Thank you, Prof: @reddileep for a well detailed and well explained class.

1. Define Arbitrage Trading in your own words.

Arbitrage trading is a process of trading that cashes in on the various cryptocurrency price in different types of exchanges at the same time.

For example, if cryptocurrency like Bitcoin price is $9,000 on the Bittrex, but it's $9,100 on the Binance at the same period. Traders may just decide to capitalize on the price that didn't balance by buying the coin from Bittrex and sell it instantly at a high price at Binance.

The reason why it is unequal in the price of the same currency in the exchange markets is that markets are changing in motion. An exchange that has a limited supply of a currency given will have to trade the currency at a higher price. The same market that has higher volumes prices will be lower.

2. Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

Arbitrage is usually a short time trading chance in financial markets, there are also other types of arbitrage chances that are covering other markets that are tradeable.

A. Risk Arbitrage

B. Convertible Arbitrage

C. Statistical Arbitrage

Risk Arbitrage:

We can call it merger arbitrage because it implies buying of stocks in the merger process and procurement. Risk arbitrage is a is well known among hedge funds, that purchase the target’s stocks and short sell the stocks of the one who acquires.

[Source]

Convertible Arbitrage:

This Types of involves purchasing a security that's able to be converted and short sell its underlying stock.

Statistical Arbitrage:

We can call it "stat arb", it's an arbitrage practical that imply multiple parts statistical models to find trading chances in the financial instruments with various prices of the market. Those models are always based on a mean-reverting plan and call for important calculation power.

3. Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

Triangular arbitrage is a trading technique that uses the arbitrage chances which exist among different three currencies in foreign currency exchange. Arbitrage perform by the logical sequence exchange of a currency to another one when there are differences in the cited prices for the currencies given.

[Source]

Triangular arbitrage chances happen when the currency exchange rate doesn't match the cross-exchange rate. The price divergence widely come up from a state of affair when one market is valued excessively while another is not valued.

Various conversions in the same market that involving 3 different types of currencies with price unlikeness are called triangular arbitrage. For example, you can buy BTC with the dollar, sell ETH to STEEM, and change still LTC back to the dollar. Yet, the price margins have to lead to an arbitrary favour. The conversion is still able on multiple markets.

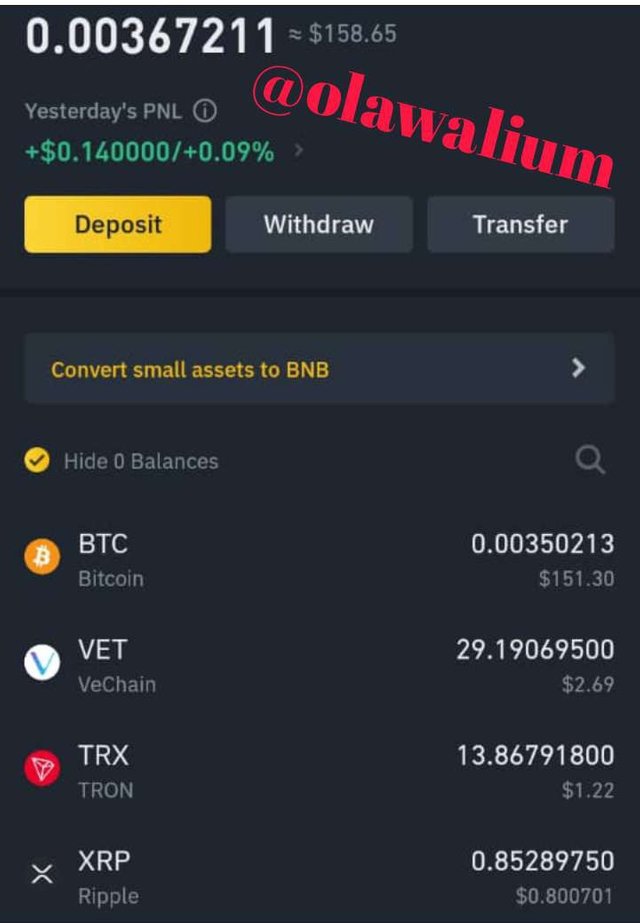

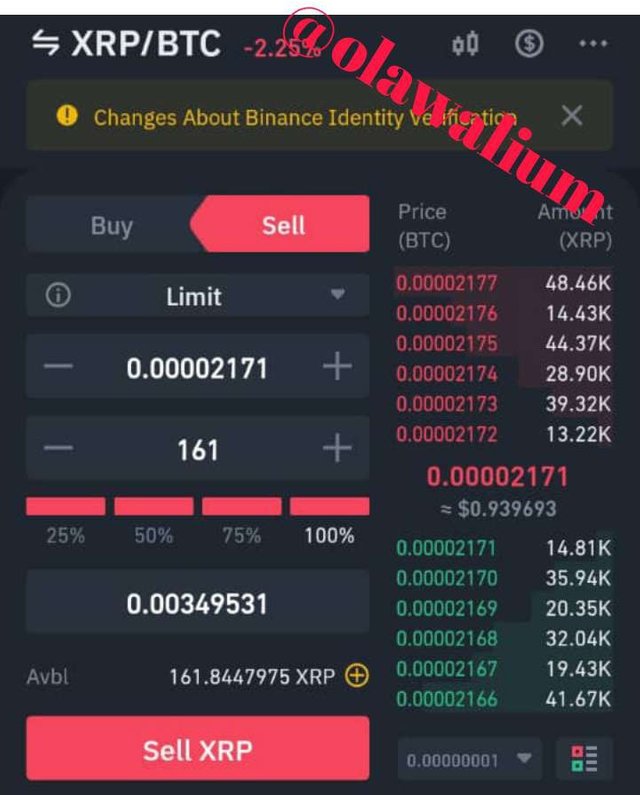

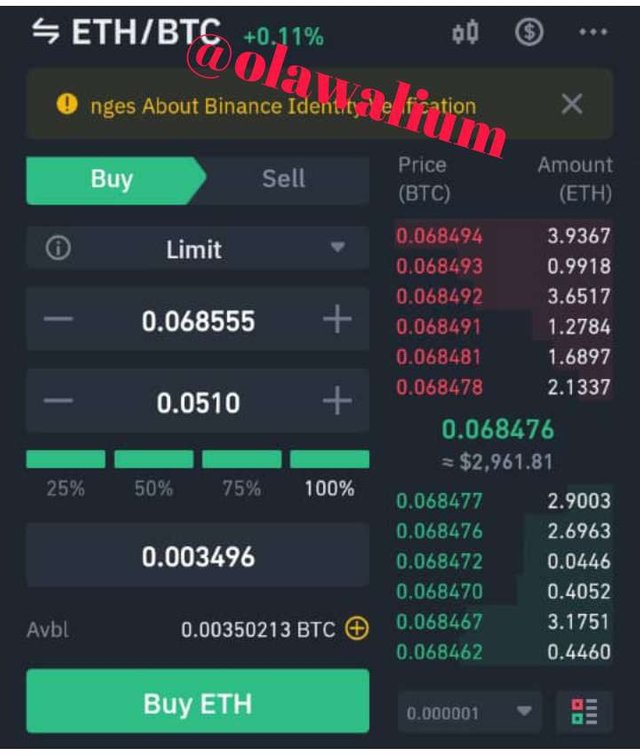

4. Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices).

to show it's a verified account

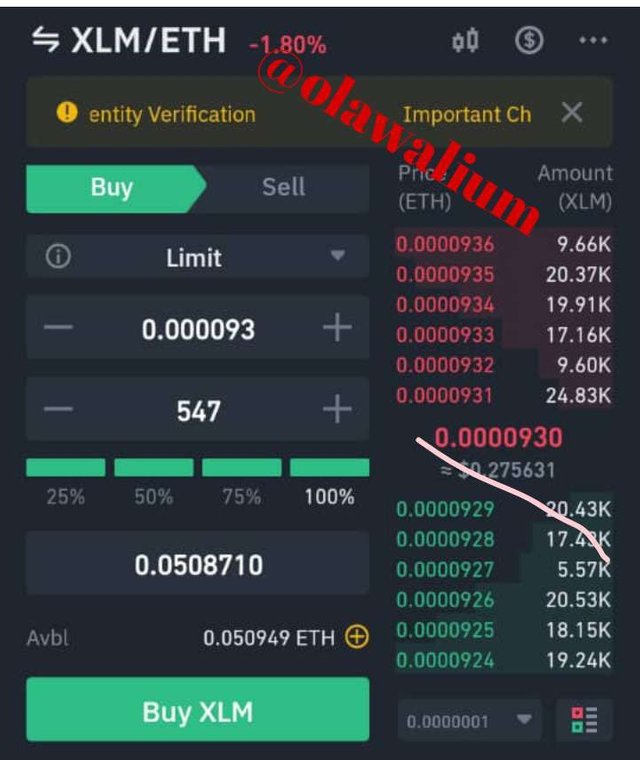

5. Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

Here are the exact steps by steps on how I make the Triangle Arbitrage

6. Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

Cons:

Low Risk

Reliable and refined system manage arbitrage trade

Safe and swift trade

Low risk:

Require profits at low-risk extreme exposure because purchasing and selling are done in a simultaneous way to depend on the price changes. The trade is active with aiming to book a fixed gain by trading in large shares volumes.

Reliable and refined system manage arbitrage trade:

Money, speed and big volumes of stocks imply in arbitrage trading. Those that engage in arbitrage depends on refined and computer that has highly efficient software to know arbitrage chances by detecting small price variations and performing trade of purchasing and selling stocks in thousands, to have the option of reserving a huge gain.

Safe and Swift Trade:

Arbitrage trades are made in a sure and fast way by a software called "smart trading" that is unaffected by the intervention of humans or mistakes. They aren't long term investments, so they are low risk and they can assure gain, they take the chance of existing price differences and capitalize on it. It's not trading with exposure and it's not affected by market forces which can cause price fluctuations.

Pros:

Delay in Transactions

Transaction fee

Theft in exchange

Delay in Transaction:

Because of the high number of transactions in the cryptocurrency exchanges, delays in transactions always occur. Moving coins from a platform may take much time before the coin land on the next exchange. In that delay, the price difference might have change and the gain will then vanish.

Transaction fee:

Many exchanges do charge fees on withdrawals, deposits and some procedures. If a trader didn't think of those expenses before going into arbitrage, the exchanges may eat up all of their gains or even encounter debt.

Theft in Trading:

To practice Arbitrage, you will need to store your cryptocurrency on an exchange while you are waiting for any chances. There is a disadvantage although hacked platforms and theft of customers funds are not common anymore.

Conclusion.

I'll describe Arbitrage trading as eat and go because it's an investment you'll make instantly and you'll have your profit immediately, not a long time investment, once you see any chance, just make use of it. Although it has disadvantages this disadvantage can be controlled once you are in a safe hand.

Reference:

Thank you for your time.

My pen doesn't bleed, it speaks, with speed and ease.

Still me,

My tongue is like the pen of a ready writer.

Olawalium; (Love's chemical content, in human form). Take a dose today: doctor's order.