A very good lecture on Stability in Cryptocurrencies. In this lecture I have leaned that how many types of stable coin and how they work. Professor give a brief explanation on this topic. Few questions mention at the end. I try to answer the questions. I hope this post will help you to understand this topic .

Explain why Stability is important in Digital currencies.

In cryptocurrency market we know that the volatility is very high. Price of asset will increase or decrease in moments. Due to this cause we cannot store our asset in the form of cryptocurrencies because the price of asset is not stable. So, in order to store our digital cryptocurrency Stable coin are designed.

Stable coins has similar price of our fiat currency value. In this way we can store our digital asset in the form of stable cryptocurrency form. This why the stability in cryptocurrency is very important because we can store our asset in the form of stable coins.

Due to the expanding the knowledge about cryptocurrency, In present days there are many stable coins that are introduced in the market. There are basically three types of Stable coins

1 . Fiat-Backed Stablecoins: This is a type of stablecoin that is supported by the fiat currencies. Most of coins are backed by USD. Tether and BSUD are example of Fiat- Backed Stablecoin.`

2 . Commodity-Backed Stablecoin: These coins are supported by real physical metal like Gold and Silver. It price is really equal to the price of these commodities.

3 . Crypto -Backed Stablecoin:This is a type of stable coin that stable his price by using other cryptocurrencies. Price of this stable coin is controlled by using the supply of this coin. Digix is an example of Crypto backed Stablecoin.

Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

CBDCs is a system in which our physical currency is converted to digital currency. This concept attracts many countries toward CBDCs system. This digital currency value exactly equal to the value of physical currency. It is only a digital currency not like the cryptocurrency. As physical currency that is issue by the state bank of that country in the same way this digital currency is also issued by state bank. In this way we can say that it is centralized currency that is controlled by central bank.

CBDCs system is an advance system as compared to our physical currency system. In this system we have our own digital wallet to store our digital asset. In future This system makes the world more smart. All the activities regarding payment are performed very quickly. If this system is applied then it predict a more bright future of digital world.

In my country so far their is no concept of digital currency. But I hope in coming days there is a chance of introducing digital currency. Here we will discuss we Advantages and Disadvantages of this digital currency.

Pros and Cons of CBDCs system

| Pros | Cons |

|---|---|

| It provide ease in trading and other currency exchanging procedures | It is controlled by central authority. Your assets can be affected Government rules and regulation policies |

| It is legally issues by the central government. We can use this currency as like physical currency | All our record of transactions are stored on the central authority database. There is no privacy present is this system |

| In CBDCs system we have our own digital wallet. There is no more need of Banks to store our assets. | This Technology is successful only in those place where peoples are familiar with technology. It does not cover other backward area where technology of mobile phone and computer is not available. |

| Speed of payment is very fast as compared to physical payment method | It is decentralized system this is why the security element is take into count. Someone can hack you digital wallet. |

Explain in your own words how Rebase Tokens work. Give an illustration.

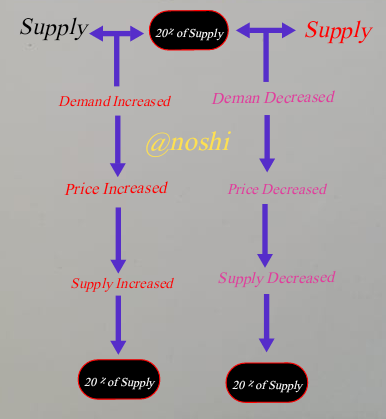

Rebase token are specially designed stable tokens that hold their price by using supply and demand of that coin. Rebase token try to stable the price by playing with demand and supply. When demand increased then price automatically increased. To hold the price at one point they increase the supply of this coin.According to the law, when supply increased then price goes down.

In the same way when demand decreased then price automatically decreased. To bring the price back at initial level they decrease the supply of this Rebase coin. According to the law, when supply decreased then price of that Rebase token is increased.

Here is an illustration in which I display that how it works.

Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the Rebase %. What else can you find on the page?

We have formula of Rebase % calculation. Here is the formula of Rebase.

In order to calculation the Rebase % We need to find the necessary parameters. We need the values of Oracle Rate and Price Target. After getting these two values we are able to calculate the Rebase %.

For getting these parameter we need to visit the Ampleforth site. This one of the Rebase token that stable his price by controlling the supply and demand.

In the figure we can see our required parameters that is Oracle Rate and Price Target. We will put these values in to our formula to calculate the Rebase%.

Oracle= 1.021$

Price Target= 1.061$

In this way we calculate the Rebase %.

Here we can also find the Price of the AMPL. We can see the price chart of this AMPL.

- High = 1.77

- Low = 0.86

- Average= 1.00

- Median = 0.95

We can also find the Supply details about AMPL. At the right bottom you can see the detial about the supply.

- High = 200.26m

- Low = 117.m

- Average= 163.20m

- Median = 168.25m

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

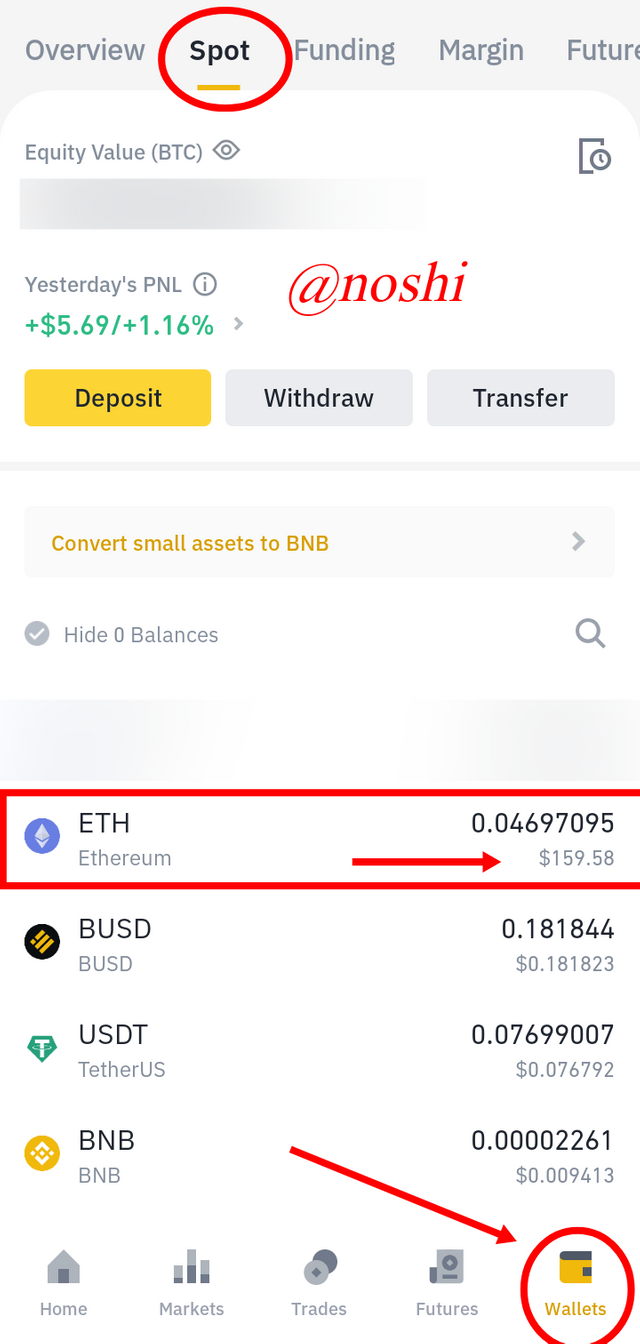

I have Ethereum in my Binance Wallet. I make transaction on Exchange the Ethereum in to USDT worth 15 USDT as requirement.

For making a trade on Binance you need to do the following steps.

Step: 1

- Go to the Wallet tab.

- Select the Spot Wallet.

- Click on the Ethereum.

