Hello everyone, this is season 4 week 8 of the steemit crypto academy. This homework task given by professor @fredquantum. The topic discussed in this week’s lesson is Zethyr Finance. After studying the task carefully I have decided to try my hands on it.

1. What is Zethyr Finance?

Zethyr is a decentralized Application than can be found on the Tron blockchain. This Zethyr has some outstanding features that makes it unique from other Apps on the Tron blockchain. The users of this platform receive some revenue that is distributed among them. Such privileges are not found on other Dapps. This has made the Zethyr to be widely used by so many people and it is widely accepted as well. The Zethyr finds itself among the top 3000 DApps that are used. Among exchange platforms, it is found among top 150.

Users that hold tokens within this Zethyr finance are allowed to lend and borrow TRX within the ecosystem. Those who make deposits within the Zethyr finance are able to attract some rewards. The deposits means that you are also qualified to apply for a loan within the platform. The deposit made can be made a collateral at the point of applying for the loan and you’re likely to be granted your demand. Those who make more deposits stand the high chance of been granted the loan when they apply.

TRON assets can be collateralized on the Zethyr finance network by users in order for these users to be able to borrow TRX assets or any other assets that are present for borrowing. Users who also lend out their assets use this as a collateral that guarantees them the privilege of borrowing.

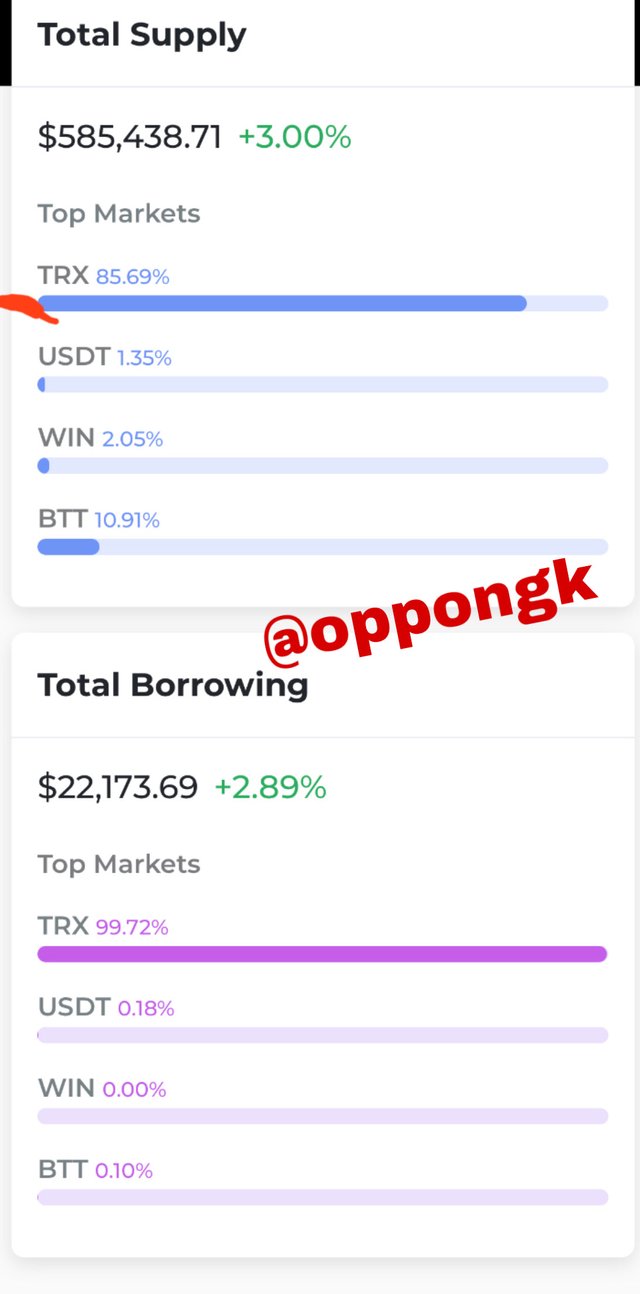

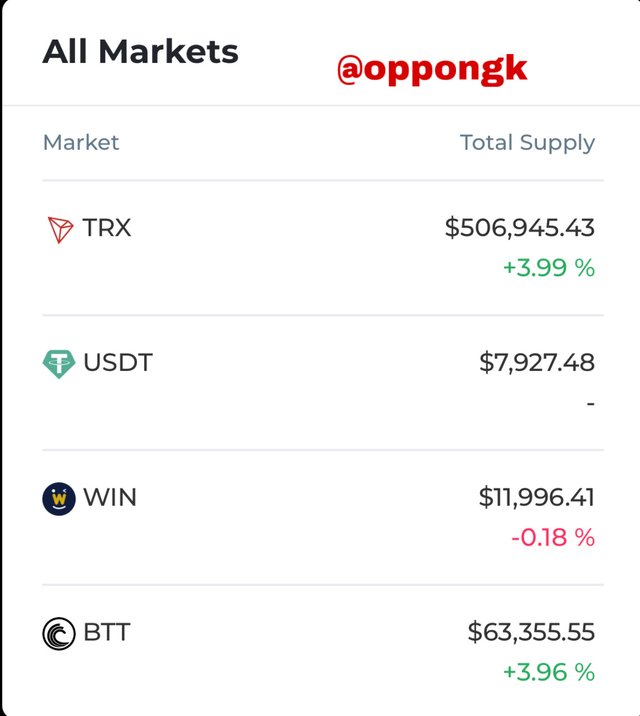

From the screenshot above, at the time of writing this article, the total supply in the Zethyr finance was $585,438.71. The total borrowing in the Zethyr finance was also at $22,173.69 at the time of writing this article. The percentage representation of the supply of various assets was as follows; TRX = 85.69%, USDT = 1.35%, WIN = 2.05% and BTT = 10.91%.

The percentage representation of the borrowing of the assets were also in this order; TRX= 99.72%, USDT = 0.18%, WIN = 0.00%, BTT = 0.10%.

2. What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

The Swap Feature

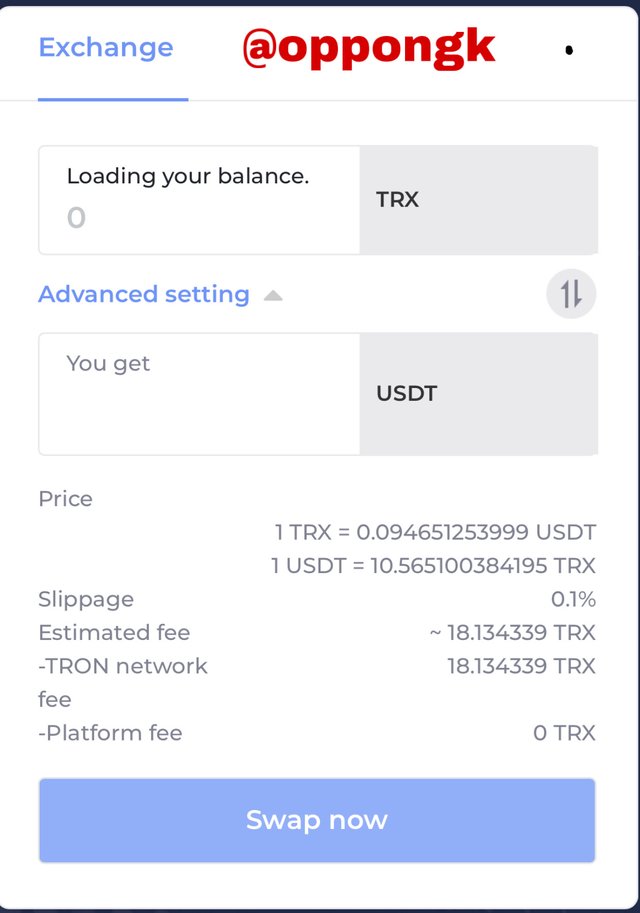

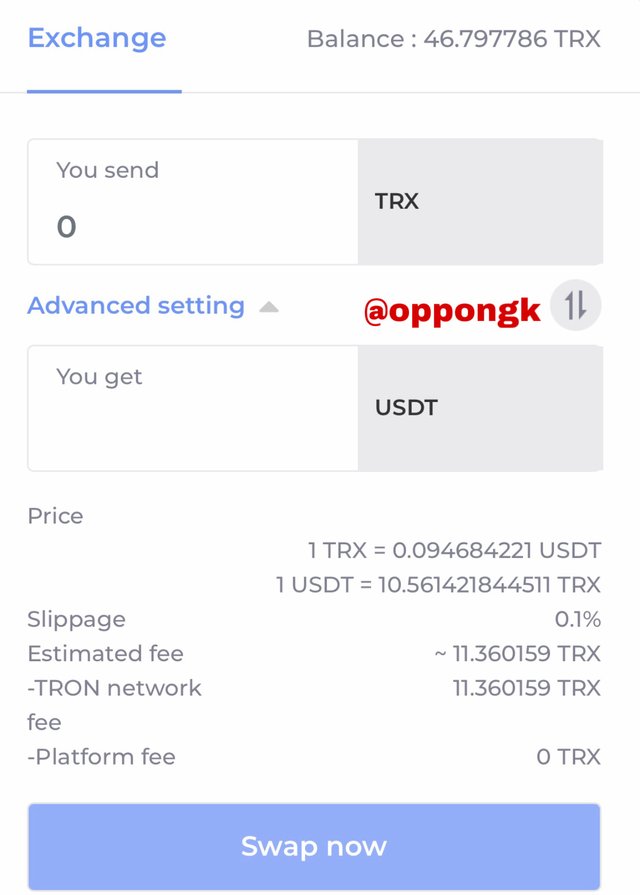

The Zethyr Finance has a feature called the Zethyr swap feature. It uses version 2.0 to swap tokens within the Zethyr ecosystem. It can use the Justswap and Binance platforms to swap TRON assets. This is done with very good rates with zero transaction fees on these TRON assets. The transaction is also done instantly and very convenient as well.

Tokens Feature

The tokens on the Zethyr finance are used to pay liquidity providers through transaction fees. Those who engage in lending for instance get their rewards in the form of these tokens. The interest that is accumulated within the Zethyr protocol through interaction of users are in the form of these tokens. These tokens are native token of the Zethyr ecosystem and they match the TRC-20 standard token. Those who want to borrow from the Zethyr finance ecosystem can use these tokens as a collateral.

Stable Feature

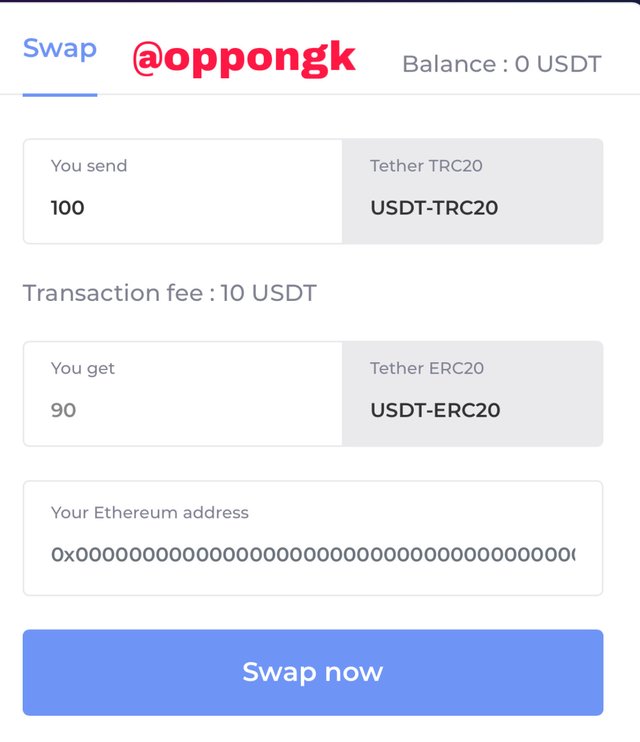

The stable feature in Zethyr Finance was introduced to enhance the swap of stable coins from TRC-20 to ERC-20 within the Zethyr finance and Zethyr swap blockchain. The introduction of this protocol has made the Zethyr finance to be used widely because it supports the simple swap of stable coins such as USDT.

For any swap that takes place, there is a 10% fee that applies as charges. Looking at the screenshot below, my input was 100USDT on the TRC-20 and I am expected to receive 90USDT on the ERC-20. This vindicates that there is a very high transaction fees when implementing this feature but the feature is also very reliable and it has a very tight security as well. We only have to make sure we use it when it is needed to avoid loosing our tokens for payment of avoidable transaction fees.

Lend and Borrow Feature

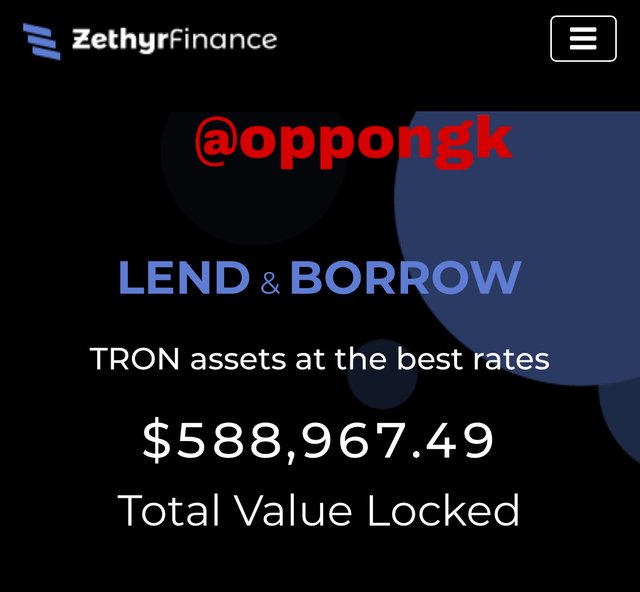

The lend and borrow feature is one of the most relevant features of the Zethyr finance. This feature allows users to be able to provide liquidity to the ecosystem and then gain rewards in return. The rewards gained depends largely on the the number of tokens that are locked at a particular time.

Looking at the screenshot above, at the time of writing this article the value of the total number of locked tokens was $588,967.49.

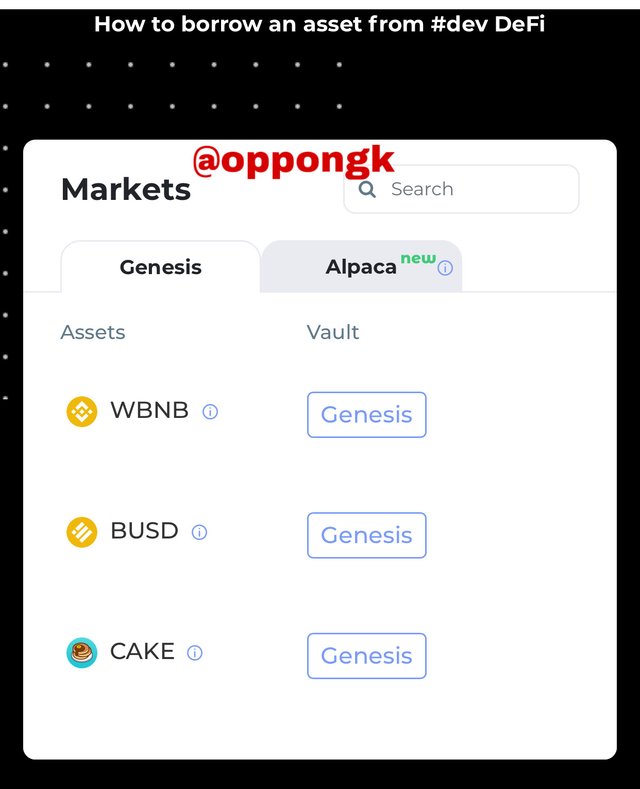

Some of the assets that can also be found in the pool can be seen in the above screenshot. Some of these assets include; BUSD, WBNB, CAKE among others.

Zethyr DEX aggregator

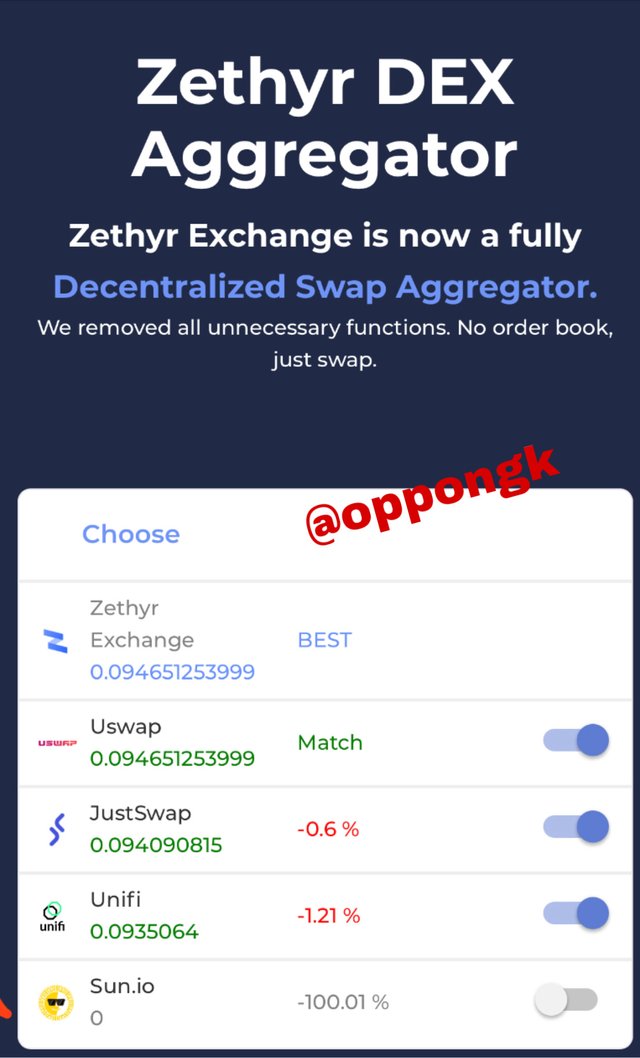

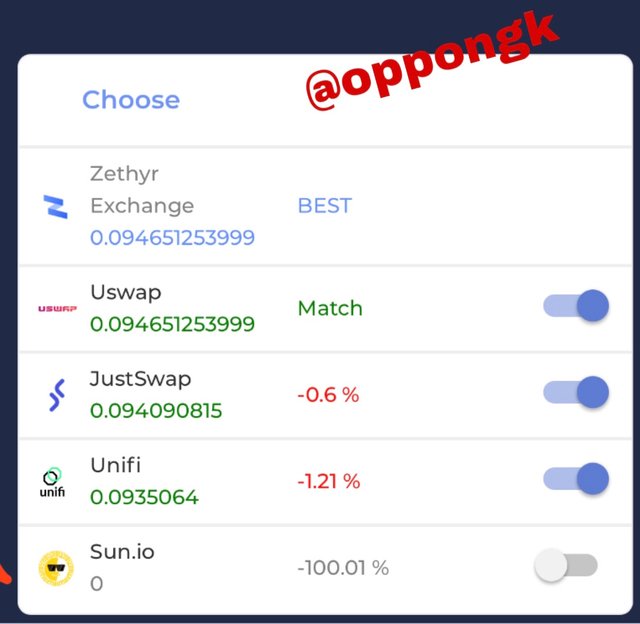

The Zethyr DEX aggregator is the combination of Zethyr finance and Zethyr swap. In order for the market to remain liquid and to maintain good price and yield, the DEX aggregator aggregates swaps and exchanges. Some of the exchanges involved are UNIFI, JISTSWAP, UNISWAP etc. The swap is mostly executed at a very good rate. Users that perform swap with the DEX aggregator get the swap at the perfect rates and also they are present at the best available price and the users get a good yield at the end of the swap. These good yields are often offered by the aggregated exchanges. Even when the markets are not explored independently, the users are able to explore the aggregated markets due to the presence of the DEX aggregator.

From the screenshot above, Zethyr matches Uswap. It can match any of the others at any point in time.

3. Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

Zethyr finance supports only four types of markets and these markets are present in the Zethyr finance in the form of Borrow and then supply. The markets that are supported by Zethyr finance are TRX, USDT, WIN and BTT.

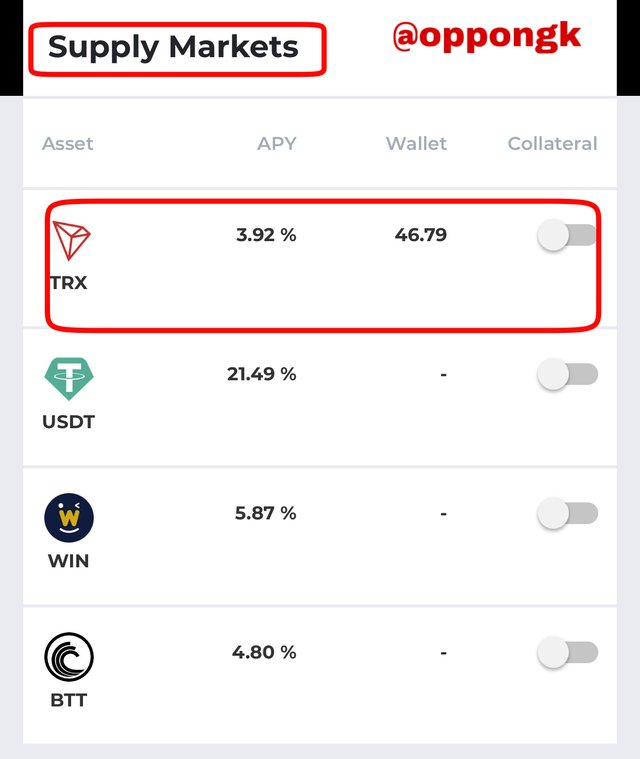

Supply Market

In Zethyr finance, the users can supply tokens to the liquidity pool. This will enable the users to be able to gain rewards from the ecosystem in the form of interest on the tokens supplied. The interest is achieved at different rates depending on the type of token supplied. At the time of writing this article, the token that offers the best APY is USDT which is 24.39%. The one with the lowest supply APY is the TRX which was 4.66% at the time of writing this article. The supply APY for WIN and BTT were 5.93% and 6.33% respectively. The APY is an operation that considers the compound interest. The Zethyr finance employs this APY method therefore making it very profitable for it’s users to gain interest after they supply tokens. The compound interest method always leads to large profits for that matter the APY method is very profitable to the liquidity suppliers.

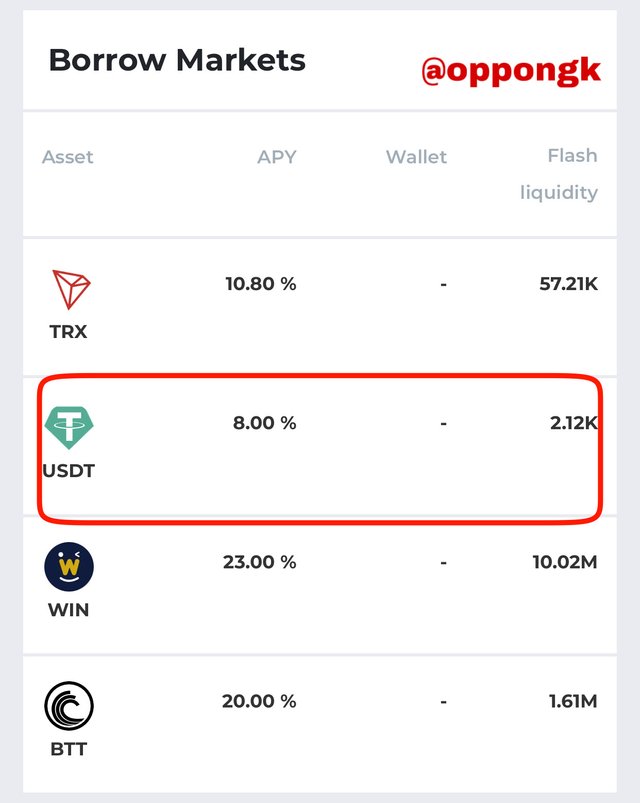

Borrow Market

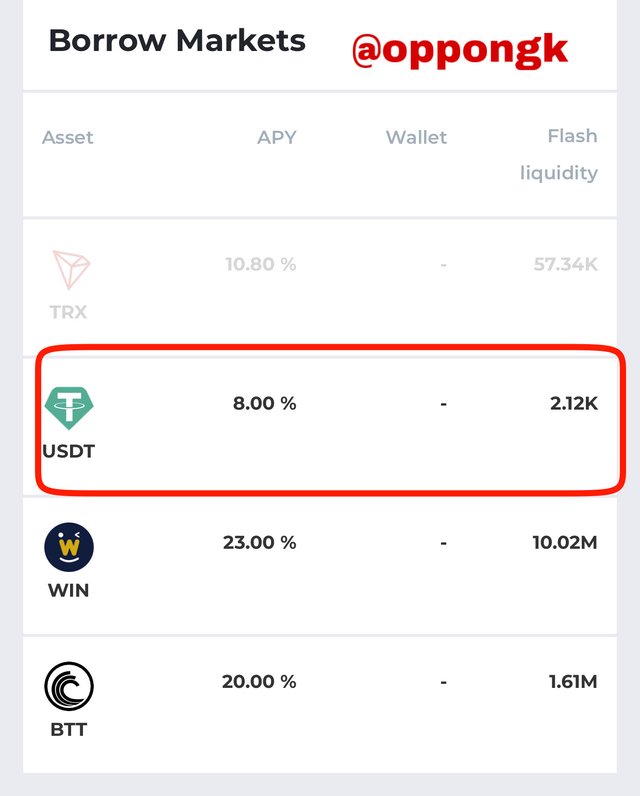

The funds that are gotten from the suppliers in the Zethyr finance are used to lend borrowers within the ecosystem. These borrowers will then pay later with interest at a certain rate. At the time of writing this article, the biggest APY within the borrow market was WIN which is 23.00%. The lowest APY is given by USDT which is 8.00% as seen in the screenshot above. Based on the APYs of all the assets, the one that will give more profit to borrowers in the USDT whilst WIN will give them the lowest profit.

4. Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

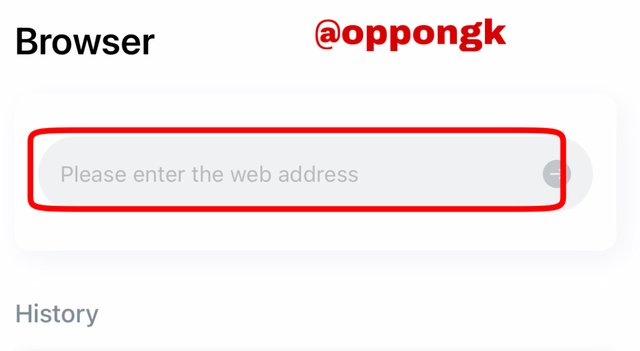

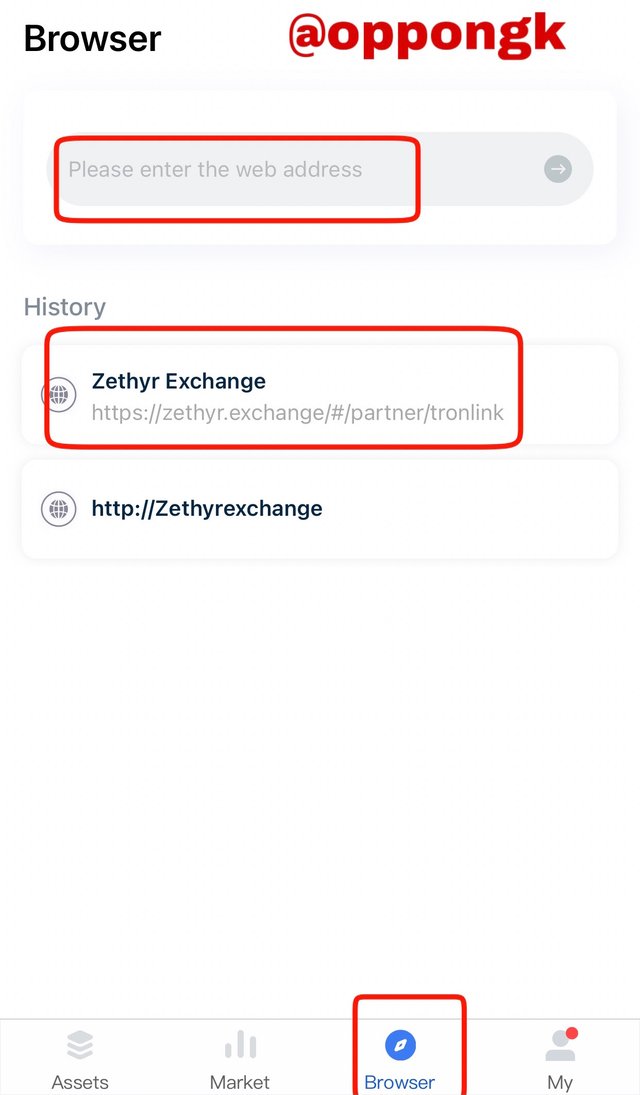

I will use the TRONLINK wallet app on my phone to demonstrate how to connect TRONLINK wallet to Zethyr finance.

I already have the TRONLINK wallet app on my phone so I will just open it.

Then I look below the screen and click on the Browser icon

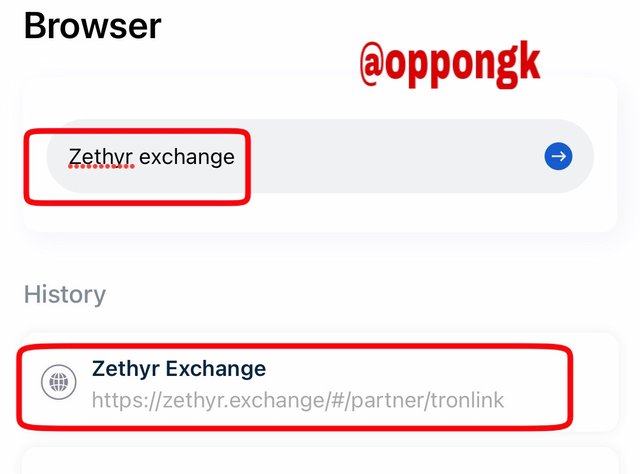

After that a search engine will appear at the top and then I will enter Zethyr Exchange. Then I will click on it to launch the DApp.

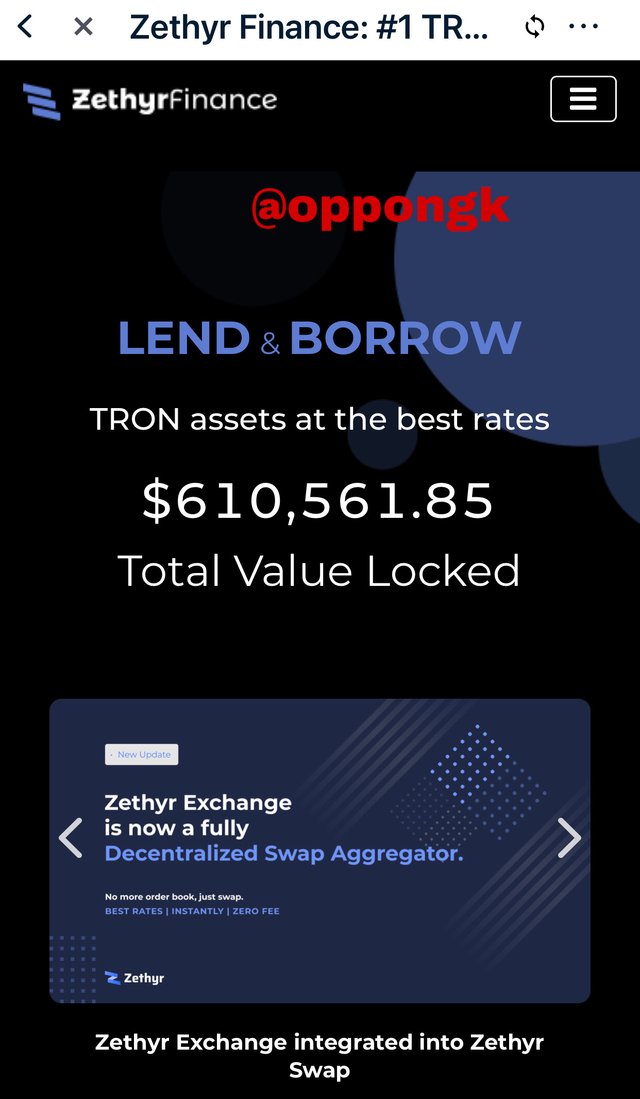

Now we can observe that the TRONLINK has been successfully linked to the Zethyr exchange when we look on the land page.

After this connection has been finished successfully, we can now operate on both the TRON network and Zethyr exchange simultaneously by using the TRONLINK wallet application on any device.

###5. Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

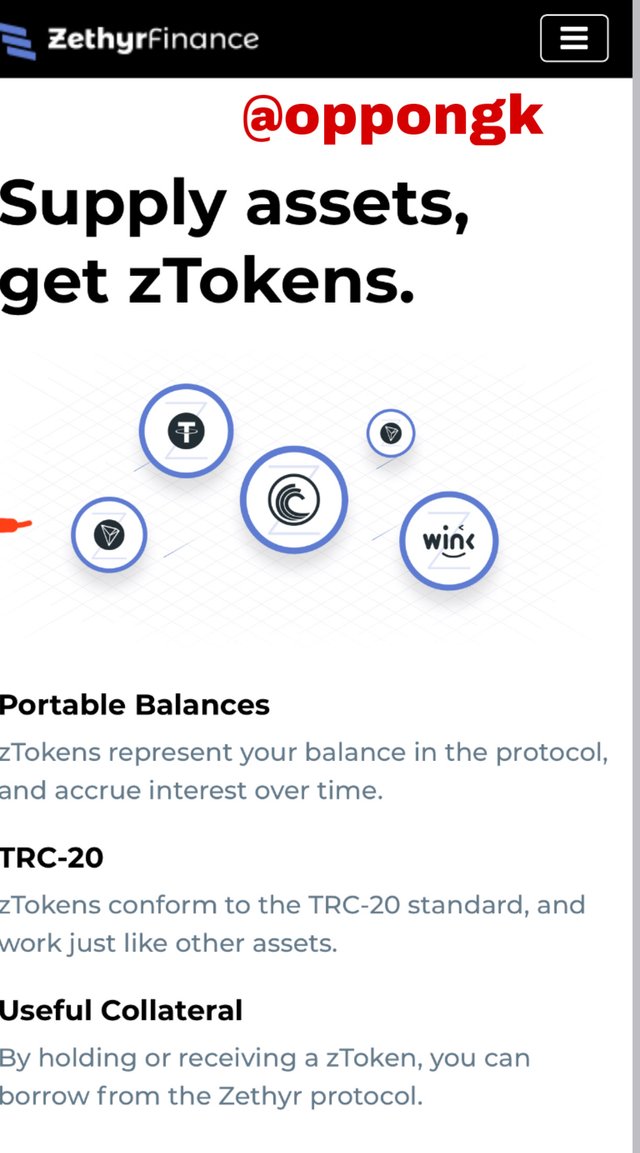

The native token of the Zethyr finance is called the ztoken. When we supply any of the tokens on the Zethyr finance, we gain our rewards in the form of these ztokens. The asset that we supply and the ztoken are pegged in a ratio of 1:1. This means that when we supply TRX to the Zethyr finance, we get the equivalence of zTRX in return. When we supply USDT in the Zethyr finance, we get the equivalent zUSDT in return. Similarly, if we supply BTT within the Zethyr finance ecosystem, we get zBTT in return and finally if we supply WIN within the Zethyr finance, we get zWIN in return with all these corresponding ztokens pegged at a ratio of 1:1. We earn rewards in the form of ztoken as interest after supplying any of the tokens on the Zethyr protocol. The system is designed in a way that when we supply any token in the Zethyr protocol, our wallets are credited with the ztoken that we deserve. The ztoken is burned and released in the case of a withdrawal of any supplied assets. The ztoken can be used in the Zethyr finance ecosystem to perform any function that the four tokens within the ecosystem system are used for. For example zUSDT can be used to carry out the function of USDT within the Zethyr finance ecosystem.

Another token that serves the same purpose

The JustLend platform is another platform that employs a similar token. The token used on the JustLend platform is called the JToken which operates similar to the ztoken. The jtoken and the underlying token are also pegged at a ratio of 1:1. For instance for every 1 TRX supplied, an equivalent of 1 jTRX is gained.

6. Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

Connecting the supply asset pool and enabling it

- The TRONLINK wallet is already installed on my device so I open it.

- Then I click on the browser icon below.

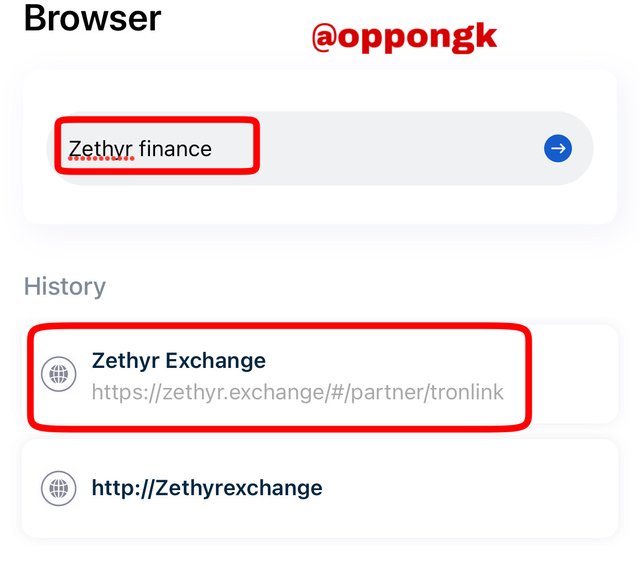

- A search engine will pop up so I’ll enter Zethyr finance

- It is indicated that I have connected the TRONLINK and DApp already.

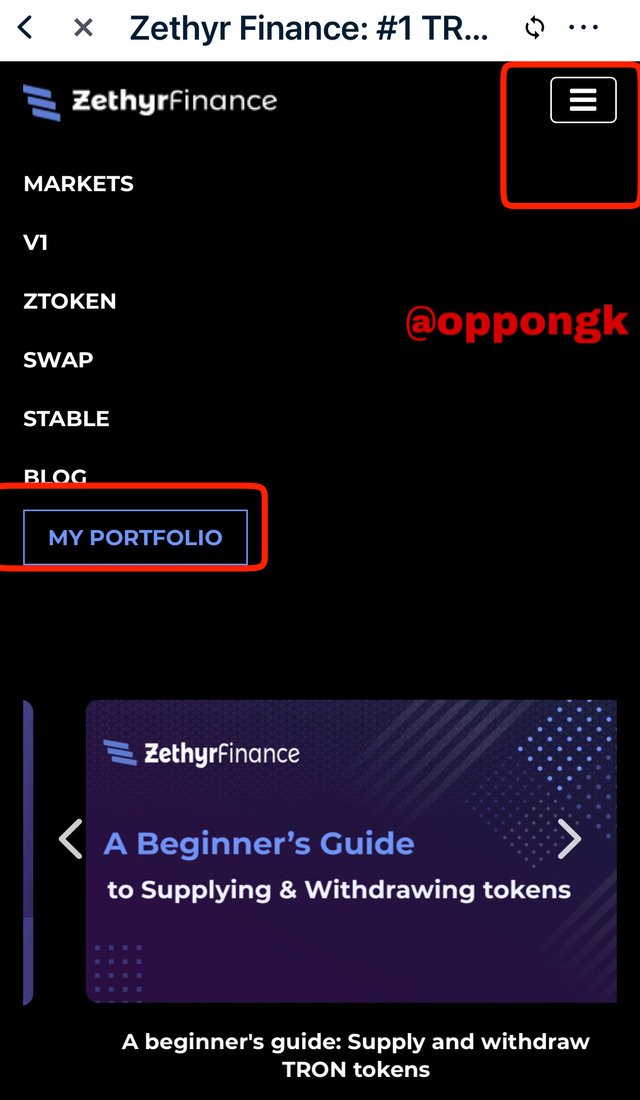

- To confirm that the account has been connected, I will click on the three lines at the top left corner

- After that I will move on to click on portfolio and click on supply.

- I have TRX in my wallet so I will use it for this demonstration. So here I click on TRX as my preferred asset.

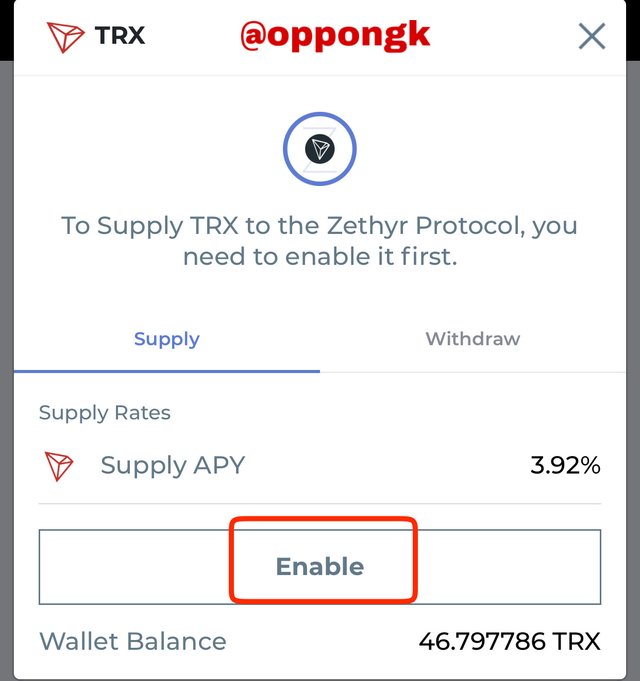

- Then I will click on the supply option and then enable it.

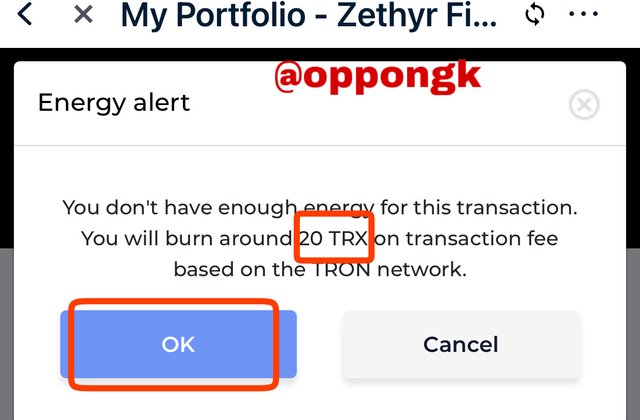

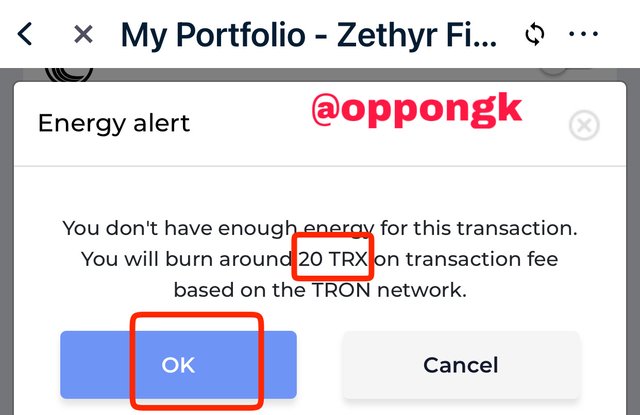

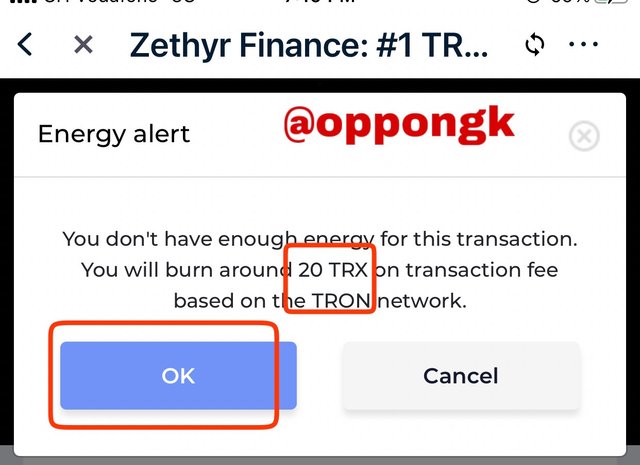

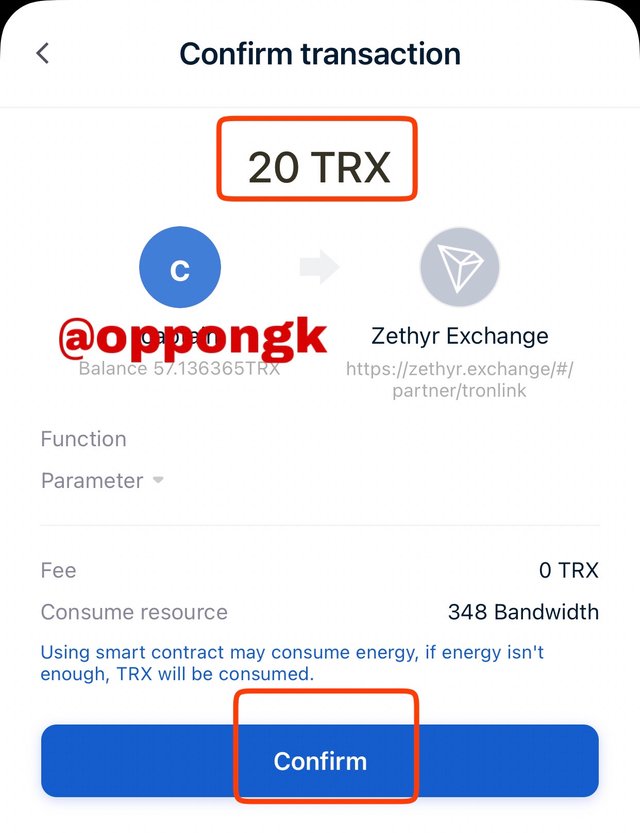

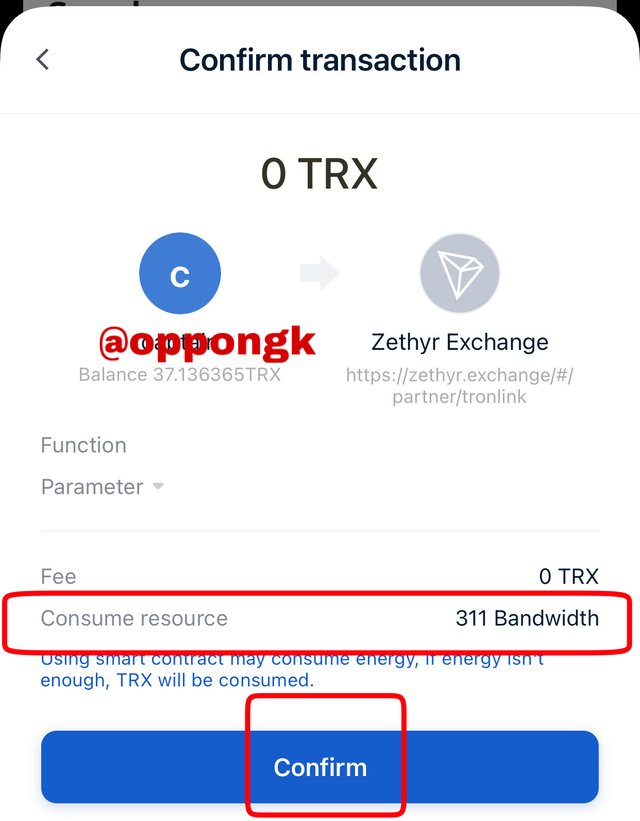

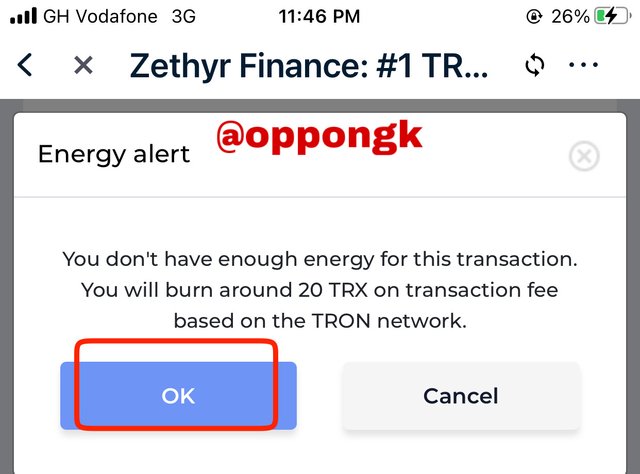

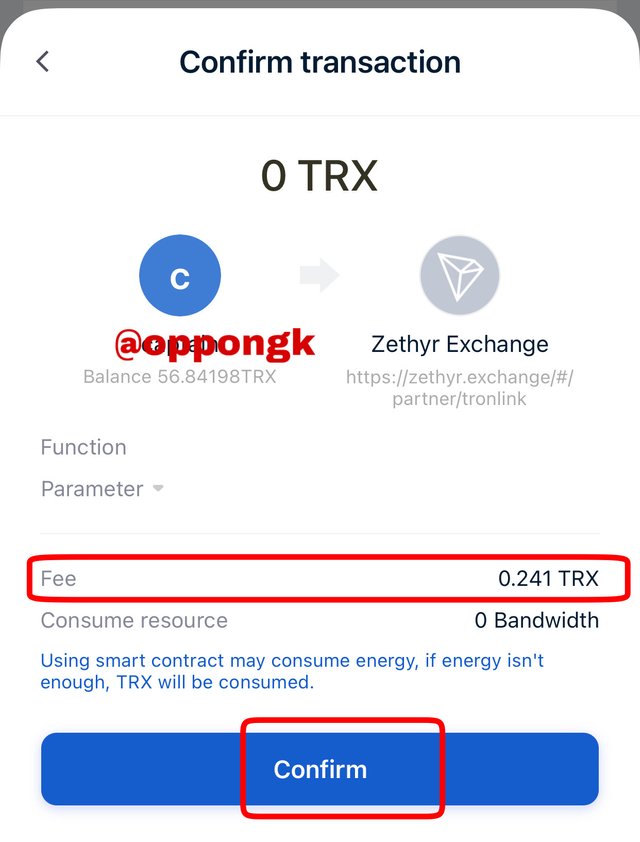

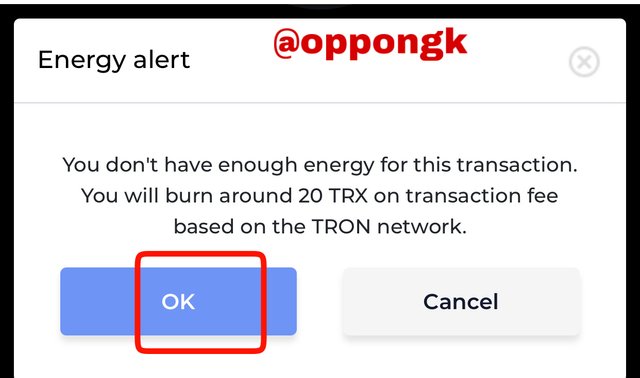

- In this case I decided to burn 20 TRX representing the transaction fee.

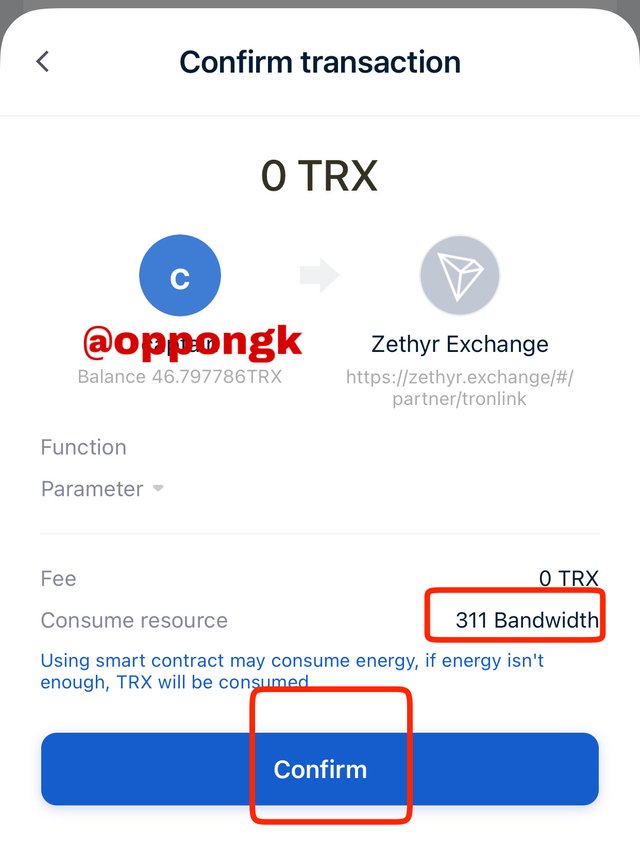

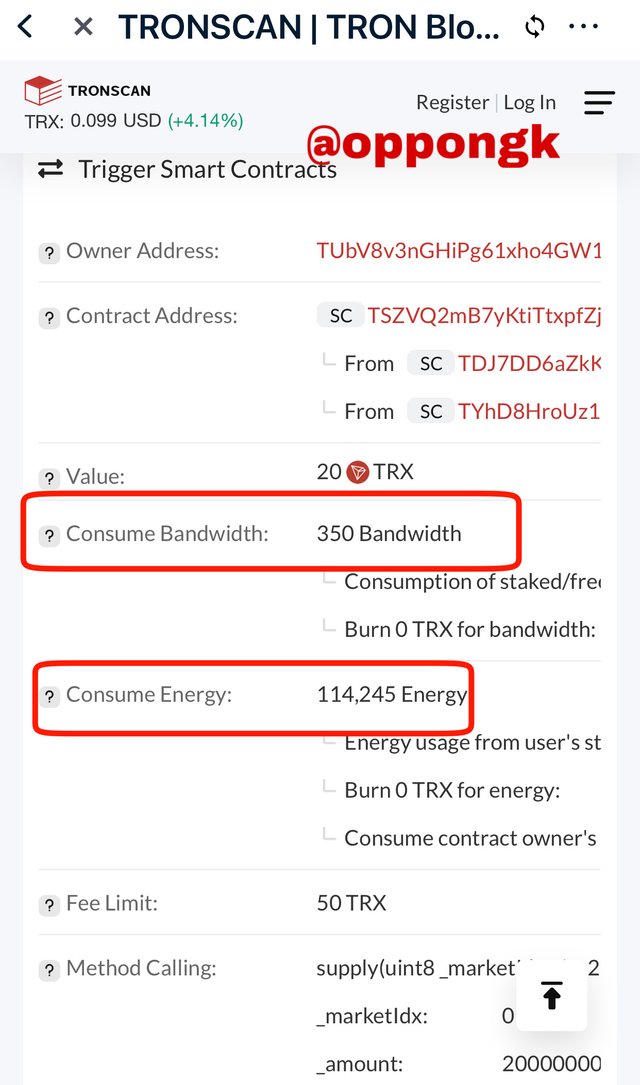

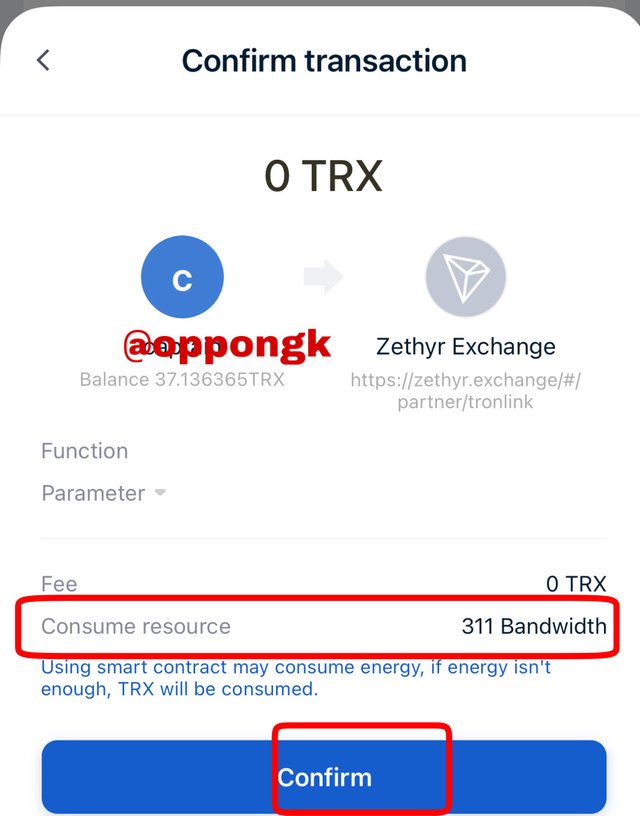

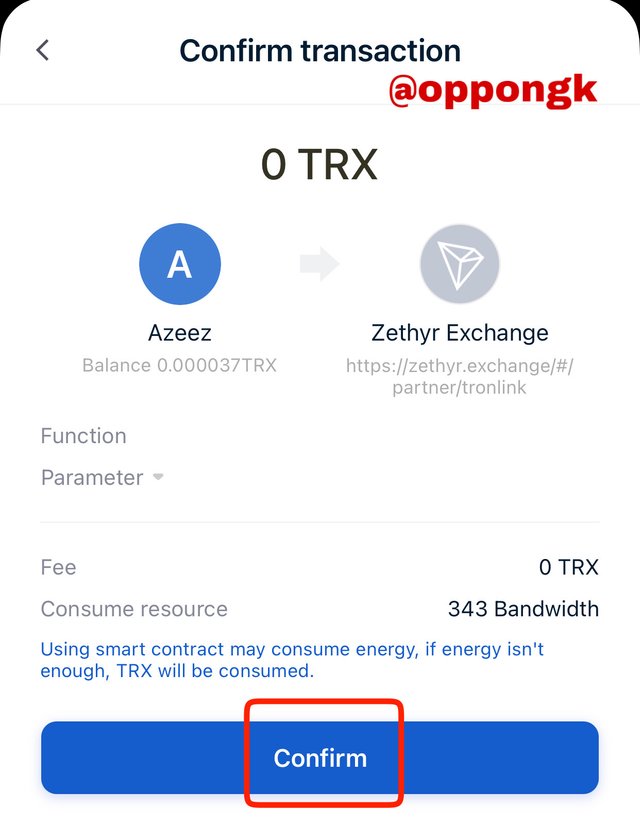

- The bandwidth fee required is

- After that I confirm it.

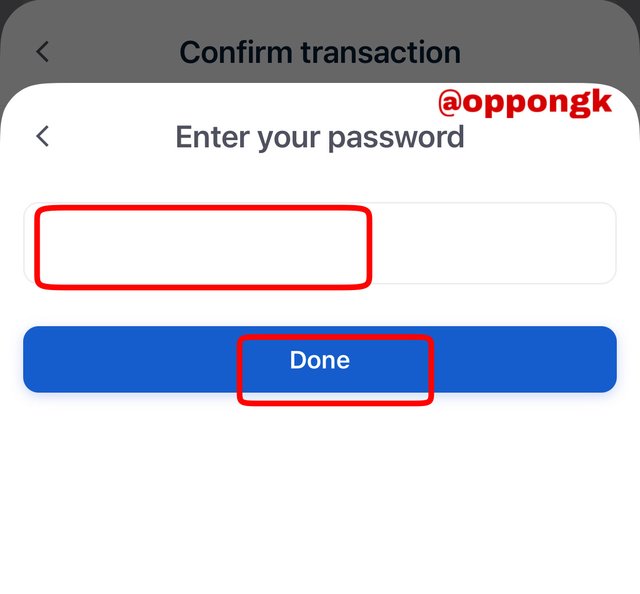

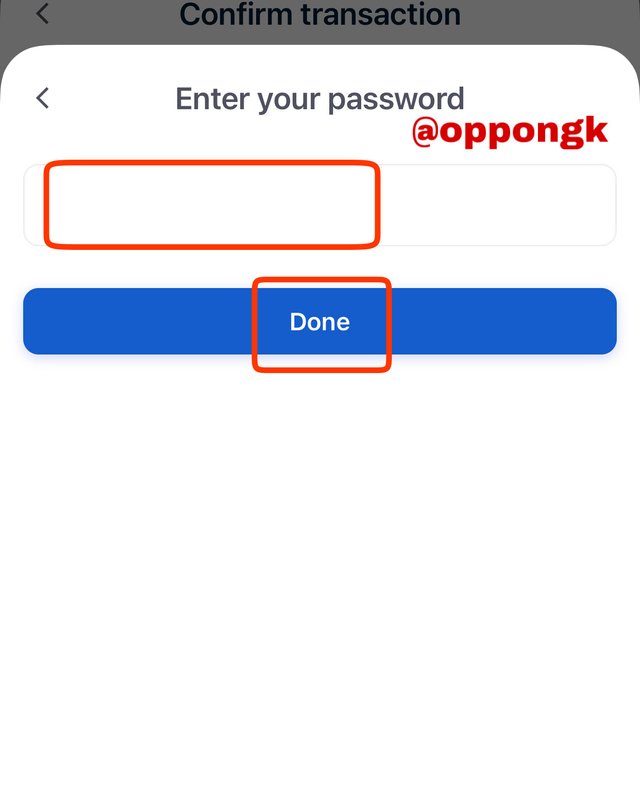

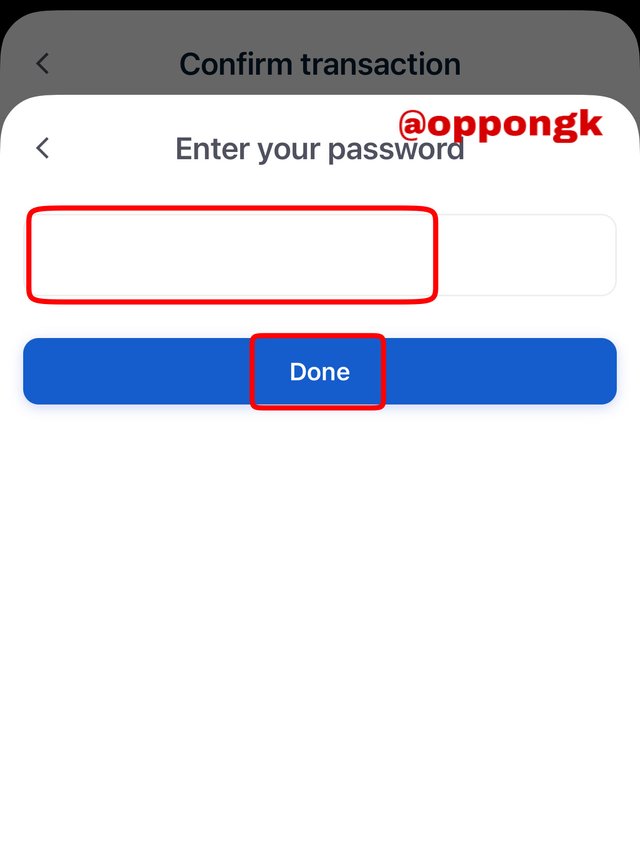

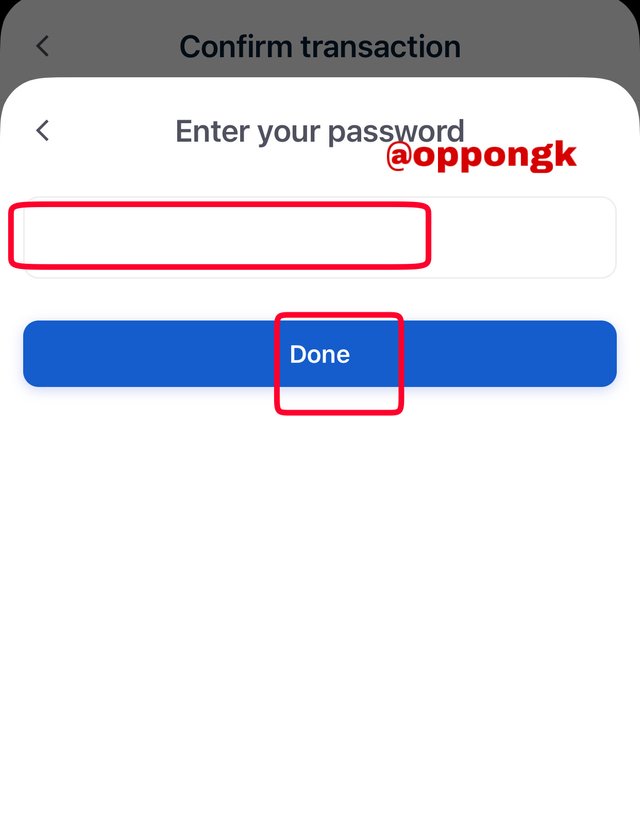

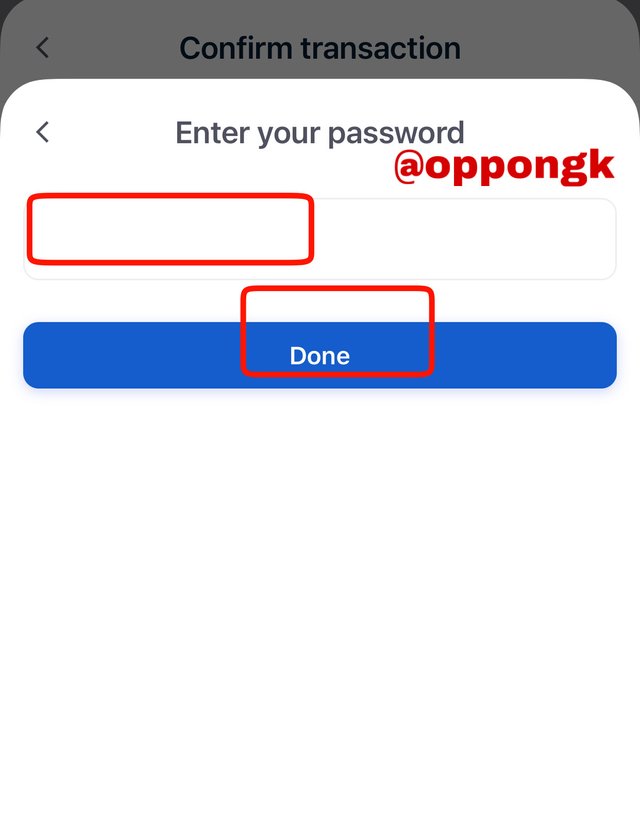

- Then finish the transaction up by entering my password.

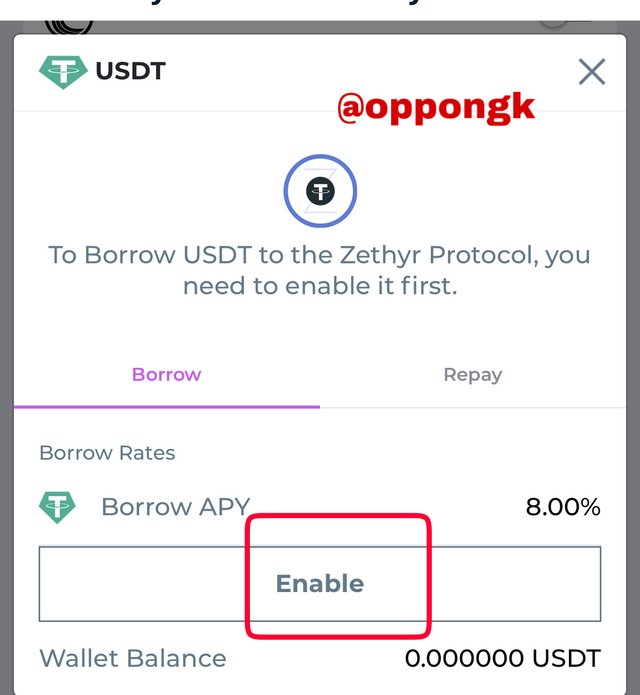

How to enable the borrow asset pool

After the supply pool has been enabled, we have to enable the borrow pool as well by following similar steps that were highlighted above. The continuation steps are as follows:

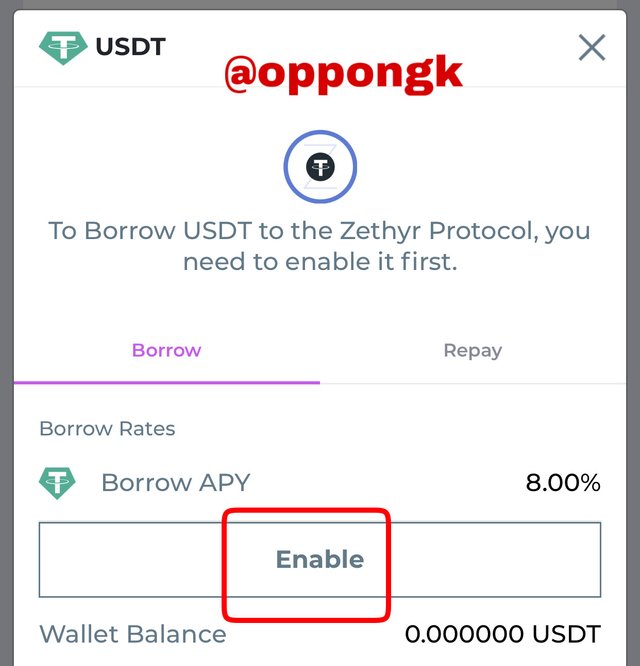

- In the borrow market, we click on the USDT assets as I decided to borrow USDT in this scenario

- Then we enable it by clicking on the enable button

- Then we press OK and then CONFIRM.

- Then finally, we enter the password as required to complete the process.

Supply of TRX in Zethyr Finance

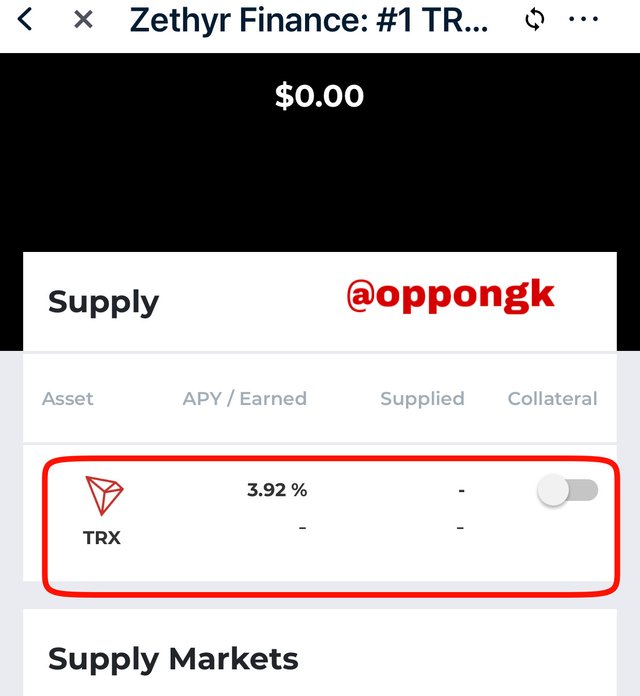

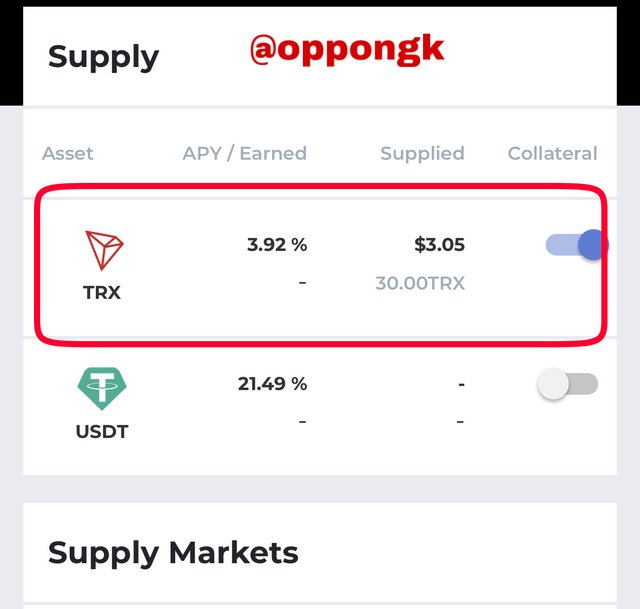

- First of all I will click on the TRX asset above the supply market.

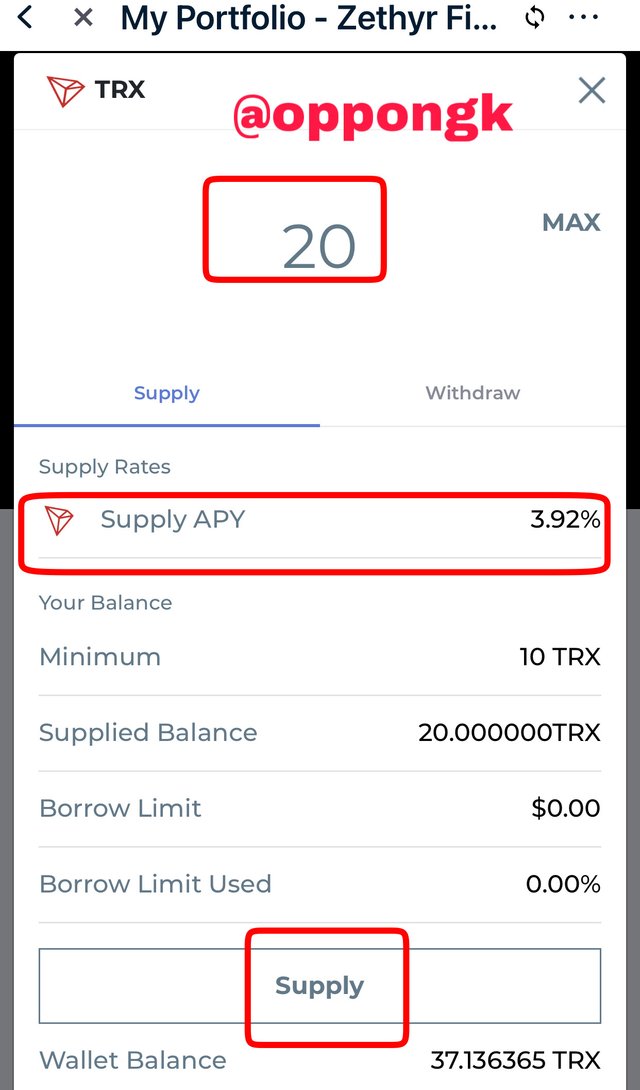

- After that I enter the amount of TRX I want to be supplied

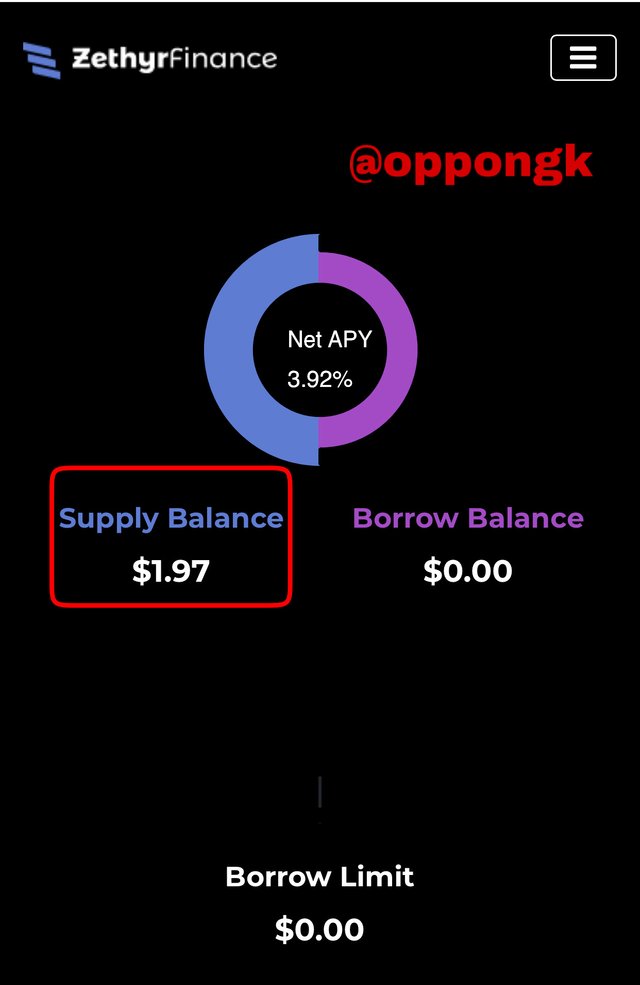

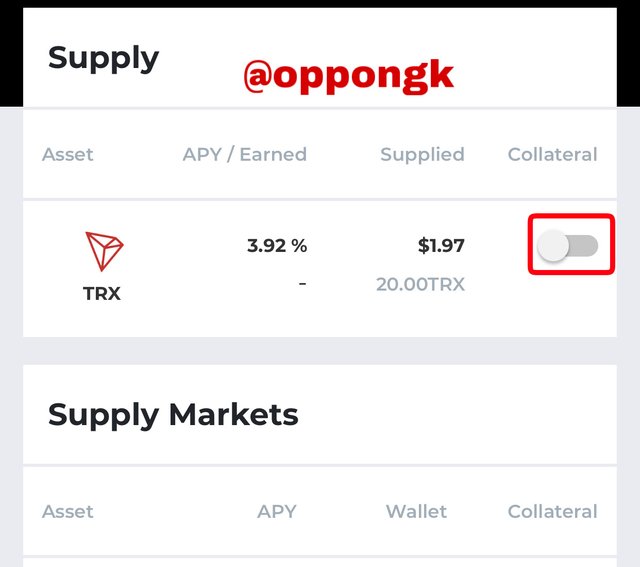

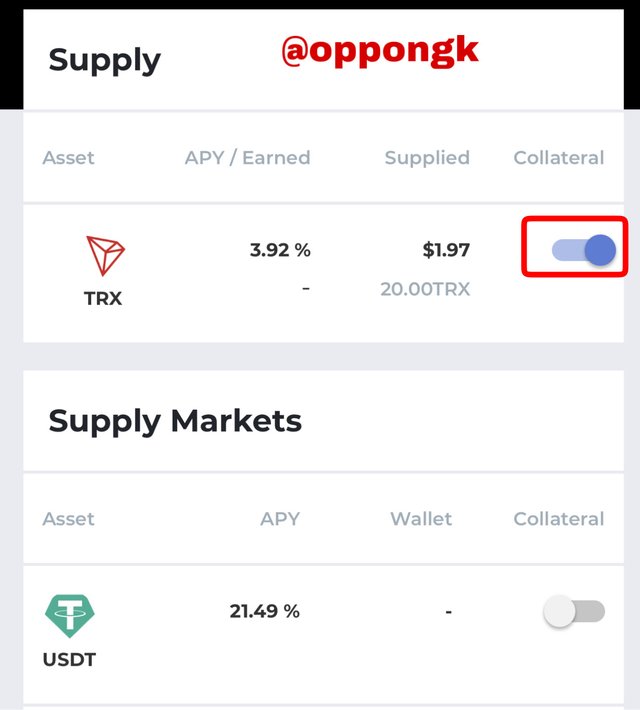

- The supply APY I have is 3.92%.

- After that I click on supply

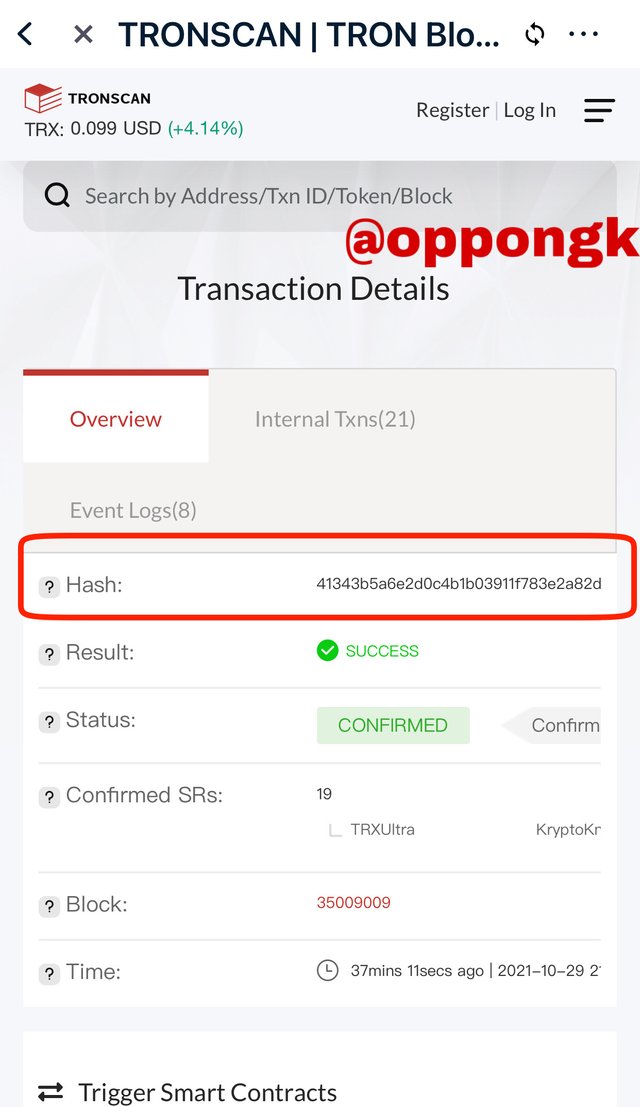

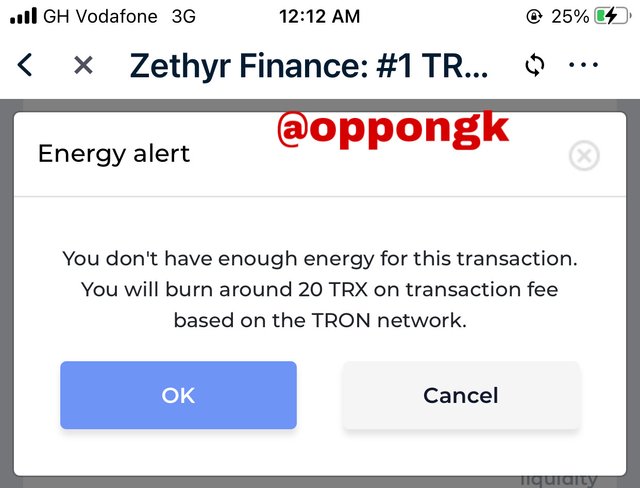

- As we can see below energy of 20 TRX is required to burn the transaction. The we can confirm after this.

- After that we can enter my password to complete the transaction

- The supply has been successful and the supply balance is $1.97

7. Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

How to collateralize my asset

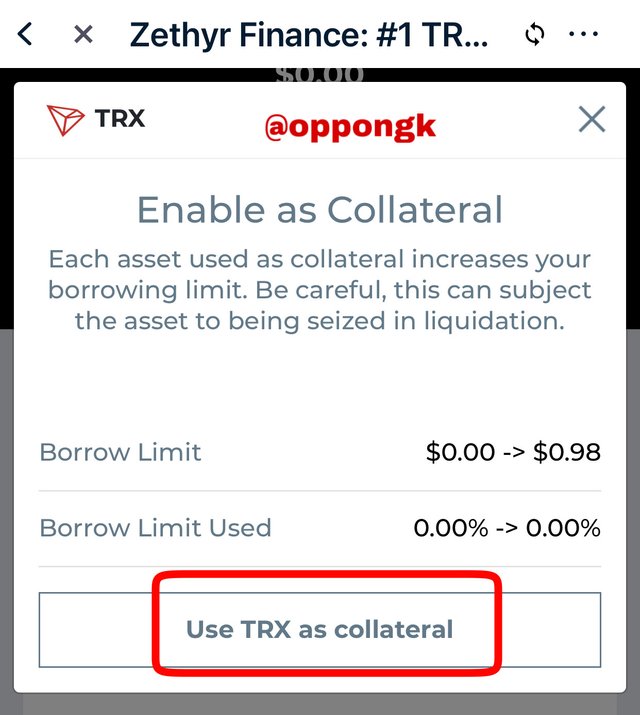

I will slide on the arrow key on the asset I have supplied already. The sliding is done from left to right

Information will pop up and then I click to use TRX as collateral.

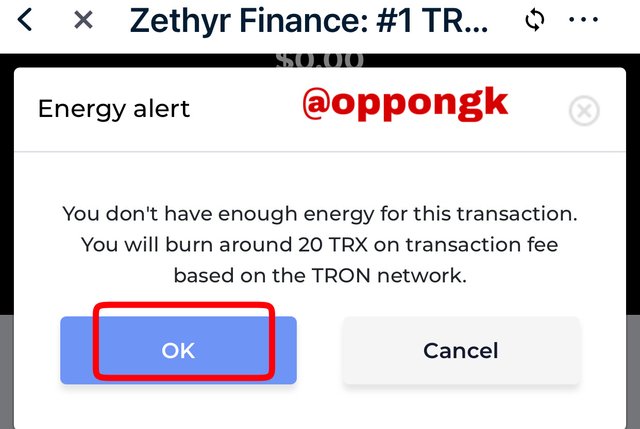

The energy required for the transaction is 20 TRX. So I will press on OK to continue. Then I will confirm the transaction.

Then I will enter my password to complete the transaction and then the button is activated as seen below.

Steps to follow to borrow from Zethyr Finance

- First of all I will go to the borrow asset option

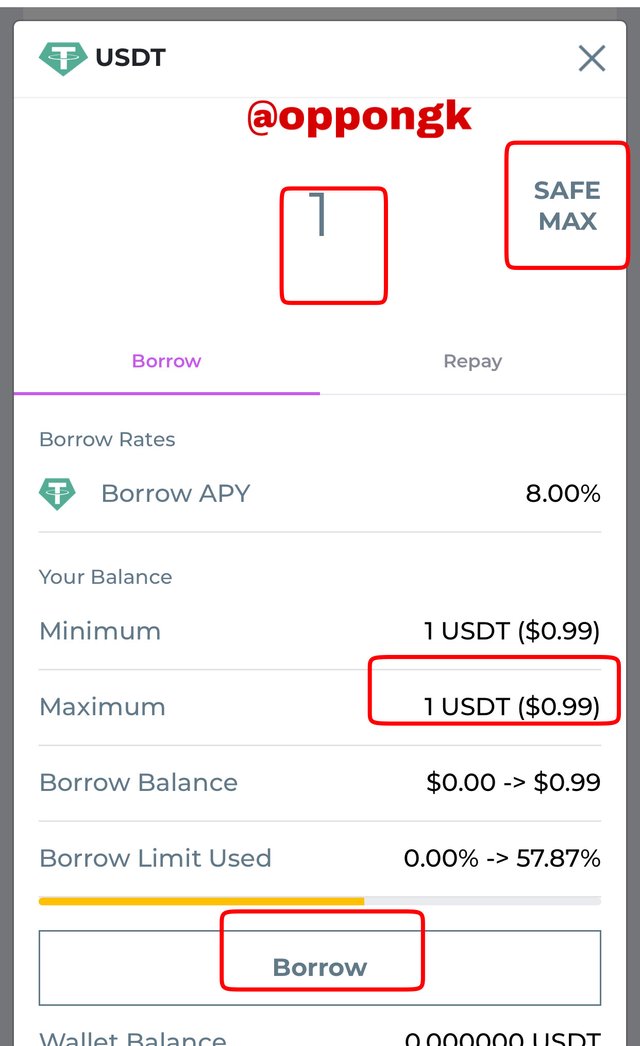

- I already used TRX for collateral so I can’t borrow TRX assets again. I have decided to borrow the USDT asset in this scenario. My borrow limit is $0.98. Only half of the supplied assets are allowed to be borrowed to ensure safety.

- So I will move on to press on the asset I intend borrowing which is the USDT asset.

- Then I will enable it and then press on the OK button.

- Then I will confirm the transaction and then enter my password to sign the transaction.

- From there I have to press on the USDT asset that I want to borrow.

- Initially it isn’t going through because my supplied TRX doesn’t meet the requirements. So I have to supply more TRX so I will reach the requirements. So after the re-supply, my borrow limit is now $1.72 so I can proceed to borrow.

- Now I can press the MAX SAFE button or I can enter the amount I want to borrow and then click on borrow.

- Then I can now confirm and then sign the transaction.

Repaying of borrowed asset

The following steps are to be followed in order to repay assets that have been borrowed.

- First of all you press on the asset that was borrowed

- Then chose the repay option

- Then enter the amount of repayment to be done and then press the repay button.

- Then you can now confirm the transaction

- And finally enter your password and then complete the transaction.

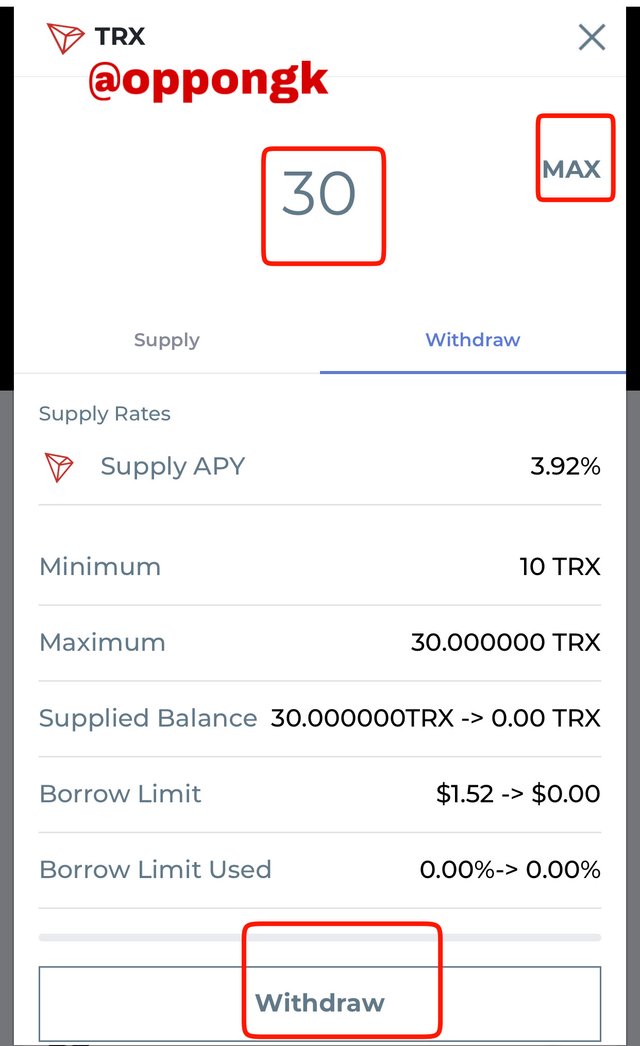

How to withdraw asset from the supply pool

- We will have to press on the asset that we supplied already.

- And press on the withdraw option that is one the immediate left of the supply option.

- After that we press MAX and then we can withdraw the maximum amount

- Then we confirm the transaction.

- we can now enter our password to complete the transaction

8. What do you think of Zethyr Finance? Is it great or not? State your reasons.

The stable swap and other relevant features makes the Zethyr finance a very great DeFi system. Some of the characteristics that makes the Zethyr finance a great DeFi system are as follows.

users within the Zethyr finance can supply their assets to the liquidity pool and the earn interest on them. The interest comes in rewards which are in the form of ztokens. This means that users can supply their tokens which they don’t intend to use in the near future to the liquidity pool and they earn rewards from the supply in the form of ztokens and these ztokens can be used within the Zethyr finance ecosystem at anytime when needed.

The Zethyr Finance also have the stable swap feature. This feature can be used to swap stable coins such as USDT across different blockchains. This means that when a user is in need of USDT from another blockchain, it can easily be swapped on the Zethyr finance.

The Zethyr finance has a very low transaction fee which makes it user friendly.

when users supply assets, the ztokens they gain comes in the ratio of 1:1 with the underlying token. This makes it unnecessary for a user to withdraw the token supplied because equivalent amount of ztokens are gained.

Depending on the collaterallized assets of a user, the user can borrow assets in the Zethyr finance ecosystem and the payback later. However this borrowing comes with an interest and the interest comes in the form of compound interest.

Any coin on the Zethyr finance can be swapped for any coin on the TRC-20 blockchain due to the swapping feature in the Zethyr finance ecosystem.

There’s also a feature in the Zethyr finance which caters for liquidity of trade and minimize liquidation risk within the Zethyr finance. This feature is called the SAFE MAX feature.

The DEX aggregator is also another wonderful feature of the Zethyr finance. This feature allows for the swap between coins on the TRC-20 blockchain which have the best rates. Before the swap, the coin rates are compared to other rates on different exchange platforms.

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit