THE DONCHIAN CHANNEL

QUESTION 1:

EXPLAIN AND DEFINE IN YOUR OWN WORDS WHAT THE DONCHIAN CHANNELS ARE?

Hi, trust your day is going great? I hope so.

The Donchian Channel would be the center of our attention in this session of study. I'll be taking us on a detailed and explanatory trip on what Donchian Channels are, their Origin implementation in today's crypto market, and how we can use it in confluence with other price action techniques to place profitable trades based on percentage.

The images I'll be making reference to in this study session is gotten from my private wall on TradingView

INTRODUCTION

In introducing us to the concept of the Donchian Channels, I would like us to have a clear understanding of the origin of its invention, what it is, why it was created, where, and when amongst others.

The Donchian Channel is basically an Indicator created by Richard Donchian, a well-known and successful futures trader in his days, he invented the Donchian channel in the 1950s. Apart from being a successful Futures trader himself, He was also a fund manager credited with starting the first publicly managed futures fund, and the methods of funds management he incorporated have grown to become the basic foundations for today's modern-day money management firms. Although Richard Donchian was from a humble background of Turkish immigrants to the US, He worked his way to the top of his trading career through sheer persistency and unparallel ingenuity. He is widely regarded to be the "father of the trend following" trading system and even some modern-day trading methodologies. His invention of the Donchian Channel arises out of the need to measure volatility in the market, Richard Donchian realized volatility is what moves the market around and that if he could measure its impact at the end of the day it could help him to understand where the majority of the market participants are and what direction to anticipate the next move and also to help him in properly placing his stop-loss levels so as to avoid leaving a winning trade early. The Donchian Channel also helps to identify overbought and oversold areas of the market, potential reversal zones and can be used to identify areas of key support and resistance zones and to know when these areas have been broken so we can position ourselves to enter a profitable trade based on probability. I want us to know also that the Donchian Channel looks similar to the famous Bollinger Bands but in its case is only made up of three lines. Now that we have been duly introduced to who Richard Donchian is and his creation of the Donchian Channel, we can now move into discussing what the Donchian Channel really is.

THE DONCHIAN CHANNEL

In my own view, the Donchian Channel is a technical analysis indicator that is used to measure the level of volatility in the market. what is volatility? Volatility is basically a measurement of how far the price of an asset is moving up or down, when an asset moves up or down rapidly, we can say such a market is volatile and as such trading opportunities are present to either be long or short with probability for profit. The Donchian Channel attempts to measure the level of volatility that is present in the market so as to identify when the market is ready to buy or sell, and it also gives us an idea of which direction the market might expand towards and how to enter such trades. The Donchian Channel is an all-around indicator that can give profitable trade calls if properly understood, employed, and utilized. However, we must not forget that no indicator is able to provide by itself 100% accurate trade signals, to eliminate this inconsistency therefore, the Donchian Channel has to be blended with some price action techniques so as to get better trade entries and increase our probability of winning at the end of the day.

WHAT MAKES UP THE DONCHIAN CHANNEL

Visually, the Donchian Channel looks identical to the Bollinger Bands, but it is only made up of only three lines, the lines are used to identify the varying degrees of volatility and the different price levels the market has traded to in a predetermined period of time or candlestick formation.

The Donchian Channel lines are:

• The upper band: The upper band of the Donchian Channel shows to us the highest point price has reached in a particular period or amount of candlestick formation. The period is usually derived by assigning a fixed number of candlesticks formed from past price data, for example, purposes if we assign 20 as the period of the upper band, the upper band will calculate and highlight to us the highest point price has reached during the last 20 candlesticks, on that particular timeframe (e.g 4H, daily, weekly, etc).

• The lower band: The lower band of the Donchian Channel shows us the lowest point price has traded to in a specified period of time or candlestick formation, for instance, a 10 period lower band would help us to identify the lowest levels price has traded to in the past 10 candlesticks formation on the timeframe.

• The midrange band: This is the line that is formed in the middle of the upper and lower range, it helps us to identify the average movement of price volatility over a given period of candlestick formation by deriving the mathematical average of the upper and lower range bands.

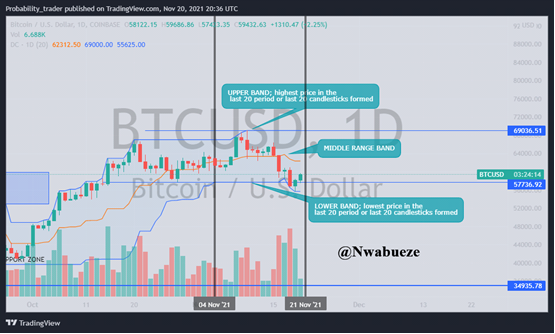

The screenshot above delineates the Donchian Channel's upper band, lower band, and midrange components on a Bitcoin 4h chart.

IMPLEMENTING DONCHIAN CHANNEL IN TRADING

The process of implementing an indicator as a strategy in our trading system holds some excitement, this is because implementing a trading system offers us the prospects of making profits when we can make a correct analysis and prediction of the market move, and who doesn't like the feel of profit-making I dare to ask.

However, an extra layer of care is required in implementing the Donchian Channel is a trading strategy since no indicator is able to provide by itself 100% accurate trade signals, the Donchian Channel has to be blended with some form of price action so as to increase our probability of winning at the end of the day.

DONCHIAN CHANNEL- UTILISED AS A BREAKOUT STRATEGY:

A top-notch way to utilize the Donchian Channel is by using the breakout strategy. The breakout strategy (can also be called rupture strategy) is a popular strategy that basically utilizes the Donchian Channel upper and lower bands to identify structure levels, after identifying the structure levels we wait till price breaks through the level and close above or below the range then we can begin to place our trade entry. Note, the price must close above the previous support zone (in a bullish case) before we can consider a trade entry. A decent 1:4 risk to reward can be realized if properly implemented, however, because breakouts are prone to fail at times, we must make sure to implement the Rupture strategy with adequate price action analysis on the higher time frames, so as to understand the general direction the market is approaching before entering.

DONCHIAN CHANNEL- UTILISED AS A REVERSAL STRATEGY:

In our journey to understanding how The Donchian Channels can be implemented, it is realized that the Donchian Channels can be as a reversal strategy, that is to it can be utilized to trade what is commonly referred to as a "counter-trend" method. This is done by using the upper and lower bands to identify overbought and oversold regions, as such when the price gets to these major zones we can expect a reaction to the opposite direction. when the price is at a support level, we wait for the price to react and break the midrange band, when this occurs it signifies weakness in the market condition and a reversal might occur. Note, we must wait for the price to break through the middle range band before placing the trade. A decent 1:2 can be realized from such reversal trades if properly analyzed and implemented with price action techniques.

ADDING DONCHIAN CHANNEL TO OUR OUR CHART

Adding the Donchian Channel to our chart will be done on the widely used tradingview, using the following steps:

• click on the indicator feature on your tradingview

• type "Donchian Channel" in the search box

• click the first Donchian Channel result that pops up, and it will be automatically added to your chart.

QUESTION 2:

EXPLAIN IN DETAIL HOW DONCHIAN CHANNEL IS CALCULATED?

In continuing the thorough exposition of the Donchian Channel as a viable trading system, we shall be exploring the methodologies involved in the calculation of the Donchian Channels.

By now we have established that the Donchian Channel is made up of three components

• Upper Band

• midrange Band

• Lower Band

The Donchian Channel can thus be calculated by calculating separately the upper band, middle band, and lower band

The upper band is calculated by deriving the highest point price has traded to in a specified period of time, this period of time can be denoted as n, and n can be assigned any value based on the timeframe it is being used. for example, if we assign n to be 20, then on the Daily chart the Donchian Channel would be calculating the highest point price has traded to in the past 20 days, similarly, if n is input as 14 on the 4H chart, then the Donchian Channel would be calculating the highest point traded to in the last 14 -4H candles that have been formed

The lower band is calculated by deriving the lowest point price has traded to in a specified period of time, which is n, so if our n is assigned to be 20, on the Daily chart the lower band would be calculating the lowest point price has reached in the last 20 days

The middle band, however, derives its reference from the average of the upper and lower band, that is we add up the upper band and lower band and divide them by 2 to get our middle band value

Let me explain this process vividly using an example of a Donchian Channel on the BTCUSD chart. However, On the computer chart, the Donchian Channel has plotted automatically, however, we have to put in the required period.

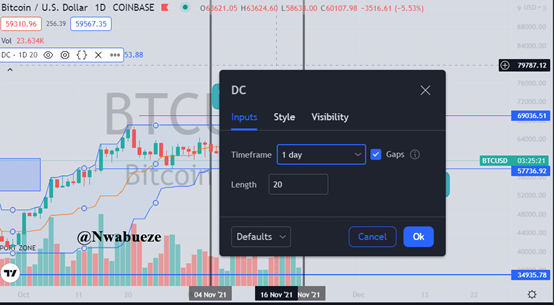

In the chart above the length is the period and it is set to 20, while the timeframe the indicator will be used on is the Daily timeframe.

Having set the Donchian Channel to 20 periods on the Daily Chart. The horizontal lines delineate the last 20 days on the BTCUSD chart and within this area, we can see the upper line showing us the highest point price traded to in the recent 20 days, the lower band shows us the lowest point price traded to also in the last 20 days and the middle range is fit in the middle showing the average of the upper and lower range.

QUESTION 3

EXPLAIN THE DIFFERENT TYPES OF USES AND INTERPRETATIONS OF DONCHIAN CHANNELS (WITH EXAMPLES OF BULLISH AND BEARISH TRADES)?

So far in this session, we have shown us what Donchian Channels are, their components and how they can be implemented on the charts also we looked at how they are formed on the chart.

We would be taking it a step further by looking at the various ways in which the Dochian Channel can be used and interpreted to maximize our trading experience.

Volatility:

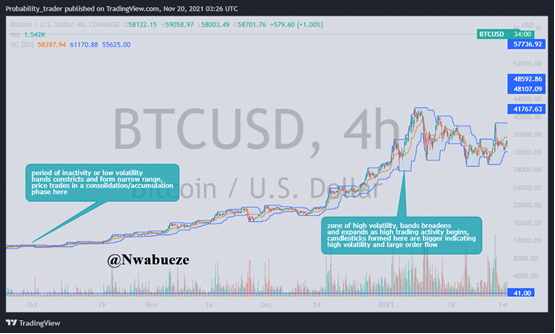

We must recognize that the Donchian Channel's primary function on the chart is to show us the level of volatility present in the market in a specified period of time. The Dochian Channel reveals this vital information through its bands. The bands tend to encapsulate the candlesticks on the chart and forms a sort of range in which price trades in, during periods of high volatility when buyers and sellers are active in the market the range of the Donchian Channels will expand as price rises or falls and price will cling to the upper or lower band in a bullish or bearish scenario. Let me reiterate that the expansion of the Donchian Channels indicates the presence of volatility in the market, also it can be observed that the candles formed are usually bigger, this can serve as a way of indicating the massive flow of orders from buyers and sellers. However, during periods of inactivity or low volatility in the market, the bands contract and form a narrow range within which price consolidates before the next expansion phase begins.

The screenshot shows how the Donchian Channel narrows and expands as volatility is detected in the market

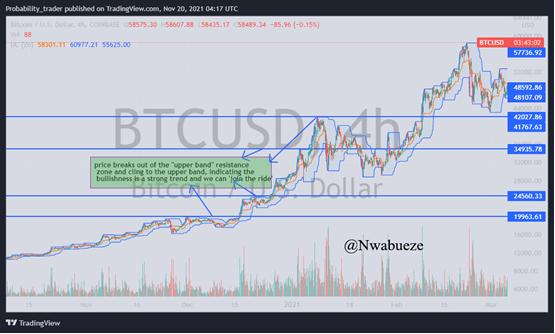

Key support and resistance zone breaks: The Donchian Channel is such a versatile technical analysis tool, its upper and lower bands can be utilized as key support and resistance zones. When we identify the support and resistance zones using the upper and lower bands We can observe when these market structure points are being broken and take advantage of such phenomenon to place meaningful trade entries based on probabilities.

The upper band represents the support zone, so when the upper band is broken to the upside and price clings to it and expands, this tells us the market is in a strong bullish trend and we can ‘join the ride’ depending on the direction.

Meanwhile, the lower band represents the resistance zone, when the lower band is broken to the downside and price adheres to it and falls, this indicates a strong bearish trend and we can identify meaningful trade entries based on probability

Overbought and oversold: In furthering our understanding of the uses of the Dochian Channels it is observed that the upper band zone can be referred to as an area of overbought. This is because in a volatile market, for the price to have traded to the upper band zone, there is usually a massive influx of buy orders, so at this point, we can say the market is in a state of overbought.

The opposite applies to overselling. as the lower band helps us to identify when the market is in the oversold region, due to the concentration of massive sell orders at the lower bands. The Donchian Channels help us identify overbought and oversold markets, which can be utilized to take reversal trades at each extreme

TRADING WITH DOCHIAN CHANNELS

Having looked at the Dochian Channels from different perspectives, defining it, examining its component, and looking at its various uses. Now is the time to look at practical examples of trading opportunities with the Dochian channel in a bullish and bearish scenario.

BULLISH TRADE EXAMPLE:

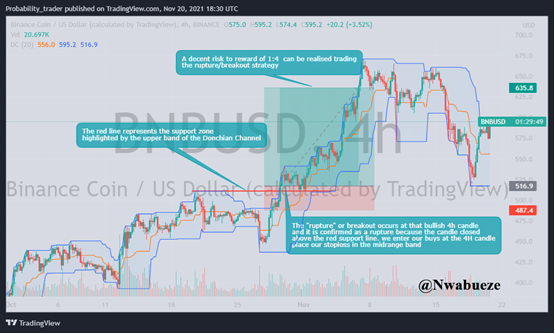

The Dochian Channel is well suited to trade in a bullish environment, we can effectively utilize the "Rupture" strategy also known as the breakout trading system, although we have previously explained the rupture strategy, we would be looking at it in this case with a practical example on the chart

On the chart, we can see the red line highlights the upper band which is our resistance zone. We have to wait however for the resistance zone to be broken and we most importantly close above it. Once the break of the resistance upper band is confirmed, we can then begin to plot an entry, by placing our stop-loss at the base of the midrange line. a 1:4 risk to reward can be gained using this method in a bullish market, which can prove to make us profitable in the long run with probabilities

BEARISH TRADE EXAMPLE:

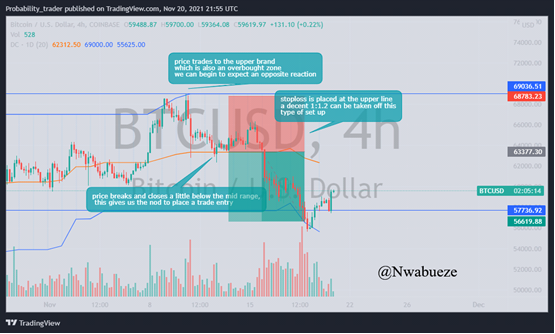

In a bearish environment, the Donchian Channel can still be employed by using the reversal or counter-trend method. This idea is based on the overbought and oversold theory of the Donchian Channel. As we have previously established, the upper line can serve as an overbought region and the lower line as an oversold area, due to the magnitude of buy and sell orders that id driving price at each extreme.

• In a bearish trade case, when the price reaches the upper zone, which is our overbought zone, we can expect certain weaknesses to creep into the market and make the price fall, this would be due to the introduction of new market participants and profit-taking by the buyers already in the market, the market can be expected to reverse towards the Donchian Channel lower band at least. This method can be used to take advantage of the retracements that tend to happen at overbought zones in the market. In this type of trading, the critical criteria that must play out before we consider a trade entry is;

• Price must be at an oversold region, I.e at trading at the upper band

• Price must breakthrough and close below the midrange line

It is after this has happened that we can then seek a trade entry

The chart below explains the bearish trade example in clear form

CONCLUSION

During this session, the Dochian Channel was explained in full detail and we see it is an old but still very effective technical analysis tool for making trade entries decisions in both bearish and bullish market scenarios.

I now understand in better detail, how the Drochian Channel works, and how it can be implemented on the chart to profitably trade the market.

At this point, however, I must issue a sound of warning, as the Drochian Channel is not to be independently used by itself in the market, but should be confluence with price action so as to eliminate to a reasonable extent inaccuracy in our analysis.

In all this study session was educating in all ramifications and I look forward to the next session.