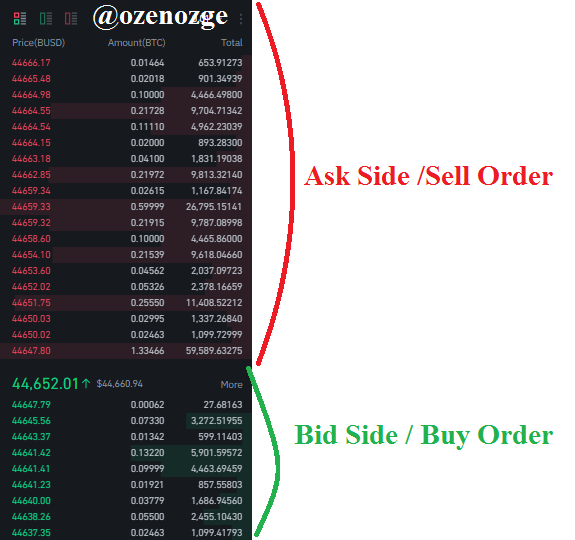

1-Define the Order Book and explain its components with Screenshots from Binance.

The Order Book can be defined as a book in which buy and sell orders opened for a commodity are listed. This Order Book for the stock market is digital and consists of two parts, buy orders and sell orders. In other words, as we learned in our previous lesson, we can say that it is divided into "bid side" and "ask side".

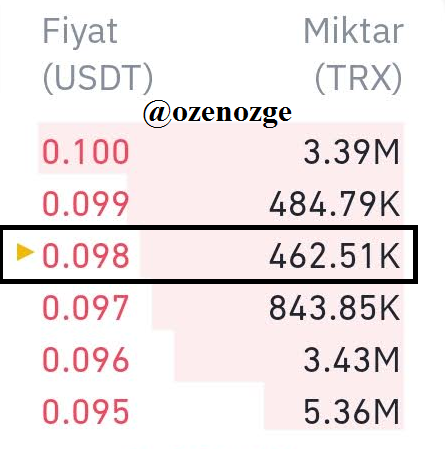

As can be seen in the image above, the Order Book is divided into two sections and there are three columns in each section. In these columns, price, quantity, and total price are given.

The most basic feature of Order Book is that everyone can see the tradings and prices. Thus, it is seen that crypto transactions are made in a transparent way. Apart from this, by examining the Order Book, the liquidity of the market can be observed roughly, it can be determined whether the market is in an ascending or descending trend, or the support and resistance points of the relevant coin can be determined.

Let us briefly explain these related items.

➤As a Liquidity indicator

In the first part of this lesson, we learned that a small amount of "The Bid-Ask Spread" indicates that liquidity is high, and a large one indicates low liquidity.

Starting from here, when we examine the Order Book, we calculate the Bid-Ask Spread approximately and give an idea about the liquidity.

➤To determine a prevalent market direction

By looking at the amount column, we can have an idea of whether the market is a Bearish or Bullish market. If the orders on Bid Side are more, it is an indication that the prices may increase, on the contrary, if the orders are high on Ask Side, it may be an indication that the prices may decrease.

➤To determine support and resistance levels

While the price of a commodity cannot easily pass the support level, it does not fall below the resistance level. If we examine the Order Book, we observe an accumulation of support and resistance points. We can observe that bid orders accumulate at the support level and ask orders are accumulated at the resistance level.

2-Who are Market Makers and Market Takers?

In order to answer this question, it is first necessary to briefly explain the Limit Order. The creation of a buy and sell order for a commodity at a certain price is called "Limit Order". Limit Orders are in the Order Book until the trading is done. Market Makers are the people who create these orders.

In other words, when a Market Maker creates a buy or sell order for a coin, it sets the price itself. These orders may not be executed if the price is given is not at the market value. These people buy at The Bid Price and sell at The Ask Price.

Market Takers, on the other hand, buy a coin in the market at the current price. For this reason, transactions take place instantly. These are the people who accept the price as it is without bargaining for the product they will buy.

3-What is a Market Order and a Limit order?

Market Order is the order opened at the current price of the asset to be traded. For this reason, these orders are executed instantly.

We mentioned Limit Order in the previous question. In a Limit Order, we set the price we are willing to pay to buy or sell an asset. If the market is not suitable for this price at that moment, the order will not be executed. Trading takes place when the Limit Order value is reached.

4-Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

When market makers place Limit Orders, the liquidity of an asset increases. If the Limit Orders are high, there are many orders opened for different prices. This excess also allows this asset to be traded easily. Market takers thus enable the product to be traded by trading these assets. They also reduce liquidity.

In summary,market makers increase liquidity, while market takers decrease it.

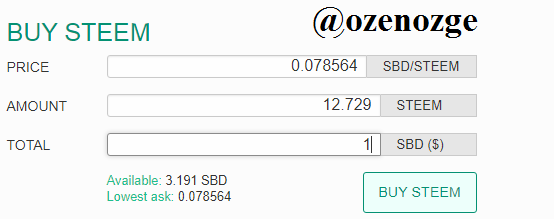

5-Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

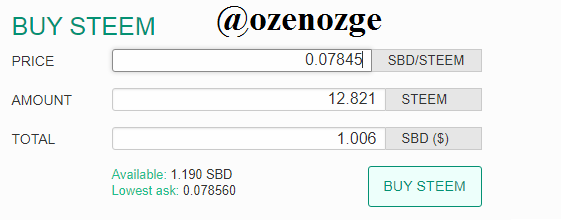

a- When preparing this assignment, the lowest ask value was 0.078564. For this reason, I entered the lowest ask as 0.0078564 for 1 SBD.

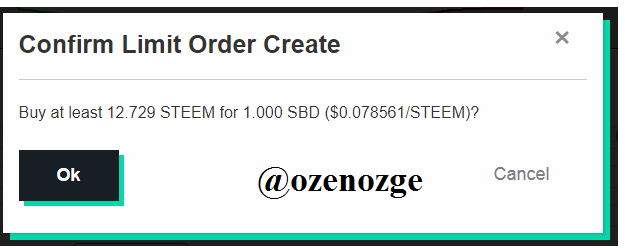

After clicking the Buy Steem button, the confirmation page was displayed.

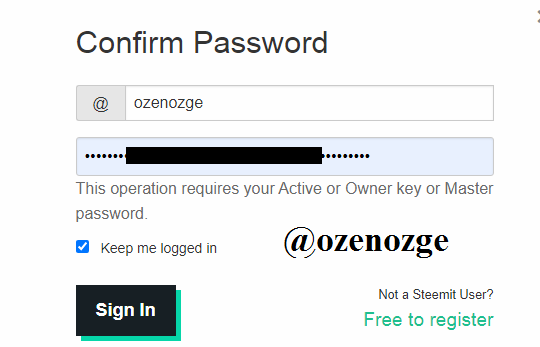

After pressing the OK button, we log in again with the user name and the activate key.Since the Limit Order was the same as the Lowest Ask value, the trading took place immediately. The Limit Order here actually became equal to the Market Order.

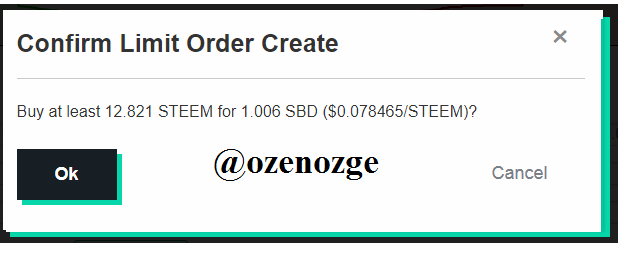

b- While preparing this option, the Lowest ask value changed and became 0.07860. I also set the limit order as 0.7845 differently. Thus, my order will not be executed before the Steem price drops to this value.

When the Steem price reaches $0.078465, I will have bought 12,821 Steem for 1,006 SBD.

6-Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

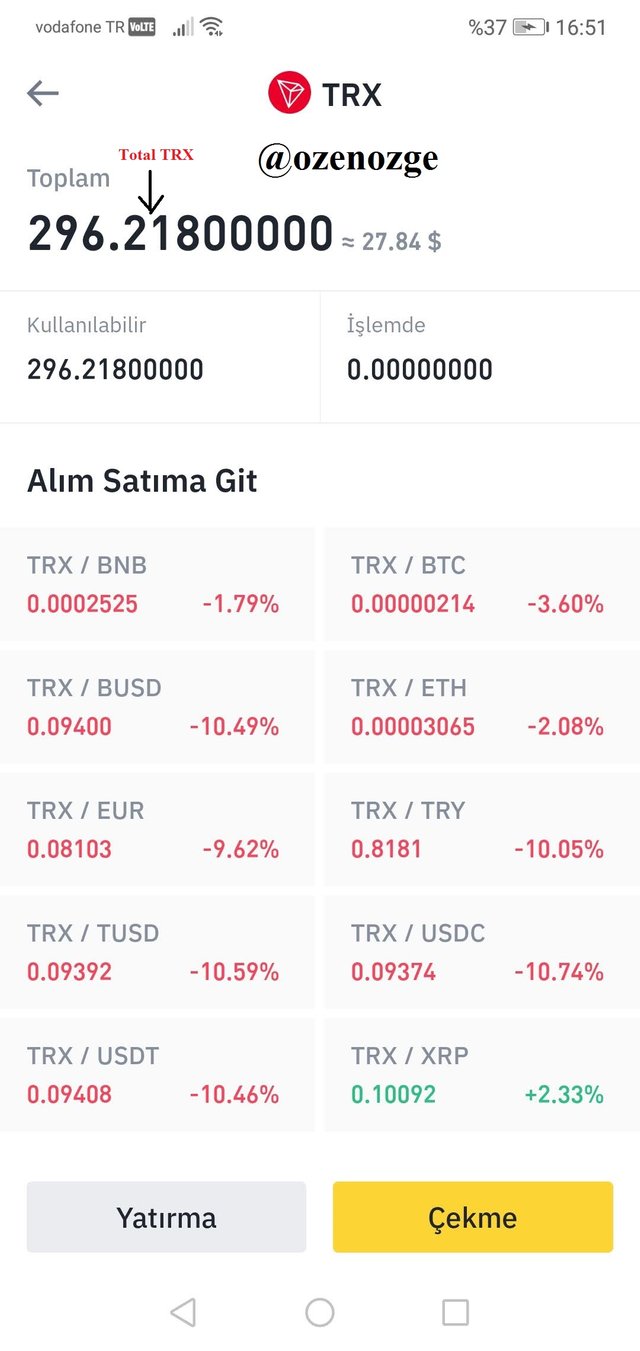

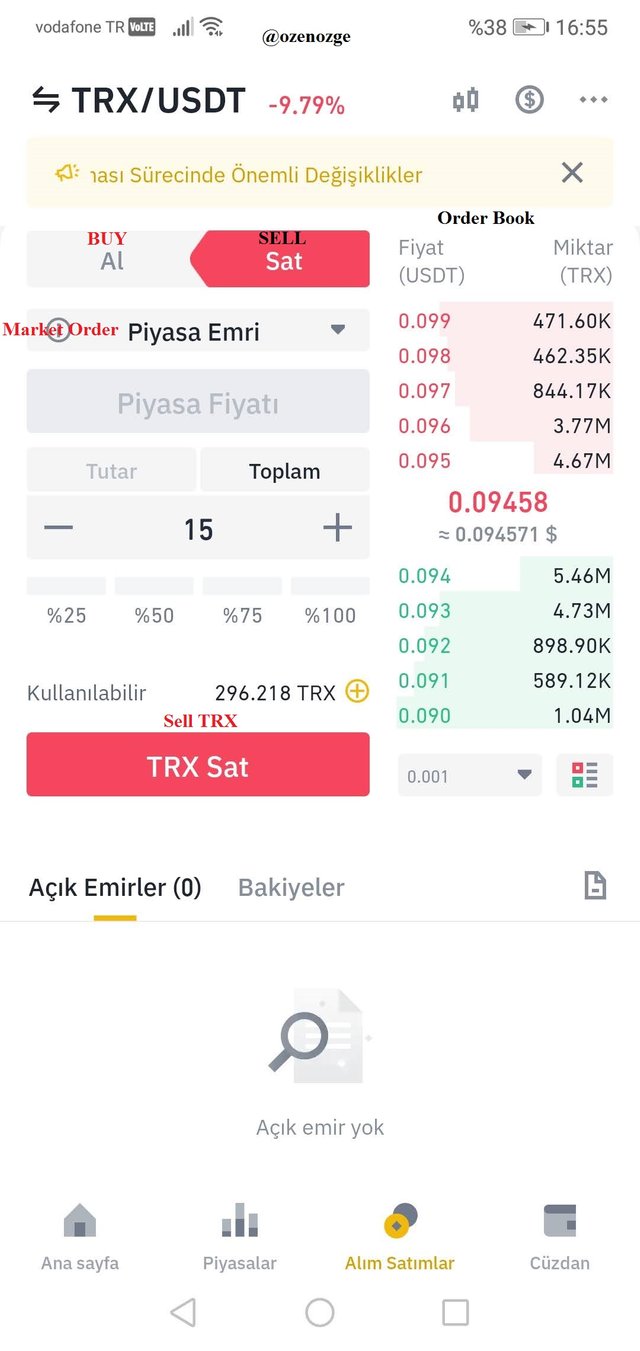

First of all, I didn't have enough TRX balance to answer this question. I bought some TRX for this reason. After purchasing TRX, my balance was as follows.

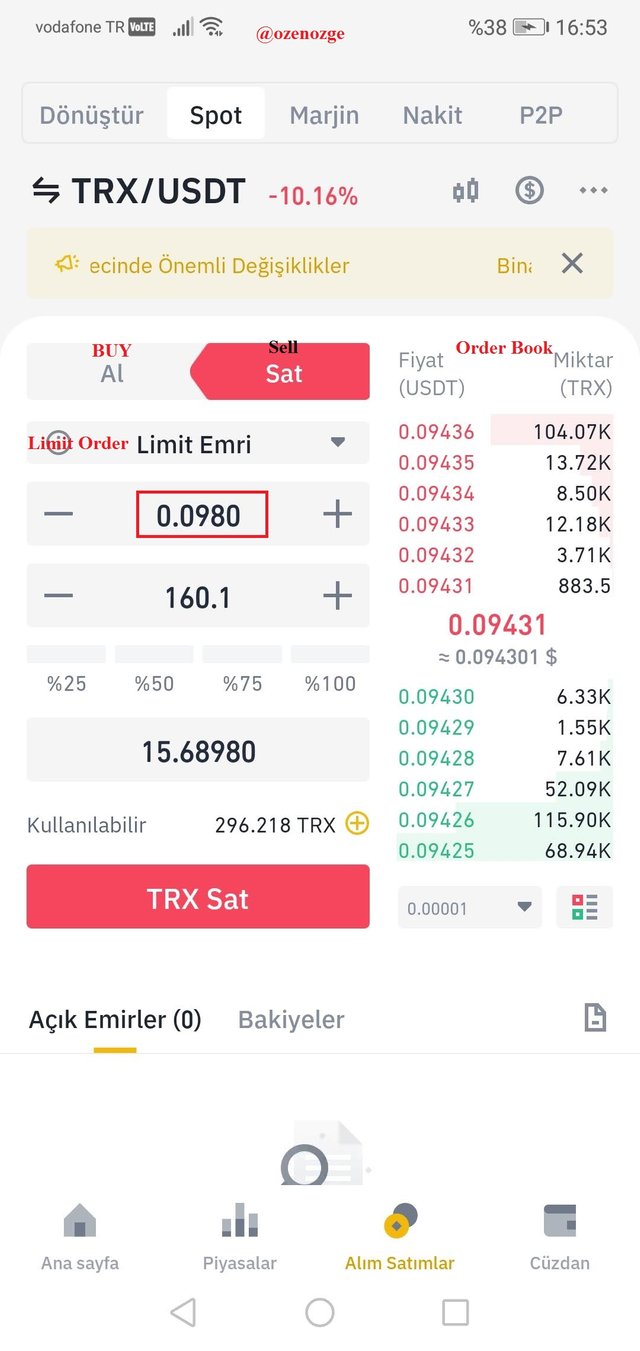

First, I created a Limit Order and tried to buy USDT with the TRXs I have. I kept the Limit Order a little high so that the trade did not happen immediately.

When I created this Limit Order, the market price was $0.09431. I set the limit order as $0.098. If I want to convert TRXs to USD, I can't get rid of TRXs until there is a buyer who can offer that price. I will have to wait a while.

I executed this limit order by clicking the TRX Sell Button.

This is how the order is displayed in the Open Orders tab. But as I mentioned, the TRX sale did not take place.

In the Order Book, the section with the limit order I opened is shown with a small orange arrow. Prices in the left column and TRX amount in the right column. In order for me to sell TRXs, limit orders of 0.095, 0.096, 0.097 must be executed, respectively. The amounts in which these orders will be executed are also given in the table. I canceled this limit order to answer the next question.

7-Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

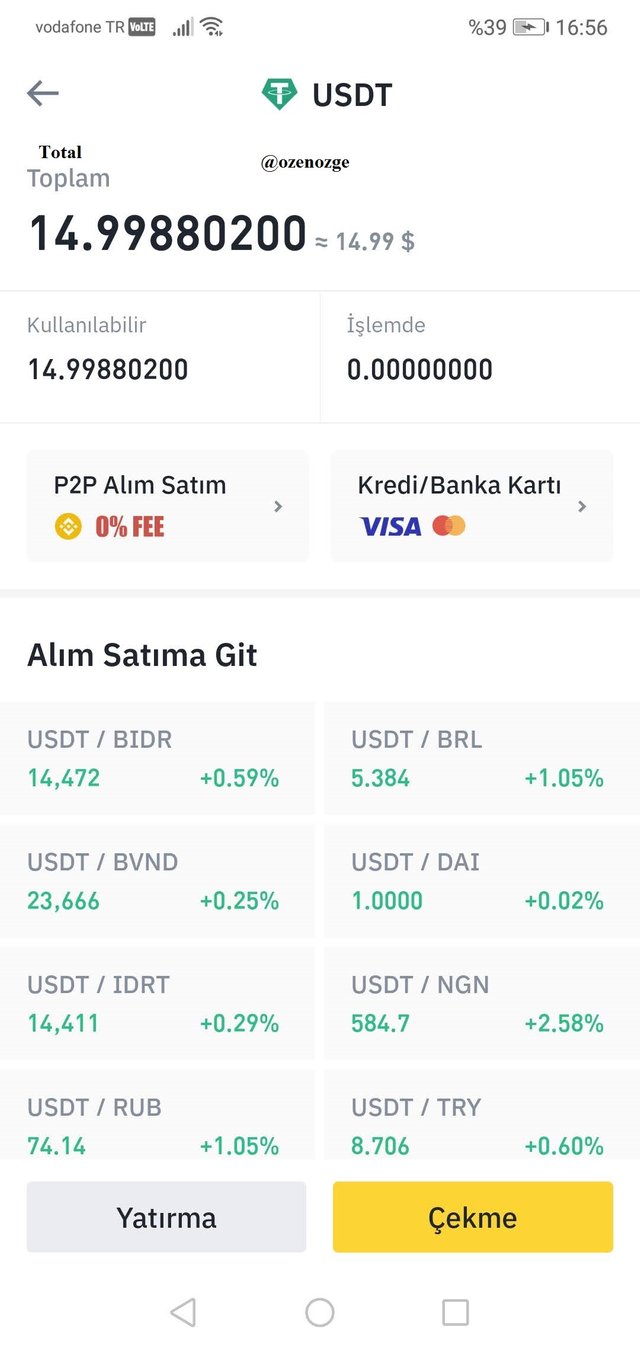

This time I chose Market Order instead of the Limit Order option. Again, I made a trade of $ 15. Here, unlike the previous question, when I pressed the buy TRX button, the trade was instant.

Before I made this transaction, my available USDT balance was 0. After this trading, I have a balance of 15 USDT as can be seen below.

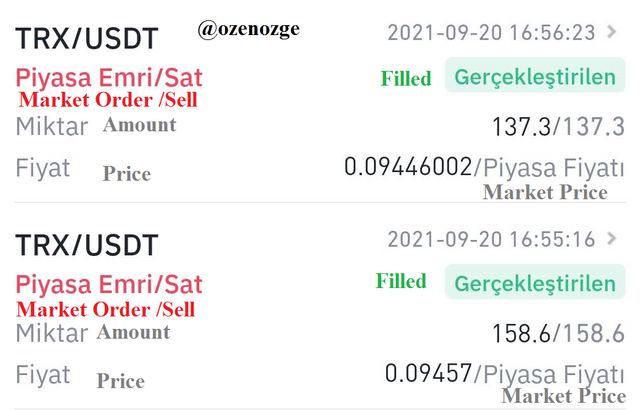

When I look at my order history, it is seen that this trading process took place in two parts. I see that I sold 158.6 of the TRXs at 0.09457 USDT, while I sold 137.3 of them at 0.09446002 USDT. In this case, the highest bid price and lowest ask price will change in the order book.

8-Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

The screenshot of the Order Book of the ADA/USDT pair at the time I prepared the assignment is given below. The highest bid price is 2.145 USDT. The Lowest ask price is 2.146 USDT.

a-As we learned in Part 1, the formula for The Bid-Ask Spread is given below;

b- The formula for Mid-Market Price is given below.

CC:@awesononso