Hi friends, the steemit crypto academy season has begun again, and this new season provides us with an opportunity to learn more about trading. The task given by professor @nane15 is based on the basics of correct trade strategies.

Cryptocurrency trading is extremely risky and one basic way to navigate through the risk is by having a basic understanding of the market operation. As a result of the news spread about profit made from cryptocurrency trading, a lot of people jump into it everyday without getting the required knowledge about its operations and this can perfectly explain the reason for the massive loss and a run away from the world of cryptocurrency entirely.

What do you understand by trading? Explain your understanding in you own words.

Trading is a form of exchange of assets, commodities, goods, stocks etc. When there is an exchange of property for another one or for money, the act is described as an act of trading. Trading as an act is present in almost every sectors of the world, trading is an everyday act and the survival of some families even depends on it.

Trading in crypto space is extremely similar with the act of trading in the physical world, it involves the exchange of one virtual token for another or the exchange of the virtual token for physical cash. Some traders purchase a token for a little amount and then hold on to it until the prices increases, they could either get the increased value of token exchanged for another token or for spendable fiat.

Basically, price change is a result of market demand and supply, the more the demand of a particuar token, the higher the price of the token will be. On the other hand, the regular sale of an asset will result in a price decline. Trading entails certain indicators and market analysis that traders use in order to make sound trade decisions. The aim of every trader is to make profit and the proper understanding of trade indicators will make it easy for the profit to be made.

Cryptocurrency traders are those who are skilled in the act of buying and selling crypto assets. A crypto trader can either be carrying out the trade as an individual or working for a company, there are different cryptocurrency platforms available, each of these platforms presents interested individuals with the right to earn, crypto traders are usually the ones who help the people earning through these trading platforms convert their earned tokens into fiat.

What are the strong and weak hands in the market? Be graphic and provide a full explanation.

I have established earlier that the market is controlled by demand and supply, the strength of the demand or supply is determined by the hands who have control over the market. The hands in the market could either be a strong hand or a weak hand

Strong hands in the market are basically the main controllers of the market and this is the because of their large capital capacity. They have the strength to manipulate market price because they buy and sell in very large quantities. A major investment by a strong hand in the market otherwise known as a whale could cause a drastic price pump, on the other hand, a major withdrawal from the market by a strong hand in the market, will result in a drastic price decline.

Weak hands in the market are small investors, the activities of weak hands in the market have no effect over the market. Weak hands in the market do not have sufficient capital to have any effect over the performance of the market.

Weak hands are usually the victim's of the market because they follow the trends master-minded by the strong hands. The activities around the market works in favour of the strong hands and leave majority of the weak hands handicapped.

Strong hands usually see the low point of an asset as an opportunity to gather assets massively, they sell off these tokens at every price increase caused by the accumulation of those tokens. Innocent traders who may have seen how the asset seem to be performing well, will also buy into the asset with the hope for more increase, this expected increase may never happen because the strong hand at this point, has gotten off with the profit he has made from the investment.

The Strong hand purchases the tokens during the accumulation period with their funds, not letting the weak hand get a glimpse of what is happening in the market, after several purchases, they start to pump the coin or push it upwards after which they weak hands notices and start to buy into the asset. After the price gets to their desired points, they start to sell off gradually, thereby causing a distribution period. The strong hands sell off their holdings completely in the distribution period when the weak hands are putting pressure to buy more, thereby causing the market to start falling and the weak hand losing money.

Which do you think is the better idea: think like the pack or as a pro?

Thinking like a pro is a better idea, because the pro understand market activities and can easily predict what the next move of the market is going to be based on proper evaluation. The pack on the other hand will easily follow the trend which is definitely orchestrated by the pro's themselves.

Thinking like a pro during trading is one smart way to make massive trade profits. Thinking like a pro is a good way to minimize possible loss even if loss during trading is inevitable. Only a few traders think like a pro, others simply follow the masses and those smart traders who think like a pro are the ones who enjoy the associated benefits of trading.

The use of technical indicators, studying market trends properly before making any financial decision is a characteristics of pro investors and everyone who wants to make profit from the market must think as such.

Demonstrate your understanding of trend trading. (Use cryptocurrency chart screenshots).

Market trend is identified when there is a price movement for a long time in a certain direction. Trend trading is the use of trade indicators to determine the movement of an asset which could either be in an upward or downward direction.

Trend trading can either be: An uptrend, A downtrend or a Range market depending on market activities.

- Uptrend Market: An uptrend in the market is characterized by continuous buy orders which will keep the asset price to continue ascending. Drawing a chart for a market uptrend is set by connecting higher highs and higher lows.

- Downtrend Market: A downtrend market is characterized by continuous sell orders which will cause the price of an asset to continually move in a downward motion. The chart describing a downward market is drawn by connecting lower highs.

- Range Market: A ranging market is a market without a direction, when the market is in a ranging phase, smart traders hold on for a while until the market makes a decision to either continue with previous trend or get to pick a new trend direction.

Show how to identify the first and last impulse waves in a trend, plus explain the importance of this (Use cryptocurrency chart screenshots).

The identification of the first and last impulse in trading helps traders identify a good point of market entry and exit, it also shows the new market direction that traders can take advantage and benefit from.

The First Impulse.

The first impulse is the first set of wave after the accumulation in the Elliot wave. The Accumulation period is the period where the strong hands purchase the asset before it starts to push forward. The first impulse allow traders get nto the train very fast and help them make profit from the trade.

The Last Impulse.

The Last Impulse is the 5th wave of the Elliot wave. This is the wave after the 4th reverse wave. The 5th wave is the wave where traders start to sell of their assets so as not to get caught up in the correction phase. After the 5th impulse wave, strong hands start to sell of their holding gradually and after the 5th impulse is the correction wave.

Show how to identify a good point to set a buy and sell order. (Use cryptocurrency screenshots).

Setting a buy and sell order is extremely important because it is the whole essence of trading. A trader would lose their entire funds if they cannot find a good entry or exit point during a trade. While trading a trend using the Elliot Wave (as in an uptrend), the buy is literally during the breakout from its accumulation period. It could also be after the 3rd impulse breaks ahead of the first impulse high.

A very good time to sell using the Elliot wave is when the current impulse has broken out of the previous impulse low. When the impulse low is broken, then a sell order is placed.

Explain the relationship of Elliott Wave Theory with the explained method. Be graphic when explaining

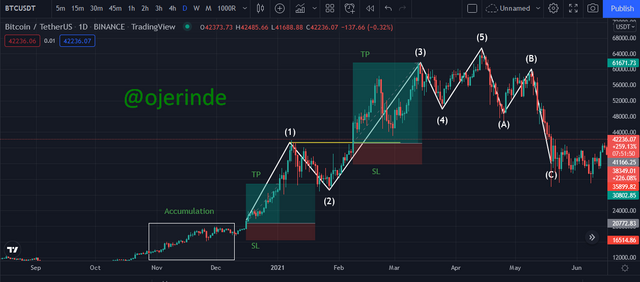

From the above chart describing the Elliot wave, the accumulation period is found before the first wave. The accumulation period is the period where strong hands buy into the market, These whales purchase assets without raising the eyebrows of any other trader, they do it in a very discrete way. The First impulse wave then begins and this is the point where intelligent traders start to get in. The first wave ends and the second wave which is a reversal begins, the second wave doesn't go below the first wave starting point proving that the Elliot wave isn't violated. When the second wave ends, the third wave begins which is an impulse that goes far above the previous high of the first wave. When the third impulse is done, the forth retrace begins but do not go below the third impulse after which the 5th impulse begins. At the fifth impulse ending, there is a distribution period which is when traders start to sell off.

This begins the correction wave A,B and C. Correction wave A gives an impulse downwards, after which a reversal wave B takes place . The reversal wave B doesn't go above the starting point of the impulse wave A. When reverse wave B is over, the impulse wave C which is a correction wave begins and goes below the low of the previous impulse A.

Conclusion

Trading goes beyond dabbling into the market and out of it, it goes as far as understanding the fundamentals and the technical analysis of the market. Understanding when to enter and exit a trade is very important and this can only be done when the trader understands the market they are in.

Trend is what identifies the movement of price so it is important not to trade against the trend of the market rather it is good to trade the trend. I must commend the effort of professor @nane15 for this impressive lecture and I am glad to have worked on the assignment. I hope to be a part of these class net time.