Hello,

This is a homework post for professor @pelon53.

.png)

Question : 1

Answer :

It is a public decentralized blockchain platform that is designed to manage decentralized applications or Dapps. The Solana foundation in San Francisco created it. It is an open-source blockchain network with consensus using POS(Proof of Stake) and POH(Proof of history). The platform was initially released in April 2019.

Solana has an internal cryptocurrency/token called SOL token.

According to the white paper of Solana, Blockchain architecture is based on POH(Proof of History), and it is a way to verify the order and passage of time between events. In Solana, POH is used along with another consensus algorithm like POW, POS, or TowerBFT, increasing security and scalability.

Solana is the fastest blockchain network with a processing speed of 50,000 transactions per second. It has 200 distributed nodes over the network, the fastest transaction processing speed known for a blockchain network. Also, the developers are still working on it, and it's still under development. They claim that after some events in growth, the Blockchain will be able to reach 700,000TPS(Transactions per second) which is far greater than any other network like Cardano or Ethereum, which can only process up to 15 to 45 Transactions per second.

It is a blockchain protocol that cryptographically creates a reliable ordering of transactions or events recorded to the ledger. By creating transaction events, it solves the problem of time agreements. POH acts as a proof for verifying the order and passage of time between transaction events, and it encodes the trustless passage of time into the ledger.

On the current blockchain version, POH works with another algorithm protocol called Tower BFT protocol, a Successor version of PBFT. Using TowerBFT alongside POH give Solana an upper hand as the TowerBFT leverages POH as a clock and suppress message overhead and latency. We can also say that the TowerBFT is one of the key factors that boost the POH of the Solana blockchain network. There are also some other key features that elevate the working of the Solana blockchain, such as Turbine, which is a protocol used in block propagation, Gulfstream, cloud break, Archives and many more. Each of them performs separate features that strengthen the Solana blockchain network and make it efficient.

PoH is a Delay function that can be verified and used as a hash function which is Sequential in nature. As PoH uses a cryptographically secure function with which the output cannot be predicted from the input. The function uses a single core to run and takes previous output as the input for the next processing. In this manner, it records the current output and the time of system calls.

Another system can verify this output by checking each segment on separate cores parallelly. And then, the data can be timestamped with the sequence. This recording of data guarantees that data creation took place sometime before the generation of the next hash in the sequence.

Well, thats all technical explanations for the working behind PoH. In simple terms, we can say that the PoH creates or generates the timestamps for operations in the Blockchain, which does not depend on any local system clock. Other networks do not contain any historical record or data for previous events, but PoH does it by creating these records on its own.

Question : 2

Answer :

It is a Solana Blockchain-based protocol and works under serum's chain infrastructure. It is created for assets that can take collective actions. On this platform, users can earn yield and get their portfolios developed. It is a decentralized financial(Defi) ecosystem. The native token used in the oxygen environment is called as OXY token.

It offers services like offerings, lenders, leverage, loans and many other tools that help in finances. As it works on Solana Blockchain, it is fast and takes less time in operations, making it highly scalable and efficient.

Users can develop their portfolios by lending out assets and borrowing other ones at the same time. We can simply say that with this platform, there can be multiple uses for the same collateral.

Oxygen enables its users to utilize their portfolios as collateral to borrow other assets, which reduces lower margin liquidation for a user's portfolio.

A preset market model needs to be adjusted manually, which takes time, effort and money. Oxygen, an order-book-based protocol, solves the issue and guarantees the best and fair prices for lending and borrowing for the user every time he uses the services.

- OXY is the native token that works under the oxygen protocol environment. The users who have these tokens can vote in governance systems that are running under oxygen protocol.

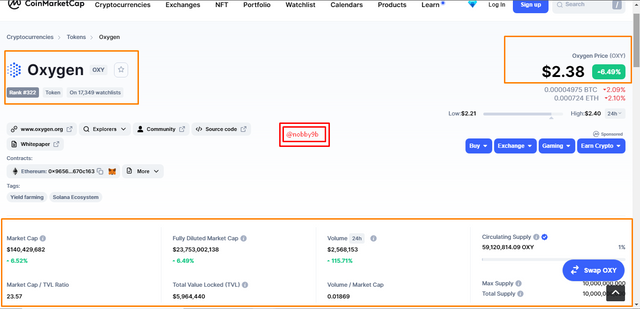

At the time of creating this post, the price details of the OXY token are as follows.

Token Price - $2.38

Market Cap - $140,429,682

Fully Diluted Market Cap - $23,753,002,138

Volume - $2,568,153

Volume / Market Cap - 0.01869

Circulating Supply - 59,120,814.09 OXY

Max Supply - 10,000,000,000

Total Supply - 10,000,000,000

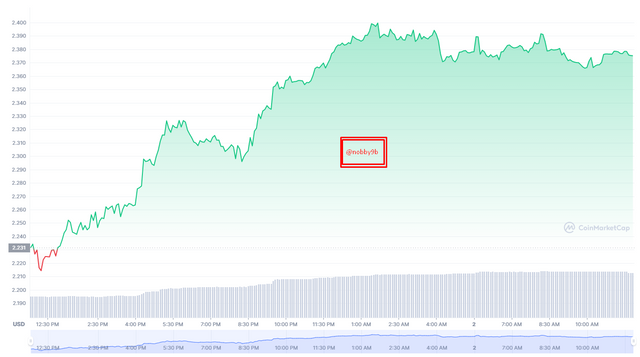

- you can see the growth and the Volume of the OXY token from the price chart above; with the power of the Solana blockchain, it has gained tremendous gains in Volume and pricing. If I only talk about the last 24 hours, the Volume of OXY tokens increased around 114.86%, which is quite a big number.

The serum is a decentralized exchange protocol that can work with Cefi and Defi(i.e., centralized finance and decentralized finance). It has an on-chain order book design that helps with both types of exchanges. It is based on the Solana Blockchain network. As a part of Solana, it operates high-speed transactions and charges low transaction fees at $0.00001 per transaction.

It is an open-source protocol that allows users to build their own Dexs and Defi games. The native token or utility and governance token which is used In the

The platform environment is called the serum token(SRM). Users can compose Liquidity and power market-based features using serum's on-chain central limit order book.

As a part of Solana Blockchain, the asset order book on serum supports Solana based trading products and features like borrow, lending, futures and many other financial and non-financial services.

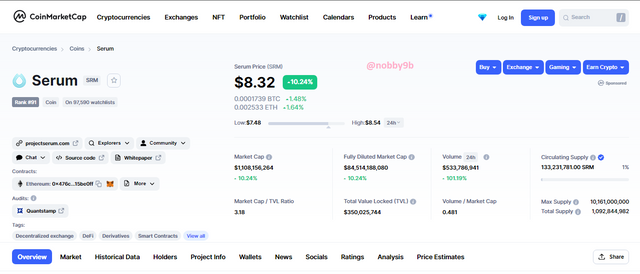

SRM token is the native token on the Serum Ecosystem. At the time of making this post, the current market prices and volumes for the token are as follows.

Token Price - $8.32

Market Cap - $1,108,156,270

Total Value Locked (TVL) - $350,025,744

Volume 24h - $533,786,937

Volume / Market Cap - 0.481

Circulating Supply - 133,231,781.00 SRM

Max Supply - 10,161,000,000

Total Supply - 1,092,844,982

The vision of serum is to bring drive the global mass adoption of Defi. And wants to reach 1 billion users with a $10T on-chain value.

Question : 3

Answer :

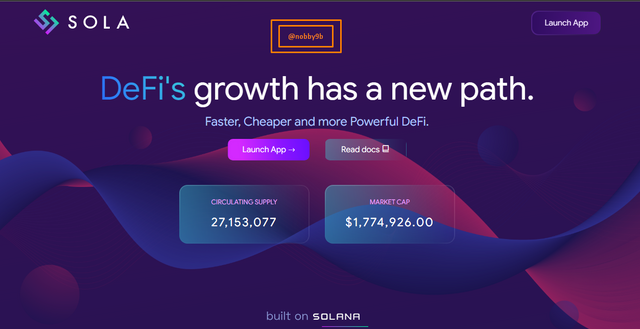

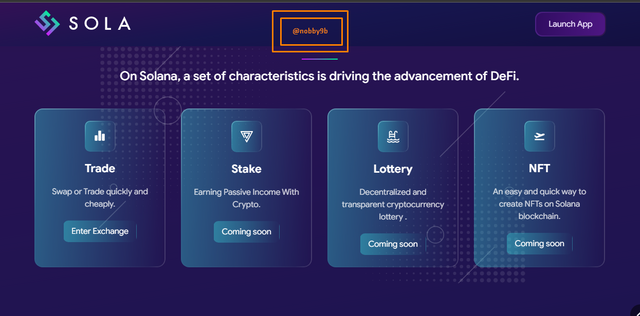

The SOLA token is an open-source native utility token for the Solana Blockchain. It is a decentralized project that's built on the Solana Blockchain. It is able to distribute Liquidity for both CEX and DEX exchanges. The token exchange is currently available with only a USDT pair or SOLA/USDT pair. As it's still in beta mode, The token is also not listed on many websites that show token Infos and market performances.

Users can view all order flows and Liquidity on serum with the sola platform. The token also offers wide Liquidity and the best price swaps within a liquidity pool for the user. It also offers IDOs, simple funding and bootstrap liquidity initiatives.

But you can find the token on the Coingecko platform.

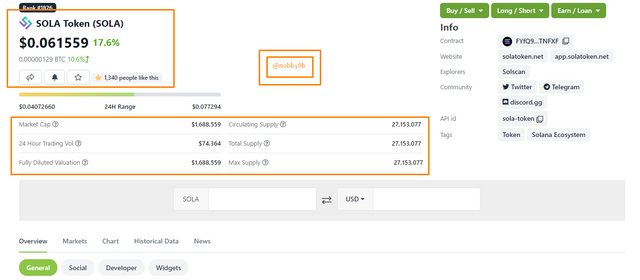

Token Price - $0.061559

Market Cap $1,688,559

24 Hour Trading Vol $74,364

Fully Diluted Valuation $1,688,559

Circulating Supply 27,153,077

Total Supply 27,153,077

Max Supply 27,153,077

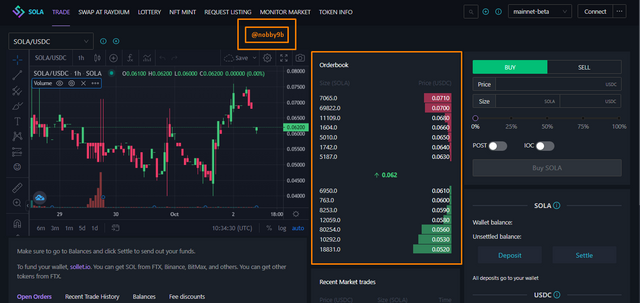

The image above shows the 24-hour price chart for the SOLA token.

you can also go to the SOLA website for more Info.

The launch app feature will show you the console where you can view SOLA price charts, order books, and buy/sell SOLA.

The Initial Supply Composition for the SOLA are as follows:-

Suppliers Liquidity: 6,153,077

Community Development: 1,000,000

Investors: 10,000,000

Marketing: 5,000,000

Token burning: 4,000,000

- The platforms aim to burn the tokens until the total supply will be stipulated at 21,000,000.

- the Token has a global 24-hour trading volume of $74,835. SOLA Token can be traded across 1 market and is most actively traded in Raydium.

- Last 7-day trades for the SOLA token Are as follows:

- The SOLA website has many features and services that will be launched soon. In the current version, the trading section is Operable with which exchanges can be performed.

Question : 4

Answer :

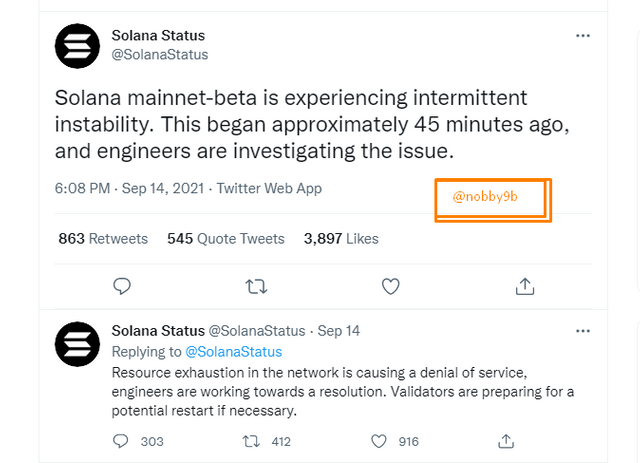

On September 14 Tuesday, Solana blockchain experienced a disruption in some of the services and crashed. The outage lasted for almost about 17 hours and kept almost $11 billion investor's money locked for that time.

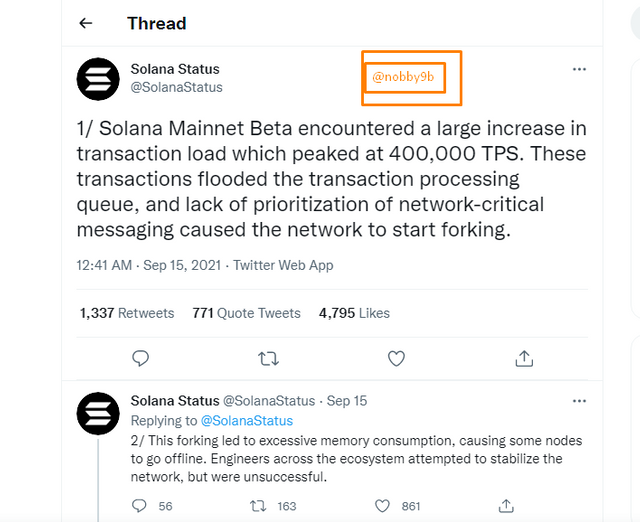

On the same day, a tweet was reported on Solana's official account confirming the instability of the network causing denial-of-services. It would have been arisen due to resource exhaustion owing to the heavy number of transactions. The official Solana account mentioned 400,000 transactions per second when the maximum number supported by the network is 60,000 per second.

It was reported that resource exhaustion had been the main issue as the transaction load reached 400,000 TPS (Transaction per second). Later on, a report was also published by Solana with the title '9-14 Network Outage Initial Overview' that explains this major collapse.

It stated that the prime issue for this big stall was a denial-of-service attack. The Grape Protocol launched an IDO on Radiyum, and the network was then flooded by the transactions generated by the bots at around midnight UTC. Therefore, a heavy memory overflow was formed that ultimately caused a lot of validators to crash. As the validators are responsible for validating the nodes and with the heavy increase in the transactions, they were overloaded, blocking the confirmation of all the new blocks. Therefore, it forced the network to slow down and, at last, stall.

To solve the ongoing outage, the validators joined at Discord server and implemented the beta version of the main net.

The next day, i.e. September 15, the official Solana account tweeted about the successful rebooting of the platform by the beta version of the main net updated to 1.6.25. Hence, the platform would be fully functional again in a few hours.

Solana Blockchain is one of the most newborns in the blockchain currently. It has gained over 250% last August, making it a top-performing cryptocurrency, Leaving Etherium and dogecoin behind. It has surged to 200 in September 2021 with 4816% overhead the last year.

After the network restart, users were flustered through the speculations about Solana Blockchain's centralization level. Many tweets could be seen regarding Solana's team handling the situation like a Centralized Corporation rather than a sturdy decentralized network.

Then, in his tweet, CEO Anatoly Yakovenko expressed that the problem required an immediate resolution due to the increasing number of users. So we aimed to solve the issue before it gets more complicated.

Question : 5

Answer :

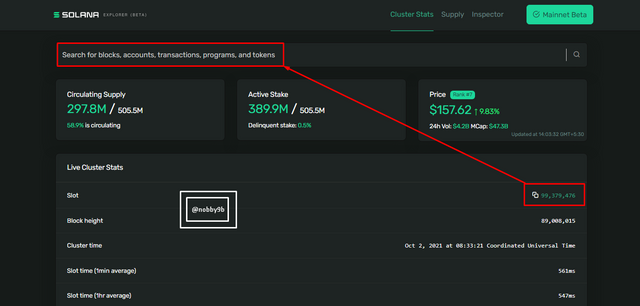

To verify the last block of the Solana blockchain, we need to go to the Solana Block Explorer, then we'll be able to find the last generated block, and the time of per block generation can be calculated.

Follow the Steps Below.

Step 1: Go to the Solana Block Explorer, put the latest generated spot to the search bar, and press the search icon.

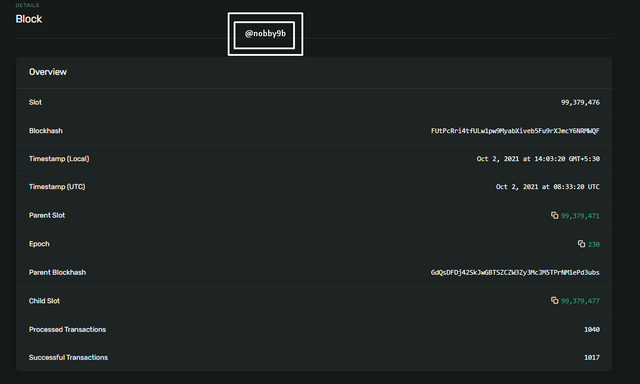

-It will show the block details.

Slot - 99,379,476

Blockhash - FUtPcRri4tfULw1pw9MyabXiveb5Fu9rXJmcY6NRMWQF

Timestamp (Local) - Oct 2, 2021 at 14:03:20 GMT+5:30

Timestamp (UTC) - Oct 2, 2021 at 08:33:20 UTC

Parent Slot - 99,379,471

Epoch - 230

Parent Blockhash - GdQsDFDj42SkJwGBTSZCZW3Zy3McJM5TPrNM1ePd3ubs

Child Slot - 99,379,477

Processed Transactions - 1040

Successful Transactions - 1017

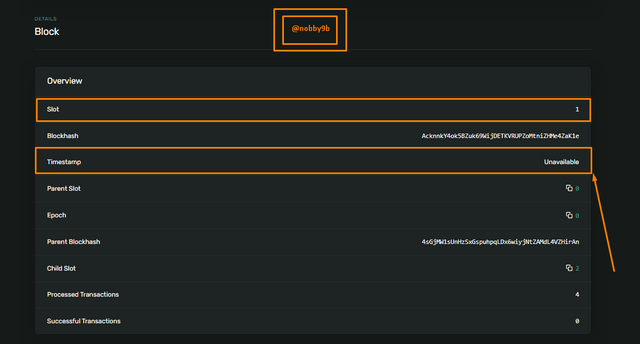

Step 2: Now, to calculate the no. of blocks generated from the start, let's go to the first block ever generated. To see the first block put the block no. of the first generated block (i.e. 1) in the search bar and press the search icon.

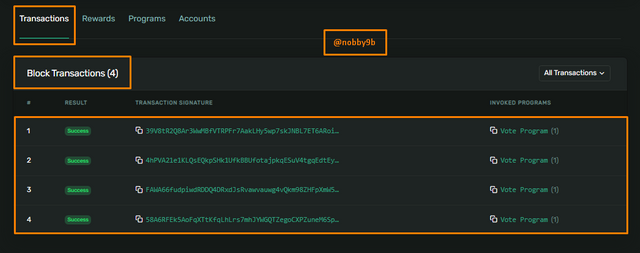

- As you can see, the first block doesn't have any timestamp, so now what? Just scroll down a little and find the transactions associated with the first block.

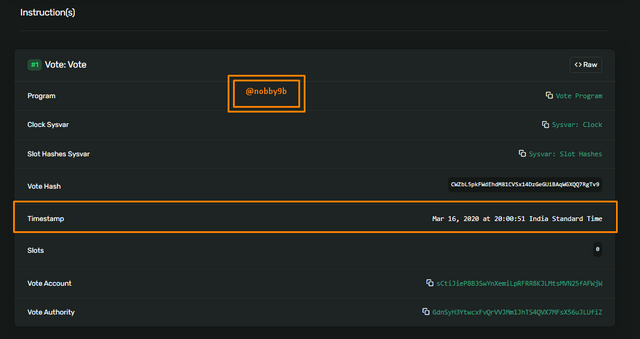

- Click on the First Transaction Block in the list, and It'll Show you Its Timestamp.

We're going to use this Timestamp as of the first block according to Indian Standard time.

And the time of the creation of the first block will be Mar 16, 2020, at 20:00:51 India Standard Time. Now we'll calculate the elapsed time from this date to the last block generation date.

** Timestamp of the First block - Mar 16, 2020, at 20:00:51**

Timestamp of the Last Block - Oct 2, 2021, at 08:33:20

Total days elapsed - 565days

Now, one day has 86,400 seconds, so 565 days will have 813600.0 Minutes or 48816000 Seconds.(Approximately)

I hour = 3600 seconds

24 hours = 3600 x 42 = 86,400seconds.

now ,565 days = 565 x 86,400seconds = 48,816,000 Seconds.

now divide these no. of seconds to the no. of the last block :

48,816,000 Seconds/99,379,476 = 0.491208064 seconds.

- This tells us that the time of the creation of each new block is 0.49 seconds. (approx)

Conclusion

This lecture was really helpful as I've learned many facts and gained a lot of knowledge about Solana Blockchain. I've learned its working mechanism, which is POH integrated with TowerBFT algorithms. This is a high-speed Blockchain that can process up to 50000 transactions per second which is far greater than any other Competitors. The Blockchain has implemented some of the best technology to create cryptographic timestamps and transaction history for the transactions. There was once a failure in the system, but it was sorted out by the developers instantly. The Blockchain is still under development, and I believe that it will bring revolutionary changes to the crypto world after the development.