Hello,

This is a homework post for professor @reddileep . In this post we will talk about Triangular Arbitage.

.png)

Question : 1

Define Arbitrage Trading in your own words.

Answer :

Arbitrage is the process that involves simultaneous buying and selling of same asset from different exchanges, platforms. Arbitrage trading takes avdavntage of the inefficiency in markets. During this kind of trading the profit will be the price difference of asset in different exchanges. Usually this profit percentage here is very small.

When we do arbitrage trading, the quantity of asset that we bought should be same as quantity of same asset that we sold. Only the net price difference is captured as the profit of trader.

Profit of trader should be large enough to cover all the fees charged in transaction. Otherwise, it will not make any sense for trader to make the trade in first place.

Question : 2

Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types).

Answer :

There are different types of arbitrage trading. But, all of them has same core arbitrage mechanism. Some of the different types of Arbitrage trading are :

1. Exchange Arbitrage

This is a kind of arbitrage trading which occurs due to the different exchange rates of same asset in different exchanges. The main cause behind the difference in the rates of same asset in different exchanges is liquidity, volume traded,..etc.

For example -

At the time of writing this homework, ETHUSDT is trading at $3299 on binance exchange. When I check price of ETHUSDT at the same time on poloniex exchange it is trading at $3295. So, comparing two exchange rates for same asset we get $4 arbitrage value. This is the profit for trader for trading the asset in different exchanges.

2. Triangular Arbitrage

This is another kind of arbitrage trading. As the word is self explanatory Tri-Angular arbitrage, this is a three steps process in which we exchange three assets in same exchange. And the profit will be the difference in price of assets when traded with one another.

This arbitrage results when the rates of assets does not exactly match up.

For example -

A trader who trades in triangular arbitrage whould exchange an amount at one rate (ETHUSDT) , convert it again (BTCUSDT) again convert it (BTCETH). In this way tarder gets the profit as the difference between the price of assets. To make profits, trader should make trades quickly and large in size.

3.Covered Interest Arbitrage

This kind of arbitrage happens due to the different interest rates on assets in different countries. This arbitrage trading involves the use of forward contract to limit exposure of exchange rate risk.

4.Merger Arbitrage

This kind of arbitrage trading happens when there is a merger of company. At the time of merge the traders buys the shares of that company at lower price before merger is completed.

These are some of the arbitrage trading strategy. Other arbitrage trading are cryptocurrency arbitrage, statistical arbitrage, cash carry arbitrage,.... many more.

Question : 3

Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration).

Answer :

As we already discussed about triangular arbitrage trading strategy, in this we trade three crypto assets in three steps within the exchange. The profit will ve the difference between the prices of assets when traded with one another.

In this arbitrage we trade asset 1 for asset 2, then trade asset 2 for asset 3 , and then trade asset 3 for asset 1. In this way, it is a three steps process of three assets within the exchange.

.png)

Here as you can see the block diagram of triangular arbitrage trading strategy. I will explain it with help of an example :

Suppose,

I first exchange BTC for BNB at the rate of 0.0088 and I get 112.6 BNB for 1 BTC. In next step I exchange BNBSOL I get 285.6 SOL for 112.6 BNB at the rate of 0.3941.

Now in last step we exchange BTCSOL at rate of 0.0036 I get 1.03 BTC for 285.6 SOL. So, in this trade we get profit of 0.03BTC.

Question : 4

Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

Answer :

For this question we use Exchange Arbitrage. In which we buy an asset in one exchange at lower price and sell it in another exchange at higher price.

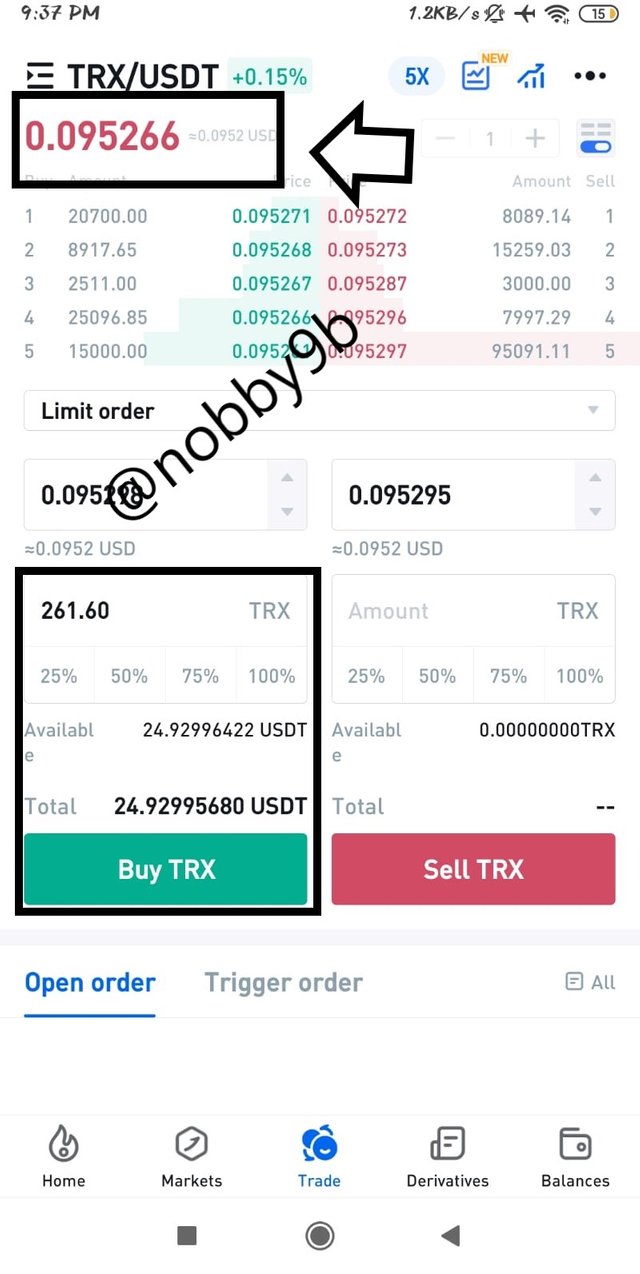

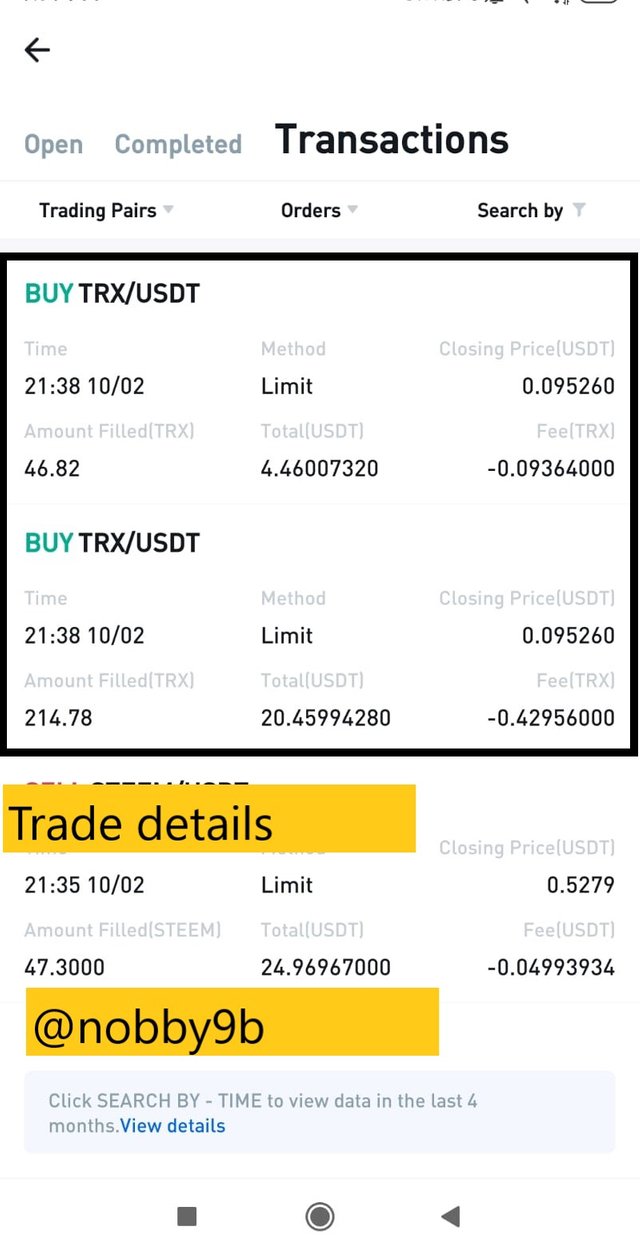

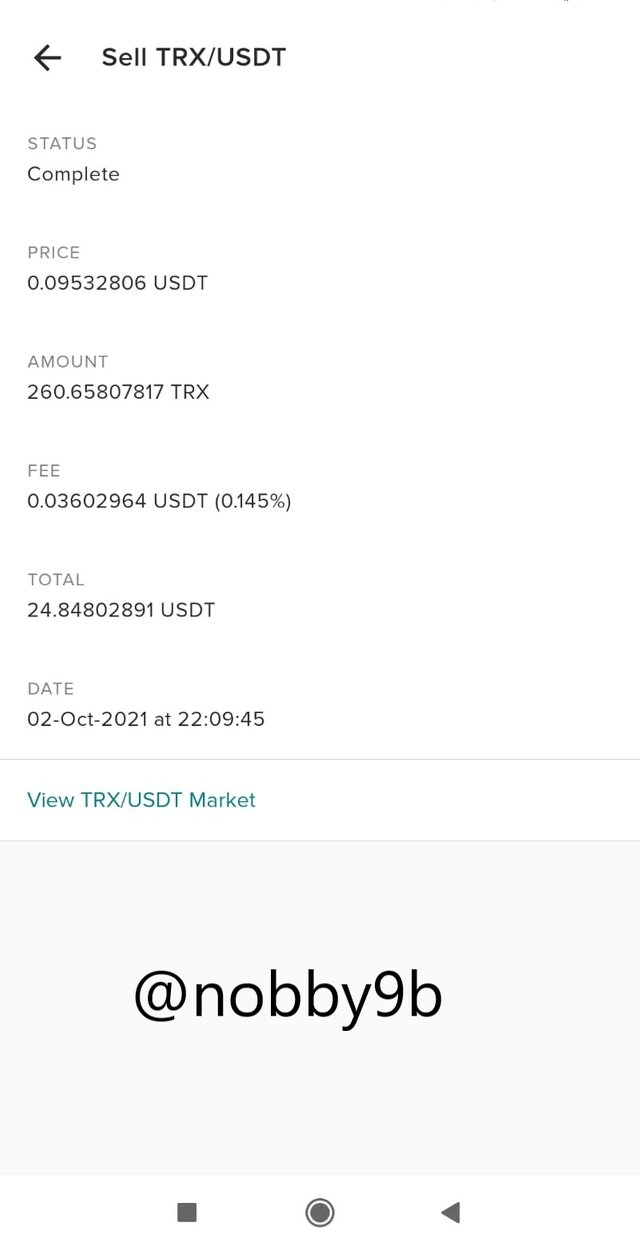

Here, I choose TRXUSDT pair for an example. I first buy TRX from USDT in my huobi pro at price of 0.095266 I get 261.6 TRX for approx 24.92 USDT.

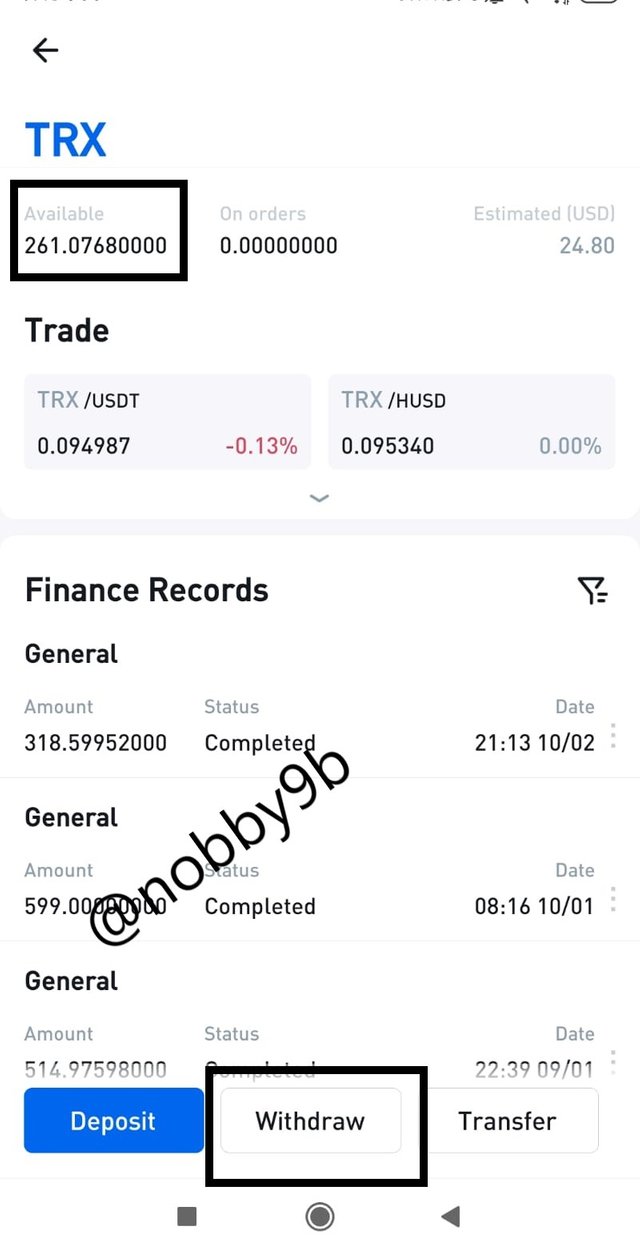

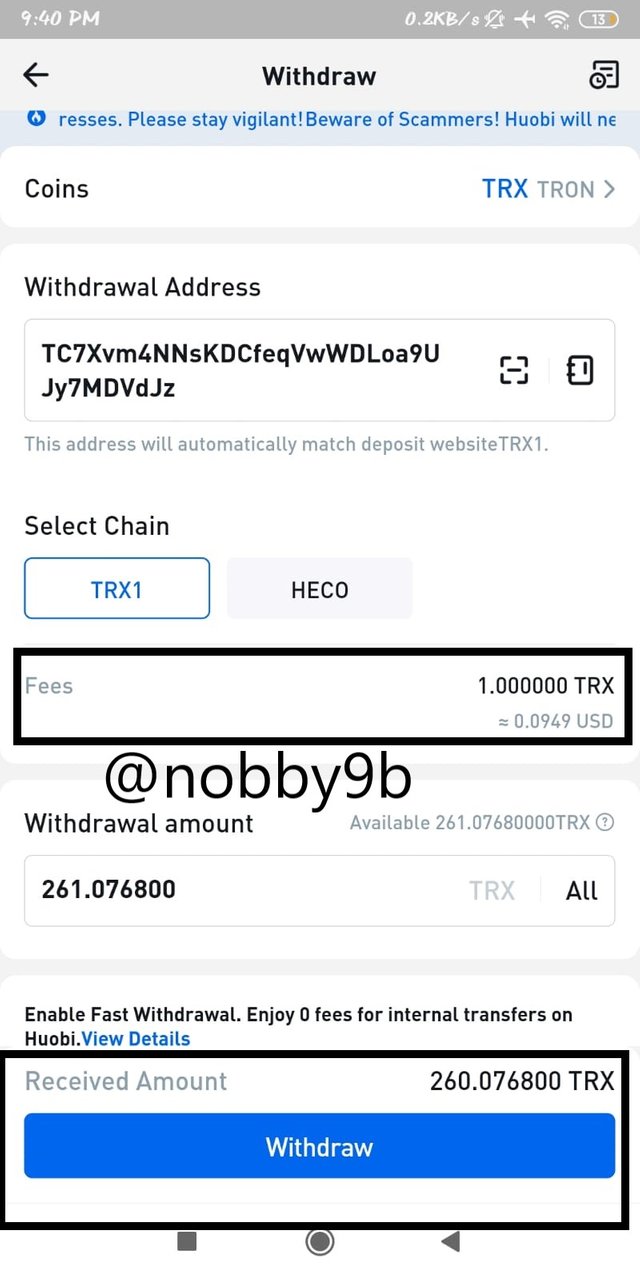

Now we withdraw these TRX into another exchange.

Now we sell these TRX in my poloniex account.

After that I withdrawn these TRX into my poloniex account and there is a withdraw charge of 1TRX. Now I get 260.6 TRX in my poloniex account and I sell these at rate of 0.9532 and get 24.84.

In this trade I made a little loss this is due to the fees charge for transaction and withdrawal fees.

Question : 5

Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

Answer :

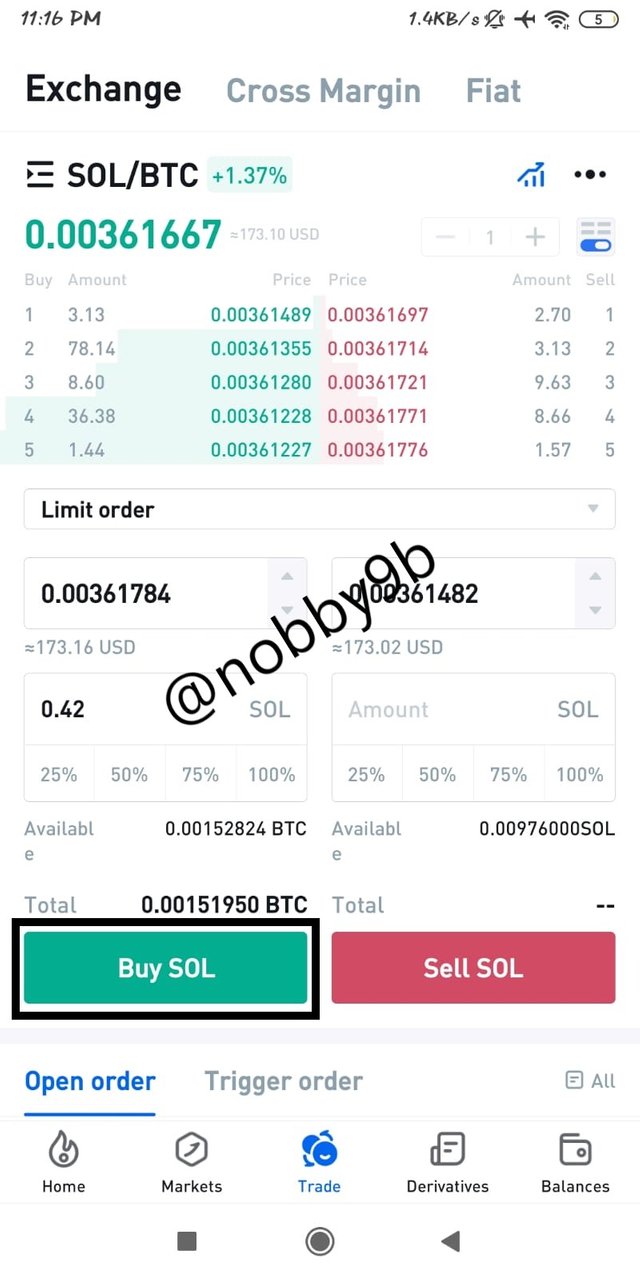

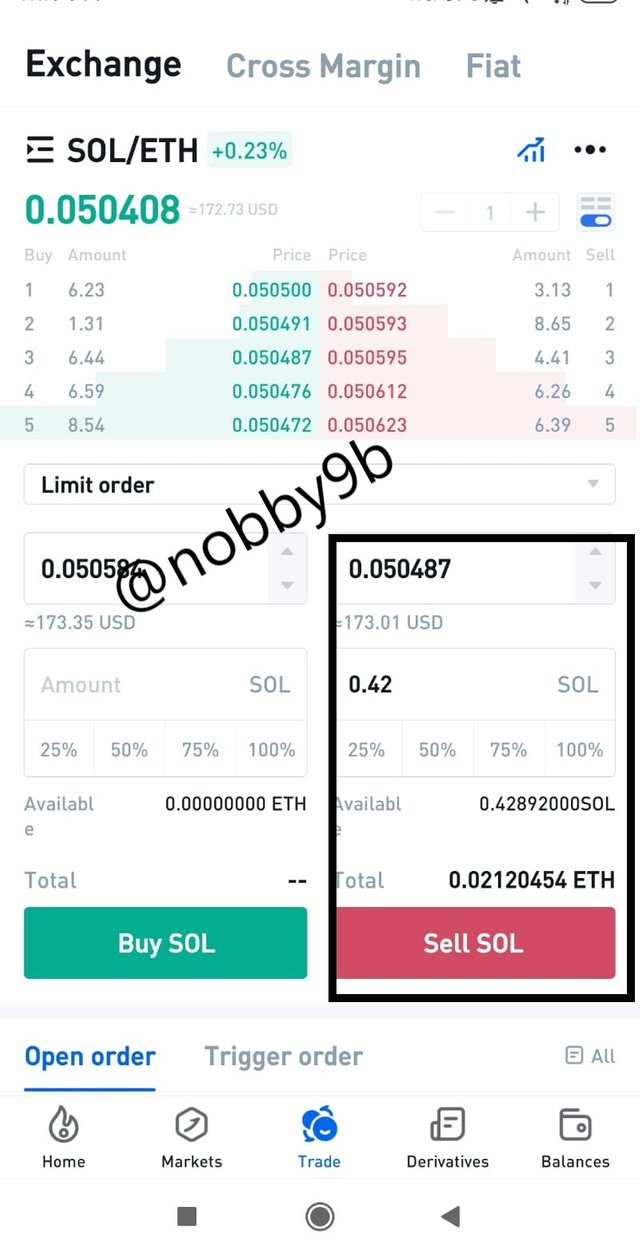

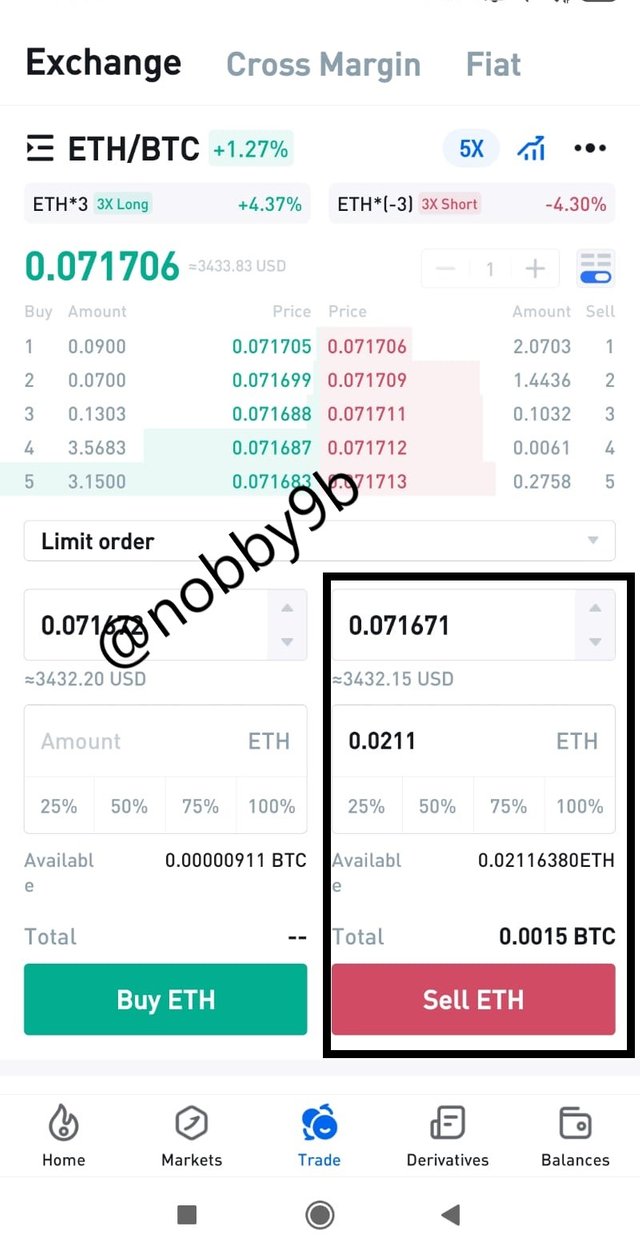

For this question I choose three assets BTC, ETH, SOL. In triangular arbitrage we need to exchange three assets in three trades within exchange.

For triangular arbitrage follow these steps :

1.So, first we will buy SOL from BTC in my Huobi pro account. Here exchange rate is 0.003613. I buy SOL for (approx $75)

2.Now we will exchange these SOL into ETH at exchange rate of 0.504

Now to complete the three steps process we need to buy BTC from ETH.

In this trade we learn about how to use triangular arbitrage trading using three assets within the exchange.

Question : 6

Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words

Answer :

| Advantages | Disadvantages |

|---|---|

| It will provide low-risk trades as trades are made simultaneously so price change is not more. | Due to higher volatility in crypto market there is always possibility of price slippage. |

| As there is higher liquidity and volatility in cryto markets this strategy helps you to find multiple trades as it depends on price difference between asset. | Due to lower liquidity in some asset it might difficult to make trades quickly. |

| This strategy is easy to use and traders can make trades using this strategy easily. | Profit are small with this strategy. |

Conclusion

In this post we learn about arbitrages and their different types. Arbitrage mainly works on the price difference of the same asset in different exchanges. Arbitrage trading style is a low risk and low profit strategy which requires higher speed for trading to avoid price slippage. Different types of arbitrage provide different trading strategy.

You have been upvoted by @sapwood, a Country Representative from INDIA. We are voting with the Steemit Community Curator @steemcurator07 account to support the newcomers coming into Steemit.

Engagement is essential to foster a sense of community. Therefore we would request our members to visit each other's post and make insightful comments.

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit