t have a mobile app but can be connected using wallets

4. Include a real example of your interaction with Just Swap, demonstrate how you can trade on the platform. (screenshots required)

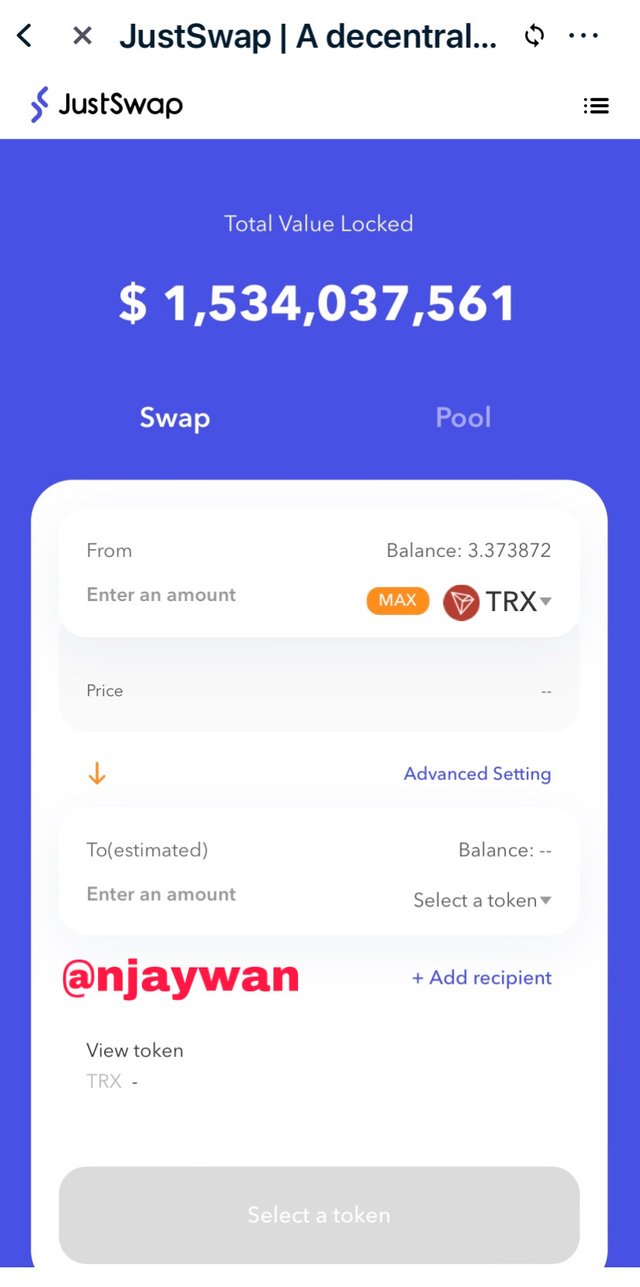

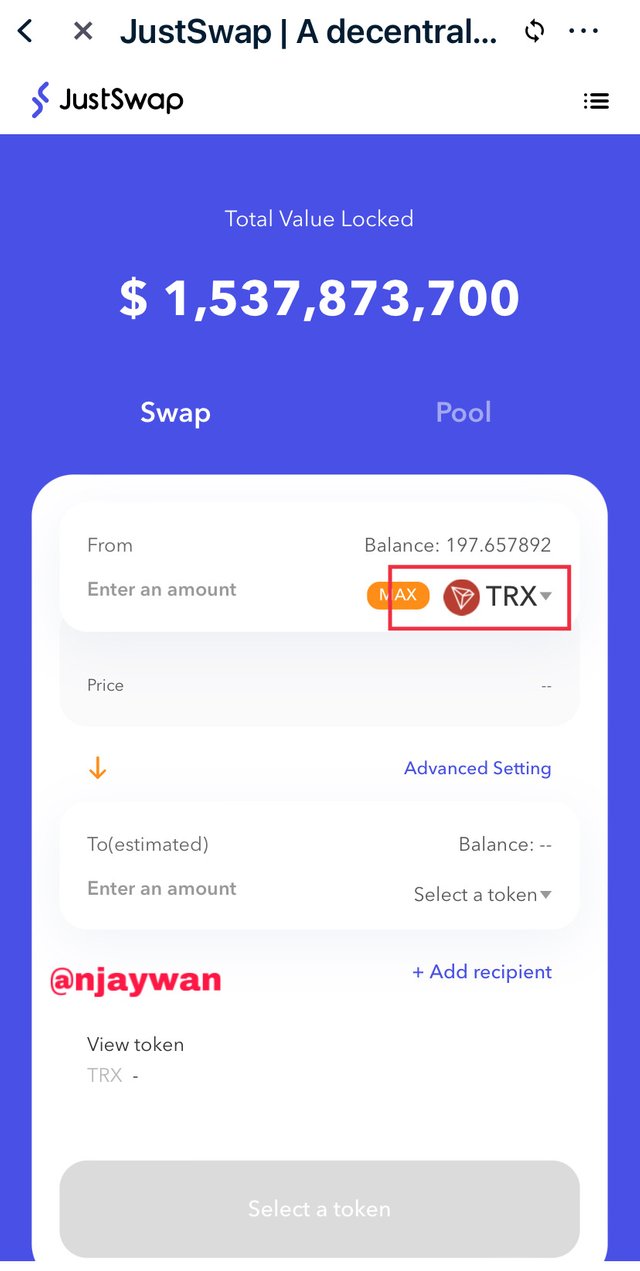

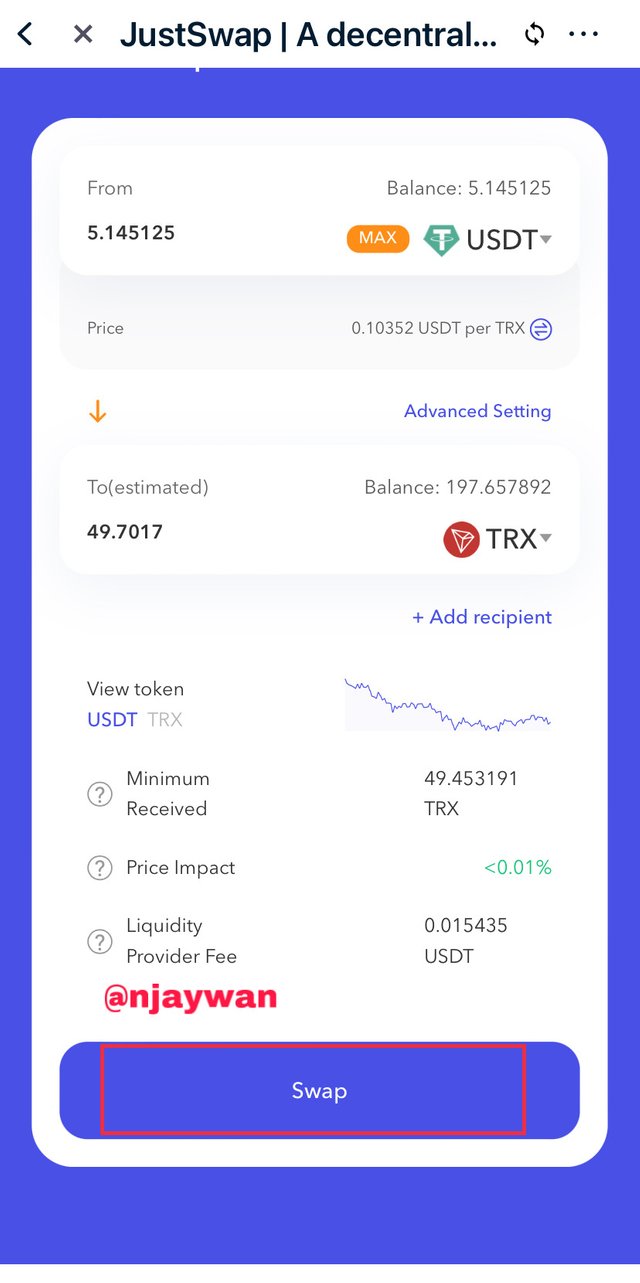

- To swap in **Justswap, open the Justswap in the tronlink wallet and click the TRX to select the token to be swapped