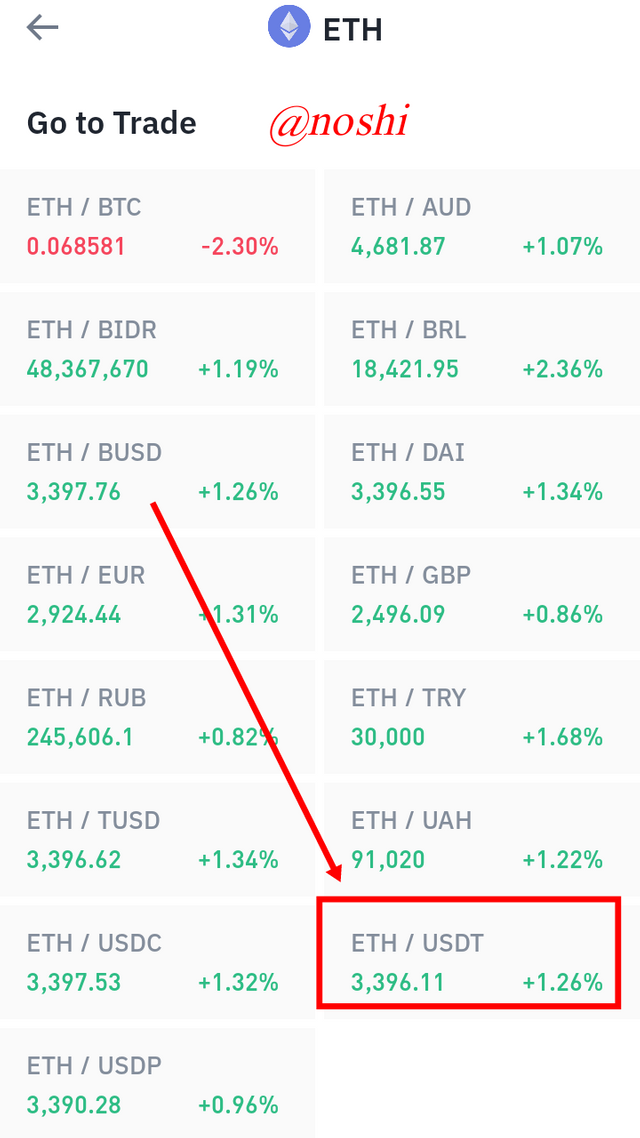

Step: 2

- Next select the ETH/USDT pair.

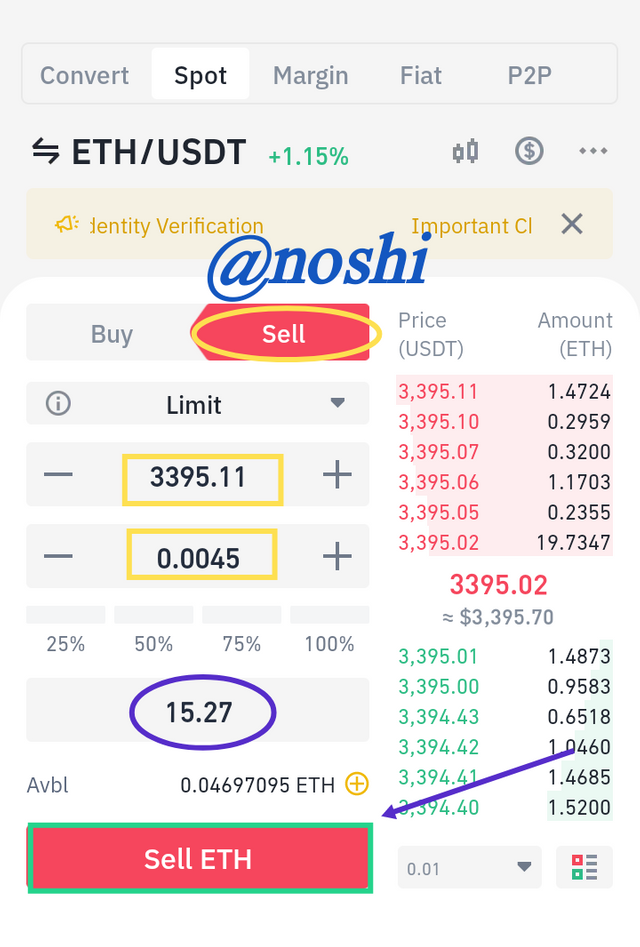

Step: 3

- Here is I place sell Order of 0.045 ETH for 15.27 USDT at the price of 3395.11S at you see in the figure.

Step: 4

- After adding requirements I click on the Sell ETH Button

Here is trade History of my Sell order. In this we do trade on Binance.

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

- I chose my Poloniex wallet wallet for this transaction. First of all I go to my Poloniex wallet and Click on the deposit funds sign. then select the USDT. Here you can see the I chose TRC20 that is Tron Network. Here I copy this deposit address for transferring the funds form my Binance Wallet to this Poloniex wallet.

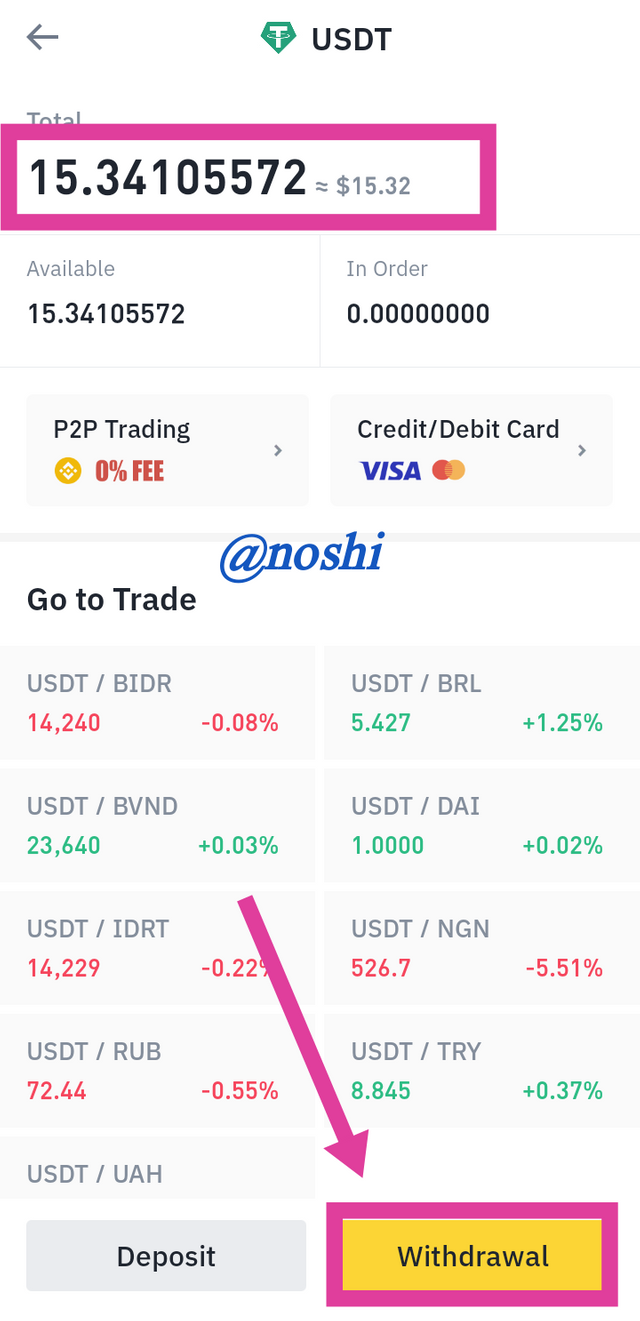

- For transferring the USDT to other wallet you need to click on the USDT on Binance Spot Wallet as you can see in the figure.

- Click on the Withdraw Button

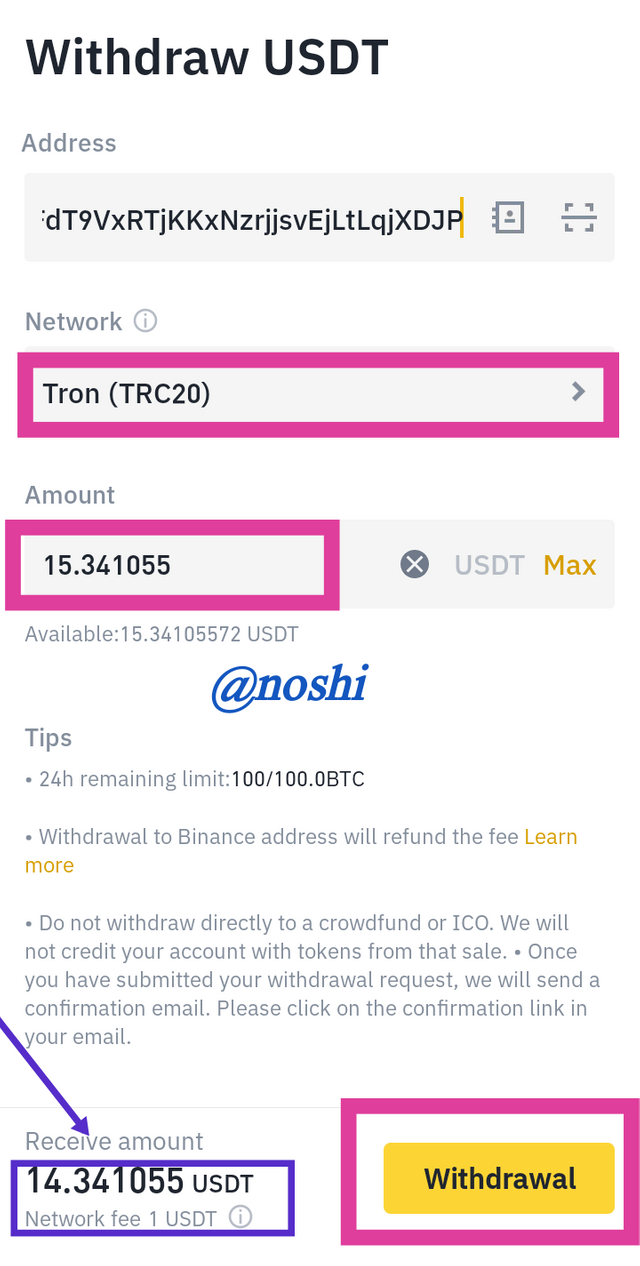

- In this figure we can see the first textbox. In this textbox you need to Paste deposit address of USDT.

- Next I chose Tron Network as requirement of question.

- Next I enter the Amount of Asset that is 15.341055 USDT

- At the end click on Withdraw button.

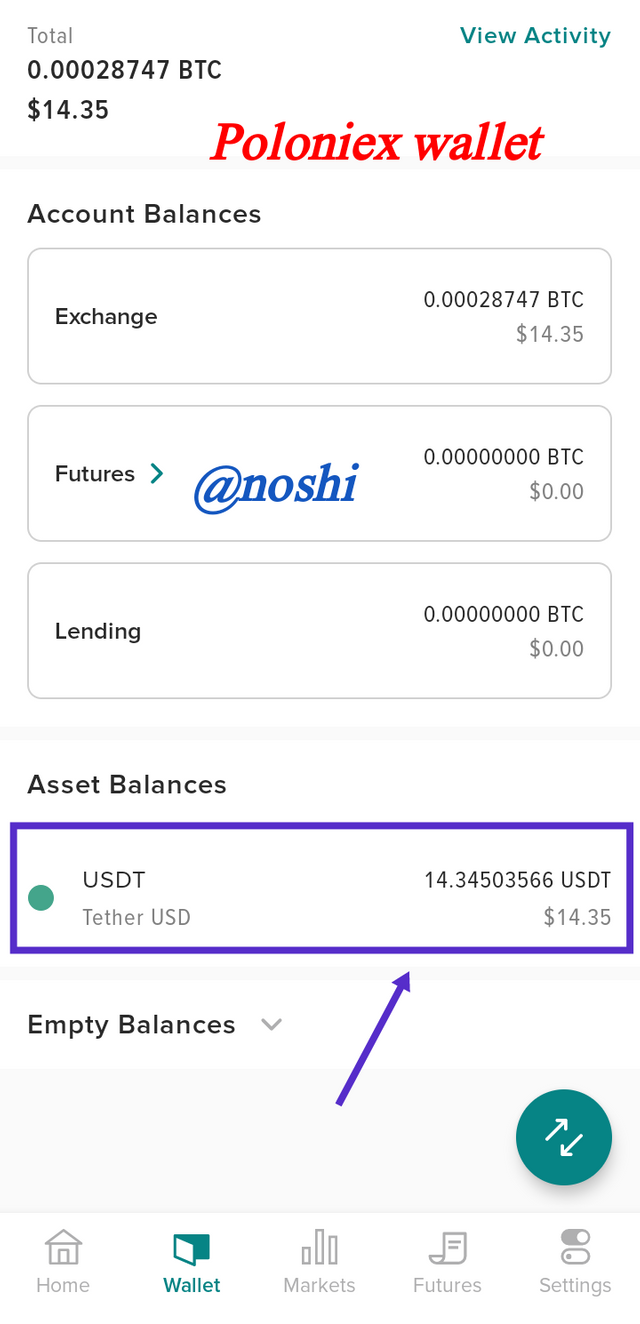

- For confirmation of deposit USDT Here you can see that In Poloniex wallet I have 14.35$.

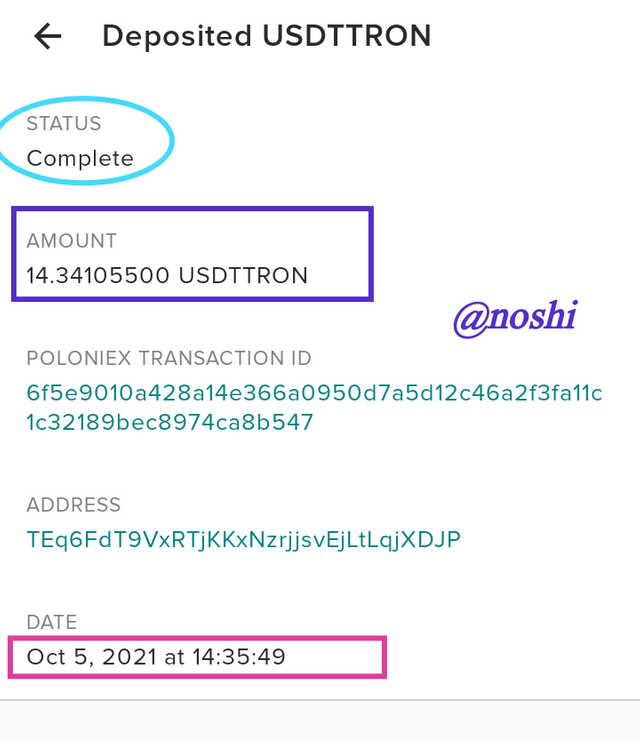

- Here is an evidence of deposit 14.35 USDT.

Screenshot from PoloniexSoure

Pros of Stable coin Transaction

- Transaction is very fast. I received USDT in my Poloniex wallet within a 2 minutes.

- Transaction is secure.

- If we make transaction in fiat currency then more charges are applied. In stable coin transaction less fees is charged.

Stability in tokens are very important in digital cryptocurrencies, because in cryptocurrency market the volatility is very high. we cannot store our asset in the cryptocurrency form due the volatility. This is why the stable coins are made to store our cryptocurrency assets.

CBDC is a good step toward making this world digital. Due to this technology our asset becomes digital. We can do our financial transaction in very easy way. UN-banking and Legally backed are major advantages of this technology. Centralization, Lack of privacy and lack of technology are major disadvantages of this technology.

Rebase coin is a special type of token that control its price by using the supply. Demand increase then price automatically increase. At this stage it increase his supply then price decreased. Overall this is interesting lecture full of information.