Again, this is a very interesting lecture on identifying the pattern. In the previous lecture, we have discussed the topic of trading with rectangle patterns. In this post, the professor explains the wedge pattern. This is a basic lecture, but I have cleared all my concepts about wedge patterns. I try to answer all the questions. I hope, it will help you to understand the Wedge pattern.

Explain Wedge Pattern in your own word.

We have discussed in the previous lecture about rectangle triangle patterns. In this same way, in this post, we will discuss the wedge pattern. Wedge patterns are made by the price of the market. Every pattern has importance in trading. Traders use these patterns for making a profit.

A wedge pattern is a pattern in which price makes higher highs and higher lows. Two trendlines are drawn in the wedge pattern. One Trendline is drawn on the upper side of the price that covers higher highs and the second trendline is drawn under the price that covers the higher lows of price.

If the price of an asset is moving up, then the upper trendline is indicating the resistance level and the bottom trendline is indicating the support level of price. The price follows the path that is defined by the trendline. Both trendlines are drawn in the same direction with spread starting points and narrow ending points.

Wedge patterns are used by traders for making a profit and saving the investment by making the right decision at right time at the formation of the wedge pattern. This is because the wedge pattern is indicating that the reversal is going to start.

It does not matter that the wedge is made on the uptrend, downtrend, and middle of the trend. Where this pattern is made it indicates the trend reversal. Trend reversal is dependent upon the nature of the wedge pattern. We will discuss the types of wedge patterns in the following question.

Explain both types of Wedges and How to identify them in detail. (Screenshots required)

There are two types of wedge patterns. One is the Rising Wedge pattern and the second is the falling wedge pattern. We will discuss both rising wedges and falling wedge patterns and also discuss that, how to identify both wedge patterns.

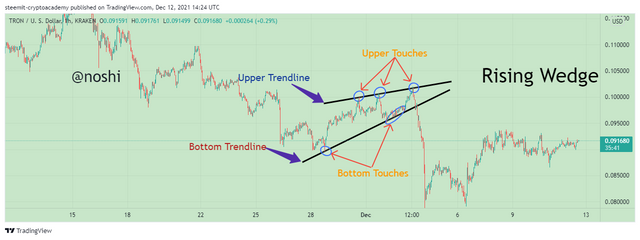

Rising Wedge Pattern

A rising Wedge pattern is made, when the market price is on an uptrend even in the market lies in any phase like uptrend, downtrend, and middle of the trend. But the current market behavior is up and making the higher highs and higher lows.

Two trendlines are drawn, one is on the upside that covers the higher highs and works as a resistance level. The Second trendline is drawn at the bottom side that covers all the higher lows and works as a support level. Both trendline direction is up. Both trendlines are spread from starting and narrow at the end. Price follows the pattern of both up and down trendlines.

At a certain point, the price breaks the bottom trendline, after that the price of the asset starts moving down. When price makes higher highs and higher lows that follow the way of both trendlines and at a certain point the price of the asset breaks the bottom trendline and start moving down then we called it as a Rising Wedge pattern.

How to identify the Rising Wedge pattern?

The identification of wedge patterns is easy when we follow the rules of identification. There are a few guidelines that are used to identify the rising wedge patterns.

- Price of asset making the higher highs and higher lows and on an uptrend.

- Two up-slopping trendlines are drawn, in which the upper trendline covers the higher highs and the bottom trendline covers the higher lows.

- The price of an asset should make more than 5 touches (including highs and lows) with trendline while up trending.

- While making the wedge pattern, the price should be creased gradually.

In the above figure, you can see that all the conditions that are discussed above are satisfied. In this way, the rising wedge pattern is identified.

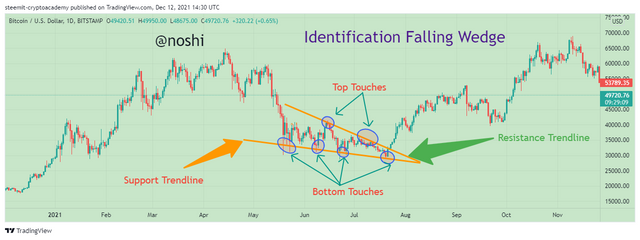

Falling Wedge Pattern

A rising Wedge pattern is made, when the market price is on a downtrend even in the market lies in any phase like uptrend, downtrend, and middle of the trend. But the current market behavior is down and making the lower lows and lower highs.

Two trendlines are drawn, one is on the upside that covers the lower highs and works as a resistance level. The Second trendline is drawn at the bottom side that covers all the lower lows and works as a support level. Both trendline direction is down. Both trendlines are spread from starting and narrow at the end. Price follows the pattern of both up and down trendlines.

At a certain point, the price breaks the upper trendline, after that the price of the asset starts moving up. When price makes lower lows and lower highs that follow the way of both trendlines and at a certain point the price of the asset breaks the upper trendline and starts moving up then we called it is a Falling Wedge pattern.

How to identify the Falling Wedge pattern?

The identification of falling wedge patterns is easy when we follow the rules of identification. There are a few guidelines that are used to identify the falling wedge patterns.

- Price of asset making the lower lows and lower highs and on a downtrend.

- Two down-sloping trendlines are drawn, in which the upper trendline covers the lower highs and the bottom trendline covers the lower lows.

- The price of an asset should make more than 5 touches (including highs and lows) with trendline while up trending.

- While making the wedge pattern, price volume should be increased gradually.

In the above figure, you can see that all the conditions that are discussed above are satisfied. In this way, the falling wedge pattern is identified.

Do the breakout of these Wedge Patterns produce False Signals sometimes? If yes, then explain how to filter out these false signals.

In the crypto market, we can just predict the future price behavior of a particular asset. We cannot able to predict a hundred surely that market is going in a particular direction as we predict. This is due to the unexpected nature of the crypto market.

If we talk about several patterns, that are used in trading. These patterns are also producing false signals. So, should be very careful about the breakout of this pattern. We should not rely only on the price and pattern’s structure. There are several things that we should take into count. We should use an indicator and volume in wedge patterns.

Wedge patterns produce a false signal by doing the wrong breakout. And when the breakout is true then the price behavior does not match with our expectations. Price goes in the wrong direction after the breakout. Now we see wedge pattern produces the wrong signal.

In the above figure, you can see that the rising wedge pattern is formed. We can clearly see that all the requirement of the rising wedge patterns is fulfilled. Price goes up with higher highs and higher lows following both trend lines. At the end of trendlines, the price should break the bottom trend line for making the exact rising wedge. But we can see that the price breaks the upper trendline. That is the wrong signal by a rising wedge.

False Signal by Falling Wedge

The Falling Wedge pattern produces a false signal by doing the wrong breakout. And when the breakout is true then the price behavior does not match with our expectations. Price goes in the wrong direction after the breakout. Now we see wedge pattern produces the wrong signal.

In the above figure, you can see that the falling wedge pattern is formed. We can clearly see that all the requirement of the falling wedge pattern is fulfilled. Price goes down with lower lows and lower highs following both trend lines. At the end of trendlines, the price should break the upper trend line for making the exact falling wedge. But we can see that the price breaks the bottom trendline. That is the wrong signal by a rising wedge.

How to fix These Wrong Signal

We can figure the false signals that are produced by wedge patterns. There are two steps, that we need to take. One is the use of volume indicators. And second is to use another indicator with the conjunction of volume. In this scenario, I will use the Aroon Indicator to figure the false signals.

Aroon Indicator has two oscillating lines (Aroon-Up & Aroon-Down) that produce the buy and sell signals by making the crossovers. When Aroon-Up crosses Aroon-down from button to up then it is a buy signal. When Aroon-Up crosses Aroon-down from top to bottom then it is a sell signal. The default period setting is 14. I change it to 25 for getting better results in the wedge pattern breakout scenario.

We take a single example of a true rising wedge pattern breakout. We apply the Aroon Indicator on the chart. We can see that when price breakout the bottom trendline then at the same time, we can see that the Aroon indicator makes a sell Crossover. In this way, we can verify the signal of breakout.

One more thing that we should notice is volume. When volume increased during making the wedge pattern then it is not the right wedge pattern and breaks out produced the wrong signal.

When the price breakout in either direction, then need to notice the volume and Aroon Indicator lines. When volume increase and Aroon does not make crossover then we need to avoid making an entry into the market.

In the above figure, you can see that in a rising wedge pattern. Price breaks the upper trendline. But we notice the Aroon indicator movement, then there is no crossover is here. So, in this way, we can avoid the wrong signal that is produced by the indicator.

Show full trade setup using this pattern for both types of Wedges. (Entry Point, Take Profit, Stop Loss, Breakout)

In this question, I will place two trades, one is for sale and the second is for buy with proper trading management. By doing this, we have learned that how to trade by using wedge patterns.

Buy Trade

When the falling wedge pattern is formed by price, then at the end of the wedge pattern and after the breakout in an upward direction, the buy order is placed. In this question, I chose to BTC/USD pair for placing the buy trade.

In the above figure, you can see that the falling wedge is formed by price. There are multiple touches of price on both trendlines. When price breaks the upper trendline, then it is a buy signal. I place the Buy order slightly up the breakout.

I place the order after confirmation with the Aroon Indicator. In the figure, you can see that the Aroon produces a buy signal by crossover at the price breakout of the wedge pattern. This is the confirmation of the Buy signal.

I set the stop loss and take profit limits by observing the support and resistances in the chart. You can see that; the support and resistance level is mentioned in the figure. My order details are as follows.

- Entry Price = $ 33650.31

- Stop Loss = $ 29081.10

- Take Profit = $ 45467.22

- Risk / Reward = 1/3

In this way, we can place a buy order in the market by observing the price breakout.

Sell Trade

When the Rising wedge pattern is formed by price, then at the end of the wedge pattern and after the breakout in a downward direction, the sell order is placed. In this question, I chose to TRX /USD pair for placing the Sell trade.

In the above figure, you can see that the rising wedge is formed by price. There are multiple touches of price on both trendlines. When the price breaks the bottom trendline, then it is a Sell signal. I place the sell order slightly down the breakout point.

I place the sell order after confirmation with the Aroon Indicator. In the figure, you can see that the Aroon produces a sell signal by crossover at the price breakout of the wedge pattern. This is the confirmation of the sell signal.

Is set the stop loss and take profit limits by observing the support and resistances in the chart. You can see that; the support and resistance level is mentioned in the figure. My order details are as follows.

- Entry Price = $ 0.097157

- Stop Loss = $ 0.101439

- Take Profit = $ 0.089990

- Risk / Reward = ½

In this way, we can place a sell order in the market by observing the price breakout.

Wedge patterns are very helpful in trading to make an entry and exit to the market for gaining profit. There are two things that, we should notice about the formation of the wedge pattern. First, we need two trend lines and second, we need price action touches to the upper and bottom trendline by making the higher highs and higher lows of price.

The wedge pattern is fully is identified by observing its touches to upper and bottom trends. Collectively upper and bottom touches should be up to four and a minimum of five. When this pattern is made, the price will fall down triggered up according to the nature of the wedge pattern. Rising and falling wedge patterns are the types of wedge patterns.

We can place our entry after the bullish breakout in falling wedge patterns. We can also place sell entry after the bearish breakout of the rising wedge pattern. We should use indicators with these patterns for confirmation. In this way, we can make good and secure entries.