- Choose the token you want to swap. Here we choose the USDT to TRX

- Enter amount to swap and in this case we choose max

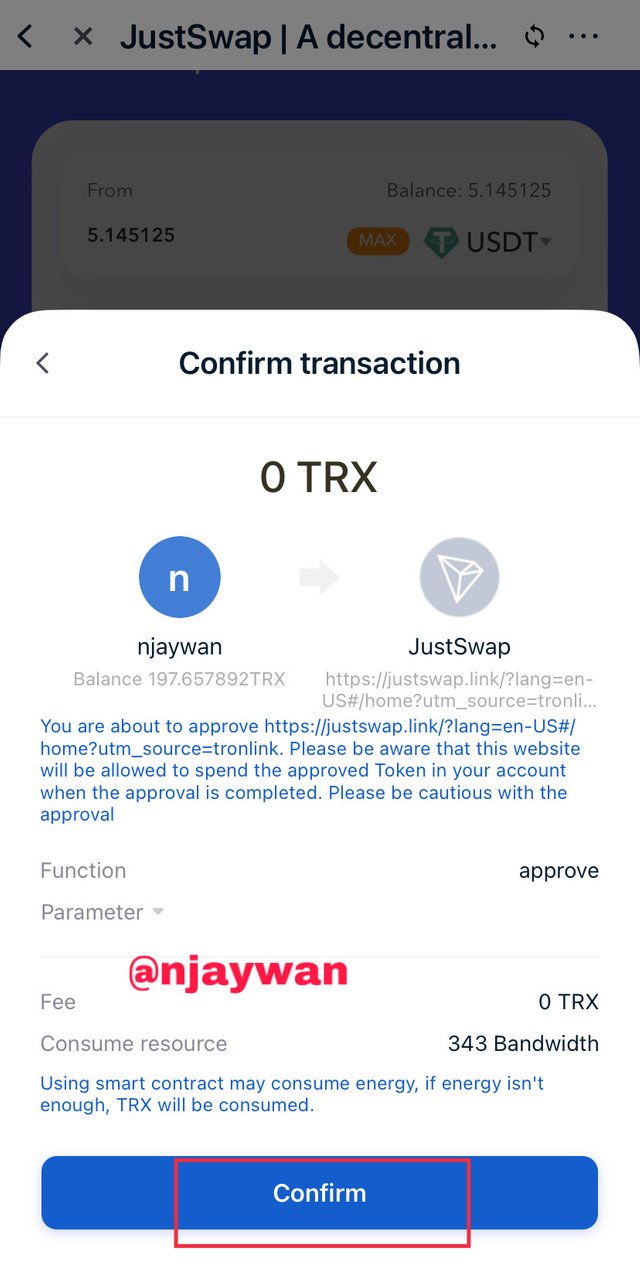

- Confirm transaction

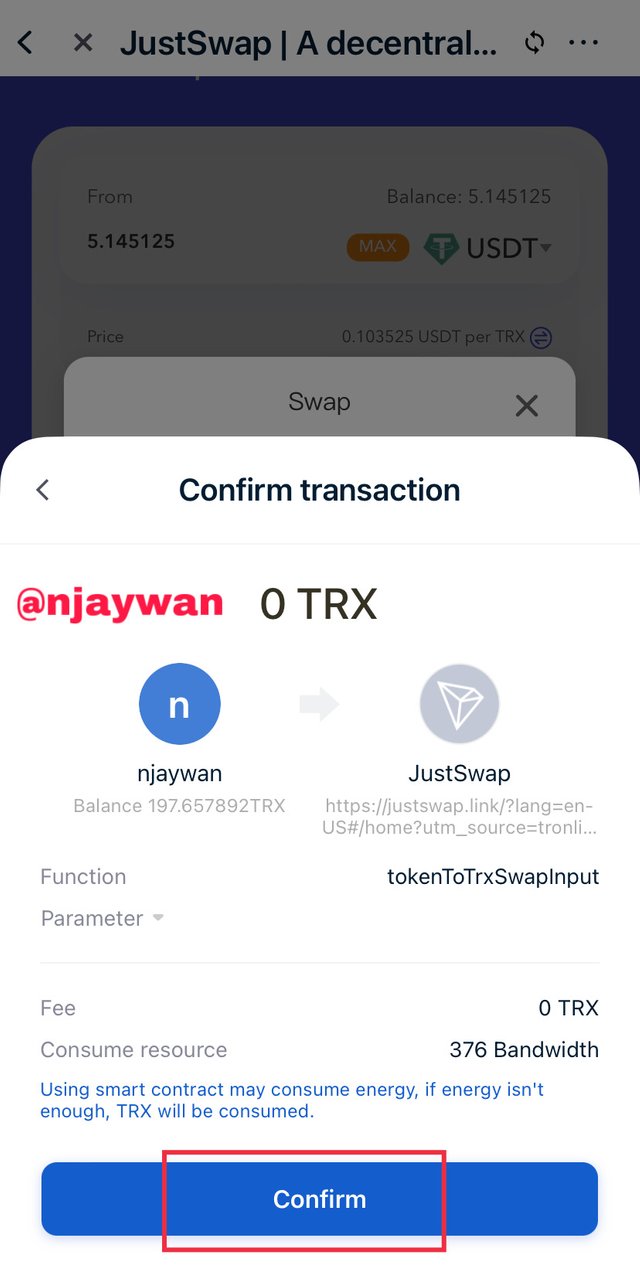

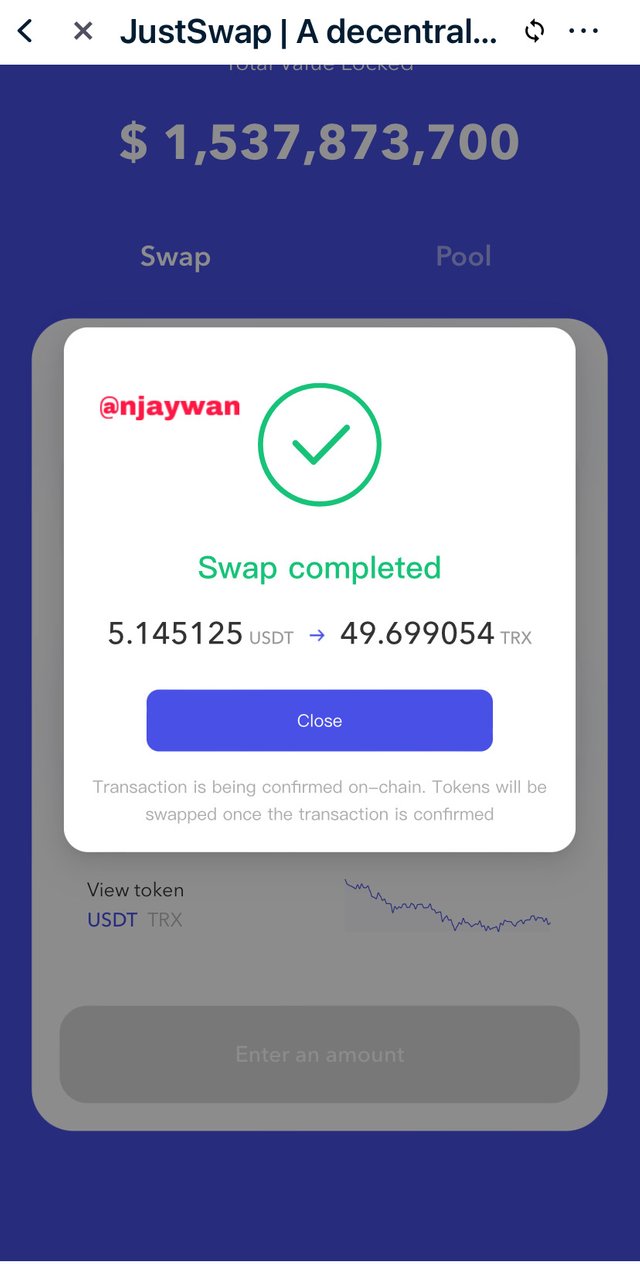

- Confirm the transaction completely

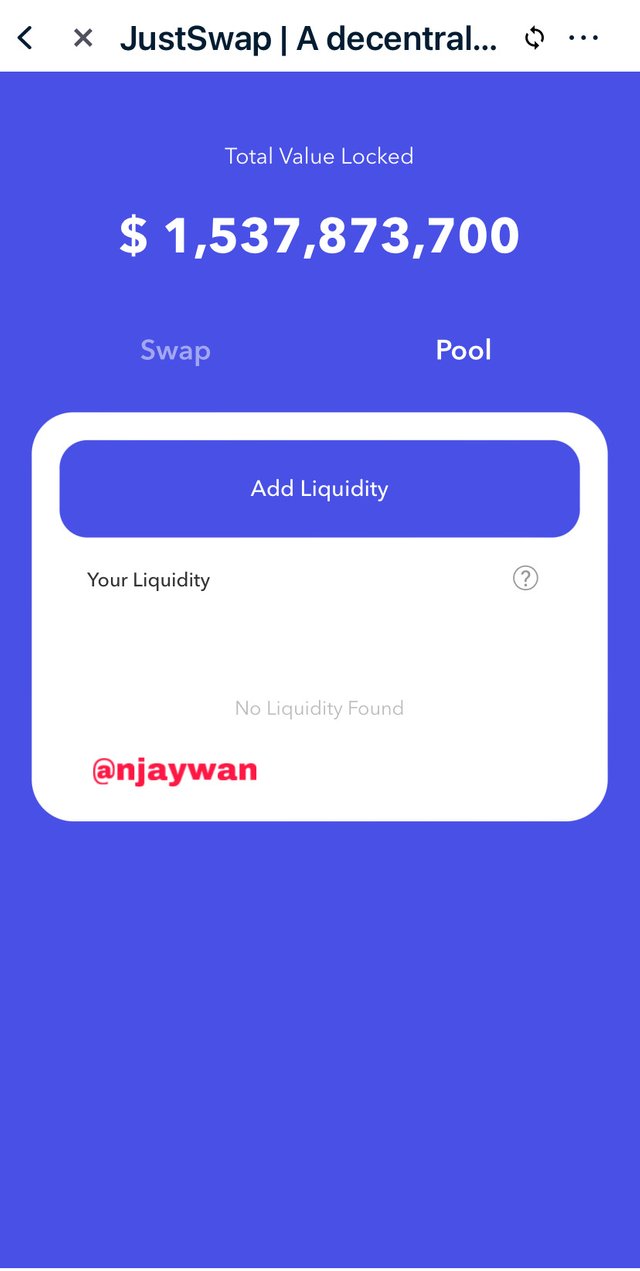

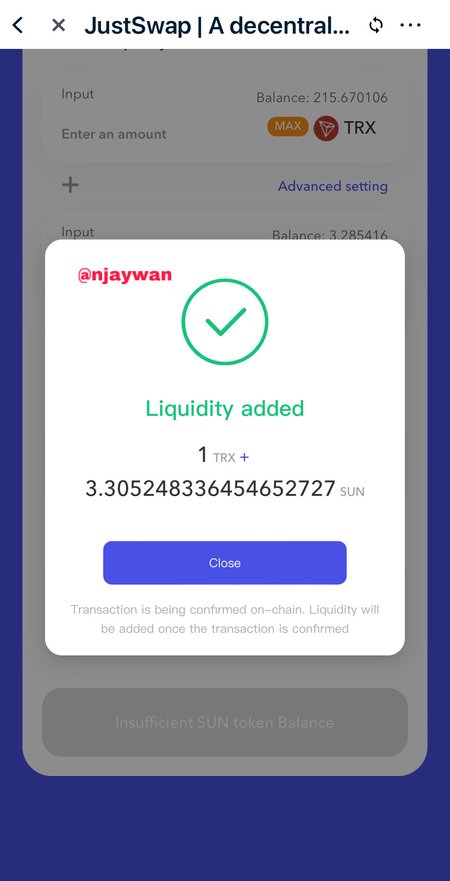

5. Include a real example of your interaction with Just Swap, explain How to add liquidity to JustSwap. (screenshot required)

Adding liquidity is quite simple,

click on pool at the Justswap interface

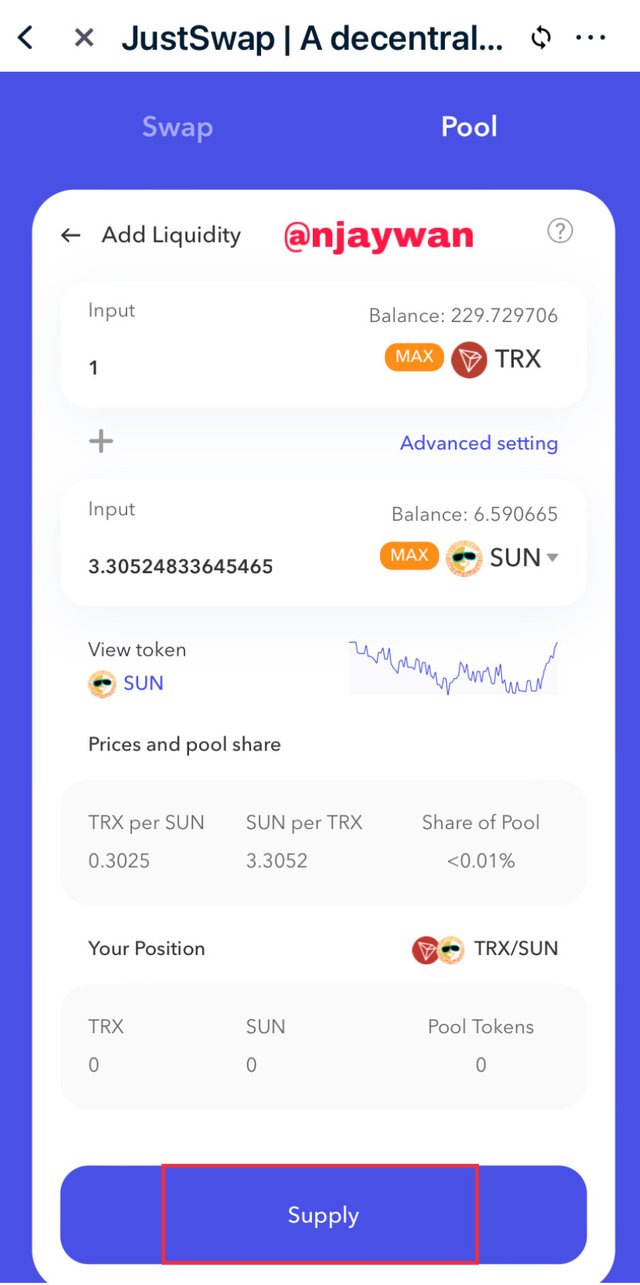

- Click add Liquidity

- Choose the token to add liquidity

- click amount of liquidity to add

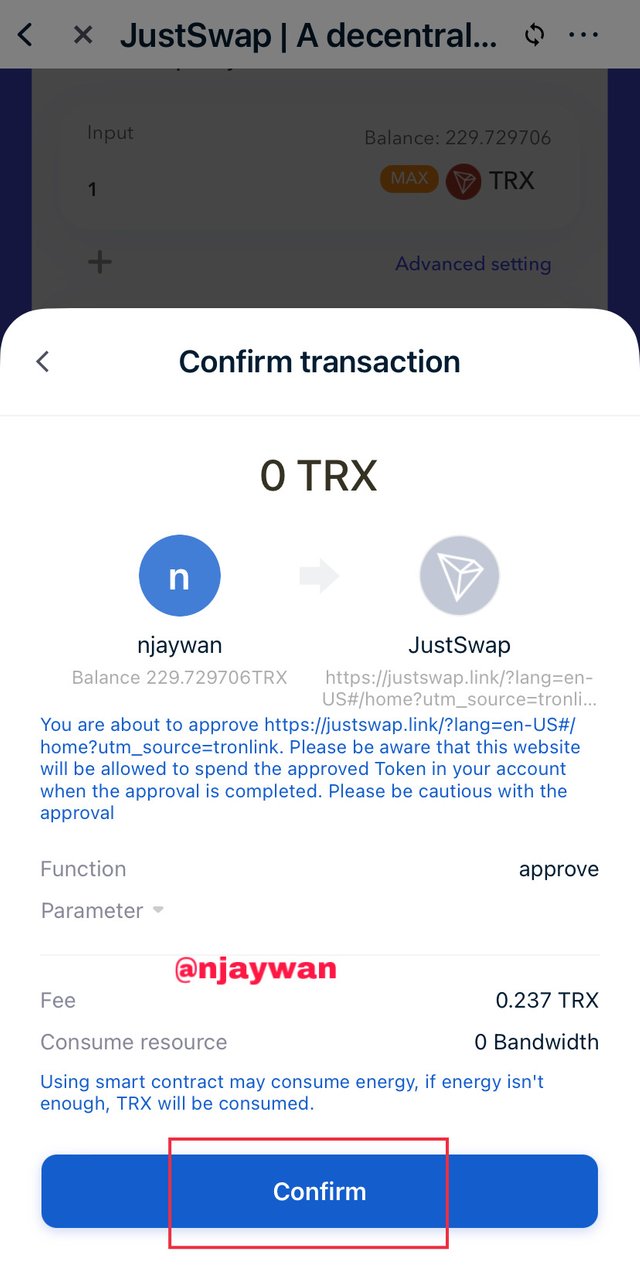

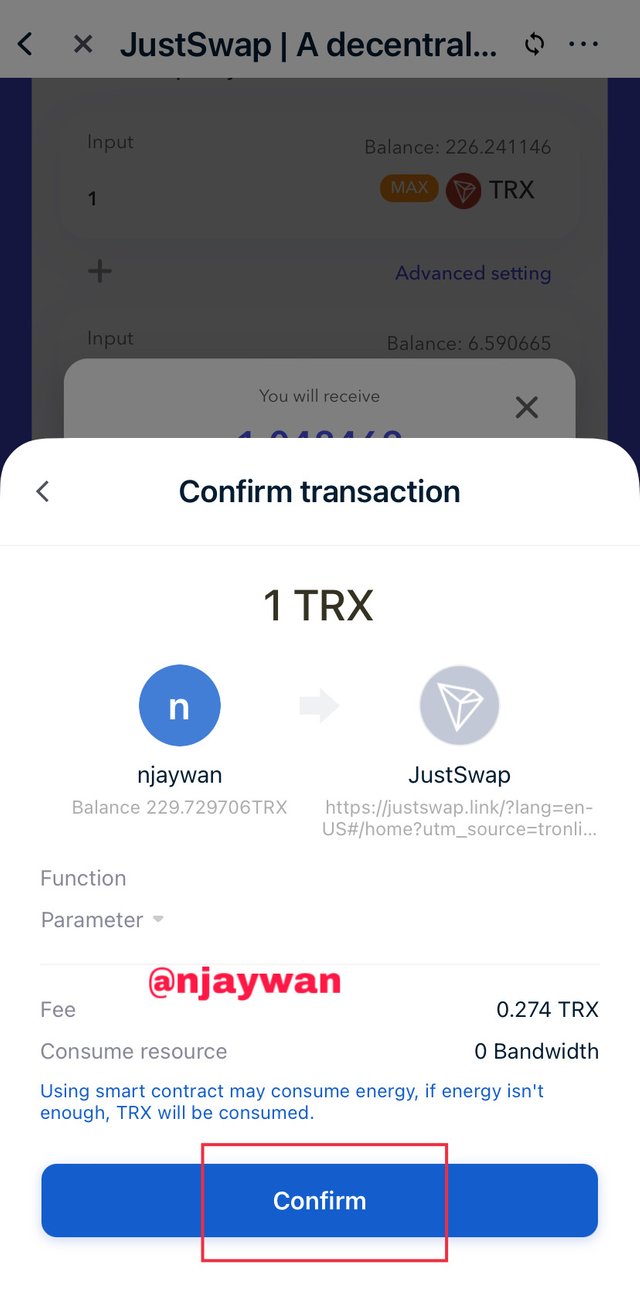

- Confirm the amount added

- Enter password to confirm

- Transaction complete

CONCLUSION

JustSwap has brought the world of defi with an amazing automated exchange platform that enhances instantaneous exchange, provides an high profit avenue for high returns for both the buyer and the maker and also removes the possibility of a single point failure due to no central authority. Liquidity providers can also earn profit from their underlying assets if they are not looking to trade themselves.

This makes it an ideal decentralized exchange to be on.

Thank you for your attention.

Hello @njaywan,

Thank you for participating in the 5th Week Crypto Course in its 4th season and for your efforts to complete the suggested tasks, you deserve a Total|6/10 rating, according to the following scale:

My review :

Acceptable content in which you tried diligently to implement what you were asked to explain. Here are some notes I give you.

The importance of the platform in the TRON ecosystem has not been analyzed in depth.

In your explanation of how JustSwap works, you are asked to prepare an illustration.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit