Order book is a book, manual or electronic in nature where all the trade information about a particular is inputed. Trade information such as buying orders, selling orders and trading history are stored in this record.

Trade book is not just something that is limited to the cryptocurrency space only, but a concept that is used in real life also, it helps traders to understand the demand for a particular coin and also the volume of the coin available and this gives potential traders a good understanding about the underlying happenings In the market .The trading order book gives a list of demand for a particular coin pair at different price levels .

Bellow are some advantages of the trading order book and how they differ from our local markets .

- Transparency : Orders ( both buy and sell) are listed for everyone to see, so there everyone knows what is happening in the backgroundnd and the trades that has been initiated in the past at a particular price for a particular asset .

- Informed decision making : The trading order book helps to give traders information on the potential price trends of a particular market, and can therefore tell if the asset price will reduce( more sell others than buy orders ) or increase ( more buy orders than sell others) provided the volume is constant.

So a trader gets access to all this data and then can interprett and make logical conclusions on the performance of the coin.

The trading order in our cryptocurrency exchanges differ from the local market in a few ways although the base don'tept is the same.

PAIRS: The main difference between the local market and the cryptocurrency trading order book is that the cryptocurrency trading order book, the coins are in paitlrs and we can only look at the orders on a coun pair basis. In a local market, I exchange my money for goods; like fish, but in a cryptocurrency trading, the exchange is coin for coin, that is, I can sell Doge and get an equivalent Tether coin(USDT) . And the trading orders are specific for each pair.

HOW TO LOCATE A TRADING ORDER BOOK ON BINANCE EXCHANGE

- Open the binance app on your device.

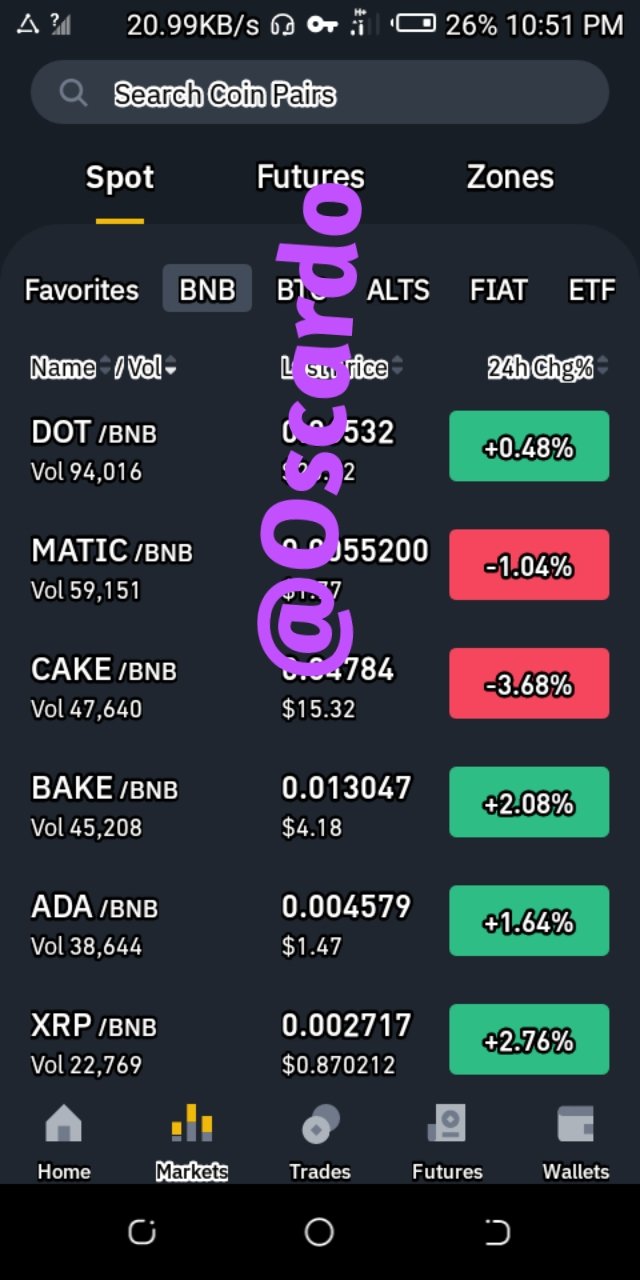

- Click on "markets" at the base of the screen.

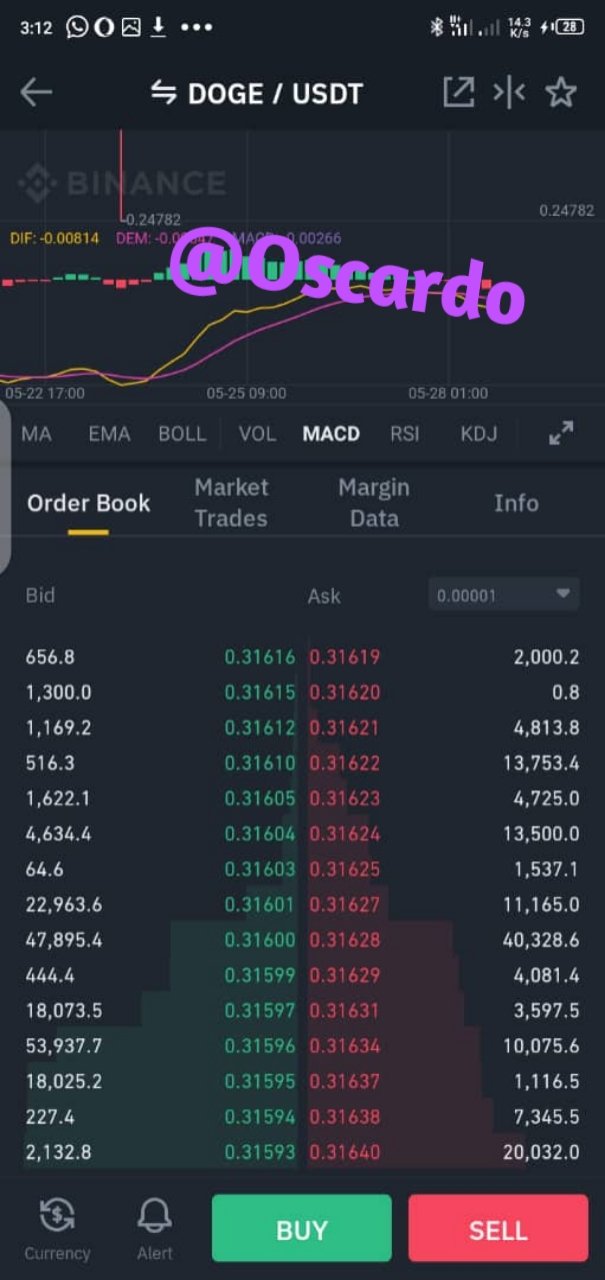

- select the coin pair of your choice( mine DOGE/ USDT).

- Click on the "depth" icon at the top right corner of the candle chart.

Scroll down to view the order book.

Cryptocurrency pairs

A cryptocurrency pair is an exchange duo. That is I want the value of one coin to be expressed in the value of another coin. So basically I can buy an equivalent value of another coin (USDT) with the coins I have(DOGE). In cryptocurrency trading coins are always in pairs and when trading, all we are doing is selling one coin and purchasing an equivalent in another coin.Example of coin pairs are DOGE/USDT , BTC/ BUSD ,etc.

Support and resistance

Support is the base or low point of a trend of interest. It is usually selected after a downward trend reversal and an uptrend usually follows .It is usually an entry point.

Resistance is the high point of q trend and it is usually a point where a trader sells his positions as a downtrend is predicted to come after it.

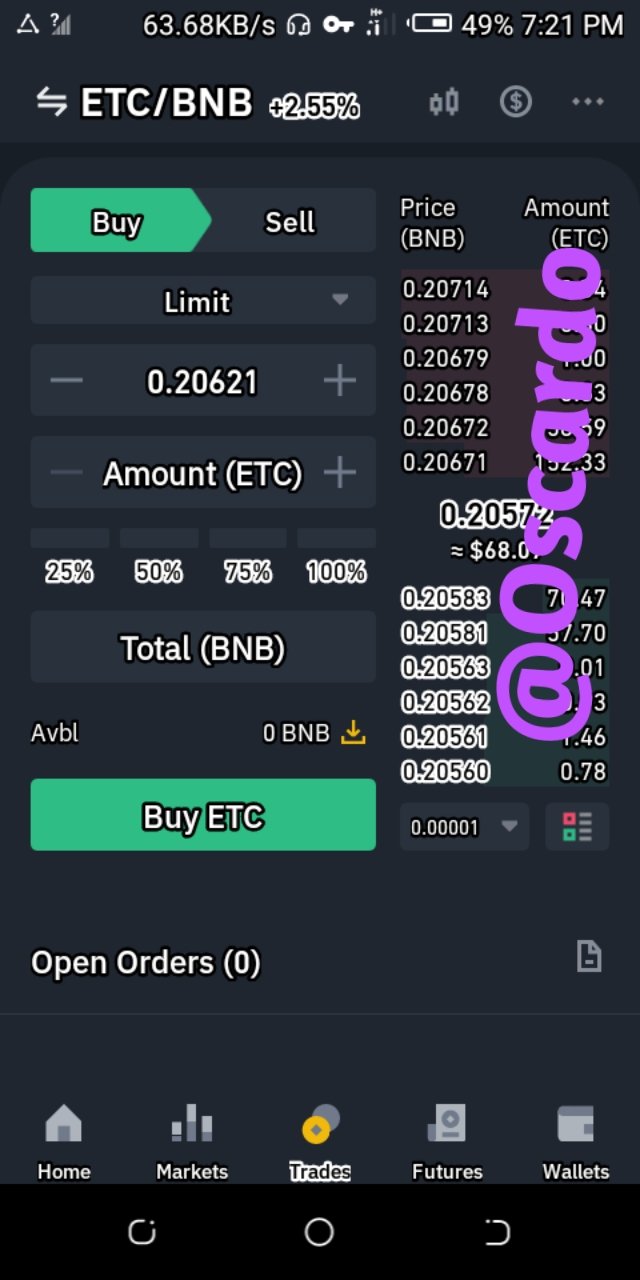

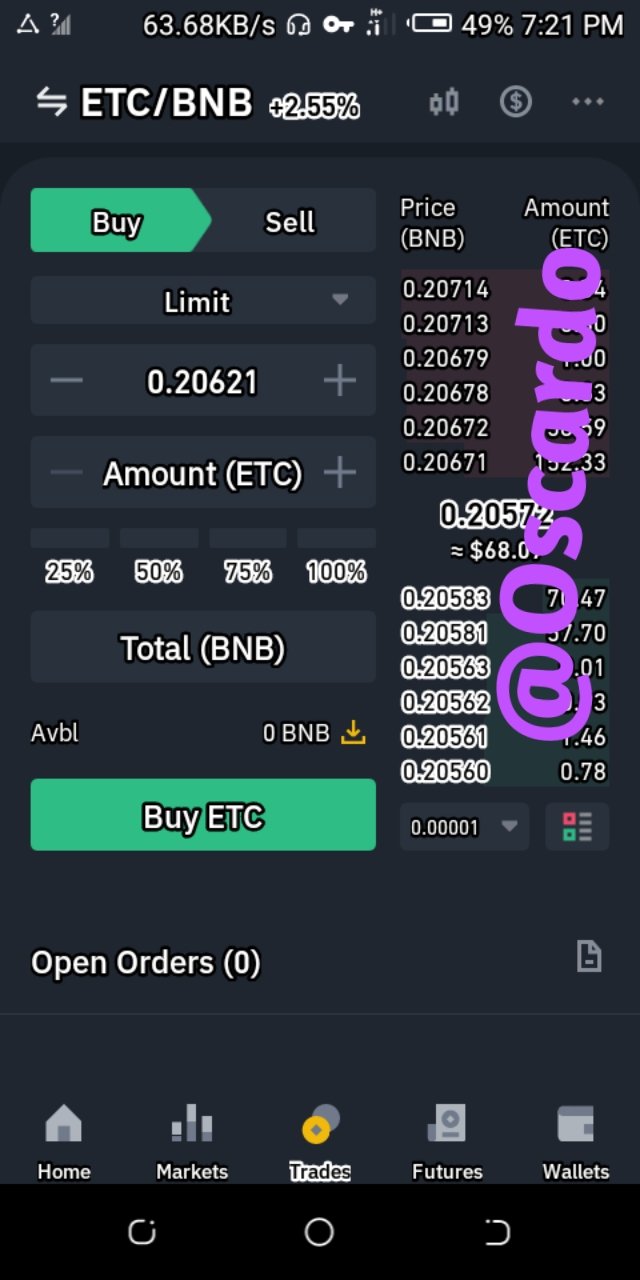

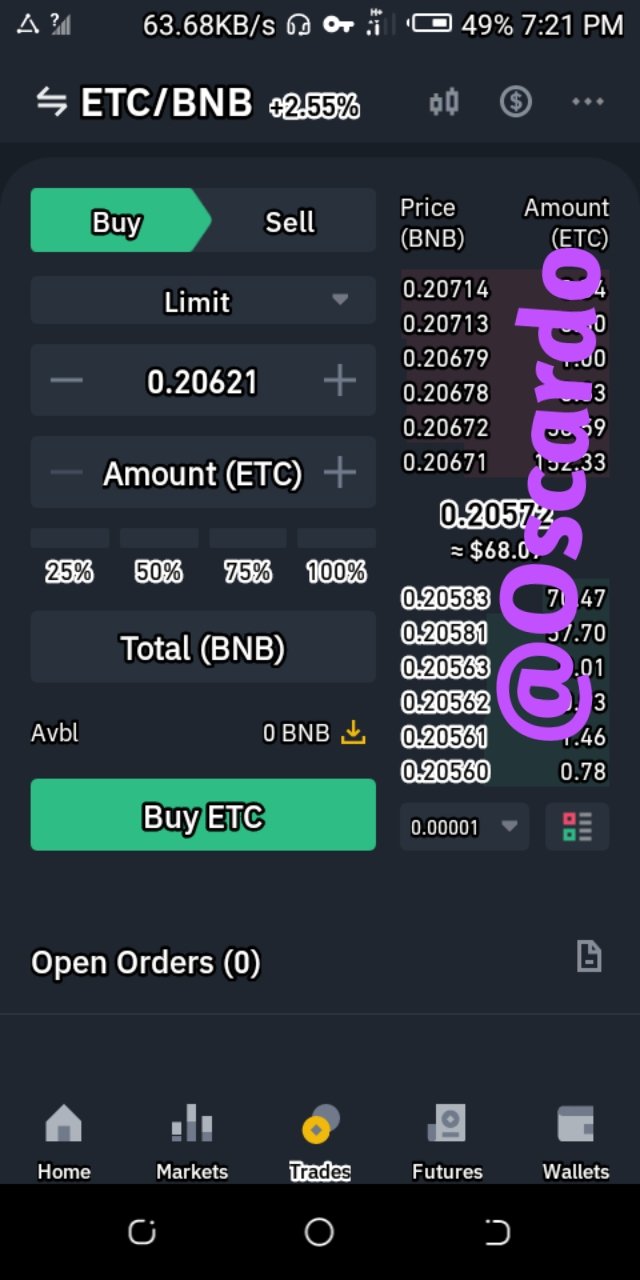

Limit order

