.jpg)

Cross Asset correlation is simply the to which the prices of assets move in relation to each other. In portfolio management cross asset core relation helps in describing the relationship between the movement of prices of different assets it also helps investors as says the diverse benefits of adding various assets to their portfolio. Since cryptocurrency turns out to exhibit high volatility, understanding the concept of cross asset correlation is important for effective diversification strategies. When investors are able to identify assets with correlation they can now construct portfolios that have a vulnerability to excess fluctuation in the value of any individual assets.

∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆ |

|---|

Now I see clearly the idea of currency pairs, for example if Bitcoin and ethereum have a low correlation holding them both will reduce the overall risk compared to holding one because it will stand market volatility.

|  |

|---|

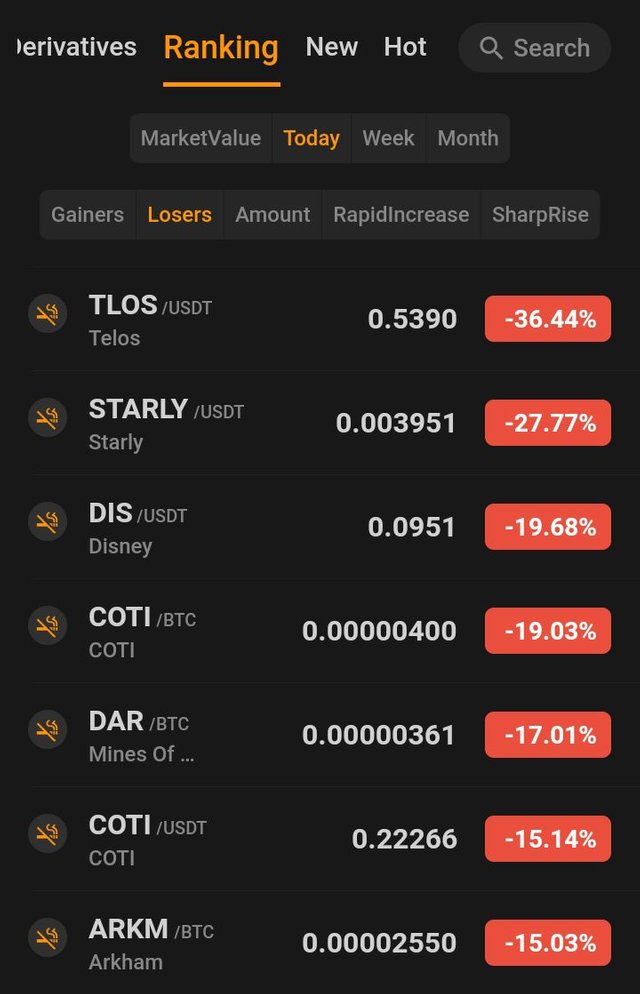

In a bullish market which is characterized by a rising asset price call related acid may strengthen as investors shift their attention to risk care asset to invest and get higher returns. The kind of tactical assets allocation of acids may be adopted by a lot of traders and things to favor risk care as it with high growth potential aiming to capture upside momentum. In declining prices and increased weeks known as bearish coated as investors switch they are a pattern of investment to safe Haven assets.

∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆ |

|---|

For instance if I experience a decline in the price in a cryptocurrency newly launched or which has been trying to access a good price but then fluctuates. I'd rather move my assets to access like usdt which is a stable coin. Traders can manage risks by employing strategies such as portfolio diversification option hedging and short selling to protect against losses. Understanding how cross acid core relations evolve during bearish and bullish periods is very important because it helps traders adapt effective portfolio strategies and also navigate changing market sentiment with greater precision.

By spreading investments across diverse assets with different correlation profiles, investors can reduce the risk of incurring significant losses during adverse market conditions. Combining equities and Bones is very important because born saves as a hedge against equity market downturns, in a period of economic uncertainty bonds appreciate in value while equities decline thereby balancing portfolio performance.

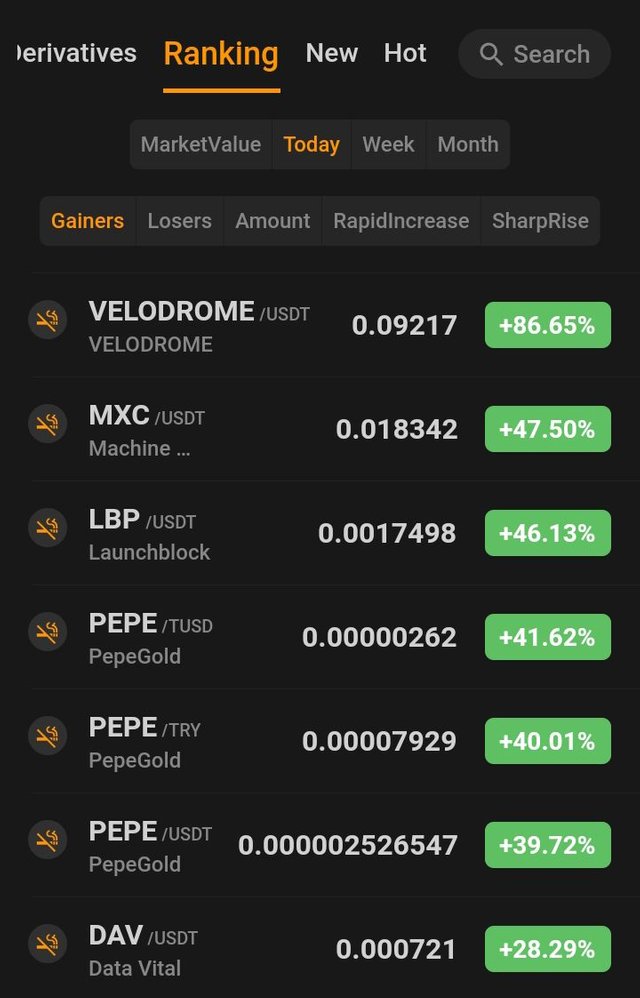

Crypto pairs

The historical correlation path and between steam and other major cryptocurrency especially bitcoin and ethereum, have undergone notable changes over time and days reflect changing market Dynamics etc.

∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆∆ |

|---|

In the early stage of steam emergence as a cryptocurrency it's called relation with BTC and ETH was relatively high and still movement was together and paripazole with BTC and ETH, as the ecosystem experience maturity everything began to evolve and divergence in market Dynamics began. Understanding the coal relation pattern of steam and measuring cryptocurrencies like bitcoin and ethereum traders can reduce overall portfolio volatility and minimize the impact of severe market movement by incorporating assets that exhibit different correlation profiles. If steam exhibits a positive coal relation with Bitcoin but a weaker correlation with ethereum traders may consider pay trading or arbitrage strategies focusing on price divergence in between steam and its pair.

The concept of cross asset correlation and its significance in portfolio management is very important to assessing diversification and managing risk. Understanding the concept helps investors to construct portfolios with acid that move independently or inversely to reduce volatility.

X promotion link

https://twitter.com/nsijoro/status/1762595321702707323?s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The concept of cross-asset correlation and its importance in portfolio management is very clear in your post. Understanding the correlation between different investments helps investors reduce volatility and strengthen their portfolio by including different assets. This is very important.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Including different assets is a way investor have derived strengthening their portfolio from. Nevertheless we are to analysis each assets well from their historical background to know if we are to invest or not. If we choose to risk it by investing including other asset especially popular assets that follow similar trend would be necessary to avoid complete loss. Thanks for stopping by.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post @nsijoro! Your clear explanation of cross-asset correlation in portfolio management helps demystify complex concepts. Understanding how assets move in relation to each other is crucial especially in the volatile cryptocurrency market. I appreciate your insights on adapting portfolio strategies during bullish and bearish markets. The mention of spreading investments for risk reduction and historical correlation patterns particularly with STEEM adds depth to your analysis. Best of luck in the ongoing contest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for stopping by, the idea of historical correlation is very necessary for investors and spreading investments helps in reduction of loss because if the market has a bullish experience, one other assets if not all will or may likely experience bullish. I appreciate your effort here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A perfect analysis and your suggestion about holding both ETH and Bitcoin, I have had both of them since 2017 and I sold a part of them in 2021. I can say whatever I hold is almost like a bonus for me because I have already taken all my investments out. I wish you success in the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for your reply here. That means you have really benefited from holding these currencies, I wish you all the best.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much, you have been so much exposed to crypto, I have read your post Sir, we grow by continous reading here. Holding a both currency is very necessary because it prevent complete lost of one asset or investment if one of the asset has bearish experience.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have done amazing job to the point and well you have try to simplify the knowledge and I must say you have good experience in the Crypto.

Best of luck for the participation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am actually trying my best, I have little experience though and I wish to improve more, Thanks for stopping

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your doing great don't worry

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

💜 😊 😃

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

🎉🎉🎉

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You don't do any work like Crypto

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with this thing that whenever there is a decline in market then investors prevents there portfolio and prevent their self by spreading their investments across different versatility of assets that have different correlation profiles but not for every time the safety is guaranteed that's why it is important for investors to first make clear analysis and then to invest in anything I wish you good luck with this engagement challenge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow such a highly detailed article I must say I learned a lot after going through your article indeed if written with so much experience, impacted so much knowledge that could enlighten anyone even a layman could understand everything you taught I said in your entry I must say I appreciate this good job please keep it up.

Also comment on my entry too thanks https://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s16w1-cross-asset-correlation-analysis

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks you for stopping by, I will do my best to drop a comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks friend i appreciate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Are you using the steemit site?, because it seems you replied more than 3 times, the site is going through a lot, but will be better soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks friend i appreciate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks friend i appreciate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow such a highly detailed article I must say I learned a lot after going through your article indeed if written with so much experience, impacted so much knowledge that could enlighten anyone even a layman could understand everything you taught I said in your entry I must say I appreciate this good job please keep it up.

Also comment on my entry too thanks https://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s16w1-cross-asset-correlation-analysis

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit