Define Arbitrage Trading in your own words.

To trade arbitrage, you need to find cryptocurrency that has different prices even though it the same cryptocurrency in different market. Basically, the idea is that you buy this cryptocurrency in one market and then sell it in other market where it's different price to profit off the difference. This is considered a risk free trade or very close to it. That is why it is hard to find in traditional market because many people are already taking advantage of it or has system in place.

This is quite a different market from the traditional one. There is over 200 exchanges with large price distribution. Just look at coinmarketcap, and click on the market. You can see all the price differences. They are due to imbalance and supply and demand. Also price discovered kind of done differently for each exchange. So, you large exchange with liquidity driving the price and then small ones following them but not immediately. Sometimes the big ones change and the small the one are slow to catch on. That is where the arbitrage opportunity exist.

Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types,).

Risk arbitrage

Retail arbitrage

Just like on cryptocurrency markets and traditional financial markets, arbitrage can also be performed with usual retail goods from your favorite supermarket. For instance the eBay platform, you will find a lot of products bought in China and sold on the internet at a higher price in a different market.

Convertible arbitrage

Another famous arbitrage strategy, convertible arbitrage, has to do with buying a convertible asset and selling it in a short while.

Negative arbitrage

Negative arbitrage has to do with the opportunity lost when the interest rate that a Debtor pays on its debt (for instance, bond issuer) is higher than the interest rate at which that money is invested.

Statistical arbitrage

Statistical arbitrage is also known as stat arb, is an arbitrage strategy that has to do with complex statistical models to find trading opportunities among financial instruments with different market prices. Those methods are usually based on the mean-reverting technique and require vital computational power.

Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

For example

BTC/ETH

ETH/BNB

BTC/BNB

You can see how these are all linked together. You buy one and sell the other and you end up with a neutral position. Hopefully, it was an ARB opportunity there you end up with a little bit of profit. So, the idea is if the implied cross. We're quoting in base and counter or quote crypto. We got a base, quote, a counter crypto. That's always going to give us the link and that's the thing we have to often get our head around with.

If the implied cross which basically the implied price of the based on the other two is not equal to the actual quote and an arbitrage opportunity exists.

For example

A/B × B/C × C/A = 1

A = Base

B + C are counter cryptocurrencies

BTC/ETH = 1.1325

BTC/BNB = 0.785

BNB/ETH = 1.4528

Buy $10000 @ 1.1325 = $11.325

Sell $10000 @0.7805 = $7,805

Buy $7,805 @1.4528 = $11.339

= $14 per $10k trade

Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

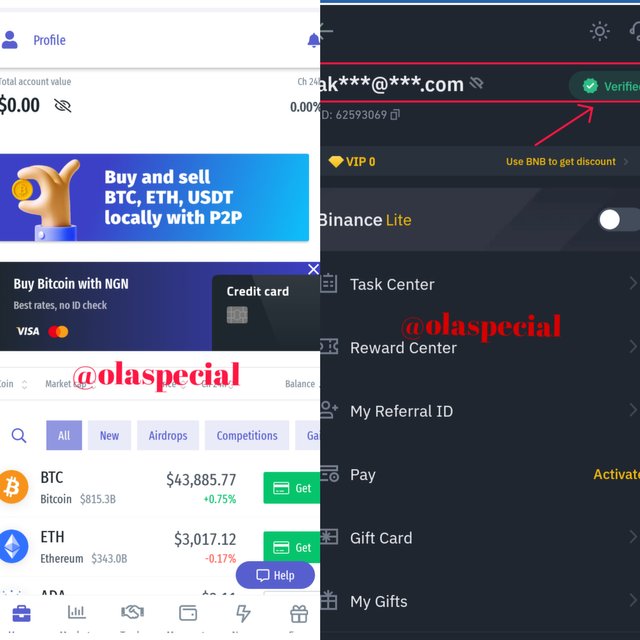

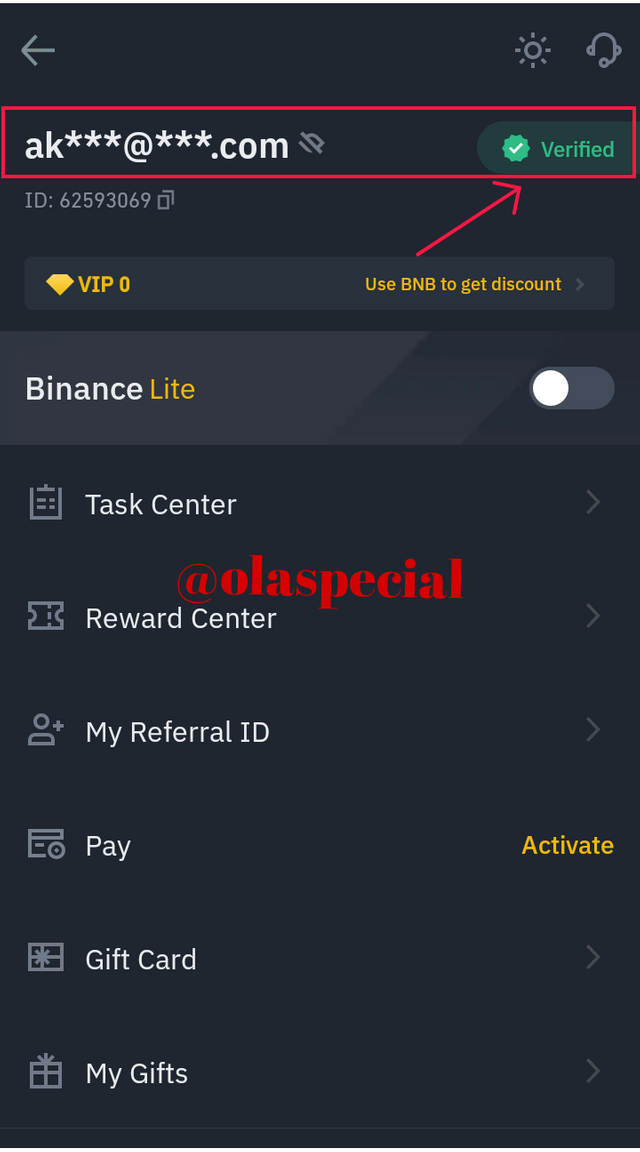

These are my verified exchange accounts.

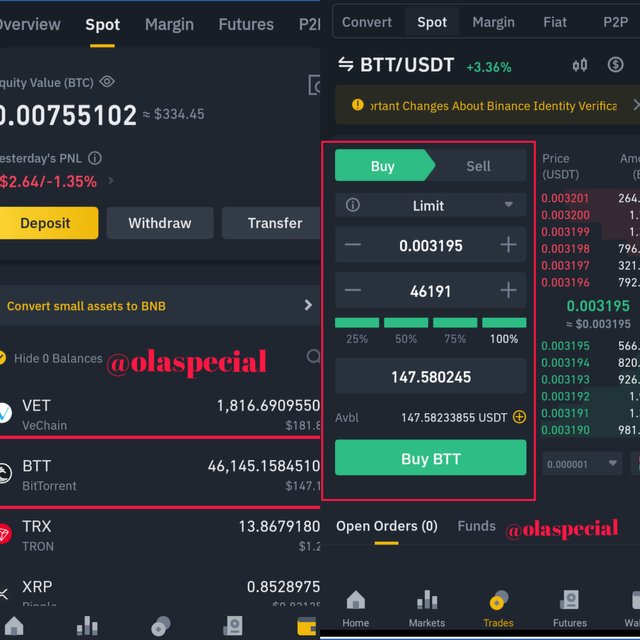

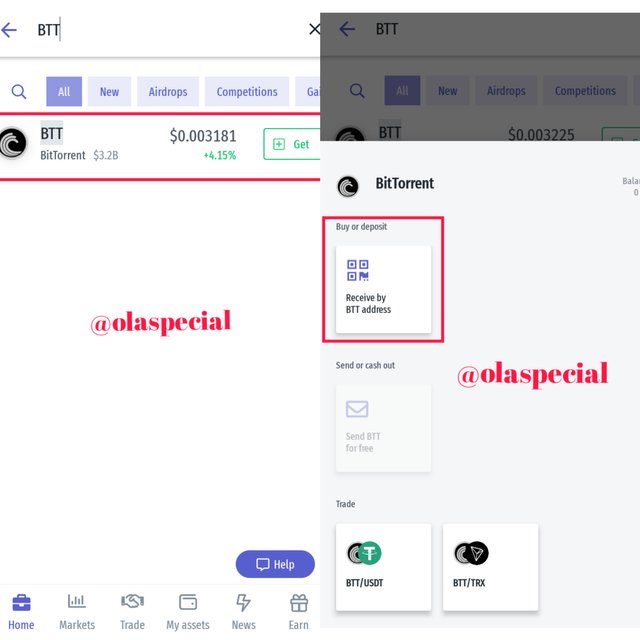

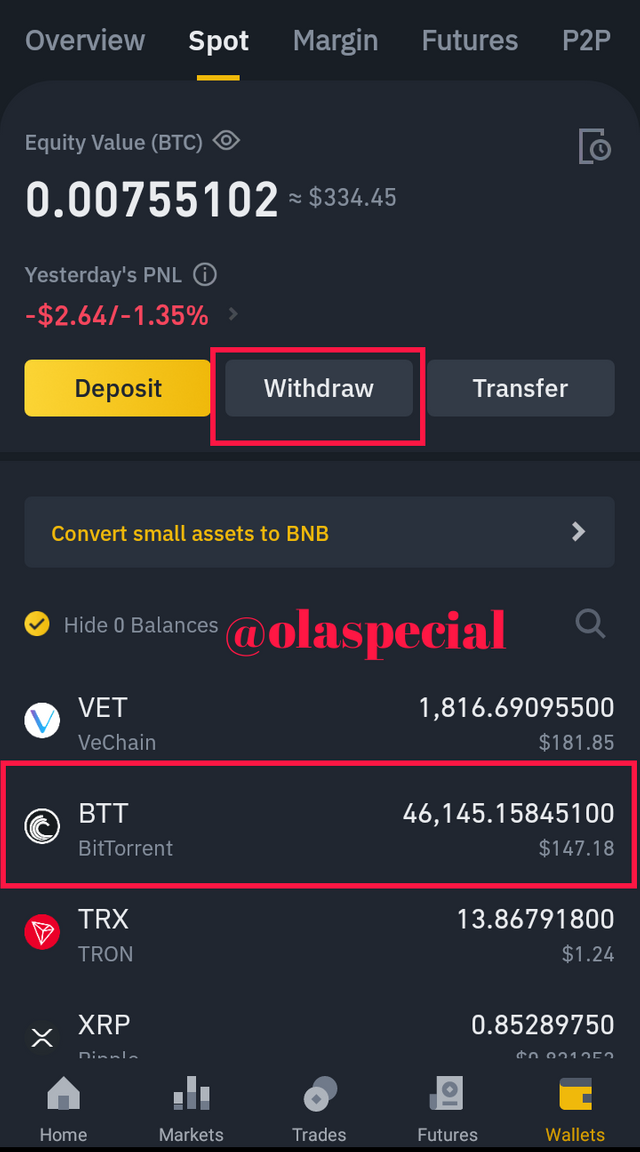

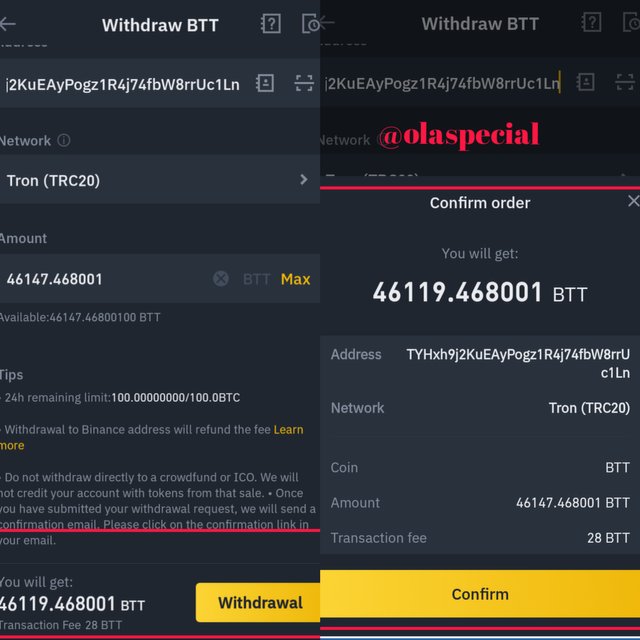

I purchased BTT for 147. As you can see on the above screenshort that I have 46,145 BTT in my wallet

On my Latoken exchange, I will click on deposi shown on the screenshort to recieve my BTT

Then I will click to copy address in other to recieve BTT coin.

Then, I will click on withdraw to withdraw my BTT coin

Then, I will click on confirm

Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

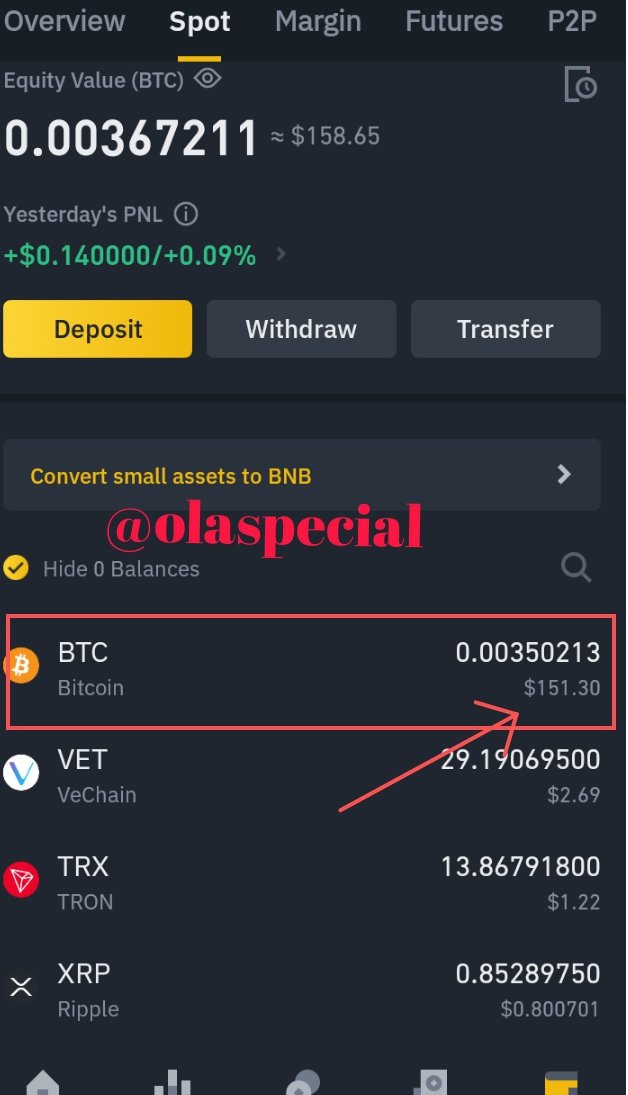

The above screenshort is my verified account.

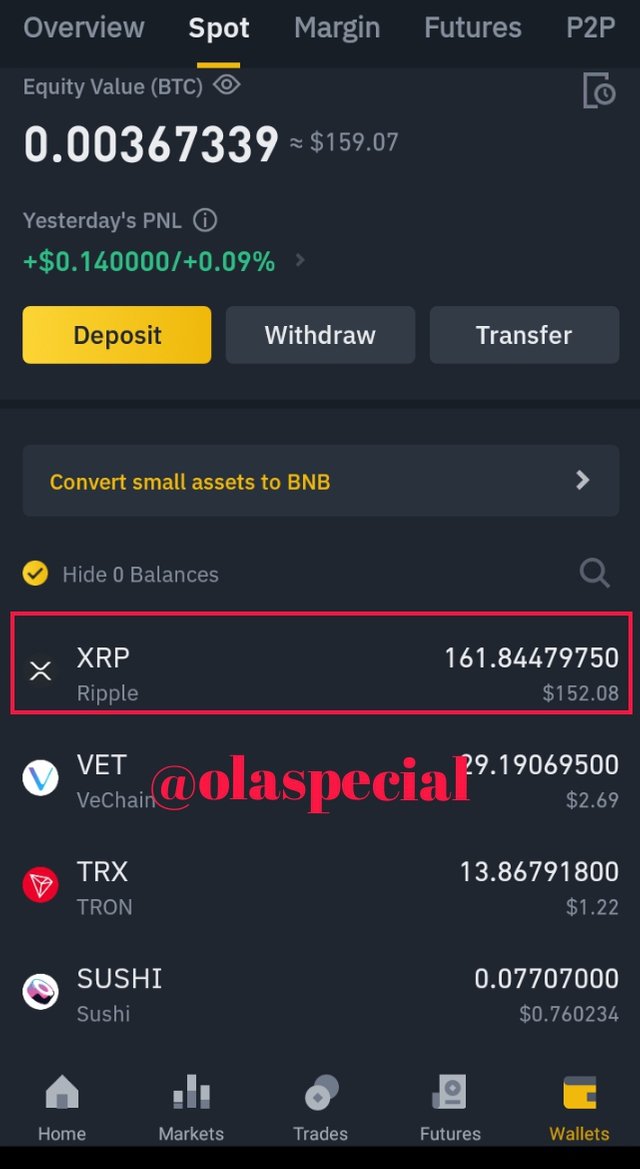

I have $152.83 XRP from which i am going to purchase 161 coins.

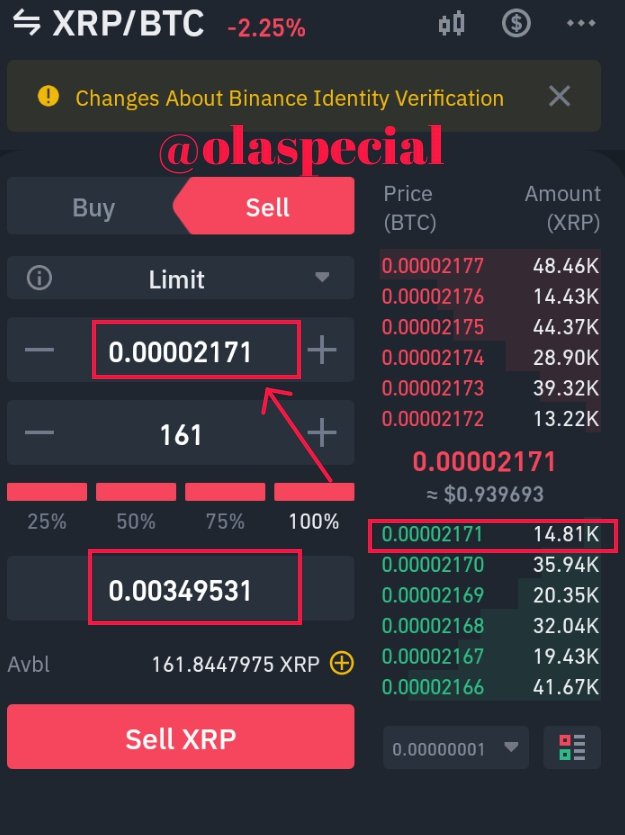

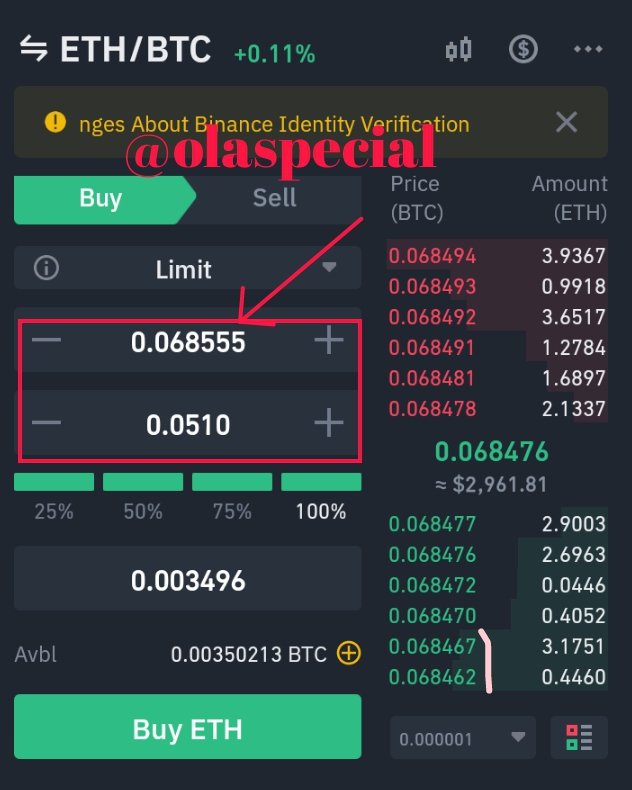

I will like to purchase bitcoin in the exchange for XRP coins. The screenshort above show that got 0.00349531 BTC in return for 161 XRP

Here we have our purchases BTC above

We will purchase ETH in the exchange for 0.003496. By sell my BTC on 0.68555. I will be getting 0.0519

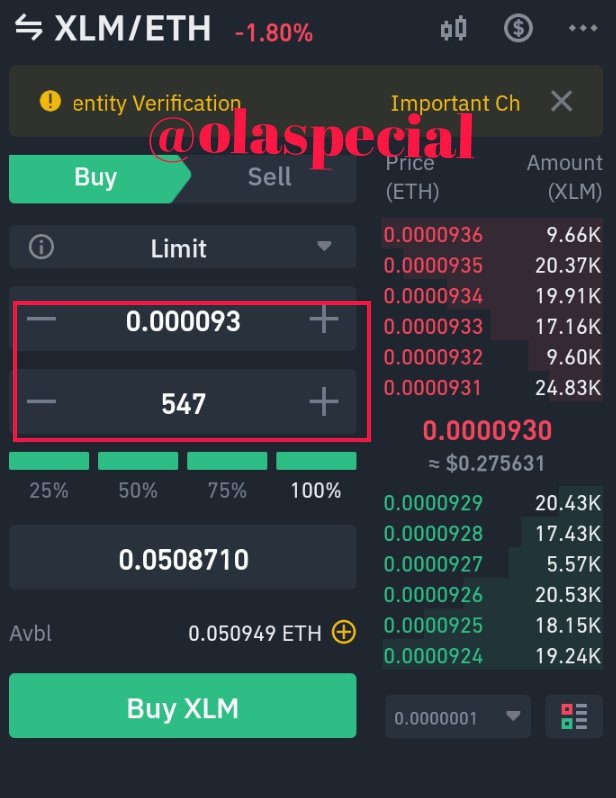

Then, i will purchase my XRP again from my 0.0508710 ETH as i got 547

Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

Advantages of Triangular Arbitrage Strategy

- 1) It allows traders to earn during price differences or unstable markets.

When well implemented, the triangular arbitrage technique carries very low risk compared to other trading strategies.

This technique helps the traders to gain more profit easily with the use of useful tools and helps in involving man-made error.

Disadvantages of Triangular Arbitrage Trading.

Triangular arbitrage opportunities are not always common and traders may need to constantly monitor them using some useful software.

The triangular arbitrage trading technique is not entirely without risk and faces several risks which include the execution risks where the exchange may delay or not fill one or more legs of the arbitrage. Such delays would lead to the failure of the technique because the market movements are always rapid.

To effectively use the technique one would often need advance instrument or software and such tools is not available or something may be too expensive for the ordinary trader.

Transaction expenses will often reduce profits gotten from the triangular arbitrage technique.

Differences in exchange rates that lead to triangular arbitrage opportunities most of the time happen in fractions of cents. For this reason; traders using this method will be compelled to use large amounts of money to gain a reasonable profit. In other words, is technique is only profitable for traders who have huge money.

Thank you professor @reddileep for the wonderful lecture