Hi professor @kouba01 !!

I have learned many new things from your lecture.This is my assignment, please take a look at it.

What is Cryptocurrency CFDs?

p

p

CFD (Contract for difference) refers to an agreement between the trader and the brokerage firm on any basic asset that can be either a stock index or a cryptocurrency. CFD enables us to trade even if we don’t have any asset in our wallet. We have to expect the value of an asset that it will go up or down. If it goes in the direction we have expected to go in, then we are paid for in multiples of the number of units, we have bought or sold. But if it goes in opposite direction; like we have expected to go up but it goes down, then we will lose the units according to how much we have moved in.

CFD allows us to trade in both ways, we can purchase an asset also and we can sell an asset also. Purchasing here refers to ‘long position’ that means we have to make a Price forecast of a cryptocurrency. We have to predict the future prices of crypto like what will be price in a certain time. Profits in purchasing depend on our levels of prediction. If we predict more precisely, chances of big profits are abundant. In selling scenario that is referred as short position, we can sell an asset we are expecting that its price will decrease in future so we can may sell it. In CFD, we trade in both directions like we can take profits from purchasing also and we can take profits from selling also.

.jpeg)

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

I believe it is one of the important questions that we should know while entering a Cryptocurrency CFD trade because of the volatility of the market. Price fluctuations are so sudden that one has to be skillful in both buying and selling assets. So knowing the viability of CFDs helps you to trade in a safe zone.

p

To know whether cryptocurrency CFD are suitable for our trade, first we must need to know how much we can offer. It is because calculated risks work in crypto trade. It is a directly proportional relation to what we are investing. If we have predicted value going up, and it goes up, we shall be benefited unambiguously and if it goes down the predicted value, then loss will happen in same way as profit could happen. One must also understand the process of CFD that what actually it is, and simultaneously investigate one’s trade. It is recommended to trade for smaller values if we want to establish a cryptocurrency CFD. Margin trading is also an important aspect as leverage. It is a sort of magnifying glass that can increase the size of your returns and at same time increase the size of your loss in case you have predicted an opposite value. Furthermore, purchasing any cryptocurrency is not a piece of cake for all traders because they are expensive and it is recommended to overview crypto markets and understand the process of trade including every minor details and all pros and cons. If our capital is small, we can go for CFD because our risk is calculated and we can take benefit from margin trading at the same time. Trusted brokers are suitable for CFD. Because we have to keep in mind one thing, it is a tit for tat trade or I can say a Karma trade and in this trade we reap what we sow.

.jpeg)

Are CFDs risky financial products?

In crypto trade, risk is an innate part of game. This risk can take you to the moon and the same risk can take you back from the moon. Here leverage and margin trading make it risky and complicated because they CFD are based on these and I believe this adds spice to the game. But if one knows all the pros and cons of CFD process and also understands all major minor details, it not a profound case that he may not get benefit. Because mostly chances of profits depend on your market exposure. The more you know here, the more you grow here. Tools such as margin trading can maximize your returns and minimize your returns in a directly proportional manner. If one takes calculated risks, and knows what he has to offer in safe zone, he surely can be benefitted from CFD.

Do all brokers offer cryptocurrency CFDs?

p

p

All brokers donot offer cryptocurrency CFDs. One reason is that it is a developing stream and another it is not a common man play because buying a cryptocurrency is not cheap. I am mentioning below some brokers that offer cryptocurrency CFDs:

- eTORO

- TIOmarkets

- PLUS500

- BitMEX

- PrimeXBT

.jpeg)

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account)

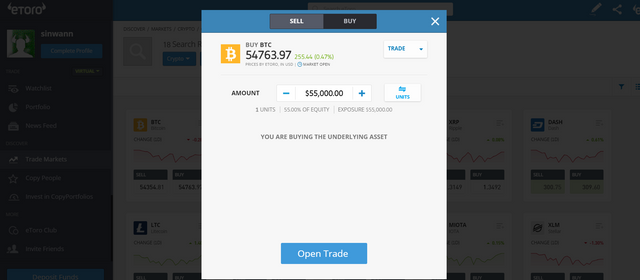

I will show by a pictorial demonstration that how can we trade with cryptocurrency CFDs. I have made my account on eTORO broker firm because it is one of leading cryptocurrency broker platform and offer cryptocurrencies including top rated Bitcoin, Ethereum and also offers investing in stocks.

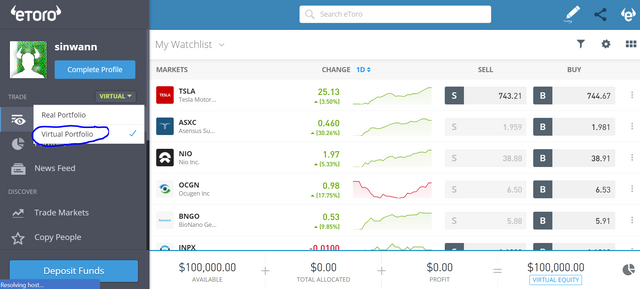

As I login to my account, I see this window.

There are two mode: Real Portfolio & Virtual Portfolio. I am using Virtual Portfolio because here I can practice my trading skills without bearing any loss.

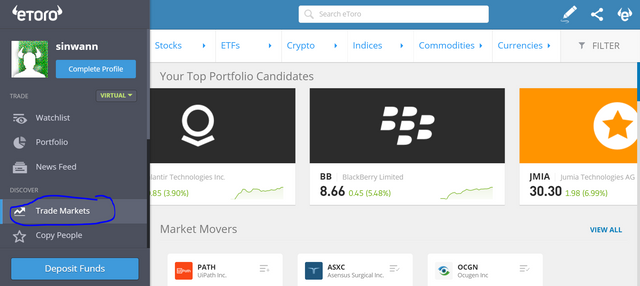

Here you can see trade markets on left side.

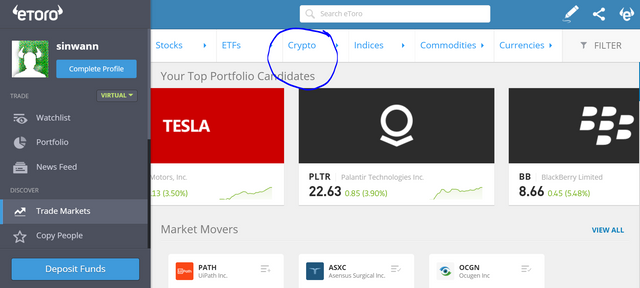

Now I will go to Crypto, you can see below it below the search bar

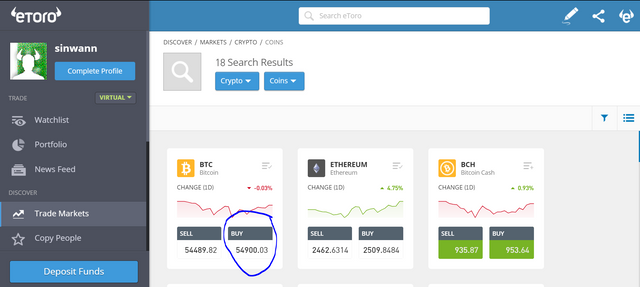

Here you can see cryptocurrencies that are being offered. I choose Bitcoin and I will buy now.

You will see this window. Set your amount how much you want to buy according to the value of crypto.

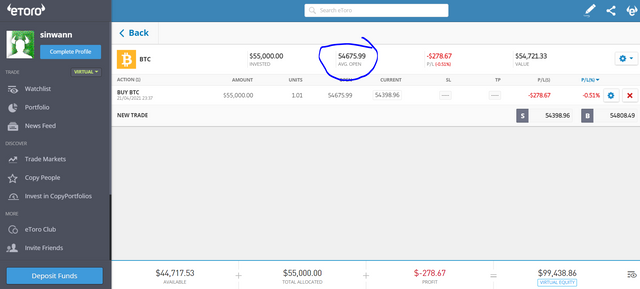

Now trade is open and if Bitcoin exceeds the price of $54,675.99. I will take profit.

.jpeg)

Conclusion:

Cryptocurrency CFDs are suitable for small value trades. Risk levels are proportional to trade value. If one is skilled at buying and selling tactics which are is Future Price forecast and analysis, then there are bright chances to get big profits. I believe one should be strong at nerves to take risks but it is advised to take calculated ones. Because in CFDs, you reap what you sow.

.jpeg)

So dear professor @kouba01 ! that was from me.

Hope you like it.

Cc:-

@steemcurator01

@steemcurator02

Hello @noraiz,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 7/10 rating, according to the following scale:

My review :

Good article, in which you got all the answers right, but there is a problem with the connection between the ideas. You could also have used another CFD broker platform so that we can share a lot of experiences and benefit everyone.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks sir for your feedback.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sir @steemcurator01 @steemcurator02 please take a look

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit