![1[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmTnaVE6JiVTDptSiYXYi45zEbX67oMqbM6wfcT1nBWyxy/1[1].jpg)

WHAT IS VWAP INDICATOR?

Volume Weighted Average Price is a very useful tool that is used by traders around the world, due to its historic efficiency and profitability. This technical analysis tool is maximized in measuring the price average of an asset by volume. It has something that many indicators in the market lack during calculation; it has a unique feature that takes into consideration the volume of money traded in a specific duration of time. This gives the idea of the total money flow during a specific trading session. It measures the total cash flow in a particular trading session for example money movement big institutions and banks giving the retail trader the idea of where the market pressure is. When used in intraday duration, it gives the direction of the market and it operates similarly to the moving averages. When the price of an asset is above the VWAP indicator it connotes that the prices are rising and when the prices are seen below the VWAP, it means that prices are falling.

How to Add VWAP Indicator

The formula with which this indicator is calculated takes into account the following details

Price,

The volume of money traded,

Number of daily candles

Now, the way in which these data are arranged to get the calculation is stated below:

Price + Volume of Money Traded / Number of daily candles

We can break this down into steps as shown below

- For us to calculate the typical price for a period

We add the high + low + close / 3 - To proceed, multiply the typical price by the volume

- Proceed to create a cumulative total of typical prices

Typical price x volume - The final step is to divide the cumulative totals which means

VWAP= Cumulative (which connotes typical price x volume) divide by cumulative (Volume)

The reality that this indicator took this information in order to calculate it gives a valuable advantage since it offers us an accurate average price, It resets its value on a daily basis which distinguishes it from other indicators as it refreshes its data after the daily candle is completed giving it an advantage at its prevents previous days values from overlapping or messing with today’s market money volume. Furthermore, it operates like the moving averages such that when the prices of a market go up the indicator responds in like manner. We can use the VWAP at any time of the day. The VWAP solves one of the most common problems that we find with various amounts of indicators that are being used in the market, and that is that the “VWAP” value always remains the same in all time frames being applied and doesn’t repaint.

It may seem insignificant but it allows traders that operate at different times and different methods to carry out their operations with the same standards, therefore, making it available for usage to everyone.

Explain in your own words how the “Strategy with the VWAP indicator should be applied correctly.

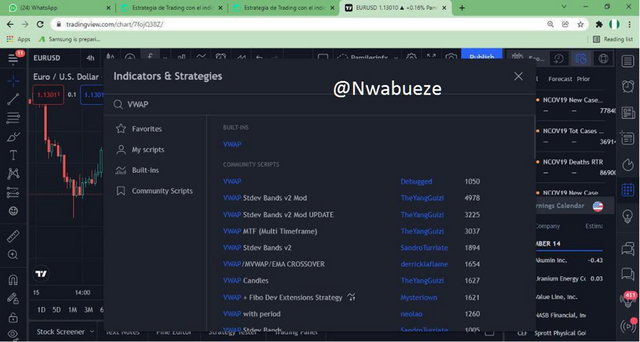

● Before showing you how this indicator is useful for being a strategy, firstly I would show you how to add the indicator to your charts using the trading view platform Steps:

● Navigate to the top of the screen and select "Indicators", place the word "VWAP" and add it to the chart

Once added to the chart graph, we go to the chart and click on the eye icon, and when the screen appears to observe only the details of the indicator, right-click on the indicator which is currently showing alone as shown in the screenshot below

The next step is to right-click on your chart and scroll to settings, style, here we will uncheck the options (Upper Band, Lower Band, and Bands Fill) and click on ok.

Click on where the blue line of the "VWAP" is, select the maximum thickness for this line and click on accept then go back and click on the eye icon again.

By now, the indicator is ready to use

With this indicator, the "VWAP" works as a magnet for the market price, since it is always attracting and moving it away, this shows that it is a very efficient trading tool to determine "Supports and Resistances present in the market ", In order to use this indicator to maximum efficiency, it is ideal to wait for the price to return to the" VWAP "to be able to make an entry, this will eliminate prevent us from using a weak trend or getting caught in small market moves, due to this, We will take advantage of the indicator giving us a very precise average price that is in line with the volume of money traded to increase our chances of success.

The Steps of The Strategy

Breakdown of Structure from Bearish to Bullish and Vice Versa

The first thing is to wait for the previous high or low to be broken depending on the current market trend (bullish or bearish) and that then the price makes a clear breakout of the VWAP to be able to take that break as valid and we then follow the other steps of this strategy to be able to take an efficient operation with this strategy.

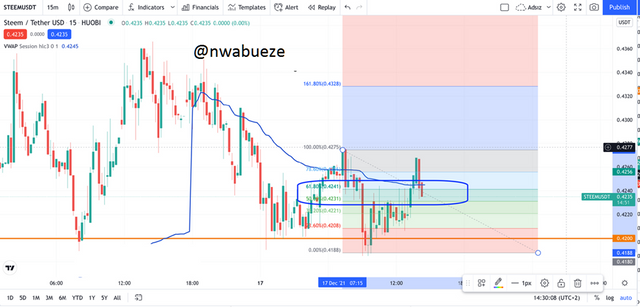

Retracement to the VWAP (Use of the Fibonacci):

The next thing that we must watch out for, is that the price begins to make a retracement after the last bearish breakout made causing the break of the last swing low,

the price starts to retrace, when we observe this movement we should take our Fibonacci tool,(Fibonacci Retracements) and measure that last momentum from the swing high. Once this is done, we must be very attentive to the 50% and 61.8% levels or (0.50 and 0.618) levels depending on your Fibonacci default settings, because that is the best entry zone as long as the price returns to the “VWAP” and it is within the aforementioned zone.

Correct Management:

The “Take Profit” should be 1.5 times More than our SL, this will give us a risk-benefit ratio of 1-1.5 to 1-2 as maximum. Generally, it is good to use stop losses that are approximately 1.5 times the initial entry point. If the price reaches the zones where we have planned (the 50% and 61.8%) zone, our “Stop Loss must go below the aforementioned zone, that is, a little below the 61.8%.

3. Explain in detail the trade entry and exit criteria to take into account to correctly apply the strategy with the VWAP indicator?

The trading entry and exit criteria of this strategy are easy, but it is necessary to follow all rules to the core to ensure efficiency and obtain the best results with it. Below I will present these steps taking into account both settings, (bullish and bearish).

When the price shows the last swing high or swing low, we must make sure that the price clearly breaks this zone, it must clearly break the zone either by little or large, it must be visible that swing high or swing low has been broken. If this does not happen the strategy will not work correctly and it is better to look for another opportunity where this specific condition is met. In essence, if we are to place trades in bullish conditions, the price of the asset must have passed the previous high formation. Also, there must be a period where the price of the asset coincides with the aforementioned critical points.

The VWAP indicator is a good tool to determine support and Resistance, before a trade a placed we must patiently wait, for the price of the market to return to the VWAP to be able to make a purchase.

The VWAP works for any kind of market. To effectively enter a trade market using VWAP, the factors below must be considered.

Structure Break down (Bearish to Bullish, Bullish to Bearish).

The breakdown of the market about the VWAP must first be understood maybe the candles are in a bullish trend in respect to the VWAP or are in a bearish trend. The below image is in a bullish trend concerning the VWAP.

Retracement to VWAP (Use of Fibonacci).

The next thing to monitor and to look out for is a retracement of the price in the market, i.e. after that last bearish trend in the market, the market move into a bullish trend. Whenever we realize retracement, we must take our Fibonacci tool which is known as a Fibonacci retracement, and measure the last momentum of the market upwards. The 50% and 61.8% levels must be taken into consideration because it is the optimal entry zone.

Correct Management.

The price, when it gets to the stage that has been planned in the 50% and the 61.8% Zone, the stop loss must go below the mentioned zone, which is below 61.8%. Meanwhile, the take profit should be 1.5 bigger than the stop loss

Validated Break

After we notice the break is validated, we must wait for the price to begin to retracement irrespective of its direction (Bullish or Bearish), After this plays out, we must trace our "Fibonacci Retracement" at the last impulsive move and wait for that the price in conjunction with the "VWAP" enters the zone of 50% and 61.8% of the Fibonacci. If the market doesn't play out exactly as I'm describing, it is advisable to look for another entry as the strategy would be invalid.

To have proper and safe risk management, our "Stop Loss" must be below the 50% and 61.8% zone, since it will not give enough room in the event that the price drops just a little bit. Our "Take profit" must be 1.5 times above based on our SL, which means that our risk and benefit ratio will be 1-1.5 and a maximum of 1-2

Bearish Trade

After choosing my currency pair I ensured that I had my Fibonacci drawn after putting into consideration my take profit and stop loss.

I used the 1.5 times rule as explained earlier, I was able to make an entry at 0.42 and my take profit level was at 0.41 which was a perfect trade for me.

Though little, but the operational principle also works in terms of big trades

Conclusion

The indicator goes a long way in helping traders of the financial market make quick decisions as to the direction of the market. Even without using another indicator in addition to it, although it's advisable to, there's a measurable degree of accurate signals the indicator gives as it works with volume.