A new week gives us another opportunity to learn more about cryptocurrency through the steemit crypto academy, and with the help of smart professors who provide us with great topics and lectures every week, we are able to improve our knowledge concerning cryptocurrency topics. This week, I will be answering the question asked by professor @shemul21 on crypto trading with moving averages. After the professor has extensively explained the topic, we have also been required to answer questions to prove that we clearly understand the topic.

Explaining Moving Average

The market is controlled by demand and supply, which determines the direction of a chart price. Also, the direction of the market determines the trends. In other, to trade excellently as a good trader, it is important to study the market and understand the direction of the market thereby allowing you to identify good entry and exit points.

Moving Average is an indicator used for trading the financial market, in fact, it is one of the most popular indicator when trading. It is used to smoothen the price data in a chart, thereby allowing a trader to identify the direction of a market. A Moving Average is an oscillating line which appears in the chart, close to the price which is calculated arithmetically by summing up the average amount of the total closing price in a particular period by the number of the period.

Example: A 20-Day Moving Average is calculated as the total amount of closing price in the last 20 days and divided by the number of period (20).

Functions of Moving Average (MA)

- Identifying Price trend (Uptrend/Downtrend).

As seen in the chart displayed above, a trader can easily identify the presence of an uptrend and downtrend with the help of the Moving Average. When the price crosses above the moving average, and the moving average is moving in an upward direction, this indicates an uptrend. In the same vein, when the price crosses below the moving average and the moving average is seen heading in a downward direction, then a downtrend is confirmed.

Moving Average (MA) helps traders identify trade signals, including entry and exits.

Moving Averages are used to know support and resistance level. To identify this, the trader looks at the precedent history of the market

Different Types of Moving Averages

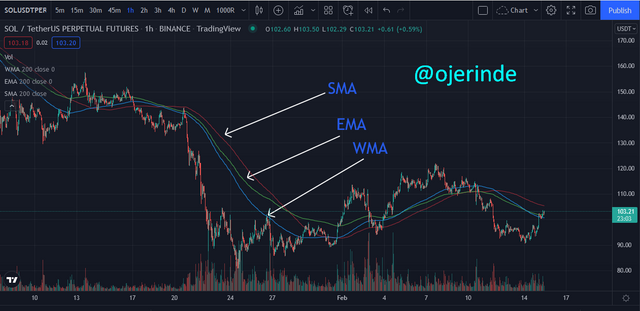

There are different moving averages, but there are three major Moving Averages that we will be exploring in this post.

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

- Weighted Moving Average (WMA)

Simple Moving Average is a Moving Average formed by calculating the average price of the asset over a specific period. It is the simplest form of Moving average and it is calculated based on the closing price of the market (although it can be calculated based on open, high, low, etc, but it is in default to calculate using the close price of the asset over a period of time).

Simple Moving Average can be calculated mathematically as;

SMA = (P1 + P2 +P3...+Pn) / n

Where n = Number of Period,

P = Closing Price

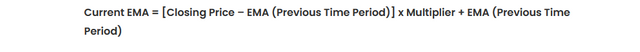

While EMA and SMA are both Moving Averages, EMA reduces lag encountered while using SMA by adding more weight to the recent price relative to the previous prices within a period. EMA reacts faster to price movement compared to SMA that reacts to price slowly.

Below is the formula for EMA calculation:

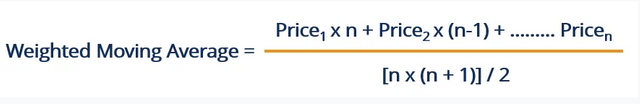

Weighted Moving Average is the fastest of all Moving Averages, it puts the most weight on the current price than the previous price. WMA puts more weight on each new price compared to its previous price, this makes it very reactive to the price and useful to traders who want to trade on a short run.

Calculating WMA:

Differentiating SMA, EMA, and WMA

| Simple Moving Average | Exponential Moving Average | Weighted Moving Average |

|---|---|---|

| It is plotted by calculating the average price of a cryptocurrency over a period of time | It Emphasizes weight on the current price with a multiplier | It emphasizes weight on the current price but pay less attention to the price before the current one and the lesser weight is emphasized as it goes farther. |

| Allows traders to trade on a long term | Allows traders to trade on a short term | It is good for trading both short and long term trading |

| It is the slowest Moving Average to follow price action | It is faster than the SMA to follow price | It is the fastest to follow the price, and it is very sensitive. |

Identifying Entry and Exit Points Using Moving Average

In other to identify an entry and exit point using Moving Average, 200-period EMA will be used.

Uptrend

At the point when the price crosses above the 200-EMA while the EMA is also moving upwards, then a buy order is entered. The buy order remains active until the price crosses below the moving average, thereby changing direction.

So many traders wait for the price to cross through the Moving Average downwards before exiting the trade, but for me, I prefer to leave a trade when the good is going and so I will exit the trade at the take profit point at risk/reward ratio of 1:5.

Downtrend

To enter a downward trade using Moving Average, the price the cross the 200-EMA downwards and the 200-EMA will be heading downwards. At the point where the price crosses downward, a sell entry is made.

The trade is done at a risk/reward ratio of 1:5, the sell trade is entered. The market can be exited when the price crosses above the Moving Average.

Understanding Moving Average Crossover

Crossover in Moving Average involves two or more moving Averages, the fast and low moving averages. The process where the moving Averages cross one another (the faster moving Average cross the slower moving average) is known as crossover.

Crossover can occur for bullish or bearish trades, the process whereby a faster moving average crosses a slower moving average upwards signals a bullish trend and it is called golden cross

The process where a faster moving average crosses below a slower moving average and heading downwards is known as a death cross. In a death Cross, the price is going downwards.

The limitations of Moving Average

Moving Average is a useful indicator with lots of benefits, but it does not exist without its own limitations, some of the limitations of Moving Average are:

Moving Average indicator cannot be completely relied on because on occasions of sudden fluctuations in price movement, a fake signal could be generated.

In Moving Average indicator, the data used are revised which means the signal generated could also be a revised one which will definitely result in the generation of false signals

The use of Moving Average does not take some data's into consideration, an example of such data is the one that is not included in the calculation of average data.

The indicator a lagging indicator which results in late signal especially when there is trend reversal.

Conclusion

This topic is a very educating topic, thanks to professor @shemul21 for the gained knowledge.

Moving Average is a great indicator that provides ease to traders by helping them identify entry and exit points easily.