INTRODUCTION

Hello friends, welcome to yet another great session of the steemit crypto academy, in this week’s task we will move on from discussing different trading patterns and techniques to discussing “confluence trading”. I will explain what confluence trading is all about, with chart screenshots to further explain better and also practical ways we can utilize confluence trading in our trading journey. Kindly follow through as this session promises to be informative and explosive.

QUESTION 1

EXPLAIN CONFLUENCE TRADING. EXPLAIN HOW A TRADE SETUP CAN BE ENHANCED USING CONFLUENCE TRADING

Confluence trading can be defined as a way of trading whereby a trader utilizes more than one technical analysis tool to derive a trade signal, this allows for more confirmation of trade, and increases the chances of such trades being a winning trade. In confluence trading, the trader does not only rely on a single chart pattern formation, or indicator signal, but rather combines different technical analysis tools together to generate a signal, if the different technical analysis tool gives the same directional bias and entry signal we can say they “confluence” and as a result, there is a higher probability of the trade signal playing out well.

Confluence trading requires a higher degree of discipline and patience from the trader, this is because the trader has to wait till all the technical analysis tool requirements are met and the various criteria align. In trading confluences, we can decide to combine certain indicators and a chart pattern formation together to generate our trade signal, this means that we will only enter a trade when a chart pattern such as divergence, break of structure, or break of trendline forms in confluence with another indicator such as the RSI or stochastic, we can also take it a step further by waiting for a moving average crossover also. Confluence trading is a more mature way of trading as it helps us to refine the trades we take and to avoid false signals that each individual indicator or chart pattern could generate by referencing them with each other.

I will show us how a trade setup on the chart can be enhanced using the ideas of confluence trading so as to avoid false signals. Let us observe a trade setup on $VETUSDT where confluences were not used.

In the chart above, we observe the RSI (Relative strength indicator) in the overbought zone, interpreting this we would say that a bullish trend reversal is about to happen because the market has now traded into an overbought region, and sellers will be looking to step into the market to move the price down from that premium area. However this was not the case, instead of price to reverse and sell, the price only retraced slightly and then continued the bullish run to even create a higher high, thus the RSI indicator generated a false signal here and if we had taken this trade, we would find ourselves on the wrong side of the market and then lose money.

In the second chart below, I will be using the EMA (Exponential moving average) as a second technical analysis tool to confluence the signals of the RSI.

In the chart above, after adding the EMA indicator we observe that price did not break the EMA, if the price had broken our EMA to the downside then we would have had a confluence for the bullish reversal scenario, however, the price bounced off the EMA and then continued buying, this shows that the market just retraced briefly to continue the bullish trend, using confluence ideas, we can see that because the price did not break below the EMA our bearish idea from the RSI indicator is not valid, therefore we would have identified the false signal from our RSI and stayed off the bearish trade.

Therefore by using two or more technical tools together, we can identify the false signals in our strategies and also generate trade setups that have a higher probability of playing out well.

QUESTION 2

EXPLAIN THE IMPORTANCE OF CONFLUENCE TRADING IN THE CRYPTO MARKET?

Having explained what confluence trading is and how it can enhance our trade setups, we will now move on to look at the various importance of confluence trading to us as traders in the crypto market. In this segment, I will be discussing three major advantages of utilizing confluences while trading in the crypto market.

Filters false signals:

The crypto market is a very volatile and dynamic market, this means it is very susceptible to sudden price action movement hence trends can change faster than they form and suddenly too, in this type of market condition indicators are faced with rapidly changing set of information and as such there might be a lag or irregularity in the way they interpret market action, this irregularity usually leads to our indicators generating false signals at times, and these false signals can cause us to enter the wrong side of the market and lose money. However, using confluence trading can help us to filter the occurrence of this unfriendly tendency because when we use the confluence of two or more trading tools we will generate a signal only when the multiple trading tools align, i.e. when they are saying the same thing, this helps to filter out the false signals that one of the tools might generate because signals that occur when the trading tools do not align will be discarded.

Eliminates the weakness in each strategy:

No technical analysis indicator or tool can by itself generate 100% accurate trading signals all the time because no trading tool is perfect, they all have one identifiable flaw due to the fact that they just focus on one particular aspect of the market movement such as volume or price action. For every strategy the trading community has come up with over the years there has been identifiable flaws and weaknesses in their functioning, this can be a result of many factors, for instance, an indicator such as the RSI that is designed to measure the volatility of the market would do poorly when the market is in a range bound zone and is not trending, this inherent weakness in the market condition it can function in, is a major disadvantage that can put the trader at risk of loss when trading such indicators alone. However, when we combine other trading tools in confluence trading, the strength of one trading tool will cover the weakness of the other. For instance, in a ranging market where the RSI tends to produce false signals we can use a chart pattern break of structure to eliminate the RSI weakness by strictly waiting for a break of structure to occur in an overbought or oversold region before we place our trade. The different ways we can possibly combine our trading tools and strategies can help us to eliminate most of the inherent weaknesses in each individual strategy.

Increase trade winning ratio:

Using confluence trading also helps to increase the winning rate of the trading signals we generate in the crypto market, the formula to making consistent profit in trading is to have a strategy that has a high winning ratio with a decent risk to reward margin while applying proper risk management. Therefore, confluence trading helps us to sharpen our trading style so we will make fewer mistakes, and generate a higher percentage of winning trades. Confluence trading also erases the tendency of false signals from our strategy so more of our trades become winning trades.

Therefore, trading confluences in the crypto market is a wise way to approach the market, this is because no single trading tool can by itself generate profitable signals all the time, however, when we utilize other indicators and chart patterns to confluence our trading ideas, we can generate better trading signals and eliminate false signals and this increases our trades winning ratio in the market.

In the next question, we shall be looking at the practical application of confluence trading with 2 levels and 3 levels of confirmation on the price chart.

QUESTION 3

EXPLAIN 2-LEVEL AND 3-LEVEL CONFIRMATION CONFLUENCE TRADING USING ANY CRYPTO CHART.

I explained earlier that confluence trading has to do with combining two or more technical analysis tools to generate a profitable trade setup in the market, however, there are different ways in which we can combine our trading tools on the chart, to give us different levels of confirmation before putting on a trade in the market. When we combine two technical analysis tools (such as a chart pattern and an indicator) they give us a two-level confirmation before we enter our trade, also when we combine three technical analysis tools together they will give us a three-level confirmation before we place our trade entry. I will explain to us in detail, how we can generate two and three levels of confirmation when trading confluences with crypto chart examples.

2-LEVEL CONFIRMATION CONFLUENCE TRADING

2-level confirmation confluence trading occurs when two technical analysis tools confluences and give a signal in the same direction, we must understand that for a 2-level confirmation confluence to happen both trading tools must give a signal in the same direction this helps to give us a double confirmation that price has a high probability of moving in that direction according to our analysis. We will now look at a practical example on a crypto chart where 2-level confirmation confluence trading was used and how price reacted to the signal generated.

In the $ALGOUSDT chart above, we can observe a 2-level confirmation confluence trading that happened on the chart, the two technical analysis tool used on the chart is the RSI and EMA indicators. On the chart, we observe the following.

The RSI traded into an overbought zone after the price made a bullish run above previous the previous high, this indicates to us that the market might have exhausted its steam after the prolonged bullishness and sellers might be willing to capitalize to sell the market short at this high premium level.

Therefore, the signal from the RSI indicator is bearish, however, because we are trading a 2-level confirmation confluences, we have to wait for a similar bearish confirmation from our second indicator before we take any action whatsoever.

For the EMA indicator, as at the time the RSI gave us its bearish signal, the price was still trading above the EMA this meant that the EMA is still indecisive, and the price is not fully bearish, therefore we have to wait till the price breaks below the EMA for a 2-level confirmation to be present.

Later on, we observe price breaking through the EMA line, this serves as the second confirmation of the selling bias, after this break of the EMA line the bullish trend reversal signal has been confirmed twice by the two trading tools

Immediately after we have gotten a 2-level confirmation confluences, we observe the market began to reverse to the downside, then the market entered a full bearish state and sold massively, this is a classic example of how a 2-level confirmation confluences should look like and how the market should also react to the signal we generate from it. Next, we will look at what the 3-level confirmation confluence is on a chart example and how the market reacts to it.

3-LEVEL CONFIRMATION CONFLUENCE TRADING

The 3-level confirmation confluence trading is a very high probability trade setup up, this is because a trade signal is only generated after the price has given us a confirmed entry on three different trading tools. The trader must have nerves of steel while trading so as to be patient enough for the three confirmations to occur in the marketplace. A 3-level confirmation confluence trading requires three trading tools to align, hence we can create a mix of two different indicators and a chart pattern, the chart pattern helps us to track price action movement in the market while we combine it with the reaction of our indicators.

For the indicators we can use the RSI when it trades into an overbought or oversold region, also the EMA when price breaks through it and crosses to the opposite side, our chart pattern can be a selection of any trade reversal patterns such as the break of market structure or the break of the trendline. This offers the trader a wide array of tools to throw in the mix in a number of different possible ways as they see fit. With time and experience, the trader will begin to understand how each tool works and will be able to tweak it as they see fit.

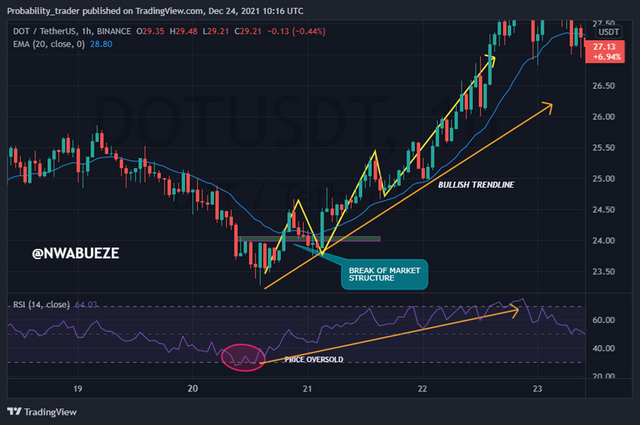

Below we will be examining a chart example of a 3-level confirmation confluence that played out on the chart.

In the $DOTUSDT chart above, we observe the following

The market was in a bearish state initially then RSI traded into the oversold zone, this gives us a bullish signal that the market has traded into a deep discount state and buyers might want to start coming into the market to drive price up.

After this, we observe a chart pattern that was formed when the price broke the most recent bearish market structure to the upside, this break of structure is a chart pattern that confirms the bullish trend to us. However, because we are looking for a 3-level confirmation trade confluence, we now look up to what the EMA is saying to us on the chart

Immediately after the break of the market structure occurred, price traded through the EMA also, this break of the EMA line to the upside, confirms the bullish trend reversal, this is the third and last confirmation that we need to see before being bullish. After these three confirmations have presented themselves in the market, we see the market immediately reverse and start buying massively.

The above chart examples show us that the 3-level confirmation confluence trading is a better way to analyze the market and generate profitable trade signals.

QUESTION 4

ANALYZE AND OPEN A DEMO TRADE ON TWO CRYPTO ASSET PAIRS USING CONFLUENCE TRADING. THE FOLLOWING ARE EXPECTED IN THIS QUESTION.

A) IDENTIFY THE TREND.

B) EXPLAIN THE STRATEGIES/TRADING TOOLS FOR YOUR CONFLUENCE.

C) WHAT ARE THE DIFFERENT SIGNALS OBSERVED ON THE CHART?

Having explained what confluence trading is all about, and the various advantages a trader can derive from it, we have also looked at chart examples on the types of confluence trading we have. In this segment, I will be placing confluence-based trades on a demo account so we can see how to practically implement all I have been talking about since the beginning.

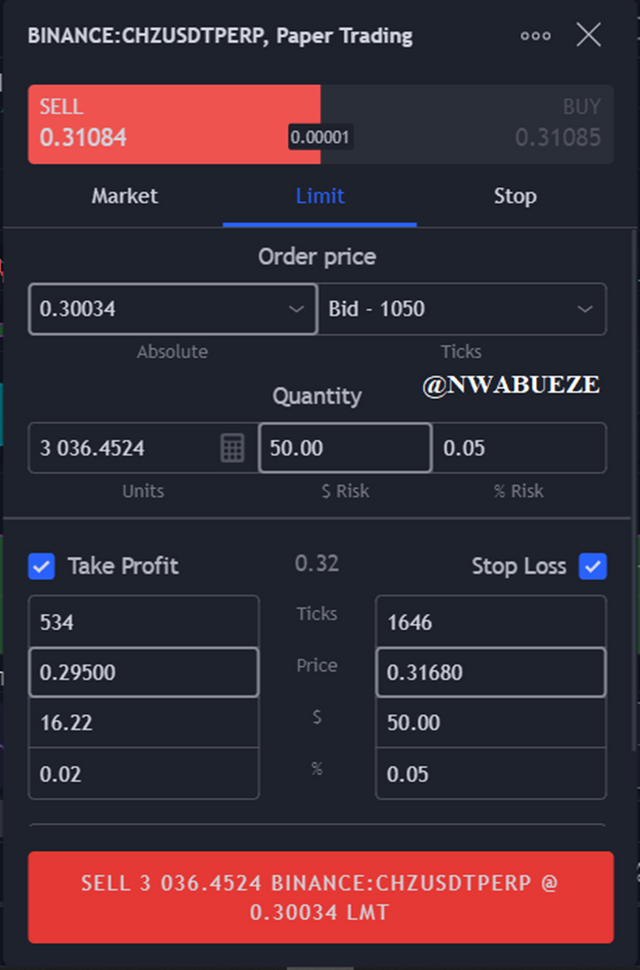

$CHZUSDT

The crypto asset that will be trading is the $CHZUSDT futures pair on the platform, below is how I identified the trade setup

TRADE SETUP

In identifying this trade setup, I made use of the 3-level confirmation confluence trading that we talked about, below is how I identified it

• The first trading tool I used is the RSI (Relative Strength Indicator), here we observe price trade into the overbought zone, this signaled to me that the bullish run might have lost its steam as sellers will be interested in coming into the market at this premium price point, hence I began to suspect a bearish trend could be around the corner

• Afterwards, I waited for further confirmation, and this came when the price traded through the EMA, this break of EMA signals that the bears have taken over the market and the market can begin to sell any moment soon. At this point, something interesting happened to me, as I began to feel tempted to place a sell immediately after the break of EMA occurred, my emotions were trying to take over and cause me not to follow my trading plan. However, I restrained myself from jumping the gun and waiting for the final trade signal

• The final confirmation I needed to place the trade occurred when price broke the most recent bullish market structure to the downside. This break of structure is a chart pattern that indicates the price is about to reverse from a bullish state into a bearish trend.

• After waiting till the 3-level confirmation confluence trade have been fully identified, I then proceeded to place my sell order in the market on the demo trading platform of

• I placed the sell order based on the current market price @$0.31084, my stop loss @0.31680 which is just above the most recent high price formed after the break of market structure, and my take profit was placed at @0.29500 which produced a decent 1:2.7 risk to reward ratio, I risked $50 on this particular trade, which means in the case the trade goes in my favor I stand to make $135 (sounds nice)

TRADE PLAYOUT

As at the time of rounding up this task, the trade had played out according to my analysis, as the market reversed and started selling to the downside almost as soon as I placed my sell order. However, I took my sell positions off when the price started to retrace towards my entry point and I ended up with a 1:2 trade profit. This shows me that, confluence trading can be utilized profitably on the live chat to make real money. I am indeed excited for what my trading journey holds in stock for me, with the confluence trading strategy in my trading arsenal.

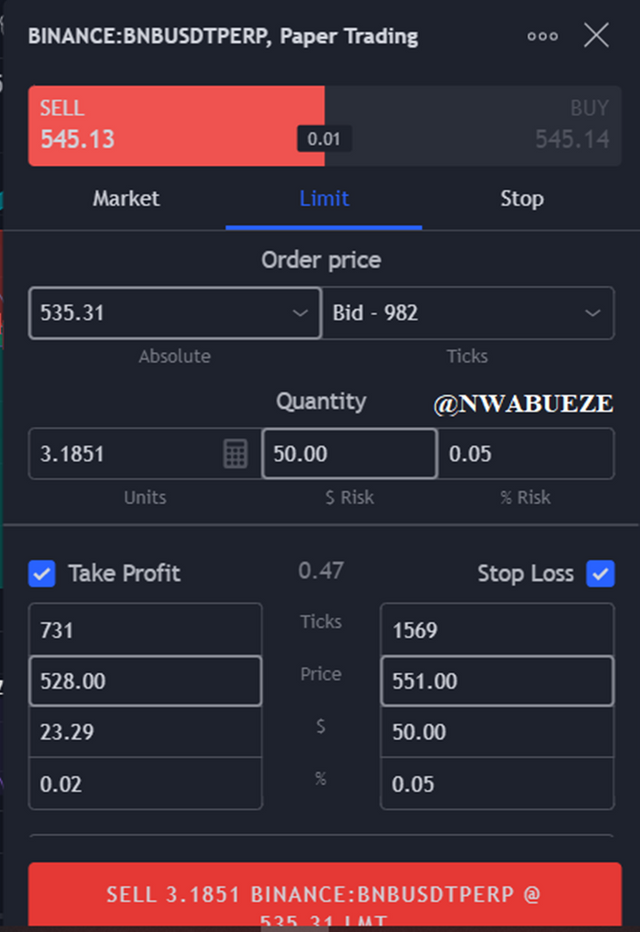

$BNBUSDT

TRADE SETUP

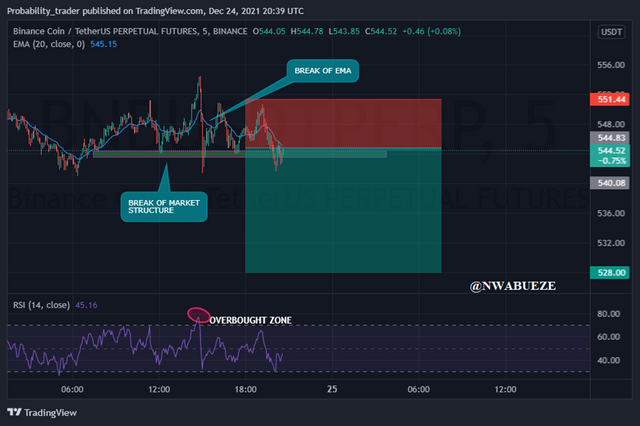

In the trade setup above, I used the 3-level confirmation confluence trading to identify a bearish signal and demo traded it, I observed the following signals in the chart.

• The RSI traded into an overbought region after making a series of higher highs, however, I started to suspect a bearish reversal could be around the corner, this is because the RSI in the overbought region indicates an area where sellers would like to place their sell orders and drive the market downwards.

• The second signal I observed was the EMA line, few minutes after the market traded into the overbought region, the price made a sudden impulse move to the downside and broke through the EMA to the downside, this break of EMA is the second confluence that confirms to us the market is beginning to enter into a bearish mode, however, a third and final confirmation is still needed at this stage.

• The third signal occurred in the form of a reversal chart pattern formation after the break of EMA occurred, price continued the impulse move to also break the most recent structure low to the downside. This is a break of market structure, and it signals that the market structure has changed into a bearish one, therefore we can sell the market shortly.

• With the 3-level confirmation confluence trade gotten, I then proceeded to place my sell order in the demo account.

Sell order was placed at the current market price of $545.13, with my stop-loss placed at the top of the most recent lower high that formed after the price broke structure $551.0, my take profit was placed at $528.0. This also gave me a 1:2.7 risk to reward ratio and I risked $50 on the trade.

TRADE PLAYOUT

After placing my sell order, the price started to sell and the trend reversed to become bearish. However, the new trend was short-lived as the market reversed and began to buy back into my entry zone. I then closed the trade at breakeven, however, I am not fazed about the outcome of the trade, since I have learned in the crypto academy that not all trades will go our way hence we have to use proper risk management at all times. On this particular trade, I exited at breakeven and incurred no loss.

CONCLUSION

Welcome to the end of my presentation, thank you for your time and attention. In the homework task, I learned a great deal about how I can trade practically by using the confluence trading method, I also learned about the 2-level and 3-level confirmation trading and how I can apply them to my trading style. However, what impacted me the most is the practical session where I identified live trade setups in the crypto market and placed demo trades. This gave me a feel of what trading is like, and also reassured me that what we are being taught in the crypto academy are practical things we can use in the real world of trading and not just theories. Special thanks go to professor @reminiscence01, for teaching us these trade secrets, I enjoy much clarity studying his lectures.

Once again thank you for your time, I wish you a merry Christmas and a prosperous new year in advance, cheers.

Hello @nwabueze, I’m glad you participated in the 6th week Season 5 of the Beginner’s class at the Steemit Crypto Academy.

Unfortunately, you are not eligible to participate in this homework task. You didn't meet #club5050 requirement and you are powering down.

Remark: Homework Task Disqualified

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit