INTRODUCTION

In our modern day globe, where most individuals want full autonomy and control over their assets, it is only right that we come up with better ways of managing our finances and maximizing our earning potential. instead of giving your money to the bank and earning a small percentage as interest, you could be your own bank and supply liquidity to a decetralized exchange and oversee its usage.

This brings us to today's topic, Zethyr Finance.

What is Zethyr Finance?

Zethyr Finance is a decentralized application on Tron's ecosystem that offers lending capabilities to its users. Due to its mode of operation on numerous nodes, that is 1,300 nodes to be precise, it has no single point failure. With this protocol, you can lend or borrow tron assets such as TRX, BTT, USDT & WIN at the best rates.

After supplying assets to the protocol, you can track your balances using ztokens. These tokens show your real time balances on the platform with the accumulated interest over time. Just like any other asset on the platform, ztokens are in line with trc-20 tokens standard.

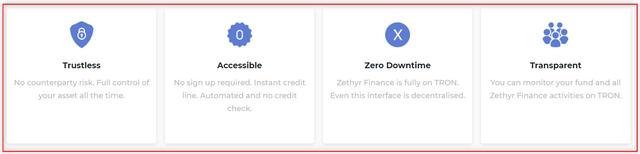

The platform is committed to being accessible at all times, giving your autonomous control of your assets, offering your full transparency of your activity and no risk of any counterparty.

It also offers a decentralized swapping aggregator platform which allows you to swap between the following assets :TRX, BTT, WIN, SUN, JST, SUNOLD, WBTT, zTRX, zBTT, zUSDT, 888, zWIN, USDJ, TUSD, UP, SUN, ETH, BTC.

What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

Features of Zethyr Finance

Here are some features you would find in the Zethyr Finance platform.

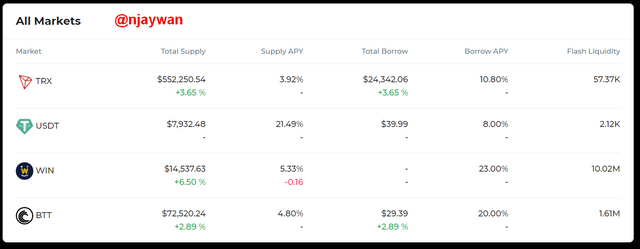

ALL MARKETS

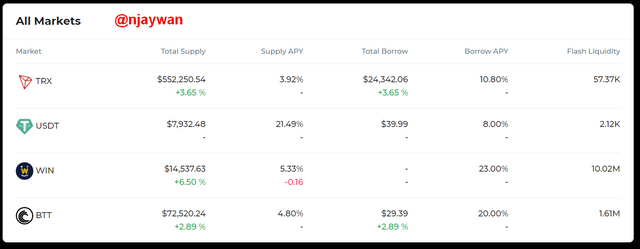

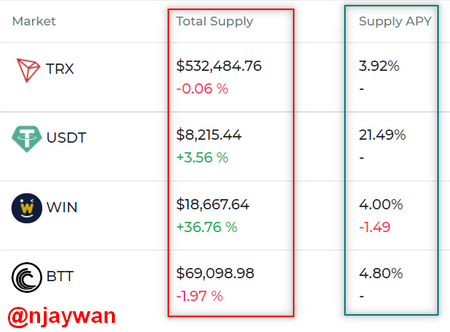

Here, you can see the various assets that are available for lending and borrowing on the platform specifying total supply, Supply APY, Total Borrow, Borrow APY and flash liquidity. At the time of this post, TRX is leading in terms of supply with a whooping $552,251.58. Usdt also has the highest annual percentage yield at 21.49%.

The lenders give other users the ability to collateralize some of their asset in order to borrow assets such as TRX, BTT, etc. You can find the real time chart of the total supply versus the total borrowing occurring on the platform below.

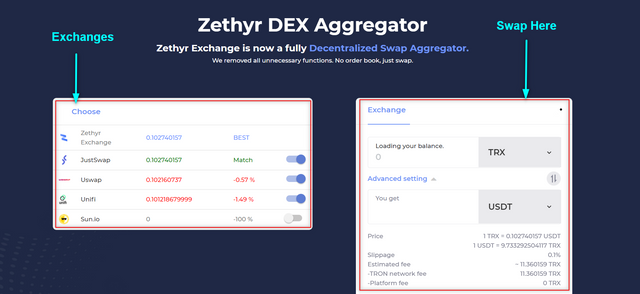

Zethyr DEX Aggregator

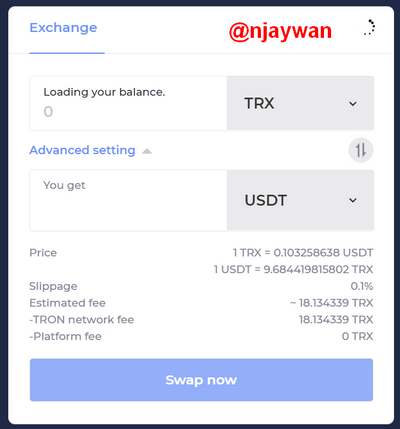

Unlike traditional exchanges that have order books and limits for trades, this one doesn't. What this decentralized aggregator does is that it considers a variety of exchanges during transactions. For now, the exchanges are: Justswap, Uswap, Zethyr Exchange and Unifi with Sun.io coming soon.

What the aggregator does is that it compares the prices of these different exchanges and determine the best rate before the swap action is executed. The platform itself does not attract any fee at all (zero fee) but a standard trx fee of approximately 11.360159 TRX is attached to compensate liquidity providers.

zTokens

These tokens show the balance you have left on the platform and accumulates your interest over a period of time. They work just like other assets on the protocol with full autonomy given to you and conform to the trc-20 rules and regulations. While holding these zTokens, you can borrow from Zethyr Protocol.

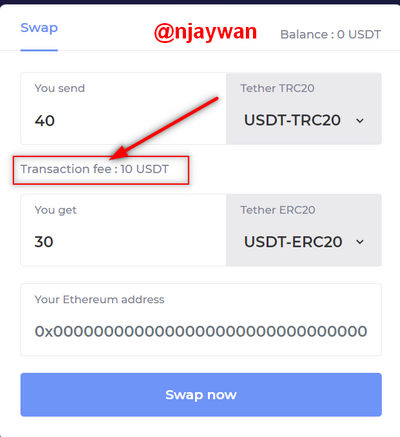

STABLE SWAP

It also offers a cross chain swap of usdt from trc-20 to erc-20 at the lowest fee available (10 usd). That way, you can convert your erc-20 usdt tokens to that of trc-20. Otherwise, the only option you have is to keep sending on either one of the chains (Erc-20 or Trc-20)

3. Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

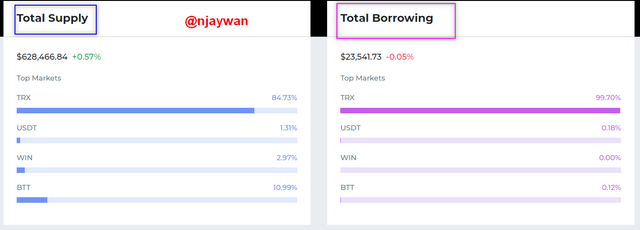

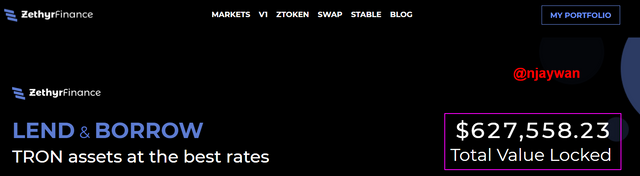

The total supply at the market of Zethyr Finance is equivalent to $628,466.84 while the total borrowing is $23,541.73, both of which trx tops the markets as seen below.

The total supply also constitutes the locked assets which gives us the total locked asset value seen on the market of Zethyr Finance below.

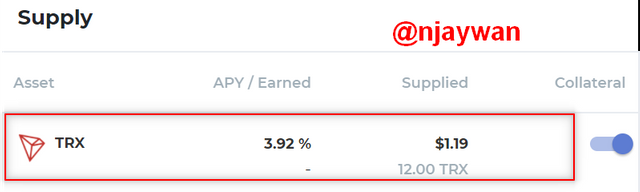

SUPPLY

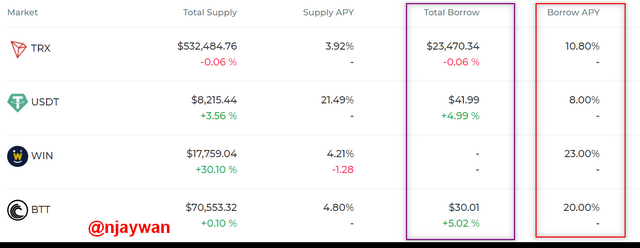

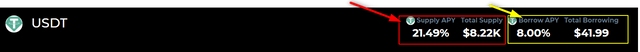

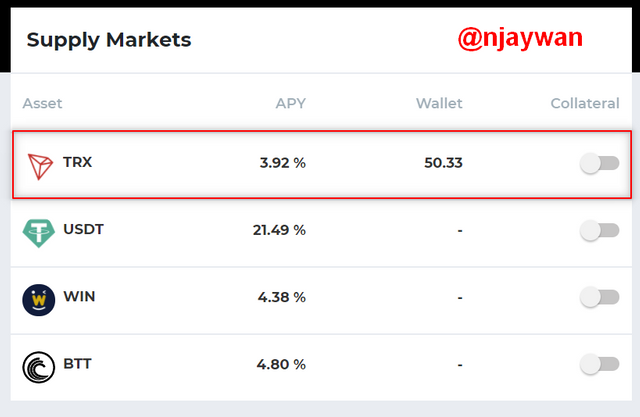

In the Zethyr Protocol market, we can observe that all the various assets have their indicated total supply and their corresponding annual percentage yield as well. From observation, TRX which has the most supply of $532,484.76 has the least APY of 3.92% while USDT with the least supply of $8,215.44 has the most APY of 21.49%.

BORROW

Considering the total borrow and borrow APY, WIN which has an unspecified amount of total borrow presents the most APY at 23% and USDT with a total borrow of 41.99.00 USDT has the least APY of 8.00%.

Thus, in terms of profitability, the USDT offers the best supply APY (21.49%) for users looking to supply assets to the Zethyr protocol and for borrowers too (8.00% APY).

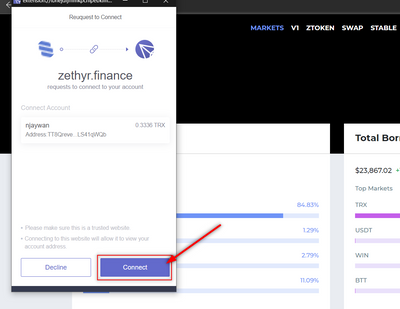

4. Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

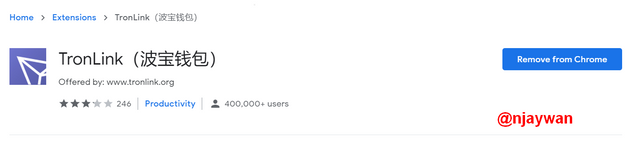

To start with, first make sure the Tronlink pro extension is installed on your computer. Then you can import your keys or set up a new account.

- After you have created a your new wallet or successfully imported your old tron account, you would notice that you have not been connected just yet as seen below.

Follow the following steps to connect your TronLink wallet to Zethyr Finance.

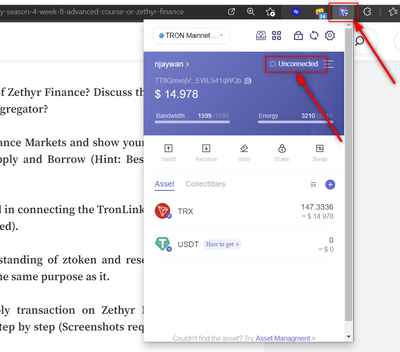

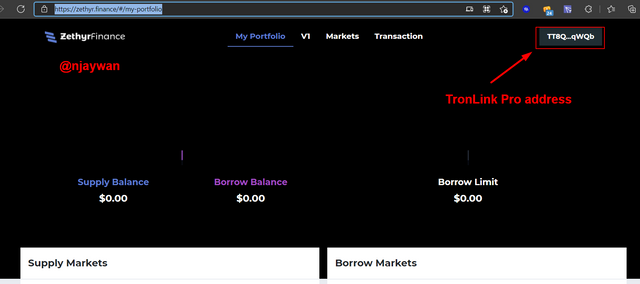

- Upon visiting zethyr finance, click on my portfolio.

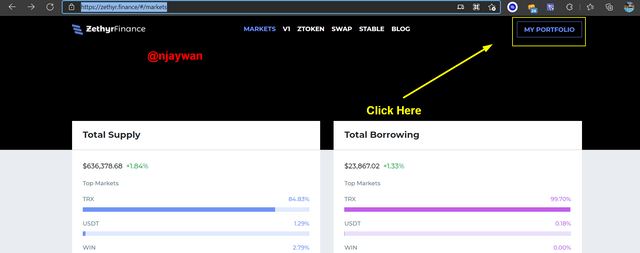

- With TronLink Pro installed, you would see a pop-up dialog box, click connect.

- Once you've been able to successfully connect your wallet, you would see your wallet address on the top right hand side of the page.

5. Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

The ztoken on the Zethyr Platform is their protocol's very own native currency that displays your supply or borrowed balance. There are various forms of ztokens seen on the platform;

- zUSDT

- zTRX

- zWIN

- zBTT

zTokens are pegged to any token you are supplying to the protocol in a ratio of 1 : 1. Thus, where you supply USDT to the platform, you would earn the equivalent of zUSDT depending on the amount you supplied. If it was rather BTT tokens that was supplied to the protocol, you would earn zBTT in the same manner.

zTokens can also be used as collateral if you decide to hold them on the zethyr protocol. Meaning, it can also grant you access to the borrowing capabilities of the protocol.

'

These tokens also dictate your level of influence on the platform. This is because, the moment you decide to withdraw some tokens from the protocol, other ztokens need to burnt in order to process your request.

OTHER PROJECT WITH SIMILAR TOKEN.

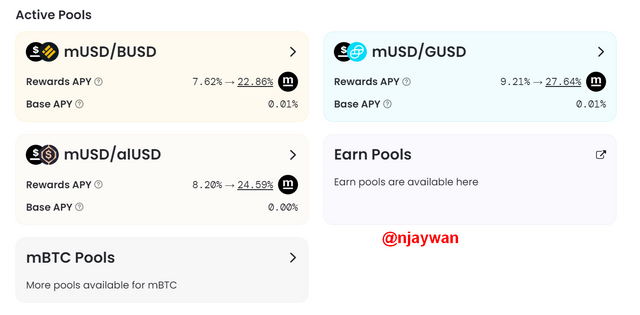

mstable

mStable is a also a protocol that seeks to unify various assets with its native mASSETS which are pegged to other assets in the ratio of 1:1. This protocol was meant to tackle various issues which currently exists with such swapping platforms such as high slippages, It also offers a system that makes you earn interests on your mASSETS similar to what we saw for the ztokens.

mstable has an all-time trading volume of over $3b+ and about 21% average USD APY.

Similar to the ztoken project, here you can also provide liquidity with your mASSETS and earn interests which are accumulated over time. Here are some pools and their corresponding APY

6. Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

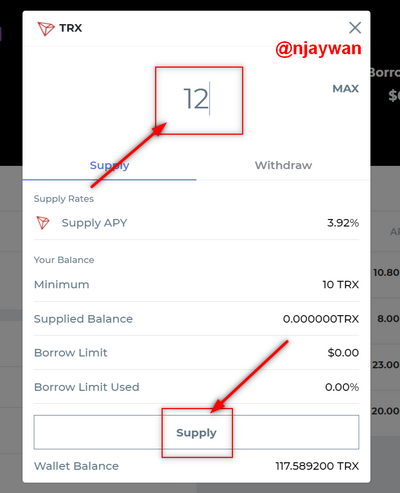

First click on the asset you would like to supply from the supply market. Here I would like to go with TRX since I have some TRX tokens in my wallet.

- So I click on TRX

screenshot: https://zethyr.finance/#/my-portfolio

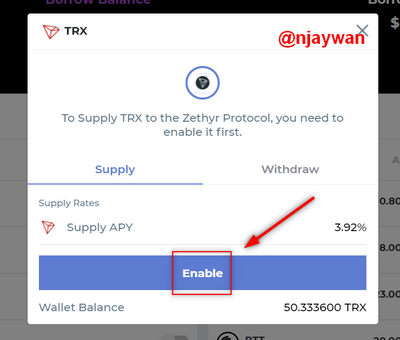

In order to supply this asset to the protocol, it must frist be enabled, and this utilizes energy. So make sure that you have some significant energy in your wallet to process this transaction.

- Now click enable.

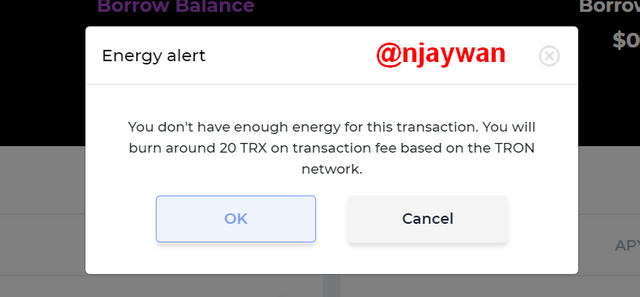

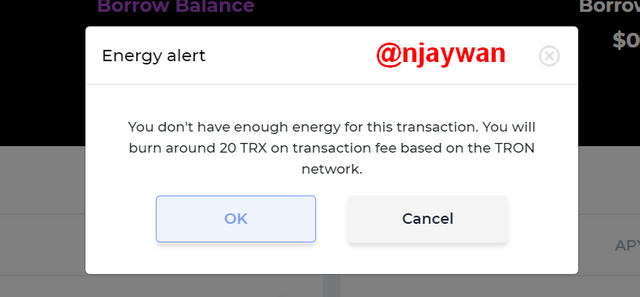

There will be a dialog box to prompt you that you would need some trx sitting in your wallet to pay for fees otherwise you would burn several trx.

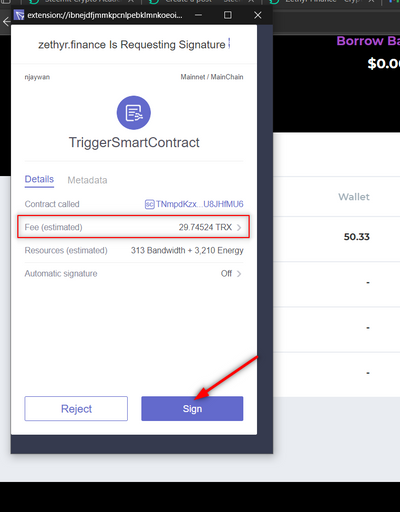

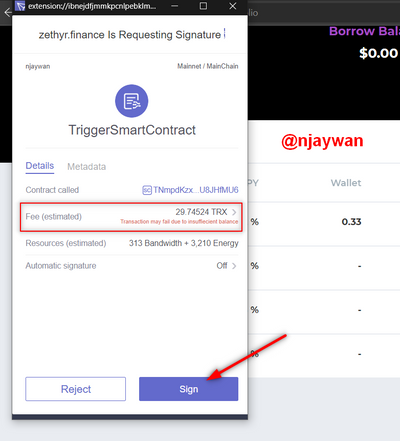

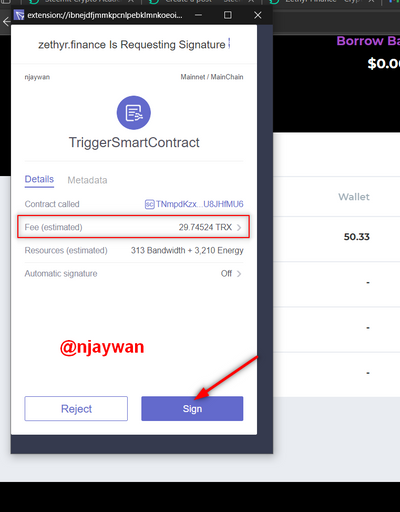

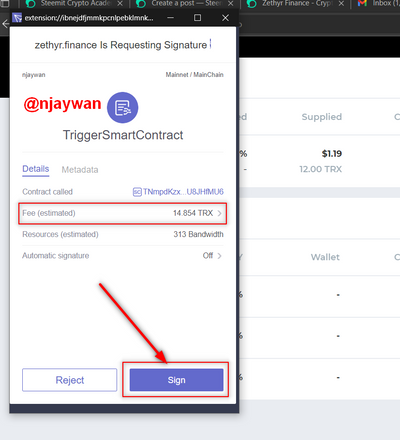

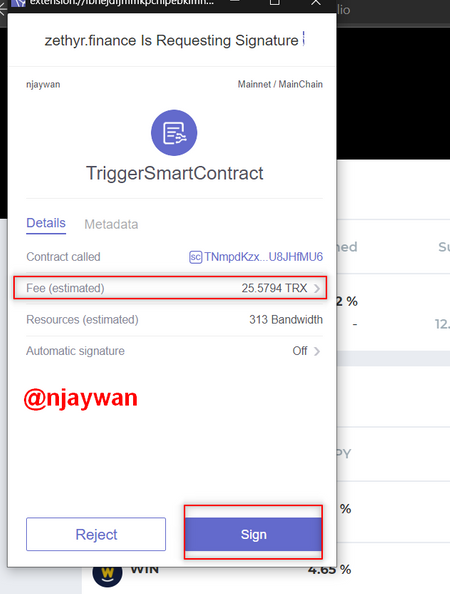

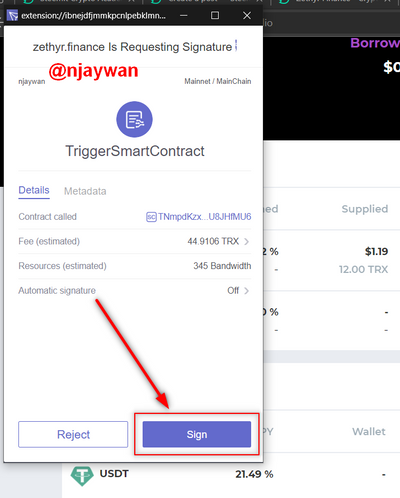

- After you hit OK, there will be a pop up box which will be asking you to sign the transaction. Before to go through carefully after which you can your trx will be enabled.

If your trx available is less sufficient to cater for the transaction fee, you would see a warning beneath the fee section.

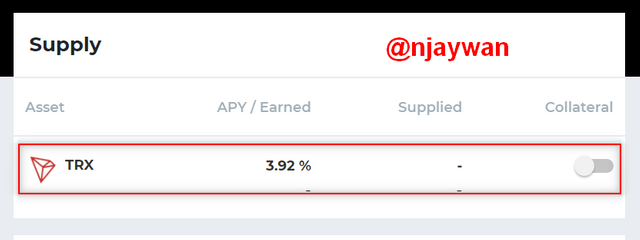

- Upon enabling your trx, you would see it move up the ladder to the Supply section where you can select it.

- Now specify the amount you would like to supply bearing in mind that there is a fee of about 30 trx attached to this transaction.

- Now you can sign to confirm your transaction and supply the trx to the Zethyr protocol. As you can see below, there was a transaction fee of 29trx with this action.

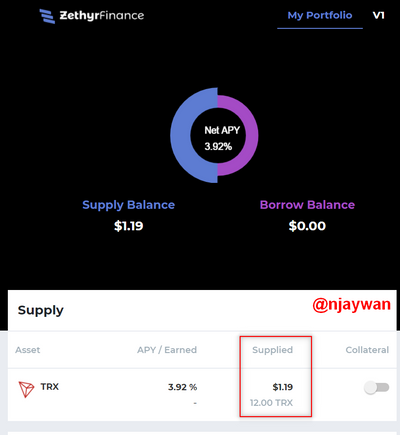

After this, you can see your supplied asset under the Supply section of the platform and APY earned as well as the supply balance on the platform.

7. Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

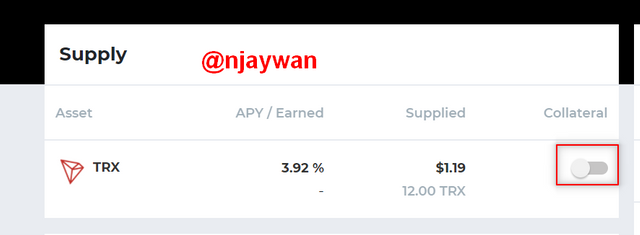

To collateralize your supplied asset, follow the following steps.

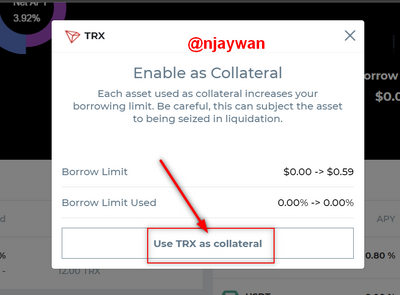

- First click on the switch beneath the collateral section under your supplied asset.

- Click on Use as Collateral

- Click OK

- Now it is time to sign the transaction. The fee here was 14.8 trx.

- It is now available under the Supply section after this.

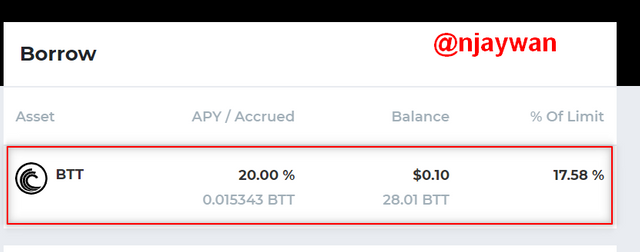

- Now go back and select BTT under the borrow market now that it has been enabled. Specify the amount within the minimum and maximum range that has been specified.

- Once completed, you need to sign from tronlink pro to confirm transaction.

- Once complete, you would see your borrowed asset under the new Borrow section.

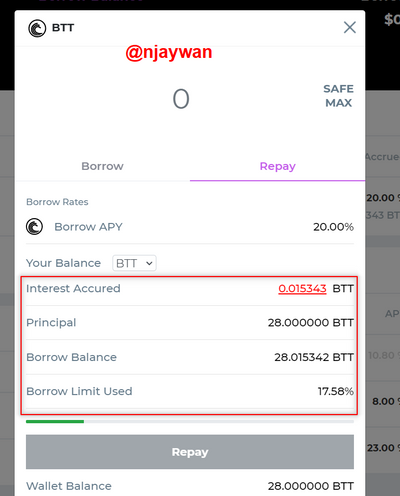

- Now to repay, simply click on the borrowed asset and specify the amount you are about to repay. Then choose repay.

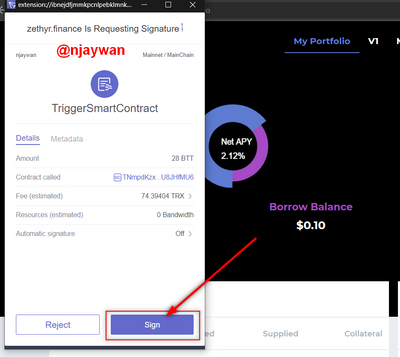

- Now sign to complete the action. This time the was a fee of 74 trx.

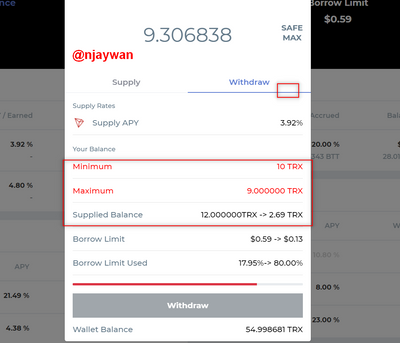

Also, to withdraw the supplied asset, simply visit theSupply session and choose the asset you would like to withdraw. Then you can click on the asset.

- Now indicate the amount you would like to withdraw.

Then sign the transaction to confirm.

8. What do you think of Zethyr Finance? Is it great or not? State your reasons.

The Zethyr Finance is a great protocol for a variety of reasons as seen below.

It has multiple features and application as it allows it users to swap, borrow and lend tokens at no fees at all. There is also very little slippage on the platfrom (0.1%).

Using the aggregator, the best prices is offered due to the aggregated value generated automatically from multiple exchange values.

This aggregator is also fully automated so nothing of the Zethyr protocol is centralized by any means. It's fully decentralized nature gives you full autonomy of your funds to do as you please through smart contracts.

Also, both the borrower and the lender of this protocol stand to gain since the lender is offered an APY on their asset while the same supplier can collateralize their assets to borrow other assets on the platform and repay later.

CONCLUSION

Zethyr finance is an amazing platfrom with a very promising future as it is not just a lending and borrowing platform, but offers a great decetralized aggregator that offers the best prices for swap trades.

However, one thing I didn't like was the amount of fees associated with each transaction that needed signing. If something could be done about it, I am sure it will catapult mass adoption.

Thank you for your attention.

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes! Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I appreciate your hard work

God bless you very much

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit