Theory

(1) State in your own words what you understand about the Perfect Entry Strategy (Place at least 2 examples on crypto assets)?

(2) Explain in your own words what candlestick pattern we should expect to execute a market entry using the Perfect Entry Strategy.

(3) Explain the trading entry and exit criteria for buy and sell positions in any cryptocurrency of your choice (Share your screenshots)

Practice (Remember to use your own images and put your username)

(1) Trade 2 demo account trades using the “Perfect Entry” strategy for both a “Bullish” and “Bearish” scenario. Please use a shorter period to execute your entries. Important you must run your entries in a demo account to be properly evaluated.

INTRODUCTION: Good day everyone, welcome to my homework in the Steemit crypto academy season 5 week 3. I trust we had a great day, I will be making my homework post on "Perfect Entry" Strategy using Stochastic Oscillator + 200 Simple Moving Average lectured by @lenonmc21. Enjoy!!! As you read.

Theory

Perfect entry strategy is a strategy that allows traders to determine a reversal point in a market Trend, it can be found in both an uptrend and a downtrend combining three strong tools which is the 200 moving average, stochastic indicator, and a specific candlestick which will be more explained soon. A perfect entry strategy is a powerful entry strategy that gives a trader's edge over the market to know when a reversal is bound to occur.

Before this strategy can work out well we have to be patient enough to allow all the three confluences to form so we will not fall victim to fake-out. Things to look out for while trading the perfect entry strategy.

- Market Trend.

- 200 moving average.

- stochastic indicator.

It is very important to determine the market trend before taking any order because there's a saying that don't go against the trend and the trend can be determined in various ways in which I love making use of trend lines at higher time frames like H1, H4 and Daily chart depending on the kind of trade I want to take and knowing the trend is a major factor in using the perfect entry strategy.

Moving averages are calculated according to the previous behavior of the market, 200 moving average was chosen because its the moving average that best suits the perfect entry strategy, in making use of this moving average we need to wait patiently to allow the price to go closer to the moving average and close there, the candlestick to be spotted is a candlestick with wick both sides looking like a Doji.

The stochastic indicator is one of the most powerful indicators that was developed by George Lane in the 1950s, this indicator calculates price action using real-time that's why it's reliable combining it with other facts when the above two confluence are ready and set we confirm it with this indicator when it is at the overbought we take a sell order and when it is oversold we take a buy order.

The best candlestick pattern to watch out for is a Doji because it has a long wick at the opening and at the closing of the candle, anytime we spot a Doji on a chart it indicates that there's an imbalance in the market price meaning the bulls trying to buy and the bears are trying to sell, the drag in market price forms a Doji candlestick pattern which is needed for perfect entry strategy whereby it's spotted close to the 200 moving average we would be ready for a reversal in trend and the most important thing is to wait patiently allow us to get all the three confluences formed, then we take ours with good risk-reward management.

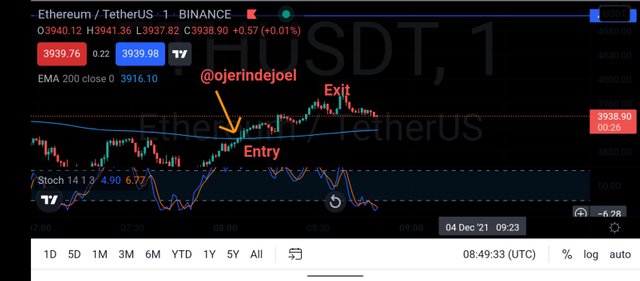

I will like to make use of ETHUSDT in making my analysis using the perfect entry strategy

BUY POSITION

To make use of the perfect entry strategy I had to patiently wait for the candlesticks to form very well so as not to fall Victim to fake out.

The arrow marked yellow denote where the 200 moving average and the Doji candlestick pattern are very close to each, respecting the fact that my stochastic indicator is oversold which is confirming the bullish reversal, then I took my entry at the cross above the 200 moving average and took my *exit where I had double tops and candles moving backs toward the 200 moving average line.

SELL POSITION

Making use of perfect entry strategy using the same principle as that of the buy position, I waited for the market price to move closer to the 200 moving average then I waited for a candlestick with wick (Doji) to form close to the 200moving average and I confirmed my entry with the stochastic indicator when it got to the overbought region I took a Sell entry when the price closed below the moving average combined with my stochastic indicator as confirmation and I exited the market when I saw the price was ranging I had to exit because ranging means that we have a lesser volume of people in the market.

Practice

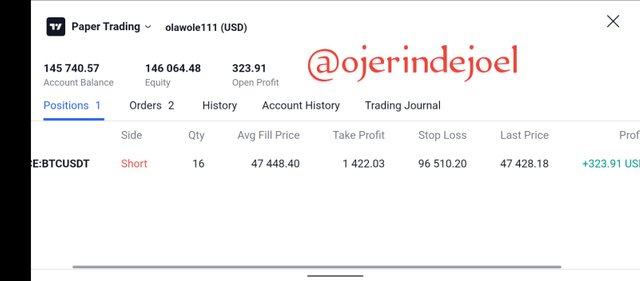

Using a 1minutes timeframe on BTCUSDT

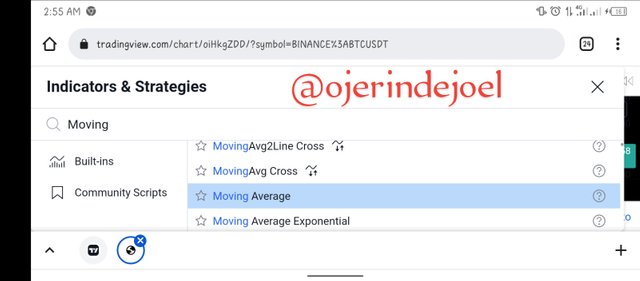

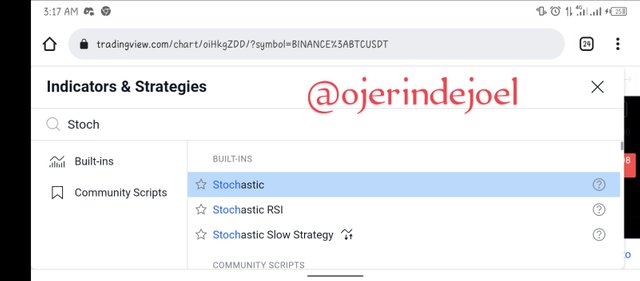

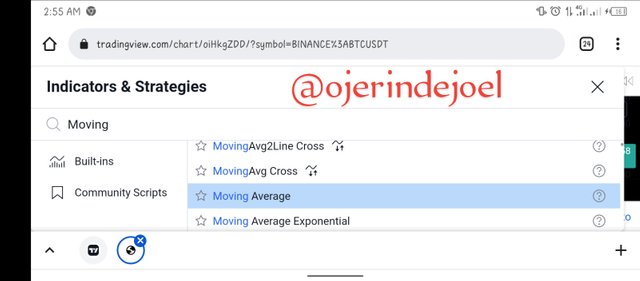

- I added moving average on the BTCUSDT chart.

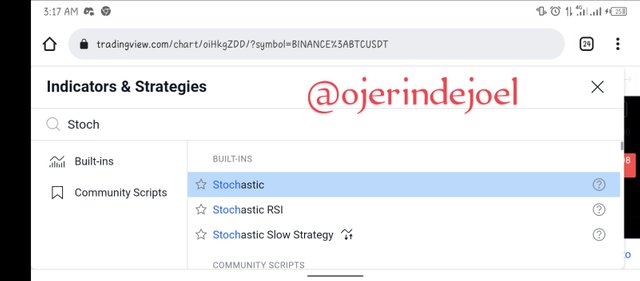

- I added the stochastic indicator on my chart also, the waited patiently for the perfect entry strategy to form.

- When the price got close to the 200 moving average and a Doji candlestick formed close to the moving average and the stochastic indicator at overbought. Then I took my entry.

- I had a profit of $323 after exiting the position.

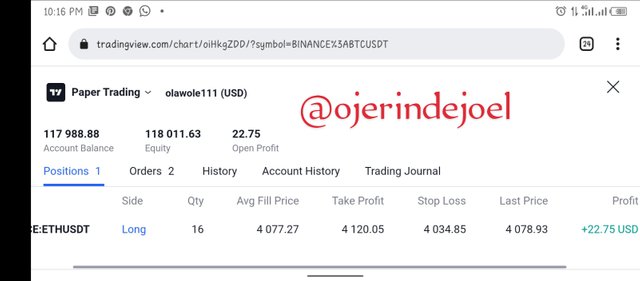

Using a 5 minutes timeframe on ETHUSDT

- After adding 200 moving average and the stochastic indicator.

As soon as the price got near to the 200 moving average, I waited for the Doji candlestick to form close to the 200 moving average merging with the stochastic at oversold.

I allowed the price to break the moving average upward then I took a buy entry

As soon as the market was making a rejection at the upside I exited the trade.

And I made a profit of $22 after exiting the trade.

CONCLUSION

Finally, it's been a nice time trading using the perfect entry strategy, it is the combination of three confluences to give a very good entry, on of the most important thing using the perfect entry strategy is waiting patiently for the three confluences to form because if only two formed out of three we might not get the maximum profit we ought to get and it can also lead to fake out and the rules behind using this strategy most be followed.

As we all know that using indicators along will mog give a better result but combining with other elements and factors will give us a perfect entry.

NB: ALL SCREENSHOTS ARE FROM TRADING VIEW.