Hello everyone, this is season 4 week 6 of the steemit crypto academy. This week’s lecture was on the study of Investment through public and private sales. The lecture by professor @fredquantum was very detailed and after going through it carefully, I have decided to try my hands on the given task.

1. What can you say about Crypto Investment and how to properly utilize the investment tools available to make the right decisions?

Crypto Investment

Investment is a long term or short term objective which depicts spending on an asset in order to make profit. Investment is made in every aspect of life and cryptocurrencies are digital assets which people chose to invest in them.

The investment made on crypto assets is called crypto investment.

Some traders will decide to make long term investments in crypto assets which means the hold the asset for a very long time in order to make profit when the price of the asset rises above the price they bought the asset. Other traders will also make a short term investment in crypto assets when they buy the asset and sell it quickly to make profit. Both of these investment methods require different strategies to be enable to executed effectively.

There are some steps you can follow as a good trader to make your investment successful. Some of these steps are discussed below.

- Do some enquiries/research on crypto assets

Before investing in a particular asset, it’s advisable you do some thorough research about the various features or characteristics of the asset before investing in it. There are a lot of information on the internet or various platforms that will give you the knowledge to invest wisely. Other investment tools such as Chart analysis, Market cap, Exchanges of the asset, price volume etc are all available to help you choose the right crypto assets to invest in. Tradingview is also a tool that can used with the help of charts and indicators to make good analysis before investment.

- Find information about the Exchange platforms and Wallets

A good investor must do research on the exchange platforms that contains the asset he wishes to invest in. Every asset has an exchange in which you can find it and make sure the wallet supports the asset he intends to invest in. The investor must also find out the exchanges that will suit his plans because there are a lot of Centralized and decentralized exchanges out there.

- Do Technical and Fundamental analysis on the asset

The traders that are able to do good technical analysis end up making good profit in the market. There a lot of technical analysis tools that aids in predicting the prices of crypto assets some of these tools are the crypto charts and indicators. The investor has to do fundamental analysis on the asset. This means he tries to find news and other information surrounding the asset he intends to invest in.

- Split crypto investment

It is usually advised that investors should not put all their funds in one asset. In this case when the price of the asset falls, the investor runs at a loss and face the possibility of loosing all his assets. Therefore it’s good for investors to invest in diversity of assets so that they stand the chance of making profit even if one of the assets fails.

- Use of Investment tools

There are investment tools that help us to make the right decisions during investment in cryptocurrencies. These tools give us knowledge on the market data, chart analysis, exchange platforms etc. Some of these tools are discussed as follows.

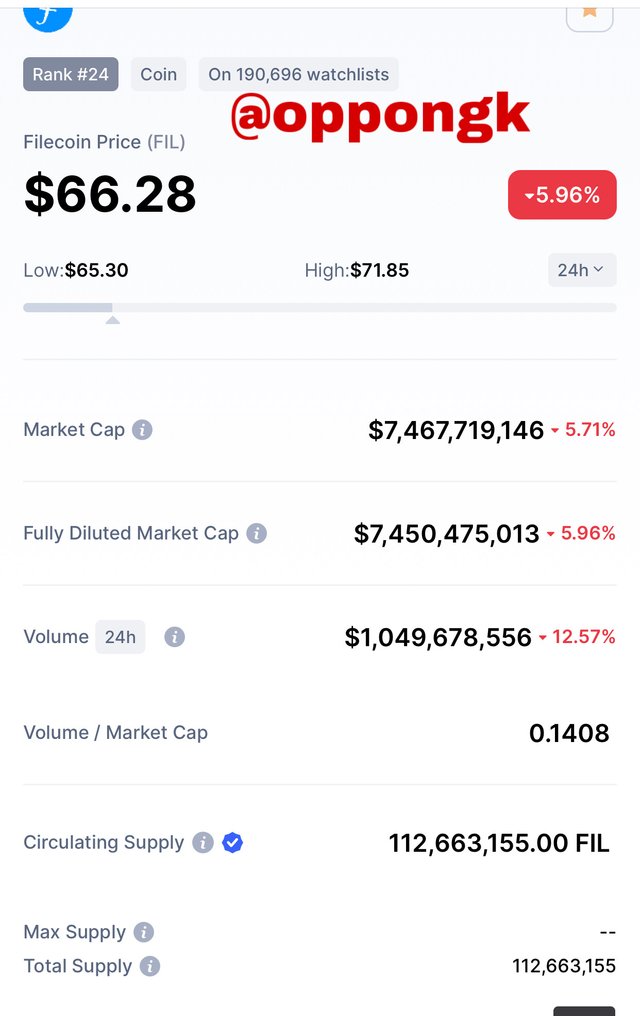

- Market Data tools

These market data tools help to give us some overview of the market of the asset. Some of these market data tools include coinmarketcap, etc. Some of the market information provided on these market data tools include the Market cap, fully diluted market cap, circulating supply, trading volume within 24h period, price etc. These tools also helps us to get the background information of the coin which will increase our knowledge on the and help us take the right inves decisions.

Screenshot from coinmarketcap

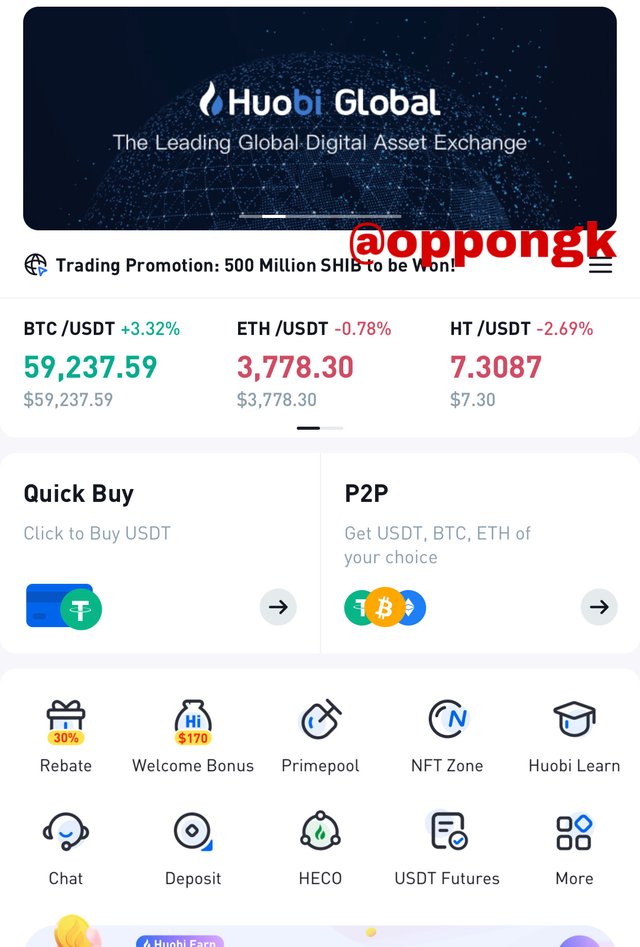

- Exchange Platforms

Exchange platforms are the digital platforms where the trading and exchange of crypto assets are done. These exchanges also have wallets that are used to hold crypto assets. There are so many assets on these platforms that can be traded. Some of these exchange platforms include Huobi pro, Binance, KuCoin, poloniex among others.

Screenshot from Huobi pro

- Chart analysis tools

These tools are used in technical analysis to predict the price of a market. This is one of the most essential aspects of investment because when the analysis is done wrong, it can lead to investment in the wrong asset hence leading to a loss. Technical analysis tools and indicators are combined to make a good prediction of the market. One of such tools is the Tradingview.

Screenshot from Tradingview

2. Talk extensively about the following. Also, highlight the benefits and risks associated with each.

i. Private Sale in Cryptocurrency.

ii. Presale in Cryptocurrency.

iii. Public Sale in Cryptocurrency.

- Private Sale in Cryptocurrency

The initial phase of the the ICO is the private sale. Capital is raised through the private sale to enhance the project. This is done by selling the first token of the project. The name “private” is used because there is an organization of a private meeting where the project is unveiled by the project developers to small group of people. At this stage the project is not advertised on social networks. Some specific number of investors are invited and the project is introduced to them.

At this this stage, the sole aim is to generate funds to maintain the project hence the tokens are given to the investors at an offer price. These investors are assured that when the token is released, they will ensure incentives that will make them regain their invested funds and also make profit on top.

Benefits of private sale

Investors can meet with the developers directly so they are able to raise their concerns if there’s any.

The investors will make much profit if the project becomes successful. This is because the buy the tokens at a much lower price as compared to the price that will be released to the public.

Another advantage of private sale is that the tokens are sold at a relatively lower price.

Risks of private sale

The project hasn’t been established at this point so it’s very risky for investors to put their funds there. They might loose their investments if the project doesn’t go as planned.

Investors are not guaranteed of the time they’ll benefit from their investment. The success of the project will determine whether or not they’ll make profit and this also depends on the subsequent phases of the project.

There are no third parties involved during the meeting between the developers and investors. So in case these an issue of fraud or scam, the investors have no where to resort to .

Pre-sale in Cryptocurrency

In the presale phase, the project is now introduced openly to new people. This is the second phase of the ICO.

During this phase, the project have websites on which they publish the project. The project at this stage is not published on social networks just yet. The money generated from the publication on their website is used to complete the final stages of the project.

At this stage the token is sold at a price that is slightly higher than the price at the private sale but it is not sold at the actual price. This price is used to attract investors as well.

Benefits of Presale

The funds generated from the investors are used by the developers to complete the final stages of the project

The price at this stage is at a discount. So when the ICO gets started, investors who invested at the presale phase make a lot of profit.

Prices of tokens at the presale phase is much lower compared to the prices at the public sale.

Risks of Pre-sale

There is no liquidity in the market until the ICO is launched.

Investors could still run at a loss if the project doesn’t become successful. The success at the pre-sale phase does not guarantee the success of the entire project.

The developers and the investors are not much familiar to each as in the case of the private sale.

Public Sale in Cryptocurrency

The Public sale is the phase where the project is fully publicised. The project is displayed both on the website of the developers and also on all other possible social networks. They are also advertised through the media by means of available channels.

As this publication is ongoing and more people joining the sale, more funds are generated and these funds are used to finalise and put the project at the best possible state. At this stage the risk of investing in the project is very less so there are a lot of people patronising the project and for that matter more funds are generated. The project at this stage will be listed on exchanges in a very short time to come.

Exchanges can also serve as a medium for advertising this project at the public sale phase. These same exchanges also allows for the trading of the project.

Benefits of Public Sale

The risk involved at the public sale phase is very low as the project also has a solid foundation and is more established now.

There’s liquidity in the token market so it is easily traded and exchanged

The outcome of the first two phases are used as a guideline to undertake the rest of the project. This helps in making the project more successful.

Risk of Public Sale

The discount used in selling the token at this phase is very low compared to the discount of the previous two phases

Public sales stands the risk of been nullified if the the pre-sale was successful and the actual target of the ICO was met before the public sale phase.

At this phase the profit target expected by the investors might not be met.

3. What are the mediums used for Public/Pre/Public Sales in Cryptocurrency?

So many mediums are used for private/Pre/public sales. Some of these. Some of these mediums are discussed below.

Websites

In the development of the ICO, a website is created purposely for the information of the project. Every detail about the project is posted on the website. The methodologies involved in the project development are all published on the website and other vital materials related to the project are made available on the website. Other information that can also be displayed on the website include white paper, contacts of the developers, the dates that are scheduled, the road maps among others.

The website is also developed so that investors interested in the token can exchange with their cryptocurrencies such as BTC, USDT, ETH, ADA etc. to get the equivalent token based on the price assigned to the project token by the project developers. The price of the token differs in each phase so the exchange price depends on the phase of the project.

Exchanges

Exchanges can also be used in advertising projects and the help in the promotion of the project. Investors prefer to invest in the projects through exchanges because it is very safe for them. It is however expensive for developers to promote their projects on these exchanges due to huge requirements that are needed to advertise on exchanges.

Crypto Launchpad

Crypto launchpad is a platform that are responsible for listing projects at their preliminary stages before they become known to the public. This launching is done before investors get to know about the project and start investing in it. Some of the crypto launchpad are as follows.

Screenshot Source

The Qube Launchpad

The Red Kite Launchpad

TrustSwap Launchpad

Polkastarter Launchpad

Unicrypt Launchpad

The TrustSwap Launchpad for instance, is used to support newly created projects that look like they have a bright future in the crypto space. The TrustSwap Launchpad has a native token called SWAP. New investors are allowed to mine up to about 4,000 SWAP in order to maintain the community within the TrustSwap.

Social Networks

Social network platforms are now used in advertising new projects. This is a very simple way of making the project known to investors without spending a lot of resources because these social networks are very common. Discord and telegram are some of the very common social networks platforms used to propagate the project.

4. Research about any recent (2021) successful ICO or IEO and give detailed information about the project. (Note: BETA token is excluded).

Strips Finance

Screenshot Source

This strips finance supports both centralized and decentralized finance. The strips finance supports the cross- chain yield market on these centralized and decentralized platforms. The finance strips are the maiden interest rate derivatives exchange platforms. The users of strip finance enjoy the liberty of trading, speculating and hedge interest rates.

Strips finance users can boost their yield farm returns with 10% collateral. They can also yield farm returns in higher quantities whilst they borrow at a fixed price . Staking liquidity in strips will earn users trading fees and rewards. Insurance fees are also rewarded to users based on the liquidity staked.

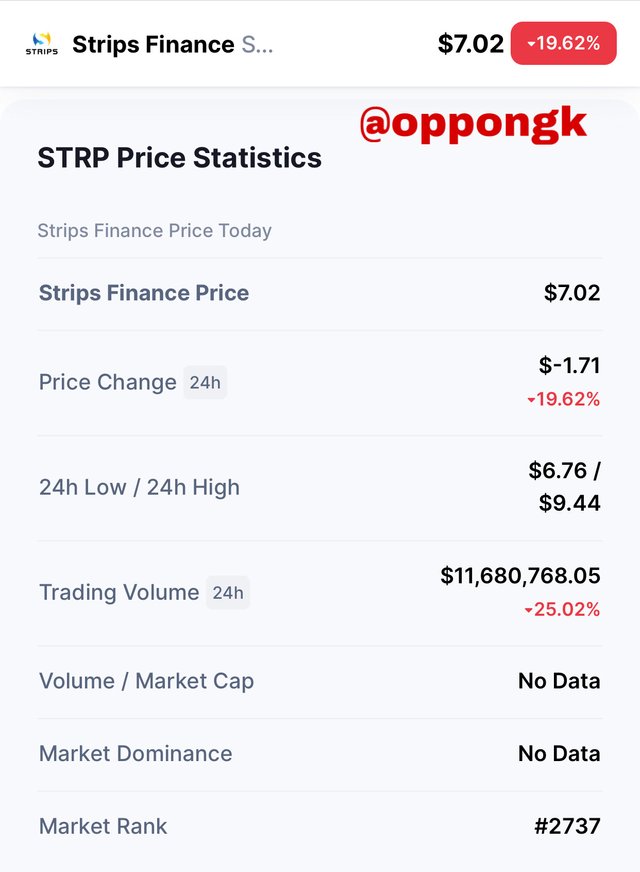

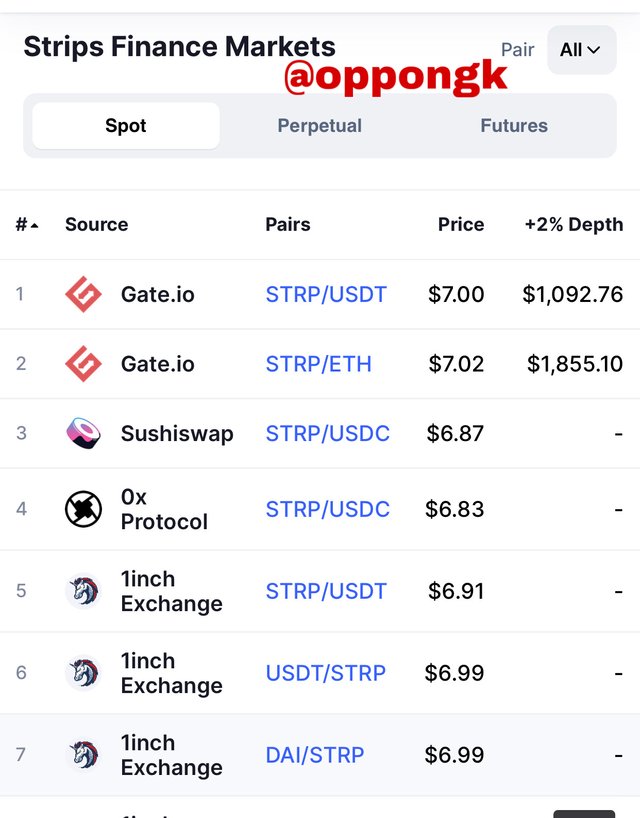

Strips Finance(STRP) is a token that is ranked #2737 on coinmarketcap rankings. It has a trading volume (24h) of $11,680,768.05. At the time of writing this article, the price of the STRP was at $7.02. The price reduced by 19.62% in the last 24 hours. Information on the marketcap was not available at the time of writing this article.

STRP can be traded on a lot of exchanges as seen in the screenshot above. Some of these exchanges include; Gate.io, Sushiswap, 1inch exchange etc.

Screenshot Source

In October, strips finance raised $8.5 million from some private investors. These private companies are fabric ventures, sequoia capital India, Multicoin capital, Morningstar capital. Some days later, over 1 million STRP tokens were sold. These tokens were sold at a rate of $2 per token.

5. Create an imaginary token. Write about the project including its use case. Develop an ICO which includes Private sales (3 stages) and Public sales (1). Note that: You are expected to explain what the funds are intended to be used for, your Private sale should have 3 stages, and specify the initial supply available, and the price you are issuing the token in each stage. Also, specify the price you are issuing the token at the Public sale phase (including the supply).

The Exhibition Control Coin (ECC)

The Exhibition Control Coin was developed to exhibit features similar to the decentralized finance. ECC is the native coin of the Exhibition control protocol is found on the Ethereum blockchain.

The objective of the Exhibition Control is to render service on the Ethereum blockchain as all other tokens on the blockchain do. Our Exchange and wallet will be launched very soon.

The Exhibition Control wallet we will be laughing will still support the Ethereum blockchain. Users using the wallet will be allowed to have total control over their assets by been able to send, receive and also hold their assets. The wallet will be connected to several decentralized Apps and those using mobile will have access to it as well.

The Exhibition Control Exchange will be provided a lot of liquidity. Users on the Exchange will be allowed to buy, sell, stake, swap and borrow crypto assets for their transactions. The exchange to provide very good rates for crypto assets and also provide reduced slippage. ECC will be the native token of this exchange and it will be used to pay transaction fees. The users staking on this platform will earn rewards in the form of the native token. The exchange will support the proof of stake mechanism as the highest token holders will have the power and voting rights on the platform.

Exhibition Control ICO

Our developers have developed the white paper for the project already. We did an analysis on the the expenses involved in the project and we intend to raise funds that will be used to develop the project through the various phases (3 phases).

We have decided to offer our coins at a rate $0.8 for the private sale, $0.85 for the pre-sale and then $0.9 for the public sale. We will create 80 million tokens and then release 50% of them for these three phases.

Phase 1 private sale ICO

Date - 21 Oct, 2021

Sale through - Official website

ECC token price = $0.8

Token Supply = 7,200,000

Fund raised = $5,760,000

Funds raised at this phase is use to maintain the project, develop the official website and recruit more developers.

Phase 2 private sale

Date - 20th Nov, 2021

Sale through - Official website

FFC token price = $0.85

Token supply 7,200,000

Fund raised 6,120,009

The funds raised here will be used to work on the Exhibition Control Exchange.

Phase 3 Private sale

Date - 24th Dec, 2021

Sale through - Official website

FFC token price = $0.9

Token supply 6,200,000

Fund raised 5,580,000

Some of the funds raised will be used to try the effectiveness of the project. The rest of the funds will be used for advertisements on social networks.

Now after these 3 phases, some huge funds has been raised so we decided to move directly to the public sale as it’s no more that relevant to pass through the presale.

Public sale

We used 5 days for public sale**

Medium - Through official website

Date - 23rd Jan, 2022 to 28th Jan, 2022.

FFC token price $1.02

Token supply 9,200,000 ECC

Fund raised $9,384,000

A huge amount of money has been made after the private and public sale.

6. What are the criteria required for listing a token on CoinMarketCap. Is there a criteria for listing an asset on a Centralized Exchange? If Yes, use an exchange for your explanation in response to the question.

Criteria for listing token on Coinmarketcap

Crypto assets or tokens have to meet some specific requirements before they can be listed on the coinma platform some of these requirements are discussed as follows.

You must submit a well structured application. The application should consist of all the necessary information that are needed to be listed on coin

CoinMarketCap have their standard requirements that must be met before your asset is considered to be qualified for listing. However an asset can still meet all the requirements and still not be listed. This is because several other steps are required to be listed on CoinMarketCap and to remain active there.

There is a link that is on the CoinMarketCap website. This link must be followed to submit your application. The use of any other means will not be accepted.

Any attempt to manipulate information will ensure that the application is rejected

listing on the CoinMarketCap platform is free.

Information should be straight forward and no deviation or unnecessary elaborations will be accepted

An asset must have all the required properties of a crypto asset be it’ll be considered for listing. Some of these properties include Medium of Exchange, Store value, Distributed Ledger among others.

The asset must have a website

Information on properties such as the trading volume, project activity and project team etc must all be presented.

A contact of one of the developers must be made available so that they can reach him when the need arises.

Trading ability of the asset is also considered

The requirements discussed above must be met before an asset is considered for listing. Any asset that falls short of any of these requirements is listed under Untracked listings.

Centralized Exchange Token listing requirements

To be able to list a coin on any centralized exchange, there are criteria that one must follow. I use the Binance exchange to demonstrate these requirements needed.

Steps to follow for Application

The Binance exchange has a website. All applications are submitted through the website.

There are different steps for submitting existing projects and new projects. New projects are submitted through a launchpad whilst old projects are submitted through direct listing.

The founder of the project must ensure his information are on the application so he can be contacted for clarification.

Guidelines

BNB is the native coin of Binance whilst BUSD is it’s stable coin. These coins must be integrated into the system if the project.

The community should show support for Binance

Updating of project on regular basis

Other necessary points to note

The processes involved must be followed systematically. No foul means should be use to fast track the application process

Developers should keep updating project in case it is rejected as it can be considered later on after some improvement is seen in the project.

The director of the Binance exchange doesn’t take any white paper from developers.

Post-Application conduct

Any information from Binance to the developer will be sent the email ID.

The developer should wait for feedback and should not be in a rush.

The developer should not hesitate in replying when they sort for some clarity on his project

Some amount of fees is paid for the listing of the coin.

Conclusion

Developers use the Private/Pre/Public phases as fund raising method to generate funds to support their ICO. This helps them to be able to go into crypto assets before they can later be listed on exchange platforms.

Investors must find more information from investment tools before they invest in cryptocurrencies. Some of these tools include Tradingview, coinmarketcap etc. This will help them to understand the behavior of cryptocurrencies better before making investment decisions.

Thank you once again professor @fredquantum for this detailed.

I need assistance with regards to my Crypto Academy

I was in the process of writing my task two when my power went off. Unfortunately, my laptop is plugged and play.

When I went online, I realized I've been verified and tagged as beginner2 without any grade.

Nonetheless, I continued with my earlier work and posted it thinking it would be graded but unfortunately it's not. I then decided to complete beginner 3 assignment which has not been graded as well

Kindly find below the link to my post

https://steemit.com/hive-108451/@ghanaba/crypto-academy-season-3-beginners-course-task-3-bitcoin-cryptocurrencies-public-chains

https://steemit.com/hive-108451/@ghanaba/crypto-academy-season-3-beginners-course-homework-post-for-task-2-blockchain-decentralization-block-explorer

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh, that was very bad, you should have copied the link and reposted to the current homework post of the Professor.

This is one Month now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit