Image source

As more and more blockchain solutions are getting rolled out, there is an increasing demand for guides on how to leverage the ever-growing ecosystem. This article explores the Terra network and some projects in its ecosystem.

Terra Station: a deep dive into the application and how to use it

Terra station is the native wallet designed to hold crypto assets belonging to the Terra ecosystem. It has features that allow users to delegate their assets to validators, participate in staking, swapping, as well as on-chain governance of the network.

Users in the Terra ecosystem must have their wallets installed to be able to interact with its Decentralized Finance products.

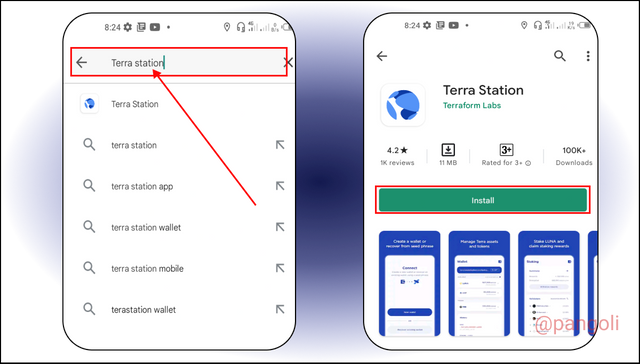

To install and set up the Terra station wallet, the following steps can be followed:

Image source

- Visit the Google play store and search " Terra station" using the search box. Then click install.

Image source

- The action above will automatically download and install the Terra Station wallet on your mobile device. Proceed to launch the app.

Image source

- After launching the app, set up a wallet by clicking the "New wallet" option. You will be required to set your password and confirm your recovery phrase.

Ensure to write down the recovery phrase somewhere safe for easy reference when trying to recover your wallet. x

Image source

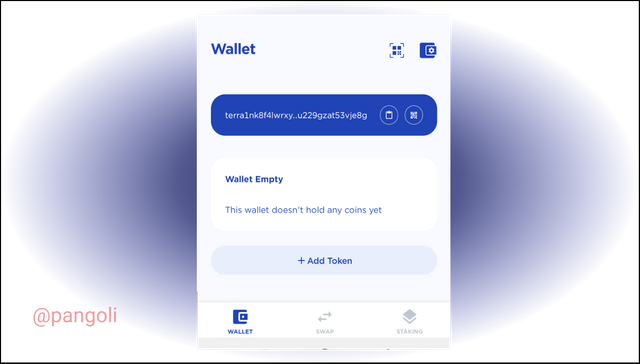

- Next, wallet creation has been finalized and we can see the wallet interface. My wallet is empty because it is new and I have not sent any assets to it.

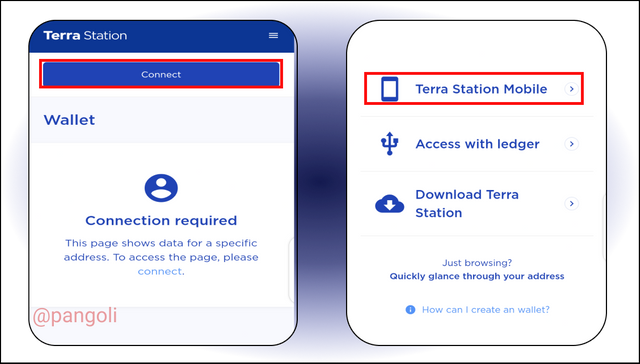

Connecting Terra Station Wallet

Image source

- Load the Terra Station website and click on "Connect wallet" at the top right corner of the screen. Then, choose the "Terra Station Mobile" option on the resulting menu.

Image source

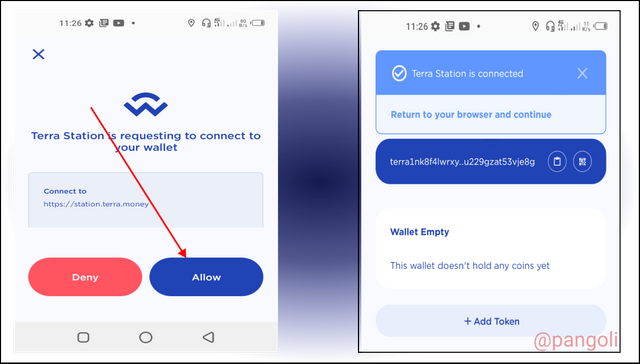

- Proceed to "Allow" wallet connection on the prompt that will appear. The wallet will get connected and the wallet address will appear at the top-right angle of the screen.

Exploring Terra Station

The Terra station wallet includes many segments that point to the different functionalities existing on the platform. On the homepage, the navigation bar contains menu items like Dashboard, Wallet, Swap, Governance, etc. Let's explore these items below.

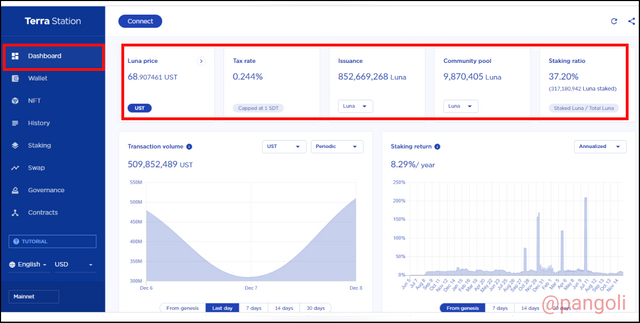

Dashboard

Image source

The dashboard features key network matrices like the current price of the LUNA token, Tax Rate, Community Pool, Staking Ratio/Return, Transaction Volume, etc. This segment gives an overview of some key project matrices that a user can draw insights from at a single glance.

Wallet:

Image source

The wallet segment displays all the assets owned by the user. From the balance in the wallet, the user can use the numerous services available on the platform. Since I have just opened my wallet, it is empty because I have not deposited any assets.

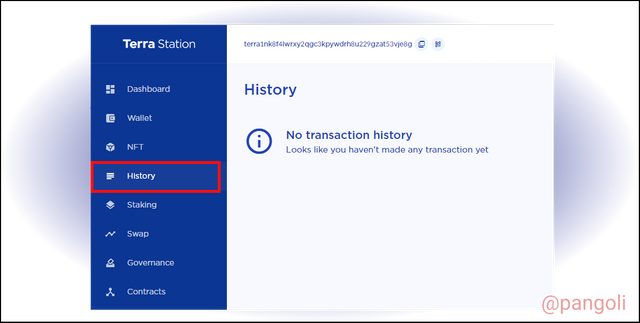

History:

Image source

This section displays a summary of all transactions made by the user. It provides a comprehensive history of transactions for easy reference.

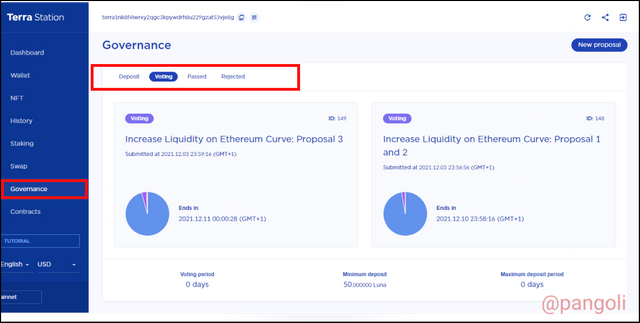

Governance:

Image source

Here, opportunities are given to users to participate in the governance of the Terra ecosystem. Users who have the LUNA token can vote on proposals in this segment.

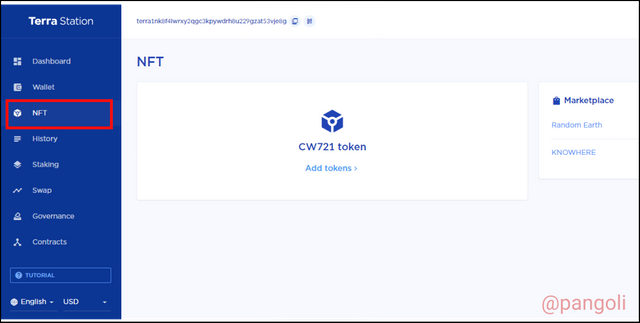

NFT

Image source

This section has an NFT marketplace where users can use their assets to mint and purchase Non-fungible tokens using the Terra network protocol.

Swap

Image source

In this segment, users can swap different tokens of choice. For instance, a user can easily swap the LUNA token in exchange for any stablecoin on the Terra network in this section.

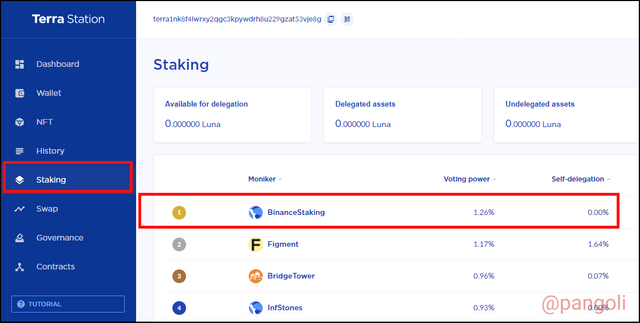

Staking

Image source

Users who do not want to swap their LUNA tokens can delegate them to validators on the network through the staking feature. These validators secure the network and earn a fee that is shared between those who staked their assets.

Anchor Protocol: The application, and how to connect the Terra Station wallet

Anchor protocol is a Decentralized Finance application built on the Terra network to offer income generating financial services like Savings, Borrowing, yield farming, etc.

Users of the Terra blockchain can easily deploy their LUNA tokens to protocols on the Anchor platform, to generate more yield and passive income.

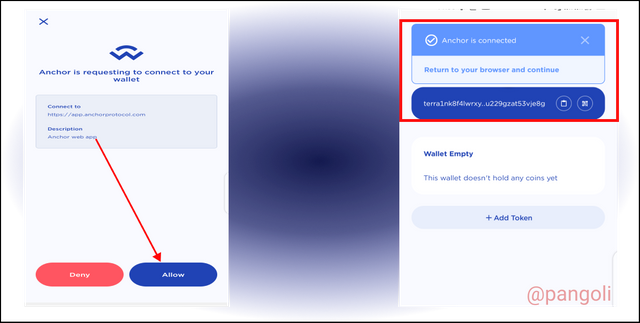

Connecting terra station to Anchor

Since we already have the terra station mobile wallet installed and set up, connecting the wallet to Anchor protocol can be done with these easy steps:

Image source

- Launch the Anchor Protocol website and click on "Connect wallet".

- Choose the "wallet connect" option. A QR code will appear, scan the QR code using the mobile app and proceed to "Allow" connection.

Image source

- The wallet is connected and set for use on any DeFi protocol on the Terra blockhain.

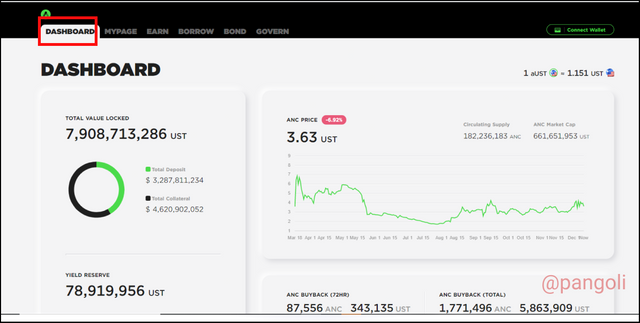

Exploring Anchor Protocol

Anchor protocol has a couple of features like Dashboard, My page, Earn, Borrow, Governance, etc. We will explore each of these sections in the following paragraphs:

Dashboard

Image source

The dashboard here contains information about assets on the Anchor protocol. Here, users can draw insights on how much deposits or borrowings have been made on the platform, as well as yield reserves and collateral, and a bunch of other information for users to glance through.

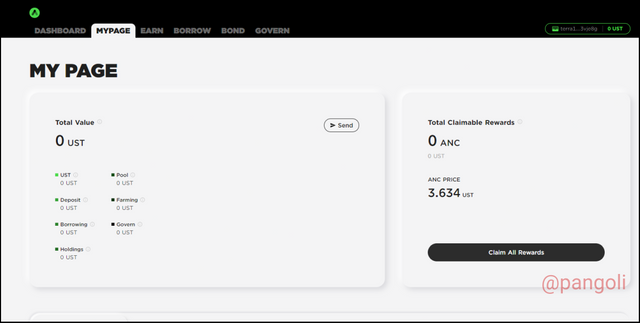

My page

Image source

This section displays users' information as a summary of their deposits and investment activities on the platform. Some display information here include total asset balance, total claimable rewards, earning, borrowing, etc.

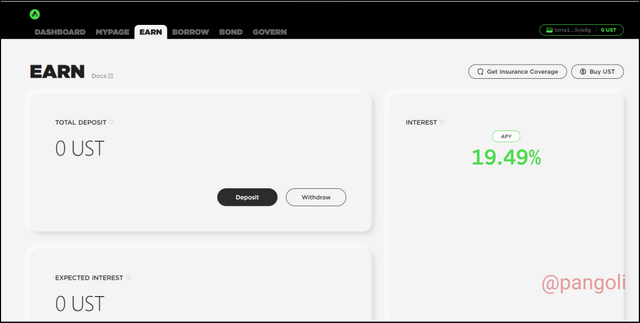

Earn

Image source

In this segment, the users get to see the interest yield on the asset they have chosen to deposit on the Anchor platform. Once the yield has been ascertained, the user can proceed to deposit their asset to earn passive income.

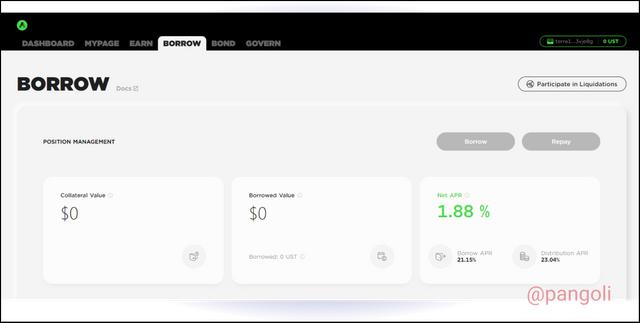

Borrow

Image source

In this section, users can obtain credit in stable coins using their crypto assets as collateral.

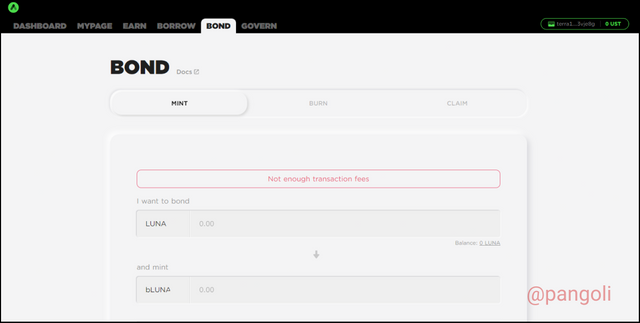

Bond

Image source

In this segment, crypto-assets can be bonded to mint the wrapped versions of crypto Assets for use on the Anchor platform.

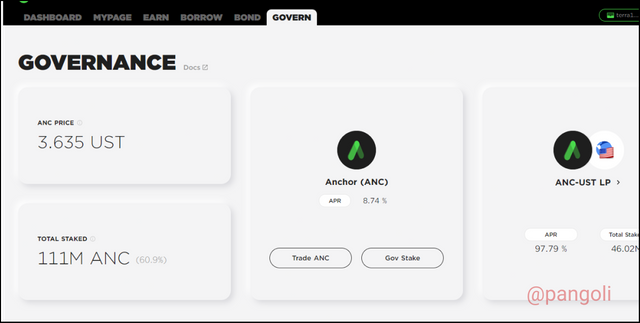

Governance:

Image source

Holders of the platform token- ANC, can participate in the on-chain governance by voting on changes made to the protocol.

Mirror Protocol: Exploring the application, and how to connect the terra station wallet

Mirror protocol is a DeFi platform on the Terra-Luna ecosystem that provides users access to trade in tokenized traditional market stocks on the blockchain. These stocks are transferred to the blockchain through oracles and trades are executed with the help of market making algorithms.

The Mirror protocol platform can be accessed using the Terra station wallet. Since Terra station wallet has been downloaded and set up already, connecting it to the Mirror protocol with take the following steps:

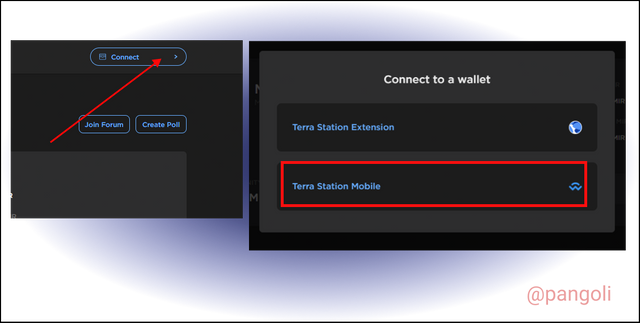

Image source

- Launch the Mirror protocol web app and click on "Connect" at the top left of the home page.

- On the resulting menu, click on "Terra Station Mobile" and proceed to scan the QR code that will be presented.

Image source

- Once QR code has been scanned, a prompt will appear, click on "Allow" to finalize wallet connection.

Exploring Mirror protocol

The Mirror protocol has some interesting features that we will explore below:

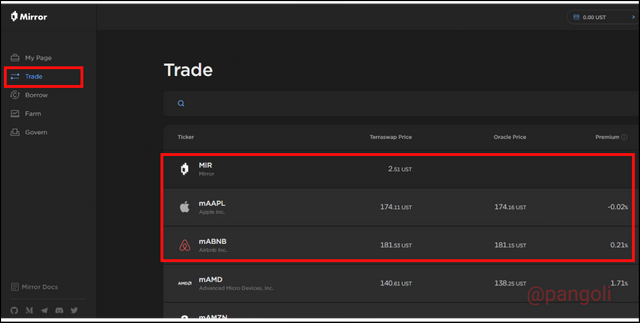

Trade

Image source

In the trade segment, a list of all assets available on the platform is presented. Users who have some UST in the balance can pick from any of these to buy.

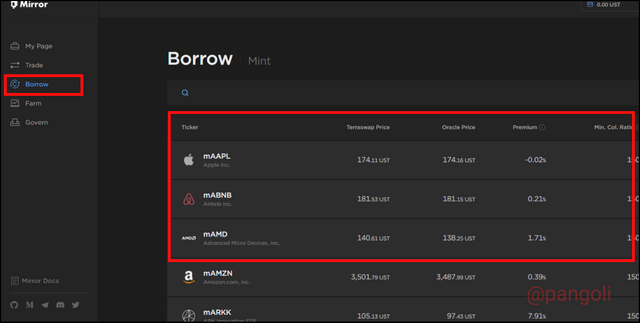

Borrow

Image source

This feature allows users to borrow Dollar-pegged assets using their tokenized synthetic stocks portfolio as collateral.

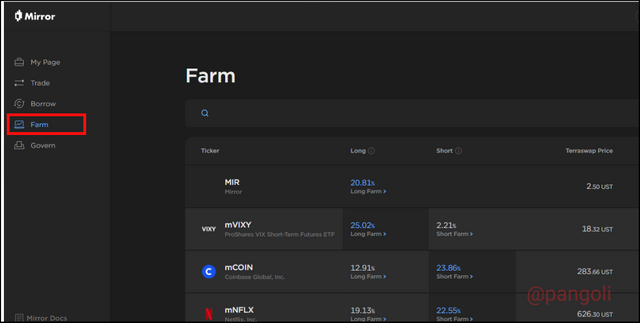

Farm

Image source

This feature provides users of the Mirror protocol platform with an opportunity to generate extra income from their assets. Using the farm feature, users can provide liquidity with their existing assets and earn yield over time.

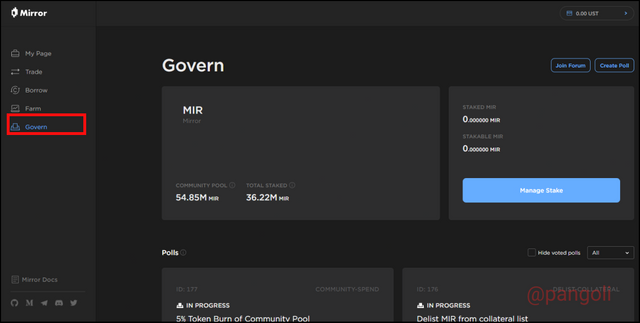

Governance

Image source

In this section, holders of the platform token - MIR, can vote on proposals concerning the Mirror protocol.

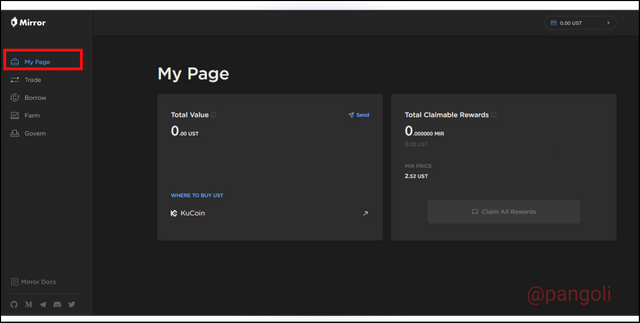

My page

Image source

This section contains a breakdown of the user's account summary. It reflects information like account balance, earnings from liquidity pools, transactions history, etc.

Terra bridge : a brief explanation

Interoperability has been at the forefront of the limitations facing most legacy blockchains. In the recent past, it was almost impossible to transfer value across different blockchains because of the differing protocol standards.

For instance, Bitcoin could not be transferred to the Ethereum blockchain because the original bitcoin was not compatible with the ERC-20 standards of the Ethereum blockchain. Hence, blockchain bridges emerged to blur the lines and make blockchains more interoperable.

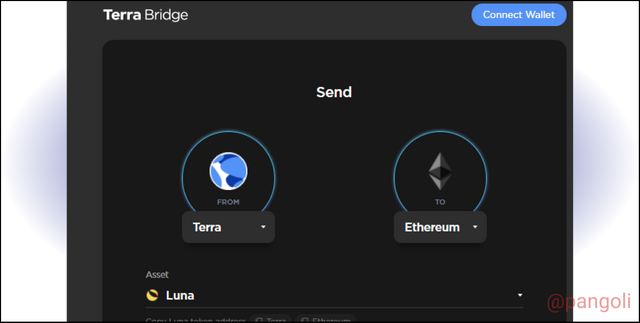

Image source

The Terra bridge serves as the mediator that enables communication and transfer of value between the Terra network and other blockchains.

Question 5: Explain how it works and what the Terra Stablecoin is.

Terra bridge helps to wrap asset from other blockchains to make them compatible and usable within the Terra ecosystem.

For instance, if I have UST in my Metamask wallet and want to send it to Terra station so I can use it in the DeFi platforms on the Terra blockchain. I will first of all bridge the UST through the Terra bridge to strip it off its ERC-20 properties.

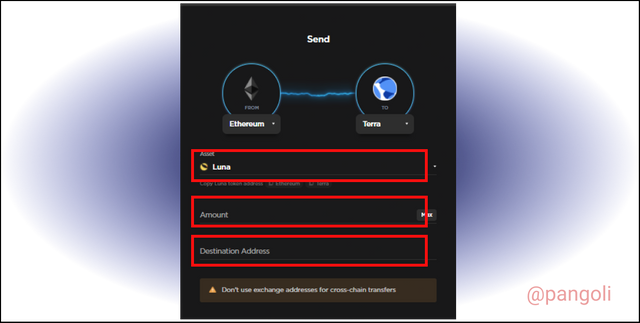

Image source

To do this, I would first of all connect my Terra station wallet to the Terra bridge protocol. Then, I will proceed to specify my source and destination wallet addresses, as well as the amount of UST to transfer in the boxes highlighted in the screenshot above.

Image source

Once the bridge procedure is completed, the UST will be transferred from my Metamask wallet on the Ethereum network to my Terra Station wallet on the Terra blockchain.

Terra Stablecoins

Most cryptocurrencies are well known for their volatile nature. Since the price of typical cryptocurrencies fluctuates very randomly, users find it difficult to use them for regular transactions.

To solve this issue, the concept of stablecoins emerged. Stablecoins are usually backed by fiat equivalents or collateral that supports a one-on-one peg to the price of an established fiat currency. Some popular stablecoins in existence today include USDT, USDC, DAI, etc.

However, stablecoins on the Terra blockchain possess their own unique characteristics. Instead of being fiat or assets backed, the stablecoins on Terra network are backed by algorithms. That is, they depend on the adjustment of on-chain algorithms to maintain a one-on-one peg with the USD.

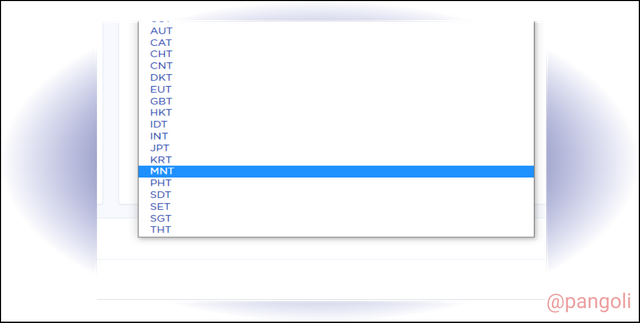

Image source

Some stablecoins on the Terra network include: TerraSDR or SDT, TerraUSD (UST), TerraKRW (KRT), etc.

Question 6: You have 1,500 USD and you want to transform it into UST. Explain in detail and take the price of the updated LUNA token.

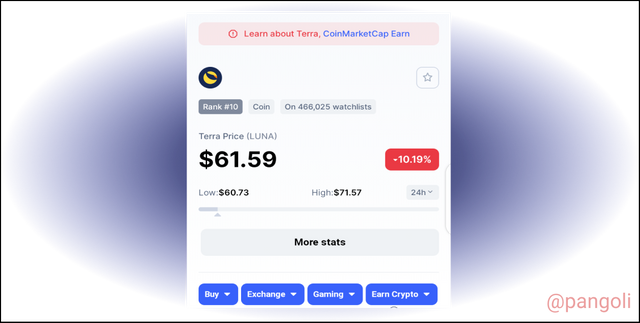

Image source

Given the current price of the LUNA token at $61.59 as displayed on coinmarketcap. If I want to transform 1500 USD into UST, I would use the following method:

Since UST is not yet available on most centralized exchanges, I would first of all buy 1500 USD worth of LUNA from an exchange and send it my terra station wallet. That will give me a balance of 24.35 LUNA tokens.

Then, I would use the "Swap" feature on the terra station wallet to convert my LUNA tokens to the Terra Stablecoin (UST) at the rate of 1UST = 1 USD.

Once the swap is completed, I will proceed to use my UST on any of the DeFi solutions available on the Terra blockchain.

Question 7: Now you have that 1,500 USD and you want to make a profit, since 1 UST = 1.07 USD. Explain in detail and take the price of the updated LUNA token.

In this case, the price of UST is greater than $1. This means that the algorithm will have to be adjusted to get the stablecoin to its ideal price.

To get UST back to its $1 peg, holders of the LUNA token will be incentivized to trade their tokens. Here, more UST will be minted to expand the circulating supply of the asset, and devalue the price.

In my case, I would get a $1,500 equivalent of LUNA token. At the current price, LUNA is $61.59. Hence, $1500 worth of LUNA will be 24.35 LUNA.

As LUNA tokens are burned to mint more UST, the supply of UST will increase to make up for the increase in demand, and the price will fall to equate 1 UST = 1 USD.

Consequently, when LUNA tokens are burnt, the circulating supply reduces and it drives up the value. Hence, my $1500 worth of LUNA will increase in value and make profits.

Conclusion

Terra blockchain is a reputable feature in the DeFi ecosystem. It's unique characteristic being the numerous algorithmic stablecoins in its ecosystem, as well as interesting yield offers in its DeFi protocols.

Not only has the Terra Ecosystem enabled Decentralized Finance through savings, swapping, staking, and yield farming through its DeFi platforms; it has also provided a means through which TradFi maximalists can engage in the traditional stock and assets market using smart contracts powered platforms.

Thank you for reading...

Hi there! If you read to this point, I am sure you enjoyed the article. Let's take this further, I'd like to connect with you on a more personal level. Feel free to hit me up on any of my social handles below: