Hello everyone...

I am glad to participate in this week's lecture with professor @pelon53. Having learnt this much about on-chain indicators, I can boldly say that my understanding of the dynamics of cryptocurrency investment has improved.

I have poured my understanding of all that was taught during the lesson into solving my homework task which I present below.

Q1: Indicate the current value of the Puell Multiple Indicator of Bitcoin. Perform a technical analysis of the LTC using the Puell Multiple, show screenshots, and indicate possible market entries and exits.

The Puell Multiple (PM) is a technical indicator in the group of oscillators. It tracks the cyclical behavior of the market participants on the supply side of the market - the Miners, to ascertain the aggregate profitability of the players on the supply side.

Given that Miners are compulsory sellers and usually have long vesting periods, the Puell Multiple indicator provides an insight into when they are most likely to liquidate their asset holdings.

Usually, the PM indicator compares miners' income (denominated in USD) to the annual average of their income to reveal how profitable the miners are at any point in the market.

If the PM value indicates that profits are above the annual average, it means that Miners have made sufficient profits and therefore have an incentive to liquidate their asset holdings. On the other hand, if the PM value indicates that profits are below the annual average, it means that miners have not made enough profits to cover their costs. Hence, they are incentivized to hold their assets until it becomes profitable.

The current value of the Puell Multiple Indicator of Bitcoin

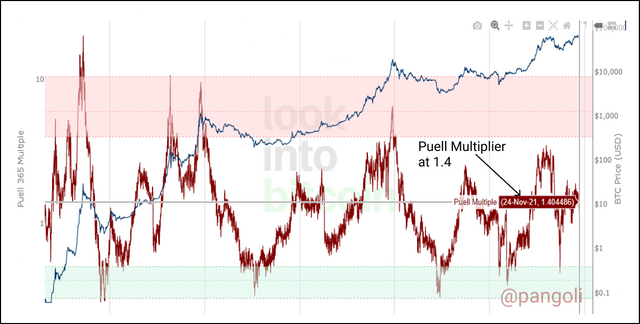

Image source

At the time of writing (24-11-2021), the current value of the Puell Multiple indicator for the bitcoin network is valued as 1.4. This implies that the current daily income of bitcoin miners is 1.4 times more than their yearly average. Although this seems very much like a reasonable profit when observed holistically, it is not safe to say that this level of profit will inspire a sell-off by the miners.

Judging from the previous bull and bear cycles, the most impulsive sell-offs occur when the Puell Multiple indicator is in the zone highlighted in red. At this point, the daily income of miners is said to be 3-4 times more than their yearly average.

Perform a technical analysis of the LTC using the Puell Multiple, show screenshots, and indicate possible market entries and exits.

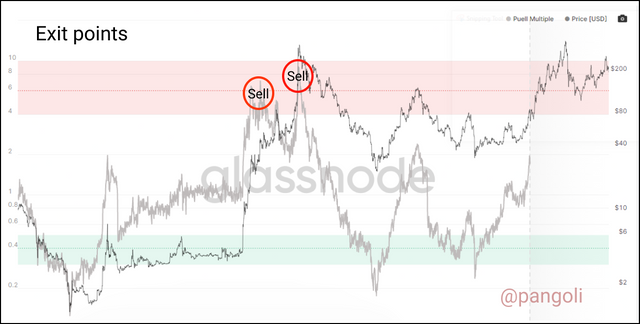

As a general rule of thumb, the safest entry and exit points when using the Puell Multiple Indicator are the green and red areas.

Image source

The area colored in red represents a point in the market where the daily income from the activity of Miners is at its peak, relative to the yearly average income; while the green area represents a point in the market where the income of Miners is at the lowest.

In a very loose interpretation, the high returns around the red area propel the miners to sell their assets for some profits. Hence, for other participants in the market, this would as well be a safe spot to sell-off and secure some profits.

On the other hand, the relatively low returns around the area painted in green are assumed to be insufficient to cover the costs of mining operations. Hence, miners at this point prefer to hold onto their assets while anticipating more returns. For a trader, it is advisable to enter the market at this point, as more price appreciation is expected before the miners start taking profits.

Let us gain more perspective on this using real market data from Litecoin's Puell Multiple Indicator chart below:

Image source

From the chart above, we can see that Litecoin's Puell Multiple indicator has touched the green area at three different points. These points represent the period in the bitcoin network where miners' daily income fall below their yearly average income. At this point, the miners are not incentivized to sell their bitcoin holdings because they would be running at a loss. Hence, these points can be described as good entry points for investors to opt in.

Image source

On the flip side, we can see that Litecoin's Puell Multiple indicator has touched the red area at the labelled points, and trended below the price line subsequently. These points represent the period in the bitcoin network where miners' daily income are above their yearly average income. At this point, the miners have made multiple profits and might decide to sell their bitcoin holdings to secure some of these profits. Hence, these points can be described as good exit points for investors to opt in.

Q2: Explain in your own words what Halving is, how important Halving is and what are the next reward values that miners will have. When would the last Halving be? Regarding Bitcoin

Image source

As implied by the name, halving denotes a process of dividing an object into two equal parts. In the crypto space, halving is one unique feature in the

economics of a crypto asset that automatically checkmates its supply schedule.

It is a mechanism that deflates the supply of most cryptocurrencies that are created through a Proof-of-Work process. In a typical halving situation, the economic incentives that are paid to Miners for evaluating blocks and maintaining the network are slashed by half.

The concept of halving was popularized by the legacy blockchain use case - bitcoin and has been maintained by several other projects who adopt proof-of-work as their consensus algorithm.

On the Bitcoin network, halving is an event that is met with huge anticipation and it happens once in (approximately) every four years. The bitcoin source code is programmed such that the number of bitcoins rewarded to Miners is halved upon the completion of #210,000 blocks after the previous halving event.

So far, the Bitcoin network has been completed 3 halving events. The third and most recent one happened in May 2020. Building on historical data, the buildup of halving events and the corresponding mining rewards would be as follows:

| Date | Event | Reward per block |

|---|---|---|

| 3/01/2009 | Genesis block got mined | 50 BTC |

| 28/11/2012 | First halving | 25 BTC |

| 09/07/2016 | Second halving | 12.5 BTC |

| 11/05/2020 | Third halving | 6.25 BTC |

| ??/??/2024 | Fourth halving | 3.125 BTC |

| ?? /??/2028 | Fifth halving | 1.5625 BTC |

| ??/??/ 2032 | Sixth halving | 0.78125 BTC |

| ??/??/2035 | Seventh halving | 0.390625 BTC |

The miners' reward will continue to decrease every four years until the last block is mined -that is until the 21,000,000th bitcoin is released into circulation. According to speculations obtained from investopedia.com, the maximum supply of bitcoin will be reached in the year 2140.

Q3.- Analyze the Hash Rate indicator, using Ethereum. Indicate the current value of the Hash Rate. Show screenshots.

Oftentimes, investors find it hard to tell the extent of security available on a blockchain network. For every blockchain project, a 51% attack is seen as the worst thing that can happen to the network.

So, how can a potential investor determine the extent of security on a blockchain network? Hash rates!

The legacy blockchains like Bitcoin and Ethereum are widely known for the specialized hardware machines used in their proof-of-work mining.

These machines come with different computing abilities and those with higher computational ability are more likely to solve the proof-of-work faster than the machines with lower computational ability. When deployed for mining activities, these machines are called nodes and they serve to validate transactions and secure the network.

The combined computational power of all active nodes on a network is called Hash rate. The hash rate increases as more active nodes join the network; and decreases as active nodes leave the network.

A high hash rate is seen as a healthy on-chain security matric for any blockchain as it eliminates the possibility of a coordinated 51% attack on the network by bad actors. On the other end, a low hash rate presents a weak link through which the entire network could be attacked.

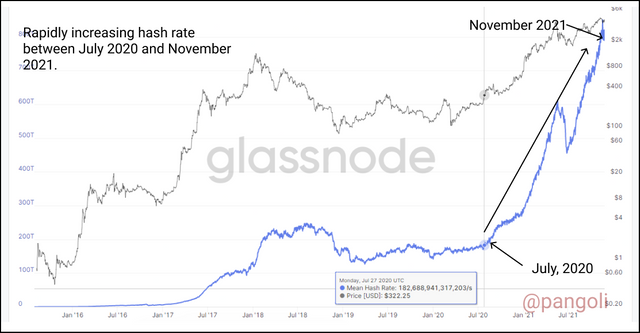

Image source

The hash rate indicator is a simple two-dimensional graph that captures the network situation of a blockchain. It presents a comprehensive graph of the average daily hash rate of a network and how they have increased over time.

Image source

The screenshot above captures the hash rate of the Ethereum network over the years. From the chart, it is obvious that the Ethereum network's hash rate has seen an explosive increase from 157,333 TH/day in December 2019, to an All-Time-High of 863,950.0578 Tera hashes per day as of 24th November 2021.

This explosive growth goes to establish the wide adoption that the Ethereum network has gathered based on its numerous use cases. As a result, investors have faith in the network and are committing their capital to engage in mining activities on the network.

Q4: Calculate the current Stock to flow model. Explain what should happen in the next Halving with the Stock to Flow. Calculate the Stock to flow model for that date, taking into account that the miners' reward is reduced by half. Show screenshots. Regarding Bitcoin.

The Stock to Flow (S2F) model provides a means of valuation for Bitcoin by comparing its existing stock to the annual production. This model ascertains the extent of scarcity of bitcoins, and by implication, impacts on the value of bitcoins at any point in the market.

In other words, the Stock to Flow model creates a working valuation metric for bitcoin through a ratio obtained from a quotient of its total supply and aggregate annual production. When the S2F ratio is high, it is interpreted as "hard." That is, the said asset is scarce and difficult to come by, and vise versa.

The current S2F ratio of Bitcoin can be obtained using the following formula:

S2F = Stock / Flow

Where:

Stock = Circulating supply

Flow = Aggregate annual production `

At the time of writing, the total supply of bitcoins is at 18,882,525 BTC.

The current block reward for mining is 6.25 BTC/block.

BTC mined every 10 minutes = 6.25

BTC mined per hour (60 minutes) = 6.25 × 6 = 37.5

Daily aggregate = 37.5 × 24 hrs = 900 BTC

Annual Flow @ 6.25/block = 900 × 365 = 328,500

Hence, to derive the current Stock to Flow,

S2F = Stock (= total supply)/Flow ( = Annual flow)

= 18,882,525/328500

= 57.5

A stock to flow ratio of 57.5 implies that, at the current production rate of 6.25 BTCs per block, it would take approximately 57 years and 5 months of production to create the current supply of all bitcoins in existence.

To derive the stock to flow model, let's apply the formula:

Stock to Flow model = 0.4 ×( S2F3)

Hence,

S2F model = 0.4 × (57.53)

= 0.4 × 190109.375

=$76043

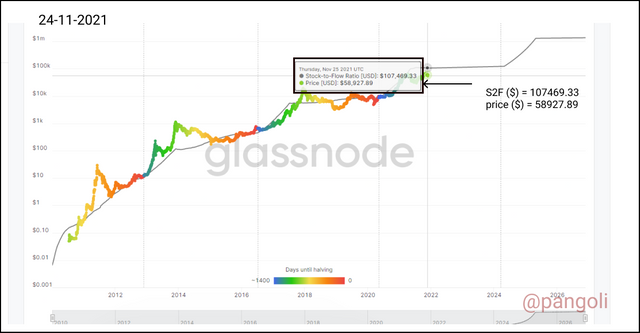

Image source

According to the image above, forecasts made by the Stock to Flow model using the S2F ratio presents bitcoin's expected value at over $100,000/BTC. But currently, the actual value of bitcoin is below the expected value.

Explain what should happen in the next Halving with the Stock to Flow.

Halving affects the S2F in a significant way. Since miners' rewards get slashed by half during a typical mining event, it means that the annual production of bitcoins for the period after the halving event will drop. By implication, the drop in annual production will reflect on the S2F ratio.

Calculate the Stock to flow model for that date, taking into account that the miners' reward is reduced by half

Let's consider a hypothetical illustration of the 2024 post-halving S2F ratio below:

Expected Block reward = 3.125/ block

Expected Flow (Aggregate yearly production) = 164, 240 BTC/ Year

Expected Stock (Total supply) = 19,537,325 BTC

Deriving the stock to Flow ratio (post-halving)

S2F = 19,537,325 / 164250

S2F = 118.95

This implies that the post-halving Stock to Flow ratio after the halving in 2024 will be 118.95. What this means is that at that ratio, it would take approximately 119 years of production to create the existing supply of bitcoins.

Also, the expected Stock to flow model following the next halving would be as follows:

S2F model = 0.4 * SF ^ 3.

S2F model = 0.4 * 118.95 ^ 3

S2F model = 673,214.30

By way of prediction, the expected post-halving price of bitcoin according to the calculated Stock to flow model is at $673,214.30.

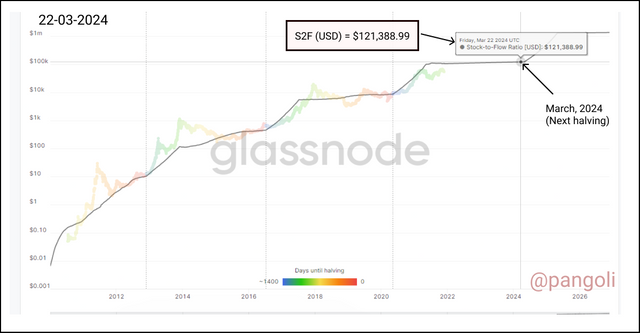

Image source

The diagram above captures the stock-to-flow ratio of bitcoin on the date of the halving event estimated as 22nd March 2024.

Conclusion

While Puell Multiple indicator has proven over the years to be very useful in identifying entry and exit points for investors by doing a concrete supply side analysis of relevant on-chain data, the hash rate also lends insights to the overall strength and security of a blockchain Network. Also, understanding and utilizing the stock-to-flow model can offer valuable insights about the potential valuation of a currency.

This goes to stress how crucial it is that investors and traders invest in the knowledge and understanding of crucial on-chain metrices. With this, they can make better decisions and also improve their chances of staying profitable in the market.

Thank you for reading...

Cc:-

@pelon53