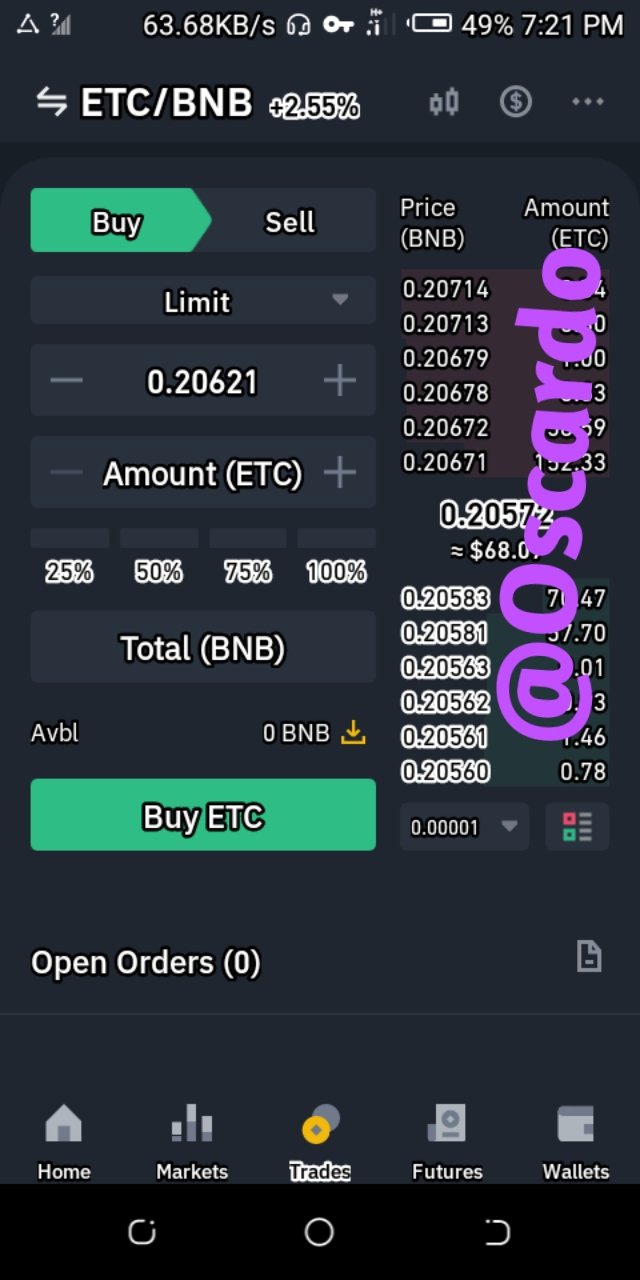

A limit order is an order that executes buying and selling of a particular coin at a predetermined fixed price or a more economic price.

A sell limit order executed sale at an already fixed price or at a higher price, to ensure maximum profit to the seller.

A buy limit order executes buying at a price inputted by the buyer or a price lower so as to ensure maximum value on the side of the buyer.

Market order

Market order is an order to sell or buy immediately at a particular price, so long as there are willing sellers or buyers.

FEATURES OF TRADING ORDER BOOK

- Bid and ask : This is one feature of an order book. The ask block is the asking prices of the sellers and the Bid block is the biding price of the buyers.

- Rates : This are the prices under the bid and ask blocks of the trading order book. The prices in the bid block are in green and those in the ask block are in red.

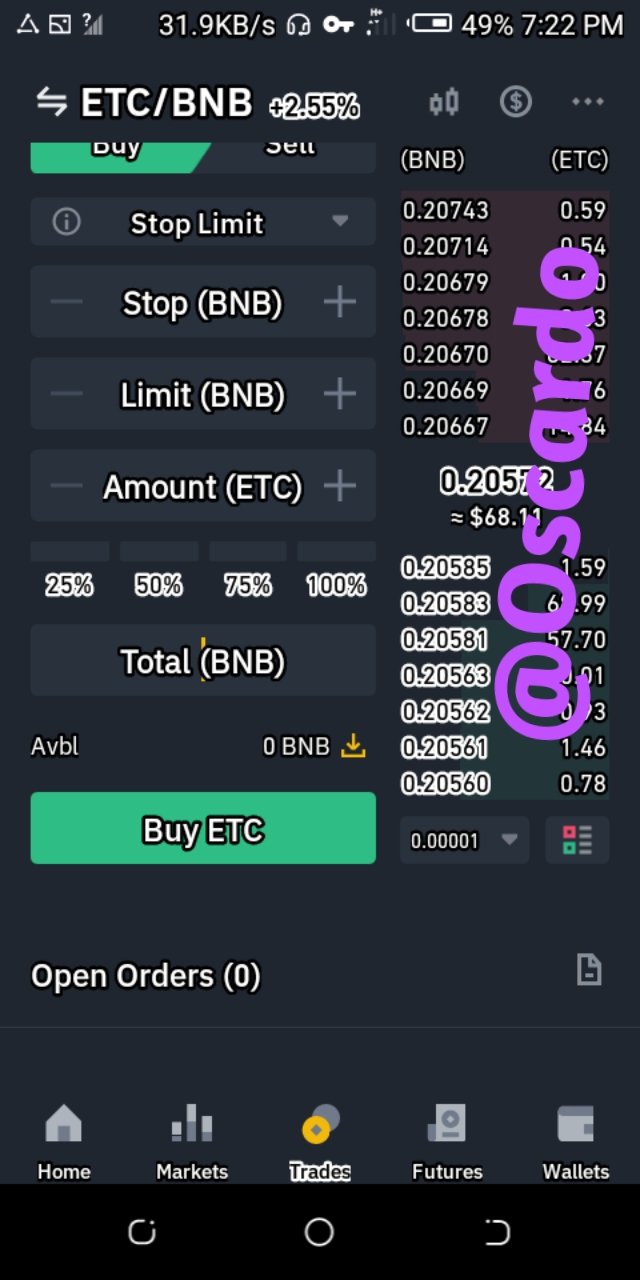

TRADING ORDERS IN STOP-LIMIT TRADE AND ONE CANCELS THE OTHER(OCO)

- Stop-Limit trade : This is trade order that consists of a stop price and a limit order and it is thee stop price that triggers the limit trade. How to place trade order in stop-limit trade

Buy order

- Select " trade " on the exchange home page

- Select "buy" and limit.

- Click on stop limit and modify your price

To place a sell order on the Stop limit order

Change step 2 above to sell

One Cancels the other(OCO) : This tool helps in the placement of two orders concurrently, that is you can place a limit order and stop-limit order at the same time.

How to place trade other on the OCO

Buy order

- Click on "trades "on the homepage

- Click on "buy "

.

- Click on "limit" and select OCO.

- Input your stop limit and limit order values.

To place a sell order on the OCO

Change step 2 to "sell" in the buy order above.

HOW DOES THE TRADING ORDER HELP IN TRADING?

The trading order books helps in making profit because traders have a lot of information readily available, and with a good analysis; knowing how much traders are willing to spend on a particular coin at a particular time makes the whole trading process efficient .

From the buy and sell other, I can easily tell how strong the demand is and therefore the performance of the coin or coin pair.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

above placing order not look well ,

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 4.8

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit