Hello,

In the 6th week of Crypto Academy, we are together again with a very educational topic. Thank you dear professor @reddileep for this useful lesson.

1- Define the concept of Market Making in your own words.

The price of cryptocurrencies changes every second. They are in a continuous upward or downward trend. In other words, cryptocurrencies never remain stable. It is us humans that cause the price of these coins to rise and fall.

When you open the order book of any coin today, you will see many buy and sell orders. These orders are generally within a certain price range.

The people who open buy and sell order orders for the coin in the market at certain intervals and ensure that the liquidity is provided with these orders are called market makers.

For example, when you want to sell crypto in your hand, there must be a buyer who wants to buy it at the same price so that the trade can take place. That is, the market must be liquid. Market makers come into play here. Market makers open buy and sell orders in a certain price range. In this way, they ensure the liquidity of the market. These people earn with the Bid-ask spread.

I will use an analogy to explain this issue better. For example, let's assume that a person living in Turkey goes to any country in Europe. The currency in Turkey is the Turkish lira, in Europe it is Euro. This person needs Euros to spend in Europe. For this reason, he should convert the Turkish Lira he has in the exchange office to Euro. For this, Euro Buying and Euro Selling tables are available in the exchange office. In this table, the buying and selling prices are different. In this example, the equivalent of the Exchange office in the crypto world is Market maker. These offices make purchases and sales at the price ranges they set for us. Likewise, when we think about cryptocurrencies, market makers open sell or buy orders at the rate they set. Just as these exchange offices make a profit from this buying and selling difference, market makers also earn from this spread.

2- Explain the psychology behind Market Maker. (Screenshot Required)

As we mentioned in the first question, the duty of market makers is to provide liquidity by opening buy and sell orders in certain quantities. This will make trading a lot easier for us. But in this case, market makers are also risking their own money. Since these individuals or institutions are not charitable organizations, they do not risk their money just to maintain liquidity. These people/institutions also need to make a profit so that they can continue this business.

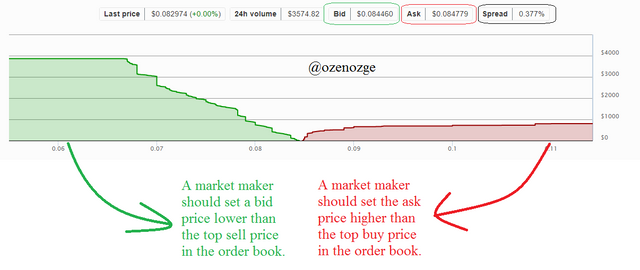

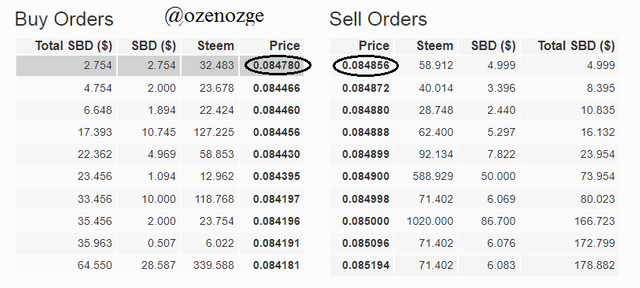

While preparing this assignment, I studied the SBD/STEEM coin pair. That's why I looked at the ask and bid values of these two coins on steemitwallet.

As you can see, the difference between ask and bid prices is very low. But in large volumes, good money can be earned with the spread to be taken from each coin. For example, let the Spread be 0.05 of an X coin. If a 100,000 USD transaction is realized for X coin, the market maker's profit will be 5000 USD.

So far, we have talked about the positive aspects of market makers. As they provide liquidity to the market, it is a win-win situation for both investors and market makers. But whale market makers can also manipulate the market and take money from small investors.

3- Explain the benefits of Market Maker Concept?

Supply Liquidity

As I have repeatedly stated in this article, the biggest benefit of market makers is that they bring liquidity to the market.

As they create buyers and sellers in certain price ranges in the market, liquidity also increases.

More efficient Bid-Ask Spread in Order Book

Market makers help to reduce the spread in the order book with the sell and buy orders they open.

Decrease Slippage

As the Bid-Ask Spread decreases, so does the slippage.

Reduce the Volatility

Market makers reduce volatility in prices as they provide a certain amount of resource flow to the market.

High Price

They cause an increase in the price of the coin they invest in. By increasing the prices of Ask and Bid at the same time, the price of the coin is also changed upwards.

The Number of Investors Increases

The increase in prices will also increase the number of people investing.

4- Explain the disadvantages of Market Maker Concept?

Artifical Liquidty

Although market makers bring liquidity to the market, these people are not fully organized. Therefore, regular liquidity is not provided, but only periodically.

Create Fake Signals

Market makers can create fake signals by raising prices unnecessarily. An inexperienced investor who sees the prices skyrocket may think that this coin will increase and buy at a high price. Later, when the market makers pull the prices back to normal, inexperienced investors sell the coins at low prices and make a loss.

Lower the Price

While market makers can increase the price of a coin, it can also be lowered. When high amounts of sell orders are given, inexperienced investors may see these orders and give an immediate sell order. Afterward, market makers can buy these coins back at a low price.

5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

We know that Market Makers can manipulate the market. By using the indicators, we can understand whether the market is rising in its normal course or is being manipulated. Thus, we do not fall into the trap of malicious people. For this reason, we aim to use indicators and not trade this time. I will use the two most common and trustworthy indicators to answer this question. In this way, I aim to interpret the graphics more accurately.

As we know, the RSI indicator varies in the range of 0-100. If this indicator is in the range of 70-100, the overbought zone, the 0-30 zone is the oversold zone.

In the example above, I examined the BNBUSDT chart. In the region I circled, the RSI passed 70, that is, in the overbought region. This shows us that the price of the coin is more than its worth and gives a SELL signal. When we examine the next price movements, we see that the price is moving in an ascending channel. In other words, when the signal was telling us to sell, the prices increased. Here, while market makers direct investors to sell, it is concluded that the prices are actually in the buying zone, that is, they are manipulated by the market makers.

Bollinger bands are an indicator that consists of the 20-day moving average and the standard deviations of this 20-day moving average. We can make many observations by looking at Bollinger bands. One of these interpretations is that if the candlesticks break the *upper and lower lines of the bands, there will be a change in the direction of the trend.

On the BNBUSDT chart above, we can see that the candlesticks have crossed the upper line of the band. Normally, this tells us that the direction of the trend will change. There is an increasing trend in the chart, but after the candlesticks crossed these bands, they did not change direction and continued to increase. Here, investors can foresee that the prices will decrease and withdraw from the investment. In other words, market makers may have created sales pressure. Investors selling here have thus left their profits at a low level.

Market makers are important in crypto markets, just as they are in the stock market. There are positive aspects as well as negative aspects. While these people ensure the liquidity of the markets, there is also the possibility of manipulating the market. Small investors like us need to consider both situations when investing.

Best regards, Özge