Hello Professor @kouba01

What is cryptocurrency Cfd ?

Now, the curiosity about cryptocurrncy has started increasing in the people, due to which it is trending very much.As crypto coins proved itself, it enabled brokers / intermediaries to invest in this sector as well. Previously, contracts were made on products such as stocks, commodities, indices, exchange traded funds, fiat currency on the difference contracts platforms. For a few years (or more), contracts have started to be made on cryptocurrency assets.

CFDs works by an individual putting down a portion of his investment amount. So this simply means that leverages can multiply the prices change on what profit the investor has gained or loose. This could sometimes lead to you losing money rapidly.

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

Everyone of us as a human being is aware of one's strengths and weaknesses. Extrapolating the same , to the trading potentials , we are all aware of areas where we are strong and areas where there is still some scope of improvement. Keeping those potentials under consideration, one has to decide weather CFDs synchronize with our trading strategy or not. Let's take examples

As a trader, I should be aware of my risk potential, weather my risk potential is conservative , moderate or aggressive. On that basis , I'll decide which CFD contract I should enter and whether I should enter or not.

Trading knowledge, skills and expertise are other factors that will help in determining whether to go for CFDs trading or not. If you are an expert trader, then you should give try to CFDs too because at times, you can secure huge profit in short intervals of time. Leverage and margin trading are other perspectives linked to CFDs where one should do proper risk benefit analysis to determine whether to enter or not.

Are CFDs risky financial products?

yes ,Just as all business and entrepreneurship, risk is part of the world economy and in cryptocurrency CFDs there are various risks.

Leverage risk: In cases like these, only a small part of the capital is deposited to open a position, however, despite that your gains or losses are based on the total value of the exposure (that is, the leverage that would be money that the broker gave you). This indicates that both gains and losses can be very large.

Another risk is the variable of the value of the asset (cryptocurrency) over time, this indicates that the fact that the currency may increase or decrease in value is risky.

Do all brokers offer cryptocurrency CFDs?

Not all brokers are into CFDs trading but the few ones among those providers are presented herein under:

- Plus-500 - A platform listed in the London Stock Exchange with the largest range of cryptocurrencies.

- IC Market - The best of Meta Trader 5 for crypto currencies.

- eToro, a top social cryptocurrency trading platform

- Ava Trade - Good at CFDs spread.

Explain how you can trade with cryptocurrency CFDs on one of the brokers

.jpeg)

Go to this websites https://www.etoro.com/ & Create account

.jpeg)

After creating account Go to virtual portfolio where you can learn trading without any fee or any loss .

.jpeg)

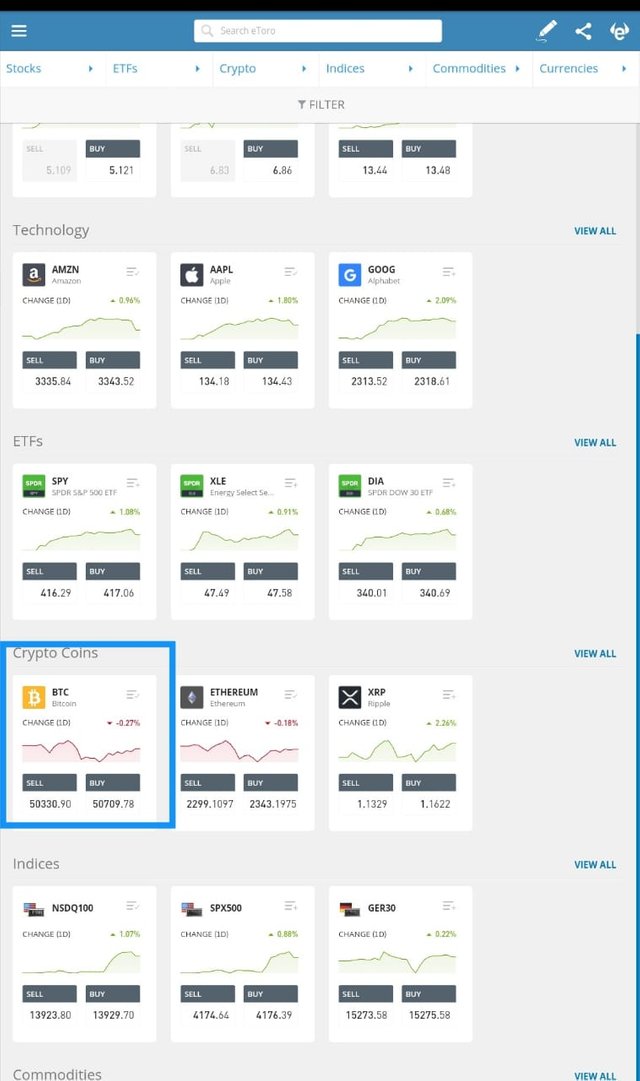

Click on trade market option where you can see options of an asset you can use for trade.

I chose bitcoin so I will be getting an asset in the bitcoin with the amount I have in my virtual portfolio

.jpeg)

you can see how much unit or asset you are buying in tue cryptocurrency you are trading or investing in. Then click on open trade.

.jpeg)

you can see your investment , profit and loss and your current value

Conclusion

I think that CFDs are very useful channels to increase the profit margin of an investment if the investor is correct with respect to the speculations that he has of the cryptocurrency or asset in which he wants to invest.

However, it should not be forgotten that the risks are increasing depending on the amount invested, the leverage, the future value of the cryptocurrency and the trust between the broker and the client.

Cc:

@steemitblog

@kouba01

Hello @okeyjeoulous02,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 7/10 rating, according to the following scale:

My review :

Article with good content, you were able to clearly answer the questions asked.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit