Hello friends, trust your day is going well? Welcome to my homework task by professor @Sachin08. In this homework, I will attempt to provide a detailed explanations of certain simple chart patterns that are used in trading.

Chart patterns are basically the various distinctive ways we view the movement of price on the chart, when the prices of a various asset move over time, they begin to form recognizable patterns that we can take advantage of to create profitable trade entries. The aim of pattern trading is usually to catch the breakout point and then utilize the volatile price movements to create profitable trade entries.

In this homework task, I will be explaining fully to the best of my present knowledge two simple trading patterns; Triangle patterns and Flag patterns. Make yourselves comfortable as it promises to be a great ride.

The illustrative images in this homework task were gotten from http://www.investopedia.com/, while the chart images were created from http://www.tradingview.com/ trading platform.

QUESTION 1

WHAT IS YOUR UNDERSTANDING OF TRIANGLES IN TRADING. EXPLAIN ALL FORMS OF TRIANGLES IN YOUR OWN WORDS (SCREENSHOTS REQUIRED)

Triangles are a special kind of chart pattern formed on the price chart when the top and bottom of price moves towards each other like the sides of a triangle, Triangle pattern occurs, when price forms a triangle shape with two sides that are joined by a base and they end up together as one at the end. The top and the bottom of the triangle represent the resistance and support zone of the price action and they tend to move towards each other till they reach an endpoint where they join and a break out occurs. The break-out usually occurs in a specific direction with massive volatility driving price movement, after the breakout, the price usually experiences a great deal of movement, so trading triangles can help us identify moments when a breakout occurs and a massive movement is around the corner. Breakouts are usually preceded by price ranging, when price ranges show us that the market is in a state of indecision, this range formation creates the triangle patterns we are talking about. So, the triangle is a pattern that helps us to identify when the price is ranging and a massive breakout of price is around the corner.

Triangles are basic and easy chart patterns for beginners to identify, and breakout traders utilize triangle formations to identify profitable breakout entry points. Triangle patterns are trend continuation patterns, i.e. they tell us that the market is ready to continue in the direction of its initial trend.

COMPONENTS OF TRIANGLES

Now that we have understood what triangles basically are, we shall be looking at the various components that make up the triangle pattern.

Triangle pattern is made up of three basic parts:

• Top:

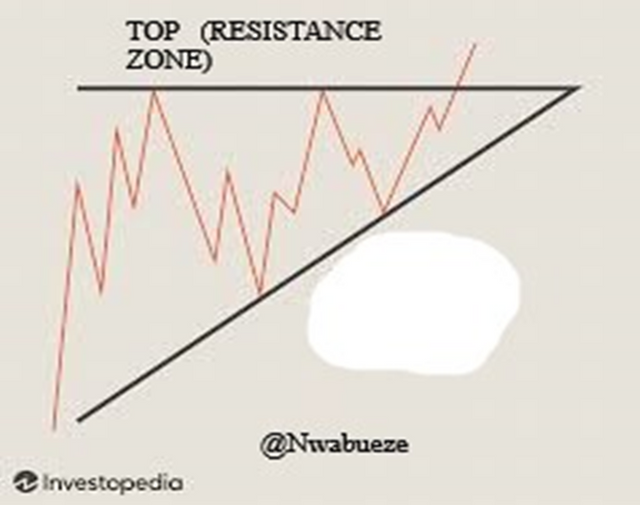

A typical triangle formation is made up of a top part, this top part can also be called the RESISTANCE. The top of the triangle shows us where the current resistance is at and how it is being formed. However, during the breakout of price, the top of the triangle could be broken and the resistance there violated.

• Bottom:

The triangle pattern also has a bottom part to it, the bottom part is also called the SUPPORT and it helps to show us the area where support is building upon the price chart. During breakouts, the bottom that forms the support zone could be violated and the price can move downwards.

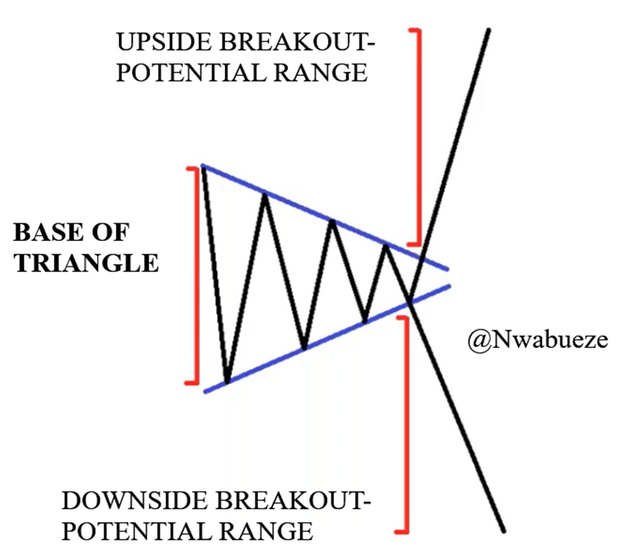

• Base:

The base of the triangle is the imaginary line that joins the open end of the triangle pattern together. The base measures the size of the triangle pattern and is a useful component of the triangle because the length of the base can be used to measure how far the incoming breakout move might go, the base of the triangle pattern offers us an idea of where to place our take profit while identifying trade entries.

FORMS (TYPES) OF TRIANGLES ( WITH SCREENSHOTS)

Having explained what triangle patterns are in trading and what they are made of, I will be explaining next the various forms in which a triangle pattern can be identified and traded.

Triangle patterns used in trading can be identified in three basic forms, which are;

• SYMMETRICAL TRIANGLE:

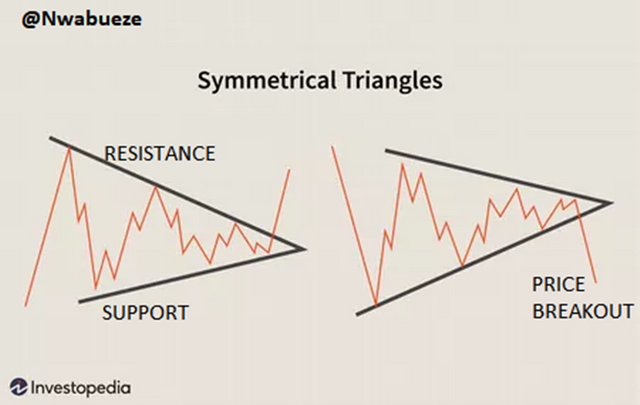

The symmetrical triangle is a triangle pattern in which the tops of the triangle are trending lower and bottoms of the triangle is moving higher such that the two sides of the triangle are slanting towards each other, we should note that the tops and bottoms of the triangle show the resistance and support zones on the price, therefore, in the case of the symmetrical triangle pattern, the buyers and sellers are equally strong hence they move price towards each other and it is not certain what direction price might break towards. Looking at the triangle pattern alone, it is usually impossible to determine what direction the price breakout might occur in, this is unlike the ascending or descending triangle pattern where the direction of the price breakout can easily be guessed.

The image below illustrates the way symmetrical triangles are formed, how they support and resistance zones tend to incline towards each other indicating equal strength of the buyers and sellers, and the directional indecision of the impending breakout

In trading the breakout of price on the symmetrical triangle, we can utilize the measured move analysis of the length of the base of the triangle, to know how far the price might go in the breakout direction.

The $CHESSUSDT chart below shows a typical symmetrical triangle formation that occurred on the H1 and the price breakout that followed afterward.

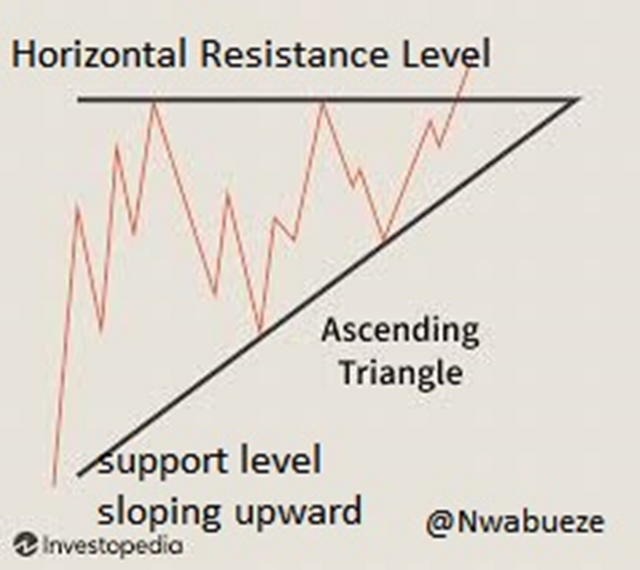

• ASCENDING TRIANGLE PATTERN:

The second type of triangle pattern we shall be considering is the ascending triangle pattern. The ascending triangle is also called the bullish version, this is because it explicitly tells us what direction the impending price breakout might occur in. The ascending triangle pattern is a triangle pattern that has an upward sloping support level while the resistance level is horizontal, it is formed when price continuously creates higher support levels (higher bottoms), while the resistance forms at the same level, this indicates to us the absence of strong selling pressure and the growing strength of the buyers and their willingness to keep pushing the price upward. In ascending triangle pattern the breakout always tends to occur to the upside, hence whenever we see an ascending triangle pattern forming we can begin to ready ourselves to enter a long position upon a confirmed price breakout. Also, when the ascending triangle is formed during a bullish trend, it is usually indicative of a continuation pattern and we can expect a continuation of the trend.

The diagram below illustrates to us the formation of the ascending triangle pattern

On $DOTUSDT price chart, the formation of the ascending triangle pattern is clearly spotted and highlighted, with the following criteria;

• horizontal resistance point

• upward sloping support level

• And the triangle base

After the occurrence of these criteria, the price soon witnessed a volatile breakout to the upside.

Also, in this price action we notice that the length of the price breakout exceeds the length of the triangle base, this shows us that the triangle base does not necessarily place a definite cap on the limit of the breakout, but suggests to us levels price might get to as it breaks out.

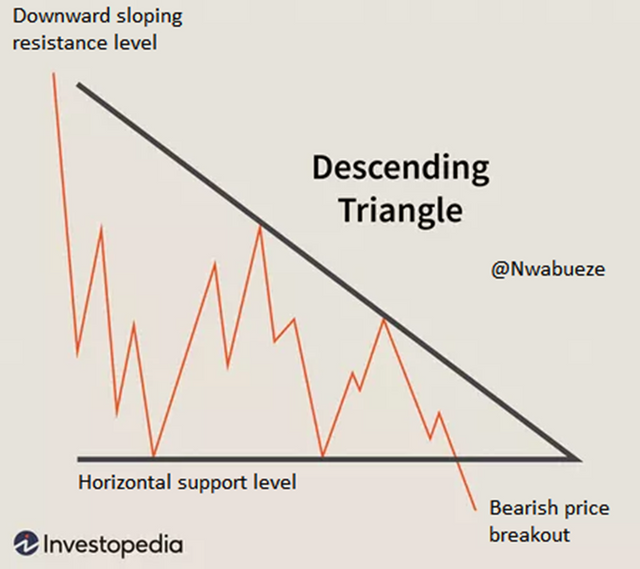

DESCENDING TRIANGLE PATTERN:

The third and final triangle pattern we shall be looking at in this homework task is the descending triangle pattern. The descending triangle pattern is basically a mirror image of the ascending triangle and has the opposite characteristics of the ascending triangle pattern.

The descending triangle is a triangle pattern that has a downward sloping resistance level, and a horizontal support level. The downward slope of the resistance level indicates to us the apparent strength of the sellers and their willingness to drive price downward while the horizontal support levels show us the unwillingness or inability of the bulls to push price up. The descending triangle pattern is useful in a bearish market condition because the price breakout of the descending triangle usually happens to the downside. It is useful as a continuation pattern and can help the trader to identify when the next price breakout to the downside is imminent.

The image below helps to illustrate how the descending triangle is formed and its different components

On $ADAUSDT price action chart, we can see a precise example of the descending triangle pattern at work, with the formation of a downward sloping resistance level, and a horizontal support level, afterwards price witnessed a breakout to the downside, validating the bearish bias that usually accompanies the descending triangle pattern.

QUESTION 2

CAN WE ALSO USE SOME INDICATORS ALONG WITH TRIANGLE PATTERNS? EXPLAIN WITH SCREENSHOTS.

Indicators are basically technical analysis tools, that gives us specific information about price action, and can help us to make profitable trade decisions, we have different indicators that are available to us on whichever trading platform we choose to use, examples of popular indicators include the Moving Average, MACD, RSI, Donchian Channel, etc. In trading triangles it has been observed by leading traders that simple chart patterns (such as triangles) alone by themselves cannot sufficiently provide all the criteria needed to place a profitable trade, this is because the triangle pattern by itself is prone to creating false breakouts scenarios, which can cause losing trades. To eliminate this inconsistency, therefore, it is advisable to employ an indicator that will supplement the deficiencies of the triangle pattern and also complement the job it does. As such, indicators are very much required as a necessary tool to combine with our triangle pattern. When we combine indicators with triangle patterns, it helps us to achieve a confluence of reasons, so we can generate more profitable trade signals.

It is therefore advisable to the beginner trader that wants to trade triangle pattern effectively to make use of one or more indicators as confluence to generate better and profitable trade signals. In the proceeding paragraphs, I will be explaining two types of indicators we can use along with triangle patterns so as to generate confluence and profitable trade entries.

TRIANGLE PATTERN AND MOVING AVERAGES CROSSOVERS:

One major indicator that works well with the triangle pattern is the Moving Average Crossover. The MA Crossover is an indicator that is made up of two moving averages that cross each other when the market trend is about to change. We can set the moving averages to any value depending on our choice. In this homework task, the MA crossover is added to our $ADAUSDT price chart on http://www.tradingview.com/ platform and its value are set to the default value of 9 and 21 each.

In using the MA Crossover indicator, we must understand how it works. First,

• A crossover occurs when the lower value moving average (9 MA) crosses the higher value (21 MA)

• A bullish crossover occurs when the 9 MA crosses the 21 MA to the upside and trends ahead of it

• A bearish crossover occurs when the 9 MA crosses the 21 MA and trends below it

• The 9 MA is colored gold

• The 21 MA is colored green

• The area in which a crossover occurs is identified with the blue cross

From the screenshot above, we can take note of the following observations;

• When the price was forming a triangle, the price was also trading in the middle of the two Moving Averages, this occurrence confirms to us that the market is in a ranging market structure and a state of indecision

• A bearish moving crossover happening right at the moment when price breaks out of the descending triangle formation

• After the bearish crossover, the 9 MA kept trending below the 21 MA confirming to us the willingness of the sellers to keep pushing price down

• The MA also offered us an opportunity for re-entry when price retraced into the middle of the MAs before resuming the downward trend again.

TRIANGLE PATTERN AND STOCHASTIC RSI

The Stochastic RSI is a dynamic type of technical analysis indicator that combines the stochastic indicator and the Relative Strength Indicator together. The RSI itself measures the amount of momentum in the market and helps us to identify when price is in oversold or overbought market conditions, so the Stochastic RSI applies the stochastic formula to the calculated RSI. This helps it to filter out market noise and generate effective signals.

It makes better sense to use the Stochastic RSI with triangle patterns because the RSI helps us to identify oversold and overbought scenarios in the market, and we know that when a market is in the oversold region then it is ready for a possible bullish move. Also, when the price is in the overbought region the buyers are exhausted and a potential bearish move could play out.

If we apply the Stochastic RSI to our price chart and spot the market lying in an oversold or overbought zone when the triangle formation is happening, this can offer us more confluence for the trade idea by showing us there is weakness in the market and price could breakout in our perceived direction. The trade screenshot below explains it better.

In the chart above we can observe the following;

• Stochastic RSI is showing the price is in the oversold region, indicating a potential upside move could begin.

• This indication correlates with the bullish price breakout that just occurred.

• This helps to provide additional confluence to the ascending triangle pattern bullish trade idea

From the two kinds of indicators explained, it is now clear that we can combine technical analysis indicator tools with triangle patterns to generate profitable entry signals.

QUESTION 3

###EXPLAIN FLAGS IN TRADING IN YOUR OWN WORDS AND PROVIDE SCREENSHOTS OF BOTH BULL FLAG AND BEAR FLAG

Having explained what triangles are, their various forms, and how they can be traded along with indicators, I shall be continuing in this homework task by explaining what Flags are, and providing images to help us understand better, the Bull flag and Bear flag types we have.

So far, I find this homework task interesting, and I hope you find my explanations educating. Therefore, let us continue.

FLAGS IN TRADING

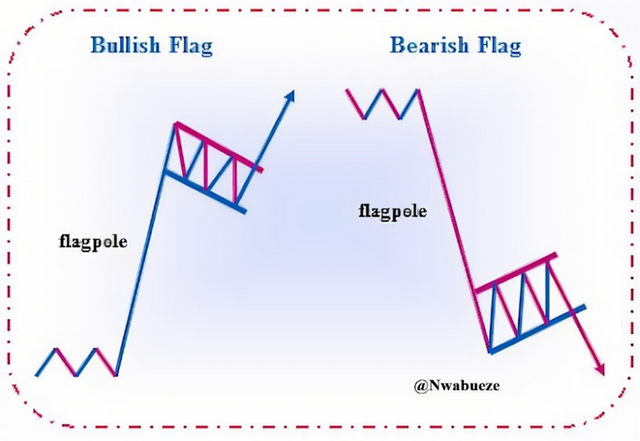

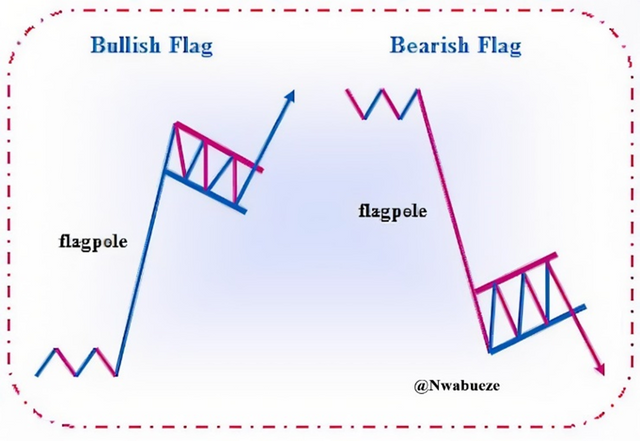

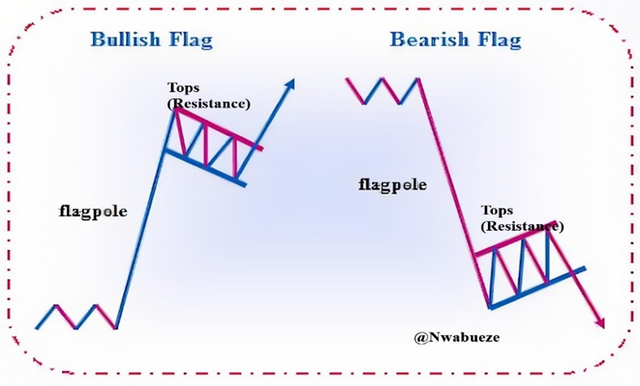

A Flag is a typical chart pattern that forms when a price consolidates after an impulsive price movement. After a sharp volatile move, price tends to consolidate, these consolidation patterns form in a way that looks like a Flag, that is why they are called ‘flags’. Although flag formations can take up many different appearances, we will do just fine by having a general idea of what they look like. The image below shows us how a flag pattern looks like

Flags are also considered a type of triangle pattern in trading, and they occur when the price is consolidating or as I like to call it “taking a rest”. Flags are useful as a form of continuation pattern in a trending market condition because they can help us to identify when the price is about to resume in its initial direction and we can also make profitable trades based on this. Flags are more rewarding to trade than the triangle patterns previously discussed because their profit targets tend to be large.

COMPONENTS OF A FLAG

We can identify three main parts of the flag pattern also which shall be discussed below

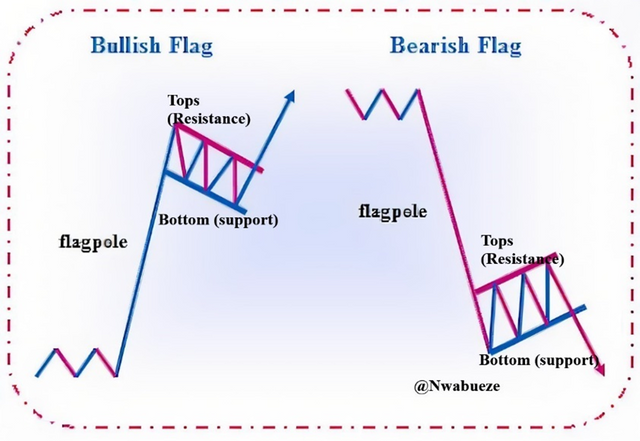

Flag pole: A major component of the Flag formation is what we refer to as the flag pole it can also be called the flag handle, the flag pole is basically the sharp price movement that precedes the formation of the flag body. Just like the base of the triangle patterns, the flagpole can also help us a get measured move of the breakout we are expecting to occur. The image below helps us identify the flag pole in a bullish and bearish scenario.

Top (Resistance): This is the tops that form immediately after price begins to consolidate, in a bullish trend, these new tops that are forming can also be identified as short-term resistance, and are usually violated by price break out. However, in a bearish trend scenario, the resistance level is utilized to identify the areas we can place our stop loss as we enter a trade.

Bottom (Support): This is the base of the flag and it identifies how support levels are building up during the consolidation. In a bullish trend after the break-out occurs, the support levels are used to know where to place our stop loss. However, in a bearish trend, the support levels are usually violated as the price breaks downward

ADVANTAGES OF TRADING FLAG PATTERN

Professor @Sachin08 helped me to understand in his lecture that flags are ‘beautiful’ triangles that can help us to place profitable and accurate trades. I have realized that trading flag patterns have some major benefits a trader can derive from it.

• Helps us identify continuation in trends; Most traders might not be able to catch the beginning of a price trend, however using flag patterns gives us the opportunity to identify areas where we can enter the market and join in the continuation of such trend.

• Provides better risk to reward incentive; The flagpole of a flag pattern is used to derive a measured move of the breakout we are expecting, the flagpole is usually much longer than the flag body itself, so the profit targets are usually bigger. Therefore, the flag pattern is especially advantageous, because if it is well identified and traded the risk to reward from such trades is usually better than those of the other triangle pattern.

The flag types can be divided into two basic forms, the bull flag and the bear flag, I will be explaining them below with screenshots.

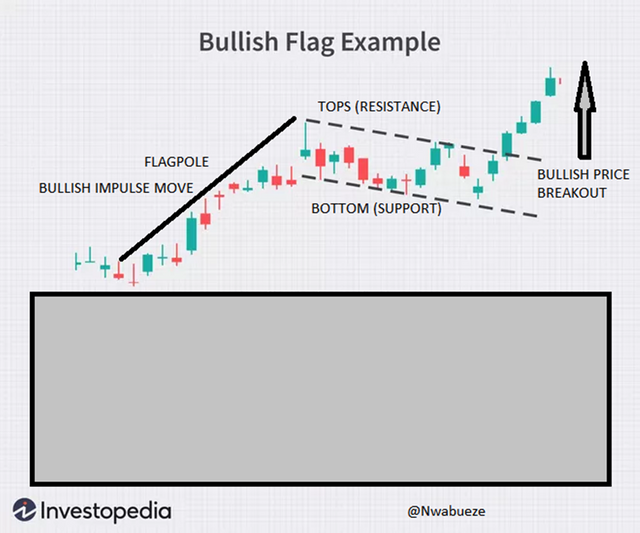

BULL FLAG

The bull flag is the flag pattern that occurs when the price is in a bullish trend. The bull flag usually occurs when the price is consolidating or (as I like to call it) “taking a rest” after a volatile price movement upwards.

CRITERIA FOR BULL FLAG FORMATION

Below are the criteria or requirements that should be present on the price chart to enable us to identify a bull flag;

• Price must be in an uptrend with a preceding strong impulse move upward

• Wait for price to begin to retrace downwards

• As price begins to retrace, the bottoms (support) levels begin to form also, indicating the presence of buyers willing to continue the bullish trend. In a flag formation, the support levels could be horizontal or slanting.

• As the support levels form, the tops (resistance) levels will also begin to form simultaneously as the price is being rejected at the top, the rejection can be due to profit-taking of initial buyers or a small presence of sellers.

The image below further explains the bullish flag to us.

On ETHUSD 4hr timeframe below, there is a bull flag pattern that is identified. After the bull flag formation, prices continued trading upwards, thus validating the bull flag as a potentially profitable pattern to trade.

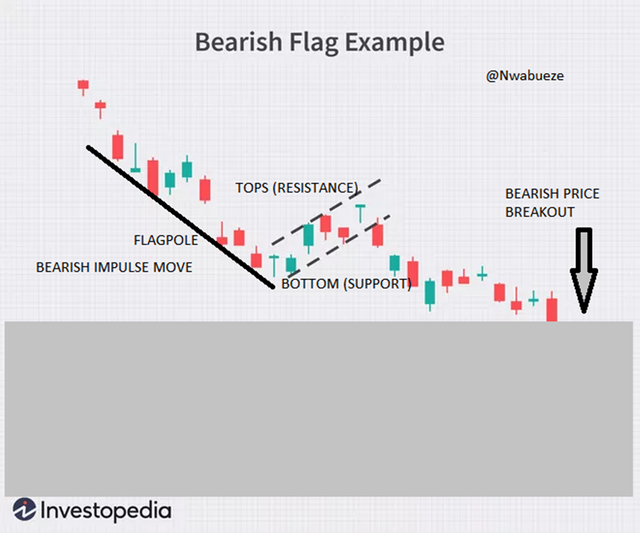

BEAR FLAG

The bear flag is the exact opposite of the bull flag pattern, the bear flag pattern occurs when the price is in a bearish scenario during which price is consolidating and a downward trend might be imminent. It occurs after a sharp sell move has taken place and the price is consolidating before resuming the bearish trend. The bear flag has certain requirements that should be present for it to be properly identified on the chart.

CRITERIA FOR BEAR FLAG FORMATION:

• Price should be in a downtrend having just completed a sharp bearish move downward

• Wait for price to begin to retrace upward, this tells us the consolidation has begun

• As price begins to retrace, the tops (resistance) levels begin to form also, indicating the presence of sellers who are willing to continue the bearish trend. In a flag formation, the tops could be horizontal or inclining to either side

• As the resistance levels form, the bottoms (supports) levels will begin to form as well, as price continuously tests the support levels. The support levels could be formed, due to the profit-taking of initial sellers or a small presence of buyers looking to turn the market around.

The image below explains clearly to us the formation of the bear flag.

On the BTCUSD 4hr timeframe chart below, we can see a clear bear flag formation that played out nicely sometime earlier this month, and that led to the current Bitcoin bearish structure in the market.

QUESTION 4

Show a full trade setup using these Patterns on any Cryptocurrency chart. (Ascending Triangle, Symmetrical Triangle, Bear Flag)

Having explained with screenshots the flag pattern, and how the bull flag and bear flag are formed, and the criteria for identifying them. We will now move to the final question in this homework task where I will be showing full trade setups by applying some of the patterns I have explained on some Cryptocurrency price charts.

Indeed it has been a wonderful journey so far, thank you for your time and attention. Now, join me as we explore the practical application of simple pattern trading on the chart.

Ascending Triangle

On the price chart of UMAUSD, I identified the formation of the ascending triangle pattern that occurred on the 4hr timeframe in October.

Below is the screenshot of the trade setup, and the process I followed in identifying the trade.

• Horizontal resistance level (Tops)

• Upward sloping support levels

• Triangle base (used for the measured move of the breakout)

• MA Crossover – I used the MA Crossover indicator for the added confluence of the breakout, the crossover of the moving averages happened moments before the price breakout occurred, this showed confluence and can boost traders confidence when taking such trades.

• The entry is at the point where the breakout occurred, after the moving average crossover occurred, a buy stop order could have been placed a little above the resistance level also, so as to catch the breakout the moment it occurs.

• Stop loss is placed directly at the low of the most recent support level

• Take profit is safely determined by the measured move of the base of the triangle formation, this generates a decent risk to reward of 1:1.6

After the trade has been observed and an entry placed, we see price continued moving upward with massive volatility, and our take profit mark was reached in no time. We can see from this trade setup that the ascending triangle pattern has a high probability of playing out well if we properly follow the rules and we could also use indicators as added confluence.

SYMMETRICAL TRIANGLE

I identified a symmetrical triangle pattern on the ETHUSD price chart, on the 30 minutes timeframe, this proves that triangles can also be used by day traders to generate profitable signals.

Below is the screenshot of the trade setup, and the process I followed in identifying the trade.

• Tops (resistance) inclined to the downside

• Support level slanting upward

• Price breakout happened to the upside

• Entry was taken immediately after the breakout is confirmed, by a candle close above the resistance level

• Stop loss is placed at the most recent support low formed in the triangle

• Take profit is placed using the measured move of the triangle base, this provided a decent 1:1.6 risk to reward.

After the breakout was confirmed and our entry was taken, the price sharply moved upward with high volatility and our take profit target was delivered effortlessly.

BEAR FLAG

The bear flag pattern trade setup is found on the ZRXUSD price chart, on the 4hr timeframe. Below is the screenshot of the trade setup, and the process I followed in identifying the trade

• The bearish flagpole was identified, which shows us price initial downtrend movement

• Tops, resistance level which price bounced off repeatedly

• Bottoms, the support level that held off the initial sells

• Price breakout happened to the downside

• Trade entry was placed at the area where the breakout occurred

• Protective stop loss placed at the recent resistance high formed above

• Take profit target was set using the initial bearish flagpole as a measured move tool, this process gave us a 1:2 risk to reward on this trade

• The bearish flagpole was identified, which shows us price initial downtrend movement

• Tops, resistance level which price bounced off repeatedly

• Bottoms, the support level that held off the initial sells

• Price breakout happened to the downside

• Trade entry was placed at the area where the breakout occurred

• Protective stop loss placed at the recent resistance high formed above

• Take profit target was set using the initial bearish flagpole as a measured move tool, this process gave us a 1:2 risk to reward on this trade

Immediately after the breakout, it is observed that the price continued to sell massively, till it trades the measured move of the initial flagpole, and then it began to retrace in the opposite direction. This further proves to us that the flagpole can be reliably used to predict the measured move of the next price breakout.

CONCLUSION

Thank you for sticking around till the end of this homework, indeed it has been a detailed and educative journey as I attempted to explain simple trading patterns such as Triangles and Flags, what they are, their various types, how they work, and how they can be utilized with certain indicators to generate profitable trade entries. I also generated some trade setups with the various triangle types and bear flag patterns. I have also learned new simple patterns trading knowledge in the course of preparing this homework task, which I believe will make me a better Cryptocurrency trader eventually.

My special thanks go to Professor @Sachin08 whose lecture on Simple Trading Patterns helped me to understand the fundamentals of Triangles and Flags and how they work. I look forward to your next class.

Thank you.