It is with great pleasure to be a participant in this week assignment of professor @reddileep, which he taught about Cryptocurrency Triangular Arbitrage , I can say I understood the class and I have been able to give back based on my own understanding and the research I made. I stand corrected in any way as I might have come short in details of a particular question.

Define Arbitrage Trading in your own words.

Arbitrage trading solely involves buying of a crypto asset at a low price and selling at an high price within two or more different platforms at the same time in order to make profit.

For this to be possible arbitrage traders requires two or more exchanges, trader need to buy from one exchange at a low price and sell in another at a high price in the course to make profit easily without waste of time.

As arbitrage trader are called Arbitrageurs, takes advantage of price difference of a crypto asset on two or more different platforms.

For example the price of ETH at the time of writing this post on the binance platform is $3005 and the price of ETH on coinbase another platform at the same time is $2895. With this point, there is an arbitrary opportunity for traders to buy ETH from coinbase and sell at an high price at binance as such users has made a profit percentage using this investment strategy.

In a simple word selling higher than you purchased on different platforms in order to make profit from an imbalance in price is known as arbitage trading, a risk free way to make profit.

Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

There are many types of arbitrary, amongst the many is the following:-

- RETAIL ARBITRAGE

- NEGATIVE ARBITRAGE

- EXCHANGE ARBITRAGE

RETAIL ARBITRAGE:-

In this type of arbitrage, trading can be performed using retail products from the market. for example some products are been ordered from China, Turkey at a very low price and sold online at a higher price on another market.

NEGATIVE ARBITRAGE:-

In this type of arbitrage, it occurs that the interest rate paid by a borrower is higher than the interest rate earned from the money borrowed.

EXCHANGE ARBITRAGE:-

in this type of arbitrate, it requires two exchange platform to perform this type of arbitrage trading. When an asset is trading in different price on a different exchange platform at the same time, it is an act of buying and selling of assets within two different exchange platform, taking advantage of price difference in the assets in question on both exchanges at the same time. for example, if the price of XRP on the binance exchange is $280 and the price of XRP on the coinbase exchange $300 the price difference is seen at the same time, an arbitrageur takes advantage of the price difference by buying in the binance exchange and selling at the coinbase exchange.

Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

Triangular arbitrage strategy can be performed in a single exchange with three different coin of price difference, thereby circulating investment within three different coin in an exchange and then back to the first initial coin before circulation.

It procedure goes as follows, when an asset is sold to another asset, whereby the new asset is sold for another asset and the last asset is sold back to the initial asset which complete the circulation in other to make profit.

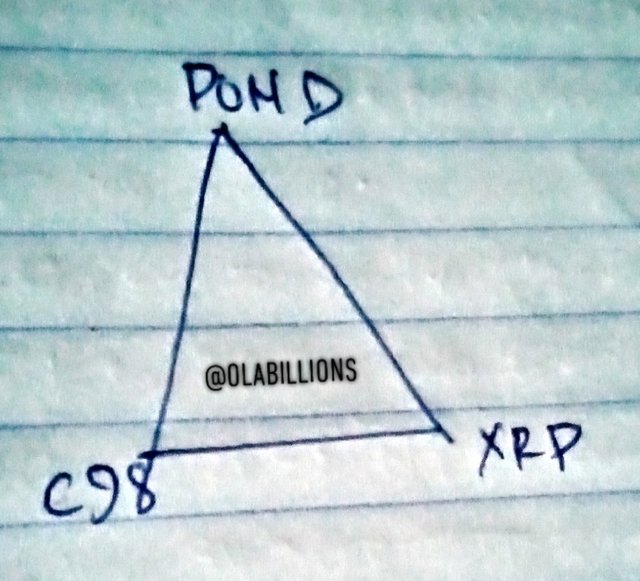

Let make POND, XRP and c98 for example, these are the three crypto coin to go under the triangular arbitrage strategy, the first coin POND will be sold to the second coin XRP, where by the second coin will buy the third coin which is c98 and lastly the last coin will buy the first coin which is POND, this circulation will make a profit without risking much if the entry point are correct.

Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

From the screenshot above the verification of both exchanges can be seen.

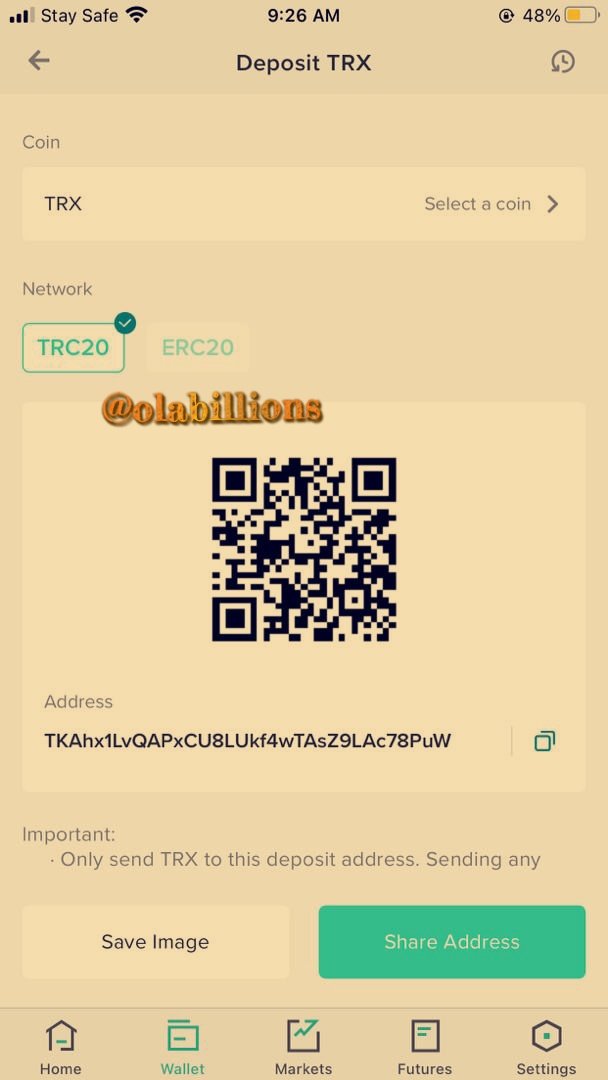

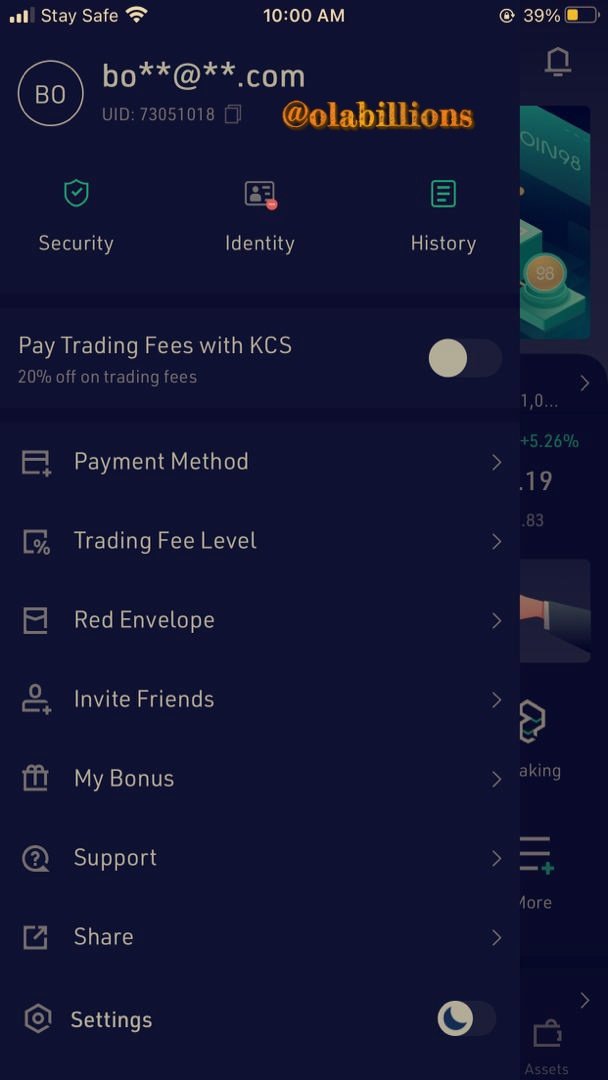

In the course to perform the exchange arbitrage, i used two exchanges of which I bought TRX at a lower price in an exchange called kucoin with 23.5625 USD at the price of 0.092605 having a 254.1868 amount of TRX.

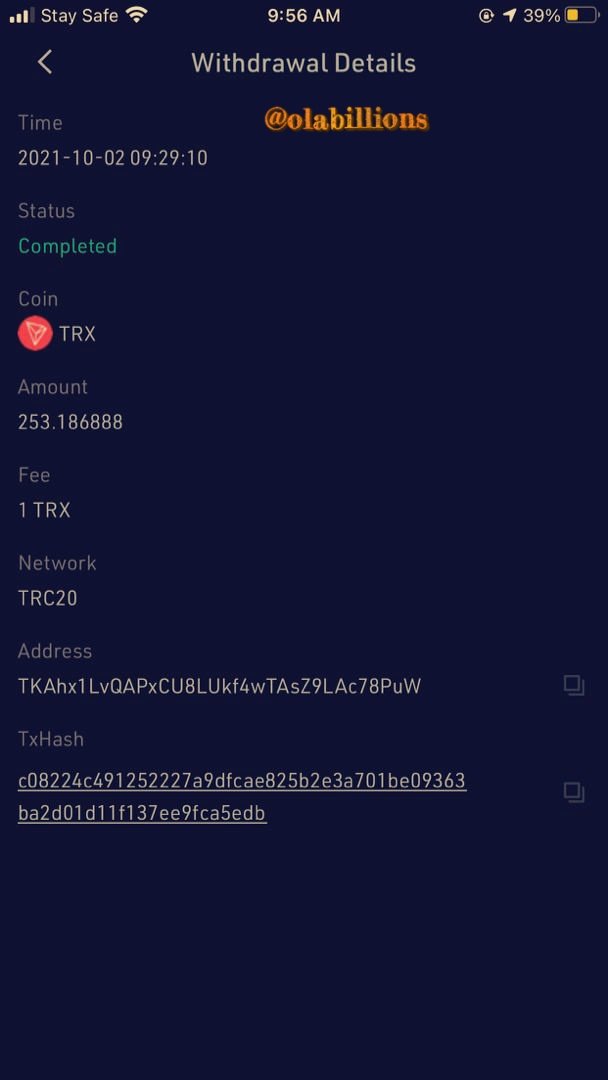

Then to sell at a high price, I transferred 254.1868 TRX to another exchange called poloniex, in the course to sell high, therefore, I then open the poloniex exchange and copied the TRX address of which I pasted in a process of withdrawal of TRX from my kucoin to poloniex exchange, in the course of transfer, a transaction fee of 1TRX was charged, making a 253.1868 successful transfer of TRX to poloniex exchange.

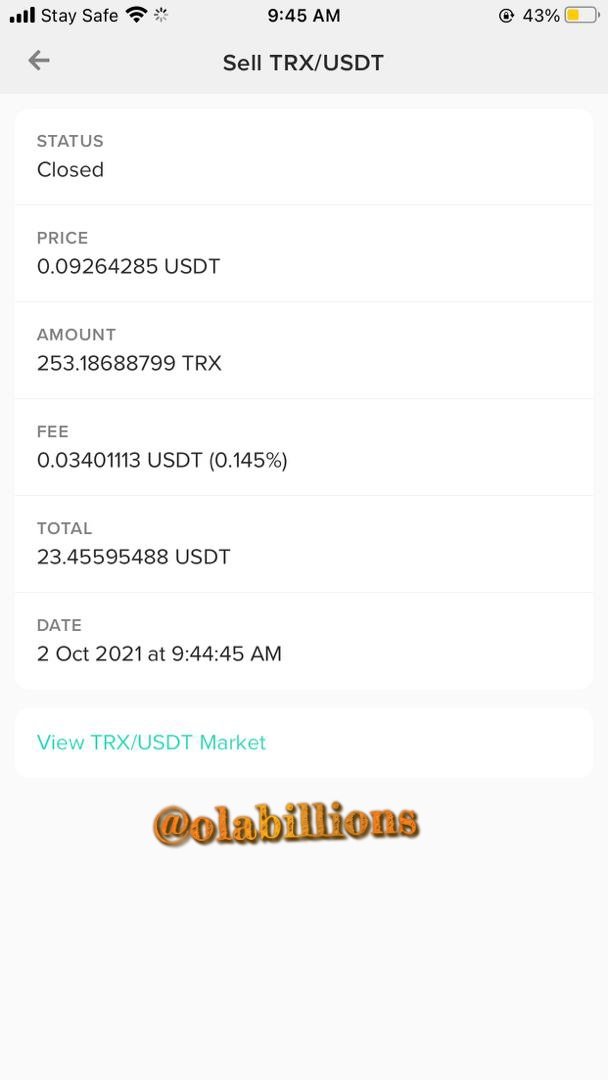

In the poloniex exchange, I place the sell order and sold at 0.926424 per TRX of 253.1868, which amounts to 23.455 USDT. The transaction was at loss due to market fluctuation, I could wait for the price to rise and make profit but since the transaction had to be performed at the same time, following the logic of exchange arbitrage. if the transaction fee/withdrawal fee were to be calculated, I would have made a little profit.

Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

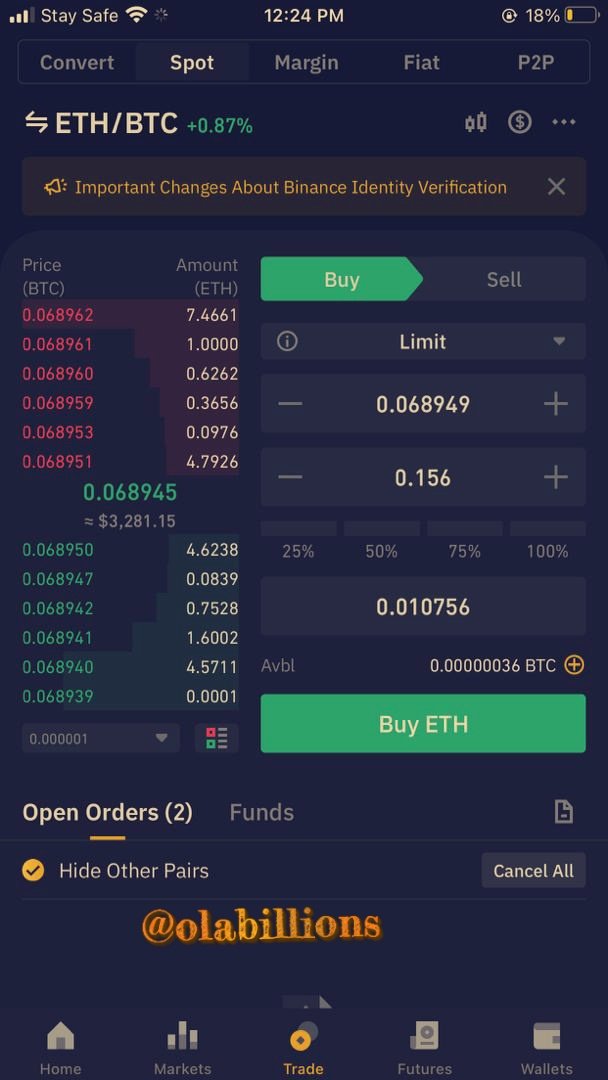

To perform the triangular arbitrage, I used STEEM, ETH and BTC coin to perform the arbitrage trading

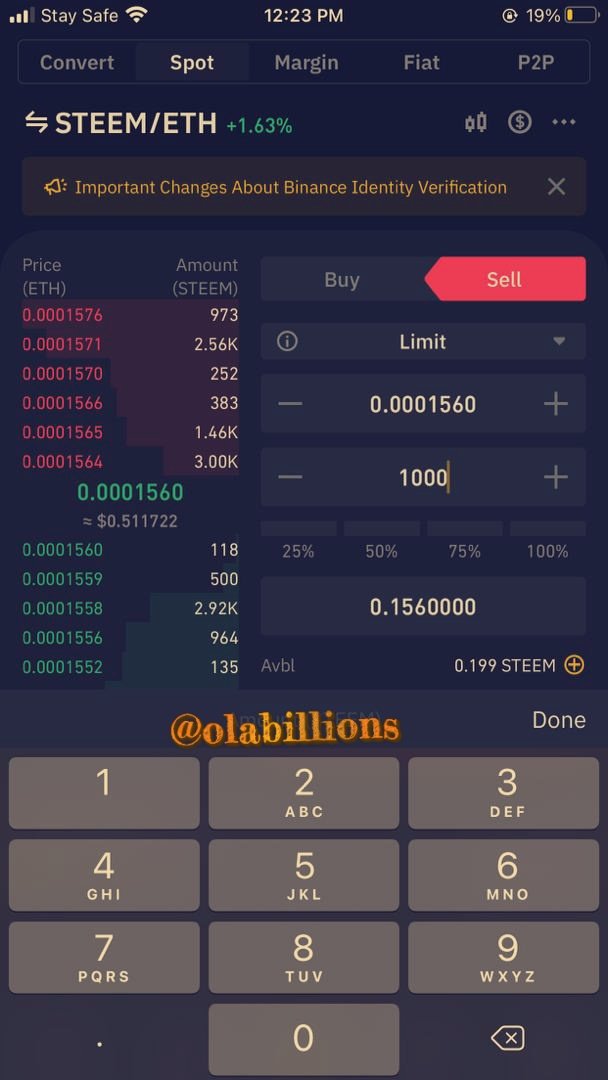

The first coin is STEEM, which I sold to 1000steem to ETH in STEEMETH pair at the current bid price of $0.0001560 giving 0.156

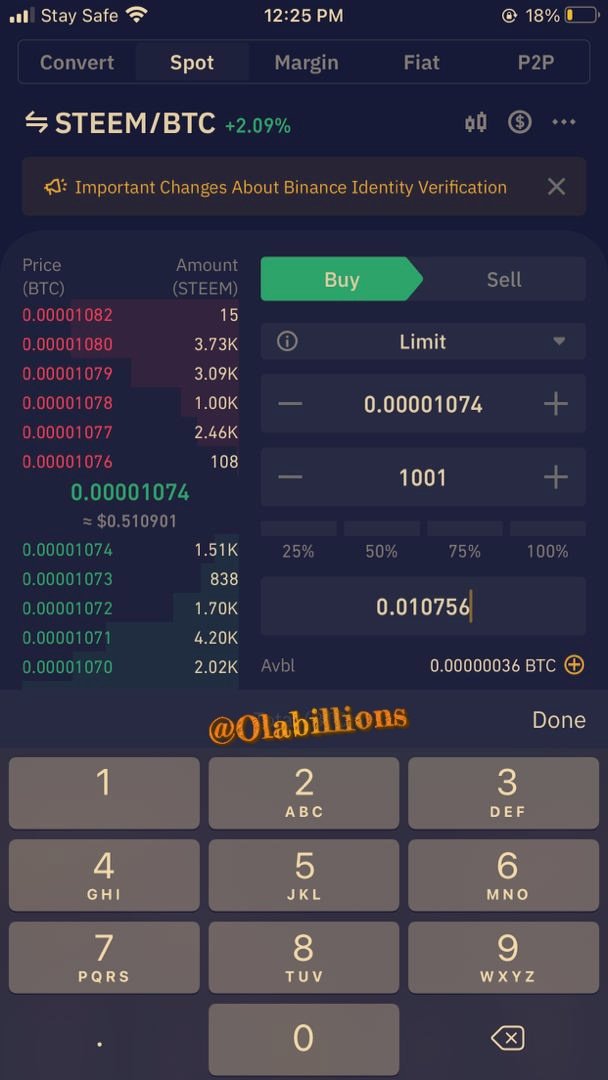

Then I bought BTC with the value of ETH which is 0.156ETH, giving 0.010756BTC ,at the current ask price.

Then lastly I used the amount of BTC, Which is 0.010756BTC to buy STEEM, giving me a 1001 amount of STEEM, the triangular arbitrage trading done fetched me a profit of 1STEEM

Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

ADVANTAGES OF TRIANGULAR ARBITRAGE

When the market is not stable triangular arbitrage strategy allows traders to earn

When the criterias of triangular arbitrage and mets, it carries a low risk profit compared to other trading strategies.

It's transactions doesn't require much time

Their are software which will increase trading speed

DISADVANTAGES OF TRIANGULAR ARBITRAGE

Sporting the triangular arbitrage strategy is very difficult because it is very rare and will require constant monitoring using software.

Traders with our investment can only make reasonable profit because the reward from this strategy comes in cents.

During trading triangular arbitrage strategy some pair or legs may not execute instantly due to market rapid movement which will lead to failure of strategy.

Transaction cost as regard trading triangular arbitrage strategy will reduce profit cost or even make it a negative expecting strategy.

Triangular arbitrage strategy requires a connection with high speed on the traders ends and the rate of trade execution speed must be high on the exchange ends.

CONCLUSION

In this lesson I have learnt the exchange arbitrage trading and the triangular arbitrage trading, user should nite that arbitrage trading is a risk effective strategy that incur quick profit to trader especially cryptocurrency traders. If I continue to perform the triangular arbitrage trading it means I will continue to make a profit of 1STEEM or more upon the number of times I perform the triangular arbitrage trading.

This lesson has been a fruitful and knowledgeable lesson to me thanks to the professor.