Discuss your understanding of the principle of linear regression and its use as a trading indicator and show how it is calculated?

Linear regression is a term that is used in statistics. It is used to find out the value of one variable by using another variable. There are two variables in this concept one is dependent variable and another is independent variable.

If we talk about variables in the context of the crypto chart then the previous data of the chart behave like an independent variable and the outcome that we generate after the calculation is the dependent variable. This dependent variable is the end result that we see on the chart in the form of a line.

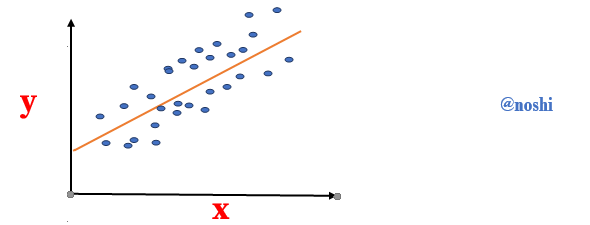

There are a few things that are included in this indicator to find out the line as a result. For instance, we have charted and have one along the x-axis that is horizontally named X. and one line along the y-axis named Y. There are multiple values lying around the line. And this line is drawn at a particular angle on the basis of surrounding values.

In the above figure, you can see that a line is drawn in the chart. There are many dots around the line. This line is drawn on the basis of calculation dots. To achieve this line, we measure the distance of each and every dot from the line. The dots that are lie above the line consider positive and those that lie below the line are considered negative. Next, we take a square of every distance value to make them positive. After that add all the values.

In the chart scenario, all the dots are the value of the previous candle. The value of a candle is opening, closing, high, and low. One more element is included that is the number of days or periods that we will consider while calculating the outcome.

How to Calculate Linear Regression?

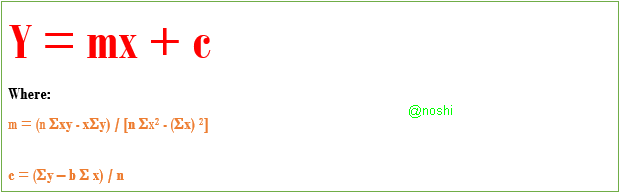

The calculation is Linear Regression is complex with respect to other indicator calculations. I will explain in an easy way that, how to calculate LRI. First, we look at the formula of LRI that calculates the value of the indicator.

Where:

y = Asset current price

m = Slop of chart

x = Current period

c = Constant

n= Number of previous periods selected

Show how to add the indicator to the graph, how to configure the linear regression indicator, and is it advisable to change its default settings? (Screenshot required)

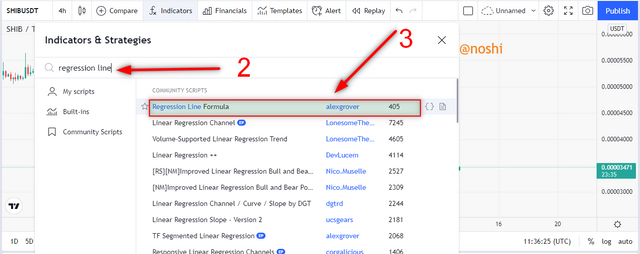

There are many platforms where we can see the chart of any asset and do technical analyses by applying the different tools on the chart. I will apply the Linear Regression indicator on TradingView.com. To apply the indicator on the chart, you need to follow the following steps.

- Go the TradingView and open the chart for any asset of choice.

- Next, click on the fx Indicator button on the top of the chart.

- Then, search for indicator and write linear and the auto-match result is the display.

- You need to click on Linear Regression Line as shown in the figure.

In this way, we can add the LRI indicator to the chart. You can in the following figure, the indicator is applied on the chart.

Indicator Configurations

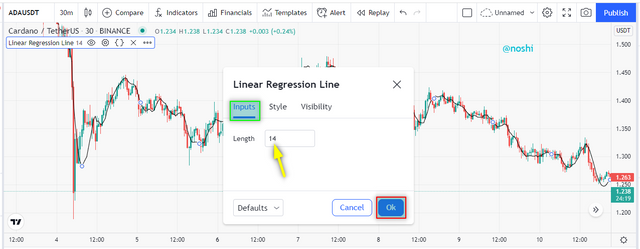

We can change the indicator settings according to our choice. Experienced traders change the indicator setting which is the best fit for their strategy. The out of indicator is changed when the setting becomes altered. There are two major settings of the LRI indicator. Click on the indicator setting button and open the setting window of the indicator.

Input Setting

In this setting, we can change the period length of the indicator. The default period length of LRI is 14. We can change the period length according to our trading strategy.

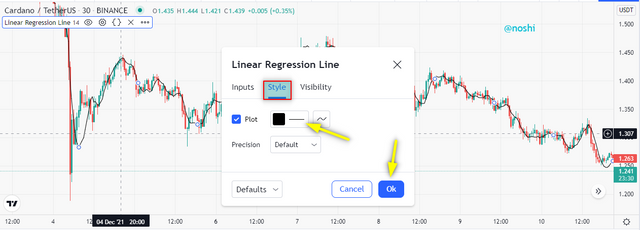

Style Setting

In this, we can change the appearance of an indicator line. Here we can change the color of the indicator line and also increase and decrease the thickness of the indicator line.

Is it advisable to change the settings of the LRI indicator?

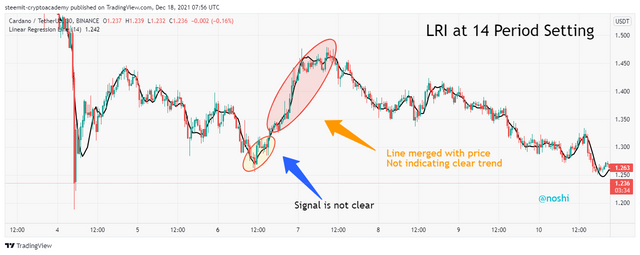

Changing the settings totally depends on you. The default period length is 14. When noticing the line of the indicator at 14 lengths, the line is stuck with the lows or highs of candles. The default setting is set by the creator of the indicator after deep studies. So, according to this, if we are not experienced traders then, it is not advisable to change the default settings.

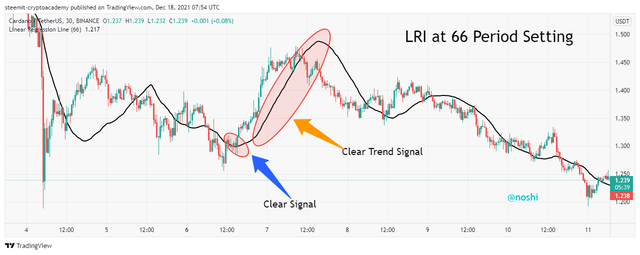

According to my perception, the line behavior over 14 periods is sticky with candle highs and lows. The line is merged with candles. I have a problem with the appearance of the indicator. So, I recommend changing the 14-period length to 66. In this way, we can find out clear signals.

The signals of 66-period length are late than 14 lengths. But one advantage of the late signal is confirmation of a bullish or bearish trend. After confirming the trend, the signal is produced by 66 length line. We can see in the figure; the late signal is produced by 66 length line. But we can take advantage of this late signal that is confirmation of the trend. Some the trend is suddenly changed and the signal produced by the 14-length period becomes false.

How does this indicator allow us to highlight the direction of a trend and identify any signs of a change in the trend itself? (Screenshot required)

Linear regression indicator is used to determine the direction of the current trend whether the trend is bullish or bearish. The indicator line is formed after the calculation of variables. The variables are previous candle’s highs, lows, closing, and openings as we discussed in the above questions.

Highlight the Uptrend

We can identify the trend direction by observing the line placement and direction. When the line of indicator remains slightly below the chart price candles and travels in the upward direction for a while, then the trend is an uptrend.

In the above, the above figure, you can see that the indicator line is slightly below the price action candles. It remains below the candles and travels in an upward direction. In this way, the area that is mentioned above is indicating the direction of the uptrend.

Highlight the Downtrend

On contrary, when the line of indicator remains slightly above the chart price candles and travels in the downward direction for a while, then the trend is a downtrend. The area in which the line remains slightly above the candles indicates the direction of a downtrend.

In the above, the above figure, you can see that the indicator line is slightly above the price action candles. It remains slightly above the candles and travels downward direction. In this way, the area that is mentioned above is indicating the direction of the uptrend.

Trend Reversal

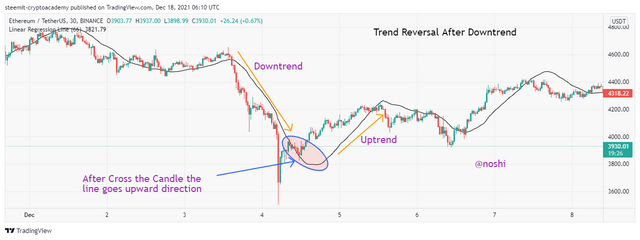

We can easily determine the change in the direction of the trend with the help of LRI. We can do that by observing the line behavior with the chart. After the trend reversal, the current trend direction is completely changed. There are two types of reversals. One is a bullish trend reversal and the second is a bearish trend reversal.

Change Trend from bottom

When the market is on a downtrend and the indicator line is slightly above the candles but not cross them, then the indicator line is changing its direction by intercepting the candles and putting itself in the upward direction, then its indicator indicates the trend reversal in the market. The is trend reversal is a bearish reversal.

In the above figure, you can notice the same condition that is mentioned above. The market is on a downtrend and the line of indicator is slightly above the price action. As you can notice that, the indicator line crosses the candles and puts himself slightly on the bottom side of the candles, then travels in an upward direction. It is indicating the change in trend direction.

Change Trend from Top

When the market is on an uptrend and the indicator line is slightly below the candles but not cross them, then the indicator line is changing its direction by intercepting the candles and putting itself in the downward direction, then the indicator indicates the trend reversal in the market. The is trend reversal is bullish reversal.

In the above figure, you can notice the same condition that is mentioned above. The market is on a downtrend and the line of indicators is slightly below the price action. As you can notice that, the indicator line crosses the candles and puts himself slightly on the upside of the candles, then travels in an upward direction. It is indicating the change in trend direction.

Based on the use of price crossing strategy with the indicator, how can one predict whether the trend will be bullish or bearish (screenshot required).

We can easily predict and determine the bullish and bearish signal by observing the crossings of linear regression indicators. can predict the bullish and bearish market by the intersection of indicator line and price candles. After the intersection, the line changes its path.

Bullish Trend

When the market is on a downtrend and the indicator line lies above the candles then it reaches the point where the indicator line intersects the candle. Most of the time, it makes a cut at the lower side of the candle and sets his path upward direction. At that point, we can say that it is a bullish trend signal that is produced by the indicator.

You can see in the above figure, the market is on a downtrend and at the bottom indicator line makes a cross with price action. After crossing it make a cut at the bottom of the lowest candle. It is a bullish trend signal. You can see that after this signal the market becomes bullish.

Bearish Trend

When the market is on an uptrend and the indicator line lies below the candles then it reaches the point where the indicator line intersects the candle. Most of the time, it makes a cut at the top side of the candle and sets his path downward direction. At that point, we can say that it is a bearish market signal that is given by the indicator.

You can see in the above figure, the market is on an uptrend and at the top of price action the indicator line makes a cross with price action. After crossing it make a cut at the high of the highest candle. After that, it changes his direction to downward. It is a bearish trend signal. You can see that after this signal the market becomes bearish.

Explain how the moving average indicator helps strengthen the signals determined by the linear regression indicator. (screenshot required)

As we discussed earlier, that the Linear regression is quite matched with the Moving average indicator. But the calculations are both indicators are completely different. The output of both indicators is similar. The regression indicator produced fast signals on the same period length with respect to moving average. because it also produces false signals as well.

On contrary, the moving average produces smooth signals with respect to LRI. Due to little difference in nature of both indicators, most of the traders use both indicators in trading for measuring the strength of a trend and also confirming the bullish and bearish signals. Now will see how they confirm the signals of each other.

In the above figure, you can see that the market is on a downtrend. when the LRI indicator line intersects the price action and changes in the direction to upwards. In the same way after a while, the moving average is also intersecting the price action. When the moving average intersects the candles, then it is a confirmation of the buy signal that this was produced earlier by LRI.

In the above figure, we can determine the strength of a bullish trend in another chart. After the intersection, the market is on an uptrend. We can check the strength of the trend by observing both indicators. when both lines lie at the bottom of the candle in the bullish market, then we can say that the bullish trend is strong. It indicates that the buyers are in control.

Now in the opposite direction, you can see in the above figure, that the market is on an uptrend. when the LRI indicator line intersects the price action and changes its direction downwards. In the same way after a while, the moving average is also intersecting the price action. When the moving average intersects the candles, then it is a confirmation of the sell signal that this was produced earlier by LRI.

In the above figure, we can determine the strength of a bearish trend in another chart. After the intersection, the market is on an uptrend. We can check the strength of the trend by observing both indicators. when both lines lie at the above side of the candles in the bearish market, then we can say that the bearish trend is strong. It indicates that the sellers are in control.

Do you see the effectiveness of using the linear regression indicator in the style of CFD trading? Show the main differences between this indicator and the TSF indicator (screenshot required)

Before knowing the effectiveness of both indicators, we understand the CFD trading strategy. CFD is a trading style in which traders earn profit in a very short time. In other words, it is a short-term trading style in which traders use a small time period for taking and entry to the market.

So, to go the CFD trading, traders want very fast signals. In this trading style, traders can’t bear the late signals, because they don’t want to miss any opportunity in the market. So, these traders use the TSF indicator and LRI indicator. These indicators are very fast in producing results in a short time frame.

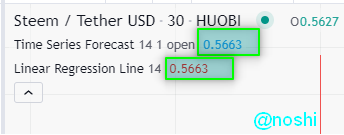

In the following figure, you can see that both indicators are applied on the chart. Both indicators out is quite matched with each other. We have mentioned earlier the working of LRI. TSF indicator is used by traders to determine the short buy and sell signals.

This is why this indicator calls it the Trend Hunter. TSF is suitable for short-term trading and the LRI is better for medium and long-term trading. Both indicators behave like moving averages.

You can see in the above, any time the value of both indicators is the same at several places. There is no difference between these indicators in many places. You can notice that in the following figure the value of both indicators is the same.

Difference Between the LRI and TSF

We if set the same time frame on both indicators then we can notice that, there is no difference between both indicators. Now, will discuss the overall difference between these indicators in the following table.

| TSF | LRI |

|---|---|

| It is mostly used by short term trading | It is used for both medium and long-term trading |

| TSF consider the Open Price of period for calculation | LRI calculate it value by considering the closing price of period |

List the advantages and disadvantages of the linear regression indicator:

There are a few advantages and disadvantages of linear regression indicators. I will explain both advantages and disadvantages in the following.

Advantages

- Linear regression indicator produces very quick and on-time signals with respect to other indicators.

- Bearish and bullish trends are easily determined by observing the crossings.

- We can easily read the signals of LRI.

- It can be used by both experienced and novice traders.

- It is suitable for trading with nonvolatile assets.

Disadvantages

- Due to its very fast nature, it produces false signals most of the time.

- It is a lagging indicator that derived the current value from previous data.

- It is not suitable for those assets that are much volatile.

Linear Regression is an indicator that is used for technical analyses of a particular asset. The process of calculation of this indicator is quite complex with respect to other indicators. Regression indicator is used by traders as replacement of Moving Average Indicator. Because the output signals are quite similar to the MA indicator.

Traders use this indicator for determining the current trend of the market. Trader also determined the trend reversals with this indicator by observing the crossing of price action and Regression lines. Both bullish and bearish trends are determined by this indicator.

After determining the trend reversals, traders use this indicator for getting the positions and opportunities of buying and selling in the market. Traders make decisions on the basis of signals produced by indicators. All the time signals are not true so, we should use more than two indicators for getting confirmed signals.